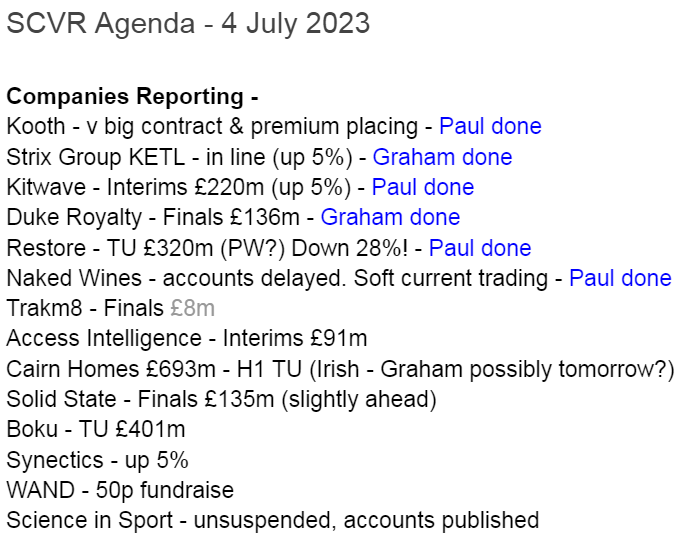

Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

We're concentrating on the price-sensitive announcements first, as usual -

Summaries of main sections

Duke Royalty (LON:DUKE) - up 2% to 33.25p (£139m) - Final Results - Graham - GREEN

I remain positive on this one as I think the discount to book value offers investors some protection against a mishap in the portfolio. The company has performed well despite the economic difficulties of recent years and is worth a fresh look, in my view.

Kitwave (LON:KITW) - Up 4% to 325p (£227m) - Interim Results - Paul - GREEN

I have a good rummage through the interim results, and am impressed that this wholesaler still seems reasonably priced on fundamentals, despite shares being up 69% year to date. Balance sheet & debt aren't the best I've seen, but not a serious concern. Good current trading too. Canaccord ups forecast FY 10/2023 EPS from 25.9p to 29.0p today. EDIT: thanks to Stegga1000000 for flagging in the reader comments that large Director sales totalling £3.3m have just been announced, which is clearly negative for sentiment.

Strix (LON:KETL) - Up 4% to 104.78p (£229m) - AGM Statement - Graham - AMBER

A reassuring “in-line” trading update nudges these shares higher. I am tempted to go green on Strix, especially given management’s insistence that leverage will reduce. The rating is cheap but the deal-making abilities of the company are arguably unproven.

Restore (LON:RST) - Down 30% to 161p (£221m) - Trading Update & Board Changes - Paul - AMBER

The second profit warning this year, from a group whose acquisitions strategy seems to have destroyed shareholder value, and hollowed out its balance sheet. CEO steps down. Today's update guides FY 12/2023 profit down by about a quarter, so disappointing rather than a disaster. Could bid interest that was fought off earlier this year, return maybe?

Naked Wines (LON:WINE) - Down 11% to 88.5p (£65m) - Trading Update (PW) and Board Changes - Paul - RED

The founder CEO returns as Chairman. Reiterates guidance for FY 3/2023, but accounts are delayed - maybe on going concern wording, I speculate? Soft current trading. Revised strategy to attempt to generate more growth. Paul sees a lot of balance sheet risk here, and is very wary, best avoided I think.

Paul's Section:

Quick comments

Harland & Wolff group (LON:HARL)

We discussed Harland & Wolff group (LON:HARL) in the reader comments to yesterday's report, so have a look at this thread for my quick review of the late 2022 results. They're dire, is the short version, so I want to warn people that without an equity fundraise, this looks extremely precarious, and is totally dependent on a large debt facility. Material uncertainty in going concern statement. Very high risk, hence I want to get it into our system as a RED. One for gamblers, not investors, I'd say. The excitement with a previous spike in share price was large orders received by the company. It has ambitious growth plans in renewables, defence contracting, etc, but a very weak capital structure, that's the problem. So great care is needed for anyone considering an equity investment here, as the accounts look very high risk of heavy dilution or insolvency, at this stage.

Cake Box Holdings (LON:CBOX)

After last year’s accounting scandal, you would think Cakebox would be trying to keep its nose clean, and let the dust settle. Unfortunately, The Telegraph reports (and The Times) that the founder CEO is in court, accused of felling 132 trees in woodland in 2021, to make room for a new-build luxury house. Obviously we’ll have to wait until the judgement from the Court, but it’s not a good look to have a “criminal prosecution” underway for environmental vandalism - social media can quickly turn on companies & Directors that get embroiled in this kind of thing. So this puts another question mark over the behaviour of the founder/company.

Kooth (LON:KOO)

261p (pre-market) (£86m) - Placing, Contract Win, and Trading Update - Paul - GREEN

Kooth is focused on an app to help people (especially children) with mental health

Proposed placing - to raise £10m - at 300p - a 15% premium - very impressive!

Net proceeds to accelerate platform development and invest in US growth, as part of its international expansion strategy…

The Company expects to deploy c.£5m of the net proceeds of the Placing towards accelerating platform development and c.£4.5m towards investing in US growth as part of the Group's growth strategy.

Contract win - $188m over 4 years, contract in California.

Material upgrade to 2023 revenue guidance

Four-year contract to serve all 6 million 13-25 year olds in California

This California contract has been on the cards for some time, so it will be interesting to see how the market reacts, ie how much upside is already in the price? The 300p placing (15% premium) suggests to me that investors are excited about this deal, so we’re highly likely to see a big uplift in share price today, probably above 300p would be my guess (writing this at 07:36). That’s why I’m focusing on this company first thing today.

Other details -

The service will launch in Jan 2024

Revenues for FY 12/2023 “material upgrade” to at least £34m (up 69% on 2022)

“Highly material” benefit to revenues from new contract in FY 12/2024.

Timing of revenue is linked to usage, promotional activity, and product development. So it sounds as if we can’t necessarily take the $188m and divide it by 4 years. Presumably it’s likely to build gradually?

Hiring 200 staff in next 12 months to build US infrastructure - some execution risk here?

Future potential - this is likely to get investors excited, I think -

This is Kooth's second significant contract in the US, following the announcement of a pilot contract with the State of Pennsylvania in September 2022.

Kooth has identified additional opportunities in the US, a key market for future growth, underlining the scale of opportunity in the world's largest health care market and the Group's ability to localise its services internationally.

Paul’s opinion - really impressive stuff, this is exciting I think! How to value the company? Absolutely no idea at this stage. This looks like a situation where the newsflow is so impressive, we could see a big speculative surge in share price here. With nobody really asking questions about future profitability, for now, that comes later. Raising £10m to spend on expansion, means it’s clearly going to be loss-making and cash-burning as it expands. Maybe 300-400p share price in the short term? We’ll soon find out. Could be worth a speculative buy on the opening bell!

Kitwave (LON:KITW)

Up 4% to 325p (£227m) - Interim Results - Paul - GREEN

Kitwave Group plc (AIM: KITW), the delivered wholesale business, is pleased to announce its unaudited interim results for the six months ended 30 April 2023 ("the period" or "H1 2023").

For background, we reported positively on KITW twice this year so far -

28 Feb 2023 - 235p - superb results 10/2022. Reasonable price. Thumbs up - GREEN.

2 May 2023 - 271p - H1 TU slightly ahead. Paul likes it as a GARP share. GREEN.

We’re now at a share price of 325p, a hefty increase of 69% YTD - well done to holders! Is that rise justified, or is it time to start banking some profit?

Some H1 figures -

Revenue up 23% to £275m

Gross margin is low (as I would expect for a wholesaler), but improved, at 21.6% (H1 LY: 19.8%)

Profit before tax up 48% to £8.3m

Seasonality - there seems to be a strong H2 weighting to profit (H1 £5.6m, H2 £12.2m last year (LY), so bear that in mind.

Due to the seasonal nature of the wholesale business trading is weighted to the second half of the financial year. We remain confident that the positive momentum seen in the first six months will continue throughout 2023.

Current trading - this is positive -

Trading since the period end has been strong across all divisions and ahead of Board expectations at the time of the trading update released in May 2023. The Board anticipates that the Group's results for the full financial year will therefore be ahead of market expectations that were established at the start of the financial year.

As you can see below, there’s been a considerable increase in forecasts, in stages, over the last 18 months -

Some of this is due to acquisitions, so I’d like to see the split between organic, and acquired profit growth.

Broker upgrade - Canaccord (many thanks!) has today upped its forecast from 25.9p to 29.0p for FY 10/2023.

KITW doesn’t seem to provide adjusted profit numbers, so is absorbing the goodwill amortisation. This doesn’t sound much though, stated as £0.4m in the commentary.

Debt - it is borrowing to fund some of the acquisitions, but this doesn’t sound excessive -

The increase in debt of £20.0 million since the year-end 31 October 2022 relates to the net cash outflow from the acquisition. Leverage has increased to 1.9x since the year end and interest costs have increased accordingly. It is expected that the strong continued cash generation nature of the Group will drive the principal debt down during the remainder of the current financial year. The Board is committed to maintaining a prudent leverage policy moving forward.

Inflation - I’m impressed that KITW has clearly succeeded in passing on inflationary costs to customers, and these comments are encouraging too -

The Group's cost base has been affected by inflationary pressures, with the majority of increases being reflected in labour and delivery-based costs. We are continually striving to mitigate such cost increases and as a result, the ratio of distribution costs to revenue is only slightly ahead of the prior period. It is expected that these cost pressure increases will ease over time, as we anticipate lower levels of fuel pricing and lower wage inflation compared to the last 18 months.

Dividends - it’s quite a juggling act to combine acquisitions and paying divis, but KITW is managing to do that. Stockopedia shows the forecast yield at around 3.5%, and today’s interim divi is consistent with that.

EPS - diluted H1 EPS is 8.7p. Allowing for the H2-weighting to profits, that seems to me we can probably expect about 25p full year EPS for FY 10/2023. Stockopedia shows 26.3p consensus, and KITW says today that it’s trading ahead, so maybe about 28-30p could be the right level to use for basing our valuation of the shares? That's consistent with Canaccord's latest 29p forecast, I like to sense check forecasts.

Hence at 325p per share, I make that a PER of between 10.8x and 11.6x, which seems perfectly reasonable, providing that level of profitability is sustainable.

Balance sheet - it’s acquisitive, so goodwill & similar are rising, now totaling £64m. If I deduct that from NAV of £74m, we only have £10m NTAV, so not much asset-backing to support the share price if trading were to deteriorate.

Gross bank debt is £37m, slightly offset with £3m of cash, so net borrowings of £34m. The £64m quoted in the commentary includes £30m of lease liabilities, which I ignore for the purposes of net bank debt.

The main financing for the business (as I would expect) is provided by its suppliers - trade creditors are £78m. That’s fine, providing the trade credit insurers are happy to maintain cover on KITW. I can’t see any reason why they would withdraw cover, so nothing to worry about there.

Overall then, the balance sheet is OK, but not strong. I think that matters because for any more material acquisitions, KITW should be looking at raising fresh equity, not taking on more bank debt. The quality & price of its acquisitions are a key consideration here. As the founder is a long-standing CEO, I presume he is likely to know the sector, and his competition, inside out. So that reassures me he’s probably making good acquisitions, and is buying good operators, with no skeletons in the cupboard. Hopefully. That would be a good line of questioning in a webinar actually - how well do they know the companies they’re acquiring? And have any gone wrong? Why are vendors selling? What prices can they be acquired at, and is this below the rating KITW shares attract? That’s key to making an acquisitive group work for shareholders - get a premium rating, then buy things cheaper than that! Rinse and repeat. It’s a great strategy that can create multibaggers, if well executed. I think problem acquisitions tend to happen when ambitious management stray outside their area of expertise, in an attempt to diversify.

Cashflow statement - looks fine. As expected, the big item is payment for acquisitions of £19.6m, entirely funded by £20m increased bank debt.

Paul’s opinion - I remain positive on this share. Despite the big increase in share price, I think that is justified by the improved earnings. Valuation isn’t stretched, although after such a big increase in share price, there are bound to be some traders banking profits.

I’ll stick to GREEN, as it’s a good business on fundamentals, and still reasonably priced on a reasonable earnings multiple.

EDIT: thanks to Stegga1000000 for flagging in the reader comments that large Director sales totalling £3.3m have just been announced, which is clearly negative for sentiment.

This share is the needle in the haystack of 2021 floats! So well done to shareholders who found it -

Restore (LON:RST)

Down 30% to 161p (£221m) - Trading Update & Board Changes - Paul - AMBER

CEO steps down -

Restore plc (AIM: RST), the UK's leading provider of digital and information management and secure lifecycle services, announces that by mutual consent Charles Bligh will be standing down as Chief Executive Officer and Board Director and that Jamie Hopkins, Senior Independent Director, has agreed to become Interim Chief Executive Officer, both with immediate effect.

An executive search process for a replacement CEO will be initiated also with immediate effect.

In addition, current Chair, Sharon Baylay-Bell, has agreed to become Executive Chair, also with immediate effect.

Trading Update (profit warning) -

Various factors have caused a deterioration in trading, helpfully quantified with revised guidance -

As a result of these factors, whilst the Group continues to demonstrate its cash generative characteristics, the Board anticipates that the adjusted profit before tax will be lower than previously expected and will be £31 million for the full year.

Adj PBT for FY 12/2022 was £41m, so the above guidance is a 24% fall in profit vs 2022.

The core business (70% of group profits) is storing of documents, this seems to be trading OK.

Other services are also trading OK.

Problems are in the digital business - eg. slower conversion of pipeline, and a slowdown in demand for bulk scanning of documents.

IT recycling is slower than expected (also mentioned in the last profit warning).

Cost-cutting is being done - reducing staff by 230, saving £1.1m in H1, and £3.4m in H2..

Paper pricing has seen a “sharp decline in recent weeks” - I wonder if that might have some positive read-across to newspapers, or packaging manufacturers? But it’s negative for RST, which receives money from selling recycled paper apparently.

Higher interest rates mean debt is now costing more - total interest cost of £9.6m expected in 2023, vs £5.9m in 2022.

Potential impact from non-cash impairment of goodwill.

Outlook - doesn’t sound too bad, not a disaster anyway -

The Board anticipates that the Group will deliver revenue growth for the year underpinned by the core storage and long term contract income that are a central feature of the Group's strength.

Cash generation remains good and net debt for H1 is in line with management expectations.

Whilst the near-term economic outlook remains uncertain, the fundamentals of the business remain strong, with the core long term contracted and storage revenues underpinning the profitability of the business, strong cash generation and the ability to implement inflation indexed price increases and structural cost savings.

Balance sheet - has been hollowed out by too many acquisitions. So intangible assets of £332m dominate the top of the bal sht.

NAV of £273m becomes NTAV negative £(59)m, or £(28)m if we’re generous and eliminate deferred tax (that’s usually related to goodwill). Not great, but not a disaster either.

Valuation - Canaccord has issued an update note, but not reduced its forecasts, which is very odd! Good thing I spotted that, as I almost published this with outdated forecasts in it.

So it looks like forecast for FY 12/2023 could come down from 22.7p adj diluted EPS, to maybe about 15p? That would mean the PER is now 10.7x for FY 12/2023.

However, forecast year end net debt of £95m is high, and quite hefty compared with the market cap now down to £221m.

So I’m wondering if divis might come under pressure to be cut, if debt reduction becomes more of a priority? So I wouldn't rely on the yield as being safe.

Also, with 2 profit warnings under its belt this year already, what’s the betting they make it a hat-trick later this year?

Paul’s opinion - I’ve never had a particularly strong view either for or against, with Restore, so we don’t cover it particularly closely here.

Roland reviewed it here on 15 May 2023, on a mild profit warning, concluding it looked quite good value (based on facts, figures, and forecasts at the time, as always - we don’t know what the future holds), but only viewing it as AMBER overall.

I seem to recall that Marlowe (LON:MRL) was trying to buy Restore not long ago, but it fell through. I wonder if the big drop in RST’s share price might now make it vulnerable to another bid approach? Looking at RST’s shareholder list, it’s just a collection of institutions, with no dominant individual or group, and little in management shareholdings. So it looks like a takeover bid would be easy to get agreed, if a suitable (>30%) premium were to be offered. Instis would probably be glad of the liquidity event, and ditching an investment that hasn’t really worked, but I’m guessing there.

At 161p, I’d say RST might be coming into buying range, but is not the sort of thing I would be interested in buying personally. I think there are cheaper value shares out there. And better growth companies. So RST sits uncomfortably between the two, of not really being value, and not growth either.

Also, I wonder if the acquisition strategy has been badly executed? The share price is telling us that acquisitions have not added value, and given that the original core business is performing well, but the rest isn’t so much, then that does reinforce my impression of a failed acquisition strategy. Probably why the CEO had to go.

It's striking to see all the growth in share price disappear, and we're back to 2014 prices -

Naked Wines (LON:WINE)

Down 11% to 88.5p (£65m) - Trading Update (PW) and Board Changes - Paul - RED

Board changes - this is interesting. The founder, and former CEO Rowan Gormley, is returning as Chairman, replacing David Stead.

Another appointment is Jack Pailing, joining as an independent Director it says.

Nothing is said about Nick Devlin, the existing CEO, so is he staying put?

Gormley wants to resurrect a growth strategy -

Rowan Gormley, incoming Chairman commented:

"My thanks to David and the team for executing a challenging transition in a turbulent market. With a proven ability to deliver profit we now progress to the next stage, and develop plans to deliver profitable, sustainable growth. I am excited to return to a much larger business that has an exciting future ahead and I look forward to working closely with the reshaped Board to deliver on Naked's full potential."

Accounts are delayed -

Naked Wines plc announces that the release of its audited results for the 53 weeks ended 3 April 2023 (the "FY23 Results"), due on 6th July, has been delayed. A further announcement of a revised date will be made in due course.

The reason given is this (below), which I suspect might be related to the going concern wording, and whether the auditors can sign off on a going concern basis? -

As announced separately today, the Board has been strengthened and is revising the Group's plans with the goal of delivering sustainable, profitable growth and cash generation. In light of the revisions to the Group's plans the Auditors require additional time to complete their procedures.

Guidance is reiterated for FY 3/2023 -

That sounds reassuring, but WINE has previously put too many things through as adjustments for my liking, in particular provisions against inventories. So I would need to see the full published results before forming a firm view on this.

Closing cash concerns me a lot, at £10m. This was £41.6m at 26 Sept 2022, so where has all that cash gone? Inventories were staggeringly excessive, at £209m in Sept 2022, so the idea was that this would be run down, and turned into cash. Yet cash has not increased since, it’s mostly disappeared, with only £10m left.

I suspect “Angels” i.e. customers, might be withdrawing their cash, which was represented by a creditor of £88m in Sept 2022. The trouble is, WINE seems to have spent their cash, and has never held it in a segregated escrow account, as it should have done in my opinion.

Current trading - sounds poor -

Sales in the first quarter of the financial year have been below expectations largely as a result of reduced levels of new customer recruitment. Extrapolating current trends through the remainder of the financial year would result in sales of around £300m.

Sales in FY 12/2022 were £350m, so it’s now anticipating a c.14% fall.

The strategy is now going to be changed to growth. But that costs money. Money which WINE hasn’t got. Therefore, I suspect a placing could well be on the cards here.

Paul’s opinion - I’m very wary about this share. It’s massively over-stocked with wine that it’s obviously struggling to sell - so I reckon more stock write-offs could be on the cards. The customer cash has been spent, instead of being segregated. Current trading is soft. The founder has come back to try to sort things out. It ran into going concern, and bank covenant problems in the recent past, and I suspect those risks could resurface.

All in all then, this smells bad to me, so I’m going to reiterate my previous RED view on 27 April. Thumbs down. We need to see the numbers, which I suspect could look horrible, and have more clarity on the cash position, bank covenants, and excessive inventories. This strikes me as a can of worms, I’d steer well clear for now, to be on the safe side.

Graham’s Section:

Duke Royalty (LON:DUKE)

Share price: 33.25p (+2%)

Market cap: £139m

Duke Royalty Limited (AIM: DUKE), a provider of alternative capital solutions to a diversified range of profitable and long-established businesses in Europe and abroad, is pleased to announce its audited final results for the 12 months ended 31 March 2023 ("FY23").

Duke continues to trade below the 40-45p area it was used to before Covid:

I covered many of the big-picture aspects of the stock in June.

Let’s catch up on the key points from today’s full-year results:

Recurring revenues +46% to £21.8m

Total revenue (includes the sale of royalties and the sale of equity investments) +19% to £21.9m.

Duke raised £20m at 35p in May 2022.

A new superior credit facility has been arranged, as I discussed last time.

Post-period end highlights.

Made a quick $2.4m profit from the “opportunistic” sale of one of its recent investments to a private equity firm.

Reached £6m in quarterly recurring cash revenue in Q1.

CEO comment:

"Having achieved £2.0 million per month of cash revenue in Q1 FY24, this represents the 11th consecutive quarter of delivering increasing quarterly recurring cash revenue. With this in mind, we have witnessed a very healthy and promising pipeline of new partners. The recent increase in deal flow has been encouraging, as it demonstrates the attractiveness of our proposition in a difficult funding market, and we are confident that our product continues to demonstrate its competitiveness against other financing options available to small businesses."

Higher interest rates: the Chairman notes that Duke has not increased the cost of the capital it provides to companies - at least not yet (“in the short-term”). The premise of Duke’s model is that it enjoys an initial yield of 12-13.5% on its investments, so I’m not sure if there is much room for it to increase from that level!

But the Chairman makes an important point that as rates have risen, this makes Duke’s offering more attractive, relative to other forms of funding that have become more expensive. He says “we have experienced a notable increase in both the number and quality of deal opportunities that Duke has been offered”.

Outlook excerpt:

…the higher level of global interest rates and continued lack of demand from the mainstream banks to lend to well-managed, profitable SMEs, puts Duke in an ideal position to selectively deploy further capital and increase market share. As a result, I expect to see a higher deployment rate in FY24 than we saw in FY23.

The dividend is running at 0.7p quarterly and the CEO reassures that it is well-covered by recurring free cash flow (yield is over 8% at the current share price).

Graham’s View

We already had a trading update in May, but today’s results do give us a few more chunks of information.

The main points to my mind are:

1. Balance sheet equity is £164m, with Duke’s investments being valued at “fair value” to arrive at this figure.

2. The company has exposure to c. 60 underlying operating companies. Diversification is reasonable but some investments have a fair value of £15-20m with significant risk to Duke if they failed.

3. Net debt is probably around £40m after the recent sale (it was £45m at the end of the financial year).

4. The new £100m borrowing facility has over £40m of available headroom and charges a margin of 5% over benchmark.

5. 94% of expected payments for FY 2023 have been received from royalty partners - that sounds good but I wonder if there is a risk of impairment associated with the other 6%?

On balance, I’m going to stick with my “Green” conclusion on this one because I do believe it offers investors reasonable prospects at this level. As I said last time, Duke has been around for long enough now to deserve some credibility - its portfolio has survived some extreme economic circumstances.

Now I’ve said that, the commentator’s curse does imply that a blow-up is just around the corner! Perhaps associated with the 6% of revenue payments for FY 2023 that have not yet been collected. However, the share price discount to book value, in my opinion, helps to price in this risk..

I should reiterate that I do expect Duke to raise fresh funds from the market, and perhaps it is waiting for sentiment to improve before it does that.

For this reason, I would be cautious about investing in Duke anywhere above book value, as you never know when a fresh round of funding could be announced. But at least the possible dilution would come with the benefit of a bigger and hopefully more diversified investment portfolio!

Strix (LON:KETL)

Share price: 104.78p (+4%)

Market cap: £229m

This producer of kettle controls and other water-related products has been severely de-rated in recent years:

Investors (and humble analysts) have been worried about its debt load, as net debt grew to £87m as of December 2022.

Today’s in-line AGM statement from the CEO helps to reassure that performance continues to improve::

I can report that this trend has continued with Group performance in Q2 improving versus Q1. We are continuing to receive increased frequency of orders from customers, albeit with smaller quantities as they manage their cash balances prudently.

The net income estimate for the current year is £25.8m.

At the same time, the company does not seem very excited about the long-term prospects for its core kettle controls business. It says that its new growth phase will see it “further diversifying away” from kettle controls.

But before it spends big on further diversification/growth, it needs to manage the aforementioned debt:

"We will prioritise debt reduction with a clear plan to get net debt / EBITDA to below 2.0x during 2023 and to below 1.5x during 2024. As capital allocation decisions prioritise this, the Board, as previously announced, has decided after reviewing the level of net debt to propose a final dividend of 3.25p per share which would represent a total dividend of 6.00p per share."

In the previous financial year, the total dividend was over 8p per share.

Graham’s view

I was neutral on this before today and I remain neutral on it now.

Good points:

Cash generation is solid (I discussed this in March).

Trading in line with expectations at this stage of the year boosts confidence that performance is stable/improving, as expected.

Management insist that they will be careful and get their debt back under control.

Less good points:

It’s probably only a matter of time until more diversifying acquisitions are pursued, similar to the £38m acquisition of Billi, bringing various risks with them.

The apparent need to keep diversifying raises question marks for me about the long-term value/quality of the kettle controls business, which is where most of the value of Strix continues to reside. Are kettle controls simply ex-growth or are there more serious issues?

It could be argued that concerns are fully priced in at this level:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.