Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Rather a lot of gaps today, so Graham has offered to help me do some catch-up items tomorrow.

Do add your own views on announcements in the reader comments, we like it when subscribers do that! :-) Especially when you spot something interesting (e.g. a big contract win, or trading ahead of expectations) -

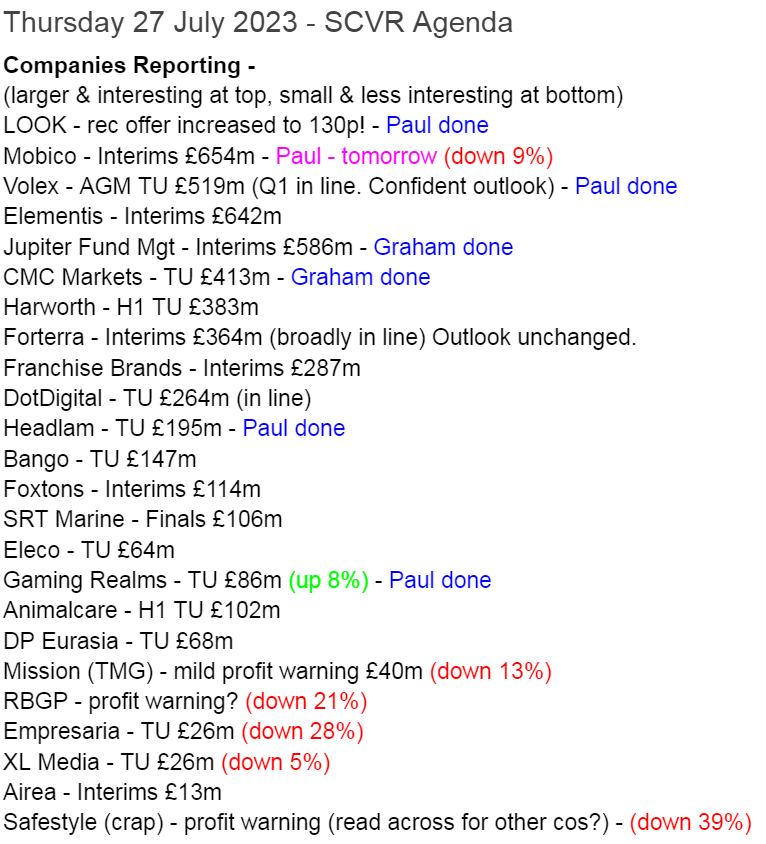

Summaries of main sections below

Jupiter Fund Management (LON:JUP) - up 16% to 125.6p - Interim Report - Graham - GREEN

The market is pleased by these numbers: profits are up as bonuses and other costs are down. The fund range has been rationalised. Everything seems to be going according to plan for the new CEO and I continue to believe that the shares have been unduly depressed.

CMC Markets (LON:CMCX) - down 1% to 146.6p - Trading Statement - Graham - GREEN

Trading activity by CMC’s customers remains weak, and that’s no big surprise. The company’s plans are unchanged and it continues to target 30% growth in net operating income by 2025 (vs. 2022). I believe this sector offers great value (disclosure: long IGG).

Lookers (LON:LOOK) - recommended bid increased to 130p

Headlam (LON:HEAD) - 239p (pre-market) £193m - Trading Update (profit warning) - Paul - AMBER

Profit warning initially slammed the share price, but recovered to -10% - rather encouraging I think, as it seems some investors had already anticipated a slowdown due to tough macro. Bulletproof balance sheet. Could be a nice recovery share medium term I think.

Volex (LON:VLX) (Paul holds) - Up 2% to 293p (£529m) - Trading Update (AGM) - Paul - GREEN

A reassuring update from this wiring products group. Trading in line, and confident outlook. Looks excellent value to me, hence why I hold some personally.

Gaming Realms (LON:GMR) Up 7% to 31.7p (£93m) - Trading Update - Paul - GREEN

My previous scepticism is removed now, by strong performance, and a valuation that can be justified. Worth you having a closer look at this one - I've only done a quick review due to time constraints, as always here.

Paul’s Section:

Lookers (LON:LOOK)

Good news here for holders - Global Auto Holdings has just announced an increased cash offer of 130p (and recommended by Lookers Board, it says). Previously it had offered 120p, but the deal looked to be falling through, as institutions were selling in the market, and major shareholder Cinch pulled its support for the 120p deal. Shares had dropped down to 98p by yesterday, and it was starting to look interesting as a possible buy back in situation, which has now been scuppered by the higher bid - it's likely to gap up to something like 128p on the opening bell (writing this at 07:35).

For technical nerds, it’s also been switched to a “Takeover Offer” instead of the previous scheme or arrangement.

It only has 11.2% support for the deal so far, so it will be interesting to see if 130p is enough to tempt existing holders to back it.

I banked the profits at about 119p on my imaginary holding in my 2023 top watchlist, as a bird in the hand and all that, especially in uncertain times. It’s not a binary decision anyway, we can sell none, some, or all of our shares in a company when a takeover bid is announced. A nice dilemma to have (providing there’s a good premium on offer).

Headlam (LON:HEAD)

239p (pre-market) £193m - Trading Update (profit warning) - Paul - AMBER

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, is providing a Pre-Close Trading Update in respect of the first six months of the year to 30 June 2023 (the 'Period') ahead of announcing interim results on 5 September 2023.

H1 revenue £332m (up 2.5% on H1 LY)

Recent trading soft, especially residential (volumes down 20%, partially offset by price rises).

Inflation hitting profits, especially wages & energy, £5m headwind.

Profit warning -

…taking a prudent view, it is now anticipated that the Company's underlying profit before tax for the year will be significantly below current market expectations**

**Company-compiled consensus market expectations for revenue and underlying profit before tax, on a mean basis, are available on the Company's website at www.headlam.com

Revised guidance -

Underlying profit before tax in H1 2023 was therefore lower at £6 million (H1 2022: £17 million), which also reflects strategic related investment to support future growth. Strategic investment is expected to total £6 million for the year, of which over half is in relation to the trade counter roll-out to support its growth to a £200 million business unit.

Outlook/Dividends - rather convoluted wording here. I think they’re trying to say that divis will be maintained, hence cover is reduced?

While current trading is challenging, the Company's strategy and investment in the business gives the Board confidence for the future, with increasing contributions from both strategic and efficiency actions. As a result, and supported by its strong balance sheet, the Company intends to temporarily lower its dividend cover in respect of the ordinary dividend payment for FY23 to that of pre COVID levels.

It’s not at all clear what that means. Badly worded.

The Company is well positioned despite the market backdrop, with ongoing expansion of its market leading position, broadening of its market presence, increased revenue streams, and ongoing efficiencies. All of which will support future financial performance, particularly as volumes return.

Paul’s opinion - a key problem with HEAD is that they don’t get any broker research out for private investors to see. So at this stage, I don’t know what the revised EPS forecast would be. With H1 uPBT now down almost two-thirds on last year, simply extrapolating that out suggests to me that last year’s FY EPS of 41.1p might turn into something like 13p this year possibly? That compares with current consensus of 28.4p, so this looks a big profit warning unfortunately.

Expect a harsh drop in share price, maybe 20-30% today, at a guess? (written just before the opening bell). But remember HEAD has very solid asset backing, with loads of freehold, so you have plenty of downside protection here, hence no reason to panic in my view.

EDIT: good to see buyers come in, after the initial plunge. only down about 10% now at 214p (at 09:58) - that seems quite encouraging to me, although only 210k shares printed as traded so far. We have no idea what's going on in the background (larger buy/sell orders being worked, which don't get printed until later). So we can't draw conclusions from short term price movements, but I think it does at least show that very few small shareholders are panic selling on this profit warning. That seems quite encouraging. It's only slightly above the pandemic lows now, which seems a bit overly pessimistic. The share count has dropped too, due to buybacks. Price is also below NTAV. So lots to like here, for patient investors only, looking beyond the current downturn. I do worry somewhat about the emerging competitive threat from Likewise (LON:LIKE) though, which is probably the main factor (alongside macro worries) which makes me hesitate in buying any HEAD for now.

Volex (LON:VLX) (Paul holds)

Up 2% to 293p (£529m) - Trading Update (AGM) - Paul - GREEN

Volex plc (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, is pleased to report a trading update for the three months ended 30 June 2023, ahead of the Company's annual general meeting, being held at 4:00pm BST today.

Interestingly, the AGM is being broadcast live I think, on InvestorMeetCompany at 4pm today. I’m not sure if they’re going to do a presentation too, or just the formal AGM business?

Volex has been pleasing shareholders with positive trading updates this year. Also a recent placing to part-fund another chunky acquisition was well supported, at no significant discount, for what looks another excellent deal. I’m very positive about the performance, prospects, and modest valuation for Volex shares, and it’s been my podcast mystery share twice this year. I also picked up a few personally a while back, and am happy to continue holding.

Today it reassures again (good, in such tough macro conditions in my view) -

Trading continues to perform in line with management expectations and the Company is pleased to report a continuation of the positive trading momentum experienced in the prior year, with year-on-year constant currency organic growth of 6.5% recorded in the first quarter of the 2024 financial year. ..

Overall, trading for the first quarter is in line with the Board's expectations, and coupled with the encouraging trends in the first quarter, gives the Board confidence that the business will continue to make further progress in the year.

Other points -

- Margins holding up

- “Healthy” customer demand

- Supply chain improving, and some customers normalising inventories

- New customer project wins, incl next generation data centres hi-speed cables - AI driving growth, and electric vehicles.

- Latest acquisition (Murat Ticaret) expected to complete in 2-3 months.

Paul’s opinion - good in tough circumstances. Volex has established a very good track record under the latest management team. It seems to be adept at bolting on cheap, but good businesses that complement its existing business, getting some synergies, and broadening markets & products. Often these seem to be retirement sales, where cultural fit, and sensitivity towards the vendor & staff, can be just as important as price, which is what Nat Rothschild was saying in the last (very bullish for him) webinar.

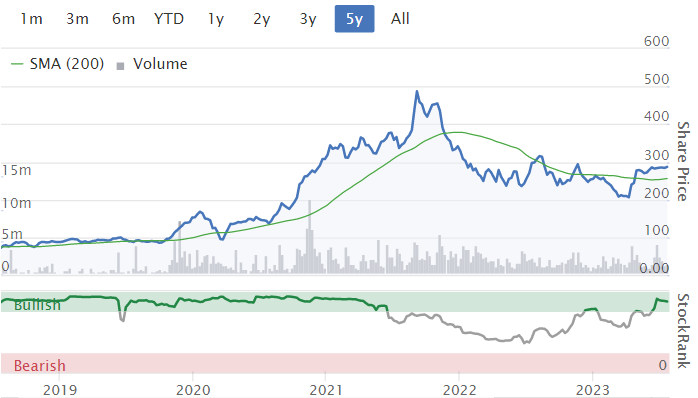

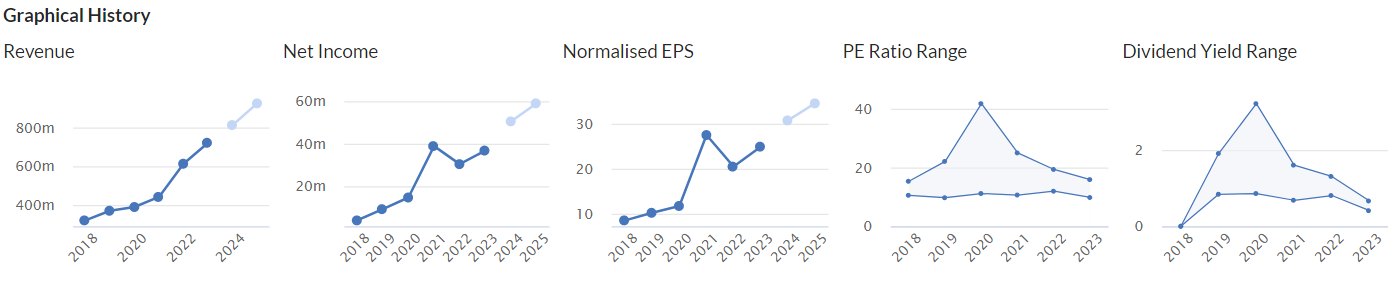

Once the next bull market in UK small caps starts, and I think we may be arguably at or near that point, then I could see a double benefit for Volex shareholders - a re-rating from its current PER of 11.6x, to something more like 15-20x, combined with growing earnings both organic and acquisitive growth.

This looks a perfect type of situation I want to be invested in actually, taking a multi-year view.

What’s the downside risk? As with anything, just something unforeseen going wrong. In the absence of that, I imagine Volex shares shouldn’t have too much trouble pushing up from c.300p to 400p+ in the not-too-distant future, as the fundamentals justify that already, I reckon.

Stockopedia agrees, with a StockRank of 87.

If any readers disagree, then I’d love to hear from you, to see if there’s anything I’ve missed that concerns other investors. We want courteous bull-bear debate here, it’s not an echo chamber, so post away freely, whatever your views :-)

A nice looking chart too -

Note that the share count has roughly doubled over this period, to part-fund acquisitions. However, as the graphs below show, EPS has risen strongly, therefore the acquisitions have added shareholder value. Some dilution can be good, if it's to fund great acquisitions or investment that adds more value than it dilutes -

Gaming Realms (LON:GMR)

Up 7% to 31.7p (£93m) - Trading Update - Paul - GREEN

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile-focused gaming content, announces a pre-close trading update for the half year to 30 June 2023 ("H1'23" or "the Period").

The market has reacted positively to this update, shares up 7%.

This sounds good, although as with so many companies, it’s a pity they only report the sometimes unreliable EBITDA as a profit measure -

The Company is pleased to confirm that it expects to report H1'23 revenue of c.£11.4 million and adjusted EBITDA* of c.£4.6 million, up 34% and 32% respectively, year-on-year. This strong performance was driven by the continued growth of the Group's licensing business, which consolidated its market share by going live with 25 new partners and launching 5 new Slingo games.

Good year-on-year growth there in both revenues & EBITDA.

Forecasts - many thanks to Canaccord, whose analyst Mark Photiades has crunched the numbers - making no changes to existing forecasts, but pointing out the positive update today leaves forecasts “well underpinned”, which I interpret as meaning that the risk of a profit warning is probably low.

FY 12/2023 forecast is for £10.1m EBITDA, so with £4.6m in the bag for H1, that leaves £5.5m for H2 - seems reasonable considering the good growth momentum, and new product deals mentioned today (as an aside, I like the sound of Tetris licensing, as that’s the only computer game I’ve really enjoyed playing in my adult life).

Indeed the company confirms full year expectations -

This strong momentum in the Period gives the Board confidence that the Company is on track to meet its full-year targets.

What about proper profitability? Canaccord’s £10.1m EBITDA forecast for FY 12/2023 turns into £5.9m adj PBT, and 1.6p adj EPS - a PER of 19.8x - not particularly demanding, given the strong organic growth (assuming that continues).

The PER drops to 13.8x on FY 12/2024 forecasts.

Paul’s opinion - this is preliminary view, just on a quick look today, I need to do more research. It looks like 2022 was a breakthrough year, in which meaningful and genuine profitability was reached. That trend is clearly continuing in 2023. I’ve only properly spotted that today, as previously I’ve been quite sceptical about GMR, so haven’t prioritised it as one to look at, although we did flag good growth and a confident outlook here on 1 Feb 2023.

Belatedly, I’ve today had a look at the FY 12/2022 results, which look fine to me. Balance sheet is OK, so I don’t see a need for any fundraise. Also the profit looks real, being stated after amortising a similar amount to what it capitalised in development spend.

Is it worth £92m though? I think that reflects strong performance, but could end up looking cheap in a couple of years, if the growth continues.

The key Slingo product seems to have been widely licensed by online casinos, internationally, so it’s obviously popular with gamblers. I’d like to better understand how much of licensing revenue is recurring, and how much one-offs? Management seemed very unclear about that on a webinar a couple of years ago.

I’ll go GREEN on this, with the caveat that more research is needed, but on an initial review of the numbers & outlook, I like what I see.

Graham’s Section:

Jupiter Fund Management (LON:JUP)

Share price: 125.6p (+16%)

Market cap: £688m

I’ve been positive on this fund manager since October last year. The share price has been volatile since then, rising by nearly 70% before giving back most of those gains:

Today we have interim results. For starters, the key points are:

AUM finished the period up 2% at £51.4 billion, although average AUM declined.

Net revenue fell by 11% to £181m.

Staff compensation (excluding performance fees) increased to 41% of net revenues - “to ensure we attract and retain key talent and build scale across the business”.

Nothing too exciting in any of those bullet points, but now let’s look at the performance fees earned (from customers) and paid (to fund managers) by the company.

Last year, in H1 2022, the company earned only £0.7m of performance fees from customers, but it paid out nearly £25m in performance fee-related bonuses to fund managers. This is because performance fees are paid out on a delay. Those bonuses will have been earned in prior years, but would typically be contingent on the fund manager remaining at the company and various other conditions.

In the latest period, H1 2023, performance fees earned from customers have again been very low: only £0.4m. However, the good news for shareholders is that the entitlement of fund managers to get paid performance fee-related bonuses also collapsed during this period. These bonuses only amounted to £3.5m during H1!

In other words, Jupiter saved over £20m by having to pay much smaller bonuses this year compared to last year.

Additionally, the new CEO - who promised to rationalise the range of funds and costs - says that they have “identified higher than expected cost savings” from that programme.

We have also continued to remove undue complexity from within our business, following the restructuring of our operating model last year. The fund rationalisation programme is now mostly complete and, because of the focus on the tail of sub-scale funds, the resulting attrition rate remains low at 0.7% of Group AUM. We remain focused on cost control with further savings identified and implemented.

Lower average AUM also means slightly lower overheads, and the end result is that total administrative expenses fell by nearly £30m in H1, falling at a much faster rate than the fall in net revenues.

Thanks to that fall in expenses, pre-tax profits have risen by an impressive 85% to £34.8m.

Flows - there were small positive net flows in H1, as institutional customers put in slightly more money than retail investors took out.

Flows have been poor at Jupiter at a long time, but the company points out that it also had positive net flows in H2 2022. This means it has just experienced the first 12-month period of net inflows since 2017!

Outlook from the CEO highlights the success of the past 6-12 months:

In what has been an uncertain and volatile backdrop, it has been a good start to the year. Our financial performance has been robust and we have made pleasing progress against each of our strategic objectives.

We have generated net positive flows over both six and 12 month periods and are cautiously optimistic that a well-diversified pipeline will continue to deliver further AUM gains in future periods.

Our capital base is strong and we will look for opportunities to further develop our business, both organically and inorganically. The short-term outlook remains uncertain, but we are well-positioned for growth over the medium term and confident that our strategy is the right one.

Graham’s view

I am already fully invested, having bought into Hargreaves Lansdown (LON:HL.) in recent months, but I need to look under the couch cushions to see if I have any spare change with which I might buy a few Jupiter shares. It doesn’t have the quality that I typically look for, and I wouldn’t make it a core holding, but it does have enough profitability and cheapness to keep me interested.

The stock has never been more unfashionable than it is today. But I don’t believe that active funds are destined for extinction at the hands of passives, and I don’t believe that sentiment around UK funds can get any lower than it is right now. The new CEO at Jupiter is doing what he said he would do, and I’m a believer.

CMC Markets (LON:CMCX)

Share price: 146.6p (-1%)

Market cap: £410m

It’s a Q1 update (April-June) from this spread betting/forex trading provider.

Consistent with the Group's expectations announced on 13 June, quiet market conditions in the first quarter have resulted in a decline in client trading and investing activity of 15-20% year on year. These conditions have continued into the start of Q2, however weaker client activity has been offset by stronger interest income, resulting in overall net operating income tracking at a similar run rate to the same period last year.

It’s easy to forget how many financial companies benefit from higher interest rates. We really need to watch out for them. So many years of ZIRP made it easy to forget how their business models used to work!

Back to CMC, it says that its “underlying KPIs”, such as the number of active clients, remain “robust”. That bodes well for trading revenues to improve when activity picks up.

Excluding staff bonuses, the company’s spending plans for the current year (FY March 2024) “are in line with prior guidance”. More new products will soon be launched: cash equities for institutional clients, more options and futures, and the share dealing platform will be enabled for SIPPs and mutual funds.

Graham’s view

This share is down by 40% since January, when I was positive on it. So my stance then is not looking very clever right now! It had a P/E ratio of 11x at the time.

Most of the damage was done in March, when the company said that net operating income for FY March 2023 would be £280-£290m (it had already earned £153m in H1, so it was acknowledging that H2 would be weaker than H1). EPS estimates have been on a downslope:

Full-year results were published in June, and covered by Roland here. The company remained bullish on prospects out to 2025, saying “Expectations of the underlying 30% net operating income growth from 2022 to 2025 remain unchanged”.

In the short-term, however, profitability is going to be squeezed. Net operating income might be c. £290m again this year (including interest income), but then costs will remain high at around £240m, excluding staff bonuses.

It is very much looking as if FY 2024 will be a slow year for the company, as client trading activity is simply too depressed right now.

Personally, I still like the odds offered by this stock over the long-term. Although perhaps my bias is too strong when it comes to this sector: IG group (LON:IGG) is my third largest personal holding and I also think that one is far too cheap! So maybe I’m overly fond of this sector.

While profits at CMC may be a bit thin this year, the company will be set up with more institutional products and a richer retail offering both in the UK and for its Singaporean customers, and will be well-placed when trading sentiment improves.

The 2025 target does look very challenging at this stage but even if it misses that target, I still think a long-term holding in CMC shares could work out well. Lord Cruddas continues to steer the ship with his 59% shareholding and I wouldn’t mind owning a few shares in this one to see where he can take it from here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.