Good morning from Paul & Graham (back today after a week off)!

Today's report is now finished.

I woke up very early today, after having a weird dream about being interrogated/gaslighted by Ant & Dec, then Ed turned up and rescued me, only to get me involved in investigating the death of a busker. Maybe I should stick to writing these reports, as I don't think my subconscious is displaying much talent for fiction!

I used the spare time to do some investigation of my family tree - a relative made us all do DNA tests on 23andme, and it's throwing up some amazing results!

Weekend podcasts - it's good to see the audience gradually building for my weekly audio output. Part 1 is a summary of the SCVRs, popular amongst the dog-walking community, I'm told. Part 2 is my macro news/views roundup, and is new content (so not in these written reports), which people might find interesting. Or if not, then just ignore. I like doing them, as it helps me collect my thoughts after the blizzard of news & work every Mon-Fri.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

We're not impressed with the micro caps issuing trading updates today, so we've decided to look at some more interesting backlog items as well -

Summaries

Synectics (LON:SNX) - down 2% to 105.25p (£19m) - TU (in line) - Graham - AMBER

This security company issues an in-line update. An H2 weighting is in the works, so the pipeline needs to deliver as expected. Estimates suggest the shares are too cheap but underlying quality appears limited so I’ll wait a little longer before turning green on this stock.

Beeks Financial Cloud (LON:BKS) (Paul holds) - Up 2% to 118p (78m) - Exchange Cloud Contract - Paul - GREEN

A contract win for its flagship cloud computing service with Johannesburg Stock Exchange. I have a look in the section below. Reassuring, rather than game-changing. An interesting GARP stock maybe?

Concurrent Technologies (LON:CNC) - Down 1% to 70p (£52m) - Update on audited results - Paul - AMBER

A further delay to publication of audited accounts, due to several prior year adjustments, and a more conservative approach to capitalising development spend. This will also hit the overdue FY 12/2022 profit by c.£0.6m. It all looks sloppy, but fresh outlook comments sound more positive. So on balance, I'll give it the benefit of the doubt!

B.P. Marsh & Partners (LON:BPM) - up 4% to 390.4p (£141m) - Finals - Graham - GREEN

I remain positive on this investor in insurance intermediaries. In May it agreed to sell a major asset for £51m of cash, with the result that it plans to put an extra £6m into buybacks and pay out £7m of dividends over three years. Balance sheet NAV per share is over 500p.

Creo Medical (LON:CREO) (Paul holds) - Up 14% to 36.5p (£128m) - MDR Approval - Paul - AMBER

I've previously been savage about this heavily cash-burning medical devices innovator. But a webinar with Paul Jordan of Amati, convinced me that, since a £34m fundraise in March 2023, this company now looks adequately funded, and its products seem genuine game-changers for bowel surgery. Definitely NOT for widows & orphans, this is a highly speculative punt only! But its shares are rising strongly, so thought I would update you on it.

Musicmagpie (LON:MMAG) - up 4% to 18.5p (£20m) - H1 Trading Update - Paul - RED

An in line update today, with Q2 better than Q1. However, positive EBITDA turns into a adj LOSS before tax, due to large depreciation & amortisation (of development spending). So it's racking up bank debt, buying products to rent out, that it loses money on overall. I think it's a terrible business model.

Paul’s Section:

Beeks Financial Cloud (LON:BKS) (I hold)

116p (pre market) £76m - Exchange Cloud Contract - Paul - GREEN

Beeks is a niche cloud computing company, providing low latency connections to financial exchanges globally. I think it looks a very interesting high organic growth share, with recurring revenues. With the bear market in small caps, and lack of big contract news lately, the price has drifted down to a more interesting level I think.

This morning it announces that its flagship service Exchange Cloud, launched in June 2022 has won a second client, the Johannesburg Stock Exchange. Unfortunately, there is no indication in the announcement about the contract size or terms. However, a note from Canaccord (many thanks!) is newly up on Research Tree, and this indicates no material effect on Jun 2023 results (as it’s only 11 days to the year end), but “well underpins” June 2024 forecast of +20% organic revenue growth.

A bonus is that the IT kit can be supplied from inventories that Beeks built up during the chip shortage, so no cash requirement from Beeks to implement this contract.

Paul’s opinion - the story had gone a little quiet, so this contract win is a nice boost to investor sentiment. Beeks has told us before that exchange cloud contracts are large and complex, so take time to negotiate and implement. Each new site acts as a further reference site, which reassures potential new customers. So I’m hoping Beeks might build momentum.

It’s more speculative than the usual things we cover here, but Beeks is a tight ship, and has already reached profitability. Management particularly impress me (hands on entrepreneur), and the founder has lots of skin in the game, holding 38%. He's made it clear before that the plan is to build up the company, then sell it in future.

Worth a closer look for growth company investors, I think.

For balance, some investors have criticised the cashflow profile, in that new contracts require up-front capex from Beeks, which has resulted in it needing several fundraises - although far from ruinous, the share count has risen from 49m to 66m in the 5.5 years it’s been listed. During that period revenues have growth from £4m, to est.£25m this year, and it's moved into profit.

Another important point is that staff wages are low, but made up with share options (for all staff I think). So for that reason, I would not adjust out the share options charge in the P&L, as more than with most companies, it's actually staff remuneration.

I think this is one of the more credible small growth stocks on the UK market. There’s lots of detail in the archive here, as I follow this one closely, and hold some shares myself (long-term). This strikes me as the type of share which could re-rate sharply once the next bull market starts.

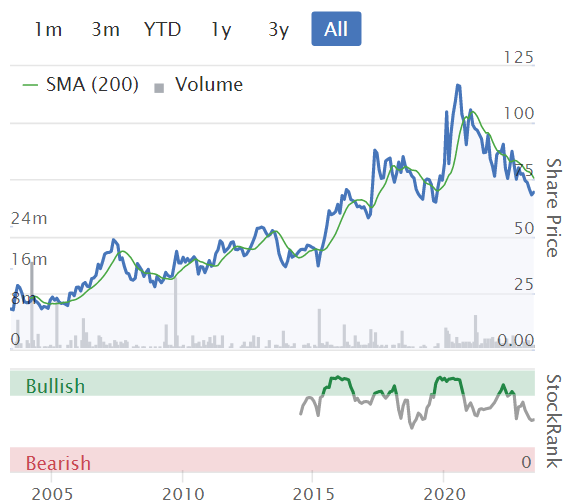

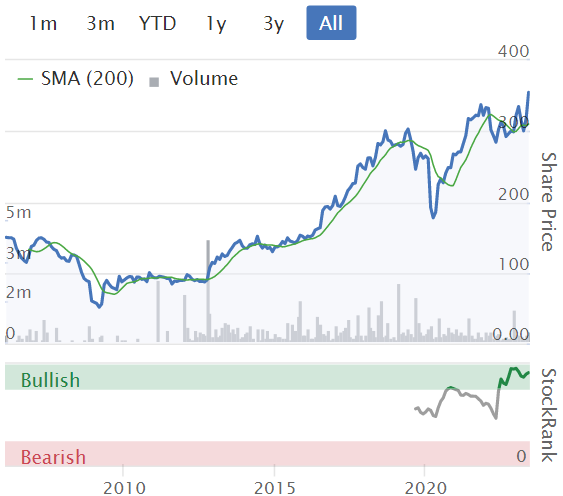

Stockopedia is singularly unimpressed, with a dismissive score of just 15 on the StockRanks - telling us to (at least) do a lot more digging into the numbers, or for the risk averse to avoid it altogether. Your call!

My view is that the company has made great progress in the last 5 years, but the share price is back down to there it was. To me that's more of an opportunity than a threat. I might add to my position on any further weakness.

Concurrent Technologies (LON:CNC)

Down 1% to 70p (£52m) - Update on audited results - Paul - AMBER

Concurrent Technologies Plc (AIM: CNC), a world-leading specialist in the design and manufacture of high-end embedded computer systems and boards for critical applications, provides a further update on the timetable for publication of the Company's full year results for the year ended 31 December 2022 ("FY22")

This is really sloppy.

There’s already been one delay, and today it says the auditors need a few more days to complete final reviews. That means it will have taken the company almost 6 months to publish FY 12/2022 results, which is the sort of timescale I normally expect from the lowest quality companies. Which is strange, as CNC is a proper business, historically profitable and paying divis, with an OK balance sheet.

I last reviewed it here in early Jan 2023, when a lacklustre trading update suggested that FY 12/2022 would only be around breakeven, after taking a hit from supply chain problems. The outlook for 2023 sounded more positive though.

The clock is ticking, as under AIM rules, as the company comments today, its FY 12/2022 audited accounts have to be published by 30 June 2023. Otherwise shares would be temporarily suspended - not a disaster, but looks really bad.

It confirms that FY 12/2022 revenue is still expected to be £18.2m. So what? Revenue is one of the simplest numbers to calculate, so I wouldn’t expect that to change post year-end! It’s profit that matters, which can change if audit adjustments are identified.

Prior year adjustments - capitalised development spend of £1.1m between 2016-2020 has to be removed and expensed instead. So that means historic profits were slightly overstated, but at something like £0.2m pa I can’t get too worked up over that.

The more conservative approach to capitalising R&D has had a more significant impact on FY 12/2022 though -

There is no material impact on the reported profit for the year to 31 December 2021, but the change has resulted in profitability in FY22 being reduced by c.£0.6 million as a result of a lower amount of R&D being capitalised.

So this means it’s now looking to be a loss of c.£(0.5)m for FY 12/2022, I think (no access to any broker notes).

This comment confirms my impression of sloppy accounting historically -

There are a number of smaller prior year adjustments requiring to be booked reflecting the rigour from both the Company and Auditors on past accounting.

Outlook - this upbeat paragraph is more important than historic accounting problems I think -

Looking forward to the current financial year ("FY23"), the Board is growing increasingly confident of delivering a significant increase in revenue over FY22 and of its ability to meet and, potentially, exceed current market expectations for FY23. This confidence is underpinned by continued growth in new orders and increasing visibility on physical delivery of key components required to fulfil backlog orders.

Paul’s opinion - I think serious questions need to be asked about the finance team, and whether they’re up to the job.

If you trust management, then the outlook comments sound pretty good to me.

Overall, I’m leaning towards giving them the benefit of the doubt, because historically this has been a decent enough little company.

Shares are priced at 20x est FY 12/2023 forecasts, which factor in a rebound from 2022’s losses. So unless you think it can beat forecasts, then I don’t see any particular attraction to this share. There might be something interesting in the products though, and their potential, but that’s the next level of research that you would need to do, I’m only looking at the current facts, figures, and forecasts, which don’t look particularly interesting. So I’ll go AMBER.

Creo Medical (LON:CREO) (Paul holds)

Up 14% to 36.5p (£128m) - MDR Approval - Paul - AMBER

MDR means Medical Device Regulation (in Europe). Approval has been achieved for CREO’s innovative medical devices for surgery on the entire gastrointestinal tract (previously only authorised for the lower part).

I’ve previously been highly sceptical about this share, due to its enormous cash burn, and it looked likely to go bust. However, major shareholders recently refinanced it at 20p per share for £34m, in March 2023. CREO now reckons it has enough cash to reach breakeven (they always say that though!). This impressed me, that it could raise a decent slug of cash in awful market conditions like this.

Paul Jordan of Amati was extolling CREO’s virtue on a webinar with Paul Hill, so after listening to that, and satisfying myself that cash was now OK, I took a speculative position personally. Well, everyone’s got to have a bit of fun!

Its medical devices allow much more efficient, safer, less invasive bowel surgery. Products have been launched, and seem to be gaining traction with experts in the field.

The bad news is prodigious cash burn (£30m last year alone!), and it’s not expecting to reach underlying EBITDA until 2025. The cash should last until end 2024, it says.

Paul’s opinion - purely as a punt, I think CREO looks intriguing, and it seems to be catching investors’ eyes at the moment. Very much NOT a value, or even GARP share, but as a speculative idea, I’d be interested to hear what readers think! The major shareholders obviously continue to believe in it, or they wouldn't have refinanced it in such a difficult market where they're probably facing client redemptions.

Have shares bottomed out now, I wonder?

Musicmagpie (LON:MMAG)

Up 4% to 18.5p (£20m) - H1 Trading Update - Paul - RED

musicMagpie, a circular economy pioneer specialising in refurbished consumer technology, announces an unaudited pre-close trading update for the six months ended 31 May 2023 ("H1 2023").

Adjusted H1 EBITDA up 7.7%; trading in line with Board expectations

Soft Q1 (Dec-Feb) due to post strikes & low consumer confidence, Q1: £0.8m EBITDA.

Stronger Q2 - EBITDA £2.0m, up 42% vs Q2 LY.

H1 total EBITDA: £2.8m.

Focus on cost control & gross margins, rather than chasing revenue growth.

H1 revenues down in both divisions, totaling £62m (H1 LY: £71m).

Gross margin up by 310bps, but this is not comparable, due to change in revenue mix towards rentals.

Lower overheads in Q2 - good, you need to cut overheads when revenues are dropping.

Active customer numbers on rentals (phones, tablets, etc) is 39k (doesn’t sound very much, but it’s up 28% since year-end of 11/2022).

Bank facility of £30m extended to July 2026, which is very surprising to me - maybe the bank sees something I don’t?

Net debt £13.7m at 31 May 2023. Remember it’s borrowing this money to buy secondhand phones to rent out to people who presumably can’t get hold of phones any other legal way.

Outlook - seems confident -

As evidenced in previous years, the Group has a much stronger second half weighting to its financial year, owing in part to seasonal peak trading around the Black Friday weekend in November. This seasonality, combined with the continued focus on own store sales and the strong performance achieved in Q2 2023, means that the Board is confident in the Group achieving its full year expectations, whilst remaining cognisant of the current tough consumer market.

Paul’s opinion - as I’ve mentioned here before, EBITDA is particularly meaningless for MMAG. Shore Capital’s update note (many thanks!) this morning estimates £8.7m EBITDA for this year FY 11/2023. But that turns into an adj LOSS before tax of £(1.5)m! So it’s not profitable at all. Yet it’s racking up debt to buy all these old phones!

This looks a terrible business model to me. Unless something changes for the better, then I think the bank are likely to get an expensive lesson in how EBITDA is not profit, or cashflow with this business model. If I’m right, then the equity could end up worth nothing.

As nothing has changed for the better, I have to maintain my highly sceptical view, RED. The business model is no good, that’s obvious from the broker’s forecasts. If you think it can smash forecasts, then it could surprise to the upside perhaps, but I wouldn't want to invest on that basis.

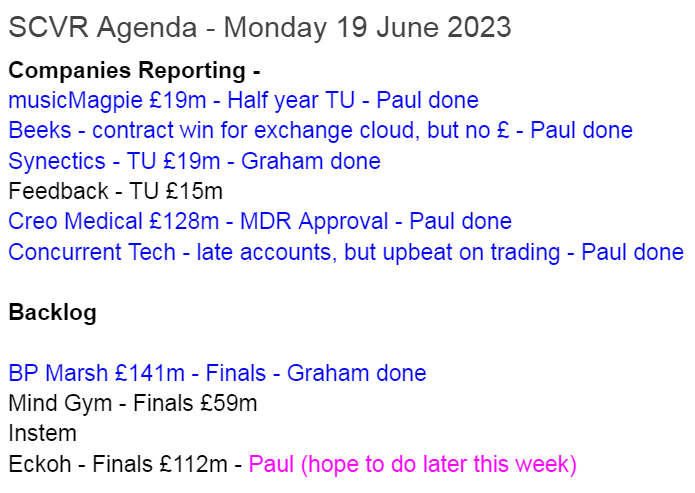

Awful chart below - yes you guessed it, MMAG floated in 2021!

Graham’s Section:

Synectics (LON:SNX)

Share price: 105.25p (-2%)

Market cap: £19m

Synectics plc (AIM: SNX), a leader in advanced security and surveillance systems, provides the following trading update for the six months ended 31 May 2023 ("H1 2023").

This surveillance/security company announces that its current order book, combined with its pipeline, “underpins the Board’s expectations of significantly improved trading in H2 2023”.

It last updated shareholders at its AGM in April, when its Systems division was “slightly ahead”, while its Security division saw “a slow start”. It explained then that the current financial year (FY November 2023) would be more heavily weighted to the second half than previously expected.

Today it says the same thing: that the current financial year is going to have a heavy H2 weighting.

When an H2 weighting appears out of the blue, it’s a sign that things are going badly. But what SNX is saying today is merely a reiteration of what was said before.

A post-Covid / oil & gas boom is underway:

Progress in H1 2023 was underpinned by strong trading in the global oil & gas market, which is expected to continue in H2 2023 and beyond. The Company has already increased supply chain and production capacity in this sector. Progress in other markets has been modest, with further improvements expected in H2 2023.

Net cash: approximately unchanged at £4m.

Estimates: unchanged, with the broker looking for adjusted EPS of 10.9p in the current year, rising to 16.8p next year.

Graham’s view

The underlying quality of this business seems to be average. Pre-Covid, in “normal” conditions, ROCE was in single digits. Indeed, so was the operating margin.

So I’m not sure I’d ever want to pay a high multiple for this one. However, in the current depressed environment, this has arguably fallen into value territory:

If the oil and gas boom continues, or if demand from casinos improves, then perhaps we can see Synectics hitting its estimates (or even getting close to them, which would still be a win for shareholders!). The PER based on next year’s EPS estimate is 6.4x, according to the company’s broker.

I am leaning towards Green on this one, but personally I would stick with better-quality stocks to bet on, so I’ll leave it with an Amber view for now. However, if it looks like it’s going to hit its FY 2024 estimates and the valuation doesn’t budge, then I might be forced to give it the thumbs up in a future report!

B.P. Marsh & Partners (LON:BPM)

Share price: 390.4p (+4%)

Market cap: £141m

This is a share I’ve previously held, and met the management team. However, I ended up selling it a few years back (I think it was one of the ones that sadly had to go in order to fund a house purchase).

My opinion of the company has never really changed: it’s an impressive, founder-led investor in the insurance sector with a track record stretching back over many years (founded in 1990). 40% shareholder Brian Marsh remains involved as Chairman.

I reviewed it positively in February, noting that a buyback had begun with the explicit aim to reduce the NAV discount at which the shares were trading. Net asset value per share, according to the full-year results published last week, was 526.2p (up from 462.7 over the year).

One of the obstacles with this share, in my view, is that it’s difficult and time-consuming to form an independent view on the specific holdings in BPM’s portfolio. So BP Marsh shares are perhaps best treated as a regular investment in a PE fund, where you are taking a chance on the diligence of the managers.

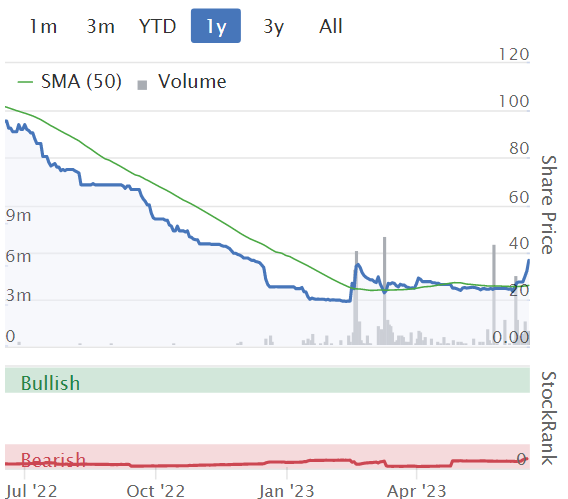

The track record here looks encouraging to me (it goes back much further than 2018):

Let’s check out some of the most interesting bits from the full-year results for FY January 2023, and the outlook.

Total shareholder return for the year of £23.9m, or 14.4% (including dividend).

NAV of £189.5m, or 526.2p per share as I’ve already mentioned.

Fully diluted for share options, NAV per share is 516.8p.

Post year end disposal of Kentro for £51.5m - this was announced to the market in May.

Importantly, the disposal price for Kentro is perfectly in line with BPM’s July 2022 valuation - this helps to boost confidence that BPM’s valuations of its investments are reasonable.

Brian Marsh comments on the results:

"The c.14% increase in NAV (net of dividend) reported in these results demonstrates the strength of our business model which focuses on difficult to replicate opportunities, principally in the growing insurance intermediary markets globally. I look forward to reporting further progress for the current financial year, subject as always to the absence of major macro-economic shocks."

Use of proceeds

With an unusually large cash windfall coming, BPM “will seek a healthy balance between returning cash to shareholders and reserving sufficient funds to be able to continue its proven strategy of making successful investments”.

Dividends: BPM wants to pay £2m to shareholders each year in 2024, 2025 and 2026, plus a one-off £1m special dividend.

Buybacks: an additional £6m in share buybacks.

The company previously said that it would spend up to £1m on buybacks, when the share price discount to NAV was at least 20%.

It’s not clear yet whether the condition of a 20% discount will apply to this new buyback, but more information will follow “in due course”.

Based on the latest share price and 526.2p of undiluted NAV per share, the shares are currently trading at a discount of nearly 26%.

The outlook doesn’t give anything away, but is confident:

The Group believes that these results demonstrate the strength of our business model which focuses on early-stage investment in the insurance intermediary market. This market continues to generate attractive opportunities for B.P. Marsh and our leading position within it means that we get first look at many such opportunities.

Separately, the CIO confirms that it’s business as usual: “The Group remains focussed on sourcing new business and has an active pipeline of new business opportunities which are currently being considered.”

Here’s a helpful breakdown of the portfolio provided by the company, with Kentro shown as 27% of the total:

The investments are split between “MGAs” (managing general agents, who work directly on behalf of insurance companies), insurance brokers and an IFA.

Graham’s view

I am compelled to remain positive about this stock, as I liked it anyway, the news is positive, and the market cap remains at a substantial discount to its balance sheet value.

Of course there is always going to be some uncertainty around the true worth of stakes in private companies, but the disposal of Kentro at BPM’s own valuation does help to boost confidence.

Regular readers will know that buybacks are one of my favourite investment themes, especially when they are carried out by good companies at attractive prices. So it’s excellent to see BPM signal a desire to put £7m into buybacks at potentially a substantial discount to fair value.

I could be wrong but personally I believe that the discount to NAV should close here, so I have to give this stock the thumbs up.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.