Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

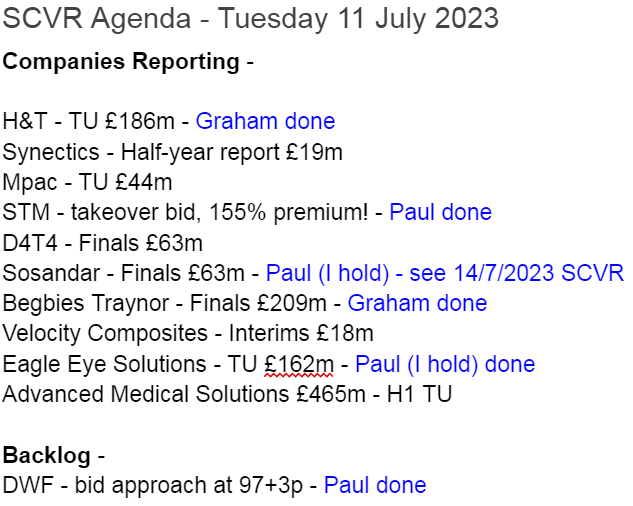

Summaries of main sections below

DWF (LON:DWF) - up 34% to 88p y’day (£300m) - Bid talks announced - Paul - AMBER

Private equity firm Inflexion is sniffing around with a possible 97+3p takeover approach. It’s not clear at this stage whether talks will proceed to a formal offer. Share price of 88p suggests some shareholders are happy to bank their profit in the market, in case talks fall through. The whole legal services sector could be getting interesting, as valuations are low.

H & T (LON:HAT) - 422p (pre-market) - Trading update - Graham - GREEN

The leading pawnbroker confirms that strong pledge book growth continues. Additionally, the softness in demand for luxury watches has hopefully been resolved by a reduction in an inventory. Estimates are unchanged and put the stock on mid-single digit earnings multiples.

Begbies Traynor (LON:BEG) - 132p (-2%) (£205m) - Finals - Graham - AMBER

This professional services company (an insolvency specialist) reports good numbers and no change to its forecasts for the year, although the EPS outlook may have worsened slightly. Adjusted PBT is 250% larger than actual PBT, and I think valuation is up with events here.

Eagle Eye Solutions (LON:EYE) (Paul holds) - Up 3% 570p (£167m) - FY 6/2023 Trading Update - Paul - GREEN

Ahead of expectations trading update for FY 6/2023, so broker upgrades EBITDA forecasts by 6-8%. This share is expensive on 40-50x forecast EPS, but it looks one of the best growth companies on the London market, in Paul's opinion, so could be worth this premium valuation in the long-term, maybe?

Paul’s Section:

DWF (LON:DWF)

Up 34% to 88p y’day (£300m) - Bid talks announced - Paul - AMBER

As usual, our daft rules on takeover approaches mean that shareholders only have to be told if news leaks to the press, thus often creating a false market in shares where active discussions are underway for a takeover bid.

This is what legal services group DWF said yesterday afternoon -

The Board of DWF Group plc ("DWF") notes the media speculation regarding a potential offer for DWF and confirms that it is in discussions with Inflexion Private Equity Partners LLP ("Inflexion"), on behalf of funds managed and / or advised by Inflexion and its affiliates, regarding a possible cash offer for the entire issued and to be issued share capital of DWF (the "Proposal").

Under the terms of the Proposal DWF shareholders will be entitled to receive a total consideration of 100 pence per share, comprising:

· cash consideration of 97 pence per share (the "Cash Consideration"); plus

· a dividend for the six month period ended 30 April 2023 of 3 pence per share which is conditional on the Proposal becoming effective ("the Special Dividend") that eligible DWF shareholders will be entitled to receive.

Whilst it’s only bid talks, the “proposal” sounds quite well developed, in terms of naming a price. The share price only rose to 88p though, suggesting that the balance of buyers and sellers in the market means there’s some deal risk of this not going ahead, and some investors are obviously banking their profits in the market. That may be sensible, given how many takeover approaches are falling through at the moment.

We commented before here that DWF looked very cheap on a PER basis, but we didn’t like the debt. So it’s quite surprising a private equity buyer is sniffing around, as their modus operandi is usually to load target companies up with more debt.

DWF only had £6m NTAV in Oct 2022 (last interims), and had £118m of bank borrowings, less £32m cash, so net debt of £86m, quite a significant starting point re debt.

Paul’s opinion - legal services shares have mostly been very poor investments, and many look remarkable cheap at the moment. Given this bid approach for DWF, maybe we should be looking at the legal services sector with fresh eyes, for some more bargains? I see that several others rose in sympathy yesterday, including £RGBP and Knights group (LON:KGH)

DWF put out an in line with expectations trading update on 30 May.

I wonder if, in a slowing economy, lucrative deal revenues/profits for legal firms might dry up?

STM (LON:STM)

Up 109% to 57.5p (wide spread) £34m - Bid approach(es) - Paul - AMBER

Sky News reported this last night -

Pension Superfund Capital, a vehicle controlled by Edi Truell, is among a number of parties to have approached AIM-listed STM Group about a takeover, Sky News learns.

This morning STM issues a statement re possible cash offer, which sounds like it’s close to being a proper offer -

The Boards of STM Group Plc (AIM: STM), the cross border financial services provider, and PSF Capital GP II Limited as general partner of PSF Capital Reserve LP ("Pension SuperFund Capital") announce that they have reached agreement in principle on the key terms of a possible cash offer for the entire issued and to be issued share capital of the Company ("Possible Offer") at a price of 70 pence per share.

The Board of STM Group has confirmed to Pension SuperFund Capital that, should a firm offer be made on the financial terms of the Possible Offer, it would be minded to recommend it unanimously to STM Group's shareholders.

Paul's opinion - We flagged STM here in Jan 2023 as a potentially interesting special situation, with the market cap almost covered by its own net cash, at the time. A potential takeover bid at a 155% premium has to be seen as an excellent outcome, so well done to holders.

Eagle Eye Solutions (LON:EYE) (Paul holds)

Up 3% 570p (£167m) - FY 6/2023 Trading Update - Paul - GREEN

Eagle Eye (LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing, is pleased to provide an update on the Group's trading for the year ended 30 June 2023…

Strong revenue and profit growth ahead of expectations

An impressive table here -

Adj EBITDA was £4.7m in H1 so H2 actually fell sequentially to £3.9m.

Note that EBITDA is a nonsense number, because EYE capitalises about £5m pa into intangible assets, which is probably mostly payroll costs. In H1 adj EBITDA was £4.7m, but that only became £0.9m profit before tax.

The closing net cash position looks healthy at £9.3m.

Untie Nots acquisition has gone well, as planned.

Outlook comments are rather general -

The market in which Eagle Eye operates is expanding, as retailers globally develop their omnichannel capabilities to address the rapidly changing consumer shopping behaviours, particularly in the current cost conscious climate. With new technology, such as AI, rapidly increasing the sophistication of promotions, Eagle Eye's central position as the technology that enables the execution of these programmes increases. Eagle Eye expects this shift towards digitisation and personalisation to continue to accelerate and for Eagle Eye to be a beneficiary of that acceleration.

Eagle Eye enters the new financial year in a very strong position, with a growing presence in North America and Australasia, alongside its long-standing European customers. The acquisition of Untie Nots has provided an additional channel for growth, as well as bringing valuable AI capabilities into the Group. Together with the Group's growing ARR, profitability and cash generation, the Board, therefore, looks to the future with confidence.

Broker update - many thanks to Shore Capital for crunching the numbers.

It upgrades EBITDA forecasts today by 8% for FY 6/2023, and 6% for FY 6/2024.

Equivalent EPS are 11.3p and 14.4p.

At 570p per share, you can see this is very highly rated on a PER basis, of 50x and 40x, so make no mistake this is an expensive growth share.

Paul’s opinion - it’s rare to find a genuinely exciting growth company, mainly growing organically, and achieving a snowballing of recurring revenues, from blue chip clients, around the world.

It’s self-funding now, so there shouldn’t need to be any more dilution (unless it comes across more acquisitions), and I don’t mind a bit of dilution anyway, from shares being issued at such a valuation premium - arguably it should be using its expensive paper to raise more cash and buy good value complementary acquisitions.

Loyalty schemes are getting much more sophisticated now, and EYE seems to be at the forefront of this niche. So I’m happy to stick with it. Definitely not a value share though!

Graham’s Section:

H & T (LON:HAT)

Share price: 422p (pre-market)

Market cap: £186m

Business has been booming in the pawnbroking trade, and the largest pawnbroker issues an H1 trading update this morning. So let’s take a look.

Demand for pledge lending remains at record levels and continues to gather momentum. Gross lending grew 22% to £128m (H1 2022: £105m). As expected, the exceptional level of redemptions experienced in late April and early May did not continue. Following strong growth, particularly in May and June, the pledge book was c.£113m as at 30 June 2023 (June 2022: £85.1m, December 2022: £100.7m). Growth was achieved across the customer spectrum and in all geographies, with key pledge book metrics remaining consistent.

It’s a remarkable growth story for a mature business - the book growing by c. 12% in just six months - and it continues to support the thesis that pawnbrokers are in a sweet spot in the lending market. They are serving customers that for whatever reason need funds that mainstream banks aren’t willing to provide. However, unlike payday lending (which faces a hostile regulatory environment), the pawnbroking product is able to serve these customers in a manner that is sustainable for both the customer and the lender. If a customer can’t afford the repayments or is unwilling to make them, they have every right to walk away!

In the current inflation/cost of living crisis, the demand for credit is evidently outstripping supply. Also see recent trends at Ramsdens Holdings (LON:RFX) (who are hoping to muscle in on H&T’s territories in the south of England).

In retail, H&T’s sales are up 10%, i.e. keeping up with inflation.

In May, I noticed some worrying comments from the company about margins for high-end watches. They confirm today that in Q2, they “chose to prioritise stock turnover ahead of margin” (in blunt language, they were dumping stock!). But it was hopefully just a temporary measure in response to short-term changes in the market. They go on to say: “We have recently increased sale prices across the majority of our retail stocks and margins are expected to improve in the second half of the year.”

FX volumes rose 19% and are at record levels, implying that there is no shortage of people taking foreign holidays.

Estimates - the RNS makes no reference to performance against expectations, but a broker note form Shore Capital confirms that estimates are unchanged. They think the shares are trading on a PER of 7.3x for 2023 and 6.0x for 2024.

Graham’s view - I was positive on the stock last time, so there is no reason for me to change my tune on it today. Growth continues without interruption and the softness in luxury watches was hopefully just a blip.

Judging by these metrics, investors are unconvinced that the recent growth seen here is sustainable, and I’d be the first to admit that recent tailwinds (inflation, regulation, price of gold) cannot be counted on to last forever. But on the other hand, even without permanent growth, I like this company as a candidate for a long-term hold. So I’m staying positive on it!

Begbies Traynor (LON:BEG)

Share price: 132p (-2%)

Market cap: £205m

This professional services consultancy (known as an insolvency specialist) issued a positive trading in May that was covered by Paul. As a result of that detailed update, the headline figures in today’s full-year results shouldn’t come as a surprise:

Some other key points:

Of the 11% total revenue growth, 6% is organic and 5% is acquired.

Operating margin improved from 16.9% to 17.9%; this “reflected the continuing increase in our scale and service offerings”

Free cash flow £14.1m enabling £10.6m of acquisition spend and £5.4m of dividends.

Total dividend for the year 3.8p (last year 3.5p).

Outlook: in line with expectations, helpfully compiled by the company and disclosed as being revenues of £127.5m - £131.4m, and adjusted PBT of £21.9m - £22.7m.

There is some dilution to watch out for, though, and changing tax rates, and this impacts EPS even if it doesn’t impact PBT! I note that our friends at Equity Development have nudged downwards their recently released FY April 2024 estimates: the adjusted EPS forecast reduces by 5% from 10.8p to 10.3p, and the dividend per share estimate reduces from 4p to 3.8p (correction: the dividend forecast for 2024 increased from 3.8p to 4p!). Another example of where the note from the analyst gives a fuller picture than the RNS!

Revenues are expected to grow from £122m to £129m; Begbies say they are now the second largest in the administration market, with 11% market share. It’s an impressive growth profile over five years: revenues have doubled, and adjusted PBT has grown from £7m to £21m. Speaking of which…

The adjustments here remain enormous, with £20.7m of adjusted PBT translating into less than £3m of after-tax net income.

Last year, £17.8m of adjusted PBT meant an after-tax loss.

The major adjustment is “transaction costs”. These costs include payments to sellers of businesses that are contingent on the sellers continuing to provide services to Begbies after the sale.

According to the accounting standards, they should be treated in a similar way as employee remuneration. There is good logic for that, but it’s not helpful for companies who wish to deduct these payments from adjusted earnings!

Graham’s view

The company has previously been very helpful in explaining the accounting treatment of these “transaction costs” and I mostly agree that they are one-off in nature, although I also think these payments highlight the importance of key employees at acquired businesses. The professional services sector, after all, depends entirely on the quality of the people providing the services.

The other major adjusting item is the amortisation of acquired intangibles: these include things like brands, customer relationships and order books.

Some other people might not get hung up on these two adjusting items but I think it’s really important to form a view on them, in cases where there is a large discrepancy between adjusted and statutory profits.

Even if you want to skip these items and go straight to the cash flow statement instead, that doesn’t entirely settle matters: operating cash flow is £17.4m only if you exclude the special transaction costs I mentioned above. If you include those transaction costs, it’s only £6.8m.

I’m not inclined to give companies full credit for adjustments such as these; there are other companies which don’t need to adjust their numbers, and I find that life's easier when I own shares in them.

The PER uses the adjusted numbers so in my view the “real” PER is somewhat higher than this. How much higher is a matter of judgement.

Overall, I do like this company but with a PER that’s probably in the mid-to-high teens, I certainly wouldn’t call it cheap for a professional services business. The StockReport agrees, giving it a ValueRank of 21. This being the Small Cap Value Report, I have to stick with a neutral view on these shares.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.