Good morning from Paul (yes I'm back!), and Graham.

Today's report is now finished. Thank you for all the reader comments, very interesting!

I've been enjoying a short break with the family in a holiday cottage in Blakeney, Norfolk ("drizzle tourists!"). What a lovely part of the country, which I've not explored before. Quite a surprise when a pleasant chap stopped me, asking "Are you Paul Scott from Stockopedia?!, and we had a friendly chat. So our community spreads far and wide! Mum asked him how he recognised me, and he replied, "Well he pops up on my computer every weekday!".

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Here's the plan below - as usual we'll probably end up doing 5-7 of these on a typical day.

Feel free to add your own views on anything in the comments section, which we very much welcome!

Summaries of main sections

Belvoir (LON:BLV) 193p (pre market) £72m - Trading Update - Paul - GREEN

Buoyant demand for residential lettings has offset a slow property sales market, leading to H1 being strong, and confidence is expressed in FY 12/2023 forecasts. That de-risks the shares nicely I think, and on a modest 10x PER, plus 5% yield, I remain positive on Belvoir shares.

Xaar (LON:XAR) - down 3% to 180p (£139m) - Trading Update (in line) - Graham - AMBER

Analysts are hopeful of an earnings upgrade later this year, on the back of improved conditions in China, but the further reduced cash balance worries me. Inventories and raw material holdings have ballooned. Current earnings do not support the valuation here.

Maintel Holdings (LON:MAI) - Up 9% to 196p (£28m) - Trading Update - Paul - AMBER/RED

A good H1 trading update, and FY 12/2023 forecasts raised significantly by Finncap. However, I'm put off by the awful balance sheet, with heavily negative NTAV, and far too much debt. It's already doubled, so I think the upside has probably mostly already happened, so I'd be a top-slicer at this stage if I held.

SCS (LON:SCS) - Down 6% to 170p (£57m) - FY 7/2023 Trading Update - Paul - GREEN

In line with expectations update for FY 7/2023, with reassuring news on order intake, and as always pots of cash (above the market cap). I discuss below what the new normal level of earnings might be post-pandemic. Assuming there's nothing going structurally wrong, then this share seems remarkably cheap.

TT electronics (LON:TTG) - up 3% to 156.8p (£277m) - Half-year Results (in line) - Graham - GREEN

This international industrial company is confident it will deliver full-year expectations. Revenue growth has been impressive, but may plateau in 2024. More importantly, leverage has reduced through higher profitability. I continue to like this stock at a single-digit PER.

Quick Comments

Not a small cap but...

Next (LON:NXT) - Q2 ahead of plan. Increases FY 1/2024 PBT guidance by +£10m to £845m. Clearance sale has gone well. As always, the sector leader performs reassuringly well.

Other snippets...

De La Rue (LON:DLAR) - some signs of improvement in the most recent update a few weeks ago, and the biggest shareholder has switched from a seller to a buyer. So looks potentially interesting as a long-awaited possible turnaround. However, today's news that Finncap has been appointed joint broker alongside Numis makes me wonder if it's limbering up for another discounted fundraise? At least we should get some research from Finncap, as Numis are useless for our purposes. I'll continue watching from the sidelines, as risk:reward looks a little wobbly right now to me, but it's guesswork at this stage. Also, I just can't bring myself to buy into a banknotes maker, when all around us are signs of countries gradually going cashless.

Devolver Digital (LON:DEVO) - down 28% to 14p (£63m) - Trading update (profit warning) - Graham - AMBER

This November 2021 IPO by Zeus Capital is now down by over 90% from its placing price. It was originally thought to be heading for a £1 billion valuation! Currently, however, its new titles are being delayed (“in order to continue value-add production to further improve their chances of success and longevity”). On top of that, subscription revenue is down, and the company’s back catalogue is failing to contribute. The economy is blamed for the poor performance of the back catalogue, which I would say is a very poor reason to give investors: old video games are one of the best value forms of entertainment.

“Normalised Adjusted EBITDA” (!) is expected to be negative in H1, and “at least break-even” for the full year. In more bad news, the company’s cash balance reduces to $64m (£50.6m) after it spent $7m buying its own shares for the benefit of its employee option schemes (stock compensation is excluded from Normalised Adjusted EBITDA, naturally). That war chest of cash should at least provide some support to the stock at this level and so I am happy to take a neutral view.

Mears (LON:MER) - up 2% to 277p (£293m) - Interim Results - Paul - GREEN

I’m almost out of time, but had a very quick skim of these H1 results. We’ve reported on Mears favourably several times, it’s a good value share, performing well.

Today it says -

- H1 saw aPBT up 18% to £21.3m.

- FY 12/2023 guidance from Mears is now: revenues £1bn+, adj PBT £40m+

Broker updates - I can’t find any, but the StockReport broker consensus figures look consistent with, or a bit below today’s update. So we should be able to rely on the fwd PER being achievable or beaten.

Balance sheet is strong, and top marks for MER providing its average daily net cash figure, which is £57.4m, as well as the year end snapshot of £116m at 30 June 2023. We need to keep nagging all companies to start reporting average daily net cash/debt. Note very large lease entries on balance sheet.

Share buyback of £20m is “well advanced”.

Paul’s opinion - this all looks reassuring to me, although the lack of available broker research is an impediment to private investors taking an interest.

I think the strong recent rally from c.200p to c.275p looks fully justified. Maybe some traders will get bored, and bank some profits, thus giving us a better buying opportunity? Although I think it looks nice value at the current price regardless. So another GREEN from me.

Facilities by ADF (LON:ADF) - up 1% to 44.75p (£36m) - H1 Trading Update - Paul - AMBER/GREEN

This heavy equipment hire company (UK-centric) for the TV film industry cleverly softens the blow of a profit warning today. Strong H1 performance to June 2023. But no surprises that the USA strikes impacting TV/film are likely to cause a softer H2. It guides £35-40m FY 12/2023 revenues, with possible upside on that if the strikes end. Some projects being pushed into 2024 as a result, so could be a catchup effect next year from pent-up demand. Cenkos (many thanks) lowers 2023 to aPBT of £1.7m, which is 1.6p EPS. But that soars to 9.6p in 2024. The balance sheet looks OK to me, with c.£19m NTAV.

Paul's opinion - I've always quite liked this company, so the obvious time to buy would be when something temporary impacts performance, which is what's happened now. The other question is whether the strength of performance has been due to unsustainable boom in streaming companies creating loads of new content? Also there have been issues with gaps in schedules hurting short-term profits before. Overall though, I'm mildly positive here, taking a medium-term view, so we'll go AMBER/GREEN.

Paul’s Section:

Belvoir (LON:BLV)

193p (pre market) £72m - Trading Update - Paul - GREEN

Belvoir Group PLC (AIM:BLV), a leading UK property franchise and financial services Group, provides the following trading update ahead of publishing its Half Year results on 4 September 2023.

Stronger than expected H1

For background, I’ve looked back at your previous coverage this year, as follows -

1 Feb 2023 - GREEN - 183p - FY 12/2022 slightly ahead exps. Finncap reduces 2023 forecast by 13%. Buying opportunity? Yield 5%.

27 Mar 2023 - GREEN - 169p - FY 12/2022 ahead exps. Paid off debt. Graham & Paul both think it’s cheap.

18 May 2023 - GREEN - 205p - in line (lowered) 2023 exps. Short-term maybe priced about right? Long-term, good value.

Today’s update sounds reassuring, key points being -

Stronger than expected H1, with revenue up 3%

“Comfortably in line” with expectations for FY 12/2023 (strange wording! Does this mean slightly ahead? Anyway, I like it, sounds like a profit warning or further reduction in broker forecasts is now unlikely, improving risk:reward for investors)

Strong acquisition pipeline.

Net cash £0.4m.

Buoyant lettings income offsetting weak sales market.

There’s more detail in the announcement.

Paul’s opinion - Finncap has confirmed (many thanks) that forecasts are unchanged, but it sounds to me that we can have a lot more comfort in these being achieved, given today’s “comfortably in line” update.

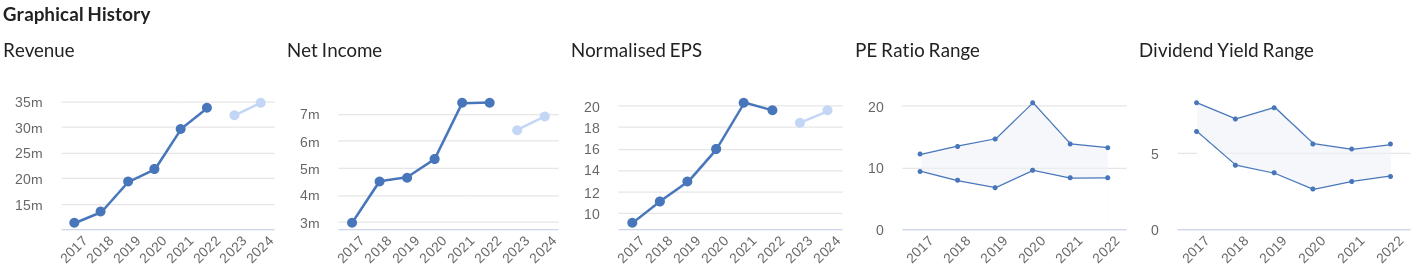

With the StockReport showing a fwd PER of 10.1x, and a 5.1% yield, and an update today reassuring us that we can rely on the forecasts, I think this makes BLV look attractive. Probably not much downside risk (as most of its revenues are linked to recurring lettings), but good upside potential in the medium term, as earnings resume growth, and the PER rating would probably rise too, in the next bull market.

Hence I’m happy to stay GREEN. Patient investors should do well here I think, and there’s a decent yield to keep you occupied along the way.

I imagine we might see the forecasts improve once the property market returns to normal, hence what looks like a flattish trend on EPS below, could resume growth - helped by more acquisitions, where BLV has a good track record. So a growth company, currently priced as ex-growth - that's attractive to me.

Maintel Holdings (LON:MAI)

Up 9% to 196p (£28m) - Trading Update - Paul - AMBER/RED

Maintel Holdings Plc, a leading provider of cloud and managed communications services, issues the following trading statement for the six months ended 30 June 2023, based on unaudited management accounts.

This very small share caught my eye today because it’s up nearly 10%, so we like to focus on big movers, in case there’s a bigger opportunity for a re-rating, or a lucrative trade.

There doesn’t seem to be anything recent in our archive, which is odd, as I can vaguely recall reviewing it at some point in the last year.

There’s been a fabulous recent rally in this share, doubling from the April-May lows of c.100p.

Today’s update key points -

“Solid H1 performance supported by business transformation”

FY 12/2023 outlook -

the Board is confident that the Company is on track to deliver results that deliver revenue in line with market expectations, and Adjusted EBITDA ahead of market expectations.

Strategy is to focus on margins & profitability.

H1 revenues £47.5m (up 2%)

Forecasts & valuation - Finncap has helpfully published an update note, which raises aPBT for FY 12/2023 from £2.8m to £3.7m, a nice upgrade. In EPS terms, this is now 22.8p (previously 16.8p).

At 196p/share that now gives us a PER of 8.6x - looks cheap? Only if you ignore the terrible balance sheet! Net debt has risen to £21.4m, and the balance sheet overall looks very stretched to me (hence risk of a dilutive placing, and little to no ability to safely pay any dividends).

At FY 12/2022, NAV was £19.4m, but this included £53.0m of worthless intangible assets. So NTAV is an awful £(33.6)m. That’s why the PER looks cheap. If we manually repair the balance sheet, just back to zero NTAV, then the share count would more than double, which means the PER would more than double, to the high teens. Therefore, I think that demonstrates the share is not actually cheap at all. Plus debt is expensive these days, in interest costs.

However, upside could come if profits continue rising. Finncap’s forecast for FY 12/2024 is a 43% rise to 32.5p. If that happens, then concerns about bank debt would recede somewhat, and all the benefit of improved performance flows to equity holders, which is why sometimes highly geared companies with awful balance sheets can be spectacular trades, for people prepared (or unaware of!) the considerable risks involved. I think McBride (LON:MCB) has been a good recent example of such a risky trade - improved performance makes the excessive bank debt less of a risk (and the bank has been very accommodating with MCB, giving it time to hopefully trade its way out of a grim financial position).

Hence it’s worth keeping an open mind with this type of recovery share (MAI as well as MCB).

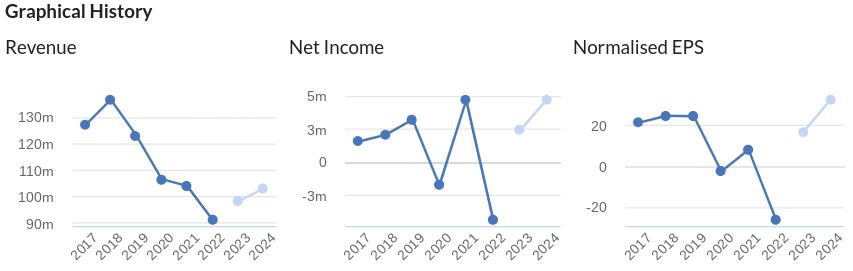

Another thing to consider is that MAI is recovering from a poor patch. It doesn’t look like a structurally growing company to me, as the graphs below demonstrate. That limits the share price upside I think, which has maybe already happened? Although someone might bid for it, and be happy to take on the debt.

Paul’s opinion - on closer scrutiny, the large share price rebound that’s already happened, combined with a very weak balance sheet, means that I’d probably be top-slicing some profits if I already held this one. Hence not of interest to me as a new purchase.

The very weak, over-geared balance sheet, means I have to warn about that with AMBER/RED. So not a disaster, but be careful with the elevated risk here - it’s up to you to decide if you think the upside outweighs the higher risk of a weak balance sheet. Sometimes it does, sometimes not.

SCS (LON:SCS)

Down 6% to 170p (£57m) - FY 7/2023 Trading Update - Paul - GREEN

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues a trading update for the 52 weeks ended 29 July 2023.

Full year profit in line with market expectations

I’m not sure why the share price is down today (and a ridiculously wide bid-offer spread), as this sounds reassuring to me -

The Group expects to report full year profit in line with market expectations, driven by effective cost management and improved trading in the second half of the year.

The Group's financial position remains robust, with cash at 29 July 2023 of £69.5m and no debt.

Furniture retailers benefit from a favourable working capital cycle, with money received from customers before the third-party factories have to be paid for making each item to order.

Since that continuously rotates, then ScS is permanently sitting on a whopping great cash pile similar to its own market cap, and should now be earning several million each year in interest income on that.

Demand and profitability have been volatile in recent years, with the pandemic lockdowns causing stop-start trading, as for so many companies. So it’s difficult to ascertain what is normal, in terms of profitability.

Order intake - I find this reassuring -

ScS's updated brand and strategy are beginning to resonate with customers, resulting in strong like-for-like order growth of 6.0% from weeks 34 to 52 building on the 5.7% previously announced for weeks 27 to 33. As a result of this growth, following a more challenging first quarter, order intake for the full year was in line with FY22.

Continuing the trend of the past two years, the ScS business continues to gain market share, cementing its position as the UK's second largest upholstered furniture retailer.

Outlook - this doesn’t say much, but has a generally satisfactory tone I’d say -

We are cognisant of the economic conditions facing our customers including higher interest rates and low consumer confidence, which are forecast to continue throughout FY24. However, we remain confident that the Group's strategy and strong balance sheet will enable ongoing trading resilience and we continue to expect to grow our market share while selectively investing in store and other strategic growth opportunities.

Paul’s opinion - SCS looks good, and dirt-cheap, as always, taking into account the market cap is entirely covered by cash - which is not just a seasonal spike, it’s ongoing.

I wonder if brokers have slipped through a downgrade? No, that doesn’t seem to be the case. Shore Capital kindly lets us see its thoughts on Research Tree this morning, leaving EPS at 14.8p for FY 7/2023. That may be in line, but it’s a long way down from the 35-40p EPS achieved in the previous 2 financial years. So is the much lower profit this year the new normal, or a relatively poor performance in a year dominated by cost of living pressure on households? Should we be anticipating stronger earnings in an economic recovery? Or is ScS suffering due to some undisclosed internal problems? I don’t know, but the cash pile gives such amazing downside protection, that I can’t help but view this share positively. Freight costs should have dramatically fallen, so I'm a bit surprised that hasn't boosted this year's profits.

Maybe to some extent, people spent their lockdown enforced savings on new settees in 2021 & 2022, and now don’t need to replace them yet? SCS does generally have a value type product, suggesting its customers might be hit disproportionately hard by cost of living pressures on food and energy?

Overall then, I see SCS shares as highly attractive value, taking a medium-term view. It has to be GREEN.

Note that the share count has fallen quite a bit in recent years, due to buybacks. Surely 250p-ish might be achievable once things start to improve?

Graham’s Section:

Xaar (LON:XAR)

Share price: 180p (-3%)

Market cap: £139m

This “inkjet printing technology group” has generated hugely erratic financial results over the years. Today, it reassures investors with an in line with expectations update for H1, although I’m not very reassured by it. Here are the key points:

Revenue down 5% to £34.7m

Adjusted PBT in line with expectations, as the costs of a factory reorganisation are offset by the sale of “non-core IP assets”.

Operationally, the company seems happy with the rollout of its new Aquinox printhead. Phase one of its factory “efficiency programme” has been successfully completed.

Net cash fell from £12.6m to £7.3m, “in line with expectations”, and “reflected the previously communicated investment in inventory”.

While the company may be satisfied with this cash balance, I find it unnerving.

I got used to Xaar having cash of £20m+ (it was £40m+ for several years).

When a cash balance depletes like this, you hope that it will result in significantly improved profitability, either through acquisitions or internal investments.

It’s true that Xaar has made a couple of small acquisitions in recent years, but it also sold a valuable stake in a 3d printing business.

The really big change has been in inventories: raw material and finished product holdings have increased by almost £20m over the last two financial years, and finished 2022 at £29m. The company does have a reasonable explanation for this: while reorganising their factory, and dealing with fragile supply chains, they needed to be sure that they would be able to meet customer demand.

So my question would be: when can investors look forward to inventory reducing again, and releasing all of that cash back to the company and its shareholders? Xaar doesn’t seem to have made any promises on that front.

The Outlook statement only says that the investment in inventory “means the Group is well placed to capitalise on further commercial opportunities”.

They expect conditions to improve further in China in H2, and are looking forward to both customer product launches (which increase the demand for Xaar’s products) and new Xaar product launches.

CEO comment:

"We remain focused on the delivery of our strategy and taking advantage of the significant opportunities we have that will drive profitable growth. Our products continue to generate strong interest from customers, demonstrating our leadership in printing highly viscous fluids with all the sustainability benefits they can deliver. We have positive momentum, a growing product pipeline and look forward to continuing to accelerate our strategy and performance in H2 and into 2024."

Estimates: the forecasts from Progressive are unchanged. They are hopeful of upward revisions to forecasts, but are waiting for the picture to be more clear when the interim report is published in September.

The adjusted PBT estimate for the year is £2.5m.

Graham’s view

I don’t think I’ve ever given this stock the thumbs down, but I’m close to doing that today. It’s just that I know how volatile Xaar’s earnings can be, and I worry what will happen if they have another rough patch:

If conditions toughen for them again, they might not have the luxury of a huge cash balance to cushion the blow. This is the type of company that I think needs a large pile of cash, to help it survive the bad years.

I will remain neutral on it for now, on the grounds that the buildup in inventory and raw materials may unwind, at least partially, now that their factory reorganisation is complete.

But it’s important to note that current earnings don’t support the market cap: these shares are pricing in an earnings recovery and I have little faith in that happening in the short-term.

TT electronics (LON:TTG)

Share price: 156.8p (+3%)

Market cap: £277m

This is a main-market listed manufacturer of electronic components. I’ve been positive on it since last November, when I noticed that it was trading cheaply despite showing excellent revenue growth.

It was carrying too much debt, but laid out a clear objective to get its leverage multiples under control.

There hasn’t been any sustained improvement in the market cap since then, but it has paid a dividend:

Here are the H1 results - :

Revenue +12% at constant FX to £309m

Adjusted operating profit +34% at constant FX to £25.6m

Adjusted operating profit margin improves from 6.8% to 8.3%

Return on invested capital improves from 10.5% to 12%

It’s not all that common to see companies calculate their own ROIC - but it’s a huge green flag for me whenever I see it. Even if, as in this case, the ROIC is unspectacular, it shows that management is trying to make it as high as possible.

Achieving high ROIC is about generating high profit margins as efficiently as possible. One of TTG’s goals is to achieve a double-digit operating margin: again, even if they fail to hit this target in the short-term, it’s important that they are at least trying! They say that a 10% adjusted operating margin is “within reach”.

Adjustments: the company adjusts out nearly £5m of costs. These include nearly £3m of amortisation and £2m of miscellaneous one-off costs.

It’s an improvement on H1 last year, when £9m of costs were adjusted out. One of things I’ve been looking for from TTG is cleaner accounts, with fewer adjustments.

Net debt is little changed at c. £139m, but the leverage multiple falls below 2x thanks to increased profitability.

2x is the company’s target upper limit for leverage; at current profitability the multiple is 1.8x, and they expect it to reduce further.

It does very much sound like they intend to reduce leverage through increased profitability, not by reducing the actual amount of net debt. They are monitoring an “active pipeline” of M&A opportunities, and have been spending heavily on R&D and capital equipment.

Interim dividend keeps pace with inflation, increasing 8% to 2.15p.

Order book “provides visibility for balance of 2023 revenues with cover building for 2024”.

Book-to-bill ratio is not provided, and it sounds like it was below 100%, i.e. orders received did not fully replace orders fulfilled. In the CEO’s words: “As expected, order intake has started to normalise, but has still broadly tracked our revenue growth in the first half”

I wouldn’t be overly concerned about this, although it does imply that revenue may plateau. That would be in line with existing forecasts: Stockopedia shows that 2024 revenues are only expected to grow to £641m, from an estimated £636m in the current year.

Outlook - they have “increased confidence” in delivering full-year expectations:

…we remain focused on executing on the order book, delivering continued strong profit growth and driving a material step up in free cashflow and further reducing leverage by the year end.

Graham’s view

This is playing out more or less as I hoped it would. The leverage multiple is reducing (albeit through increased profitability, not by paying down debt). The accounts are looking cleaner than last year. Revenue has grown in line with inflation, although revenue growth may cool between now and 2024.

As the share price continues to drift, this company is trading at a single-digit earnings multiple. Is that fair?

TTG will have a new CEO from October, and I guess that does introduce an element of risk. However, it looks set to be an orderly transition, and the new CEO was in charge at Rotork (LON:ROR) (market cap: £2.6 billion) until 2017.

I’m going to remain positive on TTG, as I think it’s a higher-quality company than the market is giving it credit for.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.