Good morning from Paul & Graham!

Today's report is now finished.

Mello Monday is tonight at 17:00 - details here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Here's what has caught our eye today -

Summaries

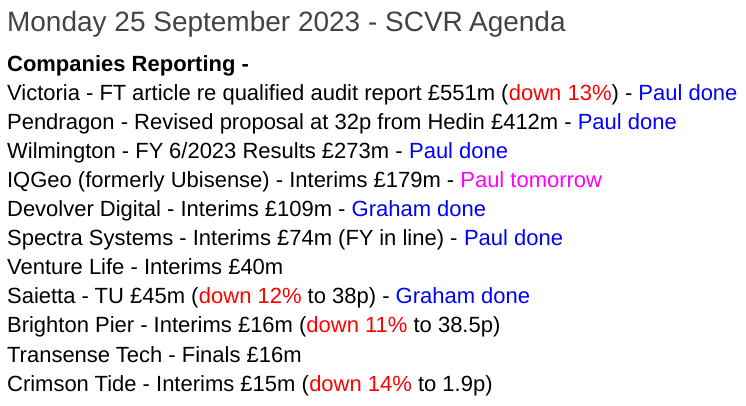

Spectra Systems (LON:SPSY) - 166p (pre market) £74m - Interim Results - Paul - GREEN

Excellent H1 numbers, with most of the FY 12/2023 forecast earnings already in the bag, so I expect an earnings beat later this year. The cash pile is 18% of the market cap. Generous divis from healthy cashflows, with a very asset-light business model. Assuming it continues to perform well, then these numbers stack up very nicely, hence a thumbs up from me.

Pendragon (LON:PDG) - 29.6p (£412m) - Revised proposal from Hedin at 32p - Paul - AMBER

Announced on Friday afternoon, major shareholder Hedin has sweetened its takeover proposal (not yet a formal bid) to 32p. This strikes me as a better offer than the plan by management to sell (too cheaply?) the core business, give shareholders a 16p dividend, then keep a rump holding of its Pinewood software business. Maybe time for PDG management to capitulate?

Devolver Digital (LON:DEVO) - unchanged at 24.4p (£108m) - Half Year Results - Graham - AMBER

This publisher of indie games announces bad results, as expected, and reiterates guidance for adj. EBITDA breakeven in the current year. I keep my neutral stance because it does at least have a large cash balance. Interesting games coming out over the next 12 months.

Victoria (LON:VCP) - down 12% to 486p (£557m) - FT article re audit report - Paul - AMBER/RED

A highly critical FT article today (flagging the qualified audit report issued last week) caused a big spike down in price this morning, for this floor-coverings group. Is it a storm in a teacup, or signs of deeper problems? I don't know. I've taken the opportunity to review the last accounts, and am put off by huge adjustments, and a nasty balance sheet with negative NTAV and far too much debt. So it's definitely not for me.

Saietta (LON:SED) - down 18% at 35p (£36m) - Full-year trading update (earnings downgrade) - Graham - RED

A terrible trading update from this EV drivetrain company. Its cash balance has fallen to little over £1m; it says that this is enough but forecasts suggest a rising net debt position. Its results are late and must be published this week to avoid a rule breach. Bargepole stock.

Wilmington (LON:WIL) - Unch 311p (£273m) - Results FY 6/2023 - Paul - GREEN

Super results from this lovely GARP share. It ticks pretty much all my boxes - good profit growth, high margins, reasonable valuation, strong cashflows, plenty of cash in the bank, and ample dividend paying capacity. I suspect this might become a takeover bid target, and like the shares a lot.

Paul’s Section:

Spectra Systems (LON:SPSY)

166p (pre market) £74m - Interim Results - Paul - GREEN

A nice clear description here of the group’s various niche activities -

Spectra Systems Corporation ("Spectra Systems" or the "Company"), a leader in machine-readable high speed banknote authentication, brand protection technologies and gaming security software, is pleased to announce its interim results for the six months ended 30 June 2023.

I have a favourable impression of this share, and checking my spreadsheet summary (using CTRL+F, ticker), find the following positive previous commentary here -

20 March 2023 - GREEN 170p - 12/2022 results ahead exps. Lots to like, thumbs up.

24 April 2023 - GREEN - 160p - down 13% on abrupt departure of CFO. Paul likes this GARP share.

14 June 2023 - GREEN - 166p - Minor, reassuring update about 2 contracts.

The only concern there is the CFO departure, which can sometimes be a sign of trouble ahead. The share price has been going sideways this year - not bad in a bear market.

Interim Results (6m to 30 June 2023, reporting in US dollars) - key points -

H1 revenue $11.6m (up 25%), helped by earlier delivery of a key contract, WHI note says.

Adj PBT $5.8m (up 59%) note the very high profit margin, at 50% of revenue!

The P&L is characterised by having high margins, and low overheads - this is clearly a lean operation, relying on know-how rather than fixed assets.

Statutory PBT is similar, at $5.5m, so only small adjustments (generally a good thing)

Adj EPS 10.8 US cents.

Outlook - on track to achieve record earnings, and meet market expectations for FY 12/2023, it says. Since Allenby’s full year forecast is 13.1c, and 10.8c is already in the bag from H1, it strikes me that an earnings beat now looks highly probable. Hence risk of a profit warning looks very low.

Balance sheet - very healthy indeed, including $16.6m in cash, about £13.5m (remember to translate all numbers into sterling, easily forgotten!), or 18% of the market cap.

NAV is $27.2m, less $7.0m intangibles, gives NTAV of $20.2m, which is nearly all cash (since fixed assets are minimal). Note that the cash pile is now earning interest, with $172k interest income in H1.

Cashflow statement - looks fine. The simple version is - it generates real cashflows, and pays it out in dividends. That’s pretty much it! There’s little (almost no) capex, again emphasising what a lovely business model this is.

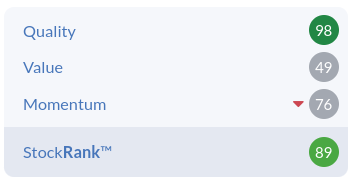

Paul’s opinion - remains very positive. Given the likelihood of an earnings beat, then I’d guess the PER is usefully lower than the 15.1x shown on the StockReport. Something nearer to about 12 is probably more likely, if H2 is even half-decent.

Plus you’ve got c.18% of the market cap in the company’s cash pile (which is mostly permanent, not timing differences from customer payments).

Spectra’s propensity to be generous with dividends is another positive - it’s not often you find high margin growth companies that pay out value share dividend income!

So these numbers get an enthusiastic thumbs up from me, again. Obviously what I cannot tell you is what the future holds. You have to make your own assessment of that, and this is arguably the main skill in investing - spotting future winners. It seems to me that the commentary today contains plenty of interesting nuggets about future business, to be hopeful that strong performance might continue.

So assuming that performance continues to be positive, then the numbers stack up very nicely for this share, hence another thumbs up from me.

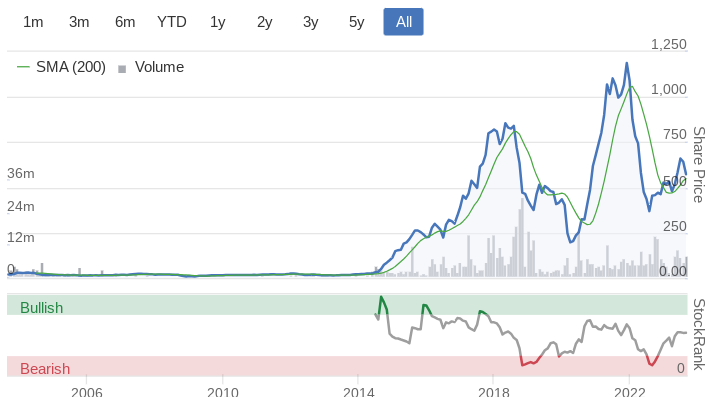

Shares started to take off in 2017, have multibagged since, and not looked back!

Note also the high StockRank, which we like!

Pendragon (LON:PDG)

29.6p (£412m) - Revised proposal from Hedin at 32p - Paul - AMBER

I think this could be the decisive move in the takeover battle for car dealers Pendragon. Major shareholder Hedin/Penske has sweetened its indicative proposal to 32p cash, which I think is more attractive than the company’s original proposal to sell its core business (too cheaply?) to US-based Lithia, then change its listing into the standalone Pinewood software business. That deal would give shareholders a 16p dividend, and a residual holding in a small software company (which many shareholders may not want).

Probably time for management to capitulate.

The shareholder vote on the Lithia deal has to go ahead, as it’s been signed. So the question arises, what would the costs be to terminate the deal with Lithia? Let’s hope the lawyers drew up the contract well to allow PDG to extricate itself without heavy penalties.

Shares have almost doubled in recent weeks, so well done to people who had the sense to hold, I’m still kicking myself for selling just before the approaches were announced. Can’t win ‘em all, so never mind! For remaining holders, it must be tempting to bank some profits in the open market now, as there’s no guarantee the Hedin proposal will go ahead, they haven’t done any due diligence yet. Also, one of the Sunday papers reported that there’s a large contractual dispute with a Far Eastern company at PDG’s software division, which could muddy the water, and be expensive if the case goes against PDG, or could scupper any deal in the meantime, who knows?

Victoria (LON:VCP)

Down 12% to 486p (£557m) - FT article re audit report - Paul - AMBER/RED

A friend flagged up an article in the FT today, which spotted that the recent audit report is qualified, for this rapidly expanding (through lots of acquisitions) floor-coverings group. It’s complicated, and seems to only relate to some kind of shenanigans at a small acquisition. Although VCP management apparently restricted the scope of the audit over this issue, which is not a good look. Therefore I think investors & potential investors here need to carefully scrutinise the audit report in the 2023 Annual Report here.

The FT article seems quite scathing, and it does raise some important questions. Although I think once the initial shock has worn off, it will probably be quite easy for the company to bat away these concerns, no doubt saying that they relate to a tiny, immaterial subsidiary only.

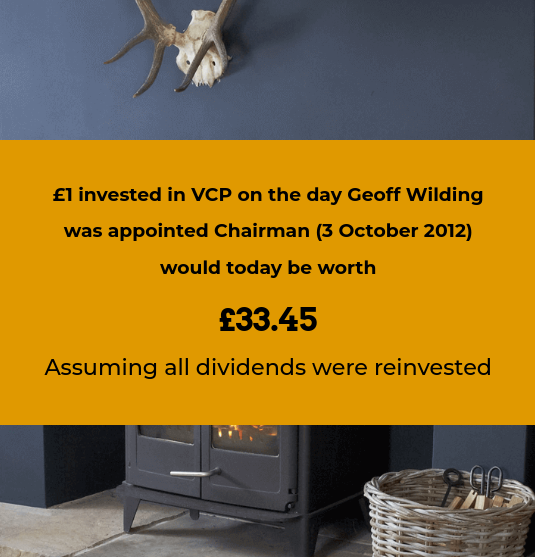

I’ve got mixed feelings about Victoria. I recall a very good meeting with the Chairman a few years ago, where he very convincingly explained his strategy of picking up sleepy, over-capitalised European floor-coverings companies, then applying proper discipline to their processes and working capital, thus freeing up a large part of the acquisition price from the target’s own resources. Clever stuff, no doubt about that.

However, looking at its most recent accounts, what I see is a seriously over-stretched balance sheet, with far too much debt (although a lot of it is secure bonds), heavily negative NTAV, and mind-boggling adjustments that make it impossible for me to deduce whether this thing is highly profitable (adjusted numbers), or loss-making (statutory numbers).

Paul’s opinion - I don’t understand the accounts, they’re too complicated and over-adjusted. But I can see a weak balance sheet when I see one.

Overall then, I think it’s too risky and opaque for me to consider investing in, hence my overall AMBER/RED opinion - just best avoided I think.

The gyrations in share price today have been a nice opportunity for traders, with it spiking down as low as 410p, with a strong rebound currently underway (back up to 505p, down 8% on the day) as I write this (at 11:25).

Opaque accounts, and sometimes dangerous levels of gearing, have been a recipe for a wild rollercoaster ride in share price in recent years. Although Geoff Wilding can still point to this share having been a major multibagger since he got involved. Indeed what I call the "Geoff-ometer" on VCP's investor relations website (below), makes sure we don't lose sight of who created the shareholder value here!

Wilmington (LON:WIL)

Unch 311p (£273m) - Results FY 6/2023 - Paul - GREEN

Wilmington plc, (LSE: WIL, 'Wilmington' or 'the Group') the provider of data, information, education and training services in the global Governance, Risk and Compliance (GRC) markets, today announces its results for the year ended 30 June 2023.

I’m really impressed with the results from this group, so it’s an easy GREEN conclusion.

Here are my notes of the main points for FY 6/2023 -

Revenue up 9% (continuing operations) to £122.1m

Adj PBT £24.1m (up 30%) - note the impressive 20% PBT margin.

“Efficiency of digital-first model” is helping grow margins, very nice.

Regulation, risk, compliance, these all strike me as growth areas to be focusing on, so I like the business model here, and imagine there’s open-ended growth potential internationally (it already sells into 120 countries).

Adj EPS 21.3p (up 27%) is in line with broker forecasts.

PER of 14.6x looks reasonable to me, for a nice quality, growing business that’s good value actually I think.

Total dividends 10.0p (up 22%), giving a 3.2% yield. However note that I think the dividend paying capacity is a lot higher, so there’s scope to grow divis considerably.

Net cash has more than doubled, to £42.2m, and the un-needed bank facility was cancelled in August 2023, due to the strong cash position.

Adjustments are small, with statutory PBT of £24.0m almost identical to adj PBT of £24.1m.

Current trading - in line with expectations. Note that FY 6/2024 forecasts are set quite low, with minimal growth, so I think it’s set up to produce likely earnings beats.

Balance sheet - NAV £80.6m, less intangibles of £66.3m, gives £14.3m NTAV - not very much, but it’s an asset-light business model, with cash paid up-front by customers, hence why it’s sitting on a £42.2m cash pile (£33.6m of which has come from up-front subscriptions and deferred income).

Cashflow statement - very impressive, this is a strongly cash generative business. As mentioned above, it could clearly pay much larger divis if it wished. I imagine management is likely to keep using cashflow for more bolt-on acquisitions, self-funded.

Paul’s opinion - highly impressive numbers, this ticks all my boxes as a GARP share (growth at reasonable price). An enthusiastic GREEN from me.

I also think this could be set up nicely to be a bid target, so a potential +30% profit to be had here, if a private equity bidder comes along - this is the sort of quality, high margin, structural growth type of business that is attracting bids at the moment.

High StockRank too, puts the cherry on top!

Graham’s Section:

Devolver Digital (LON:DEVO)

Share price: 24.4p (unchanged)

Market cap: £108m

This is a video game IPO of 2021 vintage that has gone off:

However, in the short-term, the stock has bounced by a remarkable 74% since we looked at it in August.

I took a neutral stance then, as the majority of their market cap was covered in cash at the time (thanks to $65m/£50.6m of cash on the balance sheet).

Let’s take a look at today's interim results.

Highlights:

Revenues were $43.9m, down 17%. It’s rare that a company is so reluctant to share its absolute revenue figure - you have to scroll down through lots of other commentary and information before finding this!

Statutory net loss $10.1m (last year: $16.6m loss).

As previously announced, “high potential titles have been delayed to 2024 to ensure that they have the time, effort and support to succeed”.

The Texas-based company also “declined subscription deal proposals that undervalued the titles' value and revenue opportunities in 2023 and 2024, resulting in lower subscription revenues.”

Let’s skip ahead to the outlook statement and see if there is anything new:

This is a reiteration of guidance. Zeus (who floated the company at 157p less than two years ago) have left their forecasts unchanged, i.e. adjusted EBITDA of breakeven in the current year, rising to $8m in 2024.

Chairman’s comment excerpt:

"The first half of 2023 was a reset for Devolver, with delays to new releases as we prioritise the quality and long-term potential of major titles scheduled for the second half of 2023 and 2024. Devolver's DNA is to commit relatively low spend on high quality titles that stand the test of time. We look forward to returning to our normal cadence of releases in the rest of 2023 and 2024 with big titles to come such as Wizard With A Gun and The Talos Principle 2, as well as The Plucky Squire and Baby Steps.

Trailers for some of Devolver’s future games can be viewed here and here, for example - I must admit they look very nice!

Cost management - there is “a group-wide exercise to reduce overall expenses”, including rents, professional fees, and admin. They are also going to seek co-funding for publishing larger titles in future.

Graham’s view

The cash flow statement shows $15m flowing out of the company in H1, although hopefully the $7m spent on buying back shares (to fund staff bonuses) is a one-off event.

If we treat that as a non-recurring event, then the cash flow performance is not too concerning - again, considering the company’s very large cash reserves.

The games are quirky and fun, but they are indie games, not flagship titles. Personally, I find the appeal of indie games difficult to understand: if you have a modern gaming console, why wouldn’t you want to play games that push the technology to the limit with the most advanced graphics and gameplay possible?

That said, there is clearly a large market for indie games. The trailer for Devolver’s delayed title Wizard with a Gun has amassed 1.2 million views, for example. There is clearly a good deal of excitement around it, but also frustration that the game has been delayed for so long.

I’m remaining neutral on this share:

The June cash balance still covers nearly half of the market cap.

Financial performance should improve with a much busier release schedule coming up than the company had in H1.

Against that, the track record in terms of profitability is patchy and the company doesn’t have much of a financial history to hang your hat on. I have some doubts when it comes to investing in indie video games and there is probably no one who can estimate with confidence what this company’s financial performance might look like a few years from now. So there isn’t any other option for me but a neutral stance.

Saietta (LON:SED)

Share price: 35p (-18%)

Market cap: £36m

This “electric vehicle drivetrain ("eDrive") specialist” has given a full-year trading update ahead of its AGM tomorrow.

It still doesn’t have full-year results for FY March 2023 (!) and it is remarkable that its AGM will go ahead without an annual report for the prior year.

The Company is concluding the preparation of the annual report and accounts for the 12 months ended 31 March 2023 which have been delayed to allow time to conduct the impact assessment for impairment of intangible assets arising from the discontinuance of Retromotion activities, the revised contractual arrangements with Consolidated Metco Inc ("ConMet") and the suspension of marine product commercialisation. The annual report and accounts will therefore be released after the AGM with a target date of 29 September.

Remember that there is a six-month rule for AIM-listed companies to publish their annual results, and so Saietta is set to run right up against this deadline. If they miss that deadline, things could get messy.

We haven’t covered this one since Paul looked at it in April. Saietta’s CEO resigned shortly afterwards; a new CEO will join in October.

Here are the unaudited results for FY March 2023:

Revenue +40% to £6m

Adjusted EBITDA loss £9.9m, including losses from discontinued activity of £6.4m.

Pre-tax loss £23.8m including all writedowns and discontinued activities.

You probably don’t need me to tell you that this is about as bad as it gets.

And now for the cash position:

Cash as at 31 March 2023 period end of £7.3m (2022: £18.4m) and at end of August 2023 of £1.2m which, combined with additional sums receivable from key customers and JV partners, the Board is confident that this provides the Company with sufficient funding to meet its current requirements for its focused AFT eDrive production plan.

This does not sound believable to me, although the company insists that it has restructured and cut its operating costs significantly. Does this mean that £1.2m is enough? Personally, I would be very surprised.

The company’s broker estimates that it will have a net debt position of £5m by the end of the current financial year (FY March 2024), and £10m by the end of FY March 2025. The broker also significantly downgrades EBITDA expectations for the next two years.

Outlook

It is now working on one product category only::

Led by immediate customer requirements, Saietta is undergoing a transformational shift from a multi-segment product development company to a focused eDrive manufacturing business. The Board expects to be able to announce production contracts and specific developments in this regard over the coming weeks.

Chairman comment:

Saietta has reached the point of inflection as we expect to go into series production at our manufacturing plants in Sunderland, UK and at our all-new facility in Delhi, India. We are focused very heavily on our core target market of lightweight electric vehicles (LEVs) which offers the biggest, nearest and most certain commercial opportunities…

Graham’s view

I have to put this in the “bargepole” category, for a number of reasons:

Extremely large losses, with the company still a long way from breakeven.

Balance sheet weakness: very little cash left and a very strong risk of dilution (which actually would not be a bad outcome - it could be worse).

Late results: shares are suspended if companies can’t get their results out within six months. Not only is it very inconvenient for shareholders to have to wait so long for audited results, but it also suggests that there are more problems inside the company, if it can’t get its numbers audited in a reasonable timeframe.

Two thumbs down from me; I would avoid these shares with great enthusiasm.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.