Good morning from Graham and Paul!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

There's far too much for us to cover everything today, but this is what we'll attempt to review - I've parked some of these for tomorrow -

Summaries

IQGeo (LON:IQG) - down 8% y’day to 267p (£164m) - Interims - Paul - AMBER/RED

Very rapid growth from this interesting software company. Looks set to have a breakthrough year into profit (at last). However, the balance sheet concerns me, in particular excessive and overdue receivables, which needs explaining/resolving, as it could sow the seeds for a future write-off. Hence I'm wary because of this specific issue, and valuation looks like it's run ahead of things a bit.

PCI- PAL (LON:PCIP) - 49p pre-market (£32m) - Wins patent case - Paul - AMBER/GREEN

"Total victory" declared PCIP last night, in its UK High Court patent case. Expect a strong rebound in share price today. Well done to holders, this removes a big uncertainty and cash drain.

A G Barr (LON:BAG) - down 1% to 486p - Interim Results (in line) - Graham - GREEN

This Scottish soft drinks maker confirms it’s trading in line with recently upgraded expectations. It grabs volume and market share in an industry struggling with high inflation and lower volumes. I remain a fan of Barr, despite the significant sector challenges it faces.

Videndum (LON:VID) - down 33% to 370p (£172m) - Interims - Paul - RED

Another profit warning, but worse than that, it says an equity raise may now be needed to ease the excessive bank debt. There's also a worrying "material uncertainty" over going concern. We've previously warned here earlier this year about the problem level of bank debt. I see this as too risky until it's refinanced, so uninvestable for now.

Redde Northgate (LON:REDD) - up 2% to 340p (£773m) - AGM Statement - Paul - GREEN

A positive-sounding update, with demand still outstripping supply of vehicles, and residual values remaining strong. That won't last forever of course. So the impressive value stats (a yield above the PER, and full asset backing) may not last at these levels. Extremely tempting to pick up a few at this attractive valuation, I reckon.

tinyBuild (LON:TBLD) - down 21% to 9.9p (£19m) - 2023 Half Year Results (in line) - Graham - AMBER

I’m stubbornly sticking with a neutral stance here despite the company suffering very badly: revenues are sharply lower and recently downgraded expectations may be vulnerable in H2. It still has some cash and forecasts suggest that cash flow breakeven is possible next year.

ASOS (LON:ASC) - down 1% to 381p (£457m) - Trading Statement - Paul - AMBER/RED

Lots of information as usual in this year-end update, which is difficult to pull together. Profits at bottom end of range, and cashflow not as good as expected. But heavy discounting means inventories have been greatly reduced, which is encouraging. I need to see the full accounts to form a firmer view, but remain sceptical, as Asos still has big problems to sort out.

Paul’s Section:

IQGeo (LON:IQG)

Down 8% y’day to 267p (£164m) - Interims - Paul - AMBER/RED

IQGeo Group plc (AIM: IQG), a market leading provider of geospatial productivity and collaboration software for the telecoms and utility network industries, is pleased to announce its interim results for the six months ended 30 June 2023.

I haven’t looked at this company for over 5 years, when it used to be called Ubisense, but always seemed to be promising jam tomorrow, and generating losses, hence I lost interest.

Things seem to have moved on considerably since then, with a big rise in revenues, although still loss-making, and a multibagging share price.

It recently caught my eye when a fund manager was raving about it on a podcast, saying how interesting and useful its software is for utilities companies to track and identify their infrastructure. So I made a mental note to take a look at the next set of numbers, which were published yesterday (interim results).

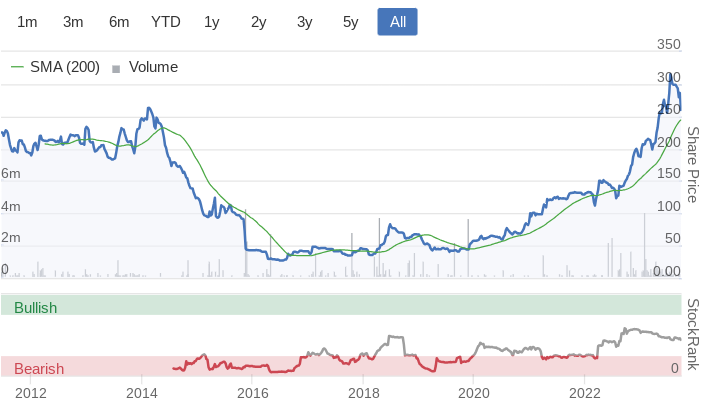

The Stocko graphs below show that it could be about to break into significant profitability (at long last) -

Key numbers for H1 results (to June 2023) -

Very strong revenue growth, up 124% (83% organic) to £20.5m in H1

Exit ARR (annual recurring revenue) is £16.9m, so less than half revenues are recurring (only 35% in H1), which is quite low for a software company.

Costs are also rising fast, which blunts the operational gearing.

Comsof acquisition is going well.

Outlook - in line exps, says outlook is very positive.

Adj EBITDA £2.7m (up strongly from £0.2m in H1 LY)

Loss before tax of £(177)k, slight improvement from £(483)k in H1 LY

Here’s the reconciliation from EBITDA to the small PBT loss (bold is this year, unbold is LY comparative)-

Balance sheet - I do enjoy it when I find a problem balance sheet, and there is definitely a problem here.

NAV of £21.8m is nearly all intangible assets (of £20.1m), so NTAV is threadbare at only £1.7m. To be fair, software companies don’t usually need much in assets, as there’s negligible fixed assets to finance, and customers often pay up-front. Even so, for £164 market cap company, I would have liked at least some asset backing.

Cash of £6.9m is OK, although trade creditors contains £8.2m deferred income (the amount customers have paid up-front).

This is the problem - receivables (unpaid customer invoices) looks far too high at £13.9m. This item should usually be about 60 days sales + VAT. So c.£8.2m would be about right. There’s actually another £5.7m over and above what’s reasonable. I cannot find any explanation as to why receivables is so high. So I looked at the 2022 Annual Report, and this also showed excessive receivables, with the notes showing that £908k was more than 90 days overdue, and £7.0m was 0-90 days overdue. It alluded to customers having financial problems, hence not having paid their invoices on time.

It looks as if the position has not been resolved in the latest interim numbers.

So we need to find out who these late-paying customers are, why they’re paying late (it might be disputed invoices, not necessarily financial stress), and whether it has since been resolved.

The danger is that IQG might be forced into making bad debt provisions against receivables, which would essentially mean that some previously reported profit was invalid.

Hence we have here the possible seeds for a future profit warning, if receivables write-offs are required. For this reason, I’m wary of this share, and wouldn’t invest unless the excessive receivables issue has been explained and resolved.

Paul’s opinion - looks an interesting company, but I think the market cap might have overshot on the upside for the time being. Also I would need to see the issue of excessive receivables explained/resolved, as that’s too large a risk factor at present, the way I read the numbers.

That said, the very rapid growth does look exciting

PCI- PAL (LON:PCIP)

49p pre-market (£32m) - Wins patent case - Paul - AMBER/GREEN

“Total victory” thundered PCIP last night in an RNS, concerning its expensive & protracted UK High Court battle over patents with competitor Sycurio. More details will follow shortly.

Paul’s opinion - this seems excellent news for PCIP, since the patent case cast a cloud over the company, and was absorbing a lot of fairly scarce cash. Therefore to remove this uncertainty, and financial drag (not to mention management time) is a big boost for the shares.

I think there was also a US action ongoing, so am not sure if/how that is affected by the UK court victory for PCIP. Also what happens with costs, who pays those?

It’s fun to guess what the share price might do (writing this at 07:50), I’m going to say a decent jump could be on the cards, maybe 60-75p today? That looks justified on fundamentals. Anything above that would be getting a little excessive I think. After all, PCIP is still very small, and modestly loss-making, albeit with strong organic growth, so let’s not get too euphoric!

Videndum (LON:VID)

Down 33% to 370p (£172m) - Interims - Paul - RED

Videndum plc ("the Company" or "the Group"), the international provider of premium branded hardware products and software solutions to the content creation market, announces its results for the half year ended 30 June 2023.

Chairman announces he’ll be stepping down at the 2024 AGM. The company seems to think he’s done a good job, but I doubt many shareholders would agree with that.

H1 figures are poor, with problems driven by macro, customer de-stocking, and the writers’ & actors strikes in Hollywood deferring film/TV projects and hence purchases of equipment by customers.

Revenues in H1 are down 25% at £165m

Adj PBT down 65% to £10.1m

Statutory loss before tax is very large, at £(50)m, so about £60m of adjustments there, mostly relating to discontinued operations - looks like something quite big went wrong then.

All the above is survivable, understandable, even. However this is the big problem (as we flagged here on 3 May 2023 - an acquisition splurge, funded by taking on excessive debt, now leaves the company in a precarious position.

Net debt of £216.1m is clearly way too high, although this includes £36.2m of lease liabilities, so net bank debt is £180m. It is close to covenant limits, but these have been relaxed for Dec 2023, so no immediate crisis.

Equity raise - here’s the bombshell that, for now, makes this share uninvestable for me - why take the solvency/dilution risk at this stage? I’d rather wait until after it’s refinanced, then look at it fresh, and maybe then benefit from a recovery in trading once the strikes have been resolved -

We have excellent relationships with our banks and the Group is proactively working to reduce leverage and recapitalise the business, which may require an equity raise.

Going concern - is bad, a material uncertainty -

As stated in note 1, these events or conditions, along with the other matters as set forth in note 1 to the condensed set of financial statements, indicate that a material uncertainty exists that may cast significant doubt on the company's ability to continue as a going concern.

Outlook - in a word, uncertain -

Encouraging news about the strikes, however, it is not clear when productions will restart, therefore there is a wide range of potential outcomes for FY 2023, and it is difficult to provide financial guidance. Nonetheless, when productions restart, the Group remains well positioned and we expect to benefit from a significant recovery in revenue

Balance sheet - is weak, with nil NTAV.

Obviously far too much bank debt too, which was a conscious decision management wrongly took, to acquire too many companies, using too much debt.

If even a humble shares blogger foresaw that management had overdone the debt-fuelled acquisitions, it does make me wonder why they did this? Surely it’s just recklessness, and a failure to plan for any downside scenarios?

My opinion - sorry for any subscribers here holding this share. I can understand that the various factors it mentions have hurt performance this year, and there should be a recovery in due course.

However, the weak, overly indebted balance sheet, means it doesn’t have the financial strength to be able to ride out a bad patch. This was caused by poor management decisions, to over-expand, using too much debt.

It’s specifically told us that it might need an equity raise. I’d say that’s almost a certainty actually. Who knows what terms that might be done on? The discount could be modest, or it could be huge, it’s total guesswork at this stage. So I see existing small shareholders as potential lambs to the slaughter, if whoever refinances it with fresh equity demands their pound of flesh.

The beauty is that small shareholders can sell up, and watch from the sidelines if we want to, a massive advantage over institutions, who are high and dry with their large stakes.

We’ll take a fresh look once it’s refinanced, but for now, I see this as much too risky.

Redde Northgate (LON:REDD)

Up 2% to 340p (£773m) - AGM Statement - Paul - GREEN

Strong start to FY2024 with good momentum and healthy demand

Redde is the no fault accident vehicle credit hire company that works co-operatively with insurance companies. Northgate is the white van hire business in UK & Spain. Simple to explain really, unless you’re the company itself, which comes out with this meaningless twaddle -

Redde Northgate plc (LSE:REDD), the leading integrated mobility solutions platform providing services across the vehicle lifecycle…

Today’s update sounds good - key points -

FY 4/2024 has “started very well”, strong trading, healthy demand.

Rentals - demand outstripping (improving) supply still.

Vehicle residual values still high, giving disposal profits.

Redde - new client win, and “robust pipeline”.

Share buyback - done £3.6m of £30.0m planned.

Debt maturities comfortable, out to 2031.

Dividends - final 16.5p, giving total 24.0p (yield 7.1%)

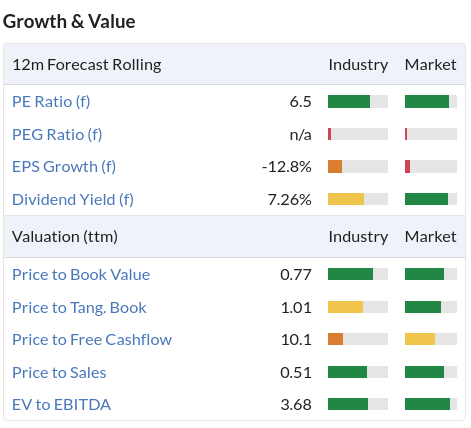

Paul’s opinion - this is looking very tempting again as an entry point. We know that profits are likely to fall at some point in future, as vehicle residual values normalise, so doing some sums to estimate how that might pan out is probably the key thing to research yourself. I don’t have any access to broker notes.

These value stats look highly appealing, especially the yield that’s higher than the PER, and full net tangible asset backing for the market cap. Chips and rice, as they say!

Note the very high StockRank too -

ASOS (LON:ASC)

Down 1% to 381p (£457m) - Trading Statement - Paul - AMBER/RED

This is for the final quarter, and FY 8/2023 (actually 53 weeks to 3 Sept 2023).

Checking back previous SCVRs, I was RED on both 10 May, and 26 May 2023, flagging up awful H1 results, the weak balance sheet, and a very expensive refinancing with specialist lender Bantry Bay. Although on 15 June 2023 I moderated to AMBER/RED, due to a trading update with some signs of improvement, stakebuilding by Frasers, and the potential strategic value of this large, well established online retailer.

Today’s year-end trading update is the usual mish-mash of cherry-picked figures and comments, which are difficult to combine into a coherent overall view. Some key facts & figures -

Revenues down 10% for FY 8/2023 (-12% in Q4) - as expected, since Asos is now chasing profitability, not growth.

Inventories down 30% in the year - this is highly significant I think, as it was seriously over-stocked, which puts a strain on cash. Although it’s having to discount prices (taking a lower gross margin, which has always been too low to begin with, Asos’s achilles heel), and says discounting will continue into FY 8/2024, which isn’t going to help profits.

EBIT at bottom end of £40-60m range is a bit disappointing, and bear in mind it faces large finance costs, which EBIT obviously ignores, so it’s probably loss-making overall still.

“Test and react” model is being used more, and working well - they’re rather late to the party here, other companies like Next and Boohoo have been using that strategy for many years.

Liquidity of £430m sounds ample.

Cash generation - it says has lagged expectations, due to timing differences.

“Partner fulfils” model for third party brands sounds good - which will reduce inventories, and handling costs, this is probably what Asos should have done from the start - just taking a % of the sale, and letting the brands do everything else, and take all the risk.

Exiting unprofitable customers - an increasing trend in eCommerce, and a good thing (e.g. serial returners of large proportions of good ordered, and people using them like a hire shop - wear once and then send back for a refund, etc). Charging for returns in some markets. These are all good, and necessary things - shoppers have been spoiled in the past with free, no quibble, unlimited returns, and it’s become widely abused.

Paul’s opinion - some signs of life at Asos, but it’s a big, lumbering, inefficient ship to turn around. I’d need to see the full accounts for FY 8/2023 before drawing any firm conclusions. I think the shares definitely have some strategic value, since its massive revenues, and established market position with millennials has to be worth something. Could Shein even come knocking on the door with a takeover bid?

The more I look at what Shein, Frasers, etc, are doing in this sector, the less I want to invest in it. Asos shares could go either way, and I don’t really have any particular view on what’s the most likely outcome. Given all the well-known problems at Asos, and its struggle to achieve any level of real profits, I’ve got to stick at a sceptical AMBER/RED for now. Then we’ll react to whatever the newsflow and numbers say in future.

Could the glory days return? Who knows!

Graham’s Section:

A G Barr (LON:BAG)

Share price: 486p (-1%)

Market cap: £544m

This is the soft drinks company whose leading brand is IRN-BRU. The complete list of brands can be found here (including Snapple, owned by Keurig Dr Pepper, which Barr has the right to distribute).

I covered Barr’s ahead-of-expectations trading update in August, and I’ve been positive on the stock in recent years.

The share price has been steady. Here’s the three-year chart:

And now onto today’s H1 results, which come with the headline:

Strong first half performance - confident of delivering full year profit in line with recently increased market expectations.

I’ve highlighted some of the bits I find most important:

Total revenues are up 33% due to the acquisition of Boost Energy Drinks, but the 10.4% like-for-like growth is proof of a strong underlying performance.

I’m also enthused by the 12.6% growth in reported PBT, even if it’s growing more slowly than total revenues.

The decline in adjusted operating profit margin reflects “the impact of current lower margin Boost business model”.

However, they also say that they “chose not to pass on the full impact of cost inflation to customers in order to remain focused on offering consumers great value”. I’m always sceptical when companies say that they haven’t charged more out of generosity to their customers! But I believe that Barr has already raised prices significantly in the post-Covid era, and they may have felt that further large price increases were unnecessary.

Cash - Barr bought Boost for £20m and also spent a few million pounds increasing its ownership of Moma Foods, so this goes a low way towards explaining the fall in the company’s cash balance over the past year. But they still have a very healthy war chest for future acquisitions or internal capex.

I also note that the company says earnings per share would have grown 12% if not for the higher corporate tax rate. So I wouldn’t be overly concerned about the small decline in EPS.

CEO comment:

"We have made significant financial and strategic progress in the first half and have exciting plans in place for the balance of the year to sustain our growth momentum.

We remain confident in delivering a full year profit performance in line with our recently increased market expectations and are well positioned to deliver strong shareholder returns for the long-term."

As we’ve previously noted, this CEO is planning to retire over the next year - I’m expecting a very orderly transition as the company has plenty of time to find his successor.

Comments on the soft drinks industry are relevant for some other shares we cover here, including the likes of Nichols (LON:NICL) and Britvic (LON:BVIC) etc. The UK soft drinks market has increased in value by 8% in H1, even though volumes were down 4.2%. This implies double-digit price inflation. Barr says that they gained “both value and volume market share”. If that has come at the cost of a slightly reduced operating profit margin, perhaps it’s worth it!

Outlook excerpt:

We have strong plans in place across the business for the balance of the year to support our growth momentum. In August we communicated our expectation of delivering a full year profit performance marginally above the top end of analyst consensus. Despite the extended period of poor weather across the summer, we remain confident in delivering in line with these revised market expectations.

Graham’s view

There’s no reason to change my view on A.G. Barr today - I’m a long-term fan of this one, and it remains attractively priced in my opinion:

There are some long-term concerns about the soft drinks industry:

Sugar tax (since 2018) - a sign of things to come, with increasing taxation and regulation of sugary drinks?

Packaging - the deposit return scheme will complicate matters if and when it is introduced (possibly in late 2025)

Competition - there are new entrants to the soft drinks market, particularly from popular YouTubers (e.g. Prime).

So for a variety of reasons, you could argue that Barr should trade on an average mid-teens earnings multiple, i.e. at its current valuation. However, I’ll stick to my guns and continue to give Barr the thumbs up, as I do consider it to be an above-average company trading at an average price.

tinyBuild (LON:TBLD)

Share price: 9.9p (-21%)

Market cap: £19m

tinyBuild (AIM:TBLD), a premium video games publisher and developer with global operations, is pleased to announce its unaudited results for the 6 months ended 30 June 2023.

The market seems to be less pleased than the company is!

Key points:

Revenues down 19% to $23.3m, “primarily due to a sharp drop in development service revenues and underperformance of Versus Evil”.

Adj. operating loss $4.7m

On the income statement, there is an actual operating loss of almost $32m.

The company suffers a $19m impairment of development costs it previously capitalised, along with various other impairments which add up to $28m of balance sheet damage. That explains the difference between the adjusted and the actual operating loss.

Cash: $14.3m, down from $26.5m at the end of December 2022.

The cash flow statement shows $6.5m of cash from operating activities, but then another $17m was spent on software development (the type of spending that just resulted in a huge impairment bill!).

The financial performance is clearly awful, but let’s see if the comments from the company can inspire any hope.

Outlook excerpt:

The combination of a weak macroeconomic environment, geopolitical instability and shifts in the industry dynamics, dampens the Company's growth potential in the near-term.

The pipeline for coming months includes a number of new titles (e.g. Critter Cove, Kill It With Fire 2) and further expansion of the catalogue (e.g. Cartel Tycoon launch on consoles), but headwinds observed in the first half of the year will likely continue to weigh on profitability.

So no, these comments are not going to inspire much hope, but they do also say that they are “on track to deliver results in line with recently-reset expectations”.

I’ve checked the latest note from Progressive Research; they say “meeting estimates will require a recovery in H2 benefitting from seasonality, strong performance from the H1 and H2 releases, and ongoing cost management”. So it sounds as if there is a lot that needs to go right, in order for this to happen.

The 2023 expectations are: revenues of $50m and adjusted PBT of $0.5m.

The 2024 expectations are: revenues of $53.7m and adjusted PBT of $1.1m.

CEO comment:

"The first half of 2023 was a story of two halves, with strong underlying direct sales to consumers, offset by a sudden drop in development service revenues. The speed of change in the video games industry is insane and we know we have to adapt quickly if we want to grow above peers. For this reason, we have been gradually shifting towards what we call the 1000-hour game…

"Our core strategy hasn't changed: we are building a diversified portfolio of own-IP, which gives us the best upside with the minimum risk.”

Graham’s view

Looking back on my notes from June, it would have been reasonable to give this one the thumbs down at the time - it released an absolute horror show profit warning at the time.

Today’s release raises doubts in my mind as to whether full-year expectations can be met, and the downbeat outlook comments suggest that investors should be very careful in terms of their growth expectations moving forwards.

On the other hand, the reason I stayed neutral in June was because the company said that it expected to finish 2023 with cash of between $10-$20 million. It reiterates this statement today, although the analyst at Progressive is estimating only $10.1m, the very bottom end of the range.

Cash is clearly moving in the wrong direction but surely the company is going to want to stop burning it before it gets itself into debt? Now with a sub-£20m market cap, the estimated year-end cash balance does account for a significant portion of the market cap (especially after today’s further share price decline).

Therefore, I still can’t bring myself to give this one the thumbs down. Their acquisitions from 2021 have been impaired; surely they aren’t going to waste their remaining cash pile on more bad deals? They say “M&A multiples still appear anchored to unrealistic expectations, so we stepped away from some potential acquisitions…”, which I take as a positive sign.

On the other hand, their development spend is still huge relative to the size of the company. $17m of capitalised spending in the last six month period is not far off the market cap of the entire company! There is a risk that they are going to spend themselves into shareholder oblivion - but I’ll keep a neutral stance for now, optimistically hoping that they can get back to cash flow breakeven next year, in line with market forecasts.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.