Good morning from Paul! A leisurely start this morning, as it's Friday.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Paul’s Section:

Dechra Pharmaceuticals (LON:DPH)

Up 8% to 3644p (£4.1bn) - Recommended cash takeover bid - Paul - AMBER

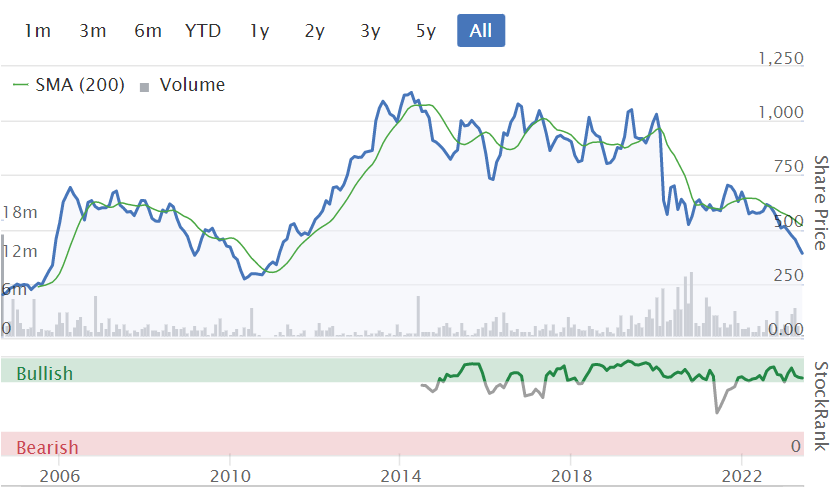

Shareholders in mid-cap Dechra Pharmaceuticals (LON:DPH) will barely need to dust down their Coronation bunting, to celebrate this morning, with a cash offer priced at 3,875p. That values Dechra at £4.46bn. As you can see from the chart below, it already had a bid premium in the price, hence why the 8% uplift today is modest. The bidder is Scandinavian private equity group, EQT.

Dechra also puts out a profit warning today, so shareholders got lucky that the takeover bid has happened, as otherwise this probably would have been a nasty down day -

The Dechra Board expects that full year underlying operating profit for the year ending 30 June 2023 will be materially below £186 million, the guidance provided within Dechra's interim results announced on 27 February 2023 ("FY23 Profit Forecast").

Paul’s opinion - none, as it’s not a company or sector I follow. However, the shareholder value created here look fantastic, so well done to anyone who has owned this share over the long-term -

PayPoint (LON:PAY)

Up 6% to 401p (£290p) - Trading Update - Paul - GREEN

This share came up in the “BASH” discussion session at Mello which I participated in, so I did some very quick research on my phone a few minutes beforehand. The result of my shallow research was positive, that PAY looked great value, but the obvious concern is whether its core activity of utility prepayment cards has longevity or not? Mind you, investors have been worrying about that for many years, and like newspapers too, it keeps spewing out profit/cashflow despite being possibly in long-term decline. Plus it’s making acquisitions too, including an opportunistic bid for gift card business Appreciate.

Positive Trading Update and Confirmation of Preliminary Results Date

Here’s the whole of today’s update -

PayPoint today reconfirms the guidance issued in the post-close trading update on 20 April 2023 that Group net revenue for the financial year ended 31 March 2023, excluding Appreciate Group, is expected to be around £125m (FY22: £115.1m) with accelerated revenue growth across all three business divisions. The Group anticipates that profit before tax for the financial year ended 31 March 2023 will be at the top end of the range of market expectations, excluding exceptional items and Appreciate Group impacts since completion of the acquisition, driven by the strong momentum across the business.

The Group has materially enhanced its platform and capabilities in the past year: our integrated payments platform has expanded with the addition of Open Banking and prepaid solutions to our solutions across card, Direct Debit and cash; our retailer and SME proposition is now stronger than ever, with multiple opportunities for partners to earn revenue; and our e-commerce offering has gone from strength to strength, delivering record volumes and an unparalleled in-store experience for consumers. This enhanced platform will unlock future opportunities and deliver sustainable and profitable growth for shareholders, underpinned by our business-wide partnership philosophy and intensity of execution.

The integration of Appreciate Group (now known as Love2shop) continues to progress well, opening up further revenue opportunities, expanding our capabilities further in the gifting, rewards and prepaid savings markets and enabling the creation of enterprise level solutions into new markets, combining our extensive payments and commerce solutions across the Group. These opportunities have accelerated since completion.

Trading has been positive early in the first quarter of FY24, and we look forward to updating the market further at our preliminary results for the year ended 31 March 2023 on 6 July 2023.

Sounds pretty good to me.

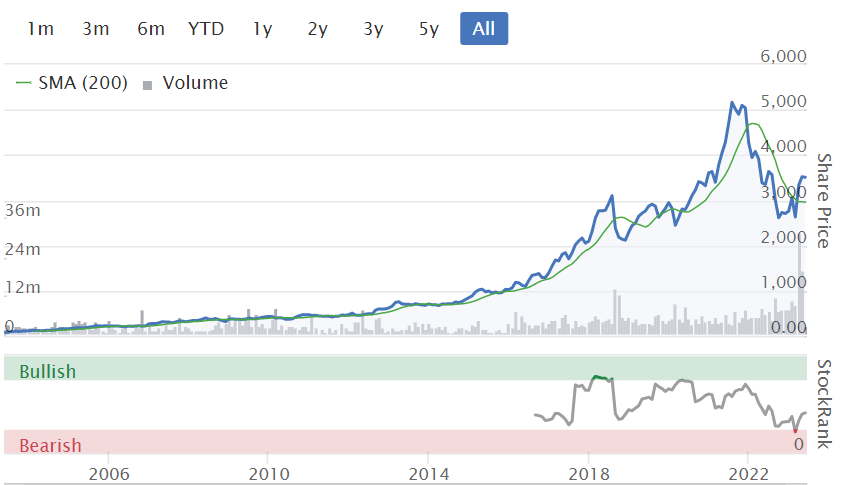

A note from April 2023, kindly published by Liberum, via Research Tree, estimates 58p EPS, and 41p divis for FY 3/2023, rising slightly for FY 3/2024.

At 401p per share, that’s giving a remarkable yield of just over 10%, and a PER of only 6.9x

Paul’s opinion - value investors would be negligent not to do more research on this share, when the value measures are this cheap! I can only give it a thumbs up, so green opinion from me, due to the fantastic value on offer here.

Gateley (Holdings) (LON:GTLY)

Down 2% to 163p (£206m) - FY 4/2023 Trading Update - Paul - GREEN

Gateley (AIM: GTLY), the legal and professional services group, is pleased to announce a trading update for the year ended 30 April 2023 ("FY23"), ahead of the publication of its audited results in late July 2023.

I’m not keen on this headline, as it’s ambiguous -

Growth in-line with market expectations

Thankfully, the next paragraph clears up any ambiguity -

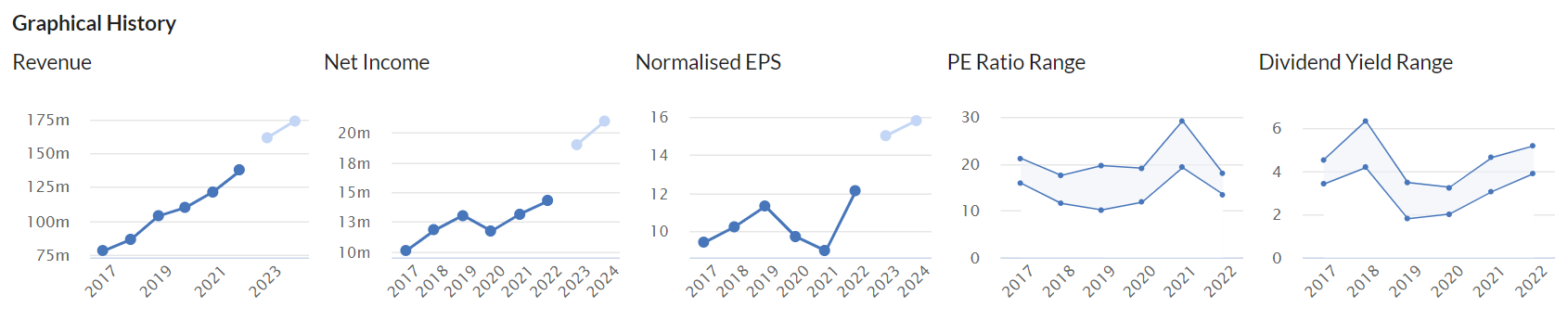

The board is pleased with the Group's performance for FY23, a year of further revenue growth demonstrating the resilience of the Group's diversified business model. Revenue for FY23 is expected to be not less than £161m, a c.17% increase on the prior year (FY22: £137.2m) with underlying adjusted profit before tax expected to be in line with market expectations.

The Group had net cash (pre IFRS 16 liabilities) of £4.3m at the period end.

Many thanks to Liberum, for an update note today, forecasting £24.2m PBT, up nicely from £21.6m last year. In EPS terms, it’s 15.3p for FY 4/2023, with just over half paid out in divis of 8.8p.

Valuation is therefore a PER of 10.7x, and yield of 5.4% - good value I’d say.

Look at the performance graphs, which are strikingly good for a share that’s only rated at 10.7x

The market seems to be giving GTLY little credit for a decent track record of growth -

Paul’s opinion - I’m not a fan of legal services business, or indeed any people businesses where there’s a natural conflict of interest between fee earners, and outside shareholders.

However, the sector has some striking bargains in it, where this might be a good time to pick up some cheap shares, and GTLY seems to fit the bill.

I also recently looked at Knights group (LON:KGH) which looks astonishingly cheap, on a forward PER of just 4.3

Given the cheap valuation, and in line trading update today, I haven’t really got any choice than to view GTLY shares positively, so it’s green from me, thumbs up (the same thing).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.