Good morning from Paul & Graham.

Pretty much a clean sweep today, with 13 companies covered. That leaves us clear to focus on some backlog items from earlier this week in tomorrow's report. Sorry for the delays, but as you know, we can't cover everything. So today's report is now finished.

We're going to attempt to catch up today, with a few missed items from yesterday, but obviously we can't cover everything, especially if it's just trading in line with expectations (hence not price sensitive, so our previous opinion would usually be retained).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Here are our quick comments (i.e. no sections in the main report below), and what's left on the to do list -

.

Paul’s Section:

Superdry (LON:SDRY)

108p (pre-market)

Market cap £89m

I’m rushing to get this section out before 08:00, as it looks significantly price sensitive - I suspect this share will open a good bit higher. Although it’s one of those RNSs where you have to read to the end, to get the full (good, but not quite so exciting as it initially looks!) story.

An upfront fee of $50m receivable by Superdry has been signed with a South Korean based company called Cowell Fashion Company Ltd, for the IP rights over the Superdry brand, in certain countries in the Asia Pacific (APAC) region. Cowell is listed on the S. Korean stock exchange, so we should be able to look up its finances. It is an established business which licences brands, and manufactures products.

The Agreement comprises the assignment of all of Superdry’s IP assets in the APAC region, but excludes India, Bangladesh, Pakistan, Sri Lanka, Australia and New Zealand where Superdry will retain its IP rights. Superdry will also retain all its IP rights outside of the APAC region.

The good bits - That’s a remarkable deal! Definitely pulling a gigantic rabbit out of the hat, for a business that is clearly struggling, despite the strenuous attempts of management to cover up that reality, in permanently upbeat presentations. I think this deal validates the value in the SDRY brand.

What is even better, is that it’s not as if SDRY is selling off the family silver. It is only foregoing £7.4m revenue, and £2.5m profit contribution (before central costs allocated) in this disposal. SDRY had previously attempted to expand into China through a partner, but abandoned it in 2020 after suffering “material losses”. So it makes a lot more sense to licence the brand to Cowell (for a substantial up-front fee, NB not yet received).

The bad bits - the net receivable amount is considerably lower, at £34m (after tax and costs).

Also, this is not going to be enough, and SDRY tells us it needs to raise more cash, which suggests to me that it’s probably trading badly still, and might breach banking covenants possibly? (why else would it need to potentially raise more equity?) -

The net proceeds from the Sale will be used to increase the strength of the Company’s balance sheet, boost liquidity, and fund its ongoing working capital requirements, including the implementation of a significant cost reduction programme. The Company is also considering additional steps to further strengthen its balance sheet in connection with its turnaround programme, which is being delivered in a challenging market, which could include a potential equity issue.

I should also point out that Cowell only has a market cap of about £290m, so paying a $50m cash up-front fee seems unusually large for a company of that relatively modest size. I'd want to see the cash actually in SDRY's bank account, before assuming this deal is a certainty.

My opinion - this is clearly a fantastic deal for SDRY, assuming that nothing goes wrong - remember the £34m net proceeds have not actually been received yet, and there are conditions to be met (shareholder vote, and lender agreement - but these should both be a formality. Also an escrow agreement has not yet been finalised).

The spanner in the works is that SDRY today says it could do an equity raise. The danger for private investors, is that today’s update could cause a large spike up in share price, followed quickly by a discounted placing to raise the additional cash the company has said it needs.

Recent news was that SDRY had called in Interpath Advisory to help it restructure & reduce costs. Again, suggesting a distressed situation.

Raising more cash doesn’t solve the problem of poor trading, which is SDRY’s fundamental issue. The last update on 27 Jan 2023 showed stabilised trading in the stores, but a collapse in wholesale orders. We’ve not heard anything since, so I’m assuming nothing has improved much, otherwise the company would have been shouting about it in today’s update.

Hence I suspect a big jump in share price today, which could provide a nice exit point for nervous holders, if it really goes bananas. SDRY seems to attract over-excitable punters, probably because the CEO/Founder is permanently super-bullish, and we’ve seen huge spikes up in share price before here (which tend not to stick). So today could be a really exciting day for holders.

But the company is not out of the woods yet, and we’ll have to see what terms an equity raise happens on. So enjoy the surge today, but keep expectations grounded, as this deal hasn’t fixed the underlying problem of poor trading. It’s just made it a lot less likely that the company would go bust if poor trading continues.

Each year that the company survives also means more onerous leases expire. Perhaps the long-term solution is to be a wholesale & brand licensing business, with just a handful of flagship stores?

Fevertree Drinks (LON:FEVR)

1150p (up 7% at 08:31)

Market cap £1.34bn

Preliminary Results to 31 Dec 2022

I’m happy to have a quick dip into mid-cap territory occasionally, if a company looks interesting. This premium branded non-alcoholic drinks (mixers, eg. tonic water) company has always intrigued me, and reached a sky high valuation in its heyday peaking at c.3775p in late 2018. Is it a bargain at less than a third of that price now?

In a word, no.

FY 12/2022 results key points -

Revenue £344m - split roughly evenly between 3 main markets of UK, US, and Europe.

Adj EBITDA fell from £63.0m in 2021, to £39.7m in 2022, due to cost increases - so a lower gross margin, and increased admin exps.

Profit before tax was £31m in 2022 - not much for a market cap of £1.34bn.

Good balance sheet, with NTAV of £186m, including £95m net cash (down sharply, as a 42.9 special divi was paid (May 2022) from surplus cash, not from cash generation in the year).

Guidance for FY 12/2023: revenues £390-405m, EBITDA £36-42m (so flat on 2022).

Valuation - it did 21.3p EPS in FY 12/2022, giving a PER of 54x so clearly investors are assuming a big increase in future profits.

Cashflow was poor in 2022, with operating cashflow down, and that was mainly sucked into increased inventories.

My opinion - I’ve seen enough to be clear that this is not a value share! Is it a GARP (growth at reasonable price) share though? Possibly. If we assume that it can pass on cost increases to customers (which it says is planned), and continue growing the huge US market, and achieve a dominant position there, as it claims to have done in the UK, then this share might be a long-term winner. The largest 2 shareholders are Lindsell Train, and Fundsmith, which (certainly in Fundsmith case), my perception is they focus more on long-term leading brands, and aren't shy about paying top dollar for the best companies, then sitting for the long-term for the companies to grow into the valuations.

Growth in the US was good in 2022, up 23% to £96m revenues.

Drinks brands that are seen as market leaders can have very big values.

Overall, I think the current market prices in too much future upside for me. FEVR has made amazing profit margins in the past, but then input cost inflation, and higher freight costs (since abated though) hit profits. So investors really have to hope that it beats existing, flat, forecasts for 2023 profitability. Why would you pay a PER of nearly 60x when there’s so much uncertainty? Thumbs down from me, purely on excessive valuation short-term. Long-term, it could be a big winner. I’ll keep an eye on it. Growth companies are never cheap though are they!?

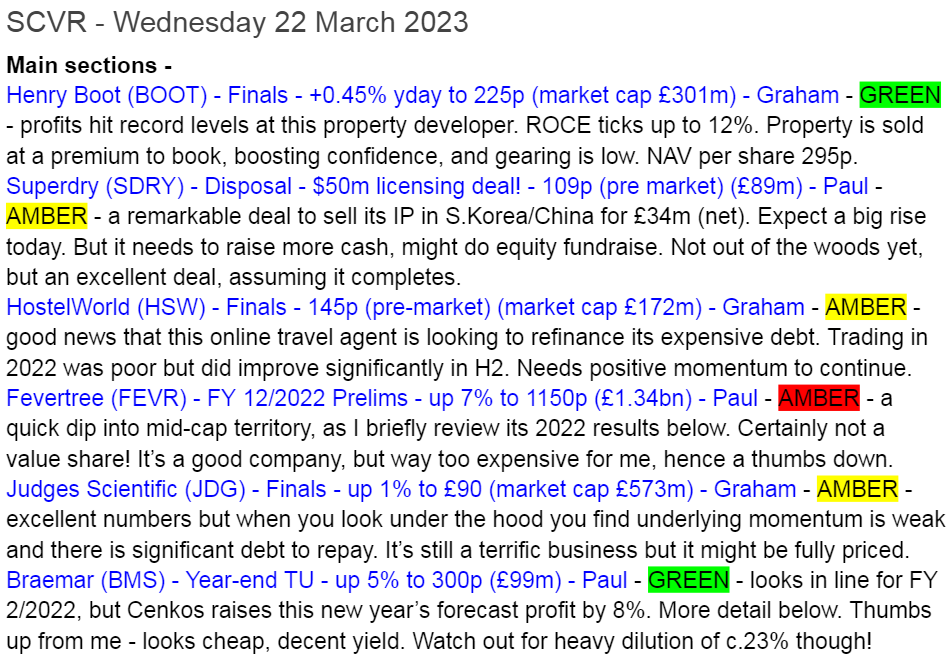

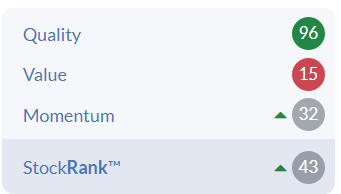

The StockRank exactly mirrors my thoughts - great quality, but poor value -

The long-term chart since it listed is remarkable! Timing was everything here -

Braemar (LON:BMS)

300p (up 5% at 10:04)

Market cap £99m

Trading update - a record year for Braemar

It’s certainly eye-catching when companies put something good in the actual title of the announcement! I expect we’ll see more of this happening as PRs latch onto the idea.

Braemar Plc (LSE: BMS), a provider of expert investment, chartering, and risk management advice to the shipping and energy markets, today announces an update on trading for the year ended 28 February 2023.

I think I’m right in saying there are 2 listed shipping services companies, a small one (Braemar) and a bigger one Clarkson. Both have been trading well, the sector seems buoyant.

I last looked at Clarkson here on 6 Mar 2023, and took a neutral view - good performance, but the deal-breaker for me is that over half the massive cash pile is apparently ear-marked for staff bonuses.

I last looked at Braemar here on 14 Feb 2023, complaining that its trading update was annoyingly vague, but positive in tone. Concluding that Braemar looked a good company, at a reasonable price.

Let’s hope we get some clearer guidance in today’s year end update -

Revenue at least £150m (up 48%+)

Underlying operating profit of £20m+ (doubled from LY) - very impressive indeed! Although this looks in line with expectations, looking back to a Cenkos note from Nov 2022.

Divis - 4p interim, 8p final, so 12p total = a decent yield of 4.0%, and more importantly I think this looks comfortably affordable (more than twice covered by earnings), and given the Feb 2023 net cash position of £6.9m (reversed from net debt of £9.3m a year earlier).

Balance sheet - just quickly checking the last reported one (Aug 2022), and it’s adequate - not strong. With NTAV of only about £2m. So depending on timing of monies in & out, I reckon it could be using its overdraft intermittently still. Remember that a year end net cash/debt figure is only a one day snapshot, often massaged into looking good.

Outlook -

Trading in the first few weeks of the financial year has started well and the board looks forward to the rest of the year with confidence.

Share options - this looks to be a problem, because in H1 there was a huge shortfall (far more than usual of say 5-10% for most companies) of over 23% between diluted EPS and basic EPS. So this needs to be checked out for anyone buying or holding this share, to make sure you’re comfortable with what looks like wildly excessive generosity to employees (same as Clarkson's huge bonuses).

My opinion - I need to see the full numbers in due course to give a more detailed view on Braemar.

It’s clearly had an excellent year in FY 2/2023, helped to some extent by dollar strength. So we need to understand better how much of the big profit growth is sustainable, and how much is one-off in nature? That’s the key area to research thoroughly.

As the numbers stand, it looks very good value. Cenkos (many thanks) is forecasting 36.1p fully diluted (essential to use the diluted number) EPS for this new year FY 2/2024, which at 300p puts Braemar on a PER of 8.3x

Together with a forecast 13p divi, that’s a yield of 4.3%

So it looks a decent value/GARP share, providing these strong numbers are sustainable, and not just a bonanza year due to external factors. I don’t have a view on that, but am giving a thumbs up for the numbers as they stand.

Graham’s Section:

Henry Boot (LON:BOOT)

Share price: 225p (+0.45%)

Market cap: £301m

Let's check in on the full-year results for 2022 from this property developer.

Revenue +48% to £341m, driven by the disposal of thousands of plots and the completion of urban development works.

Underlying profit nearly doubles to £56m

PBT +30% to £45.6m.

PBT was impacted by over £10m of negative revaluations caused by falling commercial property values.

ROCE - the company calculates its own ROCE as 12%, within its 10-15% target range.

NAV per share - increases by 5% if you exclude gains on its pension scheme. Including those pension gains, NAV per share increased by 10.5% to 295p. The share price is at an interesting discount to this level.

Net debt - increases to £48.6m, “following strategic investments made during the year”.

The balance sheet shows £578m of total assets (almost entirely tangible) offset by £184m of total liabilities. Given the large surplus of assets over liabilities, it’s hard for me to imagine that BOOT’s net debt position should be a concern. The company says that its current level of gearing is at 12%, “at the bottom of our 10-20% target range”.

Speaking of the balance sheet, Boot also reports the following news within its “Property Investment and Development” division:

Well timed sales within the investment portfolio of £29.6m, at an average 17% premium to the last reported book value, contributed to total return outperformance of -1.5% versus CBRE Index of -9.1%

We do have to be careful not to get too excited about this, because the sales which took place might not be representative of the group’s portfolio as a whole. Indeed, these sales that took place at a 17% premium to book value are likely to represent a best-case scenario in terms of the value that can be realised. But I still think it augurs well for the value of the balance sheet in general, if these sorts of premiums can be achieved.

Land bank - is 96,000 plots, up from 93,000. Unfortunately, only 9,000 plots have planning permission. The CEO has this to say on the subject:

I am increasingly convinced that the UK planning system is in need of urgent reform. The delays and complexities can no longer be blamed on COVID. Whilst we would derive greatest satisfaction from a more efficient system on account of the benefits this would bring local communities, the challenges of the current situation mean that the land we successfully promote and the expertise we bring in navigating the planning system remain increasingly in demand.

Outlook

Profits in 2023 are set to be “more subdued” than 2022, due to the economic slowdown, but BOOT is already seeing signs of recovery.

The company’s remarks on the economic outlook should be of interest to investors generally, so I’ll quote them extensively:

Whilst the immediate outlook is uncertain, a number of leading indicators suggest that the economic slowdown will not be as severe as forecasts in the final quarter of last year predicted. It looks increasingly like interest rates are close to the so called 'pivot', we are seeing early signs that supply restrictions are lifting and with that some prospect of cost pressures easing.

There are early signs that our markets are improving. Occupier demand for I&L [GN note: Industrial and Logistics] has remained resilient, and whilst yields moved out quickly during the second half of 2022, there are investors already looking to buy, tempted by the strong fundamentals of the market.

Likewise, whilst data is available only for the first two months, housebuilders generally and SBH [GN note: this is Stonebridge Homes, a joint venture by BOOT] specifically, have seen a partial recovery in home buyer interest this year from the lows experienced in the final quarter of 2022. The march of the BtR sector, both in terms of customer and investor demand, continues.

My view

I’ve seen a lot to like here. We have a share price discount to NAV firstly, which I’m always happy to see.

Then we’ve got the company reporting a decent ROCE of 12%, and management who are keen to keep it at a respectable level. BOOT’s StockReport suggests that their ROCE is more often than not at a reasonable level.

Also from the StockReport, I note that BOOT passes two bullish screens:

Finally, I like what I saw on the balance sheet with a huge surplus of assets over liabilities, so that I’m not concerned about the level of gearing.

I’ll give this company the thumbs up, thinking that it might be oversold due to economic worries. I can’t predict the economy, however, and it’s something that’s beyond BOOT’s control - in a severe recession, these shares could get cheaper still.

Hostelworld (LON:HSW)

Share price: 145p (pre-market)

Market cap £172m

We looked at this online travel agent when it issued its full-year update in January. This morning sees the release of its full 2022 results.

Highlights:

Revenue €69.7m. Comparisons with 2021 are not relevant due to Covid impacts. Revenues from 2016-2020 were always in excess of €80m.

“Profitable adjusted EBITDA” - a good achievement for the year after a very poor H1, but the operating loss is still €13.6m.

Average booking value (ABV) is €14.90, up from €12.11 in 2021 due to “bed price inflation”. ABV hadn’t moved much for several years.

Balance sheet

I’ve been banging the drum about Hostelworld’s high-cost €30m loan. There is good news on that front this morning as we learn there is a refinance process underway:

The Group has borrowings of €31.1m (2021: €28.2m). In February 2021 the Group signed a €30m 5-year term loan facility with certain investment funds and accounts of HPS Investment Partners LLC (or subsidiaries or affiliates thereof). An amount of €28.8m, net of original issue discount, was drawn down on 23 February 2021. The facility bears interest at a margin of 9% per annum over EURIBOR. The Group will look to refinance the facility in 2023 to obtain lower margin interest rate costs.

This could help change my view on the stock, as I shuddered to think of the company paying millions of euros of interest while also generating an operating loss.

With a market cap of almost €200m equivalent, perhaps a small equity raise would help to fix the problem without diluting shareholder value too much?

Outlook

In 2023 we will continue to develop and progress the opportunities enabled by our social network strategy, while remaining committed to delivering high levels of operating performance and cost discipline. Hostelworld operates in a resilient and growing category with a loyal customer base that has a strong desire to travel and meet other people despite the uncertainties the economic cycle may present. We are encouraged by the trends we have seen since the start of the year and believe that the business is firmly on track to deliver the targets for FY 2023 presented at our Capital Markets Day in November 2022.

My view

I’m going to stay neutral on this stock for the time being.

I’m encouraged by the very positive trend of improved trading in H2 2022, and a refinancing of its overly expensive debt could cut the company’s interest bill significantly.

On the other hand, I’m still sceptical of the idea that the company is building a valuable social network - although I do think that it’s a nice bonus feature to help hostel travellers to meet each other online.

Finally, the financial results here have been poor for some time, albeit for reasons that were beyond the company’s control. Let’s see if the positive momentum can continue.

Judges Scientific (LON:JDG)

Share price: £90.00 (+1%)

Market cap: £573m

We have frequently covered this highly successful acquirer of companies in the scientific instruments sector. This morning it published full-year results for 2022.

Highlights:

Revenue +24% to £113m

Adjusted operating profit +60% to £30m

Statutory operating profit +17% to £18m

The very large acquisition, Geotek (£80m), “significantly enhanced full year earnings and achieved the maximum earn-out”.

The company finished the year with net debt (excluding leases) of £52m.

As I remarked at the time of the full-year update, there are signs of a slight loss of underlying momentum in the sense that organic order intake increased by only 0.5% year-on-year. A large part of the blame seemed to relate to Covid-related problems in China.

So I’m looking for signs of improvement on this front. The company says the following with respect to its outlook:

As we look ahead, the macro environment remains uncertain, with differing factors impacting our business both positively and negatively. Whilst we are encouraged that the market in China is more stable as Covid restrictions are eased and we continue to see Sterling benefit UK exporters, we are cognisant of continued geopolitical uncertainty and supply chain challenges, alongside higher levels of inflation and interest rates. In addition, the increase in UK headline corporation tax from 19% to 25% from April 2023 will affect EPS going forwards…

Our Group started the year with a record Organic order book and has since benefitted from solid growth in Organic intake versus the first two months of 2022.

My view

The company admits that the post-Covid recovery is “still a work in progress”, and I agree.

While operating profit bounced up to £18m, and cash from operations improved from £20m to £24m, this was done at a very significant cost that leaves the company with an unusually high debt load.

Return on invested capital has also reduced due to the Geotek acquisition.

However, I calculate the company’s Return on Equity (using unadjusted figures) as 26%, which is still excellent. There remain signs of high quality at Judges:

However, the ValueRank is only 4, and I also believe that the valuation is currently rather stretched. I was already nervous about it when the market cap was c. £500m (see my previous comments). As it approaches £600m, I’m forced to take a neutral stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.