Good morning from Paul & Graham!

Today's report is now finished at 13:53

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Main Section Summaries

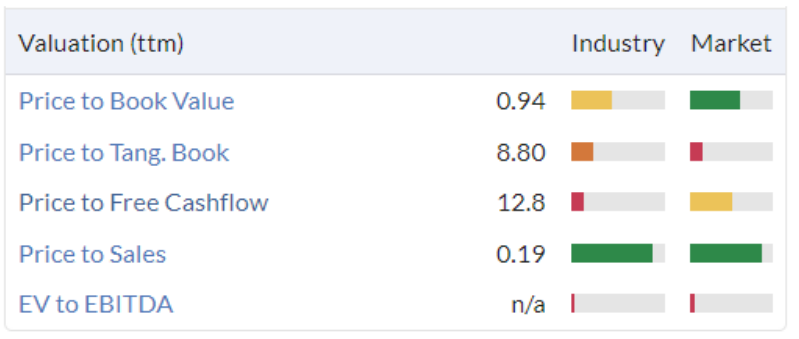

(more detail in sections below)

Superdry (LON:SDRY) - down 5% to 80p (£67m) - equity fundraise - Paul - AMBER

As expected, it’s doing an equity fundraise. Only c.£12m, although that’s flexible. Underwritten by Julian Dunkerton. Priced at a 10% discount, at 76.3p. My thoughts are below. A step in the right direction, but SDRY is not out of the woods yet.

Videndum (LON:VID) - down 9% to 713p y’day (£333m) - mild profit warning - Paul - AMBER

Issued a rather vague, but seemingly mild profit warning yesterday afternoon. I can’t quantify it yet, as no figures or broker updates available. I’m worried about excessive debt after an acquisition spree - not a good look when combined with now softer trading.

Reach (LON:RCH) - unchanged at 82p (£260m) - trading update in line - Graham - AMBER

This newspaper group is on track for large adjusted operating profits of c. £95m this year. They are bravely expanding in the US and the shares are superficially very cheap. This could get very interesting if revenues stabilise and as the pension deficit is reduced further.

TI Fluid Systems (LON:TIFS) - up 15% to 124p (£639m / €714m) - trading update in line - Graham - GREEN

This auto parts manufacturer enjoys a share price rally despite making no change to its 2023 outlook. Recovery is expected in profit margins as inflation feeds through to revenues. It has a large €600m debt load but with robust trading could be underpriced at this P/S multiple.

Card Factory (LON:CARD) - down 7% to 104p (£354m) - FY 1/2023 results - Paul - GREEN

Results are in line with expectations, and current trading slightly ahead. I have a good rummage through the accounts, and find nice clean figures. I no longer have any concerns about the balance sheet. Valuation is still quite modest, and I see decent medium-term upside on this share for patient investors, providing nothing goes wrong.

Lords Trading (LON:LORD) - up 6% to 73p (£118m) - FY 12/2022 results - Paul - GREEN

This builders merchant is growing through multiple acquisitions, and I'm quite impressed with the 2022 figures, and the modest valuation. Could be interesting. But beware the tiny free float, and highly concentrated major shareholder list.

Quick Comments

Barratt Developments (LON:BDEV) - down 1% to 499p (£4.9bn) - TU - Paul - GREEN

Another mid-cap housebuilder reporting that things are improving after a nasty patch triggered by global factors (higher interest rates & inflation), and worsened by the UK mini budget. In line trading for FY 6/2023. Net cash of £0.9bn. Demand supported by energy efficiency of new homes, and increased cost of renting.

Paul’s view - I’m keen on this sector, as the housing market is clearly now recovering from a sharp downturn. Bad news is in the forecasts, so reports now are in line, could maybe be above later this year? BDEV shares have had a v strong rebound since last autumn, but still look quite good value, and copper-bottomed by NTAV. Shares are only priced at 1.08 NTAV, which gives rock solid downside protection, providing house prices don’t fall sharply, which looks to be receding as a risk. Especially as Govt mooting reintroduction of Help To Buy scheme. Right now Persimmon (LON:PSN) and MJ GLEESON (LON:GLE) look attractive value to me, and might do a catch up with rest of the sector that have bounced much more strongly, perhaps?

Wickes (LON:WIX) - unch at 137.5p (£358m) - TU - Paul - GREEN

Wickes is a chain of 230 home improvement stores, and online. Today’s TU is for the 16 weeks to 22 April 2022.

It’s in line with expectations, despite some adverse weather effects, and LFL sales down 0.5% (not good when inflation is 10%). It seems to have a nice balance of business, with softer DIY demand being offset by good trade demand. Cost savings achieved.

Outlook comments sound confident.

Paul’s opinion - WIX, and ECEL were on my top value/GARP list for 2023 (and beyond). I think investors are too gloomy on valuation, due to worries over demand. However, this overlooks big favourable tailwinds on margins, from cheaper sea freight, firmer sterling vs dollar, etc. Hence I think it’s possible that earnings forecast for 2024 (16.6p EPS) could be too gloomy now, set at 29% below 2023 forecast (23.5p). Nice solid balance sheet, and a lovely 5.8% yield too. So WIX continues to earn a thumbs up from me. This strikes me as a nice solid value share. It’s not exciting though, so won’t be a multibagger.

Paul's Section:

Superdry (LON:SDRY)

85p (£70m) pre-market - last night: equity fundraising - Paul - AMBER

I’m oscillating between red and amber on this unconvincing turnaround. This struggling mid-market fashion brand had already told the market that a placing was coming, and the likely dilution, so this isn’t a surprise. A placing is being done, at a 10% discount, so 76.3p per share. 15.7m new shares are to be issued (but this is flexible), which is 19.1% expansion of the existing share count. It’s being underwritten by founder Julian Dunkerton. To raise gross £12m, which doesn’t radically change the financial position.

Paul’s opinion - of more importance to me is the expected net proceeds of £34m from selling its IP in the Far East. I’d want to see that cash in the bank, before even considering punting on this share. However, once both the placing (plus retail offer via REX), and the £34m IP sale have completed, then risk would possibly be low enough to risk having a punt. The argument being that if the turnaround does work, then it could be a multibagger. There’s a lot to sort out though - and I think Dunkerton’s explanations of how well his brand reset is going are considerably detached from reality, so it’s best to ignore him completely and instead look at the numbers, which are bad. Worth keeping an eye on though, and punters who get lucky, and time an entry right, could do well possibly.

Note that, until now, there hasn't been any dilution, and even the 20% dilution being done now is not excessive. So if the brand returns to former glories, as you can see below, this share could be a multibagger - that's what is attracting some punters towards this share, I think. Or, as lots of people think, is the brand now old-fashioned and tired? The wholesale customers seem to think that, with reduced orders for this season. Had to bring in consultants to suggest cost cuts, which smacks of a badly run business to me - good management should be all over their cost base all the time.

EDIT: Drapers Record reports today that SDRY's COO, Silvana Bonello, has stepped down, which hardly inspires confidence in current trading.

Videndum (LON:VID)

Down 9% to 713p y’day (£333m) - mild profit warning - Paul - AMBER

“the international provider of premium branded hardware products and software solutions to the content creation market”

A mild profit warning was Issued during market hours, at 15:14 yesterday, a bad start. The warning seems vague - saying that FY 12/2023 is being impacted by macro factors, and more specifically a US writers’ strike (film and TV), which has apparently deferred some sales for equipment that VID supplies (a category which is 20% of its revenues).

VID is now saying this will result in a wider range of outcomes for FY 12/2023, and a larger than usual H2 weighting. It is uncertain about the extent at this stage, and it could worsen if the writers’ strike is prolonged.

I’m a little concerned that it mentions bank covenants, and that it’s conserving cash, and seeking to reduce debt.

There are also some positive elements in the detailed announcement, including new product launches in the last 3 years generating around half current revenues. It reminds me a bit of Focusrite (LON:TUNE) which has also reported a slowdown recently, and has to constantly innovate with new products.

Paul’s opinion - neutral at the moment, it’s not a share I follow that closely. The value metrics on the StockReport look attractive - low PER, and nice yield. Although these are now likely to be reduced, but there aren’t any research notes available on Research Tree. So we’ll just have to wait and see what happens to the broker consensus forecasts.

The main risk here is that net debt is too high. Looking at its FY 12/2022 numbers, the P&L is good (big profit, and a high margin), but it looks as if management has overdone the acquisition spree, leaving a weak balance sheet (only £6m NTAV), and bank debt that could be excessive if profitability drops a lot from what might be last year’s high water mark.

I think we need more clarity here on likely performance, and with the heavy debt burden, I’m leaning more towards a RED point of view, but will go with AMBER for now. Hopefully the slower trading indicated at the moment might bounce back once this writers' strike is resolved?

Card Factory (LON:CARD)

Down 7% to 104p (at 10:04)

Market cap £354m

cardfactory, the UK's leading specialist retailer of greeting cards, gifts and celebration essentials, announces its preliminary results for the year ended 31 January 2023 ('FY23').

There’s been a fair bit of two-way business this morning, with the share price hunting for direction, and about 1.6m shares traded so far (plus of course whatever larger orders are being worked in the market behind the scenes, which are only reported once they’re complete).

We’ve had several ahead of expectations trading updates from CARD in recent months, and there seems to be a very convincing turnaround underway.

The figures today look in line with the recent trading update -

Revenue £463m (up 27%)

Profit before tax (PBT) £52.4m (up hugely from £11.1m LY) - includes £3.5m of one-off benefits, as previously disclosed.

Gross margin (on product) is very strong, at 68.6% - one of the highest I’ve seen for a retailer, because CARD is vertically integrated, making some high margin products itself. There could even be scope to raise that further, I reckon, now forex and freight costs have turned from headwinds into tailwinds.

Current trading/ outlook -

Trading in the first weeks of the new financial year has been encouraging and slightly ahead of the Board's expectations…

… we continue to have confidence in our ability to mitigate cost inflation through a combination of productivity initiatives and targeted price actions. This approach, together with our clear growth strategy and compelling value-led proposition, gives us confidence the Group will continue to make strategic and financial progress in the year ahead.

Medium term targets -

As part of our Capital Markets Strategy Update, we will outline a pathway for revenues of around £650m and margins around 14% in FY27, supported by a capital investment plan of £24m per annum, over the next three years.

I need some clarity on what measure it is referring to with “margins around 14%”? Presumably operating profit or profit before tax. It would have been helpful to be more specific, maybe it’s somewhere else in the announcement? If any readers know, do post a comment.

Balance sheet - is still weakish, but we knew that already.

NAV of £268m, becomes NTAV of negative £(58)m, which given the nature of the business (selling for cash, so little in receivables), and its now high level of profitability, is no longer a concern to me. Although I would ideally like CARD to hold back on paying divis for a while longer, to fully repair its balance sheet. This is important because companies need to be financially stronger in preparation for whatever the next major shock is (another pandemic, or a banking collapse, wars, it could be anything. Companies should never go into a crisis up to their eyeballs in debt, as CARD did in 2020).

Also debt is now more expensive, as the free money era of 2008-2022 appears to be over.

Gross bank debt at CARD was £67.5m, which is moderate given the big increase in profit to £52m, and cash of £11.7m takes it to a net bank debt position of £(55.8)m - I’m comfortable with that. There’s little to no dilution risk now, as opposed to this being a very high risk a couple of years ago. Investors who gambled on it not having to dilute got lucky that the bank was so accommodating!

Lease entries - the IFRS 16 numbers intrigue me. I was wondering previously if, recovering from the pandemic, multi-site chains like retailers, pubs, etc, might boost their profits from writing up the bombed out right of use asset values ascribed during the pandemic.

Doing a little digging into CARD today, note 10, this assuages my fears -

Application of these assumptions resulted in a net impairment charge of £1.3 million (2022: £5.0 million), comprised of impairment charges of £3.7 million (2022: £5.0 million) and the reversal of previous impairment charges of £2.4 million (2022: £nil).

This means CARD does still have some loss-making sites. Although this is probably only a small number of sites, since the RoU asset totals £100.3m, and the total property lease liabilities total £105.4m. That means a net deficit of £5.1m, which I see as pretty trivial. Therefore we can probably forget about property leases, as there don’t seem to be any issues there, good or bad, so it’s reassuring overall.

Dividends - note 7 indicates loan arrangements mean that it is currently prohibited from paying divis. That should be only a temporary issue, and if trading continues at anything like the current strong level, CARD should be back on the divi list, sustainably, fairly soon I reckon.

Software capex - note that CARD capitalised a hefty £9.4m into software intangible assets in FY 1/2023, up from £3.3m LY. That boosted profit, since the amortisation charge was only £2.3m + £1.5m impairment charge. I’d like to know the nature of that software spend, because about 10% of total profit has come from this diverting of costs onto the balance sheet, compared with if they were expensed. No doubt the accounting policy is allowable, but it has helped boost profit.

EPS - it doesn’t seem to produce adjusted EPS figures. That’s probably because there’s no amortisation of goodwill, so nothing needs adjusting out. We like nice clean numbers, with no adjustments, here at the SCVR.

Diluted EPS is 12.8p, up big-time from 2.4p the prior year. So at 104p per share, the PER is only 8.1, which seems cheap for a company performing so well.

It’s almost as if the market isn’t yet convinced that this level of profit is sustainable. If it is, then I would expect this share to re-rate to something more like a PER of 12+, which implies a share price of 154p+, which is 48% higher than the current share price. Looks interesting!

Cashflow statements - are totally messed up by IFRS 16 entries. The only thing that matters to me is that net debt is being paid down at an encouraging rate. In future that will be able to fund divis, I reckon a c.5% yield is possible from next year onwards maybe? Historically CARD overpaid divis, and weakened its balance sheet, putting it in a highly precarious situation during covid, which it only survived thanks to Govt, and bank support. They mustn’t get into that mess again, so I hope new management appreciate the need to be more careful.

Paul’s opinion - thumbs up from me. It’s still cheap, I think. Plus there’s potential upside if various growth strategies can deliver results. The half-hearted online efforts of the past have given away huge upside to companies like Moonpig (LON:MOON) - which is itself now in a financial mess after making a bad, debt-fuelled acquisition. So maybe CARD can start eating some of MOON’s lunch, instead of the other way around?

In the short-term, maybe the big jump in profits has already happened? So I think the opportunity here is more about the market giving it a higher PERx as confidence builds, and then maybe another benefit from medium term earnings growth? So I’d be pencilling in a share price target of maybe 150-200p, if you’re prepared to be patient (say over a year or two). That seems realistic to me, providing nothing goes wrong, as with everything.

Stockopedia's computers love it too, with a StockRank of 97.

There's been no dilution since 2017, so in theory there's no reason why the share price couldn't recover previous highs, if profit growth continues back to pre-pandemic levels. Also, I think it's now clear that online has not killed off physical card sales. So CARD might be viewed as a GARP share, rather than a cigar butt value share (in slow decline) which was how it was viewed pre-2020, as I recall.

Plenty of stuff to like with CARD. I'll try to put some in my own portfolio, when funds become available.

.

Lords Trading (LON:LORD)

Up 6% to 73p

Market cap £118m

Lords, a leading distributor of building materials in the UK, is pleased to announce its annual results for the year ended 31 December 2022 ('FY22' or the 'year').

I’ve only reviewed this share once, here on 24 May 2022, when I concluded that it looked quite good! Here we are a year later, and I’ve quickly whizzed through the FY 12/2022 figures & commentary. Here are my notes -

April 2023 - refinanced “enhanced” bank facilities, 3 year term, with consortium of 3 banks. Using debt to fund multiple acquisitions.

Webinar recordings are on IMC.

25 Jan 2023 - ahead exps trading update.

Revenues £450m (+24% thanks to acquisitions, I can’t find the exact split of organic/acquisitions growth)

Good profit performance - adj PBT up 42% to £17.4m. Adjs look fine - mainly relating to amortisation re acquisitions. Only £400k share-based payments adjusted, which looks reasonable.

Adj basic EPS is 8.0p (up 32%), so a PER of 9.1x which looks a modest valuation, although this sector doesn’t tend to attract high valuation multiples.

Dividend per share 2.0p, for a yield of 2.7% - probably not a great idea to be paying divis, on top of making multiple acquisitions fuelled by increasing debt!

Net debt has soared to £19.4m, from a net cash position a year earlier of £6.5m - but this is a reasonable level of debt relative to EBITDA, the customary method of assessing debt reasonableness.

Plumbing & heating division is about half revenues, and saw a marked improvement in EBITDA margin from 4.4% to 6.0% (overall target is 7.5%)

Shortage of new boilers in 2022.

Current trading & outlook - in line with expectations - reiterates FY 12/2023 guidance.

Consolidator - only has 1% of a large, fragmented market. 40% of builders merchants are independent, so there’s an obvious role for a consolidator in the sector, which is LORD’s strategy. The business model makes a lot of sense to me. Of course it’s all down to execution now - this share’s success or failure will depend on how good mgt is at acquiring, integrating, and managing multiple businesses. That’s the key part to research.

Ownership - it’s family controlled. Only 7% free float. Top 5 shareholders (only 1 is an institution, the rest individuals) have over 75%, so risk to small shareholders is elevated - the big holders can do whatever they want with the company, so you have to trust them, or don't buy the shares!

Balance sheet - is OK overall. Although note that the NTAV is falling with all the acquisitions, and intangibles are piling up - this is the drawback with acquisitive groups.

Paul’s opinion - thumbs up. It looks cheap for an acquisitive group. I’d like to know more about who management are, how experienced, competent and trustworthy are they? That’s what will determine success or failure long term here. Mgt owns a controlling stake, so outside shareholders are totally in their hands.

The numbers look fine - good progress has been made in 2022, so I’ll hand it over to subscribers here for you to do your own, hopefully much more detailed research.

StockRank is 66.

Graham’s Section

Reach (LON:RCH)

Share price: 82p (unch.)

Market cap: £260m

Let’s review the trading update from this well-known newspaper group.

Reach plc ('the Group') is issuing a trading update for the 4-month period to 23 April 2023 ('the period'), ahead of its 2023 Annual General Meeting today.

Trading is in line with expectations, so adjusted operating profit is still expected to be within a range of £93.7 - 96.5m this year.

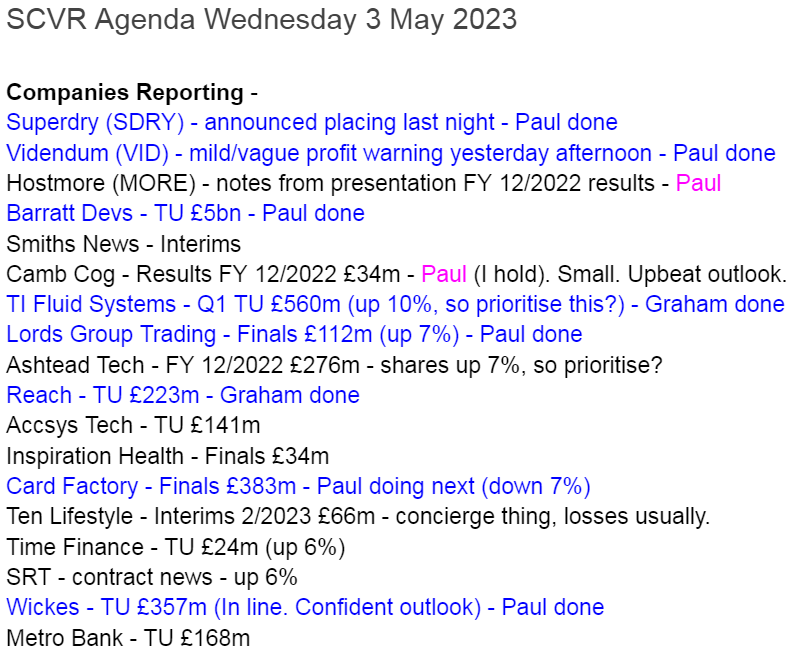

Here is the revenue table published today:

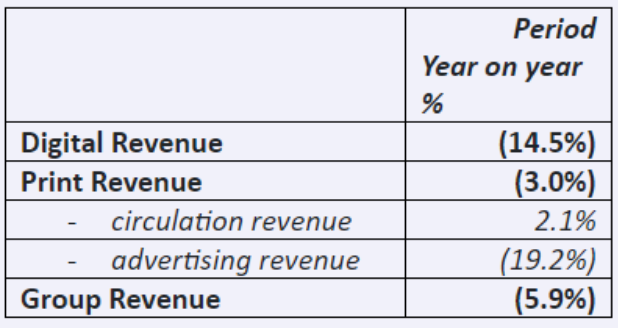

I wonder what the table showed us at the corresponding 2022 update…? Here it is:

Comparing the two tables, there is little comfort to be had from the “second derivative” - i.e. not only are revenues falling in 2023, but the fall is noticeably worse than in 2022.

Circulation revenue is the only category with rising nominal revenues. This category will also have some of the highest input cost increases, so inflation must be passed on:

Print revenue has remained strong. Volumes remain robust, with circulation revenue benefitting from cover price increases during FY22, with advertising slightly ahead of our expectations.

Digital revenue is suffering from some of Facebook’s decisions, a reminder that it's the monopolistic platforms who have all the power in online media:

The page view slowdown, referred to in March, has continued, with recent changes to the way Facebook presents news content, causing a reduction in referred traffic across the sector.

Cost cuts: operating costs to be cut by 5 - 6% this year.

Outlook

Looking forward we expect to benefit from strategic actions to address the decline in page views, expansion in the US and a reduction in operating costs. In addition, H2 digital comparatives are less demanding, mainly due to suppressed Black Friday and Christmas trading last year.

My view

Paul had a look at the full-year results here, noting the P/E ratio of circa 3x.

Against that you have to consider that there could, once again, be very significant adjustments applied to earnings. Investors also need to consider the declining revenue profile and a balance sheet with negative tangible net assets (minus £200m+). This includes a large, billion-pound pension scheme in deficit.

The attempt to launch a larger US operation is noteworthy for a UK company that investors generally consider to be in decline. They are trying to build the American audience for the Mirror, Express and Irish Star, and also trying to serve American soccer fans. Maybe it can work?

I’m going to stay neutral on this stock. I can see the multi-bagging potential, but I wouldn’t be brave enough to buy into it myself.

For example, they made cash contributions to their pension schemes of £55m last year, and £64m in the prior year.

I’m hopeful that rising interest rates and the passing of time will help to make this pension issue go away, but these schemes have been sucking lots of cash out of the business and so the P/E ratio is currently something of a mirage.

Perhaps I’ll miss the rally, but I’d prefer to go green on this one when there was better evidence of stabilisation - firmer revenues, and an even stronger balance sheet.

TI Fluid Systems (LON:TIFS)

Share price: 124p (+15%)

Market cap: £639m / €714m

This is a former midcap that became a smallcap:

We’ve discussed it twice previously in the SCVR: I opened coverage of it in November 2022, and Paul looked at it in January 2023.

It’s “the industry leader in thermal solutions and fluid systems for vehicle manufacturers across the world”, with an HQ in Oxford and a main office in the United States.

I’ve noted previously that it’s very cheap on price/sales, but profit margins have been lacking.

Here is its Q1 2023 update:

Group revenue for Q1 2023 was €869.8 million, an increase of 15.2% versus Q1 2022 at actual exchange rates. At constant currency, revenue grew 14.9%...

With light vehicle production (LVP) volumes increasing by 5.7% in the quarter, revenue outperformance, at constant currency, was 920 basis points (bps). This outperformance was supported by product launches, favourable regional mix as well as our inflationary recoveries which delivered the expected benefits in the first quarter.

The company did previously signal that it had negotiated price increases with customers, and these increases are now bearing fruit with very decent revenue growth.

Geographic breakdown: growth is particularly strong in Europe and Africa (+20.5%), including benefits from higher volumes of hybrid vehicles and battery EVs. Again, we have possible grounds for optimism that TIFS is able to make the transition to a world where EVs are more mainstream.

The only weak point geographically is China, although even here TIFS says that its revenue decline was not as sharp as the broader market decline. It remains confident for full-year performance in China and reports €332m of new BEV bookings, of which more than half are in China (with Chinese manufacturers).

Outlook: no change to outlook.

…the Group continues to make good progress with inflationary recoveries which, together with a larger number of launches this year, underpins our expectation that the Group will outperform LVP [light vehicle production] growth in the year.

The adjusted EBIT margin is expected to get above 6% this year, an improvement on last year’s 5.5% (though still below 2021’s 7.2%).

My view

It seems important that these shares are up by 12% despite no change to the company’s full year outlook. If I was looking for some confirmation bias, I would say that it confirms the market became excessively pessimistic on this stock, and priced in an imaginary profit warning!

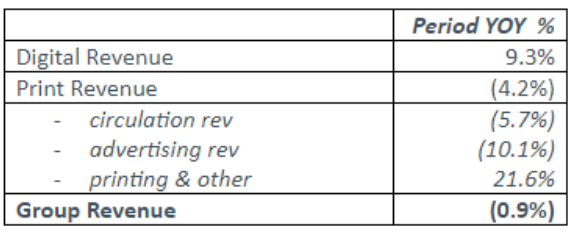

I remain drawn to this company’s price to sales multiple:

A major bear point could be the net debt figure, which was €625m as of the year-end 2022. The company reported this as 1.9x adjusted EBITDA. This is a private equity float, after all. So the enterprise value is around €1.3 billion.

I’m getting splinters from sitting on the fence for too many stocks, so I’m going to give this one the thumbs up. I wouldn’t have the confidence to bet heavily on it, but it looks like a very large company trading at a small-cap valuation. It needs to continue to handle the challenges of inflation/margin recovery, the transition to electric vehicles, and a significant debt load, but it appears to be doing all of this currently.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.