Good morning from Paul & Graham!

Today's report is now finished.

Sorry for the logging in problems yesterday, should now be sorted. Apparently any remaining login problems can be resolved by clearing your cache (I just googled it last night, and it's very simple!)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Yes! Some interesting companies to write about today - we ran out of time for the tiddlers, so I'll look at those tomorrow.

Summaries of main sections

IG Design (LON:IGR) - down 1% to 134p (£130m) - Finals - Graham - GREEN

I take a positive view here despite the company being a low-margin maker of celebration, gifting and stationery products. The bull case is intact as adjusted PBT rises and recovery to pre-Covid performance remains within the bounds of possibility in the next few years.

Somero Enterprises (LON:SOM) - down 14% to 283p (£158m) - Trading Update (profit warning) - Paul - AMBER/GREEN

Profit warning due to various factors, but not a disaster by any means. I bounce ideas around below, as to how things might pan out. Is this a temporary blip in performance, or the start of a deeper downturn? Who knows.

SThree (LON:STEM) - down 1% to 363.5p (£494m) - H1 TU - Graham - GREEN

This staffing and recruitment business updates on a “resilient” H1 performance. Revenues are flattish (down in real terms if you take inflation into account), reflecting post-Covid trends. But I think this share retains plenty of attractive features for investors.

Lords Trading (LON:LORD) - Unch 61.5p (£101m) - AGM Statement - Paul - GREEN

A nice clear update, this building products distributor continues to trade in line with market expectations. Looks cheap, but obvious worries about the deteriorating macro position. Rather over-concentrated shareholdings structure. More detail below.

Saga (LON:SAGA) - Unch at 130p (£183m) - AGM Trading Update - Paul - AMBER

Frustratingly vague overall. Only says profits will be up on LY, but no reference to market expectations, so is this a disguised profit warning? Possibly. Cruise & travel doing well, but insurance struggling a bit. Still trying to sell insurance underwriting business. I discuss the positives & negatives in more detail below.

Paul’s Section:

Next (LON:NXT)

Up 5% to 6742p y’day (£8.7bn) - Unscheduled Trading Update - Paul - GREEN

A flurry of excitement at 12:53 yesterday, from this fashion retail bellwether, key points -

- Last 7 weeks trading “materially better” than guidance.

- Full price sales (Next’s usual measure) in 7 weeks +9.3% vs LY, compared to guidance of -5%, that’s a very large out-performance. So it looks as if consumers are undeterred by price rises, and are spending quite freely, at least at Next.

- Full year FY 1/2024 profit guidance raised by £40m to £835m, up 5%

Reasons for out-performance?

Warmer weather in May & June helped, especially after a wet & cold April.

Household pay awards in April -

In an inflationary environment, annual salary increases deliver a significant uplift in real household income at the time they are awarded. For example, during April annual inflation2 was running at 8.7% and monthly inflation was 1.2%; if an individual received a pay rise of 5.0%, then their real income would have risen by 3.8% in that month.

We do not think it is a coincidence that sales stepped forward so markedly at a time of year when many organisations make their annual pay awards.

2. Source: Office of National Statistics, Consumer Prices Index (CPI) published 24 May 2023.

But don’t get carried away! -

If recent pay rises and the sudden change in weather have indeed contributed to the current over-performance, then it is reasonable to expect that the effect will diminish over time because ongoing inflation will slowly erode the positive effect of annual pay increases. This is why we are not anticipating the current performance to continue at the same level going forward, albeit we have moderately improved our guidance for the rest of the year (see guidance below).

Paul’s opinion - one of the reasons I’m mainly invested in consumer stocks is precisely because the big raise (around 10%) in benefits and pensions from April 2023 (and pay rises generally) provided the scope for consumers to have a spending splurge before their mortgages become unaffordable next year! We’ve also had positive recent reports from the hospitality sector (e.g. +13% LFL sales reported from Fuller Smith & Turner (LON:FSTA) last week)

This pushes the likelihood of a recession further into the future I think, but it also raises worries about the risk of a wages-prices spiral, which I know some readers are concerned about (rightly so, it is looking an increasing risk). Hence higher interest rates for longer, with the recession that would be likely to induce maybe next year?

For individual shares though, Next raising guidance is a positive sign, for now. Whether that reads across to other, lower quality players in the consumer sector, is not necessarily guaranteed.

Lookers (LON:LOOK)

Up 34% to 118.6p (£453m) - Sky News says possible bid at 120p? - Paul - GREEN

Sky News yet again seems to get the gossip before anyone else, how do they do it? They must have moles in the City!

Sky reported last night that a Canadian firm is looking to bid for LOOK at 120p, a healthy premium.

Paul’s view - we’ve been saying here for ages that the whole sector is in play, and they’re all cheap (and nicely asset backed with freeholds). So maybe just buying a basket of UK car dealer shares would maximise the chance of catching a bid? I bought a few Pendragon (LON:PDG) last week, as it spiked down on the Odey stake issue. We also very much like Vertu Motors (LON:VTU) here, as the best asset-backed car dealer, and with v good mgt.

Both VTU and LOOK were on my "runners up" list of top watchlist ideas for 2023, which should help improve performance there, if there is any substance to the bid rumour.

UPDATE: Confirmation, in an RNS from the Canadian trade bidder, Global Auto Holdings - recommended all-cash offer at 120p, A great result for LOOK shareholders, who can now recycle the 34% larger pot of money into a cheaper rival! Vertu Motors (LON:VTU) has risen only 6% in sympathy, and Pendragon (LON:PDG) (I hold) only up 4%. So maybe there's an opportunity here to make it a double, as the whole sector seems to be in play! Well done to holders, and there's no need to pretend you're disappointed with the price, because nobody will believe you ;-) It already has 42% support, so is likely to go through. The question now is, whether to sell in the market & recycle the money into something else that could be bid for, foregoing only about 1% of the proceeds, or to hold on, hoping for a higher competing bid and the last 1%? Personally, I'd be selling in the market, and buying up a cheap sector peer!

Boohoo (LON:BOO) & Revolution Beauty (LON:REVB)

BOO: 35p (£443m) - EGM Requisitioned at REVB - Paul - AMBER

Fast fashion eCommerce group Boohoo has accumulated a 26.6% stake in Revolution Beauty (whose shares are still suspended). BOO has requisitioned an EGM to insert 2 of its own Directors (including its long-serving CFO Neil Catto), and to kick out 3 existing Directors of REVB at the AGM on 27 June, saying they have stabilised the business, but don’t have the skills to take it to the next stage.

REVB itself put out a holding announcement, saying it is considering things.

It will be interesting to see how other shareholders will react to this, as the obvious accusation would be that BOO is trying to take control of the business, but without actually buying it, which other shareholders might shy away from, despite BOO saying it would insert other independent Directors if it takes control.

REVB does make a natural fit with BOO, I think, so they should bid for it.

EDIT: another update this morning from REVB says it is potentially taking legal action against its founder & former CEO, to recover some of the exceptional costs, which it blames him for. That would be an interesting (and no doubt slow & expensive) legal case to follow, if it proceeds. Maybe they'll strike a deal out of court? He's not meaningfully responded so far, it says.

2nd EDIT: Mike Ashley of £FRAS has just popped up with a new 5% stake in Boohoo! I don't suppose the Kamani family will be happy about that!! I can just imagine a meeting between Mahmud Kamani and Mike Ashley, that would be quite a spectacle to behold!

Somero Enterprises (LON:SOM)

Down 14% to 283p (£158m) - Trading Update (profit warning) - Paul - AMBER/GREEN

Somero Enterprises, Inc. provides the following update on trading for the five months ended 31 May 2023 and on expectations for 2023 results.

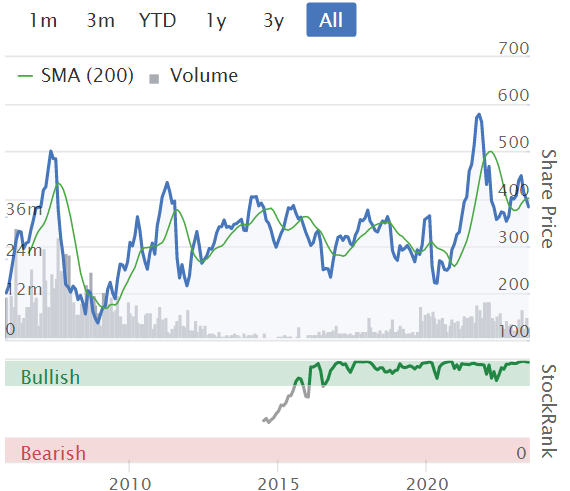

This US-based designer/vendor of laser-guided concrete laying machines, has been a marvellous performer in recent years. Is it now past peak earnings? The share price has been in retreat since the Jan 2022 peak, suggesting the market is already expecting a considerable slowdown -

This is what it says in today’s update -

- Main markets remain healthy.

- New factors have impacted trading in the US (by far its biggest market) -

- Elevated interest rates

- Tighter bank lending criteria

- Delays (not cancellations) to project starts due to bottlenecks in planning permits (in USA)

- Production delays for one specific product, S-22EZ, hence delayed sales

- Limited supply of concrete in the US is a continuing issue.

Lowered guidance FY 12/2023 -

- H1 revenues 15-20% below H1 LY (a record period at $68.5m), so $55-58m H1 this year

- FY 12/ 2023 revenue guidance: $120m, down 10% on 2022. This implies H2 stronger than H1, based on S-22EZ production becoming available for sales.

- Forecast EBITDA now $36.0m, down from previous guidance of $42.8m - far from a disaster, but will it be the last profit warning, or the first?

- Year end cash forecast $32m (up from $31m previously guided) - a very healthy position, completely unlike the scarred memories of 2008, when I recall it almost went bust, with a weak balance sheet. It’s the opposite now, with no such worries as management has sensibly retained a good cash buffer, only paying out anything surplus to requirements to shareholders.

Actions taken -

- Reduced operational workforce by 10%

- Strict cost controls for rest of 2023.

- Minimising inventories, and tight control of receivables, should be positive for year end cash, it says.

CEO Jack Cooney’s comments - interesting, as I was expecting the operational gearing to really hurt here, on reduced revenues, but actually SOM seems to have mitigated things well -

"Our customers continue to report high levels of non-residential construction activity across our territories. While some projects in the US are experiencing delays, we are confident the underlying market remains in good health and provides the Company meaningful opportunity. We expect to see an improved second-half with strong demand for the S-22EZ that will reach full production imminently.

Outside the US, we are pleased with the performance in Europe and Australia that are each poised to deliver strong first half and full year contributions.

Our proven operating model provides the Company the flexibility, through a high level of variable costs, to adapt quickly and effectively to changing conditions. This continues to be a key strength of the Company. As such, we have been able to mitigate the impact of reduced near-term volumes on profitability without compromising our long-term growth initiatives."

At least it provides a concrete reason for the H2 weighting, rather than just hope.

Broker update - many thanks to Finncap for crunching the numbers, quite easy as SOM gives such specific guidance.

Forecast FY 12/2023 EPS reduced by 17% to 44 US cents. At £1 = $1.28 that becomes 34p EPS.

The share price has dropped 14% to 283p (at 08:19), so the 2023 PER is now 8.3x

That’s either a bargain, or it’s cheap because the market thinks another profit warning is likely. Plus there’s also the point that SOM shares always look cheap.

Paul’s opinion - I still like this share, on medium to long-term fundamentals. But today’s update is a reminder that the good times don’t last forever, but it's far from being a disaster either - quite a mild profit warning really given the tough macro situation.

I remember back in 2008, plenty of companies continued reporting good trading, despite all the chaos going on in the financial sector, which made us wonder if it was all a false alarm. Then one by one, they issued profit warnings, and share prices collapsed, as bank credit was withdrawn. This especially hurt highly indebted companies, and companies supplying big ticket, capital equipment. Many such companies (including SOM at the time) continued falling, to previously unthinkable lows. So people trying to catch the bottom got massacred. I remember it very well. If you think this market today is painful, 2008 was orders of magnitude worse!

In Somero’s case, unlike 2008, it’s now very securely funded, and I’m impressed that it’s taken prompt action to cut costs. Maybe the expansion of overheads over the last year or two was ill-timed, but at least it can be partially reversed.

All you’ve got to decide is whether this is the start of a downward trend for earnings (in which case the shares are best avoided), or whether it’s a blip and the share price will recover?

Overall, I very much like this company, and it’s cheap on the lowered forecasts. But the macro picture, particularly more expensive, and harder to secure debt for its customers, is a big headwind. Shortages of concrete should get resolved, so that doesn’t worry me.

Investor timescales also matter here. People with patience can ride out any downturn, and should do well in the next cycle. It is likely to be able to pay divis still.

I can’t make up my mind, what’s your view?!

It’s probably worth reviewing our portfolios for any big ticket capital items suppliers, and consider selling, as it might be safer to watch from the sidelines until the macro picture becomes clearer, but that’s up to you. Also in many cases the damage has already been done, with large share price falls already having happened, so holding through gritted teeth is also a justifiable strategy, rather than selling at what might be near the lows. Your money, your choice, as always! I can see merit in either strategy. Also, with interest on cash now c.4-5%, sitting on the sidelines is a much better strategy than it was during the last 15 years of zero interest rates, so I suspect more investors are likely to be playing it safe this time around.

Musicmagpie (LON:MMAG)

Down 2% to 18p (£20m) - Broker forecast reduced - Paul - RED

I reviewed this yesterday - a seller/renter of secondhand phones/iPads (main products, but it also has a dwindling books & CD/DVD resale business). I think it's a hopeless business model, and the company is running up bank debt, buying old phones to rent out, but overall it loses money. So without a big turnaround in performance, the future looks very grim (as in shares worth zero), I reckon. It trumpeted seemingly positive EBITDA, but that turns into an overall loss, due to very large amortisation charges (not for acquisitions, but for capitalised IT spending), and depreciation on the phones it buys to rent out.

Why am I mentioning it again today? Because an Edison note has come through, lowering forecast profits - despite the company specifically saying yesterday in an RNS, that it was trading in line with Board expectations. So maybe this is a case where Board expectations were lower than market expectations?

Anyway this is what Edison says today -

We have lowered our FY23 and FY24 revenue estimates by 13% and 16% and EBITDA estimates by 11% and 8% respectively.

Paul's opinion - has gone even lower, as it's now clear we can't trust the company's trading updates! For me, this share is a bargepole job, based on current trading and rising bank debt. But who knows, anything could happen in future, so I'll keep an open mind and change my view if the fundamentals significantly improve.

Lords Trading (LON:LORD)

Unch 61.5p (£101m) - AGM Statement - Paul - GREEN

Lords, a leading distributor of building materials in the UK…

Reassuring, and crystal clear -

"Since the release of our full year results on 3 May 2023, the resilient trading performance of the Group has continued and we maintain expectations for full year trading performance for the year ended 31 December 2023 ('FY23') to be in line with market expectations(1).

(1) Lords Group calculated analyst consensus for FY23 of revenue of £473.9 million, adjusted EBITDA of £31.0 million and adjusted profit before tax of £17.9 million.

That’s how trading updates should be - no weasel words, no deliberate ambiguity to cover up things that are going wrong, and yes to giving us clear, specific guidance, instead of making us go round the houses to work out what’s actually going on! Bravo to Lords, and its advisers.

Other points -

Macro - tough, but diversified products means robust demand for some products has offset softer demand for others. That sounds good.

Continuing to expand geographies & product ranges.

Acquisitions all performing as expected, and more in the pipeline (lots of scope for growth, with only c.1% market share)

Refinanced bank facilities in April 2023.

Paul’s opinion - for more detail, I reviewed FY 12/2022 results here in early May. My impression was positive when the shares were 73p. So now they’re usefully lower at 61.5p today, despite an in line with expectations update, the shares seem more attractive value.

However, the macro situation has considerably worsened in recent weeks, because expectations are now for stickier inflation, and higher interest rates than were previously expected just a few weeks ago. So it’s no wonder most shares in the building products sector have been weak of late. A worry, or an opportunity? Maybe both!

The only significant drawback (apart from obvious risk of a wider cyclical downturn), is that the free float is tiny, and management maybe has a bit too much skin in the game?

I’d like to see more liquidity in the shares. Brokers need to stop floating things with hardly any free float, it just creates future problems.

Overall though, based on the facts, figures, and forecasts we have available today, I have to maintain my positive, GREEN view of this share. Although that’s obviously a hostage to fortune in that the future might see a downturn in demand, if macro gets worse. So we have to weigh up all these factors, and decide accordingly. It might be safer to sit on the sidelines for the time being, possibly?

One other thought that occurs to me, is that whilst heat pumps might be growing now, what happens when gas boilers are phased out? I'd like to know what the gains & losses would be, and the timing of the switchover?

Saga (LON:SAGA)

Unch at 130p (£183m) - AGM Trading Update - Paul - AMBER

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, provides the following update on trading covering the period from 1 February 2023 to 19 June 2023.

The story so far - a painfully slow recovery from the pandemic, when its 2 owned, nearly new cruise ships had to be mothballed, and the other travel businesses switched on & off. The insurance businesses operated by SAGA seem to also have had mixed fortunes. Although the group has already returned to profit, Roland reviewed the FY 1/2023 numbers here. Debt concerns some investors, but as I keep pointing out, the structure of it looks OK to me, providing trading remains profitable (and hence doesn’t potentially trigger covenants on the bonds). The £150m 2024 bond can be repaid in full from cash already on hand, for example.

Base case is that it can accumulate cash in the coming years, then repay, or refinance the £250m 2026 bond. Bear case is that it has to raise fresh equity in advance of the 2026 bond maturing - hardly a pressing concern now, in mid-2023.

Worst case scenario is trading falls off a cliff, it breaches the bond covenants, and has to do an emergency equity raise at a deep discount, or gets taken private by the major shareholder for peanuts. So take your pick!

I should stress that we often get into strident arguments about what is going to happen. Please bear in mind that nobody knows. So boldly stating this or that will happen in future, is a bit silly, when the truth is that there are a wide range of potential outcomes. Nobody knows, so let’s not pretend we know. Unless you’re a time traveller from the future, or a close relative of Mystic Meg!

Right, on to today’s update.

Summary is this -

"Four months into the financial year, we have continued to build on the momentum in our Cruise and Travel operations, while making further progress in our growth agenda through the development of our newer businesses. Year-end underlying profit is expected to be well ahead of the prior year.

As readers have complained, they should be telling us how performance is going versus market expectations.

Last year’s underlying PBT was £21.5m, so saying “well ahead” could be anything. Maybe £25m+ at a guess?

Stockopedia shows broker consensus PAT of £37.1m, so if I gross that up to add back 25% estimated corporation tax, it’s £49m PBT forecast.

So my natural suspicion is that this choice of wording means that the current year actuals might be heading for a miss against £49m PBT forecast, but “well ahead” of last year’s £21.5m.

There are no broker notes available to us pond life, you have to be an institution to get privileged access to broker research (eg from Numis), which in turn have had privileged access to the company. All highly unsatisfactory.

All we can do is watch the broker consensus numbers in the next few days, and see if they change. I suspect we might see a further dip in broker forecasts.

Although they have been stabilising around 26p EPS for this year -

There’s lots more detail in today’s update, but all a bit vague, and it’s not tied together with an overall conclusion, so I share readers’ frustration with this update.

A few key points -

Ocean cruise ships - good, bookings are up nicely - load factor 79% (72% at same point LY), and daily rate per passenger up 6%. On track to deliver £40m EBITDA per ship, but that’s before overheads (don't know how much these are). H2 seasonal weighting expected. Next year’s bookings for launch of 2024/5 was “the strongest on record”, already 34% booked. Only a 1% increase in prices though.

River cruise & travel - no change, sounds OK - revenue 37% up on last year -

on track to return to profitability in line with previous guidance.

Insurance broking - sounds weak, with total policy sales down 6% on LY.

Insurance, market conditions, particularly in motor, continue to weigh on our Group result.

Private medical - “secured a valuable partnership with BUPA…” - sounds interesting, but no indication of materiality is provided.

Pet insurance - plan to launch later this year. Again, no idea how significant or not this will be. They need to be careful, as some pet policies are not worth the paper they’re written on, and owners get very upset when exclusions mean the insurer won’t pay out.

Insurance underwriting business - a potential sale fell through recently, but SAGA is still trying to sell it, to reduce risk, and pay down some debt.

Other new products are being launched, but no details on how material or not these are likely to be. I see from TV ads that Saga is doing equity release loans, which is dubious ethically in my opinion, as the interest compounds.

Liquidity - available cash of £149.5m, after paying £15.8m in cruise ship debt. We really need to know the full picture, with gross debt, cash, and net debt itemised, but this is missing. As at 31 Jan 2023, it had £157.5m of gross cash, so that's fallen a bit.

Paul’s opinion - personally I would have preferred less detail, and more clarity on overall profitability.

I’ve got mixed feelings on SAGA overall. I don’t think management are much good, but it does have the owners’ eye again, since Sir Roger de Haan refinanced it during covid.

The brand could perhaps once again become a powerhouse, and it’s targeting a lucrative, affluent customer base in the over-50s. We just haven't yet seen much evidence that the former glories of hundreds of millions profit each year are coming back. Maybe its markets are now permanently more competitive, with silver surfers shopping around, rather than filling in a form and posting a cheque every time they get a renewal quote, or a travel brochure through the post?

Travel is improving, and so there should be good profit upside from that.

Insurance not so good.

New products - I struggle to see how anything they’re proposing is going to be a gamechanger, but who knows?

Debt - I think is too high, but not dangerously so, due to the long maturities on the ship loans, and the 2026 bond being the only potential issue is not a worry right now. It also means fixed interest costs of course, which is now looking a very smart move, so higher base rates are not harming SAGA, I believe - I’m pretty sure the big ship loans are also fixed interest, but you might want to double-check that. The bonds of course are fixed interest.

I see the 2026 bond pays 5.5%, and is trading at c.75, having recovered some of the plunge it took last autumn down to a low of 63. So that’s a 17% yield on the bond, including the uplift on redemption to 100, indicating some doubt over whether it will be redeemed, but our bond experts can comment more meaningfully on that.

The May 2024 bond is priced at 91.5, so buyers of that should get 100 back in May 2024, and a 3.375% pa coupon. Not bad for 11 months, and there’s little doubt about it being repaid, since Saga has the money in the bank, and Sir Roger personally extended a £50m backup loan facility.

Pulling all this together, and noting we’ve been AMBER on SAGA the last couple of times we’ve looked at it here, I think we have to stay AMBER. The vagueness of today’s update, and the refusal to comment on performance versus market expectations, says to me it’s probably trading a bit below market expectations.

If the debt worries you, then obviously you would steer clear of this share, which is a perfectly valid alternative interpretation.

The long-term chart is staggeringly bad. Although note that dilution has not been too bad - 82m shares in issue when the share price was c.3000p, compared with 140m now the share price is just 129p. Which extends the possibility that if trading really improves a lot over the next few years, there could be exciting upside here. I'm just not convinced that exciting upside is likely to happen, given the painful, modest progress in the last couple of years.

Graham’s Section:

IG Design (LON:IGR)

Share price: 134p (-1%)

Market cap: £130m

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of Gift packaging, Celebrations, Craft & creative play, Stationery, Gifting and related product categories announces its audited results for the year ended 31 March 2023.

This is a share we’ve been following at the SCVR for signs of a turnaround.

Pre-Covid, it commanded an impressive mid-cap valuation:

I’ve nostalgically checked the archives: there is an SCVR from January 2020 in which I covered IGR’s large US acquisition.

IGR appeared to pay heavily over the odds for this deal, and raised £120m to fund it - an amount similar to its current market cap!

Back then, IGR was valued at £700m+.

But since Covid, it has struggled to restore margins and in a much more sober financial environment, its shares have reflected this.

Here are today’s full-year results for FY March 2023:

Revenues down 8% to $890m

Adjusted PBT $9m (last year: a small adjusted loss)

Statutory pre-tax loss $19m

Net cash: increases by $20m to $50.5m (as Paul and Roland have noted, there are significant seasonal swings at this business).

Average leverage: 0.6x (last year: 1.0x).

“Leverage” is calculated as net debt to adjusted EBITDA, and is a key metric used by banks when assessing financial risk.

For equity investors, its usefulness is questionable. Even so, the decline in leverage from 1x to 0.6x is an important win for IGR shareholders, as it’s a step in the direction of a healthier balance sheet. Given how depressed these shares are, every win is precious! Especially if financial risk is reducing.

Performance

The decline in revenues was “mainly as a result of adverse foreign currency movements, lower second-half volumes in DG Americas and the strategic decision to continue to exit from unprofitable contracts in the US”.

More positively, margin recovery was thanks to “continued efforts to manage costs, simplify the business and some recovery of prices in the face of continued high cost inflation”.

Management changes - the former CFO becomes CEO, and a new CFO joins the company.

Additionally, the US business gets a new CEO and CFO.

Outlook

The company has an “aspiration to return to pre-pandemic operating profit margins by the end of FY 2025”, and expects to make further progress towards this goal.

The operating margin pre-Covid was 4%-6%, i.e. on $900m of sales there would be operating profit of over $36m!

However, it won’t be easy to get there:

Inflation remains an issue, with pricing challenges in all markets, but especially so in the UK

The order book is also weaker than last year as a proportion of expected revenues, although the company says that this is a normalisation:

The FY2024 orderbook continues to build, at 62% of budgeted revenues (FY2022: 71%), reflecting a return to more normalised phasing of orders between H1 and H2 than experienced last year, as customers expect more stable supply chains

Graham’s view

The improvement in adjusted PBT to $9m is a clear sign of progress, and so I think there’s still enough here for bulls to chew on. Another year of similar progress in the margin could see adjusted PBT of c $20m. Which would of course be terrific news for investors at the current market cap of only £130m ($166m).

Indeed, this is roughly what analysts are forecasting, with the analyst at Progressive looking for adjusted PBT of c. $18m next year.

The year after that (FY March 2025), he is optimistically looking for an adjusted PBT of $45.5m.

I consider that to be the bull case scenario, with other much less favourable outcomes also possible, but I also don’t consider it to be wildly unrealistic. After all, it is only a restoration of the company’s margin performance to what it did before. Why can’t it do that? Perhaps it won’t get all the way there in FY March 2025, but why not in FY March 2026?

If you want a really bullish view, the analyst at Progressive Research even suggests that the company needs to start planning for the growth it will achieve after it hits its target profit margin.

Now that is optimism - I would like to see IGR start earning real profits first, before it gets carried away with more growth plans! I’m sure that many shareholders would be perfectly happy with another few years of falling revenues and rising profits.

I’ll give this stock the thumbs up simply because I like the risk/reward. It’s not a particularly high-quality company, but there is a simple bull case with a clear rationale for a re-rating of the shares back to a higher level.

If I’m wrong, I’ll be in good company. Here are the StockRanks:

SThree (LON:STEM)

Share price: 363.5p (-1%)

Market cap: £494m

SThree plc ("SThree" or the "Group"), the only global pure-play specialist staffing business focused on roles in Science, Technology, Engineering and Mathematics ('STEM'), today issues a trading update for the half year ended 31 May 2023.

Paul has been regularly covering this recruitment/staffing share but I’ll take a look at it today.

It has four UK-based businesses and three others that are based in the Netherlands and the United States. Most fees are generated in Germany, the Netherlands and the USA.

Here are the H1 highlights:

Net fees £208.6m, down 2% at constant FX. On a like-for-like basis, excluding restructured businesses, fees were down 1%.

The performance is described as “resilient”, “against the strong post-Covid comparative period… and backdrop of global macro-economic conditions”.

Contract fees rose slightly and are now 81% of total fees (last year: 77%)

Permanent fees down 19%, reflecting market conditions, tough comparatives, and STEM’s strategic focus on growing its Contract fees (higher-quality fees, because they are more stable/recurring).

Q2 fees were down 7%, quite a bit worse than H1 as a whole - the company again says that this is due to the difficult comparative.

One of the main areas of weakness appears to be the USA Life Sciences sector, down 16%. STEM says this is “in line with market conditions for that sector”.

Net cash £72m, up nicely from a year ago (£48m). There is also an undrawn £50m RCF, an undrawn overdraft and an undrawn accordion facility. This is not a company short of liquidity!

CEO comment - he says the company “will be in a position of strength once the macro-economic environment eases”.

Graham’s view

I don’t like this sector but STEM strikes me as one of the better companies in it. For the following reasons:

A very long history of profitability.

A clever strategic focus on high-quality contract fees.

A clever strategic focus on growing areas of scientific work.

Super-strong balance sheet.

Minimal dilution over the years.

Good shareholder orientation shown by dividend payments.

I hope I have given enough reasons!

So I have to give this share the thumbs up at this valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.