Good morning! It's Paul & Graham with you today.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Here's today's to do list - as usual, we may not necessarily manage to do everything, but will do our best -

Summaries of main sections below

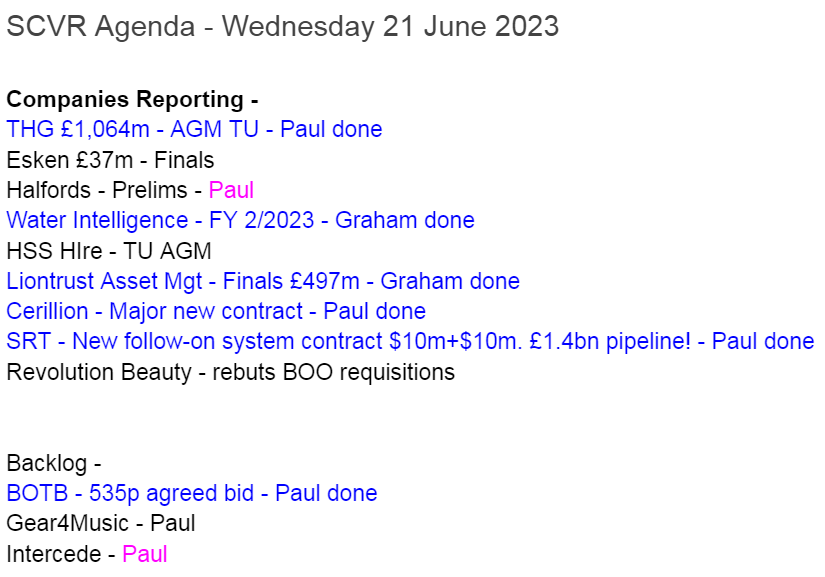

Best Of The Best (LON:BOTB) (Paul holds)

Down 6% to 520p y’day (£49m) - Recommended 535p cash takeover - Paul - AMBER

A shock announcement yesterday afternoon that founder management has agreed a cash bid of only 535p from 30% shareholder Tedi Sagi - known for his lowball bids, and strong-arm tactics. I ponder the situation in more detail below.

Liontrust Asset Management (LON:LIO)

Down 2% to 750p (£487m) - Finals - Graham - GREEN

This fund manager reports full-year results and reiterates its high hopes for the acquisition of GAM. I go on a treasure hunt to understand its high “amortisation” number. Normally I would not give this stock the thumbs up, but the value on offer here strikes me as unordinary.

SRT Marine Systems (LON:SRT)

Up 1% to 61p (£111m) - New Follow-on system Contract - Paul - AMBER/GREEN

It's not actually a signed contract yet, so this RNS seems premature. I discuss below how SRT has over-promised and under-delivered in the past, but news this year does seem game-changing. I'm still nervous, but maybe risk:reward is leaning towards the positive now? I discuss bull:bear points below, and am leaning slightly towards the bull case, but only as a speculative thing at this stage.

Cerillion (LON:CER)

Unch at 1465p (£432m) - Major new contract - Paul - GREEN

A useful 6-year contract, about £2.5m pa in subscription revenues. Doesn't move the forecasts though, so seems like it was already in the budget as an expected upgrade from an existing European customer. I recap on the share in more detail below, and remain very positive about it, although 34x fwd PER doesn't leave any room for disappointment.

Water Intelligence (LON:WATR)

Down 2% to 429.5p (£83m) - Finals - Graham - AMBER

I am tempted to give this US-based leak detection company the thumbs up, as it continues to grow and benefit from high-quality franchise royalty income. Valuation might be about right here but as it continues to invest for the future, it offers an interesting proposition.

THG (LON:THG)

Up 6% to 77p (£1.12bn) - AGM TU (in line) - Paul - RED

Some signs of life in this update, with better margins, and it hopes to reach free cashflow breakeven. Not exactly inspiring for a company valued at over £1bn! I explain below why I think it's still overvalued, despite some signs of life.

Paul’s Section:

Best Of The Best (LON:BOTB)

Down 6% to 520p y’day (£49m) - Recommended 535p cash takeover - Paul - AMBER

I had barely signed off yesterday’s report, and was relaxing in the sun on my lounger, listening to company webinars, and news came through for an agreed takeover bid at BOTB, which is my largest personal holding. Exciting!

Except when I saw the price - only 535p, which is a discount to the previous share price, which had been settling around 550-600p, after a nice surge from 400p to up a peak of to 680p in Jan 2023, after a strong trading update.

It looks like 30% holder, the notorious Tedi Sagi, must have strong-armed founder management into submission somehow, as they’ve agreed it. Including in-the-money share options, management holds 20.5%.

So together with Sagi’s 29.9%, that’s just over 50% voting for the deal.

What we need to know now, is what the institutional holders think? Slater is the biggest outside shareholder, at 9.1%, and if you recall, the institutions were stitched up in April 2021, with a secondary placing that saw mgt bank c.£60m personally by selling about 2.5m shares at £24 each. A pandemic boom was passed off as structural growth (which the market believed at the time, as mgt was adamant that was the case, I can remember the conversations), hence the eye-wateringly high secondary placing price.

.

Mgt banked another £8.7m in Sept 2022 by selling 30% of the company at just 400p to Tedi Sagi, who owns many businesses, including online gambling companies. The low price did raise eyebrows at the time, but the thinking was that, a bit like Dragon's Den, a low entry price for Sagi would be offset by the value his team would add to BOTB via international expansion.

So the hope, and the stated aim, was that this partnership with Sagi’s company Globe Investments Ltd, would result in turbocharging BOTB’s performance via improved marketing skills, and international expansion. The existing business was trading well too, so the market share price recently looked great value, on about 10x PER. With BOTB also having a superb history of paying special divis, doing tender offers, etc, BOTB shares looked to me a terrific each-way bet, a highly cash generative value share, but with exciting growth thrown in for free with an expert partner.

Yesterday’s news that mgt have decided to throw in the towel, and hand over the company to Sagi, at just 535p is incredibly disappointing. They should have held firm, and negotiated a much better deal. It seems to me that Sagi has successfully walked all over them. He’s well known for that, and did something similar at KAPE. Still, hard negotiation is not a crime.

Why has BOTB management thrown in the towel? I don’t know, but the numbers suggest to me that having already essentially banked their profits at a price that might never be repeated (£24), with together with the more recent sale, has banked mgt c.£70m. So their remaining stakes pale into the background, at about £8m current value. It probably isn’t worth their time or the hassle, hanging on and trying to fight off Sagi, when they can retire very comfortably, and go off and do new projects.

Reading the offer document, it sounds like Sagi said he wanted full control in order to press ahead with the big expansion plans, which in any case would have probably resulted in dividends being stopped, and a move into losses to build up international operations - which AIM investors used to the nice shareholder returns might not have particularly liked anyway.

Is it a done deal? I don’t know. I can imagine institutions might want to stall this deal, and hold out for a better price. That’s my feeling too, so I won’t be selling at this level, unless forced to do so with an imminent delisting, which needs 75% I think. Although as always I reserve the right to change my mind at any time. If a more attractive investment idea comes up, then you have to sell something to get the money for new ideas, even if you're not happy with the price.

Apparently at KAPE, Sagi also tried to buy it on the cheap, but upped his offer slightly from 344 to 360, I am told (I’ve not checked those figures). Hence something similar might happen at BOTB - maybe an increased offer to 550-560p, if we hold out for more?

Paul’s opinion - I bought quite well here in Jan 2023 at 458p, so a 535p bid is a 17% profit in 5 months, in a bear market for small caps - I can think of worse outcomes!

There’s a buyer in the market, I did a dummy trade yesterday afternoon. At the time the published bid price was 510p, and you can usually only get a quote for 500-1000 shares in BOTB, but was bid 515p for 2k shares, or 512.5p for 10k shares. I’d rather sit and wait for the 535p bid (and possibly more).

Is there a chance of a higher competing bid? The document says management have given irrevocable undertakings to back the deal, so probably not. Although irrevocable undertakings are not always irrevocable, so who knows.

Disappointing for sure. Bids should be at a premium of at least 30%, so this deal is taking the proverbial I would say. But clearly mgt have already largely cashed out, so didn’t want to fight for a decent deal for their small shareholders. Or maybe the business is only worth 535p? They know it best, after all.

Also a mental note that when Tedi Sagi appears on any shareholder register, we should probably sell into any spike up, rather than buying!

I’ve read some of the offer document, but after a few pages had got the gist of it, so now I’ll just wait to see how the institutions react. There must be a good chance they’ll reject this lowball offer, and hopefully give mgt a good grilling too. Although I’ve got mixed feelings there - long-term shareholders did have an opportunity to bank a c.30-bagger in the pandemic, so if people didn’t sell, then that was your choice - people got too greedy. Plus mgt were very fair to outside shareholders with generous divis/buybacks, modest remuneration, and little dilution, etc.

EDIT: a hat tip to member Chris Brown, who posts additional detail in the comments below, pointing out (I had missed this) that Finncap says the terms of the offer are "not fair and reasonable". I cannot recall ever seeing a broker say that before, can anyone else remember a similar case? Usually brokers just rubber-stamp deals. I don't suppose this will change the outcome, but could it open the Directors to possible legal action? If Slater latches onto this, and threatens to sue, it could result in a higher priced bid maybe, in order to achieve Finncap's approval? Or management and Sagi could just tough it out. Who knows?

SRT Marine Systems (LON:SRT)

Up 1% to 61p (£111m) - New Follow-on system Contract - Paul - AMBER/GREEN

SRT Marine Systems plc ('SRT'), a global provider of maritime domain awareness systems and technologies for security, safety and environmental protection…

SRT says that an existing customer will be awarding SRT (i.e. hasn’t yet signed) a new contract, for the next phase of its maritime surveillance system.

Estimated value is $10m, delivered within 12 months of signing (expected in “the next few months”). So that sounds as if it might straddle FY 3/2024 and FY 3/2025 results.

So not material, in terms of existing forecast revenues of £71m for FY 3/2024.

There’s also a possible additional $10m for customised hardware mentioned.

CEO comments are, as always, super-bullish. As I've mentioned before, I do worry that announcing the staggering pipeline figures, that get bigger with every passing year, might be counter-productive, given the historically very poor visibility and conversion of pipeline into actual money.

Simon Tucker, CEO of SRT Marine Systems, commented:

"The accumulated investment of many years is now being reflected in the accelerating pace at which our new contract opportunity pipeline is growing and then transitioning into contract. Over the last year, our pipeline of new system contract opportunities, has grown to an approximate value of £1.4bn, of which £380m are at a mature stage in the sales cycle with increasing surety of timing. I am delighted to receive notification of another new contract sooner than expected from this long-standing customer, which will likely result in additional revenues for SRT in the current financial year. I expect to continue to see further conversions from our pipeline, along with more additions to the pipeline into the future."

Paul’s opinion - I’ve followed this company for 18 years, and have seen investor sentiment ebb & flow, along with performance - repeated false dawns, with surges in revenues (and brief spikes into profitability). For that reason, I’m deeply sceptical about SRT’s ability to become a consistently profitable company.

Checking our archive here, we were RED on 23 March 2023, due to a huge profit miss for FY 3/2023. Despite that, shares have risen, as the market placed more emphasis on the outlook & pipeline optimism.

Then on 18 May 2023 we changed up a gear to AMBER, as a major $180m contract win does look game-changing. Although things could still go wrong, the money’s not in the bank yet.

Today’s announcement looks premature, as the latest deal isn’t signed yet. But taken at face value, it sounds encouraging for an existing customer to be looking at awarding a follow-on deal.

Having said that, if we can believe all the announcements, then SRT is looking intriguing, and I can see the merit in dipping a toe in here with a small, speculative position, possibly. Just don’t be surprised if something goes wrong, because that’s what has happened repeatedly in the past. So I’m leaning towards AMBER/GREEN. To go fully bullish on it, I’d need to see audited evidence of profits, and cash in the bank.

Everyone can make up your own minds, balancing up risk:reward as you see fit, so there's no right or wrong on this - it's educated guesswork for all of us.

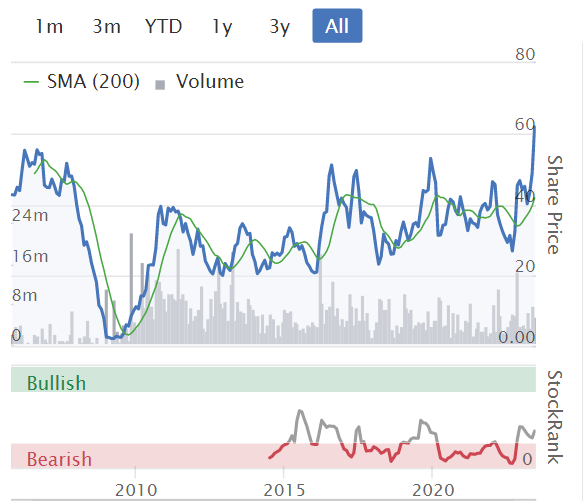

Cerillion (LON:CER)

Unch at 1465p (£432m) - Major new contract - Paul - GREEN

Cerillion, the billing, charging and customer relationship management software solutions provider…

Key points -

6-year contract

Existing customer, in Europe

Worth a total of £15.1m, so £2.5m pa, assuming evenly spread

(for context, FY 9/2023 forecast revenue is £38m)

Looks as if this was already in the budget, as an expected contract win -

All of the revenue is subscription income that will be recognised over the term of the contract, and will support current consensus market forecasts.

Management comments -

Louis Hall, Chief Executive Officer of Cerillion plc, commented:

"We are delighted to further extend and broaden our relationship with this customer. It is another demonstration of the clear operational and commercial benefits of our solutions. Telecommunications companies are looking for solutions that enable them to drive more revenue from their network infrastructure and improve their end-customers' experience. Our solutions efficiently and cost-effectively meet this need."

Paul’s opinion - CER remains one of my favourite GARP shares, although the forward PER of 34x is stretching the RP (reasonable price) part of GARP!

That said, when you find a company that’s in a sweet spot, with the right products, in demand, and generating superb growth in recurring revenues, then I think quibbling over valuation is often a mistake.

For that reason, I’m going to remain GREEN here. Although it's easy to be bullish on companies that are doing well, so it's important also to consider what could go wrong, and whether current strong performance is sustainable. I've not seen anything to make me doubt that at CER, although that's not saying much, as I'm no sector expert, and problems can be complete surprises to everyone when they do happen.

This is a stunning track record I think, and I’m pretty sure it’s all organic too -

By far the best interview with the CEO that I’ve heard is actually mine - I recorded it here in Nov 2022, which gets to the crux of why the company is doing so well. All still relevant, and a manageable listen at 32 minutes.

Hitting all-time highs in a weak market -

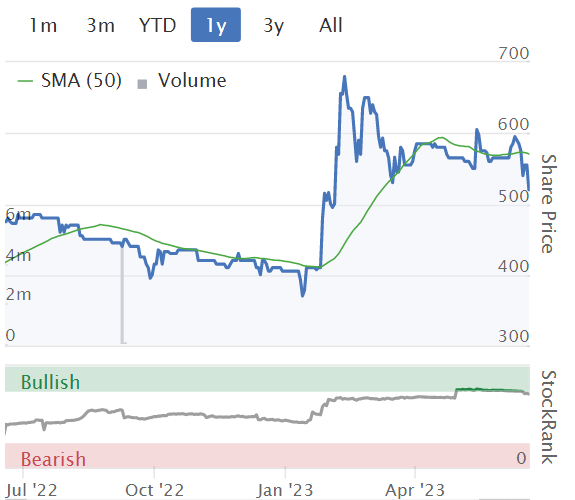

THG (LON:THG)

Up 6% to 77p (£1.12bn) - AGM TU (in line) - Paul - RED

See my notes from 12 May 2023 for details on why I think this share is so awful. Both management and shareholders seem delusional about what it’s worth, and don’t seem to have noticed that the irrational tech boom has ended (or has it?!) and that this isn’t actually a tech company anyway.

Today’s update says that guidance for FY 12/2023 is in line with broker consensus.

H1 adj EBITDA of £44-47m is up on £32m in H1 LY. However, EBITDA is nothing like real profit, or cashflow, at this company, so is best ignored.

Free cashflow is negative at -£(40)m in H1, and is ahead of (clearly not every ambitious!) expectations. Signs of life for the full year though - although this is lamentable for a company valued at over £1.1bn! -

The Group remains well on track to deliver free cash flow neutrality[3] for the full year, with adjusting items materially lower than the prior year.

[3] Group free cash flow is calculated after working capital, net capital expenditure, adjusting items, tax and financing (prior to debt capital repayments and deferred consideration on acquisitions).

I’d want to see the full accounts before relying on any of these snippets in trading updates, given the rampy presentation of numbers in the past.

Good news on margins though, to be fair -

THG Nutrition has had a particularly strong start to the year, with the pricing decision to support consumers through exceptional market-wide inflationary conditions in FY 2022 now paying dividends. Commodity prices continue to ease, with further margin benefits expected in H2 2023.

Outlook - also sounds more reassuring than what we’ve heard in the past -

For the Group, Adjusted EBITDA margin accretion into FY 2024 and beyond will be driven by annualised commodity pricing benefits, ongoing automation efficiencies and operating leverage, in addition to normalised capital expenditure, underpinning positive free cash flow guidance for FY 2024.

The founder’s “special share” has been cancelled.

Paul’s opinion - no broker notes are available, but I can see from the StockReport that consensus is for continued losses after tax of over £100m in each of FY 12/2023, and £FY 12/2024. So investors are being asked to continue valuing a massively loss-making cumulatively business at over £1bn, in the hope that it can eventually reach breakeven.

I can’t see the appeal to that, but maybe I’ve missed something?

At least today’s update shows some progress is being made towards the goal of turning this into a viable business. Although it seems likely that achieving free cashflow breakeven, but still heavy losses on the P&L, must involve favourable but unrepeatable working capital movements from reducing inventories, I reckon.

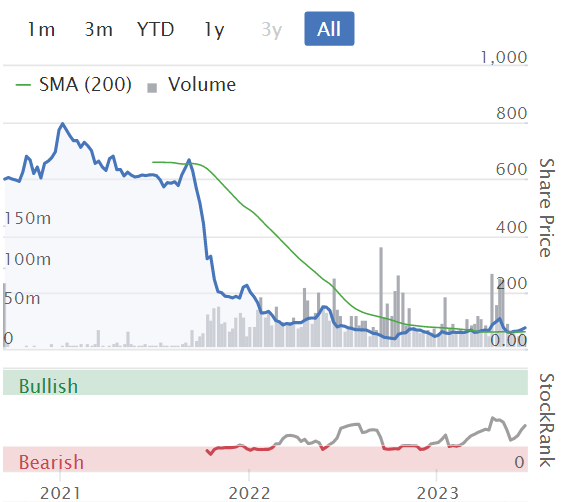

As you can see, this was another utterly ludicrous valuation, pandemic era float, and it remains too expensive, even after this collapse in share price -

Graham's Section:

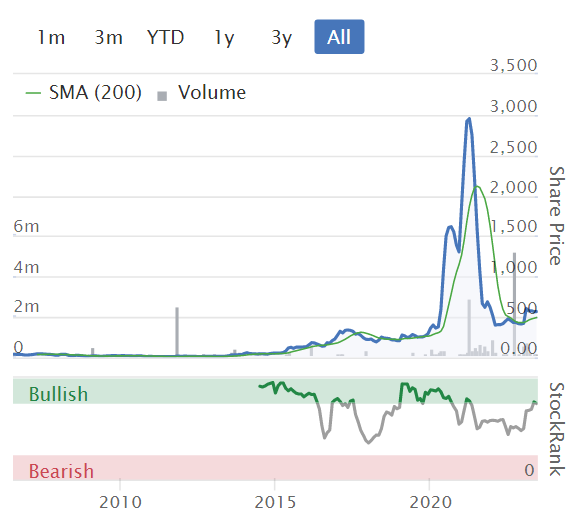

Water Intelligence (LON:WATR)

Share price: 429.5p (-2%)

Market cap: £83m

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence" or the "Group"), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water, is pleased to present its full, audited results for the year ended 31 December 2022.

This US-based share has been very highly rated in the past, commanding enormous P/E ratios:

However, it has come off the boil over the last two years, and is now down over 50% from its peak.

Here are the key points from today’s release.

Overview:

Market demand for the Group's water leak detection and repair solutions remains strong reinforced by increased public sector spending forecast in US and EU for aging water and wastewater infrastructure.

2022 results:

Revenues +31% to $71.3m

Adjusted PBT +12% to $7.8m

Total network sales are the best indicator of the total size of the business, as they include both direct sales by WATR to end consumers, plus sales by franchisees. This metric grew by 11% to $165m.

And note that most of WATR’s profits are generated by high-quality royalty income from franchisees, rather than by the company’s own direct sales.

As we are already halfway through 2023, I won’t dwell on the results from last year. The company confirms again that there has been a “strong start” to 2023.

Net debt as of May 2023 is $8.4 million. This figure includes c. $12m of deferred acquisition payments, some of which aren’t due until 2027. So in reality the liquidity situation is a little stronger than this net debt figure suggests.

The company chooses to not yet pay any dividend. That’s probably the right decision, given the outstanding obligations and its growth ambitions.

Chairman - the chairman is crucial to the story here. He owns nearly 28% of WATR and is a shareholder of a company that owns another 14%.

In 2022, he was paid $590k plus stock options with a value of $80k. So total comp is over half a million pounds sterling. Is that perhaps a little high, given the size of the business?

Graham’s view

The company doesn’t provide much more information on the outlook for 2023, so it’s time for me to start wrapping this up.

Overall, I’m neutral on this one. I can see the attractions of a franchise-based business providing essential services. Profit margins are quite good and overall quality is above-average (QualityRank is 84).

At the current valuation it may be worth considering - it’s not cheap in a traditional sense, but the track record of growth suggests that shareholders could do well from here. So I’m open to the idea of giving this one the thumbs up in a future report.

Graham’s Section:

Liontrust Asset Management (LON:LIO)

Share price: 750p (-2%)

Market cap: £487m

This fund manager publishes full-year results for FY March 2023.

It’s a stock which I have viewed as simply “too cheap”, along with several other fund managers who have seen their shares collapse due to the poor sentiment (and volatile performance) of equities.

Adjusted PBT for the year comes in at £87m. This is slightly ahead of the figure suggested by the company when it raised expectations in April. But it is still down 10% on the prior year.

Statutory PBT is a lot lower - only £49m, down 38% on the prior year.

Since the discrepancy between adjusted and statutory PBT is so large, let’s go straight to the reconciliation and see what is going on.

What jumps out at me is the “intangible asset amortisation” (third line from the bottom), which is up by £18 million (from £9.6m to £27.6m)..

Unable to find a satisfactory explanation for this in today’s RNS, I’ve had to go back to the interim report to look for clues there.

What I discover is that what Liontrust refers to as “intangible asset amortisation” is in fact amortisation and impairments, and the impairments are significant. But today’s RNS didn’t break out the impairment charges.

In the interim report, I find this table, showing the amortisation and impairment at two acquired businesses::

I could be missing something, but the £4m impairment figure for Majedie doesn’t make sense to me - add up the columns and rows and you’ll find that this table just doesn’t work. Does it include an error?

It’s not the first time that I’ve found Liontrust’s announcements to be less than entirely helpful.

Last year, in a trading statement, the company announced that AuMA (assets under management and advice) had fallen by 5.5%. It was left to investors to figure out that excluding acquisitions, AuMU was down by c. 20%.

It is a standard pattern for companies in general that when the effects of acquisitions are beneficial, they are likely to be included in the headlines. But when the effects of acquisitions are less beneficial, investors have to go searching for them!

Let’s move on and look at some other aspects of today’s full-year results:

AuMA £31.4 billion, down 6% (remember that this number has been boosted inorganically by the Majedie acquisition, which brought in £5.1 billion. The organic fall in AuMA is much larger).

Net outflows of £4.8 billion, with more outflows in H2 than H1.

The CEO comments on the planned purchase of GAM, a Swiss fund manager.

The proposed acquisition of GAM will help us achieve our strategic objectives through the global distribution footprint, expansion of asset classes, processes and investment capability, and the combined business infrastructure.

The collective scale of and expertise across the enlarged group will provide financial stability and certainty to GAM's clients and shareholders.

CEO comment

Many shares in Liontrust’s “sustainable” fund category have had very poor ValueRanks, i.e. they were quantitatively poor value and probably on the speculative end of the spectrum.

Today’s CEO comments touch on the performance of Liontrust’s “sustainable” investments::

…the rotation from quality growth to value stocks had started to impact the performance of many of our funds. While this has continued over the past year, I am proud of the proven long-term track record of our teams and their processes. This includes the Sustainable Investment team, who have delivered strong returns following previous periods of relative underperformance.

Outlook - gives little away, but talks up the GAM acquisition.

GAM buyout - this deal is being paid for in Liontrust shares. At the cost of some dilution, AuMA is set to significantly increase, if the deal goes ahead.

According to older estimates from Singers, the combined group would have a cash balance of c. £222m. Profitability would improve with the help of £56m in planned synergies, including the rationalisation of roles and various other cost synergies (offices, data, other administrative expenses).

Graham’s view

Again, I must reluctantly give this stock the thumbs up.

At the current share price, it offers investors £61 of AuMA for every £1 invested in the shares.

This figure should rise if the GAM deal goes ahead.

I don’t believe that either the Liontrust brand or the GAM brand are particularly strong right now - continued outflows speak to this - but I expect that fund investor inertia will enable these companies to continue to generate significant profits.

Here’s a reminder of the value characteristics of the share, with the typical sign of extreme cheapness being that the dividend yield is higher than the P/E ratio. The company is paying another 50p dividend, so the total payout for the year is 72p.

No company is perfect but nearly every company is too cheap at some price. I think Liontrust is now in that position.

It passes two of Stockopedia’s bullish stock screens: the Philip Fisher Growth Screen and the Free Cash Flow Cows Screen.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.