Good morning from Paul & Graham!

Weekend podcasts - I'm only publishing these on the main podcast platforms now, not on my own website. If you prefer a web-based version, this is the web page created by acast, the publisher I use for my podcasts, which you might want to bookmark, if interested. I must change that picture too for one with a smaller double chin!

My macro view is certainly getting more bearish, after the latest lurch higher in gilt yields, core inflation proving more stubborn than expected, and market expectations for peak interest rates being a lot higher than a week ago. One month's data is just that, but even so it strikes me that we might be inching closer to a recession. Who knows? It's difficult to see why small caps would start a bull market any time soon, given that people can earn a nice return, with little to no risk, from cash, or fixed interest instruments. So I think we should really be questioning valuations, that in some cases don't seem to adequately reflect the completely changed environment we now have. Mind you, once we're through this period of higher inflation, maybe interest rates might come back down again? All the more reason perhaps to lock in some higher yields on fixed interest stuff?

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

DWF (LON:DWF) 66p (+6%) (£226m) - Full-year TU, misses FY 2023 estimates but forecasts for future years are unchanged - Graham - AMBER

This RNS leaves out most of the bad news, as investors have to find the broker note instead for profit and debt figures and how they relate to prior expectations. Estimates for future years are unchanged due to anticipated cost savings. Very cheap shares but debt is high.

Hunting (LON:HTG) - 232p (+15%) (£381m) - Major order, improved guidance - Graham - AMBER

Pleasant news of a 3-year order from Vedanta for Indian operations, total value $91m. Hunting’s EBITDA guidance gets raised once again. The very large, short-dated order book is now $575 million. Market cap should allow for more gains if this momentum continues.

Hollywood Bowl (LON:BOWL) - up 1% to 262p (£450m) - H1 results & in line outlook - Paul - GREEN

A high quality, high margin business, that continues to trade well - in line exps for FY 9/2023. Self-funding expansion & refurbs, plus decent divis too. Lots to like here, but nobody knows whether the boom in ten pin bowling is here to stay or not.

Likewise (LON:LIKE) - unch at 25p (£61m) - Trading Update (in line) - Paul - AMBER

A fast-growing competitor to Headlam (LON:HEAD) run by its former CEO. Reassures on trading today, in line with expectations. Good growth. Could be one to watch maybe?

Paul’s Section:

Hollywood Bowl (LON:BOWL)

Up 1% to 262p

Market cap £450m

Hollywood Bowl, the UK and Canada's largest ten-pin bowling operator, is pleased to announce its Interim Results for the six-month period ended 31 March 2023 ("H1 FY2023").

Company’s headline -

CONTINUED STRONG CUSTOMER DEMAND REFLECTING ATTRACTIVENESS OF OFFER AND GREAT VALUE FOR MONEY PROPOSITION

Key numbers for H1 -

Revenue £110.2m, up 10% vs LY, or +20.7% if the one-off VAT benefit to last year’s figure is adjusted out, to give a like-for-like (LFL) comparison.

LFL revenues (i.e. excluding new sites, and closures, if any) is up +3.5% - well below inflation, but the prior year comps are tough to beat as there was a bowling boom after the lockdowns ended (which still seems to be ongoing!)

Gross margin - note the very high gross margin of 82.8%, since a lot of revenues will have little to no direct cost of sales (playing games, as opposed to buying a physical object). Although this is down from 85.1% in H1 LY (last year).

Adj EBITDA (pre-IFRS 16) is a healthy £35.1m, up 13% vs H1 LY. Note that the margin on this measure has fallen from 33.95% LY, to 31.85% this time, but that’s still a very good margin I think, and it takes into account all central costs. So the individual site EBITDA margin would be even higher. I think EBITDA is actually a useful performance measure in the hospitality and retail sectors, and is widely used. That’s only for a half year remember, so this is a highly cash generative, high margin business.

Balance sheet - net cash is £44.1m (ignoring leases, because they are not debt, they are future operating costs from which profits will be generated).

NAV is £139m, which includes £89m intangible assets, quite a lot. That gives NTAV of £50m, which is only one-ninth of the market cap, so it’s not really an asset-backed investment.

The lease entries show an overall deficit of about £41m, which surprises me, as that implies the group has some loss-making sites where the notional asset value is well below the future rental payments. That would be a good question to ask management to explain.

Being a leisure business, the balance sheet has very little inventories and receivables. So it has negative (i.e. favourable) working capital. That means there’s a lovely cash pile sitting there, or £44.1m, with no bank debt, just an unused £25m facility.

The short version is, everything’s fine, this is a well-financed business, so I don’t see any solvency or dilution risk..

Although very high gross margin companies like this are sensitive to downturns. By my rough calculations, revenues would have to drop by about a third, to eliminate profits and reach breakeven, which is a very extreme scenario.

New sites, refurbs, and Canada - the commentary says all are performing well, at or above plan. BOWL is clearly in a sweet spot, generating loads of cash, which enables it to keep expanding & improving its offerings - a virtuous circle I’d say.

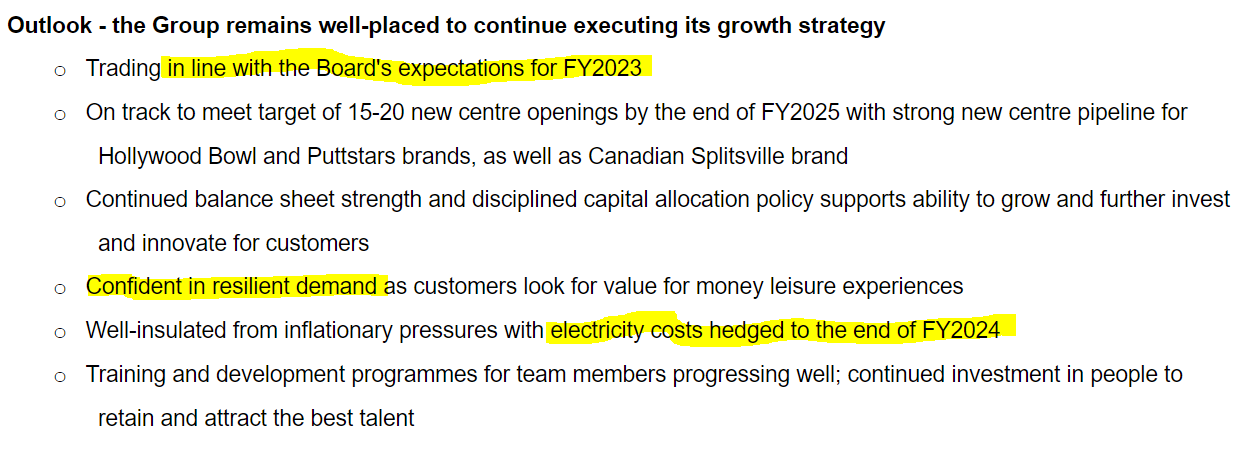

Outlook -

I can’t see any information on what the LFL sales growth (if any) has been since the half-year end of 31 March. If I’ve missed it (possible!) then do please leave a comment. I suspect sales growth might now be hard to come by, given strong comparatives. Not that it matters too much, because the company confirms that it’s trading in line with expectations for FY 9/2023.

The StockReport shows a broker consensus for this year of 18.7p EPS, so at 262p that’s a PER of 14.0x, or an earnings yield of 7.1% - I’d say that feels about the right valuation given current macro conditions.

Paul’s opinion - I can’t find fault in BOWL - it’s trading very well, generating tons of cash, which it’s using to self-fund growth, refurbs, international expansion, and pay a fairly decent divi yield forecast at 4.3%. That’s an impressive combination. So it has to be a thumbs up from me!

Obviously the big unknown is whether, and for how long, the current popularity in bowling is likely to last. Maybe it’s permanent? Remember though, that if demand really drops off, eg in a big recession, then that 83% gross margin, and a largely fixed overheads base, could generate high operational gearing on the downside. For that reason, I don’t think it’s necessarily a good idea to be chasing this share higher in such a wobbly macro environment.

I see BOWL shares qualify for a GARP (growth at reasonable price) screen - I've not looked at this one before, but it might be worth checking this to see if we can find other similar shares. This is a clickable link - I see this GARP screen only picks up companies with a >£200m mkt cap, but that can be easily amended to look for smaller companies, if you wish.

Healthy-looking chart, given that we're in a pretty horrible bear market for smaller companies - although it's quite surprising it still hasn't recovered to the pre-pandemic peak, given how well the business has performed since then. Although note the share count has risen from c.150m to almost 172m over the period of this chart, so some dilution -

Likewise (LON:LIKE)

Unch at 25p

Market cap £61m

Likewise Group plc (AIM:LIKE), the fast growing UK floor coverings distributor…

I remember previously researching Likewise, and was confused that it had 2 admission documents on its investor relations website. It turns out one was for an obscure Channel Islands listing, but it then moved to AIM in Aug 2021.

This group is run by Tony Brewer, who was a former, long-serving CEO of Headlam (LON:HEAD) (I hold). I had a get to know you phone call with him last year, and the business model is very simple - LIKE is expanding organically (opening new warehouses), and by acquisition, with the aim of becoming a major player in the UK floorcoverings distribution market - so it’s trying to eat the lunch (my words, not his!) of Headlam, and mop up independents too.

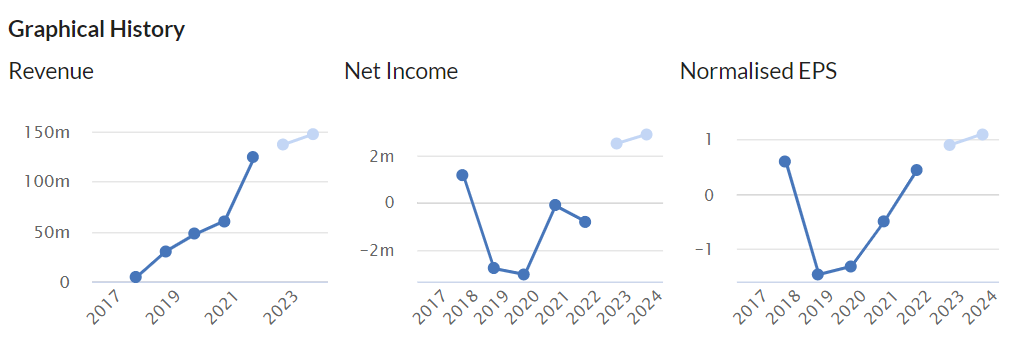

As you can see below revenue growth has been impressive, but it has yet to make a meaningful statutory profit (it did manage to squeeze out an adjusted profit in 2022) -

Today’s update sounds encouraging (given that HEAD has recently issued what sounded like a mild profit warning, and was unsure about consumer demand) -

…is pleased to announce that despite certain adverse comment regarding the New Build and Refurbishment Markets, that its businesses in both Residential and Commercial Flooring have continued to increase following the last announcement on 16 May 2023 and the Group continues to trade in line with current market expectations.

Year to date Group Revenue has now increased by 17.7% against the corresponding period last year and the Likewise Branded Businesses by 24.5% due to the ongoing investment in Sales and Marketing continuing to accelerate gains in market share.

Its medium-term target is to reach £200m revenues. Note that for comparison, HEAD did £664m in FY 12/2022.

The next update is on 29 June 2023.

Paul’s opinion - we’re in a nasty bear market for small caps, so I’m not prepared to pay up-front for future profit growth, when I can buy existing profits cheaply at HEAD (which I’ve done, taking a tiny opening position in it recently).

That said, I think LIKE looks credible, has a reasonably sound balance sheet (with some freehold property), and experienced management. Adding new capacity is pretty simple - it’s just more warehouses, with some simple racking in them, and more staff.

The plan is to keep adding more salespeople, who generate multiples of their salaries in gross profit.

As mentioned in my recent comments on HEAD, my worry is that LIKE and HEAD could just be in a race to the bottom on margins, to the detriment of both businesses.

It’s difficult to imagine what LIKE can do better than HEAD, other than undercut it on price, which doesn’t excite me as something to invest in.

Overall then, I’ll be neutral on LIKE for the time being, but will keep an eye on it. The obvious upside case, is that if it can scale up to the same size as Headlam, but without excessive dilution, then the shares could be a multibagger from the current £61m market cap. That won’t be easy to achieve though. Also, it's the type of share that would probably re-rate onto a more punchy valuation once the next bull market starts.

The chart is starting to look a bit healthier too. Although StockRank is not yet convinced!

Graham’s Section:

DWF (LON:DWF)

Share price: 66p (+6%)

Market cap: £226m

This professional services company issues a trading update for FY April 2023.

Key points:

Revenues c. £380m. The broker note tells us that this is 2% below forecast. Organic growth for the year was 5%.

The RNS does not tell us the profits for the year. The broker note says that adj. PBT was £44.1m, 4% below forecast.

“Lock-up days” (time taken to convert work done into cash) is 190 days. The broker note tells us that this is ten days longer than forecast, and that this results in year-end net debt of £98m, £9m higher than forecast.

I find it remarkable that the RNS doesn’t tell us that revenues were below forecast, doesn’t tell us that profits were below forecast (or even what those profits were), and doesn’t tell us that net debt is higher than forecast (or even what the net debt figure is).

The RNS does give us reassurances on medium-term guidance:

Highly confident in medium term guidance provided in July 2021, underpinned by the cost programme which is now expected to remove in excess of £15m of cost by end of FY24 (versus £10-12m reported in December 2022), helping to protect the business from broader inflationary cost pressures.

That bodes well for FY 2024/FY 2025, and forecasts are left unchanged for those years with “upside risk to profitability”.

It is thought that revenue growth will continue at a rate of 13% in the current financial year (but remember that this is not all organic growth).

CEO comment:

We have delivered consistently strong revenue growth and underlying organic growth, with the initial benefits of our cost control programme also coming through. Our transaction in Canada has also given us great momentum in North America, which is a geography that continues to be of high importance to our future growth story. In combination, this gives us a high degree of optimism as we begin FY24.

My view

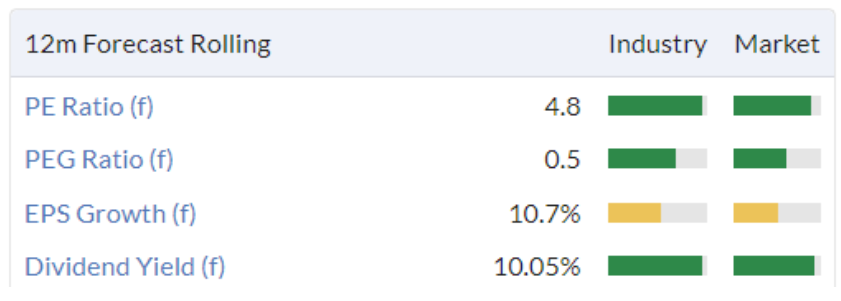

These shares are strangely cheap, even in a bear market for UK small-caps.

Almost anything with this sort of rating is worth investigating! If only to understand why it is so cheap.

Personally, I will stay away from it, because of my bias against the professional services sector (including law firms), which has been a minefield for investors. However, it’s possible that these shares are now simply too cheap relative to the size of the business. The price to sales ratio is materially below one.

Some of the concerns and quibbles investors might have could include:

Net debt of nearly half the market cap

Net debt higher than forecast, with cash locked up for six months - how confident can we be that all bills will be paid?

Organic revenue growth of 5% is less impressive when you consider the inflationary environment.

The RNS leaves out a lot of useful information - why can’t it say what the profits and net debt figures are, and how they relate to expectations?

I take a neutral view of this share, because a P/E rating this low is clearly already pricing in a lot of bad news. Managing the debt will be key.

Hunting (LON:HTG)

Share price: 232p (+15%)

Market cap: £381m

Today’s news provides a welcome boost to Hunting shares after a difficult start to 2023:

It has a new three-year contract covering 100 oil wells, which the company interprets as a sign that market sentiment remains “extremely strong” in the industry.

Hunting PLC (LSE: HTG), the international energy services group, today announces that its Asia Pacific operating segment has won a new, significant Oil Country Tubular Goods ("OCTG") contract that management estimates to be worth up to $91 million with Cairn Oil and Gas, Vedanta Limited, for its operations in Rajasthan, India.

New guidance - EBITDA for FY 2023 is now expected to be $92 - 94 million, versus prior guidance of $85 - 90 million. This follows another upgrade from $80 million that we commented on in December.

The order book goes to c. $575m, a very nice uplift from $500m six months ago.

Cash/debt - the company says there is no change to guidance for cash at year-end. The latest Zeus forecast suggests net cash of $41m at December 2023.

A word of warning, however - there are significant swings in working capital during the year in this industry and we should not treat this as we would an “average” figure.

CEO comment:

"Hunting's successful run of significant OCTG and Subsea orders since H2 2022 demonstrates that our technology and global footprint is well positioned to deliver significant growth in the medium term. US market activity remains stable and with the orders received for China, Guyana, Brazil and now India, Hunting continues to see a strong growth profile given our standing and recognition with major energy companies, coupled with the strong international market sentiment being reported in many regions."

My view

I’m neutral on this, leaning towards green as the value metrics are attractive, the cash position is not bad, and the earnings momentum has been impressive lately.

When I last commented on it, the market cap was £450m (vs. £380m today). As such the arguments for value are now slightly easier to make, with firm and rising EPS estimates helping to reassure that things are on track.

So if you like the oil services sector, this strikes me as a nice candidate for further research.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.