Good morning! I'm starting to worry a bit about the outcome of the General Election, so have opened up a short position in the FTSE 100. Yes, I know that most of the FTSE 100 earnings are now overseas, so it's not a very good proxy for UK earnings, but the election outcome is more about sentiment than earnings. People are (rightly) starting to worry about a weak Labour Govt being propped up (i.e. held to ransom) in coalition with the Scottish Nats.

Casting my mind back to the 2010 election, I recall that the big worry then was the risk of a run on the pound, and Gilts. Here we are, with the National Debt far higher, and nobody seems to be worrying any more. There again, economic recovery seems fairly well established now, when it wasn't in 2010.

I won't be adjusting any of my long positions, as it's too expensive with small caps, to trade in & out, due to the wide bid/offer spreads. So having a short on the FTSE 100 will help me sleep at night, and will provide a cash buffer if the market as a whole does go into panic mode. After all, you need cash to be able to buy at the bottom.

I wonder if other people might now be reluctant to open any new positions until the General Election uncertainty has passed? It could throw up some interesting buying opportunities, if good companies drift down in price due to a buyers' strike.

Laura Ashley Holdings (LON:ALY) issued their results mid-afternoon on Friday last week, which was a bit of a nuisance, so I had to do a write-up on them here. Also I slotted in another interesting company, OMG (LON:OMG) - I hold long positions in both, as is always disclosed within each section of each report - and I think both look excellent companies, so if you haven't seen that report then the link is here.

Getech (LON:GTC)

Share price: 60p (up 12.5% today)

No. shares: 30.3m

Market Cap: £18.2m

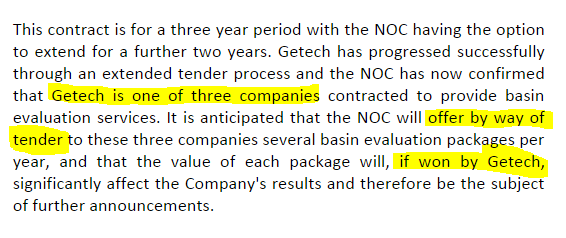

Contract win - this is an interesting one. The company says it has won a contract with a national oil company, but on closer inspection it sounds as if they have actually made it onto a preferred supplier list, and will now be invited to tender for various work, in competition with two other companies. So not quite the same thing as having won the contracts!

So perhaps early buyers this morning might not have read & digested this announcement carefully enough, who knows?!

My opinion - checking the archive here, I last reported on Getech on 24 Mar 2015 when they published interim results which were remarkable good, considering how difficult market conditions must be in their sector (Getech provides seismic data to oil companies for exploration purposes).

So far so good anyway, the company's strategy of focusing on larger oil companies seems to be working out well.

Telit Communications (LON:TCM)

Share price: 238.5p (up 1.3% today)

No. shares: 114.3m

Market Cap: £272.6m

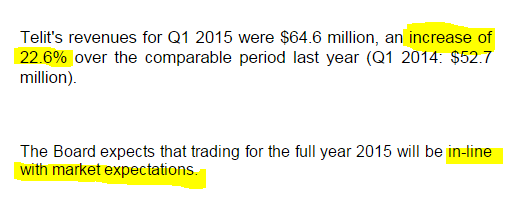

Q1 trading update - for the three months ended 31 Mar 2015. This sounds encouraging;

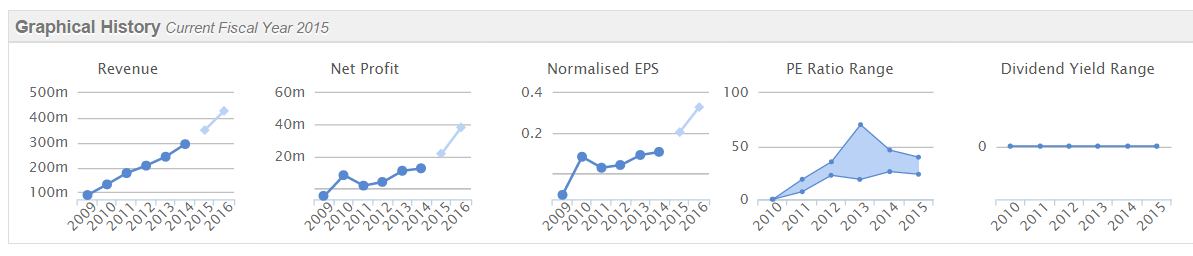

The Stockopedia historical graphs provide some interesting pointers;

Revenue has been rising impressively, and there's been some growth in profit & EPS too. Although checking some of my previous comments on this company, I think some of the growth has come from acquisitions - which is inferior to organic growth, obviously.

Valuation - note how broker forecasts assume a considerable increase in profitability & EPS both this year (calendar 2015) and particularly next year. Given that the company has today said that it's in line with forecasts for the current year, then this is starting to look potentially interesting.

Broker forecast is for a near doubling of EPS this year to $0.21, so that puts it on a PER of about 16.8 for this year, dropping to just 10.4 for next year. Although aggressive growth in broker estimates for future years can often be pie in the sky.

Dividends - there aren't any, so a negative mark there. I like to be paid to wait for shares to go up.

My opinion - I don't know anything about the technology this company sells, other than that it's a trendy area - the internet of things - so it seems to be hardware/software to let your fridge order milk for you, and things like that.

The company is apparently headquartered in London, but the Directors' names all sound foreign, so I would need to check where the company's operations are based, as generally I am not keen on overseas companies listed on AIM (there's often something wrong with them). Although this one is reasonably large, and profitable, so that helps.

Have any readers looked at Telit before? It looks potentially interesting to me - worthy of further research anyway.

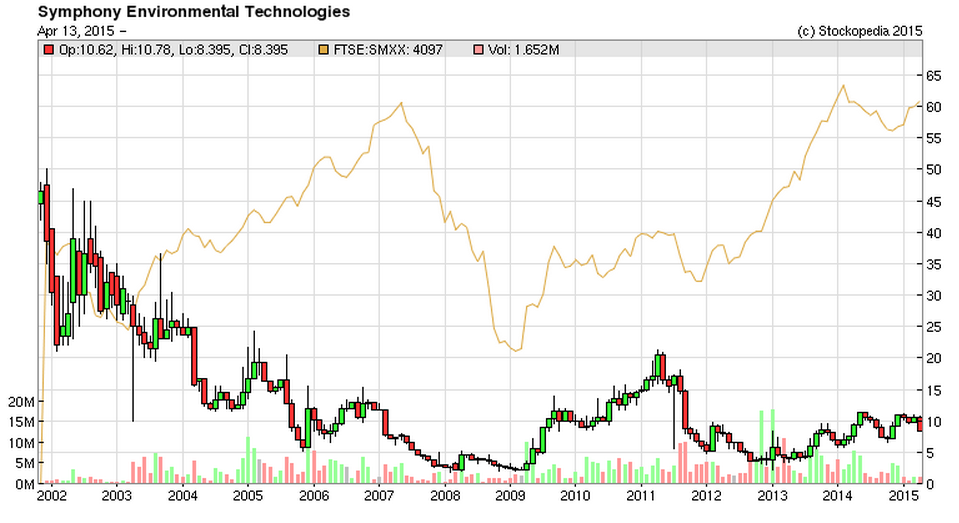

Symphony Environmental Technologies (LON:SYM)

Share price: 8.4p (down 21% today)

No. shares: 144.6m

Market Cap: £12.1m

Preliminary results - for calendar 2014 are out today. As a general point, I think we're getting to the time of year where decent companies really should have already reported their 2014 figures. Especially small/micro caps where, let's face it, it should be a doddle to produce the annual figures for such small businesses, for any half-decent accounts team.

I'm speaking from experience here. My accounts team used to have finalised figures ready for audit within about 5 weeks of the year end, and that was in the 1990s (when some reconciliations were still being done manually), for a group of companies with about 150 branches in the UK & abroad. The audit was wrapped up in 2-3 weeks, max, because there were never any audit adjustments, because I made sure the figures were 100% correct from the start. So having done the job properly myself, I've not got much patience for companies which are putting out results in Q2 of the following year - that's just sloppy.

Anyway, going back to Symphony, the figures don't impress. Turnover is actually down (never good for a purportedly growth company) by nearly 12% to just £6,352k for the year. So a tiny business.

It generated an operating loss of £265k against a comparable of £159k last year. Note also the £126k of finance costs in 2014, indicating that there is some debt, It looks to be expensive debt too, with a balance of £1,153k outstanding at the year end, so looks as if they're paying c.10% interest, roughly.

Although the debt is almost offset by £938k of cash at the year end, which came from an equity fundraising during the year.

Outlook - the Directorspeak here is promising jam tomorrow, saying that legislative trends are pushing the use of biodegradable plastics. Although the expectations of growth seem to be founded on expressions of interest, and small initial orders, rather than a bulging order book.

My opinion - the cash burn here looks very modest, so because of that it is probably not as dangerous as most jam tomorrow shares. However, turnover falling, and a lot of commentary about lengthy trials with customers, etc, puts me off. I'd have a flutter if the market cap dropped to about £4-5m, but at £12m, for an essentially unproven business model, with (so far) limited growth, that is now actually going backwards, it's difficult to get excited about this one.

There must be thousands of other companies also doing biodegradable plastics all over the world too, so why is this one likely to succeed in particular, I wonder?

Also, this stock seems to have been around for many years, with the odd flurry of interest, but no sustainable profits emerging. So it looks a very stale story stock now, as the long term chart below suggests. Maybe it will have another short-lived burst of excitement at some point, who knows?

Universe (LON:UNG)

Share price: 7.7p

No. shares: 220.3m

Market Cap: £17.0m

Preliminary results - for calendar 2014. Turnover and profit are usefully up, which they say is due to 16% organic growth, plus acquisitions made in 2013 kicking in.

Broker consensus is for 0.75p EPS for 2014, with the result coming in a bit below, with "underlying" EPS of 0.71p.

Outlook - there's nothing specific, but generally positive noises are made in the Directorspeak.

Balance sheet - not great, but not alarming either. Net tangible assets are just about positive, at £2.0m. The current ratio is 1.18, which I could live with, given that inventories are very low. There is a modest amount of debt, c£1.8m, which was more than covered by year end cash of £2.1m, although one would expect the year end cash balance to be untypical, as most companies like to window-dress the year end figures.

Cashflow - net cashflow from operating activities is very good, at £3.0m, however don't get too excited because they spent £1.1m of that on capitalised development costs - so the usual issue with IT companies in that the headline EBITDA figure is not a reliable way of measuring genuine profitability.

Dividends - none, unfortunately.

My opinion - the price looks about right to me. This company has performed fairly well in the last two years, and so the price of a PER of about 10 looks about right. Investors should remember that small companies like this really should be cheap - as their profits tend to be volatile, and the company is often heavily reliant on a small number of key customers, staff, and contracts. So a single digit PER is the right sort of price, stretching up to about 10 if the company is performing well, as in this case.

If there was some catalyst for a big increase in future profits, then I might be interested, but there's nothing of that nature in the narrative that I can see. Therefore it's not of any interest to me - I think there are better growth opportunities elsewhere.

It comes up with a good StockRank of 88 mind you, and the operating margin is quite good now too, so maybe I'm being too pessimistic about it?

Safestay (LON:SSTY)

Share price: 69.4p

No. shares: 19.2m (NB. Thomson Reuters data on this appears to be incorrect, so I have used the correct figure here, as stated in note 5 to today's accounts. I have flagged the issue to Stockopedia for correction)

Market Cap: £13.3m

(at the time of writing, I hold a long position in this share)

Final results - for calendar 2014 - well I say that, but the company listed on AIM on 2 May 2014, and that was also the date it acquired its first premises, being the former Labour Party HQ at Elephant & Castle. Safestay are now using the building (freehold) for something far more useful, I am pleased to say - as an upmarket hostel for budget travelers.

So these are part-year (8 months), maiden results, and therefore need to be viewed as being the starting point around which a hopefully much bigger company will be built. The company acquired a second freehold site, in York late in 2014, and a third site in Holland Park (which sounds very interesting, as it looks to be a historic building, on a 50-year lease), due to open in summer 2015 after a £2m refurbishment.

Profitability - the 8 month figures show turnover of £1.9m, and a very impressive £580k operating profit. However, this is for the elephant & castle site, which is freehold, so there's no rent cost. However, the interest charge (for debt to finance the freehold) is very high, at £444k. This leaves behind only a profit before tax of £137k.

Whilst that may seem disappointing, you could regard it as being rather encouraging that the company is able to cover all its central costs from the profitability of only one site. It's not often you see a roll out type investment stack up with just one site.

For that reason, I don't think earnings metrics make any sense at this stage, but for the sake of completeness, diluted EPS was 1.18p, so the PER works out at 58.8!

Individual site performance/potential - this all sounds positive;

Elephant & Castle - "trading performance... continues to improve". Note that the pro forma results for this site were impressive at £972k EBITDA for the 12 months to 31 Dec 2014, which is about double the likely entire company's interest charge for 2015 (£9.3m debt at avg interest rate of 5.26% = £488k).

York - "We are delighted with the results of the refurbishment and the first year of trading as Safestay York is comfortably on track to meet management's expectations"

Holland Park - scheduled to open in summer 2015. "...we are confident that the hostel has excellent trading potential given the building's aesthetic appeal and its highly convenient location in a very desirable central area".

Outlook - this all sounds upbeat;

Living Wage - I'm really pleased to read in the narrative that SafeStay has signed up for the Living Wage Foundation, and pays staff a living wage. I think this is very important, as staff who are paid fairly are more motivated, and tend to stick around. Let's hope more companies follow suit, instead of trying to exploit low paid staff for lowest pay they can get away with.

On a commercial level, I also think that making a big song & dance about paying a Living Wage should help Safestay attract customers, generally younger people, who will see the living wage as something they aspire to themselves, and hence a very good thing to support.

The more brutal capitalists amongst the readership here may not agree with me on this point! Usually on the basis of, "I had to work for tuppence ha'penny a day when I were a lad, so why should today's youth be molly-coddled?!"

Balance Sheet - this is dominated by the £15.0m freeholds (which are revalued upwards, based on independent valuations from a respectable firm that I've come across before, Edward Symmons LLP).

The freeholds are financed by bank debt, which was £9.1m gross, a little on the high side perhaps. Although bear in mind that the company did an equity fundraise in late 2014 to finance the refurb of the new Holland Park site, so it had £3.3m in cash at 31 Dec 2014, bringing net debt down to £5.8m, which looks OK to me, given the cash generative nature of the hostels which are already operating.

Overall NAV is £8.7m, and there are no intangibles capitalised. The market cap of £13.3m is therefore a 53% premium to book value, which sounds fine to me, as I'd expect the existing (and new) sites to be revalued upwards again as trading improves.

My opinion - as regulars here will know, I'm pretty good on value share stock picking, but my more speculative stock ideas are usually rubbish! So it might be safest to ignore me on that front!

However, in this case, Safestay is one of my favourite long term, somewhat speculative stocks. I've held since just after the IPO, and intend holding for 5 years+, as I really like the concept, and the fact that it is already profitable despite only just starting out.

The whole concept of an upmarket hostel is a clever idea, and searching the internet for customer reviews, it's clear that the customers like it. Here is Safestay's website, to get an idea for what they do. So repeat business is building, and more sites will be opened. With Europe still economically depressed, there should be plenty of good value sites to secure on favourable terms, so I hope Safestay really get cracking with the roll out to more sites asap.

The main downside is that the company will need to do repeat fundraisings to raise the cash to secure sites and refurbish them. That said, management are experienced property people, so seem to know what they are doing, and so far, so good.

I don't see any particular reason for the share price to go any higher in the short term, but am hoping to see steady appreciation over a number of years here as the roll out gathers pace.

Regards, Paul.

(as mentioned above, of the companies discussed today, Paul has a long position in SSTY and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.