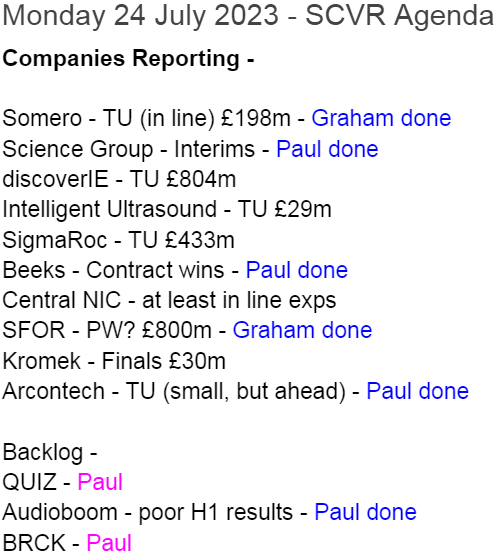

Good morning from Paul & Graham!

Today's report is now finished.

A fresh start this week - let's have polite, and constructive reader comments only from now on please. Standards slipped last week, from a handful of people, and we don't want that happening in future. Nobody wants the community here to turn into advfn!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections below

Audioboom (LON:BOOM) - 225p (£37m) - Interim Report - Paul - RED

A large onerous contract write-off has incurred a hefty loss, heavily dented the balance sheet, and now made the prospect of dividends fade away. I'm finding it difficult to see any value in this share, but who knows, someone might bid for it, given the low market cap.

Beeks Financial Cloud (LON:BKS) (Paul holds) - Up 6% to 108p (£71m) - Private Cloud Contract Wins - Paul - GREEN

Nice to see some contract wins announced today, but nothing said about trading overall vs market expectations. Assuming no profit warning is in prospect, then this company looks a bargain to me, once the next bull market starts.

Arcontech (LON:ARC) Up 3% to 66p (£9m) - Trading Update - Paul - AMBER

An ahead of expectations update caught my eye, but on a closer look it's not of any great significance. The big cash pile, and consistent profitability make this a potentially interesting special situation value share. But is its product old hat?

S4 Capital (LON:SFOR) - down 20% to 111p (£644m) - Trading update (profit warning) - Graham - RED

This advertising group had a difficult H1 and lowers its forecasts for 2023. Analysts have also slashed expectations for 2024. Doubtless there are factors beyond S4’s control which contributed to this. Even accepting that, I fail to find many attractive features to this stock.

Somero Enterprises (LON:SOM) - down 3% to 346p (£193m) - Trading update (in line) - Graham - AMBER

This update is in line after a recent profit warning. Somero is hopeful that activity will pick up in North America in H2, as the construction industry there was challenged in H1 by a range of macro factors. I like this company and the shares but there are some niggling doubts.

Science (LON:SAG) - Unch 415p (£188m) - Interim Results - Paul - GREEN

Not the easiest share to understand, and I'm a little baffled by the moving parts - with profits collapsing at its Frontier division, but more than replaced by growth (helped by TPG acquisition) in Consultancy. It's soundly financed though, and reasonably valued, so could be a situation where you just back owner/management, without really understanding what's going on!

Paul’s Section:

Audioboom (LON:BOOM)

225p (£37m) - Interim Report - Paul - RED

H1 numbers came out on Weds week (19 July 2023), for this podcasting company. I watched the management webinar on IMC, and have to say it put me off the company even more than before.

Background - BOOM looked a basket case for years, it’s been around on AIM since 2003. In recent years though, new management successfully turned it around, growing revenues impressively, and stemming the losses, with more recent profitability (on an adjusted basis - with the profit being consumed by excessive share option charges).

A maiden dividend had been declared for payment in 2024, although I suspect that might be pulled, due to a disastrous onerous contract mis-step.

So far this year, I’ve reviewed BOOM as follows -

23 Jan 2023: AMBER. 405p - Profit warning concealed in an upbeat-sounding TU (trading update) . Missed 2022 revenues by 10%.

24 March 2023: RED. 435p - OK results, but share option charges consume all the profit! Hence I switch to a negative view.

23 June 2023: RED. 210p - down 26% on the day, profit warning.

Results, 6 months to 30 June 2023

Audioboom (AIM: BOOM), the leading global podcast company, announces its unaudited half-year results for the six months ended 30 June 2023.

Not good at all. Revenue is down 22% to $31.8m in H1, which it blames primarily on a lost contract (called “Morbid”) which switched to another provider - which is the main problem with BOOM’s business model - the podcast makers shop around for the best deal.

Divis likely to be stopped.

Excessive share based payments

Onerous contract has incurred a disastrous $8.9m loss.

Loss before tax is $(10.6)m

Advertising market is tough (this is BOOM’s income), and smaller advertisers are stepping away from podcasting ads - I don’t blame them, as end users hate the interruptions from podcast ads, so I think advertising in podcasts is a mistake and does damage to brands that do it.

Balance sheet has taken a big hit from the onerous contract provision, with NAV down from $17.5m at Dec 2022, to $9.3m at June 2023. Cash is OK (for now) at $5.3m.

Paul’s opinion - this onerous contract problem (some kind of uncompetitive agreement entered into at the peak of the advertising market) is a big red flag to me. How did this happen, and what’s to stop it happening again?

This seems a weak business model, and I see little to no value in the shares.

However, it is a US-based business, and someone might come along to bid for it a tech valuation, you never know. Podcasting is a very crowded & competitive market, with low margins, so there’s little to attract investors into this.

BOOM has done well to avoid insolvency, but I can’t see much potential for it to generate decent profits in future. Although maybe the retrenching of Spotify and others, might leave more pickings for BOOM?

The market cap is only £37m now, so it might be a speculative punt for more adventurous and optimistic investors?

Good growth at the time, and takeover rumours, helped fuel the crazy spike up in price in 2021-2 -

Beeks Financial Cloud (LON:BKS) (Paul holds)

Up 6% to 108p (£71m) - Private Cloud Contract Wins - Paul - GREEN

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets…

New contracts signed, valued at >$4m (but not stated over what time period)

One contract is with one of the UK’s largest banks, won via a partner.

“Good contract momentum”...”increasing levels of revenue visibility for FY24 and beyond”.

“Strong & growing pipeline”

The largest contracts, Exchange Cloud, “have the ability for considerable expansion”, with a pipeline or similar opportunities (which take time to progress to signing).

Paul’s opinion - it’s nice to have news of contract wins - this is the type of share that needs a regular boost from positive newsflow. Otherwise shareholders get bored, and drift away, assuming that a profit warning might be in the pipeline.

What’s missing today is any mention of whether the company is trading in line with expectations or not! I can’t see the point in just announcing contract wins in isolation, with no confirmation on how overall trading is going.

We’ve not had a proper update since the interim results on 27 Feb 2023, which I reviewed here. that’s 5 months ago, much too long. We need updates at least quarterly, I think, from all companies, especially in bear markets, when investors worry more.

Broker forecast (only one broker) don’t seem to have changed this year, with Canaccord helpfully providing an update note today - FY 6/2023 revenues of £25.0m (up 37%) and aPBT £3.1m. There are also sponsored research notes from Progressive.

In my view, it’s very unusual to find a high organic growth tech company, that’s already profitable (just), at a valuation of only £67m. I think BKS could re-rate significantly once the next small caps bull market starts (which I think could already be starting now), so how you view this share will also hinge on your overall macro/markets outlook.

The customers are sticky, there doesn’t seem to be much competition, and it’s nicely building recurring revenues. Also the moat seems good, in that financial institutions won’t commit to a supplier unless they’ve been around for a while, and the tech is proven. Once committed, they stick around, and contracts tend to grow. This share looks a good opportunity to me.

For balance, bears tend to dislike the up-front capex that BKS has to undertake with new contracts (buying servers, and cabling). Also there are too many adjustments to the figures, and I tend to put share options back in, as these are clearly recurring staff remuneration, not one-offs.

Overall, I’m keeping my GREEN view, as I think it’s a reasonably priced growth share (GARP).

The share price is back down to historic levels, despite the company having made a lot of progress and growth over this time -

Arcontech (LON:ARC)

Up 3% to 66p (£9m) - Trading Update - Paul - AMBER

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading…

Trading update for FY 6/2023 - key points are -

Revenue in line with market expectations.

Profitability ahead expectations (EBITDA by 31%, and aPBT by 49%)

Outperformance caused by one-off staff cost savings, so nothing to get excited about.

Current year FY 6/2024 expectations unchanged.

Results due out in early Sept 2023.

Paul’s opinion - move on now, nothing to see here!

I’ve looked at Arcontech several times over the years, and it seems far too small to be listed on the stock market. It cannot make sense to incur all the costs of an AIM listing, which is usually c.£300-400k pa, for a company that is only doing £2.7m revenues (at high margins though).

The worry is that Arcontech looks to be in a mature, legacy software spot, seemingly unable to generate any growth. So whilst it’s generating regular profits of £0.5m to £1.0m pa, I wonder how long that is likely to continue for, and what the end game is? It's probably also dependent on a small number of key people, what happens if they decide to leave?

Divis are good, at c.5.6% yield.

The balance sheet is unnecessarily strong, with £5.9m in net cash (although I would deduct £1.85m deferred income from that) - so most of the market cap is cash. Interesting.

One for special situations value investors I think. Although the lack of liquidity makes me wonder if it’s the type of share that you can buy, but then never get out of. There could be worse situations to be stuck in though, at least this is cheap, profitable, and cash rich.

I only looked at it because it seemed to be an out-perform update, so might have been an interesting buying opportunity, but it’s not really out-performing.

Probably priced about right, but there could be a catalyst eg if it does a tender offer?

Science (LON:SAG)

Unch 415p (£188m) - Interim Results - Paul - GREEN

Science Group is a science & technology business providing consultancy and systems to an international client base. The Group comprises five operating divisions, supported by a strong balance sheet including significant cash resources and freehold property assets.

Background - SAG is a rather unusual business, but we’ve covered it positively here in previous SCVRs -

24 Mar 2023 - GREEN - 387p - Good FY 12/2022 results. Modest valuation. Great track record. Cautious outlook. Very good balance sheet. Thumbs up!

18 May 2023 - GREEN - 400p - In line AGM TU. Good value at 12x PER. Good track record. Owner managed.

Revenue £56.1m (up 25%) - helped by acquisition of TP Group.

There are a range of profit measures as you can see below (bold is H1 this year, unbold is last year H1 comp) -

Where adjustments create quite a big uplift compared with statutory profit, I always like to carefully consider if these adjustments are valid or not for my valuation purposes.

The largest adj of £2.5m is one I’m happy with, being goodwill (or similar) amortisation - which is customary, and sensible, to adjust out.

Share-based payments I don’t think are valid adjustments, especially where it’s a recurring part of remuneration, as it clearly is here.

The other items are too small to worry about.

So my personal adj operating profit would be £10,420k - £1,102k share options = £9,318k, or 11% lower than the company’s figure.

Note the lower taxation charge this year has flattered a 3.2% increase in PBT into a 16.0% increase in PAT (which of course drives EPS), so caution is needed here, because EPS has only really gone up mainly because of a favourable tax movement.

Adj basic EPS up 14% to 16.6p (FY 12/2023 forecast is 30.8p, so that looks reasonable).

The divisional commentary shows good performance from most divisions, plus the acquisition of TPG, mopping up what looks a very sharp downturn in the Frontier Smart Tech division, which does digital radio modules, and saw revenue plunge almost two-thirds to only £5.4m, generating a “small loss”. (see my table below)

There are quite a lot of moving parts here, and it’s not simple to analyse what’s going on.

TPG looks a bit of a can of worms, needing a good sort out, which I think was already known, eg. onerous contracts, since resolved.

Freehold property is in the books at £20.7m, with the last valuation being £21-35m, which seems a very wide range, and is now historic, being from March 2021. That could have gone down a lot, in the new higher interest rate environment, so I would have preferred a more up-to-date valuation. Anyway, it’s decent asset backing.

Summary & outlook - a bit too vague, but continues the cautious theme from earlier this year -

In summary, the first half of 2023 has continued the Group's track record of resilient performance, delivering record results in line with the Board's expectations. However the Board does not underestimate the potential impact of the prolonged uncertainty in the current economic environment, both UK and international, and is maintaining its conservative attitude to risk, governance and financial discipline.

At the same time, economic downturns may present further acquisition and/or investment opportunities for Science Group. With a very strong balance sheet, including significant cash resources and undrawn debt facilities, Science Group is well placed to explore any such opportunities.

Balance sheet - companies claiming they have a strong balance sheet is like a red rag to a bull for me! I have to check, as often they’re misleading us.

Goodwill & other intangible assets have shot up at June 2023, after the big acquisition of TPG, to £52.5m (up from £25.8m at Dec 202”)

Fixed assets of £25.3m is mainly the freehold property of £20.7m, providing a nice asset.

Current assets includes a healthy cas pile of £29.2m, albeit down from £43.6m 6-months ago.

Creditors include £13.5m “borrowings”, does that include leases I wonder? No, lease liabilities are listed separately.

More information on the borrowings is provided in note 10, which seems to have locked in some cheap facilities, which are worth running to expiry I’d say -

Overall, the balance sheet has NAV of £81m, from which I’ll deduct the intangible assets of £52.5m, and the (usually related) deferred tax creditor of £4.3m.

That gives me NTAV of £32.8m, which looks a comfortable, well-financed position.

Net cash is £15.7m, which also looks comfortable, and gives scope for more acquisitions I think.

Hence SAG’s balance sheet survives my careful scrutiny!

Going concern statement - is fine, short & sweet, as I would expect for a well-financed business.

Cashflow statement - often more useful than the P&L.

This shows decent cashflow generation.

The big item is a £17.8m acquisition cost, relating to buying the remainder of TPG not already owned.

£2.25m was spend on paying divis, and £1.1m on purchasing its own shares.

Very interestingly, it funded the TPG acquisition from its own cash pile, which fell £14.6m, rather than taking on any more debt, and no dilution of equity. Very nicely done I’d say. Owner/managers do excel in protecting equity usually, which is why we normally like them, apart from when the odd one stuffs small shareholders with a cheap takeover bid, or delisting threat.

Segmental analysis - note 4 gives me the information I’ve been wanting, ie where does the profit come from? So I’ve summarised it in a spreadsheet -

As you can see, the collapse in profits within Systems (DAB radios) was more than offset by strong profit growth within Consultancy services, which includes a contribution from part of TPG. Also note the new Systems division has no prior year comps.

I really don’t know what to make of this! Sum of the parts if the obvious way to value SAG shares, but I don’t feel I have enough information to do that.

Can the “Products” division return to profitability in future?

Nearly all the profit is now coming from the Consultancy services division, so I’d want to understand more about what that business is, how it makes money, what the competition is like, etc.? Any major client risk? Any key people?

Another question is what potential does TPG have? It was a dog when listed independently, so have SAG turned it around, and what profit can we expect from it in future? Are there any remaining contract disputes or liabilities?

Paul’s opinion - all rather a lot to take in!

Broker Liberum (with thanks) has indicated 30.8p EPS for FY 12/2023, giving a PER of 13.5x which seems reasonable, especially given that we have an in line with expectations update today.

The increased profit in H1 obscures a collapse in profits within the DAB division, Frontier. That worries me a bit.

The TPG acquisition looks to be very important to group performance, and we need more information about its prospects under SAG’s new management. If they can turn it around, then there could be nice upside.

Overall then, I still like SAG, and will keep it as GREEN, but I definitely need to understand the business better, and cannot ascertain what the future potential is, either way.

This looks a remarkable chart, considering we've had an awful 2-year bear market for small caps -

Very good StockRank too.

Graham’s Section:

S4 Capital (LON:SFOR)

Share price: 111p (-20%)

Market cap: £644m

I see that Paul may have been onto something when he gave this the thumbs down in May and again in June.

The stock marched to the top of the hill during the Covid rally, and then marched all the way down again, back into small-cap territory:

S4 Capital is Sir Martin Sorrell’s new venture (since 2018), after his long association with WPP. The mission of S4 is to “build a purely digital advertising and marketing services business”.

Today’s update brings bad news:

Net revenue in the second quarter was below budget with May and June in particular, reflecting the challenging macroeconomic conditions and clients, especially those in the technology sector, remaining cautious and very focussed on the short term. We continue to see longer sales cycles, particularly for larger transformation projects.

H1 sees like-for-like net revenue growth of 5% and the company is now only targeting net revenue growth of 2-4% for the year. It was previously targeting 6-10%. So we’ve gone from a company whose revenue was maybe keeping up with inflation to a company that is now materially behind inflation.

Of course there are knock-on effects for margins and profits; the latest note from Dowgate suggests “Normalised” PBT for 2023 of £99m (previously £112.5m).

Looking further out, the Normalised PBT forecast for 2024 gets an even bigger cut, down by 19% to £129m.

These may sound like big numbers relative to the current market cap, but remember the adjustments that get applied to S4’s accounts tend to be extraordinarily large.

When it comes to explaining the 20% decline in the share price this morning, I don’t think we need to look any further than the percentage decline in the 2024 forecasts. Better growth was baked into the cake, and those hopes have now been quashed.

Net debt improved during the quarter to £115m (it was £136m at the end of Q1), but is expected to rise to £180-220m by year-end.

The company says its balance sheet is “strong with sufficient liquidity and long-dated maturities”, and says net debt can reduce again in 2024.

While that may be true, the debt position means that profit warnings such as today’s can have an outsized impact on the share price (as they introduce an elevated financial risk).

Graham’s view

It’s hard to argue against Martin Sorrell, as WPP has been an undisputed success. However, there are a couple of important points to bear in mind.

Firstly in terms of valuation: since S4 is unprofitable, the best option for now might be to look at its price to sales ratio: it's currently trading at around 0.6x. This is the same as WPP currently trades at.

Both companies carry significant levels of debt (compared to their respective market caps), and I would not be enthusiastic about investing in either of them. But it looks like they are being valued in a similar way by the market.

The key difference, of course, is that WPP is already at substantial scale and is profitable.

Also, I note that WPP’s guidance, issued in April, was for LfL revenue growth of 3-5% for the year. That’s similar to, but higher than, the guidance just issued by S4.

Therefore, I have to say that WPP strikes me as being possibly a more interesting prospect than S4. It has a very large debt pile but at least it is profitable, and it might outperform its much smaller rival in terms of LfL growth this year. And yet it is being valued similarly on a Price/Sales basis.

I’m going to give S4 the thumbs down today. That might be a little harsh, but it just doesn’t tick enough positive boxes for me. And if someone wants to invest in the advertising industry, they have a reasonable alternative in the form of WPP. But perhaps Martin Sorrell can prove the doubters wrong again?

Here is WPP’s StockRank:

And here is S4’s (as of last night):

Somero Enterprises (LON:SOM)

Share price: 346p (-3%)

Market cap: £193m ($248m)

We frequently cover this American maker of construction equipment, so let’s catch up with its latest trading update.

The most important sentence is the final one: the company is “confident” that 2023 results will be in line with expectations.

Expectations call for revenues of c. $120m (2022 revenues: $134m), EBITDA c. $36m, and year-end cash c. $32m.

These are lowered forecasts following a profit warning in June that was covered by Paul. A wide variety of issues had combined to hurt the company’s revenues: interest rates/bank lending to US construction, planning permits being delayed, and a limited supply of concrete.

The problems appear to be concentrated in North America. By contrast, Europe, Australia, Latin America and the Middle East are all up compared to H1 2022.

Somero is looking forward to a better H2 in North America:

…the Company anticipates improvement in H2 2023 trading in North America compared to H1 2023 driven by increased availability of the S-22EZ, supported by direct feedback from customers indicating healthy non-residential construction activity across a wide range of project types that translates to extended project backlogs. The Company also anticipates healthy contributions to H2 2023 trading from Europe and Australia, and H2 2023 trading comparable to H1 2023 in the Rest of World territories.

Graham’s view

There’s no reason to change your view on this stock today, as it’s merely an “in line” trading update. Although the slight reduction in the share price suggests that some people may have been hoping for more positive news?

The big picture is simple enough: everybody knows that construction activity is cyclical, and that Somero (regardless of its other high-quality characteristics) has no ability to control this cycle. US construction is currently challenged by macro forces, and so the company is going through one of its occasional rough patches.

Long-term progress still looks good:

In January 2023, at 400p, I stayed neutral on these shares, arguing that it was impossible to tell when growth would return. The company was already on a downward slope from peak profitability in 2021.

Today, the company’s financial performance is in retreat and the shares are below 350p.

Arguably we are at bargain levels already, although the same could have been said in January:

In the end, I don’t have enough conviction to give this one the thumbs up, but I do recommend it for deeper research. It’s just so tricky to form a view on trends in the construction industry! I am inclined to think that Somero’s customers in this industry will have to get used to higher rates for the foreseeable future, and that this could be an ongoing headwind.

There’s one final point I’d like to mention, before finishing up: for many years, I thought that Somero had little or no competition in the design of advanced concrete levelling equipment.

However, there is a company called Ligchine, founded in 2007, that appears to be a direct competitor. It turns out that Somero attempted to sue Ligchine in 2020 for patent infringement, but the case was dismissed in 2021 “with prejudice” (i.e. the case can’t be brought back again). Ligchine lists its own patents on its website.

So I wonder if competition might start to become a factor for Somero? It has enjoyed very high returns for many years. Perhaps it won’t be quite so easy to do that moving forward, if there are others who are trying to muscle in and get some of these profits for themselves?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.