Good morning from Paul & Graham.

Today's report is now finished. I'll put catch up items into tomorrow's report, so am working away on that now.

Banking problems are rumbling on, with the latest contagion risk apparently over who owns the bank bonds that are seemingly being potentially wiped out in refinancings/takeovers. That topic is beyond my pay grade, so if any of our banking experts have a view on it, do post a reader comment below. I might reach out to my network of experts and see what they say, so if I pick up anything useful, I'll pass it on.

Rail strikes - it seems that a settlement has been reached. So I'm wondering if any of the companies (especially in hospitality) which blamed the strikes for poor trading, will now start issuing ahead of expectations updates instead?! To be fair though, it should help the sector at least somewhat, for companies which operate in city centres anyway. (EDIT: readers are saying in the comments below that the rail strikes are not yet fully resolved, so looks like I jumped the gun here, apologies!)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda

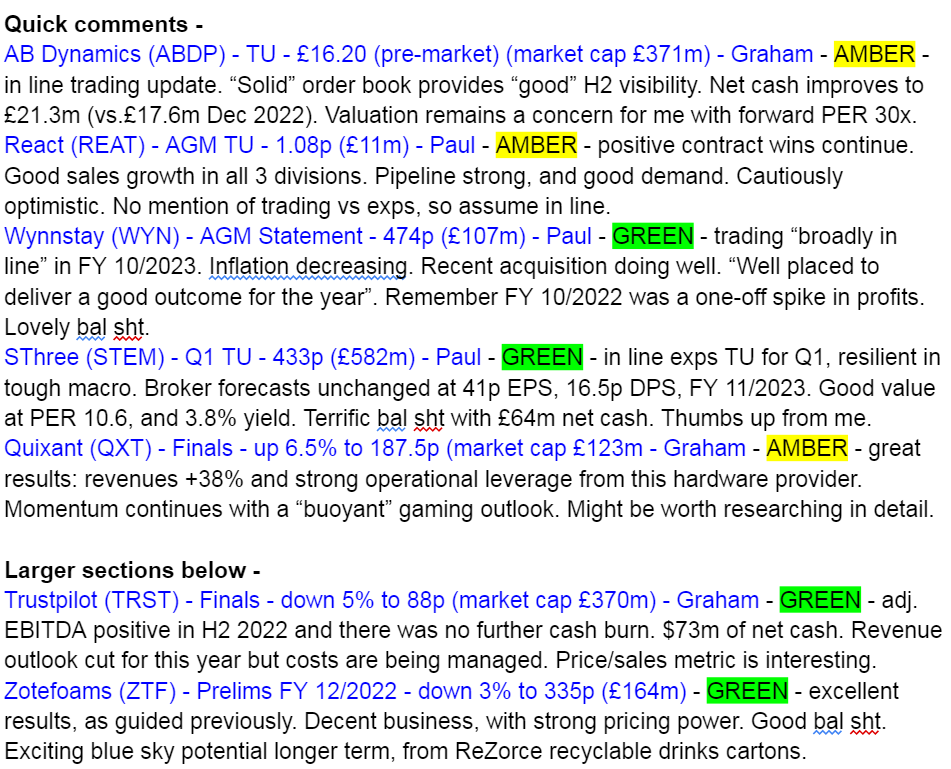

Masses of results are out this morning, so we'll work through as many as we can - we'll be doing mainly shorter sections today, to cope with the volume -

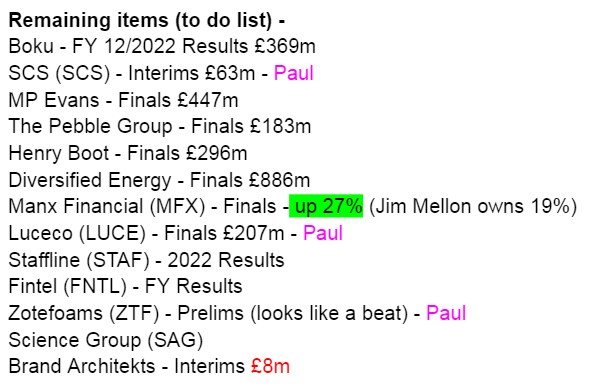

It's getting too big, so I've had to split this into two. Here's my remaining to do list, not sure how many of these I'll manage to cover today - oh dear, this overwhelmed me for today's report I'm afraid. I'll see what I can prepare this afternoon, for inclusion in tomorrow's SCVR.

.

Paul’s Section:

Zotefoams (LON:ZTF)

335p (down 3% at 11:18)

Market cap £164m

I’ve written a lot about this specialist foams company in the last year, and it’s one of my top watchlist shares ideas - just to clarify, these are not short-term trading ideas, but good solid, value/GARP companies that I think should do well long-term, and are priced sensibly in the meantime. There’s also an emphasis on good balance sheets, and decent divis, to reduce risk. Some will work, and some won’t, as is always the case with shares - nobody can predict the future with 100% success. I deliberately picked things that could weather a profit warning without becoming high risk too, given that we came into 2023 with a very wobbly macro backdrop. So far both the main tabs on my watchlist are fanning out into winners & losers (short-term), much as I would expect, and are slightly above breakeven YTD, so pretty similar to the market as a whole so far (very early days).

Getting back to ZTF, I reviewed its FY 12/2022 trading update here on 19 Jan 2023. It was another in a series of ahead of expectations updates, so the company has been on a roll for some time. Indications were for £127.4m revenues (up 26% on 2021), and PBT at least £12.0m, up 70%.

For more background, see my transcript here from Oct 2021, when I did an audio interview with the CEO, David Stirling.

Zotefoams plc ("Zotefoams" or "the Company" or "the Group"), a world leader in cellular material technology, today announces its unaudited preliminary results for the year ended 31 December 2022.

Revenue - exactly as guided, at £127.4m (up 26%) - importantly, a lot of the increase is a result of higher prices - so ZTF has demonstrated very well that it can cope with higher input inflation, and pass it on to customers, protecting profits. A very important strength. Think of the many companies where profit margins have collapsed in 2022, due to higher input costs. So for me, ZTF firmly sits in the category of companies that have demonstrated strong management, and pricing power, hence a quality company. Within the StockRank, Stockopedia recognises this too, with a decent Q score of 82.

Profit before tax (PBT) of £12.2m, slightly ahead of guidance, and up 74% on 2021. So a very successful year, as expected & previously guided, hence not price sensitive today.

Footnote 1 says this is after £258k of amortisation, which I think most companies would adjust out. So on a comparable basis to other companies, I would use PBT of £12.5m.

Basic EPS is up a whopping 129% to 20.6p, helped by a tax charge that the CFO says has normalised this year (after being unusually high last year). It’s expected to stay around 18% due to the ongoing benefit of R&D tax credits.

Diluted EPS is 20.2p, giving us a PER of 16.3x at 335p per share - that looks reasonable to me, provided that level of profitability is sustainable of course.

Comparing the basic, and diluted EPS is always useful, as it’s a quick way to see how much dilution there is from share options. It’s only about 2% here, which is fine by me. I personally don’t like to see share options exceeding about 5% dilution, and 10% is generally seen as a hard stop - anything above that is just out of control management greed.

There was a mix of headwinds & tailwinds in the 2022 results - e.g. energy obviously a headwind, as were raw materials prices. Forex (strong dollar) was a favourable tailwind, adding £2.5m to profit.

Profit margins now back up to pre-covid level, thanks to selling price rises/surcharges.

ROCE has risen to 10.1% (2021: 6.1%) which is looking better, I know this has been challenged by some investors. Personally I like stronger balance sheets, like this one where ZTF owns the freeholds for its main factories. That depresses ROCE, but makes it a much better, safer company to me, hence why I put less emphasis on ROCE than many other investors. Everyone’s got their own way of doing things, and there’s no strict right or wrong.

Broker forecasts for FY 12/2023 are about 19p EPS, near enough the same as 2022 - so a flat year, following an outstandingly good year.

Bear in mind also that ZTF is currently absorbing the startup/developments costs of its exciting ReZorce new product (fully recyclable drinks cartons), which were £1.9m in 2022. So I think this could be adjusted out as a separate activity, which would lower the PER by maybe 15% (there would probably need to be a partially offsetting tax adjustment, for R&D tax credits)

Dividends - quite modest, with a yield of just over 2%, but as you can see below, it’s been a reliable payer, with just one gap during the pandemic -

Balance sheet - is excellent in my view. £110m NAV, with very little intangibles, is more than enough, and as mentioned, includes the freeholds to its factories.

There’s a small pension deficit, but not material.

Net debt is £27.8m, (2021: £34.3m), which is more than covered by freehold property, so doesn’t concern me in the least. Also the bank offered extremely cheap interest rates (reduced) when it was last renewed, which tells us that the bank is also relaxed, as they tend to be when there’s rock solid security in the form of freeholds. The key multiple of EBITDA is also now much lower.

The factories have already been modernised in a previous multi-year capex programme.

So that’s all fine. So there shouldn’t be a huge capex requirement in future.

Outlook - this sounds fine to me, and seems consistent with the broker forecast of profitability in 2023 flat vs 2022. Hopefully with some surprise upside to come, which is what happened in 2022, with several upgrades throughout the year -

2023 has started well, with demand for our AZOTE polyolefin foam products in line with the previous year but with higher revenue from price increases implemented over the past twelve months. Sales of high-performance products are showing strong growth in the first few months, mainly due to the timing of shipments compared to the prior period. Sales across both businesses continue to benefit from a stronger US dollar.

The environment for input costs is less acute, with both energy and polyolefin polymer prices reduced from the peaks seen last year but remaining well above their long-term average. Prices for energy and energy-intensive commodities such as nitrogen remain uncertain, with forward-market pricing at a significant risk premium to spot. We are closely monitoring input costs and our pricing in the polyolefin foams business in particular.

Whilst uncertainty persists, we currently expect that, for the year as a whole, polyolefin foams volumes will be at a similar level to last year, with more challenging conditions in the UK and continental Europe offset by growth in North America and other geographies. Our High-Performance Products business should see further growth in footwear and continued strong growth in both our ZOTEK F and T-FIT insulation products.

Within our MEL business unit, focus has progressed to commercialisation trials for ReZorce cartons.

Overall, the Board remains confident about the future prospects for our business.

ReZorce - this is the exciting blue sky project, which is thrown in for free, the way I look at it. Latest comments today indicate that it’s about a year until full scale trials start. Small scale trials (about 1,000 cartons) have been successfully filled with water, but CEO commented, “It’s not perfect yet”.

The market size is mind-blowing, over $10bn globally pa, just for the materials for making drinks cartons (so think cartons of fruit juice, etc), although that figure might include other food & drink packaging too? It’s massive anyway, and ZTF claims to have something unique, that is fully recyclable, with IP protection. Existing drinks cartons are composite, so cannot be fully recycled.

It’s very interesting anyway, and the sort of thing that we usually see as a standalone AIM company that would run out of money every couple of years, dilute private investors down to dust, and eventually delist for a 99% loss for PIs.

The beauty of having a blue sky project within a successful company like ZTF, is that you’ve got high calibre management who can steer the project to success. Plus it can be done without any dilution, and funded by the existing business.

ZTF is seeking partners for the potential big scaling up of this project, which I suppose looks likely to be 2024 or 2025 onwards? I hope they don’t give away too much of the upside. If the project is a barnstormer, then there’s a lot to be said for ZTF itself doing a placing from a position of strength in due course, and keeping all the upside. Placings are not always bad. If it’s to fund something big, on the cusp of major commercial success, then it should be welcomed. Which ReZorce might be, but it’s too early to be sure.

My opinion - I’ve spent far too long on this, and haven’t even read the full RNS yet, just skimmed the key numbers.

I remain of the view that this looks a really interesting, buy and forget type of share, that should do well from the core business. Plus there could be exciting upside (in for free) from the ReZorce project. Hence a thumbs up from me. In terms of share price, it looks reasonable to me, probably priced about right for now in a wobbly macro environment, but with nice longer-term upside I reckon. Hence a thumbs up from me.

Stockopedia approves too, with a good StockRank of 81.

Graham’s Section:

Trustpilot (LON:TRST)

Share price: 88p (-5%)

Market cap: £370m (=$454m)

I will again refer readers back to our September 2022 SCVR where I laid out an investment thesis for this stock.

Time for an update this morning as the company has issued full-year results for 2022. This statement does include a revenue warning for the current year.

Financial highlights for 2022:

Revenue +23% at constant currency to $149m (very important to note that Trustpilot reports in US dollars, although 40% of revenues are from the UK)

Annual recurring revenue +20% at constant currency to $162m

Loss for the year $15m (2021: loss of $26m)

Year-end net cash $73.5m (2021: $93.2m)

I was curious to see the H1/H2 split of losses and cash burn, so I’ve had a quick look back at the most recent interim results.

In H1 of this year, the company suffered a loss of $9m. This implies that the loss in H2 was only $6m.

Additionally, the net cash position had already fallen to $73m by the end of H1. So there was no further deterioration in cash in H2.

Therefore, H2 looks like a significant improvement over H1.

For what it’s worth, Trustpilot’s founder-CEO confirms that the company achieved positive adjusted EBITDA in H2 (versus a loss of $5m in H1).

Let’s move on to the strategic highlights:

46 million new reviews added, bringing the total to 213 million

Active domains rose from 84k to 100k

11% increase in annual views of the “Trustbox” (the Trustpilot logo showing a company’s Trustpilot score) to over 100 billion.

Fewer fake reviews needed to be removed due to additional measures implemented in 2022.

All of this sounds good to me.

Current trading and outlook

As our business expands, we are expecting to move to adjusted EBITDA profitability and positive adjusted free cash flow in FY23. Our focus on sustainable growth, plus the impact of the investments we have made, give the Board the confidence that the business will deliver margin expansion in FY23, and it remains confident of the significant and growing long-term market opportunity.

As with one or two other companies I’ve covered recently, bottom-line profitability is still some distance away here. Positive adjusted EBITDA and “adjusted free cash flow” are not the same thing as profitability, although they may sometimes be treated as substitutes for the real thing.

In my previous coverage of this stock, I’ve acknowledged the ongoing losses here. But my suggestion has been that the enormous cash pile provides a long runway for profitability to be achieved.

Unfortunately, we also get a revenue warning in today’s outlook statement:

In the current year, we have felt the effects of the uncertain macro environment on new business and retention bookings in Q1, which will result in lower revenues from in-period bookings in FY23, and consequently we are more cautious in our outlook and expect a mid-teens percentage constant currency revenue growth rate in the current year, albeit with greater operating leverage and higher adjusted EBITDA than previously expected.

This sounds strikingly similar to what happened with the expectations for 2022. Trustpilot’s revenues didn’t quite hit expectations, but they “actively managed our business” to control costs and boost their profitability. So 2023 is shaping up to be similar.

International performance

In the UK, Trustpilot enjoys “highly attractive unit economics”, because it is here that (in Trustpilot’s words) “the viral network effort has taken hold”.

The question is whether Trustpilot can turn this into long-term international success.

Revenue growth in North America was only 10% for 2022, but it was a much more interesting 28% in the “Europe and Rest of World” segment. I thought this piece of commentary was worth mentioning here:

Whilst we do not need to invest in marketing in order to enter and grow within markets, during the year we chose the Italian market to test the potential for marketing as a means of accelerating our growth and have seen promising early results.

The campaign significantly increased Italian consumer's awareness of Trustpilot, rising from 18 per cent to 25 per cent at the end of November - and 28 per cent amongst the business audience. We look forward to tracking the longer-term benefits to our brand in Italy.

Management plan - in a separate RNS, we learn that the founder-CEO “wishes to transition into the role of founder and non-executive director where he will be an evangelist and brand ambassador”. The Board will look for a new CEO and an “orderly handover” will be arranged.

My view

Overall, there is slightly more bad than good in today’s update. The revenue warning perhaps shouldn’t come as a huge surprise, and the news on profitability offers some consolation. But it would be more satisfying to see the company’s profits improving through revenue growth rather than through cost management.

The news regarding the founder-CEO also requires some pause for thought. Is he looking to gradually move on from the business so that he can spend more time doing other things? Or is he simply looking for someone else to do the dirty work of day-to-day management, while he continues to work hard for the company’s big-picture success? I hope it is more of the latter than the former.

Valuation is also clearly still in the speculative end of the spectrum. But if I check the price/sales metric (using ARR for sales), I get a Price/Sales ratio of 2.8x. This is not expensive relative to what high-flying tech companies with quality earnings streams can achieve.

If I deduct the cash balance from the market cap to get Enterprise Value/sales, using the same method, I get a ratio of 2.3x. Again, this is not expensive for high-quality recurring subscription revenues.

Therefore, I’m going to continue to give the share the thumbs up. It’s much riskier than the companies I usually like, but I think it’s a genuinely unique business.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.