Good morning from Paul!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

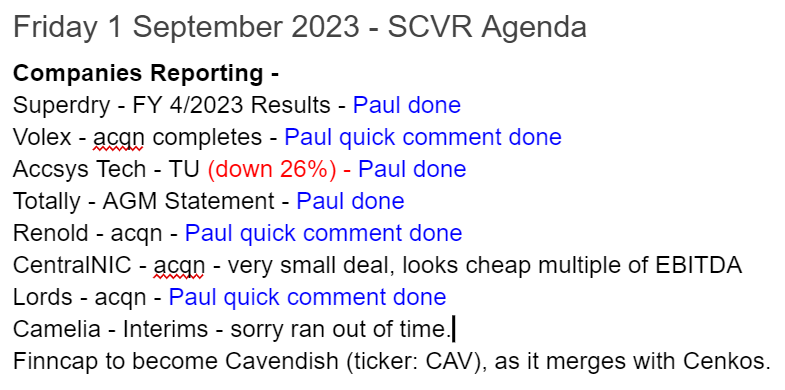

Here's today's news. I should be able to cover most of these -

Summaries

Totally (LON:TLY) - down 12% to 9.4p (£19m) - AGM Statement - Paul - AMBER/RED

An update that seems contradictory to me - mentioning negative factors, but keeping previous guidance. I suspect another profit warning might be gestating. Is this low margin, accident-prone NHS contractor actually any good? I have my doubts. Although the very low market cap could see a bounce in it at some stage, so one for traders perhaps?

Superdry (LON:SDRY) - 56p (suspended temporarily) £55m - Results FY 4/2023 - Paul - RED

Good news (why not announced earlier?) is receipt of £35m net from IP sales in the Far East. However, the results for FY 4/2023 show a move into losses, and Q1 current trading looks very bad, especially wholesale. I think it can survive for the time being, but unless something significant improves, then I imagine it could go bust in 2024. Going concern contains "material uncertainty", so beware, this is high risk. One for traders maybe?

Accsys Technologies (LON:AXS) - down 24% to 74p (£162m) - Trading Update (profit warning) - Paul - AMBER/RED

After a good start to FY 3/2024, demand has now slowed, meaning EBITDA is likely to be "significantly below" expectations. I haven't looked up broker updates, as I've already decided I wouldn't want to get involved here, due to the heavy borrowings from ABN Amro - not a good fit with deteriorating demand & profits. Probable read-across to other building supplies companies, in that it doesn't forecast any recovery until H2 of calendar 2024.

Small cap acquisitions announced today

Volex (LON:VLX) (Paul holds) - GREEN - confirms that a previously announced acquisition in Turkey, called Murat Ticaret, has completed. As expected, so not price sensitive, but reassuring - this is a sizeable deal, and as with all Volex’s acquisitions, seems to make sense (new markets, quality operator), and priced sensibly. I think VLX shares are likely to re-rate to a higher PER in the next bull market. Currently we’re being offered a well-managed, strong acquisitive (and organic) growth group, on a value share rating.

Renold (LON:RNO) (Paul holds) - GREEN - a small acquisition announced (£3m) of Davidson Chain in Australia. Complementary products & geography. High margin niche products. Rationale and price of the deal look attractive, and are well explained. Confirms my view that Renold is a quality business, on the front foot. Yet the market is still pricing it as if the previous problems are still a worry, which they’re not. Big pension deficit suppresses the PER, as I’ve covered numerous times in the archive here.

Lords Trading (LON:LORD) - GREEN - small acquisition of a loss-making timber merchant, Alloway Timber. The strategy seems to be buying up independent builders merchants at modest prices (eg retirement sales), then improving margins, and other synergies, which makes a lot of sense to me. Checking my previous notes, I was GREEN on Lords in both May & June this year - solid trading, cheap valuation. Only negatives are obvious macro worries, and founder shareholding is too dominant.

CentralNic (LON:CNIC) - also announces a tiny acquisition, on what seems like a cheap EBITDA multiple.

Paul’s Section:

Superdry (LON:SDRY)

56p (suspended temporarily) £55m - Results FY 4/2023 - Paul - RED - (suspension should be lifted this afternoon, CFO said on webinar today)

The precise period is the 52 weeks to 29 April 2023, but I’ll call it FY 4/2023.

Just a few quick comments before I get “Dunkertoned” on the 10:30 InvestorMeetCompany presentation.

Good news -

The Far East IP sale completed, with funds received, in May 2023. Why on earth wasn’t this announced by RNS? It should have been, as the silence naturally led me (and others) to conclude that the deal might fall through. A silly own goal there. It’s highly material, pumping in cash of c.£35m in net proceeds onto the post year-end balance sheet, so this is a big positive I think, as it provides a lifeline to prop up the business in the short term anyway. In negotiations for possible additional IP sales internationally.

Cost savings of £35m are being implemented. Seems a huge amount, so I’d like to know what these costs are, and if there are cash costs involved up-front?

Bad news - everything else basically! In particular -

Loss-making for FY 4/2023 - adj PBT of £(21.7)m loss, vs LY profit of £21.6m

Statutory loss after tax is huge at £(148m), but that includes a large tax charge, so the statutory LBT is £78.5m. The main culprit is a big provision for onerous leases.

Lease entries on the balance sheet are probably the worst I can remember seeing for any retailer - RoU assets are only £48.5m. But the corresponding rent liabilities are £60.5m current, plus £127.6m non-current. This is telling us that SDRY has a massive problem, with many, probably most of its physical shops now loss-making. Hardly surprising, given that gross margins are falling, but it will be having to pay staff considerably more. Retail sales did rebound in FY 4/2023, but are now dropping again (in Q1). Wholesale is also a major problem, but at least costs there are mainly variable. Rents are fixed until the next rent review or break clause, when they do drop a lot.

Current trading - no respite here. Q1 sees store revenues down 3.7%, online down, and wholesale down a really alarming -50%. It says this is -30% underlying, due to timing differences, and is influenced by exit from USA. Even so, it’s dismal, meaning that I think losses are likely to worsen considerably in FY 4/2024.

Going concern - contains a "material uncertainty" waring, so read this statement carefully, which confirms the risk.

Paul’s view - I think this is probably likely to go bust in 2024. Unless a genuine and significant turnaround is implemented (instead of it all being talk of a brand reset, to date). I'm listening to the IMC now, so will see if anything new emerges from that. So far, they're being pretty straight, admitting how tough things are, and liquidity having been a challenge, 8 minutes in. There's clearly some value left in the brand, as the £35m cash from selling the brand in the Far East confirms. But it's a race to stem the losses, before it runs out of cash I think. Why get involved? Although it could be a nice share to trade in & out of, for bounces after big plunges. So one for traders only I think. Tenacious management, that's for sure, highly motivated. Can they save it though? I'd be surprised, but it's a possibility.

Totally (LON:TLY)

Down 12% to 9.4p (£19m) - AGM Statement - Paul - AMBER/RED

Today’s update mentions various negative factors, but doesn’t seem to be a profit warning, as the final sentence says -

The Board's outlook for the current financial year [Paul: FY 3/2024] remains consistent with that communicated alongside the full year results of the Company in July 2023.

But this doesn’t fill me with confidence -

"We continue to work within a challenging operating environment alongside the NHS in crisis. The cost of agency staff required to deliver safe services for patients exceeds our anticipated forecasts and many decisions related to the awarding of new contracts are currently on hold.

…we are actively implementing strategies to streamline our operations and to align them with a smaller overhead base which more readily reflects the current contract requirement.

"The Board remains confident in the medium to long term prospects of the business and will ensure that future contract opportunities continue to be pursued and all contracts are managed effectively to support the achievement of Totally's goals.

Paul’s opinion - a fairly negative-sounding update, hence shares have dropped 12% this morning in early trades, which seems a sensible reaction to me.

I’ve not seen any broker updates yet. TLY has form for sounding chirpy in its updates, then slipping out lowered forecasts via broker notes, as it did on 10 July. Therefore I don't particularly trust the company’s commentary. Indeed today’s sounds contradictory, mentioning negative factors like higher contractor costs, and new contracts on hold, whilst saying no change to guidance, which doesn’t make sense to me. It sounds as if another profit warning could be gestating, so I’m not tempted to bottom fish, despite the share price having fallen a lot.

Fundamentally is this business any good? I’m not sure, but previously gave it the benefit of the doubt, being amber from Dec 2022 to 22 May 2023, but my patience ran out on the profit warning of 10 July, where I shifted to AMBER/RED. I’ll keep that view today, although I’m inching towards just going fully red on it.

The fundamental problem with TLY, is that it’s doing quite big, low margin contracts for the NHS, but seems to have a fair bit of risk within those contracts - both cost over-runs, and uncertainty over renewal. I’m therefore coming to the conclusion that it’s really not a very good business, with not much visibility over future profits.

As a short term trade, there might be a bounce in the share price at some stage though.

Shares found a floor around the current price of 10p pre-pandemic, but bear in mind that since then the share count has quadrupled! So drawing lines on the chart isn't comparing like with like at all.

Another problem in the current, illiquid bear market for micro caps, is that companies which under-perform like this one, could have a huge overhang of institutional shareholders who would like to sell, but can't, as there aren't any buyers. That can lead to a share price in perpetual decline, punctuated with the occasional sharp rally, that sellers quickly snuff out. The 5-year chart below very much confirms that is probably the case here.

It also means that the funding window has been slammed shut for a while, so the market isn't performing its function of providing cash for expansion (unless there's a really compelling story), and if they run out of cash, they're in big trouble.

Accsys Technologies (LON:AXS)

Down 24% to 74p (£162m) - Trading Update - Paul - AMBER/RED

As you can see from the 12 month chart below, AXS shares seemed to form a nice base, and then put in a strong rally. That’s gone wrong today unfortunately, with a trading update that has displeased the market.

.

This is the company that’s been developing high performance wood products, with seemingly strong demand, but never-ending production delays and problems.

Here’s a summary of today’s update -

“Strong start” to FY 3/2024 (Apr, May, Jun, Jul) - revenues & volumes both up.

Weakening customer demand, blamed on macro factors & destocking.

Mgt taking “immediate & decisive steps” to reduce costs & optimise working capital.

Trying to stimulate demand.

New Kingsport plant should commence in mid-2024 not very helpful timing, to be increasing production when demand is falling.

Profit warning - FY 3/2024 revenues will be below expectations, and EBITDA significantly below expectations.

Outlook -

Challenging trading conditions are expected to persist at least until the second half of the 2024 calendar year.

Paul’s opinion - I seem to recall that the products Accsys makes are quite high end, high spec stuff, eg for architect designed buildings (I could be wrong on that, so do correct me if so). Hence given macro factors, especially much higher interest rates, and housebuilders saying demand is well down, it’s unsurprising that Accsys is also seeing reduced demand.

This share definitely fits into the too complicated category.

It’s a pity, as it’s FY 3/2023 results looked good, in a breakthrough year for profitability.

However, on checking its 3/2023 balance sheet, I’m not happy - there’s far too much debt, which doesn’t sit comfortably with a profit warning today, and no signs of a trading improvement likely for about a year. For that reason, I’m marking down my view of this share from amber, to AMBER/RED - indicating that I see signs of some possible financial distress. It did an equity raise in 2022, and I think it might need another placing, but that depends whether the main lender ABN Amro is co-operative or not, and what the bank covenants are - all essential research. I’m just going to avoid it altogether - why get involved?

This update is further evidence, I think, that it's probably best to steer clear of anything construction-related for the time being, with a recovery seemingly pushed out into H2 2024, and all the signs seem to me pointing towards things getting significantly more difficult in the sector generally - which is what we should expect when interest rates have been hiked so much, after 15 years at near-zero.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.