Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections below

Mortgage Advice Bureau (Holdings) (LON:MAB1) - 564p (pre-market) - Trading update (in line currently, poor outlook) - Graham - GREEN

Mixed messages from MAB today as it says trading is “currently” in line with expectations, but there are “strengthening H2 headwinds”. Residential property has not yet seen the expected improvement in demand/activity. A frustrating delay, but I still like the stock.

Revolution Bars (LON:RBG) (Paul holds) - 5.85p pre-market (£13m) - FY 6/2023 Trading Update - Paul - AMBER

In line with market expectations. Bank debt is still worryingly high, but has come down from the March 2023 peak. Outlook "remains challenging". Peach Pubs acquisitions sounds like it's going well, with the core business struggling. Doesn't disclose proper LfLs, so I assume they're bad! But bottom line, it's trading in line with exps, which isn't bad for a tiny mkt cap. Special situation, only for risk-takers (I hold).

Nichols (LON:NICL) - 1035p (+3.5%) (£377m) - Interim Results (in line) - Graham - GREEN

Expectations are unchanged at this old beverage company, the maker of Vimto. The Out of Home segment continues to struggle but a completed strategic review should hopefully boost performance next year. As inflation cools, I think this stock can see better days.

Wilmington (LON:WIL) - Up 17% to 304p (£268m) - FY 6/2023 Trading Update - Paul - GREEN

Ahead of expectations update today for FY 6/2023. I think this looks very good - strong profit growth, and a reasonable valuation - seems a nice GARP share. Thumbs up from me.

Norcros (LON:NXR) - 167p (-2%) (£149m) - AGM Trading Statement (in line) - Graham - AMBER

This bathroom and kitchen products supplier owns well-known brands such as Triton. The stock usually looks cheap and is currently depressed. I can’t bring myself to give it the green light, preferring to look for cheap stocks with better performance and fewer complications

Motorpoint (LON:MOTR) - Up 6% to 108p (£98m) - AGM Trading Update - Paul - AMBER/GREEN

Strategy has been changed to focus on profit/cashflow and cost control, which I'm pleased to see. Motorpoint says this is working, with upbeat noises about Q1 and Q2. House broker has left forecasts unchanged, possibly laying the groundwork for an ahead of exps update later this year? I'm leaning towards being moderately positive on this, medium term.

Agenda - is huuuuge! We'll do what we can, prioritising not in line, price movers, and anything that we think looks interesting -

We've had a look (however brief), at everything!

Paul’s Section:

Not a small cap but…

Rolls-Royce Holdings (LON:RR.) - a striking 24% share price rise to 189p. Triggered by a very positive H1 trading update (materially ahead) and a big uplift in full year guidance. Might be worth readers having a look at this one?

Revolution Bars (LON:RBG) (Paul holds)

5.85p pre-market (£13m) - FY 6/2023 Trading Update - Paul - AMBER

Revolution Bars Group plc ("the Group"), a leading operator of 68 premium bars and 21 beautiful pubs, trading mainly under the Revolution, Revolución de Cuba and Peach Pubs brands, is pleased to update on the year ended 2 July 2023 ("FY23") which is anticipated to be in line with market expectations.

Sorry, I have to cover this one first, as it’s a personal holding, so I'd be looking at it anyway, hence might as well share my notes here.

The core business is late night bars. Like a lot of hospitality businesses, it got into trouble in the pandemic, and had to do 2 placings, both at 20p per share, which cleared its bank debt. Then more recently I was shocked when management maxed out the bank borrowings again, to buy Peach Pubs. This has not gone down well with the market, and the share price has been very weak since, mainly I think due to management voluntarily making the share high risk again, through a debt-fuelled acquisition, at precisely the wrong point in the cycle.

So this share is I would say a special situation, higher risk, in a horrible sector where it’s extremely difficult to make any money right now. So why get involved? Because the market cap of £13m is tiny, giving big % upside once recovery begins. Just for full disclosure, I bought these at c.6p a few months ago, as a turnaround/recovery/special situation, fully aware of the risk. I’m targeting an exit c.20p if recovery gets established, with a say 1-2 year timeframe.

The news today is quite reassuring to me, given the extremely low market cap of only £13m, although net bank debt still looks too high, at just over 3x EBITDA (old basis, IAS 17, which is the only basis that makes any sense!) -

With a positive contribution from Peach Pubs, and notwithstanding the challenging trading conditions for our late-night bars, we are pleased to be able to confirm FY23 EBITDA (IAS 17) is expected to be in line with market expectations of £6.6m. The Group had net bank debt of £20.8m as at 25 July 2023…FY23 has been very challenging, however we have controlled costs and limited capex in the second half to reduce net debt.

EDIT: Note that £6.6m EBITDA turns into a forecast loss before tax of £(2.7)m, due to large depreciation charges on the multiple sites.

Bank debt - that’s strange, as 6 months earlier, at Dec 2022, net bank debt was disclosed as £18.5m, so it seems to have gone up to £20.8m, not down! However, there is a disclosure in the interim results that net debt was £23.1m at 6 March 2023, so the latest figure of £20.8m at 25 July 2023 has indeed come down usefully from that earlier peak.However, single day snapshots can be very unreliable, because it all depends on when supplier payment runs, VAT payments, and payroll are run. Whereas money coming in would be on a daily basis, from the card processing merchants (hardly any cash or cheques these days, I think they’ve gone cashless in my local Revs, which I mystery shop regularly).

The interim results disclosed a facility of £27m [EDIT: Finncap note today says the bank facility is £30m] , so it’s still utilising the bulk of the facility, which makes me nervous. The fact that capex is being restricted is clear evidence that management knows borrowings are stretched.

Overall though, I think today’s update has reduced my worries about the bank debt from high, to medium-high. It’s coming down from the peak in March, but I’d like to know more about the covenants (which we were told were relaxed, in the interim statement).

As it’s not doing any more new sites, or refurbs at the moment, then it should generate positive cashflow.

Outlook -

We expect the trading conditions we operate in to remain challenging for FY24 and look forward to the all-important peak trading period at Christmas which we hope will be the first uninterrupted peak period since 2019.

The commentary seems to suggest that Revs’ generally younger customers have somehow been hurt the most by the cost of living squeeze, whereas I would have thought largely the opposite! They’ve benefited from c.10% minimum wage increases recently, and generally don’t have to worry about mortgages.

LfL sales - we need LfL figures vs last year, which I assume must be bad, as they’re not provided! Instead we’re given a comparison with pre-covid, which is not useful any more, as that’s c.4 years ago, during which time many costs (esp. food/drink & wages have increased greatly). Anyway, these pre-covid LfL sales comparisons are -

Peach Pubs +14%

Overall group -8.7%

Nicely dodging disclosing the Revs figures I see! So what might those be, worse than -10%, maybe nearer -15%? That’s pretty awful.

Still bottom line, is that it’s overall traded in line with expectations, so the forecasts must have been anticipating soft trading.

Paul’s opinion - obviously a tough sector at the moment. In line with expectations is good enough for me, and with net debt high, but reduced from the March high, I’m less worried than I was.

Not for widows & orphans this one, but if it can continue reducing bank debt, with trading not getting any worse, then the shares should recover.

Downside risk is if the bank panics again, and demands another placing.

Some of the larger pubs groups have had big rebounds, and I think there’s a decent chance this might too. As I say, very much a special situation, not a regular investment.

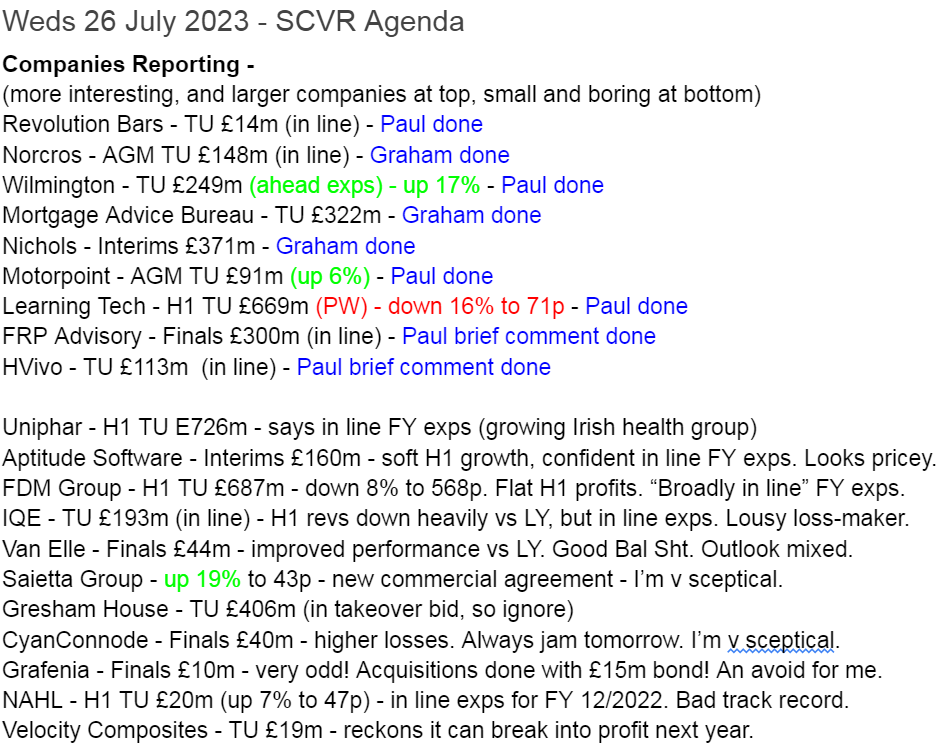

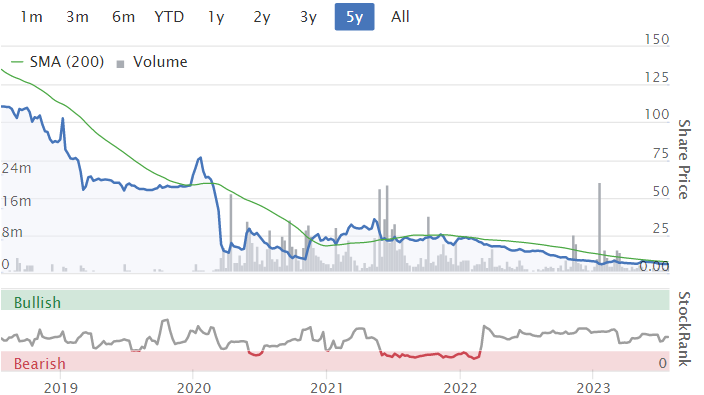

Note from 5-year chart below, the shareholder value destruction from increasing share count from 57m to 230m, via two placings at 20p. So the price will never get back to previous highs probably, so no point in drawing lines on any chart where there's been heavy dilution. Still, we can buy now at 6p, clearly a better price than the emergency bailouts, with the business stabilised post-covid now too.

Wilmington (LON:WIL)

Up 17% to 304p (£268m) - FY 6/2023 Trading Update - Paul - GREEN

Wilmington plc, (LSE: WIL, 'Wilmington', 'the Group') the provider of data, information, education and training in the global Governance, Risk and Compliance ('GRC') markets, today provides a trading update for the year ended 30 June 2023.

We’re overdue a catch up with this share, having not reviewed it yet in 2023.

I last (briefly) looked at Wilmington here in July 2022, liking its ahead of expectations update, cash pile (previous debt cleared), and an attractive valuation (at 272p/share), giving it a thumbs up at the time.

In the last year, the share price steadily rose from 272p, peaking at about 350p in Feb 2023, before falling all the way back down again by yesterday. Today’s sharp 17% rise has caught my eye.

Trading Update today - FY 6/2023.

This is good, ahead of expectations -

Adjusted* profit before tax (unaudited) from continuing operations is expected to be £24.1m, up 30% on last year.

Adjusted profit before tax (unaudited) is likely to be ahead of expectations at £24.3m* (2022: £20.7m), up some 18%.

*Adjusted profit before tax (PBT) is calculated as PBT after adding back amortisation of intangible assets except computer software and profits/losses on disposals and business closures. Market consensus Adjusted profit before tax is £22.8m.

Isn’t it great when companies report precisely like this? This is the gold standard of reporting, that all companies should do - tell us what profit is going to be, and tell us what market expectations are, rather than leaking the information to brokers with restricted distribution - which I've always thought is questionable legally, as it breaks the principle of all shareholders being told the same information simultaneously.

I’m not sure what the £0.2m discrepancy above is, maybe discontinued operations? It’s not significant though, so let’s move on.

Net cash - is strikingly higher, both on 6m and 12m view - although we need to see the full accounts to ascertain if there have been any other balance sheet movements which might have helped flatter this figure. This is significant, with £42.2m net cash being c.16% of the market cap -

Cash conversion continued to be strong with Group net cash on 30 June 2023 at £42.2m (31 December 2022: £22.9m; 30 June 2022: £20.5m).

CEO comments read very positively -

Mark Milner, Chief Executive Officer, commented:

"We continue to execute our strategy which has resulted in another year of strong organic revenue and profit growth - our revenues were up by 9% and profits were up by 30%. We have also continued to see good growth in our recurring revenues and strong cash conversion of profits.

"Over the last two years, the business has seen a solid growth in its international scale and reach which has resulted in our profits growing in each quarter."

It will be interesting to see the full accounts, so we can see whether the 30% profit growth has come from operational gearing, margin improvement, or cost-cutting? Or a mixture of those perhaps?

Paul’s opinion - I’ve commented before on Wilmington’s erratic prior year performance, and I would have expected this type of business to suffer badly in the pandemic.

Performance now seems dramatically better than even pre-pandemic, so it looks as if there must have been a turnaround (was management changed maybe?) to deliver much stronger profitability from fairly static revenues over the period in the graphs below -

With revenues now growing, and margins high, this looks an interesting situation, and still priced reasonably I’d say (as of last night) - note the high quality measures, and a very reasonable PER of 12.0, for a company that is also cash rich. Although note that the last balance sheet only had negligible NTAV of c.£2m. The cash pile comes from advance customer payments.

There’s a helpful forecast divi yield of 3.7% - maybe not that exciting now with inflation at c.8%, but once inflation is down below 5% probably in early 2024, then yields on shares would be looking more attractive again, especially as they have built-in inflation protection, and should rise over time, all being well.

Overall - this looks an interesting, high margin niche business. I like the numbers a lot here, at a reasonable valuation. Thumbs up from me, on an initial review - as always the detailed research work needs to be done by you.

Bear in mind today’s 17% share price rise is based on a c.7% out-performance in profits vs expectations. So maybe it needs to pause for breath, or retrace a little in the very short term?

Stockopedia likes it too, and I imagine the value and momentum scores might rise once higher forecasts, and share price bounce, feed through in the coming days?

Motorpoint (LON:MOTR)

Up 6% to 108p (£98m) - AGM Trading Update - Paul - AMBER/GREEN

Motorpoint Group PLC, the UK's leading independent omnichannel used vehicle retailer…

To clarify, Motorpoint sells nearly new cars from large out of town sites, car supermarkets. Also selling online.

This share is in our “potentially interesting” tray, in terms of the business model, but the previous strategy was a dash for growth, at the expense of profitability.

To set the scene, here are our previous comments on MOTR shares this year -

27 Jan 2023 - AMBER - 144p - Profit warning, only breakeven. Shares didn’t move, strangely.

6 Apr 2023 - AMBER - 131p - (Roland) - record sales, but only breakeven.

14 Jun 2023 - AMBER - 120p - Breakeven FY 3/2023 results on £1.44bn revenues. Potentially interesting if margins can be increased.

Shares recently touched 100p, but are up to 108p at the time of writing (11:47).

Is it cheap enough for us to push from amber to green? Let’s see.

Today’s update covers Q1 (Apr-Jun 2023) of FY 3/2024.

Difficult macroeconomic conditions continued into Q1.

Short term focus on higher margins, and reduced overheads, to improve profit/cashflow.

Looks like this is working -

Trading performance improved throughout Q1 and we expect this trend to continue in Q2 reflecting further improvements in margin and cost base reductions.

Liquidity - negligible net cash of £2.2m at end June 2023. Also has £35m facility headroom.

Balance sheet - not mentioned today, but I’ve looked back and see the last balance sheet at March 2023 is very light compared with the franchised dealer groups, which tend to own loads of freehold property, so have tremendous asset backing.

MOTR doesn’t, and NTAV is only about £35m. Something to bear in mind, when weighing up risk:reward.

Outlook -

As previously communicated, the impacts of high inflation, rising interest rates, and consumer uncertainty continue to affect demand for used cars. However, like others in the industry, we are encouraged by the growing number of vehicle supply options which, coupled with our increased use of data to determine optimum selling prices, has resulted in an improvement in retail margin. This will, in part, be tempered by lower finance commission as consumer uptake for finance reduces due to increased APR rates.

The Group has also focused on the costs of the business to ensure they are aligned with current market activity and, utilising the investment in technology to date, we are able to maintain a lower headcount as we conserve cash and return to profitability, whilst ensuring we are ready to invest for growth as more favourable market conditions return.

The Group continues to be confident it will emerge in a normalised market as a leaner and more valuable business ready to seize a significant opportunity.

Broker update - Shore Capital is house broker, and thanks for their update note today. I’m a bit surprised they’ve left forecasts unchanged, for a £(3.0)m loss before tax for FY 3/2024. That seems rather pessimistic, given that the company has just told us that trading is improving, and it's moving back into profit. Maybe they want to keep expectations grounded, in case macro worsens? If I were to invest here, I’d be expecting something like £3-6m PBT for FY 3/2024 - so chance of a beat in future maybe? Or at least room for some slippage.

Paul’s opinion - I’m glad MOTR has reined in its aggressive growth strategy, which saw profits disappear to breakeven. I suspect they might have been urged to do the rapid growth by an influx of American shareholders. The recent focus on improving margins, and curbing costs, I think better reflects current market conditions, and I’m sure shareholders wouldn’t want to be diluted with an equity raise at the current c.£100m market cap.

With new car supply now starting to improve (but other dealers have said they expect constraints on used cars to continue for c.2-3 years), MOTR could find it tough to eke out even a small profit for now.

Longer term, I think the car supermarket + online strategy is excellent, and could well be a winner, especially as the online-only proliferation of VC-funded competition run out of money and disappear one by one, which I expect to see happen.

Since trading is now improving, above breakeven, I’ll ease the boat out a little, so will move from amber to AMBER/GREEN - moderately positive, and reflecting that there’s nothing in the short-term to get excited about, but medium to longer term, this share could have promise.

If it manages to make a 1-2% profit margin on £2bn future sales, you can do the maths! Shares would then justify a price maybe 3-5x the current price. Although to actually get there, won’t be easy, with so much competition in the sector.

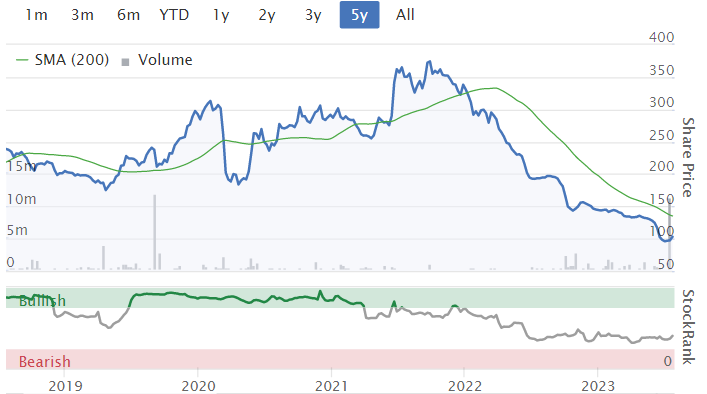

This 5-year chart below reflects that, so far, the original business model hasn't really worked. But it also gives an idea of the upside potential in an economic and stock market recovery maybe, once people start anticipating future growth. Note there hasn't been dilution, with the share count actually falling due to buybacks - so the bull case as mentioned above, is an eventual possible return to 300-500p if everything goes well. It might not of course, we don't know.

Quick Comments

Frp Advisory (LON:FRP)

Down 1% to 120p (£299m) - FY 4/2023 Results - Paul - AMBER

Mid-market insolvency practitioners. Results show a small improvement in adj profitability, to 7.83 adj EPS - PER of 15.3x - looks about right to me. Outlook - in line with expectations so far, and upbeat given favourable macro conditions for insolvency firms.

Paul’s opinion - FRP, and Begbies Traynor (LON:BEG) might be a nice safe place to park some money, if you think the economy is really going to tank.

hVIVO (LON:HVO)

Up 4% to 16.6p (£113m) - Trading Update - Paul - AMBER/GREEN

hVIVO plc (AIM & Euronext: HVO), the world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces a trading update for the six-month period ended 30 June 2023.

This looks pretty interesting, although only in line with expectations -

Paul’s opinion - short of time today to go into any more detail, but I just wanted to flag this to readers. I’ve looked at it in more depth before (see our archive), and think it’s a very interesting story. Putting me off a little, is the CEO seems too promotional in webinars, which I’m wary of.

For more detail on the numbers, see Liberum’s helpful update note today.

I can’t make up my mind whether to be green (as on 25 Jan 2023, and 6 Feb), or amber (per 10 May SCVR). Let’s split the difference, and go AMBER/GREEN.

Learning Technologies (LON:LTG)

Down 20% to 67.7p (£535m) - H1 Trading Update (profit warning) - Paul - AMBER

LTG, the leading provider of services and technologies for digital learning and talent management, announces a trading update for the six months to 30 June 2023.

LTG has previously warned of slower growth this year, hence the share price falling.

Today it guides H1 revenue will only be up 2% vs H1 LY, and flat on a LfL basis.

H1 adj operating profit (EBIT) £43m+, flat vs LY £43.5m.

Revised full year guidance (FY 12/2023) -

In light of the first half performance, for the full year ending 31 December 2023 we now expect Group revenues in the range of £550 million to £570 million and adjusted EBIT in the range of £98 million to £103 million (based on an average GBP:USD rate of 1.28 for H2 2023).

Looking back at FY 12/2022 accounts, a similar adj EBIT of £100.9m became only £40.5m statutory PBT, but most of the adjs look valid, being acquisition-related. Not the simplest of accounts to make sense of though.

LTG’s balance sheet is not good, with negative NTAV, and a fair bit of debt, which of course is more expensive now, so adj EBIT ignores finance charges, hence isn’t a good profit measure.

Balance sheet - is weak, but management falsely claim again today that it is strong. In the same sentence they then emphasise de-gearing, to net debt of £108.4m, which of course contradicts itself! The truth as I see it, is that a negative NTAV, with over £100m in debt, is clearly weak. However, the business remains sufficiently profitable to be able to cope, providing things don’t get any worse. So I’m not alarmed by the debt at this stage.

Paul’s opinion - looking at our archive, we were amber on 26 April 2023, and amber/green on 12 June, thinking the drop in share price to 99p meant the shares looked potentially interesting. Another lurch down 20% today to 68p, on what seems a fairly mild profit warning (understandable given macro conditions) could be lining up a possible buying opportunity, if you like the company and what it does. Investors can’t expect companies like this to just keep growing, regardless of macro. There are bound to be customers retrenching in some sectors. So I remain of the view that LTG might be potentially interesting to research further.

All the way back down to 2018 price. Did it expand & acquire too aggressively?

Graham’s Section:

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 564p (pre-market)

Market cap: £322m

Trading is in line with expectations at the Mortgage Advice Bureau, and yet this is a gloomy update as far as the H2 outlook is concerned. This is how the company puts it:

Despite the strengthening H2 headwinds, trading is currently in line with market expectations and the Group is well positioned to deliver further growth as the market recovers.

Let’s take a step back and see how the company did in H1:

Organic revenue growth +1%.

Total revenue +21% to £116m.

The number of advisers working at MAB’s franchisees fell slightly (4%), but they individually delivered more revenue (5%), adding up to that 1% organic revenue growth. That’s in line with expectations and surely a decent result in the circumstances? The company provides this table showing the sharp fall in new mortgage lending in early 2023:

MAB estimates that its market share of new mortgage lending rose to 8% in the first five months of 2023 (from 6.8% in H1 of last year).

Outlook

The H1 picture is clear enough: MAB grew market share in a declining market and met its expectations.

Unfortunately, the outlook for H2 appears to have deteriorated. The company had previously guided that H2 would see an improvement in performance:

The new mortgage approvals reported in Q2 2023 suggested that activity levels had started to improve. However, market conditions are now likely to toughen further in H2 2023, driven by a continued rise in interest rates and fewer consumers opting to purchase or move home at a time when mortgage rates are at or close to peak levels in this current interest rate cycle. However, we expect re-financing will continue to perform strongly

MAB now says “it is too early to anticipate” when demand and activity will strengthen again.

CEO comment excerpt:

…we find ourselves in an environment of continuing interest rate rises, reduced affordability, and cost of living increases, all of which are naturally impacting consumer confidence. Despite strong underlying demand for property, some buying decisions are understandably being delayed by our customers until we have a more stable economic and interest rate environment.

"Despite the additional market pressure, I am delighted with how MAB is performing and how our market share continues to grow. Re-mortgages and increasing numbers of product transfers currently represent around 60% of our written transaction volumes.

Graham’s view

I’ve had a consistently positive view on this company and I’m inclined to keep that today. There is no organic growth from it currently but it does appear to be outperforming the wider market. The acquisitions will hopefully boost the results too, e.g. Fluent Money (acquired last year) was expected to be “significantly earnings enhancing” in 2023.

I view this as a quality stock in a cyclical market, so I think it’s interesting around these levels.

Nichols (LON:NICL)

Share price: 1035p (+3.5%)

Market cap: £377m

This is an old beverage company that has struggled with profit margins in recent years. I’ve been positive on it, thinking that a recovery in margins should occur sooner or later.

Today’s H1 results show the gross margin falling to 41.1%, but at the same time the adjusted pre-tax profit margin improves slightly to 14.4%. So it’s not all bad news on that front, but there’s still hopefully going to be margin improvement in the company’s future.

Inflation is mentioned nine times in today’s report: the company says that the underlying cost of goods inflation is around 16%. Of course the effect of that on margins is going to be tremendous - I think that Nichols has done well in the circumstances.

Revenues rose 6.6% to £85.5m. The company says it has a “value over volume” strategy, so volumes are presumably falling, although this is not disclosed.

The company remains cash-rich, sitting on £56m.

Expectations for 2023 are unchanged. The consensus adjusted PBT figure for the year is £25.2m.

The CEO updates on some improvements to strategy:

The Group achieved significant strategic progress during the period, particularly in relation to our Out of Home business where we are making positive changes to simplify operations and focus on the areas of greatest opportunity and profitability. We are on-track to deliver the material benefits of these changes from FY 2024…

About three quarters of revenues are from the “Packaged” segment, with the rest being “Out of Home” (OoH).

As you’ll note from the CEO’s comments above, OoH has been the focus of much strategic thinking. The following disclosure of profits in each segment, which the company has never published before, helps to show why OoH has been focused on. It isn’t nearly as profitable as it should be:

Graham’s view

It’s possible that I was too optimistic on a quick recovery in margins at Nichols, but at the end of the day these results are in line with expectations. In my view, the company is still recovering from the incredible shock brought by Covid, but it is getting there:

Inflation is the key driver that is beyond the company’s control. It both disrupts profit margins and affects demand.

While we wait for things to normalise, I’m going to keep my positive stance. I still think of this one as a family business (there are two Nichols on the Board) and as a high-class investment.

Norcros (LON:NXR)

Share price: 167p (-2%)

Market cap: £149m

Norcros plc ("Norcros" or the "Group"), a market leading supplier of high quality and innovative bathroom and kitchen products, issues the following trading update covering the 13 week trading period to 2 July 2023

Full-year expectations are unchanged at Norcros. Performance in Q1 (April/May/June) is described as “resilient”.

However, like-for-like revenues are down:

Group LfL revenue down 4.2% “compared to the strong prior year comparator”.

UK LfL revenue “broadly in line with the previous year despite the tougher demand environment”.

South Africa LfL revenue down 10.9%, impacted by electricity supply interruptions.

CEO comment

We remain confident that our market leading brands, diverse channels and end markets, and excellent customer service proposition will continue to deliver market share gains for the year ending 31 March 2024

Graham’s view

I’m going to agree with Roland’s neutral stance from June.

Arguably it is too cheap, but the well-worn issues with the stock seem destined to keep it so. The dividend yield is interesting but in a high interest rate environment I think it’s reasonable to expect some sweeteners to go with a 6% dividend yield. Norcros has net debt (£50m as of March 2023), falling like-for-like revenues in a high-inflation economy, and a complicated pension scheme requiring a few million pounds of deficit repair contributions every year.

So unfortunately, this stock doesn’t offer enough to get the thumbs up from me, despite a mid-single digit P/E ratio.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.