Good morning, it's Paul & Graham here!

Today's report is now finished.

I reviewed SCS last night, and will shortly publish that below, once I've had a coffee (EDIT: that's now published, as always, do let us know your views too, in the comments section, especially if you disagree, we like bull-bear debates!)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

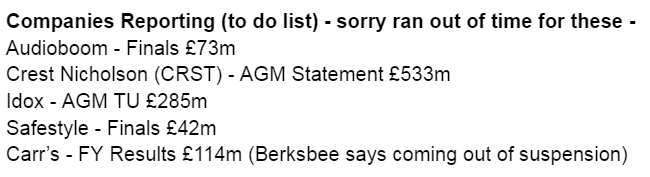

This is the stuff we didn't manage to cover today -

Paul’s Section:

Reach (LON:RCH)

Waiver of award

This impressed me, and is worth a mention. Perhaps more companies where the share price has seriously under-performed should also see Directors waive their share options?

Long Term Incentive Plan 2012 ("LTIP")

Waiver of Award Granted to Jim Mullen

On 27 March 2020 the independent trustee (the "Trustee") of the Company's Employees' Benefit Trust granted awards under the LTIP to acquire ordinary shares in the capital of the Company to Jim Mullen for the amount of 750,258 shares.

The LTIP award is scheduled to vest on or after 27 March 2023 in accordance with the LTIP rules subject to satisfaction of the applicable Performance Conditions relating to cumulative adjusted net cash flow and relative total shareholder return, as measured over financial years 2020, 2021 and 2022.

As noted in the Company's 2022 Annual Report, the indicative vesting outcome for the 2020 LTIP awards was 46.43% of maximum which would otherwise have resulted in the 2020 LTIP award held by Mr Mullen vesting over 363,274 shares. Despite this positive outcome, Jim Mullen asked that his 2020 LTIP award not vest and that his award be cancelled.

On 21 March 2023, the Company received, and the Board has accepted, a waiver by Jim Mullen of his 2020 LTIP award together with all related rights. No compensation shall be paid to Mr Mullen in respect of the waiver.

Bravo to Mr Mullen. Let's see more Directors waive LTIPs too, when other shareholders are suffering.

SCS (LON:SCS)

187p

Market cap £64m

Looking back through my notes, I was green on SCS on 3 Feb 2022, when it reported an improvement in recent order intake, and a confident outlook for FY 7/2023. Plus a cash pile of £77m. I did wonder if the share price might need to consolidate or retrace at 222p, which it has done in the recent general market sell-off, down to 187p currently.

Prior to that, we looked at SCS on 10 Jan 2023 here, when it announced a very cheap acquisition from an administrator of an online competitor.

So it’s a share I view favourably, but that might change depending on what the latest numbers look like - here we go -

ScS, one of the UK's largest retailers of sofas, flooring and furniture, presents its interim results for the 26 weeks ended 28 January 2023 ("period" or "H1 FY23").

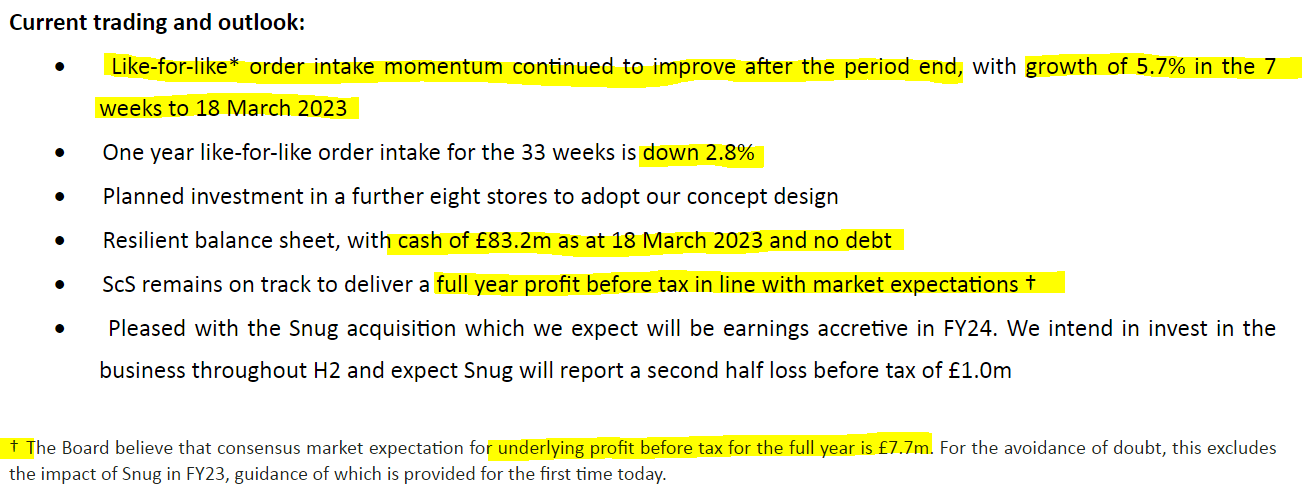

SCS PERFORMANCE IN LINE WITH EXPECTATIONS

ACQUISITION OF SNUG DIVERSIFIES GROUP AND POSITIONS IT TO FURTHER INCREASE MARKET SHARE

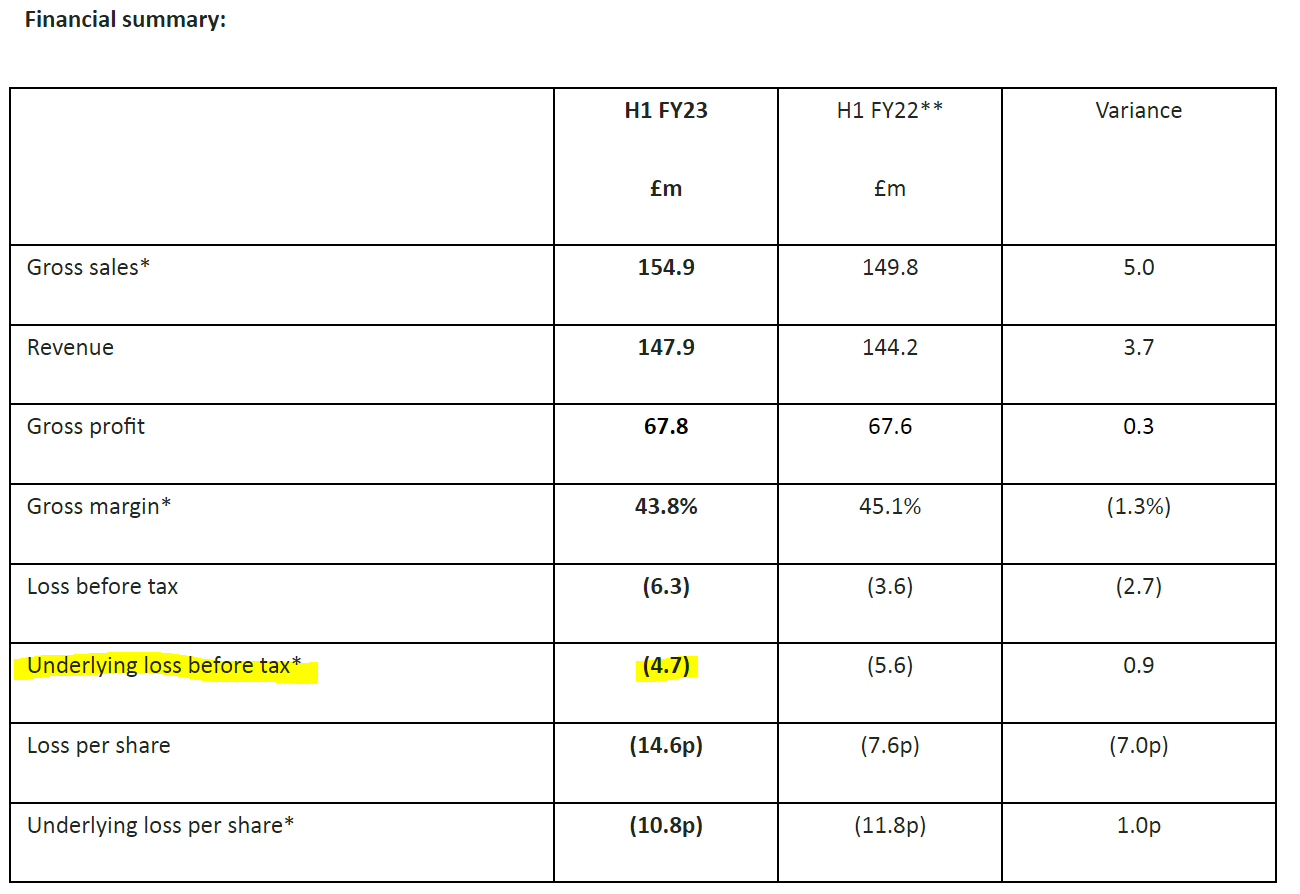

Oh, it’s a loss, that’s a bit disconcerting.

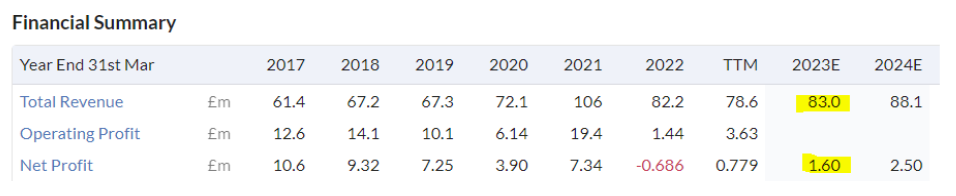

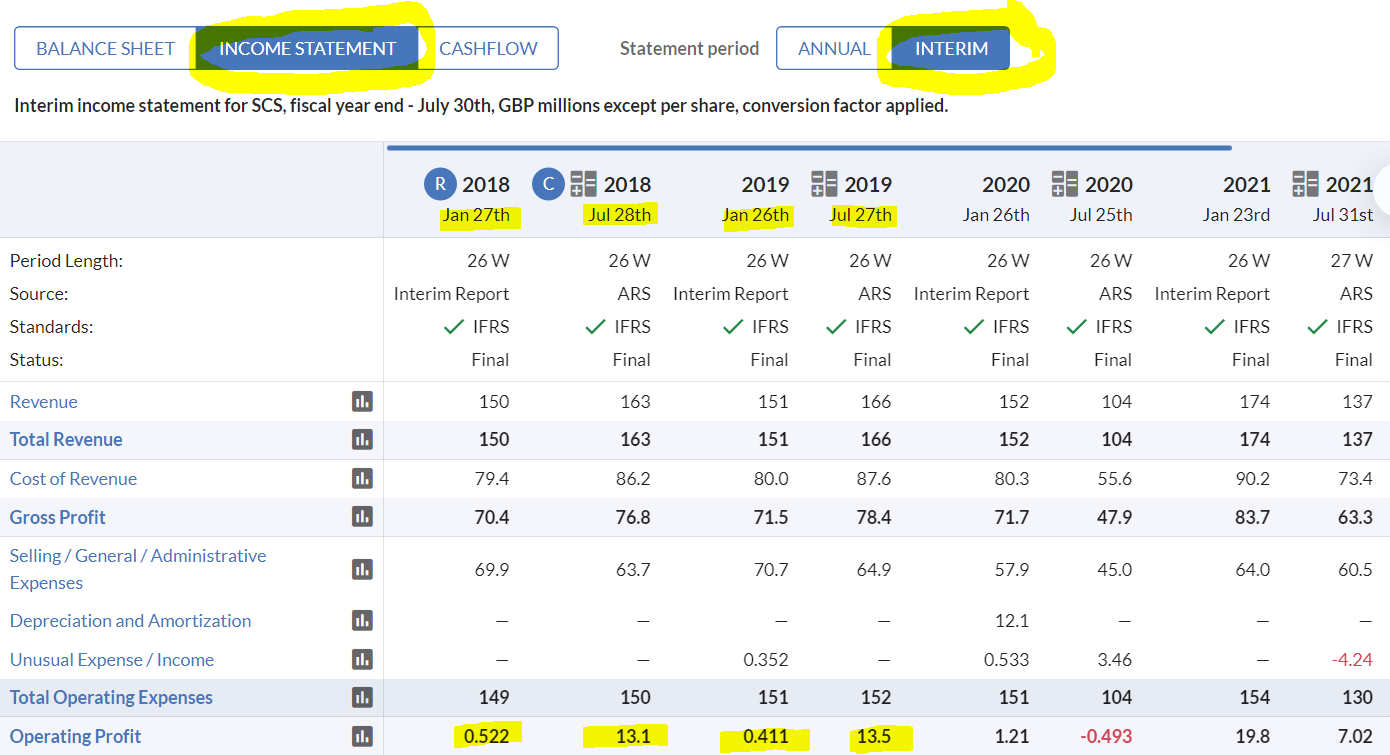

I’ve looked back pre-pandemic, on Stockopedia’s useful H1 H2 comparison tool here, and as you can see below, in both 2018 & 2019 it was a tiny bit above breakeven in H1, and all the profit was made in H2. So there’s a strong H2 seasonal weighting to profitability. Even so, a £4.7m underlying loss in H1 2023 is a deterioration from the pre-pandemic H1 performance.

(clickable link on screenshot below) -

Obviously the numbers & seasonality above then went haywire during the pandemic, but should now be settling down to some kind of normality.

The company confirms seasonality, and why it happens -

...typical of H1 performance, which includes significant marketing expenditure to support the winter sale and where profitability is substantially H2 weighted

I suppose this is because the orders taken over the winter sales period don’t actually get recognised as revenue until H2, when the product is delivered (after a delivery delay that extended out to something like 3-6 months during the pandemic in this sector, where product is made to order).

Reduced gross margin it says is due to “decluttering” as display stock was sold off.

Cash pile of £76.9m is fantastic. It’s true that this is almost matched by trade creditors of £75.7m, but both numbers perpetually rotate, so there should always be a substantial cash pile on SCS’s balance sheet in good times or bad. Larger competitor DFS has taken advantage of this favourable working capital structure to spend all of its cash pile, and max out its bank borrowings too, to pay divis & buybacks. Compare the two companies, and you’ll see that SCS’s approach is super-cautious.

Although note SCS has done significant share buybacks, reducing its share count from around 41m in 2019, to just 33.8m shares in issue now. This is very important, as it enhances shareholder returns of EPS and dividend yield.

The RNS of 17 Feb 2023 says the £7m share buyback programme has completed. What a smart move that was, I wish they had done more - management is too cautious I think -

The New Programme, together with the previous programme announced by the Group on 22 March 2022, has seen a total of 4,057,981 ordinary shares repurchased and cancelled, representing 10.7% per cent of the Group's issued share capital as at 22 March 2022. In total, ScS has returned £7 million to shareholders.

The Group's issued share capital is currently 33,954,674 o rdinary shares, each with one voting right.

Balance sheet - is absolutely fine, with about £35m NTAV.

Outlook - improving, but still not great, I’d say - but given the wobbly macro picture, cost of living crisis, etc, maybe I’m expecting too much? -

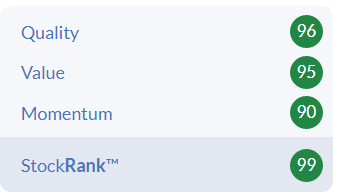

Broker consensus is about 16p EPS for both FY 7/2023, and FY 7/2024. Put that on a PER of say 10-12, and I get a theoretical share price of about 160-192p. The current price is 187p, which is within that conservative range. I’ve ignored the benefit of the balance sheet groaning with cash in that calculation too.

My opinion - this looks very solid to me. Shares possibly priced about right for now? But you’ve got the upside from a recovery in for free, and all the downside protection from a very safe balance sheet also thrown in for free.

Whereas with DFS, which I looked at recently, earnings forecasts have fallen more than SCS’s, the forward PER is about the same, but you’re getting all the financial risk of a hideously negative balance sheet laden with debt.

Hence I feel risk:reward is much better with SCS.

Thumbs up from me, although I’m not feeling any particular need to rush in and buy SCS right now, given all the current uncertainty in markets generally. Longer term though, it should recoup the 300p level in due course once earnings rise again. Plus it's paying nice divis whilst you wait. An attractive set up, maybe I should buy some?

Stockopedia’s computers absolutely love it -

Portmeirion (LON:PMP) (I hold)

353p (pre market)

Market cap £49m

I last looked at PMP here on 12 Jan 2023, when it looked significantly under-priced at 323p per share, and issued an in line trading update for FY 12/2022, which put it on a PER of only 7.2x the expected c.45p EPS.

With a decent balance sheet, and energy hedged until Q1 2024.

Accordingly, I bought a standard position size for my own portfolio, when the proceeds came through from selling my Seraphine (takeover bid) in the market came through earlier this year.

Today we get the FY 12/2022 results, let’s have a look -

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, is pleased to announce its preliminary results for the year ended 31 December 2022.

Another record sales year shows continued resilience of our brands and strong global demand

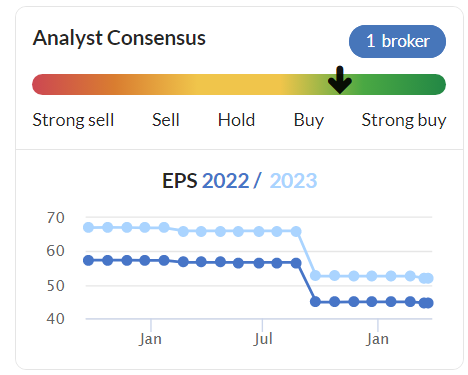

46.6p EPS is slightly ahead of the 45p I was expecting, so this is in line really (a slight beat against lowered [in Sept 2022] expectations).

Why is the share price only 353p, when the highlights table below seems to show a business that’s recovered from the pandemic, and is operating normally, and achieving solid growth vs last year? Surely this should be rated on something like 12-15x PER? (that would equate to a share price of 559-699p).

So at first sight 353p looks the wrong price to me (much too low, and a PER of only 7.6) , unless there’s something horrible in the outlook section, balance sheet, or the adjustments? I’ll check all of those. But so far, this looks like a bargain that’s been hiding in plain sight since January.

InvestorMeetCompany webinar is 11:30 this coming Monday, 27 March. I tend to watch the recordings later, as watching them live stops me doing work here, and there aren’t usually any surprises in webinars. Although I find them invaluable just for picking up the general tone of management, and sometimes throwaway remarks or answers to good questions can be quite interesting in firming up my view either way.

Profit margin - reiterates its aim to increase this -

Headline operating margin1 increased from 7.2% to 7.8% and we reiterate our long-term ambition to improve the operating margin to 12.5%.

Adjustments to profit - headline PBT is £8.0m, which reduces to £7.0m statutory PBT. The main difference is £1.0m of restructuring costs. That’s the same as the 2021 restructuring costs figure, so it could be argued that these are normal costs of making the business more efficient, which might be ongoing. So perhaps we should value the share on the more conservative statutory figure? That’s 40.35p (note hardly any dilution from share options) instead of the 46.5p diluted adjusted figure. The PER at 370p per share is still cheap at 9.2x using the statutory, diluted profit. So it stacks up well, even if we reverse out the adjustments.

Tax charge is much lower this year at £1.4m (2021: £2.7m) which obviously flatters EPS growth. We’re seeing this at quite a few companies actually - it’s explained by PMP -

The charge for taxation for the year was £1.4 million (2021: £2.7 million), an effective tax rate of 20% (2021: 46%). The reduced tax charge is mainly due to the one-off impact of the change in UK corporation tax rate from 19% to 25% in the prior year which caused an additional deferred tax charge of £1.1 million.

Inventories - planned reduction should free up cash in 2023, which I like - it made sense to raise inventories during supply chain difficulties -

Inventory levels remain elevated at year end to avoid supply chain disruption and this is expected to normalise in 2023.

Outlook - the middle point seems to contradict itself, so asking for clarity on this would be a good question for the webinar -

In addition there are signs that global supply chain disruption and general overstocking in retailers are subsiding. Similarly global shipping costs are trending back to historical levels.

See Research Tree for updates from 2 high quality brokers (Singers & Shore, many thanks).

Singers has a rise from 2022 actual 46.8p, to 51.7p for FY 12/2023, so at 370p (correct at 09:14) the 2023 PER is only 7.2x - very significantly undervalued, in my opinion. Particularly given that the outlook comments are pretty solid (in line so far this year, and good order book). So I’d say the risk of a profit warning looks quite low here. Although you can never rule out profit warnings at any company - as sometimes things that you couldn’t have foreseen can go wrong. Hence why we diversify our portfolios, knowing that the odd one will go wrong (especially with small caps, more than the odd one!).

Balance sheet - the commentary explains that inventories are elevated due to supply chain issues, but expected to reverse in 2023. £41.1m is indeed a bloated figure for inventories, so we do need to see that come down, as it’s tying up a lot of cash

A good question for the webinar would be to ask for more colour on the inventories, and how rigorous the audit testing was for slow-moving or obsolete stock? Will much of it have to be sold at reduced prices, to clear it? (which could hit 2023 margins)

Net debt is £10.1m, with £15.7m headroom on the bank facility.

NAV is £66.7m. I take off intangible assets, of £18m, to give NTAV of £48.7m - healthy for the size of company.

Overall, all the other numbers on the balance sheet (apart from inventories) look OK to me.

There’s a tiny pension scheme asset, but it required a £900k contribution from the company, so as usual with ridiculous pension scheme accounting rules, a surplus is actually a deficit.

Capex was £4.1m, similar to last year’s £4.5m. Note that £1.9m (up from £0.8m in 2021) was capitalised into intangibles, so I’d like to know what that is - website development costs maybe?

Cashflow statement - tying in with my balance sheet comments, the cashflow shows that almost all of the operating cashflow got sucked into increasing inventories. That should unwind, but we need to be vigilant in 2023 to ensure that does actually happen.

My opinion - very positive. There could be unconscious bias, as I bought some shares personally earlier this year, hence why we disclose if we hold anything. I am happy to hold, and looking forward to collecting my divis, and seeing the shares re-rate in due course, which looks likely to me (providing nothing goes wrong).

It’s a nice company, well-managed I think (the CEO strikes me as a safe pair of hands), well-financed, cheap PER, and decent divis whilst we wait. So pretty much a classic value share I would say. Thumbs up from me. I think there could be c.50% upside on this share, just to get it to a reasonable valuation.

Wickes (LON:WIX)

142p (down 2% at 09:40)

Market cap £369m

Wickes is a chain of home improvement retail sheds in the UK.

I last looked at WIX here on 1 Feb 2023, concluding that it looked an attractive value share, at 152p. Its FY 12/2022 guidance was £72-76m PBT, with trading in line.

On to today’s results. There’s a slide deck available here, which can be easier to digest than reading a whole results announcement in detail (but might gloss over negatives!)

Key points -

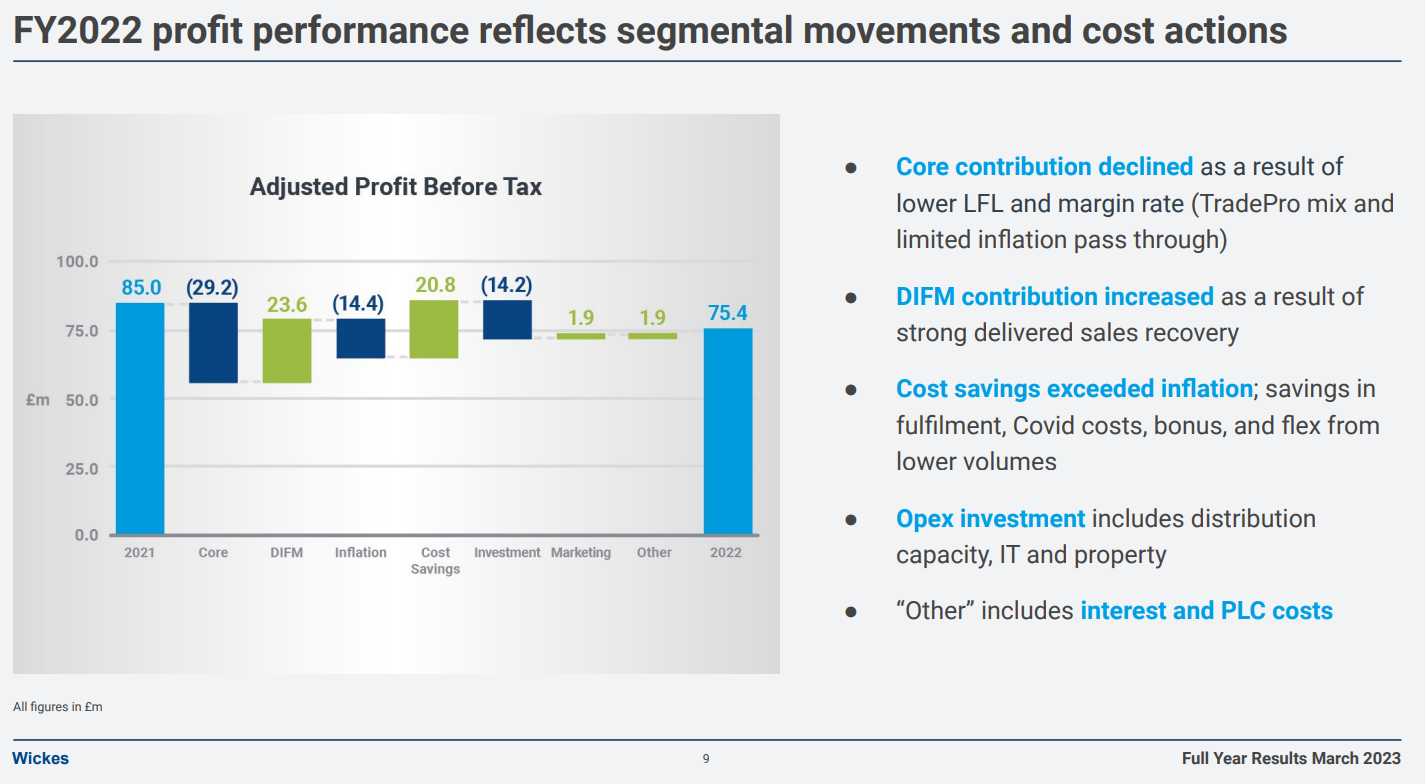

Adj PBT has come in at £75.4m (down 11% on 2021), nicely near the top of the previously indicated range of £72-76m.

Adjustments are big - adj PBT of £75.4m turns into statutory PBT of £40.3m. The 2 big adjustments are £24.4m IT separation costs (re demerger from Travis Perkins), and £15.4m leases RoUA impairment. These are adjusted out presumably as they’re seen as one-offs, and not underlying trading.

Revenues £1,559m - a sizeable business.

This profit bridge is useful (slide 9 in the deck linked to above) - it tells me most importantly that profit held up quite well, with inflation more than offset by cost savings.

I wish abbreviations would be accompanied by a footnote. I think DIFM is goods delivered to customers (as opposed to the “core” retail sheds sales)

Do have a look at the rest of the slides, as there’s useful information in there.

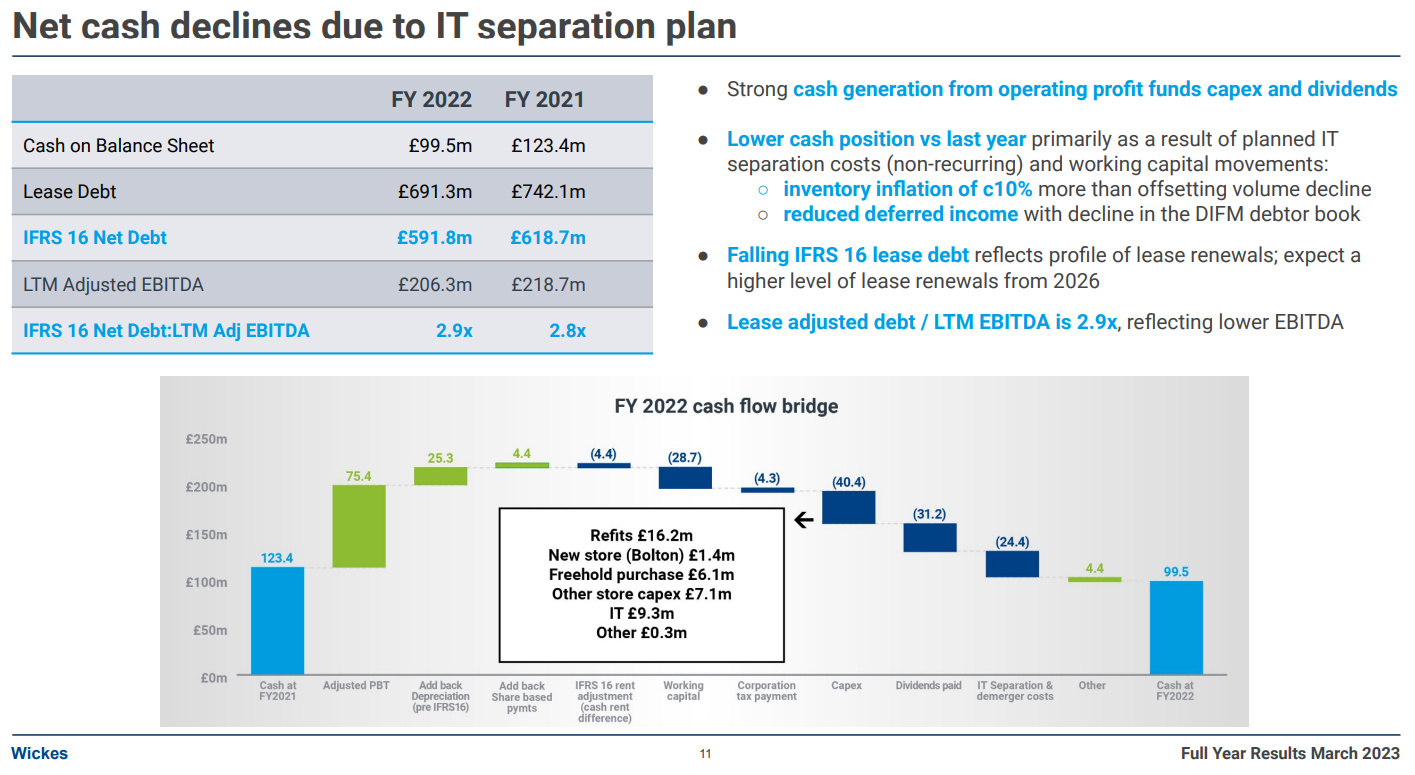

This cash bridge is fantastic, we like bridges here at the SCVR - a really easy to digest visual version of the cashflow statement -

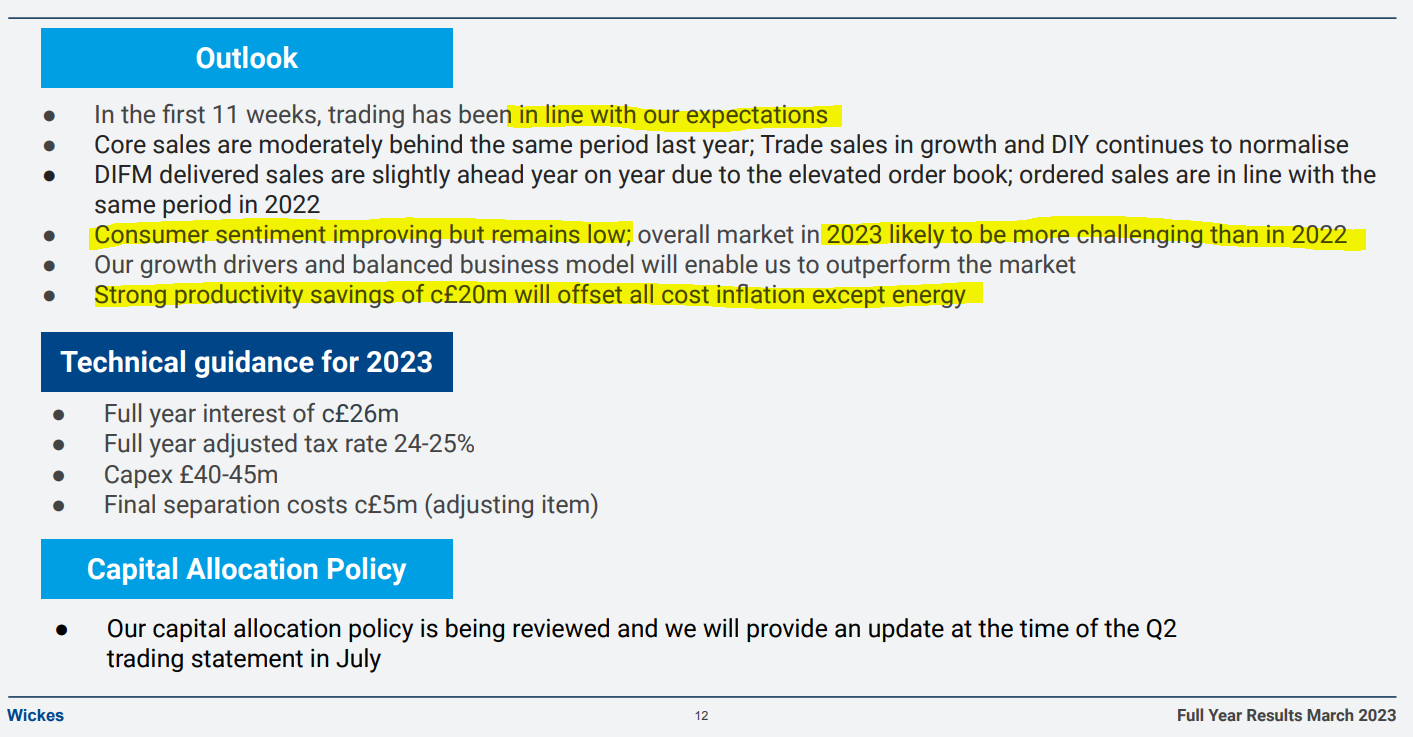

Outlook - in line with expectations so far for FY 12/2023. Again, the slide deck explains this clearly (my highlighting added) -

Balance sheet - NAV is £164m.

My adjustments to this are - remove goodwill & intangible assets = £25m.

NTAV is therefore £139m.

Remove IFRS 16 lease entries, a deficit of £(148.9)m, which boosts NTAV to £288m - which well supports most of the market cap of £369m.

Now you could argue that by ignoring lease entries, I’ve not included an allowance for loss-making sites, which is a fair point. But those are losses that will be absorbed by future trading from the profitable sites, so I don’t see those as liabilities, instead future losses.

The main reason I look at balance sheets, is to ascertain what the risks of insolvency, and dilution from an emergency fundraising would be.

In this case, my assessment is that WIX is financially secure, and the risks are low.

Retailers generally don’t tend to need massive balance sheets, because they’re selling for cash, and buying on credit.

My opinion - I like this share, it’s a good business, reasonably priced, with a modest PER of 8.6x for 2023, and a 5.7% divi yield. Finances are secure. So it’s a thumbs up from me. Over time, as the economy recovers, I think WIX shares should recover. I don't see a permanently damaged or deteriorating business here, which is what the share price seems to be telling us.

The StockRank is now very high too, which reassures me that I'm probably leaning in the right direction here.

Graham’s Section:

Sopheon (LON:SPE)

Share price: 679p (+18%)

Market cap: £72m / $88m

This morning we have full-year results for 2022 from Sopheon, the enterprise software company:

Revenue $36.8m (2021: $34.4m). There were acquisitions in Dec 2021 and May 2022, so this is not a true like-for-like comparison.

Annualised recurring revenue $24.3m (2021: $20.7m)

PBT $1.3m (2021: $1.2m) that includes the amortisation and impairment of intangible assets.

Net cash $21.1m (2021: $24.2m)

As we have noted before, Sopheon is switching customers over to SaaS contracts, and this process continues..

CEO comment:

Sopheon delivered solid growth with record ARR last year, and acquisitions and new products tripled our multi-billion-dollar addressable market. Our ambition is for Sopheon to double run-rate revenue every three to four years, with world class margin and retention metrics. This will require a contribution from acquisitions, on top of accelerated organic growth. We start 2023 with a strong foundation of ARR, a stable of new products, and a growing sales pipeline.

The company now describes its software as “InnovationOps”, as it is designed to help customers to innovate faster, more successfully and more efficiently.

After the acquisitions that took place, it has a family of four products instead of just the one flagship product.

It continues to promise that 2024 will see higher growth and profitability, as the SaaS contracts will generate better long-term revenues than the short-term revenues created under the old model.

My view

I won’t dwell on this stock much longer, because I already know that I’m giving it an “amber” view.

Firstly, on valuation. After this morning’s share price gains (to 679p currently), the price/ARR multiple is c. 3.6x.

Deduct cash from the market cap and EV/ARR is only 2.8x.

This is definitely on the cheap end of the spectrum for software companies.

However, I think there may be some good reasons for it to trade cheaply:

Organic growth appears to be somewhat limited and the company acknowledges that it will need more acquisitions to hit its growth targets.

Current profitability is also subdued. In 2022, the company capitalised $5.2m of development costs, which was nearly all of its net cash from operating activities.

2022 results were boosted by one major contract signed with the US Navy. So customer concentration could still be improved.

In summary - I do think this is cheap for a software business, but I’m not sure that it deserves to trade at a vastly higher multiple.

ECO Animal Health (LON:EAH)

Share price: 112.9p (+15%)

Market cap: £76m

It has been a while since we checked in on this company; it’s “a leader in the development, registration and marketing of pharmaceutical products for global animal health markets”.

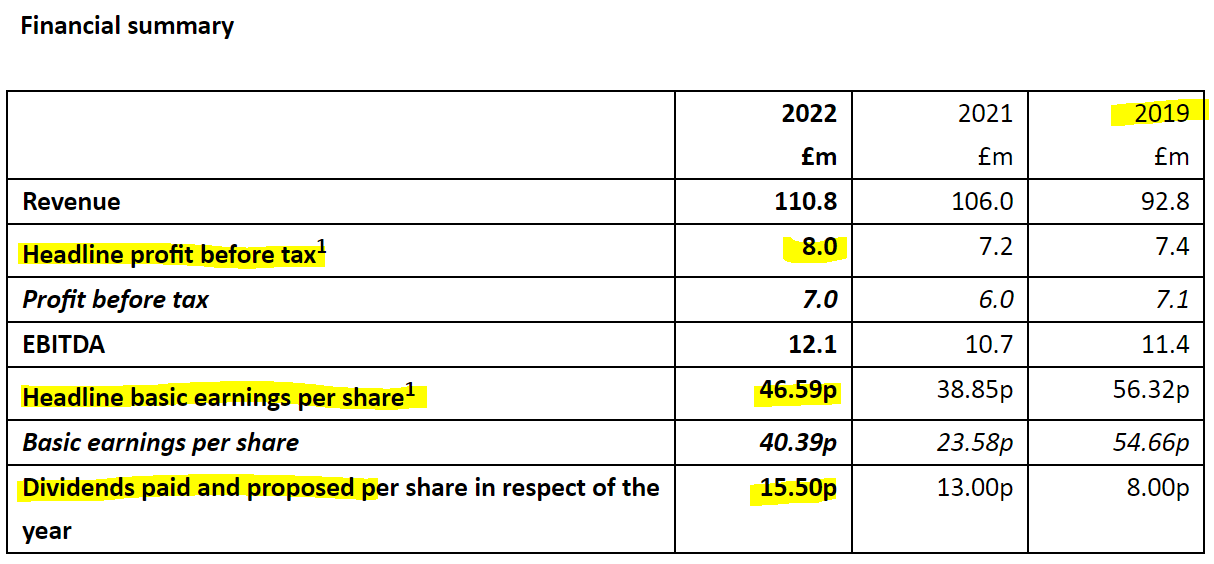

Last August, it revealed that demand in China had dropped off. With a poor revenue outlook, EPS estimates continued to slide:

Today brings better news for FY March 2023:

The ECO Group has experienced strong trading in its final quarter and it is clear that the demand for Aivlosin has been a little stronger than expected in China and Asia. As a result, the Board now expects that Revenue and Earnings before Interest, Tax, Depreciation and Amortisation will be slightly ahead of market expectations for the current financial year.

While this is indeed good news, market expectations were already very muted. So “slightly” beating them is perhaps not saying all that much:

This stock remains expensive on a P/E multiple basis. But trading appears to have stabilised after a turbulent period, and the P/S multiple is less than 1x. So I can get behind a neutral stance on this one.

SRT Marine Systems (LON:SRT)

Share price: 43p (+13%)

Market cap: £78m

Over the past six months, this company has finally delivered the huge growth in revenues that it promised for so long.

However, this update is very strange. Prior to today, brokers were forecasting revenues of £56.6m in FY March 2023 and adjusted PBT of £6.8m.

Instead we get this:

The Company expects revenues for the year ending 31st March 2023 to be approximately £30.0m, a 265% increase on the previous year, generating an EBITDA profit of £2.5m and an expected loss before tax of £1.0m.

The explanation:

These results are lower than market expectations for the current year primarily due to material systems business project milestones that had been expected to be completed by the end of the current year being delayed to the early part of the new financial year.

In other news, SRT announces a new coast guard systems project worth £145m where a Letter of Intent has been signed.

Customer funding for the project still needs to be finalised but SRT expects that once it is underway, the project will be mostly delivered within two years, and thus “generate significant revenues in the coming financial year alongside our existing system projects”.

Validated sales pipeline - the company has “specific projects where we have ongoing discussions with an estimated aggregate value of £1.4 billion. However, many of these are in their early stages and usually take several years to develop into defined projects and contracts…”

The potential £145m coast guard project is included in this £1.4 billion pipeline.

Additionally:

…there have also been some recent material events which have significantly improved timing confidence of two other potential projects. Firstly, a series of meetings at the highest level for another prospective new coast guard customer who wishes to build up a very significant national scale system over the next ten years in a series of incremental annual projects with an indicated annual project budget in the region of £50.0m commencing from 2024. Secondly an existing customer who has secured funding of up to £150.0m to undertake a significant expansion of their existing SRT supplied system starting from 2024.

My view

My view might be controversial, given that the company’s revenues have risen dramatically over the past year (despite the delays in the systems division) and given that the share price is up again today on the back of all the positive contract-related news.

However, I am going to give this company the thumbs down.

The reason is that I simply do not trust what it says about its revenue prospects. It spent 17 years over-promising and under-delivering, before the big contract news last year.

And then when it was finally supposed to land with material profits in FY March 2023, it has failed to do so and is posting another loss.

Perhaps FY March 2024 will be the year of financial success, but then I’m afraid I would have no confidence in FY 2025 and FY 2026.

SRT’s work is inherently extremely lumpy. Even if I give management the benefit of the doubt, the best I can say is that they are simply unable to forecast their own results.

One final point: when companies talk about their “validated sales pipeline”, I think it should be treated with the same level of scepticism as talk about a “total addressable market”.

SRT has a very long history of over-promising. Perhaps this time is different, but I personally don’t trust what they say and so I believe these shares should be avoided.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.