Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

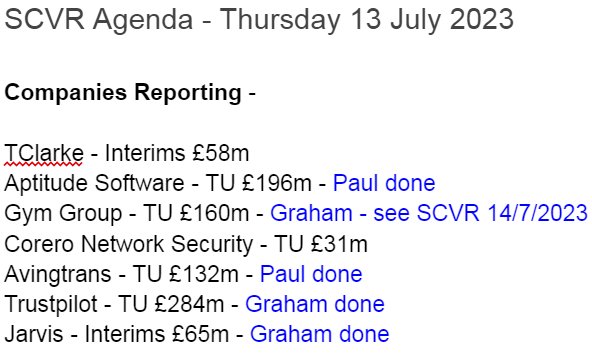

Summaries of main sections

Trustpilot (LON:TRST) - up 15% to 78p (£325m) - Trading Statement - Graham - GREEN

Pleasant news as adj. EBITDA should be above the top end of market expectations ($4m) this year. “Mid-teens” revenue growth is currently running at 18% and I remain optimistic for this company’s long-term prospects. Valuation relative to ARR remains modest, to my eyes.

Aptitude Software (LON:APTD) - down 14% to 292p (£168m) - - Trading Update & Directorate Changes - Paul - AMBER

Shares drop after an in line with expectations update, but cautious-sounding comments. So it looks as if it's in line due to cost-cutting, rather than lacklustre revenue growth. I'm struggling to see why this share commands a PER of 21x.

Avingtrans (LON:AVG) - Up 4% to 425p (£137m) - Trading Update & Possible Acquisition - Paul - GREEN

A solid, in line with expectations update. Strong order book, upbeat management commentary, and a very resilient share price further encourage me, to move from AMBER to GREEN. Valuation is probably high enough for now though. It's looking to absorb the rest of the shares in a small medical imaging company that it currently owns 18% of. Not material though at £3m deal size.

Jarvis Securities (LON:JIM) - up 1% to 147p (£65m) - Half-year Report - Graham - GREEN

Excellent H1 numbers here as Jarvis continues to benefit from rising interest rates. As I outline below, there are some significant risks involved but the stock continues to offer many attractive features for investors, including enormous profit margins and returns on capital.

Paul’s Section:

Aptitude Software (LON:APTD)

Down 14% to 292p (£168m) - Trading Update & Directorate Changes - Paul - AMBER

Aptitude Software Group plc (LSE: APTD), the specialist provider of Finance Digitalization and Subscription Management software, today provides an update on trading for the six month period ended 30 June 2023 as well as notification of changes to the Board.

The first paragraph sounds fine, so it’s a surprise to see the share price down 14% -

The Group will show modest revenue and profit progression to H1 2023 despite the macro economic headwinds faced by the sector and the economy generally. The Board are confident that the Group will meet profit expectations for FY2023.

However, the update then mentions some more cautious/downbeat things -

Higher customer churn seen in 2022 has continued in 2023.

ARR rose 3% Y-on-Y, but fell 1.4% in the last 6 months suggesting a mature, or even slightly declining business.

This sentence is strangely worded. Is it trying to say that customers are cutting back on their spending? -

...certain clients monitor spend as a result of wider economic uncertainty and high inflation.

Use of the phrase “heritage products” is unnerving, with lengthened sales cycles.

Cost cutting done in H1.

Net funds of £12.2m.

CEO stepping down immediately after a 3-4 year stint, and is being replaced by a regional CEO on an interim basis. This suggests investors are not happy with performance or strategy maybe?

Paul’s opinion - it sounds as if growth has stalled, which makes me question the premium valuation. Stockopedia shows a PER of 21.1x, which doesn’t look justified when hopes for growth seems to hinge on a new product.

Overall then, I don’t see anything of interest, so will be neutral, AMBER.

I suspect the downtrend may continue -

Avingtrans (LON:AVG)

Up 4% to 425p (£137m) - Trading Update & Possible Acquisition - Paul - GREEN

I last looked at this group here in Feb 2023, with an amber view - noting its in line with expectations trading, and a strong balance sheet (albeit with unusually large receivables, which I queried).

As you can see below, the long-term share price performance at Avigtrans has been excellent, and particularly resilient in the last year or so, when almost everything else in the small caps space has been relentlessly falling this has been solid -

What’s the latest today?

Avingtrans plc (AIM: AVG), the engineering technology group, announces a trading update in respect of the financial year ended 31 May 2023.

Given the wobbly macro outlook, this seems pretty good to me -

The Board is pleased to report that the results for the year ended 31 May 2023 are expected to be in line with market expectations*.

*Consensus FY23 Revenue, Adjusted EBITDA & Net Cash of £108.9m, £13.5m & £13.6m respectively

The momentum from FY23 has continued into FY24 and the current order book has continued to strengthen leaving us with a record order book for this time of year.

The Group is also pleased to announce that it has secured a number of positive contract wins throughout the period, notably in the nuclear sector, several of which have been set out below…

Outlook comments from the CEO sound positive -

"We are delighted by the performance of the Group in what have been difficult market conditions, including on-going supply chain disruptions, albeit that these have eased somewhat from their nadir. Despite the headwinds, order intake has been robust, notably growth in Engineered Pumps and Motors (EPM) has been particularly strong. As a result, we are pleased that the Group is entering FY24 with the best order cover since prior to the pandemic which leads the Board to view the outlook for this year with confidence."

Forecasts - no broker research has filtered down to me unfortunately, so I’ll have to go with the broker consensus figure on the StockReport, which is 22.4p for FY 5/2023, and 24.0p for FY 5/2024. Those give PERs of 19.0x and 17.7x - not bargain basement by any means. Although if you think the company will beat the FY 5/2024 estimate, then valuation could be acceptable.

Paul’s opinion - the long-term track record at Avingtrans speaks for itself, and this group has been good at creating shareholder value.

I also like the upbeat tone & content of today’s update, the group seems to be doing well despite tough macro.

Although valuation looks fairly full, I think it has to be GREEN here.

Stockopedia's computers are a bit more hesitant -

Graham’s Section:

Trustpilot (LON:TRST)

Share price: 78p (+15%)

Market cap £325m ($423m)

I’ve noted previously that this is “much riskier than the type of companies I usually like”, but continued to view it positively ever since reviewing it last September (share price at the time: 71p). Perhaps I should try to exclude this fact from my thoughts, but I couldn’t help noticing that it IPO’d at 265p as recently as March 2021!

Today brings an H1 update, with the following table:

In March, the company issued a revenue warning, stating that constant-current revenue growth in the current financial year would only be in the “mid-teens”.

However, 18% revenue growth in H1 is really at the top end of “mid-teens”, and we get the following outlook statement:

We reiterate our expectation for FY'23 of mid-teens cc revenue growth. Due to resilient trading combined with improved operational efficiency, we now expect like-for-like full-year adj. EBITDA above the top end of the range of market expectations (excluding the effects of IFRS 15 - see note 6 below).

In a footnote, the company says that it considers market expectations to be for adj. EBITDA of $2.4m - $4m.

However, the company expects to report adj. EBITDA of $3m in H1 alone, so it’s reasonable to look for a full-year result that’s over $4m!

These might not seem like very big numbers, but they are a considerable improvement on last year, when the company generated adjusted EBITDA losses for both H1 and for the full financial year.

Other key points:

Strongest bookings growth was seen in Europe and Rest of World (21%).

North America was slower at 11%; the company says that the situation improved there in Q2 with a new marketing strategy.

New CEO - as we already knew, Trustpilot’s founder wants to take a backseat. The company says it is “pleased” with the progress made in the search for a new CEO.

Graham’s view

I continue to view this as a unique company doing things that very few other companies are doing and that few other companies can do, as Trustpilot has already built a powerful brand.

The major competitive threat, that is true for many ambitious online businesses, is posed by the tech giants. Could Alphabet (in which I have a long position) create a rival product? Alphabet already has a rival product in the sense that businesses are rated on Google Maps, and these ratings can sometimes be very useful. But this product, to my eyes, still falls very short of the Trustpilot system.

So I like the business in principle, but I don't give something the thumbs up if the valuation scares me away. Annual Recurring Revenue here has reached $180m, so the company is trading at c. 2.3x ARR. This is before making an allowance for the company’s large cash balance (over $70m as of December 2022).

This is about the same as the valuation it was at before, and is much lower than I have seen many other companies trading at (especially in the US), so I have no reason to change my view on this one. It’s one of the few 2021 IPOs which I could potentially back for a recovery:

Jarvis Securities (LON:JIM)

Share price: 147p (+1%)

Market cap: £65m

Let’s catch up on the news at this small stockbroker. We have interim results:

Revenue +17% to £7.3m

PBT +23% to £3.8m

Earnings per share +16% to 6.52p

There can be few complaints about these numbers.

As noted in this report last September and again in March, Jarvis is working on some regulatory matters and this has put a cloud over the stock.

This chart shows where the market learned about the problem; the stock fell almost 50% that day, but has recovered most of those losses:

The Chairman updates on the “skilled person review”:

We have increased the resources in our compliance department to undertake this work, and we anticipate that even when the review is satisfied, we will continue with increased compliance resource within the firm. As part of the review, we have over the last six months been exiting some model B relationships which posed a higher than tolerable risk level for Financial Crime and Money Laundering compliance. This has resulted in a reduction in assets and cash under administration and has been a difficult transition for all parties involved.

Under what is known as “Model B”, firms such IFAs and smaller brokers can outsource a range of services to Jarvis, but there are clearly some regulatory factors that need to be revised.

As for the simple share dealing business, Jarvis reports that volumes remain subdued (no surprise there) but it continues to benefit from rising interest rates, as it gets to keep the interest earned on client cash. It could be argued that this is unfair, but on the other hand the share dealing charges are very low (£5.95 fixed dealing commission). In their own words:

Interest income has always been a significant contributor to the business model enabling Jarvis to maintain its fixed low-cost commission which has not been increased for over 12 years despite rising costs and the recent high levels of inflation.

Graham’s view

Jarvis keeps its reports short and sweet, and I like that. There’s not much more to analyse, so let me sum up why I remain positive on this one:

I expect interest rates to remain at “normal” (higher) levels for the foreseeable future, which will make interest income a regular and significant contributor to profitability.

I continue to suspect that Jarvis will emerge unscathed from the skilled person review.

Profit margins and return on capital remain amazing. The PBT margin was over 50% in H1. Look at these quality metrics:

Valuation. According to Stockopedia we have a PER of 11x and a dividend yield of 8.5%.

The company remains under the leadership of founder Andrew Grant who has been running it since 1984 and who remains by far the largest shareholder.

To keep things balanced, here are some negative possibilities:

Interest rates could fall again soon, depending on economic conditions and the thought processes at the BoE. That could reverse the gains in profitability we have been seeing here.

X-O only deals in UK-listed stocks. With UK markets underperforming for several years, X-O can’t offer any foreign opportunities, and foreign shares may be more popular in future.

The regulatory review could result in fines or other very negative consequences. It’s not possible to predict these things with any certainty.

Competition is intense among stockbrokers and as I’ve noted previously, X-O does need to work hard to maintain a competitive offering in this market. They may need to invest more in the future in order to do this.

We don’t have transparency on where client money is deposited, so it’s not possible to judge the credit risk that the company accepts in order to generate interest.

Overall, I remain positive on this one, and it’s still one of my favourite financial stocks.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.