Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

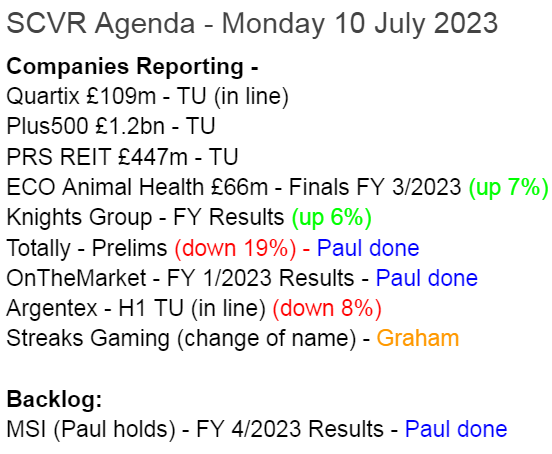

Paul’s Section:

Backlog Item -

MS International (LON:MSI) (Paul holds)

540p (£90m) - FY 4/2023 Results - Paul - GREEN

Full year results came out on 22 June, and I thought it looked an interesting company. However, I only drafted half a section at the time, and quickly got distracted with more companies to write about. So I’ve dredged it up, and finished off this section over the weekend. Also I should add that I’ve picked up a small position personally, mainly to motivate me to do more detailed research on it.

This is an unusual group, with 4 diverse divisions, each of which it says has a leading position in its specialist markets -

Defence: £32.4m revenues, £2.0m operating profit (LY: £30.2m, and £4.1 op pr)

Forgings: £23.3m revenues, £3.9m operating profit (LY: £16.5m, and £2.2m op pr)

Petrol station superstructures: £16.3m revenues, £2.1m operating profit (LY: £15.1m, and £1.1m op pr)

Corporate Branding: £12.4m revenues, £(2.7)m operating loss (LY: £13.0m, and £(1.3)m op loss)

The figures above are from note 1 in the FY 4/2023 results, which has no separate column for central costs. Therefore it seems the above profit numbers are stated after absorbing all the central costs of listing, which are substantial - e.g. the Directors overpay themselves, a common complaint from investors in MSI, withdrawing £2.1m (see note 3[b]), far too much for a company that has reported a drop in PBT from £6.0m LY, to £5.1m TY. However, this does show that the individual divisions would be more profitable if the profit numbers above excluded central costs. This could mean hidden value, say on disposal of any division that they decide is non-core, because an acquirer could strip out those heavy central costs.

Commenting on each division in turn -

Corporate Branding - loss-making this year and last year, so why is this still part of the group? There’s potential group upside from a turnaround or disposal of this loss-making division. This seems to be based in Netherlands, and does illuminated advertising displays, from what I can gather.

MSI Defence Systems - based in Norwich UK, and Rock Hill, S.Carolina USA. As you can see above, defence had a bad year, with profit halving, because a large contract was delayed slightly, and didn’t make the year end cut-off, we’re told. This is the most exciting part of the business though, in terms of orders & outlook. So the contract slippage that has harmed FY 4/2023 results, should correspondingly boost FY 4/2024 profits, setting the group up for an outperforming year this new year.

Defence products include a very impressive (see website for video) high-tech gun that detects and destroys drones (clearly a sweet spot right now). It also seems to make large guns for navies, and for tanks.

Forgings had a very good year, with profit almost doubling. This seems to be MSI-Forks, with factories in Doncaster UK, S.Carolina USA (sharing the same site as MSI Defence above), and Sao Paulo, Brazil. Its website shows a variety of forged (steel presumably) prongs for the front of forklift trucks. Sorry, fork arms, I think is the correct term. The website also shows a variety of other products such as rings & cylinders, shafts & spindles.

Superstructures division makes the canopies & other things for petrol stations, and this also almost doubled profit in FY 4/2023, making as much profit as the other 2 big divisions put together.

It seems to have subsidiaries in Doncaster UK, Krakow Poland, The Netherlands, Anderten Germany. The interesting aspect of this, is that the development of EV charging stations, opens up big opportunities for this division in future.

I’ve read the FY 4/2022 (NB last year’s) Annual Report, because this share intrigues me. A few points I noted down -

Directors are all getting on a bit! So succession planning, and potential value crystallisation of the group could provide nice upside for all shareholders.

Michael Bell (Exec Chairman) joined in 1972, rose to the Board in 1980.

Michael O’Connell (FD) joined the Board in 1985.

Nicholas Bell has probably not yet finished his trial period, being a recent Board joiner in 2013! ;-)

Their remuneration is excessive at £766k (Exec Chmn), £408 for the FD! And £357k for the other Exec Director. This did include bonuses, as FY 4/2022 was a good year, but it’s far too high for the size & profitability of the group, in my opinion (and other investors have also moaned about this).

They’ve loaded up with share options too, with 1.5m in issue at an average exercise price of just 94p. That’s just within the maximum acceptable limit of 10%, at 9.3% of the 16.2m shares in issue (ignoring shares held in treasury).

Directors are big shareholders too,

Bullish points -

- Eliminating the £2.7m losses at Corporate Branding would boost group profits significantly.

- Order book has almost doubled to £115m

- Upside from US Navy, which looks like it might be close to ordering MSI’s large naval gun.

- Positive outlook for the refuelling superstructures division due to EV charging roll-out.

- VSHORAD anti-drone system - order received for £54m, not clear if this is included in the £115m order book or not.

- Years of R&D now seems to be paying off with big orders -

- We perceive that we are achieving a significant, upward step change in the further development of the Company that will again bring additional rewards and success for the business. I look to the future with confidence.

- Therefore, together with the delayed order from last year likely to boost the current year, we can probably expect much stronger results for FY 4/2024 in due course. That could be bullish for the share price.

Takeover target? With some seemingly ground-breaking defence products attracting big orders, combined with ageing Directors with large personal shareholdings, this reminds me of Avesco, which we did very well on (5-bagger) a few years ago - with the end result being a bumper agreed sale of the company, after loss-making divisions were jettisoned or turned around, to maximise profits. MSI seems to me a somewhat similar type of situation - a rather off the radar company that contains some valuable parts, with ageing owner/managers likely to be seeking an exit.

Balance sheet - looks good. Note there is a pension deficit, with deficit recovery payments of £675k last year.

Bearish points? For balance, the main negatives seem to me -

- Not obviously cheap on historic numbers, so the investment case relies on the big order book growth translating into rising future profits.

- Excessive Director remuneration.

- Illiquid share, with wide published spread (although real prices are often well within the spread)

Paul’s opinion - it’s difficult to predict how this might pan out, as we don’t have any broker numbers. It’s one of those owner-managed companies where longstanding management, annoyingly, behave as if it were a private company, giving out little information to outside shareholders, and not having any forecasts issued by brokers.

Still, they’ll want to maximise the value of the company, and then sell it probably, when they retire.

The big new orders sound very exciting, and a high-tech system that shoots down drones, seems a very worthwhile, and non-lethal product.

I’d be interested in hearing from any readers who have looked into this company in more detail.

A sleepy share for many years, but investors have re-rated it (impressive, as this has been during a vicious small caps bear market) in the last 18 months, in response to much stronger newsflow -

OnTheMarket (LON:OTMP) (Paul holds)

Down 5% to 52p (£44m) - Audited Results FY 1/2023 - Paul - GREEN

OnTheMarket plc (AIM: OTMP), the technology-enabled property business which operates the onthemarket.com property portal, today announces its audited results for the year ended 31 January 2023.

Good reported figures here for FY 1/2023 -

Revenue up 14% to £34.4m

Adj operating profit up 59% to £4.3m

Statutory operating profit only breakeven, at £0.1m, so the key question is whether the £4.2m adjustments are sensible or not? (note 7)

Adjustments - I’ve highlighted the 2 biggest ones below (note 7) - it’s fine to adjust out £1.5m goodwill impairment. I’m unsure about the £1.375m “Agent recruitment charges” - this is share-based payments to estate agents, in return for them signing paying contracts. So you could argue it either way, as to whether that should be left in as a cost, or adjusted out. I can’t make up my mind.

Current trading - is in line with expectations.

Outlook - as I would expect, it says macro, higher interest rates, is having some negative impact on the housing market. It mentions that customer cancellations are higher than expected. H2 is expected to be more challenging that H1.

Despite that, it says both revenues and profit are expected to be higher in FY 1/2024 than FY 1/2023, which sounds counter-intuitive, given macro conditions. So my feeling is that the risk of a profit warning may be quite high here. Also the natural optimism & desire to talk things up all the time, of estate agents, is a background worry with shares in this sector!

The 2018 5-year lock-ins for agent shareholders ended in 2023, with most agents continuing to use the OTMP portal.

OnTheMarket Money - this is an interesting development, as it provides mortgage broking, thus could become a nice additional earner that would otherwise go to price comparison sites.

Good growth in new homes advertiser numbers, has mostly offset a decline in core agency customers (down 6%).

Website visits down 14%, which is disappointing - this metric needs to rise strongly, for OTMP to be a credible challenger to the dominant Rightmove.

Advertising spend of £8.6m (down from £10.6m LY) is substantial, and I’m really impressed that OTMP manages to absorb this heavy cost, and still be profitable. Most challenger companies in this sector burn cash like there’s no tomorrow, then end up going bust (e.g. Purplebricks). OTMP looks a rare exception, where it’s already a viable, profitable, cash rich company. So risk:reward looks good to me.

EBITDA - best ignored, as £4.5m costs were capitalised onto the balance sheet, including £2.3m staff costs.

Balance sheet - looks fine, including £11.3m cash (with no debt), up from £8.4m a year earlier. There is £4.0m of deferred income, which explains where some of the cash has come from (customers paying up-front). So no worries about funding, and the going concern statement is clean.

Share options are excessive at 10.2m, but they’re mostly underwater, so not a worry.

Paul’s opinion - I think this is a very interesting share, which is why I opened a small position myself, and spent a bit of time going through the numbers in detail this morning. It’s easy to buy into a cash-rich company like OTMP, when its share price is collapsing, because you don’t have to worry about it running out of cash. The increase in cash pile today reassures me very much.

Renowned investor Christopher Mills has said recently in interviews that the OTMP market cap perplexes him (in being so low, and continuing to fall). For what little it’s worth, I completely agree. This is a credible business, profitable, cash generative, self-funding heavy advertising spend and new product developments.

It gets in the obligatory reference to AI today! Imagine in a bull market how this share could re-rate upwards, if investors focus on its growth potential, and tech development? Meanwhile, the downside protection from profitable existing operations, and a healthy cash pile mean we don’t have to worry whilst we wait.

Subjectively, I think the newish CEO, Jason Tebb, is bringing new energy and a better strategy to OTMP. Plus most importantly, he’s protecting the cash pile, instead of blowing it on TV ads, which is the main risk I see. He recognises that he can’t compete with Rightmove or Zoopla on marketing spend, so instead is trying to develop useful tech tools so that agents (who part-own the business) will use it more, and become stickier clients.

Overall, I think £44m market cap is a bargain, so I’ll probably be adding to my position on weakness, to get ready for the next bull run.

We don’t have to worry about operational gearing, because in a downturn the substantial advertising budget could easily be cut.

Zeus has trimmed its forecasts for FY 1/2024 this morning, there’s a detailed note on Research Tree, so many thanks for that.

There’s probably not a catalyst to reverse the downward share price trend right now. However, I’m happy to hold this for the long-term, as I think it’s a really interesting challenger company, and shares look really cheap. I think risk:reward could be good here, for patient investors, and I’m in good company with the shrewd Christopher Mills!

A poor share price since listing, but the fundamentals have improved a lot over this period, with good growth, and a move into (adjusted) profit. Note there has been some dilution, with share count rising from c.60m to 80m now, a lot of which is issuing free shares to estate agents in return for 5-year paying contracts.

Totally (LON:TLY)

Down 25% to 12.75p (£25m) - Prelims FY 3/2023 - Paul - AMBER/RED

Totally plc (AIM: TLY), a leading provider of frontline healthcare services which increases access to quality healthcare across the UK and in Ireland by targeting the reduction of waiting lists and waiting times for patients, alongside corporate fitness and wellbeing services for corporate customers, is pleased to announce its preliminary results for the 12-month period ended 31 March 2023.

An unpleasant market reaction to these results today, down 25%, and a share price that’s now approaching previous all-time lows. This doesn’t reconcile at all with the upbeat comments I’ve heard from TLY’s CEO in fairly recent webinars - so I'm questioning whether I should be taking any notice of management commentary?

Outlook -

Post period update

The Board anticipates revenue in the year ahead to be lower than in the period to 31 March 2023. EBITDA is expected to be marginally below the period to 31 March 2023 reflecting improved margin driven by higher volumes in elective care, and the continued management and reduction of overhead spend. The Board are confident that the actions and strategy put in place over the past 12 months will ensure the Company remains in a strong position to continue to grow significantly over the coming years.

This doesn’t sound great either -

In line with our buy and build strategy, we remain acquisitive where opportunities enhance our ability to deliver increased shareholder returns and broaden services for commissioners.

In the year ahead, we will remain focused on making further progress with our growth strategy whilst ensuring we maintain the delivery of high-quality services and manage our costs.

We expect the coming year to be challenging as the NHS continues to operate in crisis and faces ever-increasing demand across all services.

The Board remains very confident in that the number of opportunities for the Company continue to grow and we are ready and prepared to further support the NHS as it continues to focus on the recovery and embedding of sustainable services able to cope with continuing higher levels of demand and the reduction of waiting times and waiting lists.

I thank all of our shareholders for their support during this challenging year. We will continue to focus on driving business growth, both within existing operations and through sensible acquisitions.

Balance sheet - looks stretched to me. NTAV is negative £(11)m, and I wouldn’t want to see it making any more acquisitions, unless funded by equity, which of course would mean dilution at a weak share price. So I think strategy is looking questionable now.

There’s negative working capital (current liabilities considerably exceed current assets). Most of the cash pile has been spent on acquisitions - a good use or not?

Paul’s opinion - are things as bad as the share price suggests?

It’s still reported profit growth, with PBT £1.8m, up from £1.3m.

The market cap of £25m seems paltry, so maybe this share could bounce, once it finds a floor? (nice and vague there!)

Very low margin public sector contracts don’t really interest me though, so it’s probably not something I would want to invest in. Although shares do look cheap now.

EDIT: Many thanks to Wolf of Small Street, who mentions in the comments below that broker forecasts for FY 3/2024 have been slashed by about half. So a nasty profit warning that the trading update seemed to attempt to gloss over. Very unimpressive, and sadly I think management now has little to no credibility.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.