Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

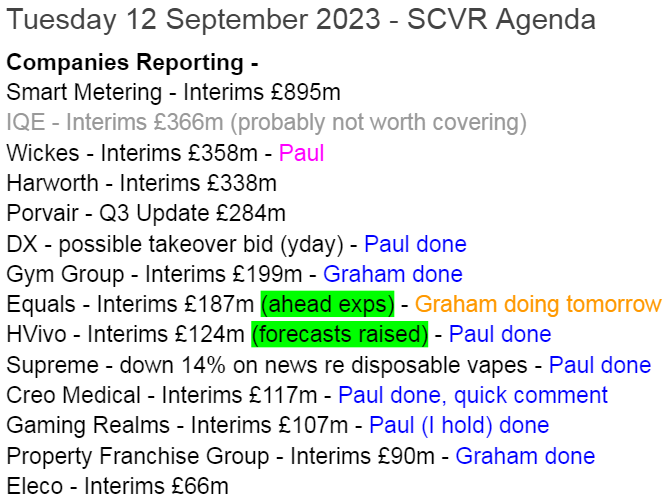

Quite busy today for interim results. We'll pick the most interesting ones (over/under expectations, or if the share looks particularly good/cheap) -

Summaries

Gaming Realms (LON:GMR) (Paul holds) - 36.4p (pre market) £107m - Interim Results - Paul - GREEN

I have a good rummage through the H1 results below, and like what I see. Outlook sounds confident for H2, so risk of a profit warning seems low. Strong balance sheet with growing net cash. Very good organic growth, with a capital-light business model. New clients and products, plus global reach, makes this share look very attractive to me as an excellent GARP share. That's why I own some myself.

GYM (LON:GYM) - 112p (unch.) (£200m) - Interim Results (in line) - Graham - RED

These results are in line, with no change to guidance. I remain negative on this one due to my concern that the company will continue to struggle with 2019 (pre-Covid) comparatives for the foreseeable future. Net debt is c. £70m, with very limited balance sheet strength.

DX (Group) (LON:DX.) - 43.5p (£263m) - Possible Offer - Paul - GREEN

A possible bid approach announced yesterday afternoon at 48.5p gets the support of management, so the potential bidder is now starting due diligence. I think the bid price looks reasonable based on fundamentals. We've reported positively on DX 3 times in the last 10 months, seeing a low PER, good yield, decent balance sheet with net cash, a decent turnaround following previous problems, and solid trading updates. UPDATE: a later announcement has been issued from HIG, which sounds like they're serious, having secured agreement from holders of c.32% of the company for a bid of "at least 45p", so are they trying to trim the price a little maybe?

Property Franchise (LON:TPFG) - 282.5p (+1%) (£90m) - Interim Results (in line) - Graham - GREEN

We had an August trading update and the results for H1 come in as expected. Growth has slowed to a crawl but in the context of the housing market and what has happened with interest rates over the past year, it strikes me as a good performance.

hVIVO (LON:HVO) - Up 6% to 19.3p (£131m) - Interim Results - Paul - GREEN

Good numbers, and Liberum ups the forecasts for 2023 and 2024. I do think this company looks very interesting, and like the high visibility from the forward order book, plenty of clients cash paid up-front, and what seems to be a lucrative niche without much competition, they tell us. I'd like to see a longer track record of profitability, ideally.

Supreme (LON:SUP) - down 14% to 93.5p (£109m) - Possible ban on disposable vapes - Paul - AMBER

We discussed this company late last week, when the Times reported that Supreme’s CEO had made a £350k donation to the Conservatives. Maybe he’ll be asking for his money back now (joke!!) , as the Govt is reportedly set to ban disposable vapes which seem to be aimed at children. I’ve been following the reader discussion on this, and some subscribers seem to think this might actually benefit SUP, whilst others present alternative views.

Is the 14% drop today a threat, or a buying opportunity? Personally I just don’t want to get involved either way with a vaping (and other products) company. I suspect plenty of institutions might take the same view, under ESG pressures, so this share could remain on a low PER permanently, I suspect.

Creo Medical (LON:CREO) - down 4% to 31p (£116m) - Interim Results - Paul - AMBER/RED

Every time a blue sky type company reports its figures, it’s a horrible reminder of the financial risks. CREO has a great story, with what seem very credible new products for keyhole surgery, beginning to gain traction. However, once you strip out its income from consumables, revenue has barely begun for the core products. Yet there are lots of expenses involved to promote the products.

It’s losing about £13m per half-year on the P&L. So the remaining cash pile of £26.5m at June 2023 might only be enough to get to mid-2024. Therefore the March 2023 fundraise almost certainly won’t be the last. Broker forecasts assume it can rapidly increase revenues, and slash costs, to avoid another fundraise. That doesn’t seem likely to me. It’s a pity, because I really like the story here, and the products, but for me the figures just don’t stack up at the moment.

Paul’s Section:

Gaming Realms (LON:GMR) (Paul holds)

36.4p (pre market) £107m - Interim Results - Paul - GREEN

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, is pleased to announce its interim results for the six months to 30 June 2023 (the "Period" or "H1'23").

The jewel in the crown of GMR’s products is a game called Slingo, which seems very popular, and is widely licensed by online casinos.

Headlines -

Content licensing revenue grew 37% to £8.8m after 12 consecutive half years of growth

37% increase in Adjusted EBITDA1 to £4.8m

The above reinforces that GMR is a good organic growth company, and still reasonably priced, which is why I like it, and bought some myself earlier this year (having previously been sceptical, but the numbers have improved a lot over the last year or so).

Key H1 numbers -

Revenue up 36% to £11.5m

Adj EBITDA up 37% to £4.8m

PBT up 74% to £2.4m

Is EBITDA a sensible number? In a word, no. Here’s the reconciliation from EBITDA to PBT, the bold numbers are H1 2023 (unbolded are 2022 comparatives) -

As I have highlighted above, there’s only one significant number, which is the amortisation charge for intangible assets. If that’s goodwill (or similar) from acquisitions, then happy days! If it’s amortisation of internal development spend, then it’s a valid cost that should not be ignored.

Following it through to the balance sheet, there is £12.6m in intangible assets. Then moving to note 6, I find that £5.1m in goodwill, which is not being amortised. £7.2m of “Development costs” makes up almost all of the remainder. £2.2m was freshly capitalised onto the balance sheet in H1 (costs which by-pass the profit number), and the amortisation charge was lower, at £1.56m in H1.

Therefore this shows that the EBITDA number is nonsense, and best ignored, because it doesn’t account for the substantial development spending.

In cashflow terms, half of EBITDA is being spent on internal development costs, so this is a very important point for valuing this share. You could see that as spending to drive expansion, but I tend to find that development spending is necessary and ongoing at this type of software company, so it's a normal cost for me, not something that could be switched on & off at will. If companies don't spend on continuous development, they go backwards after a while.

All the other costs in the table above are valid costs, so I will be valuing this share on PAT. Although that looks distorted by a negative tax charge of £(160)k in H1, meaning that PBT of £2.35m become PAT of £2.51m. So we need to know if negative tax charges are permanent, or temporary? Is it using up b/fwd tax losses maybe? For valuing the shares, we might need to normalise the tax charge first, to avoid over-valuing them (which is what Canaccord does, so the forecasts are fine).

At this point I normally check what the broker says, and helpfully Canaccord has published an update note today on Research Tree, many thanks for that.

It says forecasts “look well underpinned”, so no changes made. That, together with recurring revenues at GMR, and confident outlook comments, indicates to me that the risk of a profit warning seems low at this point in time.

Broker forecast & valuation - full year forecast for FY 12/2023 is £23.0m revenue (£11.5m already done in H1, so that looks like a number that could be beaten in H2 - good).

Adj PBT forecast is £5.9m, and they’ve forecast a normal tax charge of £1.2m (not a credit as has been reported in H1), giving PAT of £4.7m. At a market cap of £107m, I make that a PER of 22.8x, which I think is reasonable, given the strong organic growth trajectory.

FY 12/2024 sees forecast PAT rising 49% to 7.0m, which would bring the PER down to 15.3x, which strikes me as excellent value for a growth company. As we’re now quite late in 2023, we should be shifting towards valuing shares on 2024 forecasts, providing the forecasts are sensible. I think this switch is a main reason why stock markets often have a Q4 rally.

What would I value GMR shares at? I think 20x 2024 forecast is reasonable, which implies a share price target in the shortish term of about 48p - not bad upside on 36p now. That doesn’t factor in any future years’ growth too, it just assumes that nothing goes wrong in 2024, which can’t be guaranteed of course. This is why we diversify, because something unforeseen is bound to go wrong at one or two companies in our portfolios.

In adj & diluted EPS terms, Canaccord has: 1.6p (FY 12/2023), 2.3p (FY 12/2024), and 3.0p (FY 12/2025). That’s impressive earnings growth. Are the forecasts reasonable? I’d say yes, because GMR is clearly demonstrating growth, with lots of new clients (25 in H1 2023), international expansion, and new games (eg. Tetris) in the pipeline.

In the next bull market, investors might tolerate a higher PER for a growth company like this, maybe 25-30x? That would mean a share price target of 75-90p on 2025 forecasts. Compared with the price of 36p now, I find that a very attractive investment proposition, if we're patient.

Outlook - is in line with market expectations for FY 12/2023 -

Licensing revenue increased 20% in the two months post period-end compared to the same period in 2022…

…we are confident of further growth for the remainder of the year and the Board remains comfortable with market expectations around FY23 financial performance.

…"The Group has a strong pipeline of new business and the outlook for the Group remains positive. We are seeing growth in our existing partnerships coupled with new operator, product and market launches, which gives us great confidence in terms of the longer term prospects for the business."

Balance sheet - it’s capital light, being a licensing business model for protected IP, which is good.

Receivables look high at £5.2m, which is 45% of H1 revenues (I would expect to see something nearer 20-30% of H1 revenues in receivables). This would be a good question to ask management if they do a webinar.

There’s no interest-bearing debt, which is great. Cash has gone up from £2.9m a year earlier, to £4.5m at June 2023, which is excellent - I very much like companies where cash builds up on the balance sheet, as it lowers risk, and shows that management are disciplined, and don’t squander available cash. It also means divis might be on the cards at some point in future, although the current policy is not to pay shareholders anything.

Creditors are very modest, so no issues there.

NAV is £20.5m, less intangible assets of £12.6m, gives NTAV of £7.9m. That may not sound much, but for a capital-light business with negligible fixed assets, this is more than adequate. So a thumbs up for a decent balance sheet, hence lower risk I’d say. It shouldn't need to dilute, unless making a big acquisition.

Cashflow statement - H1 operating cashflow is healthy at £4.5m in H1, more than double last year. Tax payments of £579k reduces this to £3.94m post-tax operating cash generation in H1.

The big outflow is £2.2m in capitalised development spending (which is almost certainly just internal payroll costs), so this is an ongoing, regular cost, the way I see it, although capitalising it is perfectly allowable accounting treatment. We just have to remember that it’s a cash cost, that is not paid for by the tooth fairy!

Overall the H1 result is a £1.6m increase in cash.

Therefore the cashflow statement also gets a thumbs up from me - this is a simple & clear statement, and shows a decently, genuinely cash generative business.

Questions for management -

Why are receivables so high, at almost half of H1 revenue?

Why is there a corporation tax credit in the H1 figures, and will this normalise as a charge in the full year (as Canaccord forecasts)?

GMR looks capable of paying a dividend now, is this being considered?

Paul’s opinion - I really like this, and view it positively, so GREEN.

Management has plenty of skin in the game, and the trigger for me buying was NED Mark Blandford (founder of Sportingbet) making some chunky (over £100k each) buys.

This is a genuinely cash generative, organic growth company, on a moderate valuation multiple. It has a strong balance sheet with net cash (growing). Outlook sounds positive, with good growth drivers that look set to continue.

The only negative I can think of, is that some investors might not want to invest in software for gambling websites, given the social damage that gambling addiction creates (I’ve had to deal personally with the aftermath of 2 good friends recently confiding in me that they’ve squandered tens of thousands, getting into debt, etc, mindlessly playing online casinos).

Changes in gambling regulations could also be a benefit, if loosened, or a threat if tightened up. Although GMR has a wide geographic spread, which should protect it.

Overall, I’d say the numbers and GMR make it look a very convincing GARP (growth at reasonable price) share, I like it a lot. Do remember that I own it personally, so I’m biased, but as always, have tried to appraise it with an open mind. Let me know what you think (good, bad, or middling) after doing your own research - we like to consider a range of views here.

For chart followers, this looks like a bowl to me! (which some prominent investors like, eg CockneyRebel).

Stockopedia's computers looked sternly away, rolling their eyes, until earlier this year, when they raised the StockRank considerably, now upper-middling at 57 -

DX (Group) (LON:DX.)

43.5p (£263m) - Possible Offer - Paul - GREEN

This was issued yesterday afternoon, and has triggered a price rise from c.36p before the news, to 43.5p now, a rise of 21%.

DX says -

“it has received a non binding and conditional proposal from H.I.G European Capital Partners regarding a possible all cash offer for the company at a price of 48.5 pence per DX share”.

DX says it had rejected previous approaches from HIG, but 48.5p is now high enough for the Board to recommend it, should HIG proceed.

So it is now proceeding with giving HIG access to the books, to start doing due diligence (checking the figures and legal stuff like contracts, leases, etc).

Paul’s view - we reviewed DX positively here on 15/12/2022, 1/2/2023, and 18/7/2023 - in all 3 cases viewing it as GREEN, noting the low PER, good yield net cash, and a convincing turnaround. Each investor has to make up your own mind now, whether to sell some in the market now, banking a useful gain. Or whether to hold, and hopefully get another 11% upside from the deal going through, if it does. If it falls through, then I imagine the price would fall back maybe 10-20% to pre-approach levels. Or another bidder might appear, who knows? This type of business will never attract a premium rating.

Personally, I think the bid price looks fair, and management agreeing to it in principle confirms that. It’s your decision as to what to do next - it’s your money, so your choice!

hVIVO (LON:HVO)

Up 6% to 19.3p (£131m) - Interim Results - Paul - GREEN

hVIVO plc (AIM & Euronext: HVO), the world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces its unaudited interim results for the six-month period ended 30 June 2023.

Headlines - this is what we like to see, upgrades to expectations! -

Strong first half performance and record forward visibility

Upgrade of Full Year Revenue and EBITDA Guidance

H1 key numbers -

Revenue in H1 2023 up a very impressive +52% vs H1 2022 to £27.3m

(however, note that H2 2022 was higher, at £30.5m revenues, so sequentially the revenue in H1 2023 is down on H2 2022. It’s difficult to see the historic seasonal pattern of trading, due to lockdowns skewing historic numbers.

Profit before tax of £4.2m is up massively vs £453k in H1 LY.

Note that this year H1 benefited from £530k in finance income, no doubt helped by higher interest rates earning a decent return on the cash pile kindly paid up-front by customers.

Balance sheet - NAV £21.6m. Take off £6.0m intangible assets, give NTAV of £15.6m, or 12% of the market cap, so valuation has only a little support from assets.

Cash of £31.3m is nice, but note 5 shows that £19.4m of this is “deferred income” - i.e. up-front payments made by customers, for services that have not yet been provided (and will cost a lot to provide). So don’t get too carried away with the cash pile. I know the company says it belongs to them, and deposits are not refundable, but most of it will be spent providing services in future.

Or another way to look at it, is that if revenues dried up, then most of the cash would disappear funding services paid for in advance by customers.

On the upside, having a working capital model where customers pay a lot up-front is clearly a very nice business model, so no complaints from me overall.

Overall, I think this is a well-funded business, where dilution or insolvency risks look negligible.

Cashflow statement - looks good, helped by reversal of a receivables increase last year.

Note also the £1.3m boost from R&D tax credits, which is quite a significant help too.

There’s hardly an capex (physical or intangibles).

£3.1m was paid out in divis in H1 2023.

Overall, I’d want to see more of a track record of cash generation. hVIVO is unusual, in that its performance has come from nothing - it was heavily loss-making on small revenues as recently as 2019. Since then it seems to have found a lucrative niche, where it claims to be unique. That could be very exciting if the growth continues, but I’d want to find out more about what competitor activity there is, it doesn’t sound credible to me that there’s none - there must be surely?

Outlook - mainly reiterates previous announcements.

Order book at June 2023 is £78m (up a bit from £70m a year earlier). This could be capacity constrained though, which should be helped by a new facility opening in H1 2024.

Guidance for 2023 is raised (would have been helpful to indicate how much though) -

hVIVO increases its revenue guidance to £55 million (excluding other income) for 2023 and increases its EBITDA margin guidance for 2023 to c.19%...

The outlook for the business remains extremely positive, with revenue for 2023 fully contracted and our orderbook providing excellent visibility over revenue into late 2024

Broker update - many thanks to Liberum for crunching the numbers as follows:

FY 12/2023: forecast revenue upped 2.4% to £55.1m, PBT upped 7.3% to £7.1m. EPS 1.0p, so a PER of 19.3x

FY 12/2024: forecast revenue upped 3.3% to £60.8m, PBT upped 6.6% to £8.2m. EPS 1.1p, so a PER of 17.5x

Webinar - is today, at 18:00 on InvestorMeetCompany, should be interesting.

Paul’s view - I like this share, and flagged it here as GREEN on both 15/1/2023, and 6/2/2023, flagging positive contract wins, cash, and excellent visibility on forward orders. We wobbled a bit in May, going AMBER on the FY 12/2022 results, seeing both bull and bear points, but enthusiasm crept back in on 26/7/2023, with an AMBER/GREEN view, on a good trading update revealing very strong H1 growth, a big order book, and plenty of cash on hand from customers.

Overall now, I think let’s stop beating about the bush, and just get it back to GREEN! The price has gone up a fair bit recently, so personally I wouldn’t want to chase it up beyond a PER of 20x at this stage, which we’re close to. However, I can also see the positives and the story looks very good so far.

Graham’s Section:

GYM (LON:GYM)

Share price: 112p (unch.)

Market cap: £200m

Leading low cost gym operator, The Gym Group, announces its interim results for the six month period ended 30 June 2023.

I’ve been negative on this stock in 2023, due to a failure to match pre-Covid performance levels (especially when adjusted for the inflation seen since 2019).

The share price hasn't moved too far:

Here are today’s interim results:

Revenue +18.5% to £99.8m

Adjusted EBITDA is surely irrelevant due to depreciation. Plus 4.8% to £35.1m.

Adjusted loss before tax £5m (around the same as last year).

Actual loss before tax £6m (£7m loss last year).

The total revenue number is much less interesting than like-for-like figures: are members paying more, on average? And are the same sites making more revenues than they did last year?

The answer is that average revenue per member monthly is up 8.4% year-on-year, i.e. keeping up with inflation.

Like-for-like revenue, i.e. revenue from sites which are at least a few years old - is up 6.9% year-on-year, again keeping up with inflation over the past year.

The company has a metric it calls “Adjusted EBITDA less normalised rent”, which I would ignore due to the missing depreciation charge. However, GYM treats it as a key metric.

This metric is almost unchanged in H1 at £17m: “broadly flat, in line with guidance, with revenue growth offsetting inflationary cost increases”.

Outlook -

“...July and August continued in line with expectations, on track to deliver our plans for the year as a whole. We are maintaining our guidance for FY 2023… that revenue growth will broadly be offset by cost inflation; leverage expected to remain within the range of 1.5 to 2.0x (currently 1.82x)..."

Balance sheet - speaking of leverage, net debt finished the period at £70m (it was £58m in June 2022 and £76m in December 2022). The main source of debt is a bank RCF, subject to quarterly covenants.

Cash flow - cash performance is quite good in the period, and better than reported profits, due to the non-cash depreciation charge far outstripping capex.

Cash inflow from operating activities: £42m

Cash spending on capex etc. outflow £11.5m

Lease-related payments: outflow £21m

Add these up and we get a measure of cash flow that I can get behind: just shy of £10m inflow. Not bad at all.

Chairman comment

"The Gym Group has delivered a solid first half, driving growth in both membership and yield, and remains on track for the full year. I am delighted to welcome [new CEO] Will Orr on board. The actions we have taken to strengthen management, our financial position and the Group's customer proposition will enable us to continue to take advantage of the many growth opportunities in our market under his leadership."

Graham’s view

I am tempted to revert back to a neutral position on this one, but I’ll wait a little longer before doing that. My reasoning is the same as July, when I noted that like-for-like site revenues were still trailing 2019 levels:

Revenue in comparable sites is on an improving trend and is now at 97% of 2019 levels.

In other words, like-for-like revenues are still lower than they were four years ago, and that’s before adjusting for compounded inflation over that time.

It’s no surprise that the company is loss-making once we grasp this simple fact.

As noted by “zipmanpeter” in the comments last time, it’s conceivable that the loss-making city centre sites can be jettisoned in a few years once their leases expire, and that performance could substantially improve once that happens. However, I can’t estimate how long we might have to wait until that happens, or how much the company’s financial performance might improve when it happens.

The bright spot in today’s results is the cash flow statement, but I don’t think I should allow myself to be swayed too much by low capex spending over a six-month period. Net debt is up year-on-year.

So it might be harsh, but I’m keeping my negative view on these shares for the time being. It’s loss-making, significantly indebted, and capital-intensive: not a great combination.

The StockRank takes a more balanced view.

Property Franchise (LON:TPFG)

Share price: 282.5p (+1%)

Market cap: £90m

The Property Franchise Group PLC, the UK's largest property franchisor, is pleased to announce its interim results for the period ended 30 June 2023. [6 months]

We had a trading update from TPFG last month, so had a good idea what to expect today:

Revenue £13.2m, about the same as H1 last year.

Royalty income from franchisees £7.7m (£7.5m in H1 last year).

PBT +11% to £4.2m

Net cash £0.7m

A possible cause of concern might be the lack of top-line growth. I would be inclined to cut the company some slack on that front, given the course that interest rates and the housing market have taken over the past year. The growth in profits is a fine achievement, in this context.

CEO comment:

"It's another period of record revenue for us, outperforming the market in both lettings and sales. Moreover, with continued focus on costs, slightly down despite the pay increases needed by our employees, we have also set another record for profit before tax.”

This year more than any other under my tenure demonstrates the strength of our franchise business model and the power that results from a network of entrepreneurial franchisees seeking to maximise the opportunities in their local marketplaces.

The Board is “confident that trading remains in-line with expectations for the full year.”

The other day, I watched the film The Founder for the first time, about the franchise roll-out of McDonald’s. It showed the early battle between McDonald’s and its franchisees, who were inclined to change the menu from what it was supposed to be. But at the end of the day, the franchise model was unstoppable and the early battles were worth it.

In my opinion, TPFG is working the franchise model beautifully, and has been doing so for years. The model works well both for hamburgers and for real estate! It turns businesses that otherwise might not be very attractive investments (e.g. restaurants) into highly investable enterprises!

Most revenue (61%) in the TPFG network is now from lettings, so this is yet another property-related stock where managing lettings is now the core business. A sign of the times.

Outlook - it’s worth giving you three paragraphs from the outlook statement, as they all seem to be important:

We expect the current market conditions to continue through H2, with a strong lettings market and subdued sales market. That said our resilient business model is well adept to continue to deliver despite the current external trading environment.

The lettings market has shown no signs of cooling, with the lack of supply continuing to increase demand and drive up rents. We have seen double digit growth in H1, a trend we expect to see for the foreseeable future.

The UK sales market is proving to be more resilient than many commentators had been predicting. We have seen an improvement in sales' completion times post period end, with HMRC data for June and July showing an encouragingly positive trend, something we have seen continue through into August.

Graham’s view

No change to my view on this one: a high-quality stock trading at a reasonable price, so I’m positive.

It passes the Stockopedia “Neglected Firms” Screen:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.