Good morning from Paul!

This week's "mystery share" for my podcast (i.e. my best value/GARP share of the week) is Eurocell (LON:ECEL) - also note that there was a decent -sized Director buy as well.

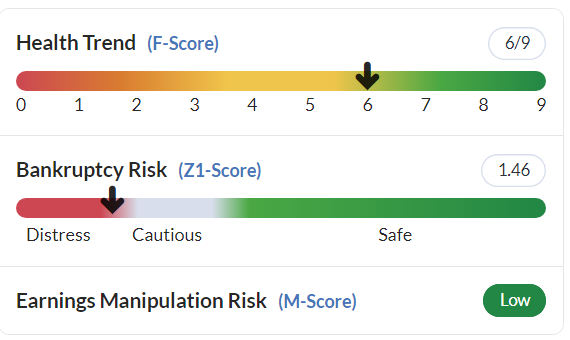

Very quiet (nothing, basically!) for small cap results/outlook today, so I've done a proper dig into figures from DFS Furniture (LON:DFS) from yesterday, and a few quick comments below from brief reviews of other value/GARP small cap results which caught my eye earlier this week.

Today's report is now finished. Thanks for reading/contributing, and have a lovely weekend!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda - there's no news today of interest, but I've got masses of backlog items, so will work my way through that list, until about 1-2pm finish time today.

Paul’s Section:

DFS Furniture (LON:DFS)

133p (y’day’s close)

Market cap £311m

DFS Furniture plc, the market-leading retailer of living room and upholstered furniture in the United Kingdom, today announces its interim results for the 26 week period ended 25 December 2022 (prior year comparative periods are the 26 weeks ended 26 December 2021 (H1 FY22) and the 26 week unaudited pro forma period ended 30 December 2018 (H1 FY19)).

I think it’s getting too complicated, and largely irrelevant now, to use pre-covid comparisons. Too much has changed (particularly big increases in costs like staff, and energy), and it’s easy enough for us to look back at pre-covid accounts anyway.

So I’ll ignore any pre-covid comparisons that DFS provides in these interim accounts.

Here are my notes, from reviewing the H1 (to Dec 2022) results -

H1 revenue £545m (down 2%)

Underlying PBT only £7.1m (LY H1: £23.3m) - I laughed when I saw that the table switches from percentage change, to pounds change, to avoid revealing that this is a 70% drop!

Note that H1 is seasonally weaker than H2, but even so, this is clearly a poor outcome for H1.

Basic u/l EPS is only 2.2p (down 70%)

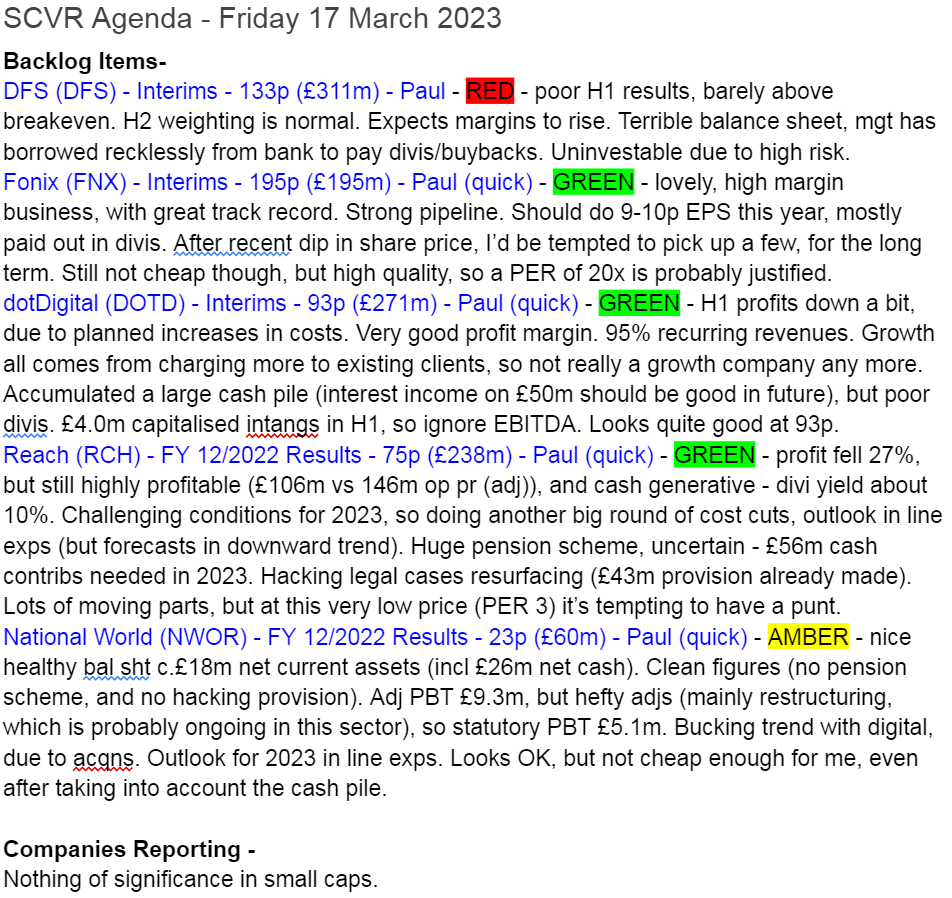

Interim divi 1.5p - it shouldn’t be paying divis at all, given the shockingly weak, geared balance sheet. Guidance is for a 3.0p final divi, subject to H2 performance (Jan-Jun 2023)

Net bank debt £135.6m (up from £65.4m a year ago), debt which has been run up recently, paying out divis & buybacks - it’s absolutely crazy to have done this as the economy was turning down, just reckless actually. Borrowing to pay divis should never happen.

Outlook - cost headwinds abating, and profit margins expected to improve in H2 & beyond.

Working capital starting to normalise.

Guidance for FY 6/2023 - Adj PBT £30-35m (which it says is in line with market expectations)

Gross margins: H1 53.8%, expected to rise to 56% in H2, then 58% “exit rate” by June 2024 - that’s quite significant, on revenues of over £1bn, each 1% gross margin gain is an extra >£10m profit. Freight costs now back to pre-covid levels.

Medium term target - £1.4bn revenues, and PBT margin 8%+ - to be fair, if this is achieved, implying £112m annual profit, then the shares would probably be a good bit higher than now. But it hasn’t been achieved yet, this is just an aspiration.

Market share in upholstered products is very high, at 38% - fragmented market.

Note that EBITDA is meaningless here, because of the £40.2m depreciation charge, £29.4m of that relates to rents, not fixed assets.

Similarly, I think the £16.0m finance charge also includes costs related to leases. Higher interest rates, and much higher bank debt now, means finance charges will rise significantly I think.

Balance Sheet - this is what destroys the investment case completely for me. It’s one of the worst balance sheets I’ve ever seen, very stretched.

NAV is £230m, but that includes £535m of intangible assets. Strip that out, and NTAV is heavily negative, at £(305)m. How is the business able to function with such a bad balance sheet? It’s dependent on bank borrowings. Also, furniture retailers have negative working capital - i.e. they get paid by customers before they have to pay their factories.

As I’ve mentioned before, smaller competitor SCS (LON:SCS) is super-conservative with customers cash, and keeps it on the balance sheet. DFS is the opposite, super-reckless, it has spent all the customers cash, and run up a big overdraft on top.

It’s a pity, because DFS is a much better business than SCS, but the terrible balance sheet continues to make DFS uninvestable for me, because it’s much too high risk.

I also question whether the big divis recently were legal, given that the retained profit line on the balance sheet is heavily negative?

Cashflow statement - is also very revealing.

The £59.9m operating cashflow in H1 looks good. Until you realise that this excludes rent-related costs further down, of £11.8m interest on leases, and £35.4m “payment of lease liabilities”. That leaves only £12.7m of cashflow, once these rent-related cash outflows are taken into account.

Look at the finance section too, it’s horrible - £75m drawdown of loans in H1, to fund divis & buybacks. Whilst performance was deteriorating badly. Crazy!

In summary then, it’s NOT generating cash, and is drawing heavily on the bank facility to pay divis and fund share buybacks. This is so bad, that the point needs to be laboured.

A key bank covenant is net debt must not exceed 3.0x EBITDA. The trouble is, the EBITDA isn’t real! I wonder when banks will figure this out?!

Going concern note - gives itself a clean bill of health, which I don’t find credible at all.

In the severe but plausible downside case, it relies on cost cutting to theoretically comply with bank covenants. But cutting costs (e.g. marketing) would have consequences - lower revenues.

My opinion - as you have probably already gathered, I remain extremely negative on this share, because of its precarious balance sheet, and the bizarre, reckless policy of management to almost max out the bank borrowings, in order to fund shareholder returns (divis and buybacks) over the last year or so. They might get away with it, but if trading gets any worse, then it might need to do an emergency placing just to stay afloat.

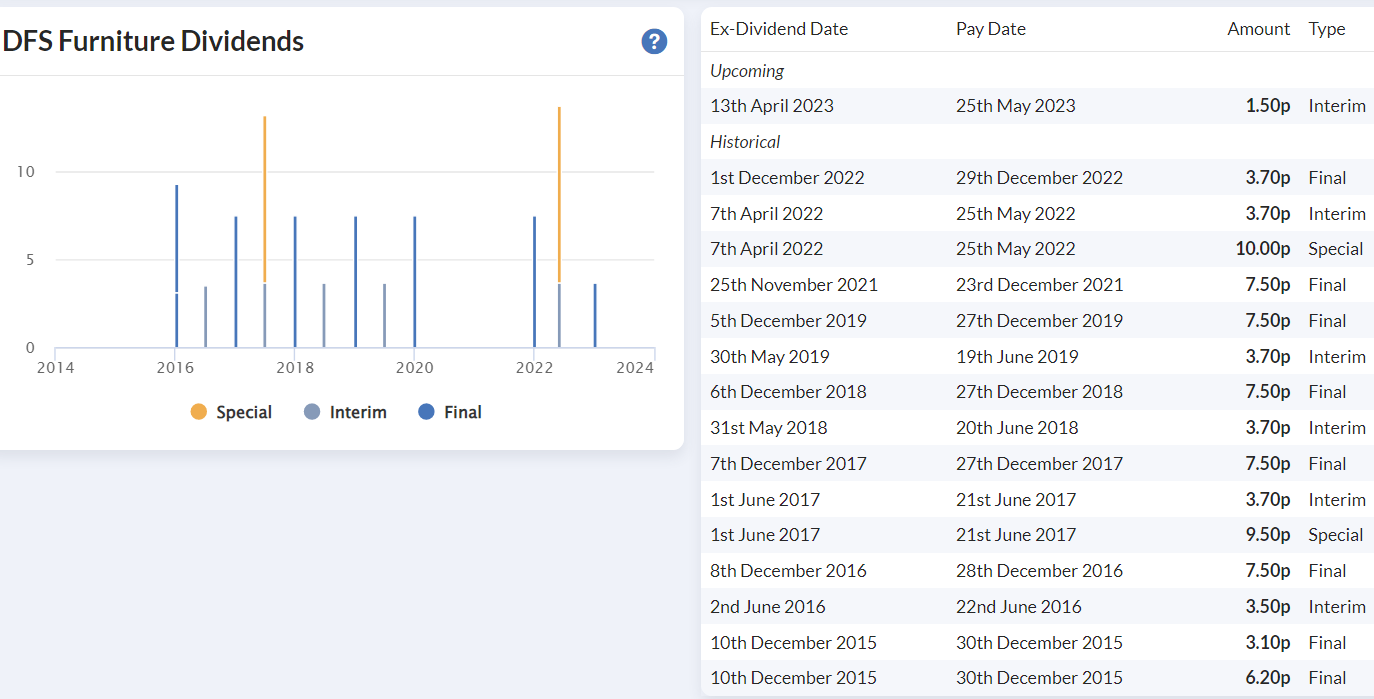

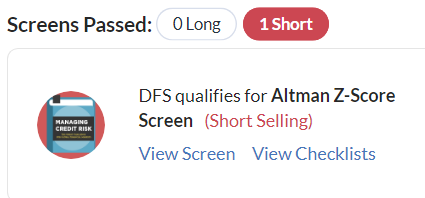

It’s not just me that doesn’t like the precarious balance sheet - DFS only qualifies for 1 Stockopedia screen, which is a shorting screen based on its weak Altman Z-Score.

I think investors in DFS are taking much more risk than they perhaps realise. They need both a significant improvement in trading, and an assumption that the bank will remain co-operative, to justify the existing valuation.

On the upside, with cost pressures abating, and gross margins rising, this could be the low point for earnings possibly? Also, if DFS does deliver the results in its growth strategy, then I could see this share doing well (maybe doubling or more?). It’s just a pity that management are sailing so close to the wind, running up bank debt to pay out divis at the worst point in the cycle.

Note a good track record since it listed. Although it has paid out 89.8p in total divis (including 2 specials of 9.5p and 10.0p) since it listed. Although the recent divis have been funded by drawing down on bank borrowings)

.

.

Although the StockRank is quite high, note that a solvency warning is sounded by the Altman Z-score, which is important to check in conjunction with StockRanks.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.