Good morning from Paul! Graham's busy today, getting ready to fly to the UK for his star appearances at Mello Chiswick. We're both looking forward to seeing many Stockopedia subscribers at Mello tomorrow, and Weds. Do come along if you can, and say hello!

Podcasts - I ran into technical trouble on Sunday, and it looks like my website has been hacked somehow, as it now diverts to an online pharmacy selling Viagra. I just wanted to confirm this is not some new subsidiary activity of mine! So I uploaded the audio to Acast this Sunday, as usual, which distributes it via most of the big podcast channels, so it should be there (search for "Paul Scott small caps"), or here's a direct link to Acast which you can bookmark if interested. Most people seem to tune in via Apple podcasts, so it seems you've mostly got iPhones or iPads. There might be a problem with google play for this weekend's podcasts, sorry about that.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Paul’s Section:

Begbies Traynor (LON:BEG)

132p (pre market)

Market cap £204m

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, announces an update on trading for its financial year ended 30 April 2023.

Good news here -

Results expected to be ahead of market expectations

How much ahead of expectations? It’s a modest beat, with adj PBT of £20.7m, vs market expectations of £20.3m (consensus). Well done to the company & its advisers for giving us the precise figures, and market expectations, in the trading update. That’s best practice.

With revenue up 11% to £122m, but adj PBT up a greater percentage, at +16%, this shows an improvement in profit margin, as well as actual profit.

Net cash of £3m, despite having made acquisition-related payments of £11m in the year. Plus it’s paying divis too, of about 3%. So this is a genuinely cash generative business.

Bank facilities sound ample at £30m.

Outlook - the general tone of this update sounds upbeat, and current trading/outlook sounds good, and a reminder that it’s also growing through acquisitions -

"We have started the new year confident in our outlook for a further year of growth. Our insolvency team will benefit from their recent insolvency appointments, together with anticipated further growth in the insolvency market. We continue to identify growth opportunities for our advisory and property teams, including the recently announced acquisition of Banks Long & Co."

Broker update - Equity Development has issued an update note, raising EPS (which is what I use) from 10.0p to 10.5p for FY 4/2023. That means a PER of 12.6x

We can probably expect maybe 11-12p for FY 4/2024, which would lower the PER to 11-12x

Paul’s opinion - at 132p per share, that strikes me as a reasonable valuation, certainly not stretched. Plus divis, and being counter-cyclical, BEG shares are nice to own if you have a negative overall macro view, since insolvencies usually increase when the economy is weak.

Overall then, I can only have a positive, GREEN, view of this share at the current price of 132p. Upside? I imagine 150p+ is possible, with some patience.

Wincanton (LON:WIN)

Up 3% to 224p

Market cap £278m

Wincanton plc ('Wincanton' or the 'Group'), a leading supply chain partner for UK business, today announces its preliminary results for the year ended 31 March 2023.

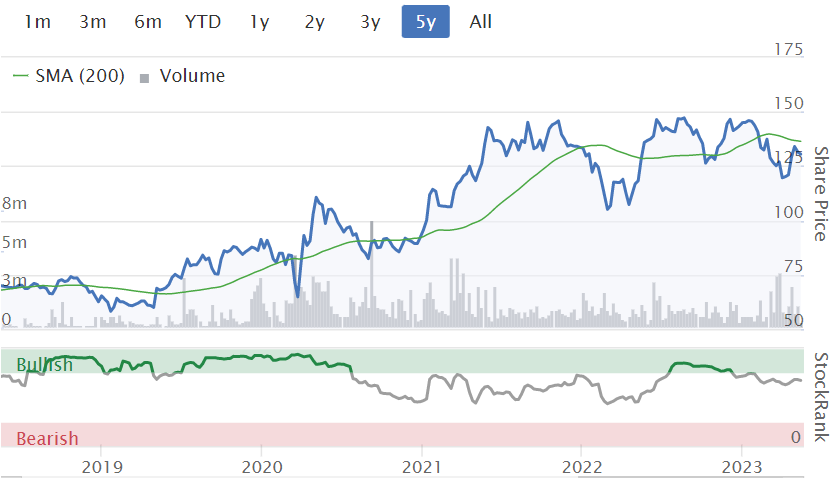

As you can see from the 5-year chart below, this logistics group did well in the pandemic, but its shares have since come all the way back down again to their pre-pandemic level - like so many small caps.

More recently, we can see the profit warning which I covered here on 7 March 2023, with a sharp vertical drop in the chart above, which has not yet been recovered.

The problem was the loss of a large & lucrative HMRC contract, which didn’t impact FY 4/2023 numbers, confirmed in line with expectations in the 7 March update. However, FY 4/2024 forecasts were cut considerably, by about 20% in EPS forecast, due to the HMRC contract loss (on re-tendering). The narrative today says important lessons have been learned about pricing contracts, and that there are good opportunities with UK Govt agencies to win more business.

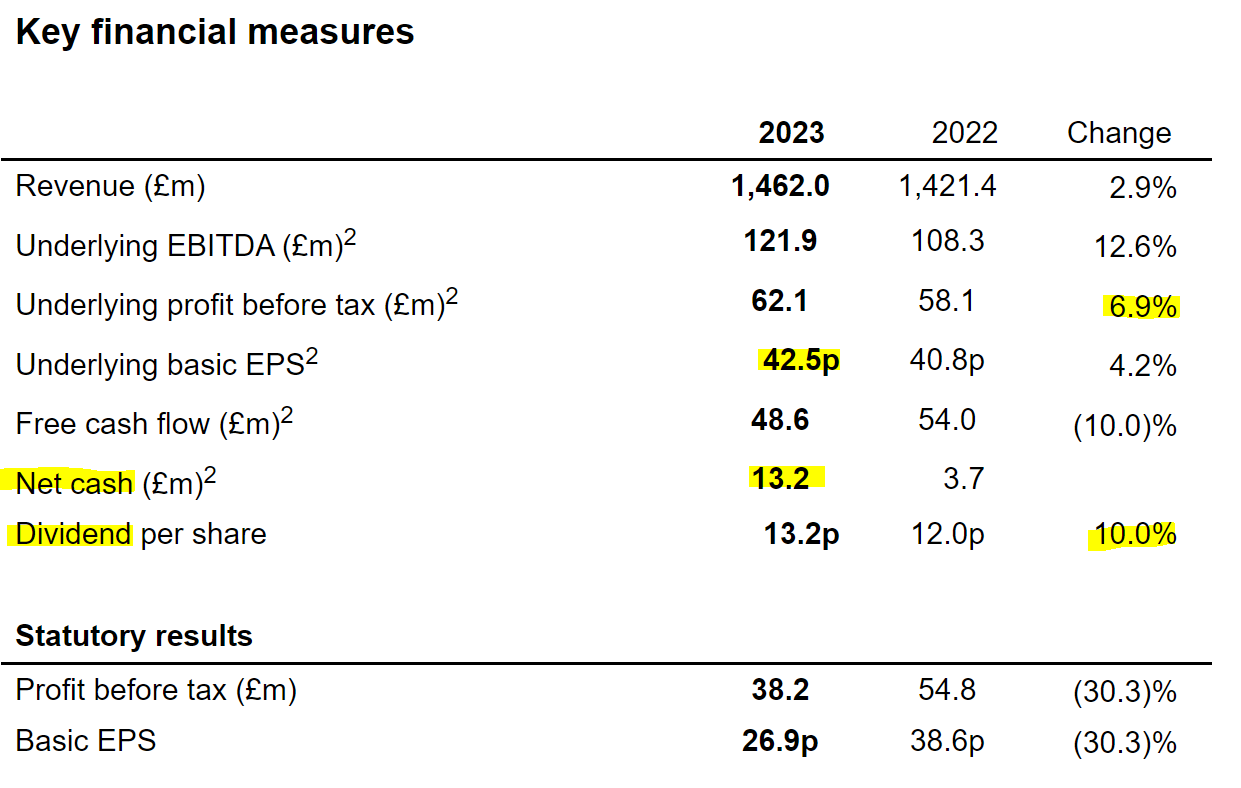

Sure enough, the FY 3/2023 headline numbers have come in slightly ahead of expectations, e.g. Liberum had 41.5p adj EPS, and the actual is 42.5p. For a share that’s only 224p, we have a really low PER of 5.3x

So far, so good.

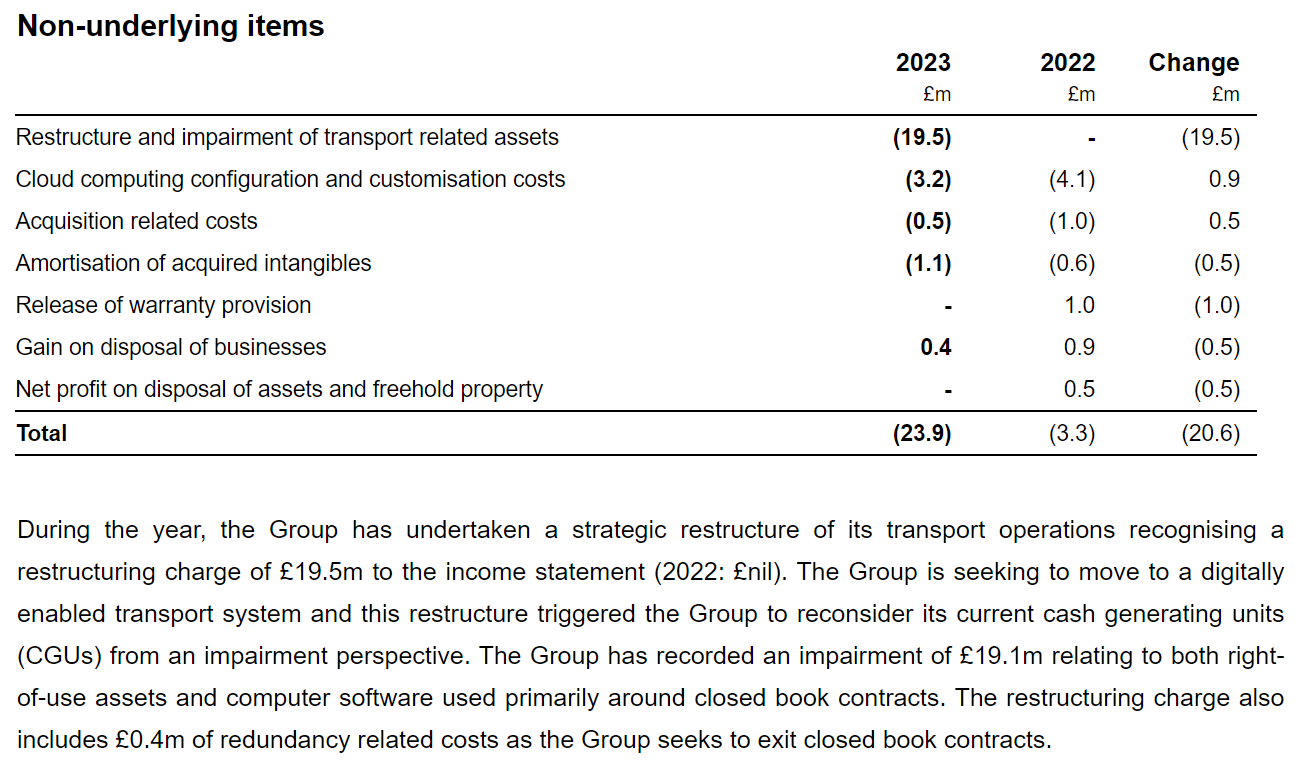

Note that the statutory figures are well below the underlying numbers, so I’ll have to carefully check what the roughly £24m shortfall is, comparing the two profit numbers above.

Inflation - just a reminder that WIN has proven adept at passing on cost increases to clients, since a lot of its contracts are “open book”, i.e. passing through costs, with an agreed profit margin.

Pension deficit - previously a major cash outflow each year, it now looks close to being fully funded on an actuarial basis (the more important method, since it determines any cash contributions). I covered this issue in more detail here in Nov 2022 when WIN’s interim results came out. In a nutshell though, I think the pension scheme is nearly fully funded, which could trigger a re-rating of the shares in due course.

The accounting surplus is about £115m, mentioned today. It’s usual for the accounting method to produce a much better picture than the actuarial basis, which is why it’s best to ignore the accounting basis for pension scheme surplus/deficits.

EDIT: although I see that Liberum's note today (many thanks) shows pension cash contributions of £22-25m pa continuing for the next 3 years - hefty amounts.

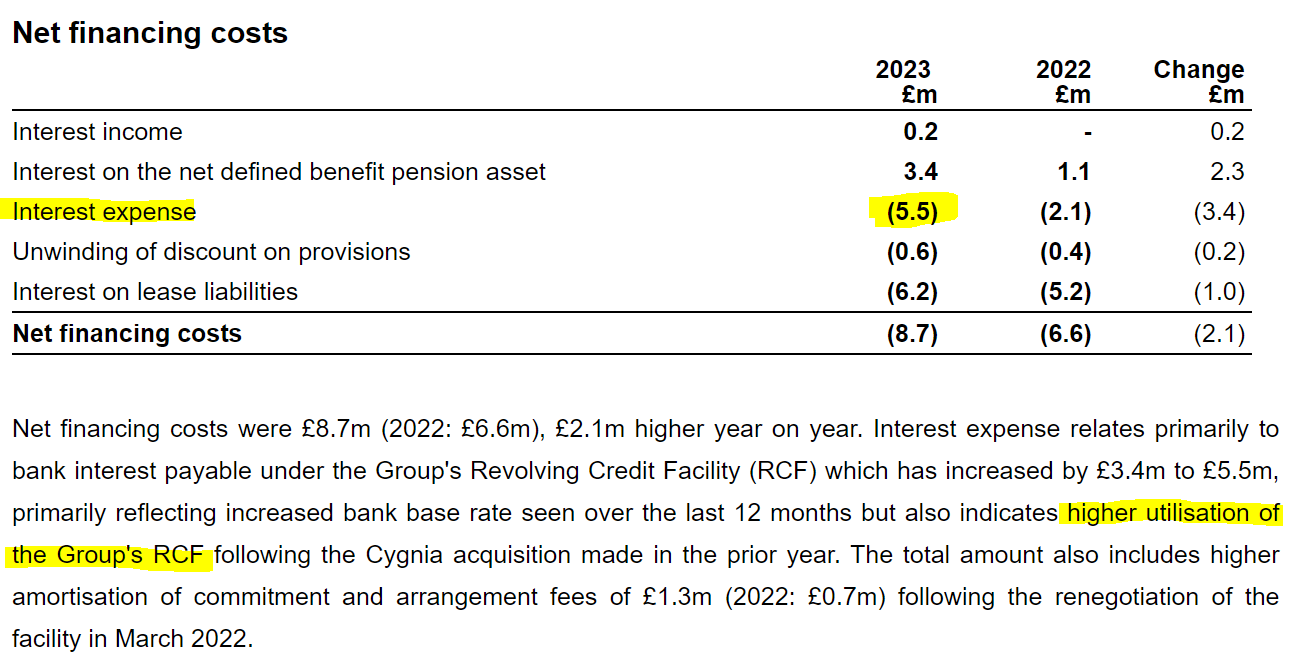

Adjustments - can’t say I’m convinced that these considerable costs below should be adjusted out. They look like fairly normal costs of running the business to me, so there’s a question mark over whether the “underlying” numbers are valid, in my view -

Going Concern note - says things will be fine, even in a severe downside scenario.

Balance sheet - is weak. NAV of £59m includes £222m in what I consider spurious assets (£105m goodwill, and £117m pension asset). Get rid of those, and NTAV is heavily negative at £(163)m. Although interestingly, there isn’t any interest-bearing debt. So this is not a stretched balance sheet. It’s just that WIN operates normally with negative working capital. It doesn’t have any inventories remember, and customers seem to pay up-front, which means it doesn’t need any net capital.

Although I would like to see what the average daily net cash/debt figure is, as that might look very different from month end snapshot figures depending on when customers pay, and when suppliers are paid.

My hunch on this is confirmed by the interest expense note, with £5.5m of bank interest costs for the year, suggesting that an average daily position on cash/debt might be something like £100m overdrawn, a long way from the small net cash position presented on the year end date!

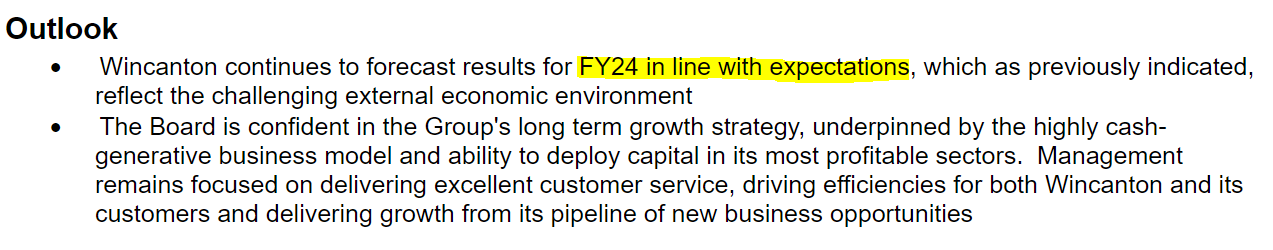

Outlook - rather bland, but confirms in line for FY 4/2024 (remember forecasts were lowered considerably before) -

As you can see below, we’re looking at c.30p for FY 4/2024, giving a forward PER of 7.4x - still good value I think.

Paul’s opinion - I remain of the view that this is a good business, and have kept it on my top 20 watchlist for 2023. It was obvious, given macro conditions, that there would be some profit warnings on my list, so only having 2 to date (WIN and QUIZ) is actually quite pleasing. These 2 fallers have been more than offset by strong performances from most of the other shares, with the list currently averaging +12% YTD - not bad at all in a depressed small caps market.

I deliberately picked shares that would be resilient, even if they suffered temporary setbacks.

That’s how I see WIN. Losing a big, profitable contract is clearly a setback, but WIN has a good track record of winning new business, and makes positive noises about that today. So I reckon this share should recover, if we’re patient. Hence I remain of a GREEN (positive) opinion in our traffic lights system (see explanatory notes from what this means).

On the downside, I find the accounting a bit aggressive, with average net debt probably a good deal higher than the year end snapshot, and the large adjustments to profit seem tenuous. Overall though, I don’t think these undermine the value case for WIN shares.

Totally (LON:TLY)

Up 4% to 21.5p

Market cap £42m

Announces "multiple contract extensions" - ie contract renewals, totalling £12m. That's in the context of £144m forecast revenues for FY 3/2024.

It says this underpins existing forecasts, rather than being additional business, so I don't think it's anything to get excited about.

Paul's opinion - not yet convinced by this share, but will keep an eye on it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.