Good morning from Paul & Graham.

Today's report is now finished at 13:00

A big thank you to Roland for covering for me last week, so I could grab some time off in the lovely, unspoiled little island of Gozo. I'm out here for another 3 weeks, so alternating holiday & work from one week to another. Of course I can't stay away from the markets, even when on holiday, but it was relaxing not having to write reports every day. Anyway, off we go again!

Podcasts - I'm doing 2 each weekend now - one covering individual company results & trading updates in brief, and the second being general market/macro news & views. These went up on Saturday, here.

Also, I recorded a very interesting podcast with renowned investor Richard Crow, @ CockneyRebel, who as usual was full of interesting share ideas, and an upbeat assessment of the outlook, so that's worth a listen. The more I think about it, the more I suspect he may be right about the outlook for consumer stocks not being anywhere near as bad as markets seem to currently be assuming. We know about all the doom & gloom, but there are also some positive things on the horizon -

- Inflation set to fall from c.10% to c.3% by end 2023, according to the Bank of England and other forecasters.

- Interest rates - have probably nearly peaked, and won't need to be at this level once inflation has been tamed. Dangling the prospect of falls in interest rates, which of course would be very nice for asset values such as shares. IMF report on that here.

- Millions of households receiving big pay rises this month, of c.10% (state pension, benefits, and minimum wage all going up by roughly that %)

- Dramatic falls in wholesale energy costs, that "will be like a big tax cut" (R.Crow) once it feeds through into household and business bills later this year.

- Improvement in gross margins for non-food retailers in prospect, from collapse in the price of container rates to import goods, and factory gate inflation having ended, or even going into reverse, from factories competing for more cautious orders.

- Full employment, or at least very low unemployment - if that continues, then households are not likely to cut back spending further.

- Signs that many households are prioritising holidays & leisure, above buying more physical things - a buying opportunity in those sectors maybe?

How this will all interact with everything else, and all the known negative factors, I don't know. Lots of companies now seem to be saying that wage inflation is their main headache, so we need to be seeing companies finding ways to improve productivity.

As mentioned in several of my recent podcasts, I'm selectively very bullish on cheap, good quality small caps, where I think we currently have abundant buying opportunities. Investor sentiment is so negative towards small caps, that it reminds me of previous market lows, where we end up kicking ourselves afterwards, saying why didn't we ignore the gloomy mood and just snap up the bargains? I could be wrong of course, and this is all just my opinion, based on the current circumstances. Anything could happen to change things, I'm not clairvoyant! Although people rarely regret buying up bombed out shares, in times of peak gloom, in good quality companies.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Not much news today.

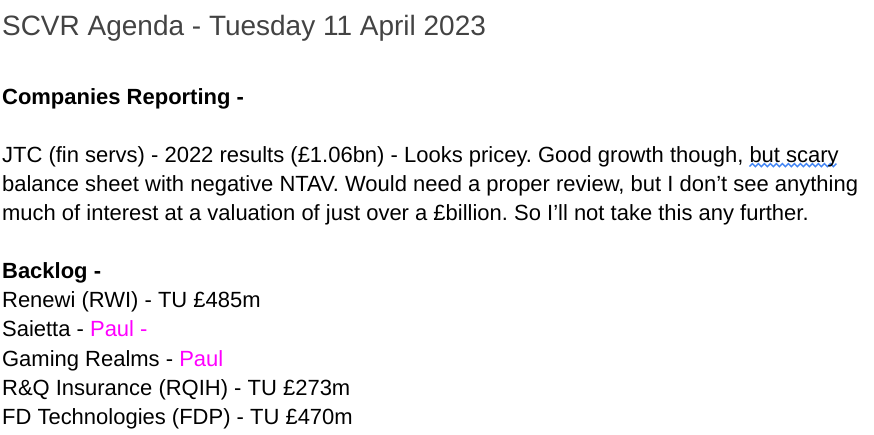

I've changed the format today, so what is in our agenda screen shot below is what we didn't get round to looking at today. Stuff we have looked at, is included in the summaries below. Mainly backlog items left, so I might have a look at those later today, and put it up tomorrow. Or, I might walk down a 1:3 hill to Ramla beach, and drink beer there for a bit, can't decide which! See you tomorrow :-)

Summaries of main sections

(more detail below)

Kooth (LON:KOO) - FY results - 230p (market cap £76m) - Graham - RED

Digital mental health provider published in-line results last week. Future US growth is the big unknown. The UK growth runway already looks limited to me. Has lots of work to do to justify its current market cap.

Hollywood Bowl (LON:BOWL) - H1 Trading Update - up 3% to 252p (mkt cap £434m) - Paul - GREEN

A positive-sounding H1 update, but it ducks the question of whether it's trading in line or not. Healthy cash position. Reasonable valuation. Continued self-funded expansion/refurbs. There's a lot to like here. The big unknown is whether current strong customer demand (and hence big profits) is sustainable or not?

Hilton Food (LON:HFG) - Finals/CEO change - 677p (market cap £607m) - Graham - AMBER

Weak results, as expected after profit warnings in late 2022. The company is optimistic that seafood performance can turn around. Very low margins and bank debt demand caution.

Quick comments only

(no sections below)

Cineworld (CINE) - Chapter 11 update - down 27% to 1.27p - Paul - RED

Yet again, it emphasises that existing equity is worthless under a restructuring plan. Yet the shares are still trading - how come? Is there some angle on this that I've missed?

MJ Hudson - another disaster - shares suspended - Paul - RED

Disposals agreed, but “it is highly unlikely that there will be a substantial, or any, amount available to Shareholders following payment of all creditors and costs.” - bad luck to holders, looks like a wipe-out for existing equity.

Spectral MD Holdings (LON:SMD) - Business combination - up 75% to 47.5p (at 12:11) (market cap £67m) - Paul - AMBER

An interesting update, which caused an 88% spike up in shares price first thing this morning, since moderated to a still impressive +61% (45p per share at 11:50). It is proposing to list on NASDAQ via an acquisition vehicle called Rosecliff Acquisition Corp I. The deal seems to provide more access to capital, and greater exposure (and a higher valuation, said to be 101p per share, with caveats).

Paul’s opinion - this looks potentially interesting, although with some way to go yet before it’s a done deal (said to be in Q3 2023). I reviewed Spectral MD here in Jan 2023, it’s unique I think, in that all revenues come from (substantial) repeat grant revenues from the US authorities. So it looks a binary outcome development project. Could be an interesting punt, but only with money people can afford to lose.

Paul’s Section:

Hollywood Bowl (LON:BOWL)

252p (up 3% at 08:28)

Market cap £434m

Hollywood Bowl, the UK's largest ten-pin bowling operator, is pleased to announce a trading update for the six months ended 31 March 2023.

The company’s headline summary shouts -

EXCELLENT PERFORMANCE DEMONSTRATING CONTINUED STRONG CUSTOMER DEMAND

H1 revenue £111.1m - up 10.9% vs H1 LY, but only 3.5% of this is like-for-like (LFL) from existing sites, with most growth coming from new sites. I’m not impressed with +3.5% LFL growth against a year earlier, well below inflation of about 10%.

Canadian business - represents about 11% of total revenue, not to be sniffed at. More new sites are happening.

UK - continuing investment in new sites, and updating existing sites. 2 new sites are both trading ahead of expectations. 2 additional sites planned for H2. There are currently 69 UK sites, and 9 Canadian sites.

Net cash of £44.1m as at 31 March 2023 looks very healthy, and is just over 10% of the market cap. BOWL is a very cash generative business, so it looks really comfortably financed, to continue self-funding further growth, and it’s paying a forecast yield of 4.4% too.

Outlook - BOWL side-steps saying how it’s performing vs market expectations (which is the whole point of trading updates!), it’s so annoying when companies do that, and introduces doubt -

The Group is confident about the prospects for the business in FY2023 based on the strong first half of the year and the continued attractiveness of its offering but remains mindful of the ongoing economic backdrop.

Does that mean we can expect it to meet market expectations? By implication, using the words "excellent" and “strong” for H1 trading, it implies they might beat least in line. The general tone sounds upbeat too. We shouldn’t have to guess though. Trading updates are not PR exercises, we just need facts - are you trading below, in line, or ahead of expectations? Maybe advisers have told them to be cautious in case the economy worsens?

Another complaint from me is that BOWL doesn’t get any broker research out to us via Research Tree - a glaring omission for a company that’s bound to have lots of private investors holding its shares.

These are all pretty basic things.

Paul’s opinion - this is clearly a very nice business, and reasonably priced.

I like the strong balance sheet, self-funded growth in new sites/refurbs and expansion into Canada, all without any need for borrowings. All this is being done whilst paying a respectable dividend too (although divis are now a lot less attractive given that investors can park money in risk-free cash accounts and get c.3-4% in interest).

There’s really only one key question - is the current boom in customer interest in bowling sustainable longer-term? Your view on that depends on how you’ll see this share.

I don’t know about that, so am basing my decision on the figures, and positive tone of this update, so have to give it a thumbs up.

High quality metrics below, and a reasonable valuation too -

Stockopedia really likes it too - note the StockRank almost on maximum now -

Graham’s Section:

Kooth (LON:KOO)

Share price: 230p

Market cap: £76m

Kooth PLC is a digital mental health and wellbeing company working to provide a welcoming space for digital mental health care, available to all.

We have rarely covered this one. It was discussed by Jack and by readers back in April 2021, with the share price c. 350p. That was in the middle of the Covid-inspired tech boom, and Kooth itself had IPO’d into this environment, in September 2020.

Last week, it issued full-year results for 2022:

Revenues +21% to £20.1m (in line with expectations)

ARR +25% to £21.1m

Gross margin 68.9% (last year: 69.5%)

Adjusted EBITDA £1.6m (last year: £2.1m)

The fall in adjusted EBITDA is explained by “investment in the US and the end of COVID projects offsetting the benefits of the US ramp up”. So results had been temporarily boosted by Covid-related work.

Cash at year-end was £8.5m.

US expansion

Kooth is working on a US expansion strategy that includes a $3m pilot contract in Pennsylvania and also a proposed contract in California “to support all 13-25 year olds”. This Californian contract is still being finalised, and flows from a huge spending plan by the Governor Gavin Newsom.

The company trumpets the fact that 95% of revenues are derived from contracts that are 12 months or longer, and that net revenue retention is 107%.

However, we need to remember that they are selling to the NHS and other large institutions - to my mind, it would be quite disappointing if they weren’t operating on the basis of long-term or recurring contracts, and weren’t able to generate more revenue from their existing customers every year.

After all, this is an unprofitable company trading at a multiple of several times its revenue - it needs to have at least a few quality features, to justify this valuation!

Also, I think it’s worth noting that Kooth defines recurring revenues as “contracts with a duration of 12 months or more”. This definition doesn’t fill me with a lot of confidence, as many companies have contracts that last 12 months or more but that are certainly not examples of recurring revenue.

UK growth prospects

60% of 10-25 year olds already have free access to Kooth in the UK. Doesn’t this imply that growth prospects in the UK are already very limited, based on the existing product set for young people?

The company seems bullish on the outlook for increased NHS spending on mental health generally, but will this translate to increased revenues for Kooth?

The company does have a product for UK adults (Qwell), and 8.8 million people now have access to it. ARR from this product is now £3m.

Outlook

The company is extremely positive on growth prospects in the US, but notes that decision-making at the NHS has recently slowed down:

Kooth is extremely well-positioned to respond to the long-term demand for digital mental health services in the US and UK, with a proven track record and detailed efficacy profile, strong recurring revenue and a net cash position.

In the UK, the NHS is not only grappling with the backlog aftermath of the pandemic, but is also dealing with the reorganisation of NHS England…

While this reorganisation offers great potential for Kooth in the medium- to long-term, we have seen near-term decision making slow down as a direct result of these newly formed organisations finding their feet, filling new roles, and starting to define their population health strategies. We are starting to see the 'end of the beginning' for this reorganisation, and I'm optimistic that it will provide greater opportunities for Kooth.

Financial performance review

Revenues - 21% growth is not to be sniffed at, but investors tend to expect very fast growth from companies at this stage of their development.

Administrative expenses (excluding share-based payments, depreciation and amortisation) - grew by 29%, a significantly faster growth rate than revenues.

On an absolute basis, these expenses increased by £2.7m, which was more than the increase in gross profits.

The pre-tax loss for the year is £0.8m (last year: £0.7m).

Capitalised software development - £3m of costs skipped the income statement and went on the balance sheet instead, in the form of capitalised development costs. The net boost to P/L from this procedure was £0.9m, as £2.1m of existing intangible assets were amortised.

Development spending looks set to ramp up:

Investment in product and development continues to be significant to the Group and we anticipate capitalising software costs at a higher rate over the next few years during a period of accelerated international product investment.

Cash flow was ok; the company benefited from the use of share-based payments, from an income tax credit, and from stretching out its payables (I think this relates to some upfront customer payments).

Graham’s View

Overall, I’m going to have to give this company the thumbs down.

My reasoning is that the company is trading at a price to sales multiple of about 3x (using 2023 expectations), but it doesn’t have enough of the “quality” features that I look for when an unprofitable company is trading at a rich valuation:

Customer concentration with public sector institutional customers.

Possibly limited UK growth prospects as so much of the population already has free access to Kooth’s current products.

US growth could succeed but is highly uncertain. Kooth’s current position is that it has one pilot contract and one contract being finalised from a Governor whose state’s finances are shaky.

Expenses growing faster than gross profits.

Development spending is only going to grow; the cash pile is safe for now but should be watched carefully.

I don’t completely rule out the possibility that this could succeed for its investors, but at the present time it looks like a long-odds bet.

Hilton Food (LON:HFG)

Share price: 677p

Market cap: £607m

This share is back with us in small-cap land, after making it into the FTSE-350 index:

It issued two profit warnings last year, the most recent of which came in November, covered by Paul. Paul also looked at the first profit warning here.

Economic conditions took bites out of both volumes and margins, and seemed to particularly impact seafood.

Let’s catch up with the current state of play, with results for FY 2022 (year-ending 1st January 2023).

Revenue +16.5% to £3.8 billion (acquisitions boosted this growth, along with expansion to New Zealand and price inflation).

Volume growth much more modest at 4.3%

Adjusted operating profit down 3.3% to £71m

Reported operating profit down 14.8% to £54m. A fire in Belgium in 2021 caused more exceptional items.

Net bank debt surges to £212m after heavy spending on acquisitions, joint ventures and capex. Undrawn facilities allow for an additional £106m to be borrowed, and the lending syndicate has agreed to keep the facilities open until 2027. The lenders seem happy for the time being.

Interest cover reduces to 4.5x adjusted operating profit. This is not at a distressed level but it’s not very comfortable either. Note that this multiple can change rapidly - it was 11x last year! But higher debt, higher interest rates and lower earnings have taken their toll.

The dividend is maintained at 29.7p for the year. That’s a significant expense: c. £26.5m, although it is covered twice by reported operating profit.

Management change: the company has a new CFO (an internal hire) and a new CEO who is hired from the Co-op.

Profit margin was only 1.8% at the operating level in 2022, down from 2.2% the prior year. The seafood business is named as the culprit.

Outlook and current trading

Performance since the beginning of 2023 is in line with expectations in a “challenging” environment. The company references continued supply chain and inflation concerns.

Looking further ahead:

Our short and medium term growth prospects are underpinned by the acquisitions of Foppen, Dalco and Fairfax Meadow, the new partnership in Singapore and recovery in our UK Seafood business as well as further opportunities arising across our markets by the development of our cross-category business and the application of our supply chain management expertise.

Graham's view

The bottom line of the income statement is very disappointing with only £17.7m of after-tax profit that’s attributable to shareholders. That's after generating £3.8 billion of revenues!

And we have to remember that the enterprise value is effectively £800m+ after adding the bank debt on.

So it’s probably quite easy to make a bear case for this stock, even after the sell-off in 2022. There could be continued pressure on margins, especially when it comes to seafood - the price of fish was one of the first things I noticed when I did an analysis of my household budget last year, and I can’t have been the only one!

The very poor margins make me want to give this stock the thumbs down, but the track record is quite solid when you look back on performance in prior years:

I think on balance I’ll stay neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.