Good morning from Paul & Graham!

Reminder - Megan & Lawrence at Stocko HQ are doing a webinar tonight at 18:00, called "Unlocking US Equity Markets: Your Path To Finding Quality Abroad" - previous webinars have been brilliant I think, giving me lots of ideas, so I'm looking forward to this one too (and no, they haven't asked me to plug it, I just plug stuff that I think is useful to you!). Subscribers should have received a sign up email link already.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

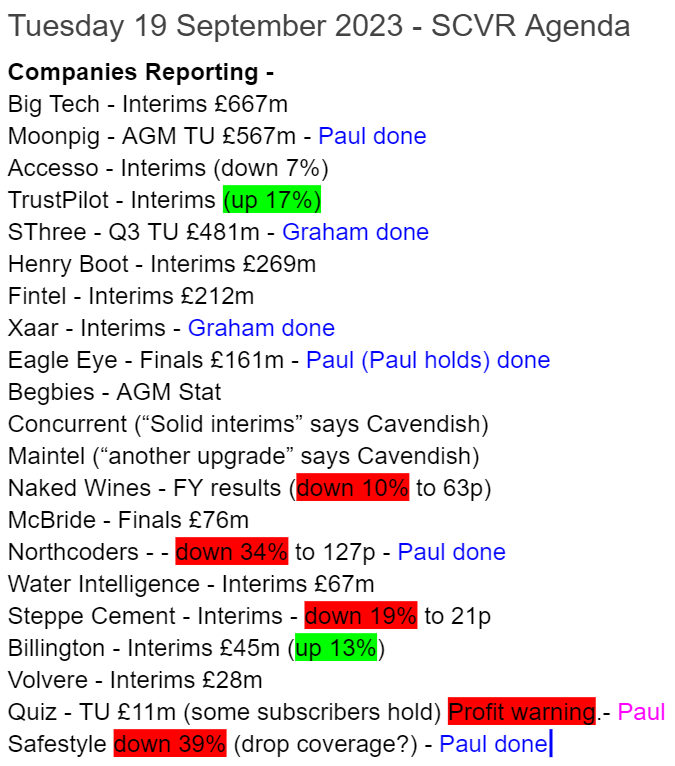

Very busy for news today - we'll probably be covering about half of these at an initial guess, as always focusing on the ones that look most price-sensitive (above or below exps), or in some other way look more interesting -

Summaries

Moonpig (LON:MOON) - 164p (pre market) £564m - AGM Trading Update - Paul - AMBER/RED

Trading is in line with expectations, but with precious little detail provided. I run through the valuation, which looks OK if you ignore the weak, overly indebted balance sheet (hence no divis). I weigh up the pros and cons below, but stick with AMBER/RED in order to highlight the unsatisfactory (to me) balance sheet weakness. That may or may not matter to you - your money your choice!

SThree (LON:STEM) - up 4% to 373p (£503m) - Q3 Trading Update (in line) - Graham - GREEN

Q3 net fees are down 7% year-on-year, but this is in line with expectations and reflects a 6% reduction in average headcount during the quarter (vs. Q3 last year). 2022 was a bumper year and I give SThree credit for tightly managing its costs in a year of fewer opportunities.

Eagle Eye Solutions (LON:EYE) (Paul holds) - flat at 553p (£165m) - Final Results - Paul - GREEN

FY 6/2023 results come out slightly above what was indicated in the last (ahead of expectations) update. I've got a few niggles, explained below, but overall I think the strong organic growth, quality of global clients, big market opportunity, and very sticky recurring revenues, make this share a potential long-term winner. Shareholders have to stomach a high valuation, and overly generous management rewards in the meantime though.

Xaar (LON:XAR) - down 7% to 163.3p (£128m) - 2023 Interim Results (in line) - Graham - AMBER

These interim results are in line but the market might be running out of patience with this one, judging by the share price reaction. The company is betting on a factory upgrade and its next wave of products to turn things around, but I have my doubts.

Safestyle UK (LON:SFE) - down 50% to 4.3p (£6m) - Profit warning - Paul - RED

This is a very concerning update from one of the UK’s largest double glazing companies. It says the market is down heavily (-24% over the summer), and although it is only down 11%, this will result in an underlying trading loss of about 10m for FY 12/2023. This is expected to cause year end net debt of c.£6m. It needs to do an emergency equity fundraise -

The Group intends to engage with stakeholders to strengthen the balance sheet in order to support its recovery and help facilitate future growth.

Paul’s view - I’m sorry to say, it’s clear as day that existing equity is probably now worth little to nothing. New equity (if they can find it at all) is just able to name their price, which is likely to dilute existing holders out of the picture. Or administration is the alternative. Please don’t be tempted to bottom fish here, unless you’re fully prepared to lose 100% of your money. 3 major shareholders might push for a delisting, then refinancing away from prying eyes, perhaps? This won't end well for small shareholders in my view. [no section below].

Northcoders (LON:CODE) - down 33% to 130p (£10m) - Interim Results (and H2 PW) - Paul - RED

A tiny IT training company, much too small to be listed. Small loss in H1 on revenue of £3.5m. Warns that H2 will be “significantly below expectations”, due to customers cancelling or deferring contracts. Hopefully the £1.0m net cash will be enough - balance sheet seems OK, so I think dilution risk is OK. No track record to speak of, so I’m surprised it’s still valued at £10m. Concentrated share ownership, so delisting risk looks high. I can’t see any good reason to get involved here. [no section below]

Rotala (LON:ROL) - up 42% to 59.5p (£18m) - Possible offer at 63.5p - Paul - GREEN

Smashing news just out for shareholders in this bus operator - a possible cash offer from the Directors at 63.5p - from my reading of the announcement, this sounds like it's likely to go ahead, and strikes me as a fair price. ROL caught our eye here at the SCVR on 28 Dec 2022 as a possible buying opportunity at 36p, and was my podcast mystery share that weekend too. So if the outcome is a 63.5p cash bid, then a healthy 76% profit has been made by anyone who followed up the idea. Although liquidity is so poor, I'd be surprised if anyone was able to buy many shares. I forgot to buy any myself, and probably didn't have any spare cash available anyway, oh well never mind! Still, it's nice to get the idea right, even if we don't make any money from it (helps mop up the inevitable mistakes too).

Paul’s Section:

Moonpig (LON:MOON)

164p (pre market) £564m - AGM Trading Update - Paul - AMBER/RED

Moonpig Group plc (the "Group"), the leading online greeting card and gifting platform in the UK and the Netherlands, is holding its Annual General Meeting today. In advance of this, the Group provides an update on its performance for the current financial year (commencing 1 May 2023) to date.

Nothing much to report here, it’s in line -

Trading remains in line with expectations and we reiterate existing guidance.

Except that they’ve forgotten to reiterate what that guidance actually is! Wasting everybody’s time having to look it up.

No mention of cash, liquidity, or in fact any numbers at all.

Outlook -

In the context of the continued challenging macroeconomic environment, we continue to expect pro forma revenue to grow at a low single digit percentage rate in the first half of the current financial year, underpinned by the Moonpig brand, which remains in growth. For the full financial year, we continue to expect consolidated revenue growth at a mid to high single digit percentage rate, with all our brands returning to growth in the second half. Adjusted EBITDA margin is expected to remain resilient.

"Pro forma revenue" - what does that mean?

Who actually wants to be told about EBITDA? Hardly any private investors in my wide network of contacts see EBITDA as a main profit measure. Indeed, most of the fund managers I speak to or listen to on webinars/podcasts also seem to dislike the focus on EBITDA. So why on earth do companies/PRs/brokers give so much focus to a profit measure widely seen as unreliable? It’s an ongoing bugbear, where the city is simply not doing its job of communicating to companies what many/most investors actually want to see in trading updates. Surely it’s the (adjusted if necessary) EPS figure that matters most, and is the most useful? Why not give us several measures, including EPS, and EBITDA, to keep everyone happy?

There are no broker notes available to us on MOON either, another basic error from the company & its advisers.

Valuation - the StockReport shows consensus of 10.3p for FY 4/2024. There are two ways of looking at that -

Bullish view: it’s double the pre-covid EPS level.

Bearish view: EPS has gone nowhere in the last 4 years.

Take your pick! There are always different ways of interpreting the numbers, it’s what makes investing so fascinating.

At 164p per share, the PER is 15.9x - not bad given that it’s perceived as a growth company (although an acquisition masked a drop in revenue & profit earlier this year).

Balance sheet - don’t forget the awful, overly geared balance sheet. This is the main reason it doesn’t pay any divis too - lack of available cash. Moonpig ruined its own balance sheet with an over-priced, ill-timed acquisition.

It’s up to you whether or not you care about the balance sheet weakness. On the upside, it’s a decently cash generative business, so I don’t see the excessive debt as creating an existential crisis here, it’s just something to be aware of, and factor into your valuation calculations. Plus of course debt is expensive now - another reason to ignore EBITDA, as it pretends that debt is free (and that tax doesn't have to be paid).

Paul’s opinion - the main negative is the horrible, overly indebted balance sheet.

On the positive side, Moonpig is a nicely cash generative business, operating at a decent profit margin, and with a very well-known brand name. With the squeeze on consumer incomes now easing (pay rises above inflation now), then perhaps organic growth might resume?

It’s held on to the growth achieved in the pandemic, although it remains to be seen how much additional growth can be achieved, and there’s plenty of competition of various types.

Do you want to pay a higher rating for MOON, when you can buy a highly profitable physical cards shop retailer Card Factory (LON:CARD) (I hold) at a bargain PER of 7.7, about half the rating of MOON?

Note that MOON’s forecast earnings have been steadily declining, whereas CARD have been steadily increasing, another reason calling me towards CARD, and away from MOON.

On that basis I find CARD much more appealing than MOON.

I’ll stick at AMBER/RED for MOON, which is my way of highlighting the weak, overly indebted balance sheet. You might decide that risk is worth taking, that’s up to you, I just like to make sure that people are armed with the full facts.

MOON broker consensus trend -

I see from the chart that MOON seems to have moved above a widely-watched moving average, which could pull in buyers who follow the charts, either entirely, or partially for their decision-making.

Note that it's a 2021 vintage float - so over-priced and opportunistic, like many others of that batch. Still, nobody is forced to buy IPOs -

Eagle Eye Solutions (LON:EYE) (Paul holds)

Flat at 553p (£165m) - Final Results - Paul - GREEN

Eagle Eye, (LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing, is pleased to announce its audited results for the financial year ended 30 June 2023 (the "Year").

An impressive highlights table, but a pity it doesn’t give me the figures I need the most - adj PBT, and adj EPS -

I reviewed EYE’s year-end trading update here on 11 July 2023, and the actual numbers above look slightly ahead of upwardly revised expectations, which is nice.

Outlook - sounds fine - but my hand reacted violently when I read that horrid, meaningless PR phrase “profitable growth” - which doesn’t mean anything! I recoil whenever I see this awful phrase -

Share-based payments - strike me as rather too high, at £2.4m (LY: £1.85m). I seem to recall there’s also a generous performance share plan, although that is based on very demanding stretch targets. Management need to be careful not to let greed take them too far from what is reasonable. That said, they seem to be performing well, so I won’t rock the boat too much (and anyway I’m only in steerage, with a small position, so they won’t hear me over the engine noise!)

Adjustments - note that all the profit comes from adjustments. Bolded figures are FY 6/2023, unbolded are prior year comps. Also note the healthy boost from R&D tax credits, under the UK’s generous support scheme for innovative companies (let’s hope it continues) - Shore Capital's note assumes the taxation is about nil in FY 6/2024, rather than a large credit, which is why the forecast EPS growth is only modest. That would be a good point to investigate - if more R&D tax credits are likely, then it could beat forecast EPS maybe? -

The Untie Nots acquisition was a one-off, and there seems strong strategic rationale for it, judging by an excellent webinar management did at the time explaining the benefits of that deal.

Balance sheet - gives minimal support to the share price, with NTAV of just under £5m. So this share is all about profit growth, not asset backing. The same can be said of many SaaS companies, so it’s not a criticism. EYE has a history of running lean in terms of cash, but that looks OK now, with £9.3m net cash, as expected, at year end.

Although be aware that, as with many software companies, it benefits from getting paid before it pays suppliers. The net current assets position is more realistic, at £4.0m, so a lot of the cash pile is really favourable timing differences, rather than permanently surplus capital.

An unusual item is £2.56m asset shown in non-current assets, called “Contract fulfilment costs”, I’m not completely clear what these costs are, so could do with some clarity on that - something to ask on a webinar perhaps.

Cashflow statement - note that a favourable increase in trade payables boosted cashflow by about a third (which may not necessarily repeat).

The £12.2m cashflow generated was all spent on heavy £5.4m capitalised development spend (which I see as just a normal cost of running the business, that has to keep innovating to survive & prosper), and £6.3m spent on the acquisition of Untie Nots.

The only other big item is £7.1m from an equity raise (to fund Untie Nots).

Nothing untoward here.

Paul’s opinion - as shown above, I do have some niggles with Eagle Eye. To summarise -

Bull points:

Strong organic growth

Blue chip large retailer clients, globally

Big retailers are seeking more relevant, tech-led ways to engage their customers

Proven success of EYE-backed loyalty schemes - becoming a sector leader maybe?

Mostly recurring/repeating revenues

Negligible customer churn, so product clearly works well.

Bear points:

Valuation multiples are high

Overly generous management reward schemes

Balance sheet OK, but doesn’t provide any meaningful valuation support (may not matter though)

New contract implementations take time.

I think that’s a fair appraisal. I have various compartments in my portfolio. EYE is in the long-term hold section, where I’m prepared to pay a lofty valuation for something that could be a big winner long-term, and seems well on the way. It might go wrong at some stage, but so far the figures and newsflow have been very convincing, over the 9 years I’ve been following EYE’s journey as a listed company. I was sceptical for most of that time, but the facts & figures have decisively turned to the positive side - nobody should be ignoring a performance like this, it’s worth investigating more thoroughly, to see if you can tolerate paying the ambitious market cap for it, or not. It takes a lot to get me to pay up for a tech company, but I think this is a rare case of an AIM growth company that actually achieves what it set out to achieve!

Here's the share price since it listed - impressive, but with high performance in one big swoosh up (not a technical term!) -

Graham’s Section:

SThree (LON:STEM)

Share price: 373p (+4%)

Market cap: £503m

SThree plc ("SThree" or the "Group"), the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics ('STEM'), today issues a trading update covering the period 1 June 2023 to 31 August 2023.

This is a Q3 update, as the year-end is in November.

We covered SThree’s H1 results in July, with the company failing to match the boom conditions of 2022 and allowing its Permanent recruitment revenues to shrink further. But I’ve been a fan of this business for years and remained positive on its long-term prospects.

The stock is not too far off its 52-week lows:

Here are the Q3 highlights.

Trading is in line with expectations:

Net fees are down 7% year-on-year, in line with the trends seen in Q2, “against a strong comparative period and ongoing global macro-economic weakness”.

Contract net fees were flat in the quarter. They are now 84% of SThree’s total net fees.

Permanent net fees fell 31% in the quarter, and are now only 16% of total net fees.

“Technology Improvement Programme” is on track and on budget.

SThree has allowed headcount to fall by 21% in its Permanent segment. I continue to view the decline in net fees from this segment as being at least partially a strategic decision. Though it also reflects less opportunity in this segment in the short-term.

In the aftermath of a Covid-related boom, I see that total Life Sciences revenues are down 24%. I believe that this has had a noteworthy impact on Permanent revenues.

Net cash rises to £83m (it was £72m at the end of H1). This underlines my belief that the company could pursue more, low-margin or even unprofitable revenues if it wanted to, but is instead making solid strategic decisions. The net cash position also leaves the company in a strong position to continue making dividend payments (the yield is 4.6% according to Stockopedia).

CEO comment: describes this as “a resilient performance, underpinned by the Group’s strategic focus on Contract”.

Our long-term opportunity is clear, underpinned by structural megatrends driving the acute need for scarce STEM talent. While we remain mindful of the macro-economic uncertainty across global markets, with all lead indicators of the Group's performance monitored closely, we look ahead to the opportunities facing us with optimism… we remain well positioned to source and place the best STEM talent the world needs."

Geographic breakdown: for two consecutive quarters, the Netherlands has been the only country showing revenue growth, and the USA has been the country with the steepest decline (I suspect that this has a lot to do with the USA having the heaviest percentage exposure to Life Sciences).

Graham’s view

This hasn’t been a terribly exciting year for SThree, as it is unable to match the excellent result seen in 2022.

However, that 2022 result was truly remarkable. Growth rarely happens in a straight line and I still think the long-term trajectory is very good:

More context for the 7% decline in net fees is given by the fact that SThree’s average headcount in Q3 was down 6% year-on-year.

So I do view the decline in net fees as being to some extent the result of the company’s own decision-making, rather than being purely the result of forces beyond the company’s control. It has an operating margin KPI which it has no hope of achieving if it does not ensure that headcount is as profitable as possible.

So there’s no change to my view on this one: it’s a well run and attractive recruitment stock, trading at an interesting price for potential investors. Stockopedia gives it a StockRank of 93.

Xaar (LON:XAR)

Share price: 163.3p (-7%)

Market cap: £128m

Xaar plc… the leading inkjet printing technology group, today announces its unaudited interim results for the six months ended 30 June 2023.

We looked at this company’s trading update in August.

Today’s H1 results are in line with expectations, and the company is “confident of delivering full year results in line with its expectations”.

However, with the shares down by 7%, the market doesn’t seem all that impressed.

Revenues are lower and if you ignore the company’s adjustments, the pre-tax loss widens:

As we noted in August, net cash has fallen to just £7.3m. There are some good reasons for this, including a factory upgrade. But for a company with such a volatile financial history, the current cash figure leaves me with little comfort.

CEO comment:

"We remain focused on the successful delivery of our strategy and taking advantage of the significant opportunities that will drive profitable growth. We have seen continued positive momentum across the business, with increased visibility over customer product launches and a robust pipeline.

Our products, especially Aquinox, are generating strong interest from existing and new customers, underlining our leadership in printing highly viscous fluids…

The company provides commentary on its market opportunities and product development initiatives - more detail than is required here.

Printheads - the company says it has maintained market share in the core printheads business. Rising interest rates “have directly impacted capital equipment purchases by some customers in the period”.

Gross margin maintained at 40% “despite inflationary cost pressures and the closing of the Huntingdon factory for two months to complete Phase 1 of the operational re-organisation”.

Outlook excerpt:

Despite the lifting of COVID related restrictions in China, sales volumes in the Printhead business continue to be affected, but we expect market conditions in the sectors in which we operate to improve during H2 2023 and this, coupled with increased customer product launches, will drive higher demand for Xaar printheads.

We have maintained our policy of increased investment in inventory during 2022 and 2023 to ensure the Group is well placed to capitalise on our targeted opportunities and satisfy customer demand.

The “increased investment in inventory” could be a fine source of cash, if it unwinds, but it’s unclear when that might happen.

Estimates: Progressive Equity Research have left their estimates unchanged, including an adjusted PBT estimate of £2.5m for the current year. They also introduce “conservative” 2024 estimates, suggesting a small increase in revenues and adj. PBT rising to £4.2m.

Graham’s view: I’m still neutral on this one, and I’m continuing to lean more towards concern than optimism. Xaar has always been turbulent but this may be its last chance to get things right before it ends up in a net debt position.

Valuation continues to price in an earnings recovery in which it is difficult to have any faith.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.