Good morning from Paul & Graham! There are lots of backlog items we want to get stuck into, so we're both working here today.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

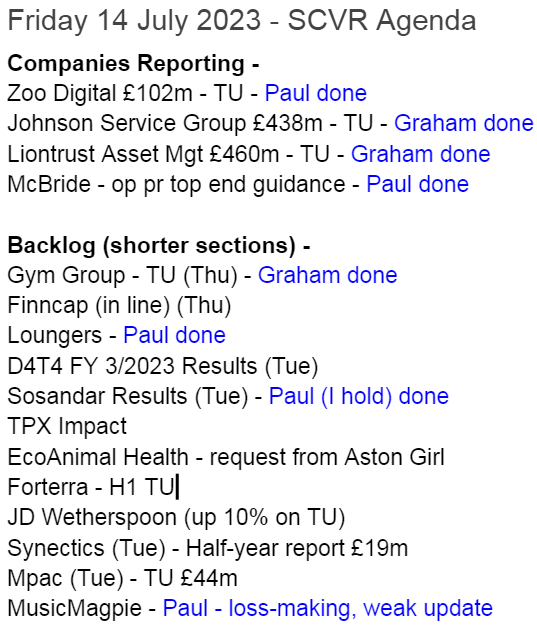

I'm not sure how many of these we'll actually manage to do, but here's the list of possibles - update: we managed some at least -

Summaries of main sections below

Zoo Digital (LON:ZOO) - Down 37% to 66p (£65m) - Trading Update - Paul - AMBER

Accounts delayed by a month, due to adjustments relating to revenue recognition - doesn't sound a big deal. A rather vague Q1 update sounds like it may, or may not be a profit warning. More clarity is needed I think (EDIT: it's actually a major profit warning, forecasts now available are down heavily). Also, the threat from AI concerns me, as text to voice software has already become so realistic. Big broker downgrades are coming through now.

Liontrust Asset Management (LON:LIO) - down 4% to 678p (£440m) - Trading Statement - Graham - GREEN

More outflows at this fund manager, as we are used to. Market sentiment appears to believe that selling active UK equity funds to retail investors is a thing of the past. I am not sure about that and I’m also open to the idea that the acquisition of GAM might work out well.

Johnson Service (LON:JSG) - up 2% to 106p (£438m) - Trading Update - Graham - AMBER

This textile rental company now expects to do “slightly” better than expectations, thanks to fixed gas and electricity costs and busy trading. The shares haven’t yet recovered after Covid (the share count increased) but I’m inclined to think they are priced about right here.

McBride (LON:MCB) - Up 20% to 31.2p (£54m) - Full Year Trading Update - Paul - AMBER/RED

FY 6/2023 update reports that a strong end to the year has delivered operating profit at the top end of the previously guided range. Although the large debt pile means interest costs will consume all of that profit. Wafer thin margins, and heavy debt means this remains high risk, but I think it's now over the worst, albeit not out of the woods yet. So it could be an interesting punt with high risk: potential high reward.

GYM (LON:GYM) - up 4% to 104.7p (£188) - Trading Update - Graham - RED

Thursday’s update left full-year expectations unchanged at this low-cost gym operator. Perhaps I’m too harsh on it but I’m not overly impressed when I see organic and like-for-like growth rates only matching inflation. This is still performing significantly below 2019 levels.

Sosandar (LON:SOS) (Paul holds) - 23p (£57m) - Full Year Results - Paul - GREEN

Lots of detail below. Results as expected. Outlook says in line with FY expectations, but Q1 growth of only 10% is well below FY 36% forecast growth. Exciting developments about to launch (App, Sainsburys in store and online, and international about to launch through third party). Strong balance sheet with ample cash now, and profitable. I think risk:reward is the best it's ever been so far.

Loungers (LON:LGRS) - 193p (£200m) - Audited Results (52wks to 16 April 2023) - Paul - AMBER/GREEN

Profit well down on LY (but that was boosted by Govt support). Fairly upbeat outlook comments. Really tough sector, but a high quality operator. Worth considering.

Paul’s Section:

Zoo Digital (LON:ZOO)

Down 37% to 66p (£65m) - Trading Update - Paul - AMBER/RED

ZOO Digital Group plc (AIM: ZOO), a leading provider of end-to-end cloud-based localisation and media services to the global entertainment industry, today provides guidance on its interpretation of IFRS 15 ahead of full year results [Paul: FY 3/2023], which are now expected to be announced in early August 2023, and an update on Q1 trading.

That sounds like a delay to the FY 3/2023 accounts, the equivalent last year being published in early July. So it’s about a month late this year, due to complications from IFRS 15 (revenue recognition) - something that I’m more than happy to leave to the qualified accountants to grapple with, who can then just tell me what the outcome is of their detailed work on the subject.

Revised guidance from the auditors now means that third-party invoices have to be accounted for as they are received, rather than being matched with related revenues. There’s a $1.2m hit to FY 3/2022 profit, as a prior year adjustment, but a $2.0m boost to FY 3/2023 results. This doesn’t sound particularly important, so let’s move on.

Two negative industry factors are mentioned as causing headwinds -

Writers strike in USA is now in its 3rd month, and having an impact on ZOO

The competitive boom in streaming services has now turned into restructuring & cost-cutting. Although ZOO reckons this will enable it to gain market share.

As a result, a softer H1 is expected, with growth returning (hopefully) in H2.

Net cash of $23m at 30 June 2023 sounds good.

Possible acquisition of Japanese localisation studio is at advanced stage.

Guidance for the new financial year is too vague, but sounds negative -

First quarter FY24 trading has been impacted due to a well publicised hiatus in the normal flow of orders across the industry, resulting in lower revenues than previous management expectations in a quarter that the Board already expected to be weaker than the previous year.

It doesn’t mention whether this is going to affect full year performance or not.

Paul’s opinion - this is too vague, but sounds like another mild profit warning like the one I covered here on 28 April 2023. That had little impact on the day, but then triggered a sharp fall in share price in subsequent days. So being an early seller seems sensible with this share.

There’s nothing in today’s update that makes me feel positive news is likely any time soon. Hence I’m continuing to steer clear of ZOO shares.

A final point to consider, is that AI has already been demonstrated (e.g. this video demonstration of the software I flagged & tested out in a recent podcast of mine) to produce remarkably lifelike text-to-voice. It’s only going to keep improving, thus I can see why maybe some investors could be cautious about ZOO’s dubbing services becoming redundant once AI has been perfected, which it’s not far off being already.

ZOO spent many years struggling, and has only achieved significant profits recently, during the streaming services boom (which is now fizzling out). Throw the AI threat into the pot too, and I can’t get excited about the prospects here. So I’ll stick with AMBER. I'd only be interested at a much lower valuation, if at all.

EDIT: I just see that the share price has opened much lower (the above all written pre 8am), down about 29%, so bad luck to holders, looks like the market is not impressed at the open, although buyers might come in later to support the price of their existing holdings, who knows?

EDIT2: Broker notes coming through now, show big downgrades to FY 3/2024 forecasts, eg a fall in EBITDA from $14.5m (FY 3/2023) to $9.0m (FY 4/2024). And of course EBITDA flatters to deceive. The further down the P&L we go, the worse the percentage falls get - eg. adj EPS forecast drops right down to only 2.9 US cents (previous forecast was 9.6 cents). So I think the bull case now rests on this being due to one-off factors, and hopes for a rebound in FY 3/2025 - not something that attracts me at all. So based on this new information, I think I have to revise my view downwards to AMBER/RED.

McBride (LON:MCB)

Up 20% to 31.2p (£54m) - Full Year Trading Update - Paul - AMBER/RED

Many thanks to yiannos1, who flagged this upbeat update in the reader comments below.

Looking back at our previous notes this year, we had to view it as RED, given the excessive bank debt, whilst recognising the improving trading updates, and the leniency of the bank, giving it time to (hopefully) trade out of trouble, and do a refinancing later.

Quickly summarising our previous notes -

17 Jan 2023 - In line H1 (6m to Dec 2022). Huge debt, but bank giving it more time.

28 Feb 2023 - TU - back into operating profit. But huge debt & high interest cost make it high risk.

I see there was another trading update here on 25 April 2023, which we didn’t cover for some reason. It looks quite good actually, ahead of expectations, and guiding FY 6/2023 operating profit of £8-13m (previous guidance £3m). Although high interest costs on the huge debt pile, mean it's still loss-making at PBT level.

On to today’s year-end (30 June 2023) trading update -

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides the following trading update for the twelve months ended 30 June 2023.

We already knew this, but it confirms a “return to profitability”.

“...exceptional input cost inflation of the past two years” - supply chain (re covid disruption), then energy crisis (Ukraine invasion).

Strong Q4 volume growth of 12.7%, improves year’s volume growth to 5.4% - this is impressive, because prices are higher now, so to be achieving volume growth as well, should combine to give a very good revenue growth figure.

Consumers trading down to supermarket own-brand is a positive for MCB.

Revenue growth 28.4% (constant currency) FY 6/2023 - excellent, but no doubt costs will also be up a lot too. The StockReport shows forecast revenue growth of 29% to £874m, pre today’s update, so that looks in line.

Revised guidance - very clear, with numbers included, which is excellent -

As a result of the strong fourth quarter trading performance, the Group now anticipates that adjusted operating profit will be materially ahead of current market expectations* and at the top end of the range indicated at the time of our trading statement on 24 April 2023**.

* Current market expectations refer to a Group compiled consensus of broker forecasts for FY23 of:

· Adjusted Operating Profit £9.7m

· Net Debt (incl. IFRS 16) £181.0m

** Guidance provided in trading update statement issued 24 April 2023:

· Adjusted Operating Profit £8m to £13m

· Net Debt £181m to £186m

I think the “materially ahead” line is rather spurious, because it’s actually within the range of previous (April) guidance, albeit at the top end, so that’s positive, but not a reason to start hanging up the bunting.

Also, note how tiny the margins are. Only 1.5% of revenue turns into operating profit, and I would guess at least all of the operating profit would be consumed by interest costs on the massive debt pile. Profit/cashflow needs to improve a lot further, before it can seriously reduce the debt pile. At the moment it looks to be just servicing the interest cost on a P&L basis.

Debt - having said that, the quote on debt does suggest it’s made some “sustainable” improvements to working capital, helping to make the debt position bad, instead of potentially disastrous, and it seems to have adequate headroom -

Sustainable working capital improvements resulted in Net Debt closing at £166.5m, better than expectations, and the Group's liquidity at £59.3m, significantly higher than the minimum liquidity requirement of £15m applicable under the Group's financing arrangements.

My opinion - this is still high risk, due to excessive debt, but the newsflow is clearly now showing a business that has managed to survive a bad patch, and things are now improving.

So it could be an interesting special situation now, for investors prepared to take more risk than most value investors would tolerate. If things continue developing positively, then you could have a 2-3 bagger here, as the risk recedes, and all the upside flows to equity. Although sooner or later, an equity placing is likely, so lots of dilution is the main risk. If management can hold off that risk until there’s a much stronger share price, then it could be a nice trade. We saw a good example of this with Card Factory (LON:CARD) - where the financing looked desperately weak, but mgt successfully held off the bank until trading improved and an equity fundraise wasn’t needed. If MCB can pull off the same thing, then you could see an out-sized return on the share price. But we can’t just ignore the risk either. Remember interest rates are now much higher, so MCB’s big debt pile is likely to continue consuming the operating profit, hence meaning little chance of major reductions in debt from cashflow (unless it does negative things like letting equipment wear out without replacement).

As mentioned by a reader MontyCarlo below, the supermarkets need companies like MCB, but don’t let them make much of a margin. The historic numbers and commentary for MCB show that it’s permanently trying to improve margins and restructure, only to find the customers grabbing the profit for themselves one way or another. So maybe expecting a 5% operating margin in future is unrealistic? More like 1-2% strikes me as sustainable. After all, that’s what the supermarkets make themselves, and they don’t like suppliers exceeding their own narrow margins.

Overall, I think the positive news this year reduces the risk somewhat (still high). So I’ll move up from RED to AMBER/RED.

Sosandar (LON:SOS) (Paul holds)

23.0p (£57m) - Full Year Results - Paul - GREEN

Sosandar PLC (AIM: SOS), one of the fastest growing fashion brands in the UK creating quality, trend-led products for women of all ages, is pleased to announce its financial results for the year ended 31 March 2023 and an update on trading for Q1 of the current financial year.

Apologies for taking my time to report on this one. I quickly skimmed this announcement on 11 July, concluding in my head that the figures looked as expected, and the outlook was “in line”, but might underwhelm some investors who focus on the short-term growth rate, which was only 10% in Q1 (against strong LY comps). Hence no rush to scrutinise the details, as I’d quickly decided to do nothing personally (neither buy nor sell), as this is a core long-term holding for me.

Key figures for FY 3/2023 -

Revenue up 44% to £42.5m - highly impressive, and all organic.

Profitable now, PBT of £1.6m - strong improvement from £(554)k loss LY.

Simple, clear numbers, with no adjustments.

Gross margin - a key indicator for retailers, at 56.1%, similar to last year, is very impressive given that wholesale (lower gross margin, but lower distribution & admin costs further down the P&L) is a growing proportion of revenues.

Third party partnerships (particularly Next, M&S, and John Lewis) have really been the key driver of SOS moving from a small, loss-making startup, into a profitable, quite well-known, and differentiated brand, with good customer loyalty.

SOS did another equity fundraise in Jan 2023, but this time it’s for building up inventories to service the large wholesale clients, which is NOT cash burn. Ended the year with £10.6m net cash at end March 2023. No more fundraises please SOS! Surely this is now more than enough cash?!

The share count is now 248m, which is a lot more than the 2017 float with 106.8m shares. Memo to self - whenever startups tell me that they won’t need to fundraise again, ignore them - they will, and probably several times! They always under-estimate the cash needed to build a proper business, and the length of time it takes. That said, SOS stands out as one of the successful ones - they actually have build a business of decent size, it has moved into profit now, and the share price of 23p is well ahead of the 15p original (over-priced, with hindsight) float - reversing into a cash shell, of a dormant failed junior resource stock worked very well, as it had good liquidity right from the start, with an established small shareholder base.

Here’s the post-period end highlights, copied to save me re-typing it -

The current financial year has started pleasingly, and we are trading in line with our expectations for full year growth. The investments that were made in Q4 FY23 are already bearing fruit across the business, and we are making large strides operationally with the development of our technology platform and finalising our international strategy. The Sosandar product range continues to resonate with our customers and we are committed to ensuring that we offer them a seamless customer experience through all of our sales channels, and continuing to deliver for all our stakeholders.

I’m not madly impressed with the +10% revenue growth in Q1.

The full year forecast is £58m revenues, up 36%. So only being up 10% in Q1 suggests the rest of the year will have to be faster growth than 36%, to reach target. So there’s a clear risk that revenue growth could disappoint later this year.

Management are great, but do have a tendency to be permanently bullish on everything!

Sainsburys launch - this will be very interesting, and the first time Sosandar clothing will be available in physical stores. This was previously explained as part of Sainsburys plans to make some of its biggest stores have clothing sections which resemble a Dept Store - so separate branded sections -

We expect this partnership to deliver a significant combined contribution in the current financial year and beyond.

International - launch is imminent. This is the bit which really excites me, as I remember the huge re-ratings that both ASOS (LON:ASC) and Boohoo (LON:BOO) received when investors realised they were both international growth stories (in their shares heyday). Could a similar thing happen to Sosandar shares? It could, but it depends on how much customer interest there is, via the vendor Global-e. It’s low risk for SOS anyway, so the worst case is that it flops, with no particular risk to SOS. I’d say that’s unlikely though, but don’t know until the company tells us what’s happened in reality.

Macro - doesn’t seem to be a worry. As we’ve seen many times before, the strongest brands & products continue selling well, even in downturns. It’s the also-rans that bear the brunt of downturns -

Whilst we are trading well and have not had any material disruption to date, we remain vigilant to the external challenges including inflationary pressures on consumer spending and believe our agile approach and understanding of our customers positions us well.

Balance sheet - I like this development, which is most encouraging, as it will help relieve pressure on working capital (hence reduce the risk of more fundraisings for working capital) -

Creditor payment days have continued to move favourably as the Group has become a more important and trusted customer for our supply partners and credit insurance is now being available following the sustained strong financial performance over the last 18 months.

Fixed assets are negligible at only £1.0m, reflecting that SOS has a lovely outsourced business model. In my experience, conventional fashion retailers spend most of their time managing & worrying about logistics, and individual store oversight. SOS’s business model is an absolute dream in comparison, with no stores, and Clipper managing all the logistics for them. This leaves management largely free to do what they do best - product design, marketing, etc.

Inventories are up a lot +69% to £12.4m, which is at cost remember, so they’re looking a bit over-stocked I think.

Working capital overall is very strong, with current assets including £10.6m cash, at £27.4m. Whilst current liabilities of £8.5m mean that it could pay all the creditors instantly from the cash pile, and still have £2.1m left over.

There’s nothing in long-term creditors, apart from £0.5m lease liabilities, which we can safely ignore.

Overall then, a very strong balance sheet, so dilution risk really should now be very remote.

Cashflow statement - operating cashflow is negative £(1.5)m because of the large increase in inventories of £5.1m. They’re scaling up the business fast, so I accept that as a legitimate thing. Nearly a third of this is offset by increased trade creditors of £1.6m.

The £5.9m equity raise probably wasn’t necessary, as it would have still had £4.7m net cash at year end if the fundraise had not been done.

I’d prefer to see a say £5m RCF put in place to accommodate any future working capital swings, rather than another (arguably unnecessary) equity raise.

When companies are growing this fast, it’s a different thing to how we look at mature companies, and cash consumption to build up working capital is both necessary, and a good thing - you can’t sell product unless you’ve got it in stock, and when demand is booming, you have to buy a lot more stock.

Note 9 - website costs are now being expensed through the P&L, which is a nice conservative accounting treatment. Actually, all the accounting looks conservative to me. So the profits are real, not conjured up through adjustments!

Note 17 - outstanding share options at 18.1m, mostly exercisable at 0p, looks a bit generous, but I suppose this can be justified given that the joint CEOs are so crucial.

Paul’s opinion - obviously I’m biased, as I’ve been keen on Sosandar since it launched about 6 years ago, seeing something unique and likely to succeed. It’s worked, but it's been a rollercoaster, and has required a lot more dilution that originally planned, which should now be over. The most sensible strategy would probably have been to just watch its progress, and only buy the shares when success was the most likely outcome, instead of taking the early stage risk.

It’s profitable now, and can actually be valued on a PER basis, at a not excessive 23.9x fwd PER according to the StockReport.

Will it grow revenues by the forecast 36% this year FY 3/2024, given that only 10% was achieved in Q1? That’s my biggest question mark.

However, there’s loads of exciting stuff about to start, including the Sainsburys website and large stores launch, plus the global sales through Global-e. If that takes off, then we could be onto a multibagger here, and that’s in for free, because the valuation stacks up on the UK business alone, I reckon.

In my opinion this is a potentially major brand being built, not just another eCommerce business. I don't see any risk from Chinese sites such as SHEIN or TEMU, as the older, more affluent Sosandar customers just wouldn't be buying from those sources.

This share is much lower risk now than it’s ever been before, given the strong balance sheet, plenty of cash, and decisive move into profit.

The main risk? It’s fashion/product risk - that the joint CEOs go off the boil, and buy the wrong product that customers don’t like.

Here’s an interesting chart for you - over the past 2 years, SOS has been a relatively safe haven stock, compared with its giant competitors BOO and Asos (the ones that are down 86% & 92% at the bottom of the chart!) - who could have predicted this?! -

Loungers (LON:LGRS)

193p (£200m) - Audited Results (52wks to 16 April 2023) - Paul - AMBER/GREEN

Loungers, a leading operator of all day café/bar/restaurants across the UK under the Lounge, Cosy Club and Brightside brands, is pleased to announce its audited results for the 52 weeks ended 16 April 2023 ("FY23").

Lots of sector experts have told me management at LGRS are the best sector operators.

Rapid expansion, with 29 new sites, and 34 planned for the current year.

Revenue £284m (up 19%)

Decent LFL (same site) revenue growth of +7.4%

Various profit measures ranging from adj EBITDA of £47m to PBT of £7.3m - which to use for valuation is up to you.

Net bank debt modest at £6.0m

Inflationary pressures mitigated, and “are now diminishing”

Strange diversification into Brightside roadside cafes (modern day Little Chefs maybe?) - has anyone here mystery shopped them? If so, do let us know your thoughts!

Outlook - sounds perky, but note the recent sales growth is still well below inflation -

Current Trading and Outlook

We continue to feel very positive about the outlook for our brands. Over the 12 weeks since the year end our LFL sales have been +5.7% despite the impact of Easter timing and we are pleased with our performance and trajectory. Our new site openings continue to perform exceptionally well, achieving record levels of sales, and our pipeline of new sites is as strong as ever.

We ended FY23 by accelerating many of the initiatives that have underpinned Loungers' resilience in FY23; opening six sites in six weeks across March and April, launching new innovative menus in Lounge and Cosy Club and restructuring benefits for our salaried staff. We are confident that the good momentum we are seeing across the business, as well as the investment that we continue to make in our operational structure, puts us in the best possible position to deliver further growth and profitability in FY24.

Weasel words there at the end - note it's "growth and profitability, not "growth in profitability" - not clever, that sort of thing just undermines my trust.

Balance sheet - little asset backing here. NTAV is only about £30m.

Cashflow statement - cash generated is used to fund the capex for its roll-out of new sites. Also helped by increasing credit from suppliers.

No divis at this stage.

Paul’s opinion - I think the squeeze on household incomes is likely to end in the next 6 months or so (much lower inflation likely according to the Bank of England). Therefore we could be looking at sectors like hospitality, where the best operators should be able to gain market share as the zombie companies (mainly independents) disappear, and maybe rebuild their margins as cost pressures ease?

So there is a bull argument for this sector, and I think LGRS is a strong, expanding, participant. Landlord deals are apparently still highly attractive too.

The commentary sounds positive, but for me the big fall in PBT from £21.6m last year (boosted greatly by Govt covid support), to only £7.3m this year, brings home the stark reality that it’s incredibly difficult to make any money in the hospitality sector right now - so why invest in it? Because investors in the sector expect margins to gradually rebuild in future years, which LGRS indicates it also hopes for.

Overall, I’d say LGRS is worthy of consideration, if you want to invest in this sector. So I’ll go up from AMBER, to AMBER/GREEN.

Shares have held up reasonably well since listing, despite all the macro problems over this period -

Graham’s Section:

Liontrust Asset Management (LON:LIO)

Share price: 678p (-4%)

Market cap: £440m

I’ve been reluctantly giving this fund manager a “GREEN” view, due to its unusual cheapness, but the market is telling me I am wrong:

Here is the chart for the past six months:

Today we have a trading update for Q1 (April to June) and it’s hardly inspiring:

Net outflows £1.6 billion

AuMA falls 6% to £29.5 billion

In 12 days after quarter-end, AUM fell further to £29 billion.

As for the acquisition of GAM, there are no signs of this deal stalling yet; both a majority of Liontrust shareholders (83.7%) have voted for it, and the largest GAM shareholder owning 17% of that company has indicated that it will support it.

CEO comment:

"The last quarter continued to show the importance and benefits of having a broad product range with diversification across investment styles as well as asset classes. In a risk-off environment, our strong focus on equities has proved to be challenging, especially when the UK market has been out of favour. This is demonstrated by equities having had net negative retail sales in the UK in 10 of the last 12 months to the end of May 2023, according to the Investment Association.”

I think the purpose of this paragraph is to make the case for the GAM acquisition; the CEO is saying that Liontrust’s offering is currently not broad enough, as the focus on equity fund sales in the UK continues to hurt them.

He continues:

Our business is in robust health despite the current market environment. This provides a strong platform for future growth with the proposed acquisition of GAM bringing us the benefits of increasing investment talent; diversifying funds, asset classes and investment styles to offer more solutions to clients; broadening distribution across the world; and expanding the client base.

“Robust health” could be justified, I suppose, in a number of ways. The most recent results (FY March 2023), for all of the negativity surrounding the stock, still showed a PBT of £49m. The company finished the year with tangible net assets (£92m) and a large cash balance (£121m).

Graham’s view

I remain torn on this one. If the company simply bought back its own shares with whatever spare cash it is generating, and reduced its share count, that would strike me as a low-risk way to put the money to work for shareholders.

Instead, the share count will increase as a consequence of the planned GAM acquisition. AuMA is also set to increase significantly, towards c. £50 billion, so there are significant rewards for shareholders if it works out. I don’t want to downplay those rewards. But combining the two companies might be very complicated - we shall have to wait and see how it works out.

The big-picture situation is that these shares are down by more than 70% since their peak in September 2021, when equity market sentiment was euphoric (remember all of the IPOs?).

It is true that EPS might be affected in the short-term by costs relating to the planned buyout of GAM. I expect large differences between adjusted and actual EPS as GAM is digested. But before too long, we could be looking at a fund management group earning fees on £50bn+ of AUM, and the acquisition-related costs won’t last forever.

As the valuation here remains extraordinarily low to my eyes, I have little choice but to maintain my positive view. Or if I wanted something simpler with fewer moving parts, I’d stick with the likes of Jupiter Fund Management (LON:JUP) .

Johnson Service (LON:JSG)

Share price: 106p (+2%)

Market cap: £438m

Aside from the Covid-impacted 2020, this stock has been a steady performer over the years, and is now back operating at pre-Covid levels of performance.

It’s in the “textile rental” business - workwear, towels, bed linen, table linen. So it’s closely associated with the hospitality sector in particular.

Today we have an H1 update:

Revenue up 22% to £215m (last year: £176m)

Particularly fast growth in hotels & restaurant revenue (“HORECA”), up over 30% to £144m (last year: £110m).

Organic revenue growth is 20.6% (JSG made a small acquisition at the start of the year).

A new HORECA site is opening in Crawley, planned for H2 2024.

It must be an energy-intensive business, and they like to fix their costs:

Whilst inflationary pressures continue and energy markets remain volatile, we do have more certainty on our costs in the short term. We have now secured fixed prices for 84% of our anticipated gas requirement and 87% of our anticipated electricity requirement for the remainder of this year. In addition, 50% of our anticipated gas requirement and 64% of our anticipated electricity requirement is now fixed for 2024 with further agreements at a lower level in place for 2025.

Outlook - “assuming the trading environment remains unchanged, we will report full year adjusted operating profit slightly ahead of current market expectations.”

Graham’s view

I think this is probably a better-than-average business, with a solid operating history, but quality metrics aren’t too special. Like Paul, I would want a cheap valuation to get me interested. The company does appear to be performing well but at the end of the day I would say that it is probably priced about right here.

GYM (LON:GYM)

Share price: 104.7p (+4%)

Market cap: £188m

Since the last time we covered this low-cost gym operator, it has found a new CEO, although he will not start until September.

He was previously MD at The Times/Sunday Times (less than three years), MD at RAC (less than three years), and before that was at British Gas for seven years.

He brings “significant experience developing and delivering on pricing, proposition, digital marketing and retention strategies, as well as operational expertise whilst prioritising the customer experience, particularly for subscription-based business models in the consumer and media sectors.”

Hopefully his skills and experience are transferable to gyms!

I turned negative on these shares in January, when it became clear that the work-from-home trend was preventing some of GYM’s sites from recovering to pre-Covid performance levels. The CEO stood down at that time, adding to the company’s difficulties.

We now have an H1 update, with news that the company expects to meet full-year expectations.

For the period ending 30 June 2023, revenue has increased by 18.5% to £99.8m (H1 2022: £84.2m) with membership of 867,000 as at 30 June 2023 compared with 790,000 at 30 June 2022 and 821,000 at 31 December 2022.

H1 average revenue per member per month (ARPMM) was up 8% to £18.81. Like-for-like revenue grew 7% year on year and comparable sites are running at 97% compared with 2019.

It sounds good initially when you hear that sites are running at 97% of revenue, compared with 2019. But I think it’s left up to us to factor in inflation. Four years of energy and wage inflation, combined with a 3% decrease in revenue per site, is a big problem.

Similarly, the 8% growth in revenue per member per month, and 7% like-for-like revenue, are not real growth rates; they are just a sign that the company is keeping up with inflation.

There are at least two positive points:

Site opening has crawled to a snail’s pace for now at least. Only two sites opened in H1, and one was closed.

Net debt reduced from £76m at year-end to £70m at the end of H1.

Graham’s view

I could switch to a neutral view on this but I’m still uncomfortable with the debt load and I’m not convinced that it’s on a path to profitability. Maybe I need to treat gym shares with the same scepticism that I bring to pubs and restaurants - simply too capital and labour intensive and with too many things that can go wrong and disrupt them over time?

The new CEO will at least bring a fresh perspective, but from outside the industry. The Chairman insists that the new management team has “the right blend of skills and experience”.

Incidentally, the Chairman happens to be the founder but he’s the only person I can see with a significant shareholding in GYM, and his stake has fallen to less than 1% after a series of large sales of stock in recent years.

For these reasons I would be inclined to give this one a miss, even with the price to sales multiple currently at just 1x.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.