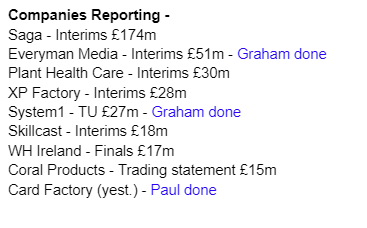

Good morning from Graham and Paul! It's a busy morning for updates, and we will both be presenting at Mello later today.

12pm: I'm wrapping this up now. Hopefully we will get a chance to catch up with the backlog tomorrow. Cheers! Graham

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Everyman Media (LON:EMAN) - down 1% to 55p (£50m) - Interim Results (in line) - Graham - RED

I remain negative on this one as it continues with its ambitious expansion plans despite seeming to be unable to make any money from its existing estate. At some point the capex spend will need to calm down, or else I’m worried for this company’s shareholders.

System1 (LON:SYS1) - up 1% to 212.6p (£30m) - Trading update (ahead) - Graham - AMBER

This marketing company says that it’s set to beat expectations for the current financial year (FY March 2024). That’s good, because those expectations are for adjusted PBT of less than £1m. I continue to wait for this company to prove its quality by showing material profits.

Paul's Section

Card Factory (LON:CARD) (Paul holds) - down 10% to 100p y’day (£343m) - Interim Results (July 2023) - Paul - GREEN

I lowered the priority for this share when the market seemed to baulk at its interim results yesterday, with it slipping downwards as the day went on, usually a sign of lacklustre figures/outlook.

After battling most of the day with intermittent WiFi in my AirBnB in Gozo, and a small number of equally annoying reader comments here, in desperation I headed for a historic town square in Victoria (Gozo), and set myself up for a few hours with a smartphone hotspot, laptop, and some red wine, to review the interim results from Card Factory, the low prices greetings card & gifts retailer.

By mid-afternoon, I really couldn’t fathom why CARD shares were constantly falling. There didn’t seem to be anything amiss in the numbers or the commentary. Several investor friends had already messaged me, asking what’s going on - they couldn’t see anything wrong, so why are people selling? Does it matter? Not if you’re taking a medium to long-term view.

The newswires like to give a quick judgement, and they said “Card Factory falls on weak online sales”. That doesn’t sound credible to me, as online sales are not material at CARD, but were down 13% in H1. I do think CARD has missed a trick with online, and could do far more in this area - having allowed Moonpig (LON:MOON) and others to carve out a large, and profitable niche.

Anyway, here are my notes from reviewing the interim results -

H1 revenue £221m, up 11.5%, with LFL (like-for-like) up about 10% - a very impressive performance in my view, revenues fully keeping up with inflation (not many retailers have managed that).

H1 adj PBT is up 105% to £22.1m

Adj EPS doubled from 2.5p to 5.0p, but bear in mind H1 is the seasonally slower half, with H2 including the bumper Christmas period, so tends to be much more profitable.

Forecast (consensus) for FY 1/2024 is 13.3p, which I think should be comfortably achievable, once we allow for 5.0p done in H1, and the seasonal bias to H2. Could be more, who knows?

Operational things I like - click and collect has been introduced, store refits planned, and 11 net new stores opened.

Outlook - there’s been some criticism of the wording, “confident in delivering a good outturn for the year”, and current trading in line with expectations since the Aug 2023 update. I think people are over-analysing the wording. It looks OK to me.

Confidence in longer term targets set at the Capital Markets event in May 2023.

Investor/analyst meeting at 10am yesterday was recorded and should be up on IR website. It doesn’t seem to be up there yet, but the slide deck is, see here.

Balance sheet - isn’t the best, but it’s actually fine, given the profitable & cash generative nature of the business. NAV of £286m includes £331m of intangible assets, so NTAV is negative at £(45)m. I don’t have a problem with that at all. Fixed assets are modest at only £41m. Note that lease liabilities are modest for the size of business, and RoU assets is almost the same as the lease liabilities, which suggests CARD probably has hardly any loss-making sites. They’re smallish units, on low rents I think, so it has considerable flexibility - the complete opposite of say Superdry, burdened with hideously expensive flagship stores that it cannot afford any more. CARD is more like a Shoezone - nimble, cheap leases.

Dividends - none at the moment, as the tranche A term loan has to be repaid first, on 31 Jan 2024, which then opens the way for divis in FY 1/2025, which of course effectively means calendar 2024 - ie soon!

Paul’s opinion - there’s nothing wrong in these numbers, in my opinion. So why has the share price fallen? Maybe because it’s had a great run, and just needs to consolidate? The biggest shareholder seems to be selling repeatedly in the market, so that looks like an overhang that could persist for a while. Do they know something we don’t? Or do they just need liquidity for any number of reasons? No idea! But if a seller lets me have a good share at a bargain price, I’ll take that trade. So I did top-up a little at c.100p yesterday. I’m keeping some powder dry for more top-ups, if the seller keeps depressing the price.

Also I think a lot of traders latched onto this share, and maybe sold because they didn’t get an instant pop on the results statement, or maybe they hoped for another out-perform update? Again, who knows, we don’t have to fill in a form to disclose why we sell, there are any number of reasons.

What are CARD shares worth? I reckon it’s a 150p share. We can currently buy at 100p, so I think that’s a very nice opportunity.

As always, I’m basing my view on the 3 “f’s” - facts, figures, and forecasts, as they stand today. All of those will change over time, so we have to continuously reassess everything.

The product is very cheap, so I’m not worried about it being discretionary spending. I bought some happy birthday stuff for an elderly relative recently, balloons, sashes, banners, etc, put them up with blu-tak, and for less than a £tenner, it created a lovely surprise. Products are high gross margin, and the whole business model stacks up very nicely I think - especially the focus on improving product ranges into complementary impulse gifts.

Thumbs up from me - there’s nothing wrong in these numbers, and CARD shares are cheap, I reckon. But the persistent seller is keeping a lid on the price for the time being.

Graham's Section

Everyman Media (LON:EMAN)

- Share price: 55.5p (pre-market)

- Market cap: £51m

Everyman Media Group PLC, the independent, premium cinema group, reports its unaudited interim results for the 26 weeks ended 29 June 2023.

Paul had a good look at this one in August on the day of its trading update. I looked at it back in April.

Here are the interim results:

Revenue down 6% to £38m

Adjusted EBITDA (a meaningless number for this company) down 23% to £5.8m

Cash generated from operating activities (another meaningless number, due to high capex which it excludes) down 21% to £7.2m

Scrolling down to the income statement, there is a loss of £4.3 million (much worse than the £0.8m loss in H1 last year).

The cash flow statement shows the £7.2m generated from operating activities. It also shows £12.1m of capex spending, offset by an inflow from the sale of freehold property - a sale and leaseback deal in Crystal Palace.

The only real bright spot in terms of cash flow is nearly £3m received in the form of landlord capital contributions, helping to fund Everyman’s lease payments.

Excluding the additional cash it borrowed from its lenders, Everyman generated a net cash outflow during the period of £2.7m.

If we also wanted to exclude the proceeds from the sale and leaseback deal, the net cash outflow was £6.6m. A far cry from the number posted in the company’s highlights.

Post-period and outlook

Barbie and Oppenheimer were released in July, i.e. after the period covered by these results. They do seem to have boosted the revenue performance significantly:

August YTD Revenue £60.2m (2022: £53.1m)

As discussed in August, the company now has a £35m loan facility with Barclays and NatWest.

Additionally:

The Board remains confident that the financial performance of the Group for the full year ending 28 December 2023 will be in line with market expectations.

The company helpfully discloses that current market forecasts suggest revenues of £94.4m (last year: £78.8m). They also say that the adjusted EBITDA forecast is £17.2m (last year: £14.5m).

CEO comment:

The recent and resounding Box Office success of Barbie and Oppenheimer drove exceptional performance throughout July and August, highlighting the value of high-quality original content. Everyman's strong year to date performance underpins our confidence in meeting market expectations for the full year, whilst equally demonstrating that the UK cinema sector is as vibrant as ever.

We remain confident in our prospects as we continue to be supported by a slate of high-quality second half releases, a carefully expanded estate and new banking facilities which ensure we are well configured to take advantage of future opportunities.

Personally, I share his optimism that H2 film releases will be very good - I’m looking forward to Ridley Scott’s Napoleon and Martin Scorsese’s Killers of the Flower Moon. It should be a good year for cinema!

Food and beverage spend per head increased from £8.96 to £10.25, which seems fine in the context of high inflation and the cost-of-living issues. Everyman also launched a new website, with average monthly visitors of 940,000 (up nearly 18% since launch). Partnerships/working relationships with Jaguar, Green & Black’s and Apple TV+ continue.

Expansion - with 41 cinemas currently, they have six others due to open by the end of the next financial year. On top of that, ”the pipeline for 2025 is well-developed, with several venues at advanced stages of negotiation”.

Graham’s view

The company’s year-to-date revenue performance seems reasonably good, especially considering the current consumer environment. But then Barbie and Oppenheimer were landmark events in cinema and can almost be considered one-off events. I don’t know if 2024/2025 will have anything to match them.

Also, the strikes in Hollywood could become a concern if production does not begin again soon; the company says there has been “minimal disruption” to 2023 but I think the effects will start to feed through if they are not resolved soon (actors and writers have been on strike since May).

But at the end of the day, the biggest problem with this company is that it doesn’t make enough money: not on the income statement, and not on the cash flow statement.

The StockReport also shows cash flow numbers (these are for 2017 to 2022 inclusive).

I’d have more confidence in the company if it didn’t trumpet EBITDA and operating cash numbers which I believe are meaningless to shareholders.

Net debt at the end of August was £17.9m. Balance sheet leases are also valued at over £90m.

It’s possible that free cash flow will turn positive if the company can afford to reduce its capex spend in future; bulls could argue that the company has been in expansion mode, and that the investments made in recent years will pay off handsomely in the years to come.

Perhaps that is true, but personally I’m not convinced and therefore I’m going to maintain the negative stance that I took in April, when the share price was 66p. If the company had net cash that would be one thing. We’ve been down this road before with capital-intensive, financially leveraged companies.

System1 (LON:SYS1)

- Share price: 212.6p (+1%)

- Market cap: £30m

This company’s share price has recovered well since I covered its full-year results in August.

The year-to-date chart shows increasing confidence:

Let’s take a look at the AGM trading statement:

With three trading days left in FY24 H1, it is pleasing to report Platform revenue is approximately 40% above the comparable period in FY23, albeit 2022 was affected by customers' budgetary response to the Ukraine invasion and associated economic shocks.

As I noted in August, what the company refers to as “Platform revenue” includes what it calls “data-led consultancy”.

It argues that this is of a higher quality than the “bespoke consultancy” which it has allowed to decline.

Platform revenue is up 40% compared to the weak H1 period last year. Compared to last year’s H2 period, it is only up by “low double digits”.

Total revenue, including the declining consultancy work, “is projected to rise modestly”.

So again, it comes back to whether you believe that the lost revenue stream is being replaced by a much higher quality revenue stream.

Outlook

The Board is encouraged by trading in FY24 H1 and believes that the Group is well set to outperform the current consensus numbers for Revenue and Adjusted Profit Before Taxation for the current financial year.

Kudos to the company for sharing its view of consensus numbers: revenues £25.7m, adjusted PBT £0.9m.

Last year, it achieved revenues of £23.4m and adjusted PBT of £0.8m.

Chairman’s comment:

The sustained improvement in performance over the past 9 months reflects the clarity on strategy achieved in last year's review of strategic options and the executive team's focus on delivering the plan.

Graham’s view

The struggle for power in the Boardroom has ended here, with the incumbents remaining in charge. They clearly have aspirations to build a high-quality company, but my impression of their work is that it remains quite labour-intensive. Swapping out one form of consultancy for another may be an improvement but it does not, in my mind, create a radically better investment proposition than what the company offered before.

The very low pre-tax profit margin hints at what I’m saying here.

So I’m still neutral on this one. For many years, it has promised to come good, but profits are still barely even high enough to justify a stock market listing.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.