Good morning from Paul!

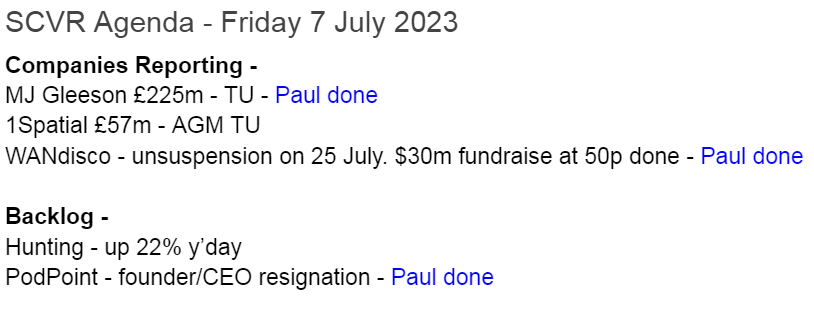

I'm going to start with a few quick comments, then move on to reviewing a big mover from yesterday, Hunting (LON:HTG) which we flagged here in Dec 2022, as a potentially interesting turnaround.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

WANdisco (LON:WAND) (Paul holds)

Suspended at 1310p - Fundraise & unsuspension - Paul - RED

This is the fraud that I got caught on earlier this year, where it turned out that all the incredibly bullish trading updates with massive new order bookings, had been fabricated. I took them at face value unfortunately, even though with hindsight the claims being made by the CEO looked far-fetched (and he was dripping with deceitful body language signals when I met him shortly before the fraud was exposed). Let's hope deep-pocketed US investors haul him into the courts.

I don’t want to waste time picking over the bones of it, but shareholders are at least going to salvage a little scrap of value.

A fundraise of $30m has been done, but at 50p, a 96% discount to the (artificial) share price when it was suspended on news of the fraud being revealed.

It will certainly be interesting to see what the share price does once it resumes trading, scheduled for 25 July.

MJ GLEESON (LON:GLE)

385p (pre market) £225m - Trading Update & Capital Markets Day - Paul - GREEN

Gleeson is a starter homes housebuilder in the Midlands and North.

Background -

Bear points - Shares in housebuilders have been under pressure of late, due to understandable investor concerns about the impact that much higher interest rates are bound to have on sentiment & affordability for new house purchasers.

Housebuilders are also having to bear the cost of cladding remediation (post Grenfell tragedy), and a corporation tax surcharge.

Bull points - valuations are cheap, and in some cases, eg GLE, market caps are now below NTAV, so very strong asset-backing (indicating the market expects asset values to decline).

Forecasts across the sector have already come down a lot, as have share prices, so is the bad news now priced-in?

Balance sheets across the sector are bulletproof, with little to no debt.

The UK’s structural shortage of housing, congested planning system, NIMBYs, onerous environmental considerations, plus little bank financing available for housebuilding SMEs, mean a very favourable demand:supply situation is likely to endure, possibly forever, for the bigger housebuilders.

The latest additional bull point, which I think could be highly significant for GLE, given its relatively small size, and that it builds affordable starter homes, is major institutions now wanting to bulk buy houses for rental. Such a deal was recently announced by GLE, which the broker expects to constitute 12% of revenues in FY 6/2024. Does this plug any gap in demand, and even give the prospect that production could be stepped up, at lower risk, with homes pre-sold to institutional buyers?

Today’s update - starts with 3 positive headlines -

MJ Gleeson plc (GLE.L), the low-cost housebuilder and land promoter, today provides an update for the year ended 30 June 2023 ("FY2023").

My summary -

Completed sales of 1,723 homes in FY 6/2023 (down 14% on FY 6/2022)

Of that, 115 were bulk deals with institutions - so without this element, unit sales would have been down 20%

Average selling price up 11% to only £186k (still very affordable)

Shift in demand - fewer first time buyers (down from 71% to 50%), and more over 55’s.

Restructuring completed - simplified operations, annual savings of £3.2m from now on.

Forward order book is stronger than 30 June 2022 and 30 Dec 2022.

Land available at “sensible prices”

Pipeline is 17,375 plots owned, or purchased subject to planning permission - looks ample at 10-years’ worth (at current sale rate).

Outlook comments defy the investor gloom, and I think confirms my view that focusing on the entry level part of the housebuilding market is likely to be relatively resilient -

Looking ahead, whilst the Board believes that demand from first-time buyers will continue at the levels seen through the last few months, it anticipates that interest from other value-driven buyers will increase as purchasers look to take advantage of Gleeson's more affordable price points and high quality.

Gleeson Land - also has a substantial pipeline, potentially for 17,831 plots, very similar to GLE’s own pipeline. I don’t quite see the point of this division. If land holdings are good, why doesn’t GLE just build on them too, instead of selling them on?

Outlook for this division sounds OK -

Whilst planning delays and economic uncertainty are causing some larger housebuilders to hesitate in completing land purchases, mid-size and regional housebuilders remain active buyers of high-quality consented land.

Cash - is down, but not a concern, as they’re building/buying tangible assets with cash, not burning it -

The Group ended the year with cash balances of £5.2m and no debt (30 June 2022: £33.8m cash and no debt). This was a pleasing outcome given the significant investment during the period in bringing forward a higher proportion of new homes starts.

Overall, as mentioned in the first headline, FY 6/2023 trading is in line with (lowered) expectations -

The Board expects the results for FY2023 to be in line with market expectations.

Capital Markets Day is today, and has this stated purpose -

…will set out a roadmap to significantly scale the Company's operations over the long term.

That’s great, but sometimes CMDs can be designed to drum up demand for a placing. Given the strong balance sheet, I would much rather GLE used a little debt, secured on its properties & land, rather than dilute shareholders when the shares are too cheap.

Presentation slides will be on the company’s website, so I look forward to seeing those when available.

Full year results are due out on 14 Sept 2023, so I’ll be sure to focus on those.

Paul’s opinion - this remains one of my favourite 2023 watchlist shares, and is up 11% YTD (year-to-date) despite the big deterioration in macro & sentiment.

Today’s in line update, and perky outlook further reinforce my positive view of this share.

Obviously the main downside risk is macro, so housebuilders won’t interest anyone with a gloomy view of the future for house prices, interest rates, etc.

I think it’s a good buying opportunity, for patient investors, who don’t get spooked by short-term share price weakness. Or investors who are happy to drip feed money into decent companies.

Pod Point group (LON:PODP)

Down 11% y’day to 64p (£99m) - Directorate Change - Paul - RED

Pod Point, one of the UK's market leading providers of Electric Vehicle ("EV") charging solutions…

It’s not just any old Director resigning, it’s the founder CEO, who has been running Podpoint since founding it in 2009. He’s stepping down with immediate effect. So clearly things can’t be going well.

A NED, Andy Palmer, has been appointed interim CEO,

… to enhance operational performance and deliver sustained shareholder value for the group.

Paul’s opinion - I reviewed PODP here in Nov 2022, coming away with a very negative impression, of a fashionable-themed IPO, which doesn’t have a viable business model at this stage (if it ever will?). Historically it has just burned cash, mainly selling low margin individual home charging units for EVs.

The only positive about PODP is the cash pile. It had £73m NTAV at Dec 2022, including £74m cash. But it guided that cash burn was expected to be substantial in 2023, reducing cash to £50m by year end. Bear in mind that deferred income (a creditor that measures how much cash has been paid up-front by customers) was £21m at Dec 2022), so I would deduct that figure off the cash pile, to arrive at a clean cash figure.

It seems to me the cash is simply being squandered, so the wide-eyed visionary type of founder CEO departing, strikes me as good news, in that a more sensible, less profligate strategy might be adopted by new management.

Bottom line, I don’t see anything attractive about this share to date, but the cash pile gives them options to re-mould the business into something that might become commercially viable after a restructure. We need to see some evidence of that first. Building the charging infrastructure for EVs is a noble aim, but subsidising this is the job of Govt. So why would I want to own shares in a company that generates heavy losses installing EV chargers?

PODP shares look the type of thing that’s probably going to continue trending down, tracking the reducing cash pile. With the occasional speculative spike up on positive news announcements (giving trapped instis a good opportunity to sell into the spike). So I think private investors are likely to be subjected to a PR effort, to induce us into being the buyers (lambs to the slaughter) to help the instis exit from their poor investment. I won't be participating in that game, for sure! So it's a thumbs down. RED.

Hunting (LON:HTG)

249p (up c.22% y’day) £410m - Trading Update & CMD - Paul - GREEN

We should have covered this yesterday, as it was a big positive mover on a trading update, so I’m prioritising looking at it today, to see if the move was justified.

Background - to get me up to speed, I’ve looked at our notes here - we’ve covered HTG three times in the last year, as follows -

25 Aug 2022 - 256p - Breakeven H1 results. Upbeat outlook - strong order book, macro tailwinds. Superb bal sht & reasonable divi yield. Paul - worth a closer look. AMBER (due to my lack of sector knowledge).

15 Dec 2022 - 269p - Good TU, raises guidance to $85-90m EBITDA (prev. $80m). Graham - GREEN.

30 May 2023 - up 15% to 232p - Major order, and guidance raised again. Very strong bal sht. Looks interesting as a turnaround. Paul - AMBER.

Here’s the latest news, from yesterday -

Hunting PLC (LSE:HTG), the global engineering group, today issues a trading update, ahead of its Half Year Results to be released on Thursday 24 August 2023.

The current financial year is FY 12/2023, so H1 is 6-months to 30 June 2023.

Key points -

H1 ahead of mgt expectations.

Strength in most international markets.

Both revenue & operating profit head of targets set at start of 2023.

H1 guidance: EBITDA $48-50m

Order book has grown in H1, $530-550m at end June 2023 (31 Dec 2022: $473m)

Net debt guidance: $51-52m at end June 2023, expected to be paid off in H2.

Capital Markets Day to present strategy to (usually institutional or HNW) investors: 13 Sept 2023. Hopefully they will also engage with private investors too somehow, even if it’s just publishing the slide deck. Ah yes, here we are, good stuff -

Hunting's management will provide a live presentation via the Investor Meet Company platform on 24 August, commencing at 3:30pm (UK). The presentation is open to all existing and potential shareholders.

This all looks impressive. Clearly the group is on a roll.

"The outlook for 2023 continues to be strongly positive, with 2024 revenue visibility also improving due to the orders secured during the period."

Broker update - many thanks to Zeus for its number-crunching.

Note that EBITDA is an inflated number, I tend to much prefer adj PBT, with the latest Zeus forecasts showing the big difference -

FY 12/2023: Adj PBT $56.3m (based on EBITDA $96.8m) - adj EPS $0.257 = 20.2p = PER 12.3x

FY 12/2024: Adj PBT $83.6m (based on EBITDA $124.8m) - adj EPS $0.382 = 30.0p = PER 8.3x

Forecast divi is about 8p for 2023, and just over 10p for 2024, so a yield of 3.2%, rising to 4.0% in 2024, and importantly these divis are comfortably covered by earnings, and easily affordable from its strong balance sheet. So the dividend paying capacity (more important than the actual yield, in my view) is very good.

Although do bear in mind its main markets are energy-related (oil services), so can be very cyclical, and I suppose probably vulnerable to long-term redundancy, when we eventually curtail or even stop burning fossil fuels. Maybe there's growth in other sectors, like offshore wind?

That could mean a permanently low PER, as maybe some investors might want to avoid the oil sector?

Balance sheet - is amazingly strong. NAV of $846m, less intangible assets of $191m, gives NTAV of $655m, or £516m. That’s 26% above the market cap of £410m, which seems an anomaly. This hidden store of arguably excess mainly working capital could be attractive to a financial buyer, who could load the business up with some debt, and cut back on its rather high inventories and receivables, possibly?

There are no dominant shareholders, so that increases the possibility of a takeover approach, I imagine. So this could easily become a takeover target I reckon - nice potential upside possibly?

Paul’s opinion - looks positive to me - guidance keeps being increased, orders are up, the PER still looks reasonable, and the balance sheet is bulletproof. Nice, well covered divis too. Plenty to like here.

On the downside, I think you would have to properly understand the sector, and cyclicality, which is not my area.

Plus it looks a possible takeover bid candidate too, maybe from an international buyer?

Hence overall risk:reward, just on a quick review of the numbers, seems good to me.

Quite a nice looking chart. StockRank is upper medium at 63, but should improve as improved quality scores feed through from the move back into significant profits -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.