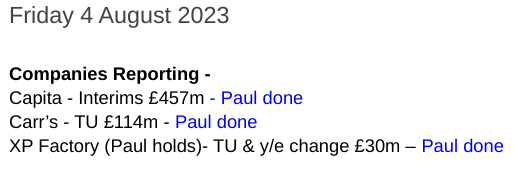

Good morning from Paul!

It's quiet for news today, so I'm hoping to finish late morning, and enjoy my last day on holiday here in Blakeney, Norfolk.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

XP Factory (LON:XPF) (I hold)

17p (pre market) £30m - Trading Update & y/end change - Paul - AMBER/GREEN

Year end is changing from 31 December to 31 March. I can see the logic for this - creating better visibility of full year results, not having to faff about with stocktakes & other year end procedures at the peak trading time of year, and making the audit and tax computations easier. So I think this is a logical move, and there’s nothing suspicious about it. Although investors do have to remember a year end change, so you don't start misinterpreting growth rates for the 15-month changeover year.

In terms of trading, the crux is that it’s in line with expectations for H1- strong Jan-Apr 2023, but “a little softer” in May & June (blaming rail strikes & hot weather).

Current trading in July was “significantly ahead” of May & June, which reassures me that there isn’t a deeper problem.

Full year expectations - in line.

Some short-term caution -

We are mindful of the pressures on consumers and on our cost base which bring an element of short term caution but we remain optimistic for the future of both our businesses and for the 2023 outturn."

Broker update - Singers has today confirmed its existing forecasts, which are £42.6m revenues (up 87% on FY 12/2022 actual), Adj EBITDA (pre-IFRS 16) £5.5m, and aPBT £1.1m. Remember that some of the sites are franchised, so the site level revenues overall would be higher than this, so quite a decent-sized business is being built here, rapidly.

Forecast £1.1m aPBT for FY 12/2023 is not a huge profit, but most of the sites were only opened in autumn 2022, in the dash for growth with the Boom Battle Bars acquisition. Hence sites should gradually mature. From this point onwards, we should see an operationally geared increase in profits, as new sites are added to a mostly fixed (and quite high) central overhead. Therefore I think the basic concepts of Escape Hunt, and Boom Battle Bars have now been proven, and the investment case for this share is that it's just a roll-out of new sites, each one adding to profitability (hopefully). Less risky through franchisees, but better control in the company-owned sites.

Cash is £3.6m at end June 2023, but we’re not told if this is gross or net. I think that's enough, but not ample. If management want to expand faster, then I think a fundraise would be needed. Although bear in mind that new sites are plentiful, and available on superb terms - with large landlord cash contributions towards fit-outs. The other option would be to use some debt for new sites, but that might not be easy to arrange in the current macro environnment. There is a small existing debt facility for fit-outs. With established sites now producing good cashflows, there's no imperative to raise money anyway, in my view. It would be a choice, for faster expansion, not to keep the lights on. I don't want to be diluted, so I would prefer them not to raise fresh equity at anything like the current share price.

New sites are being progressed with 6 in total happening this year, a much slower pace than 2022, but still good expansion. There must have been some teething problems from the extremely rapid expansion last year, so a more moderate expansion this year seems sensible to me. Dubai sounds interesting, has just recently opened, and has “so far traded exceptionally well”.

Paul’s opinion - this sounds a solid performance, but the short-term caution makes me move from GREEN to AMBER/GREEN. It’s a long-term holding of mine, because I’m impressed with the site economics, and the extremely rapid expansion in 2022 has transformed the scale of the business. Experiential leisure is very popular with customers, so this is an interesting niche to invest in, I think.

XPF is now profitable, and that’s after a large depreciation charge, so it should be nicely cash generative, enabling it to self-fund further expansion (albeit at a slower pace than the break-neck expansion of 2022).

I don’t think there are any other pure play experiential leisure shares available to us on the UK market, other than Brighton Pier (LON:PIER) which is small and niche (they can't do a roll-out of new piers!). Whereas XPF has 2 proven brands (Escape Hunt and Boom Battle Bars) which seem to work well at site level. Therefore it’s now just a case of rolling out more sites. I'm investing here because I think in say 3-5 years, this should be a much bigger business, the two formats are already proven (not speculative), hence it's just a question of trusting management to execute well in expanding the number of sites. If it works, then I'm hopeful for a multibagger. Plenty of competition from boring, generic bars, is likely to fall by the wayside I think, in current tough macro conditions.

There is competition of course, with experiential leisure bars popping up in other formats too.

It’s pointless looking at historic numbers for XPF, because so many new sites were opened late in 2022. So the figures prior to 2023 are not of any relevance.

I think the cash position looks a little tight, which means the rate of expansion is probably limited by available cash, although note that property deals mean the bulk of the site fit-out cost is paid by the landlords. That’s how it managed to open so many new sites last year with limited cash. Management made it look easy, but opening so many new sites so fast must have been an incredible amount of work - we now know management can handle rapid site expansion, when it was previously just an aspiration. That gives me confidence.

For growth investors I think this is a very interesting situation. Visiting the sites is fun, but remember that peak trading is Thu, Fri, Sat nights, so they might appear quiet at other times.

For now, the valuation looks about right to me, with a higher rating likely once the next bull market starts.

Note that the share count has increased considerably, to fund the acquisition of Boom Battle Bars, which was done at 30p. Now the acquisition has been done, and rapid expansion of new sites achieved, it strikes me as odd that shares can now be bought at almost half price! It just shows how market sentiment for small caps has plunged in the last 2 years or so - creating lots of buying opportunities I think -

Carr's (LON:CARR)

Down 11% to 128.5p (£121m) - Trading Update - Paul - AMBER

Carr's (CARR.L), the Agriculture and Engineering Group, announces a trading update in respect of the financial year ending 2 September 2023.

Background - this share was suspended earlier this year, due to a technical problem relating to the audit of a subsidiary, and an FCA investigation into the previous auditor’s work. It came back from suspension on 29 March 2023. All a bit messy.

Graham looked at Carr’s interim results here on 2 May 2023, noting a small profit warning, and wasn’t keen, viewing it as AMBER.

Carr’s moved from net debt into net cash, after a significant disposal during H1.

Today’s update - is a profit warning.

At the interim results (published 2 May 2023), the outlook section guided c.£10m aPBT (adjusted profit before tax) for FY 8/2023.

Today it lowers aPBT guidance by £2m (20%) to c.£8m.

That’s not great coming right at the end of the financial year, where guidance should have been pointing to a secure number that it could meet. Taken together with all the audit problems, this seems another indicator that financial controls are not what they should be. It’s so important that companies budget prudently, and hit their forecasts. Posting a miss at the end of the year is unimpressive.

What’s gone wrong?

- Speciality agricultural division - it blames drought in the USA, and higher costs in the UK, and a “delayed recovery” in markets.

- Higher costs relating to the disposed Agricultural Supplies division - this sounds a one-off, so fairly harmless.

The engineering division is trading well, and its order book provides confidence.

Net cash position, but no figure provided.

Paul’s opinion - rather underwhelming, but not a disaster, I’d say.

This share had a big re-rating about 10 years ago, but has since gone sideways. So the only attraction has been divis, which are OK, but nothing special, at a yield of just under 4%.

Value metrics are unimpressive, apart from price to tangible book, which is strong (the lower, the better) at 1.47.

It all just looks a bit flat. I think to buy or hold here, you would need to have some insights about the company’s future performance, and believe that it’s set up to grow profits from the current rather lacklustre level. If any subscribers are bullish, please do leave a comment explaining why, as there might be something good here that I've missed.

I can’t see anything wrong with this share as such, but also can’t see much obvious upside either, from a quick review only, so I’ll stick with AMBER.

Capita (LON:CPI)

Down 13% to 23.4p (£397m) - Half Year Results - Paul - AMBER

This is a large, complex group, that was in financial trouble, but has since drastically de-geared. I recall looking at it here in early March 2023, concluding that it looked a good turnaround around 35p/share. Unfortunately, since then the price has continued drifting down, with an extra lurch today (shedding £60m in market cap this morning alone), to currently sit at 23.4p. So it hasn't worked so far - is it still an opportunity, or a can of worms?

It looks like I briefly held a tiny position in CPI, which from memory was just a tiny spread bet, that didn’t last long. So no current holding, for disclosure, as required.

I don’t want to spend too long on this, so just a few notes from my skim-reading of H1 results today -

Adj revenue up 6% to £1.4bn, so a substantial business (not sure why they adjust revenue?)

Adj PBT £33.1m (up 34%)

Reported PBT negative at £(67.9)m - so there’s a very large different between adjusted and reported numbers, this is a key area to focus on if you research it deeper.

Net debt (excluding leases) continues to fall, at £166m (down from £289m a year earlier) - so as mentioned before here, Capita looks financially stable now.

Cyber incident - this seems to have spooked the market today, judging by the news summaries, with expected costs (net of insurance receipts) at a hefty £20-25m. See the reader comments below for some highly critical reaction to this (the incident itself had already been disclosed, but I’m not sure about the costs). Could this be the type of problem where costs, and even compensation, could escalate? It seems a considerable risk.

FY 12/2023 expectations are unchanged, the company says, and on track for improved financial performance they say.

It looks like net debt should fall further after more disposals complete.

Borrowing facilities extended.

Pension deficit - this looks complicated, so needs more work. It’s saying there’s an accounting surplus, but seems to have paid a whopping £30.6m deficit contributions in H1, if I’m reading that correctly?

Balance sheet - is pretty horrible actually. NAV of £247m includes almost £600m in intangible assets, so NTAV heavily negative at c.£(353)m - I think this rules it out for me. I don’t understand why I was sanguine about the balance sheet back in March? Possibly because management had won me over in the webinar at the time. More scepticism required I think!

There’s a huge deficit on working capital, with current assets of £774m being dwarfed by current liabilities of £1,442m. So it seems Capita needs large up-front payments from its customers to keep operating, which is a form of hidden debt really (see the £606m in deferred income creditor).

Paul’s opinion - as you’ve probably gathered, I’m a bit underwhelmed by this. That could just be emotional though, in that the share price has been so weak, and a negative market reaction today. Could it be a buying opportunity? I’m not sure, and this clearly needs a lot more work, to investigate the remaining disposals, the pension scheme, how serious the cybersecurity breach is? So I’d view this as a special situation, needing much more work, that could go either way. So I’ll just say AMBER for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.