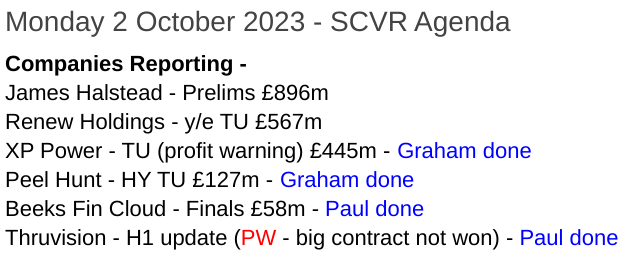

Good morning from Paul & Graham!

Now fully recovered from covid, I'm pleased to say that my summary spreadsheet is updated, and episodes 38 and 39 of my podcasts went out on Sat & Sun. So we're fully up-to-date, and raring to go!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Thruvision (LON:THRU) - 29p (pre market) £43m - H1 Trading Update - Paul - AMBER/RED

A big disappointment today, I'm afraid. The large anticipated order from US Customs has fallen through. This blows a big hole in the revised forecasts, now showing another loss for FY 3/2024. Progressive reckons cash should be OK, if it can unwind some inventories & receivables, but risk of another placing has probably risen. Pity, as this company and its products look quite good, but it's too expensive now.

accesso Technology (LON:ACSO) - up 6% to 659p (£261m) - Share repurchase - Paul - AMBER/RED

I've just realised that I mis-read this announcement, thinking that it was announcing a large share buyback of 4m shares (total is 42m). However, it's actually a repurchase of £4m worth of shares, less than 2% of the total, so not as significant as I thought when I started writing this! I looked at ACSO on 20 Sept, and dislike that the company has spent its cash pile on acquisitions - when I don't see any evidence that its previous acquisitions have added value. Also I think there's a risk that companies making acquisitions might have run out of organic growth opportunities, possibly? [no section below]

XP Power (LON:XPP) - down 46% at 1286p (£250m) - Trading update (profit warning) - Graham – RED

A nasty profit warning from this provider of power supply products, whose awfulness is enhanced by likely debt covenant breaches. The company is “initiating dialogue” with its lenders. I am forced to take a negative stance on this today due to solvency concerns.

Beeks Financial Cloud (LON:BKS) (Paul holds) - Up 3% to 93p (£61m) - Final Results FY 6/2023 - Paul - GREEN

Results as expected. I like the outlook comments, dangling "potentially transformational" contracts at advanced stage of negotiations. That's enough to keep me interested, even though the existing business is only really trading around breakeven, once you adjust staff share options cost back in.

Peel Hunt (LON:PEEL) - up 2% at 85p (£104m) - Half Year Trading Update (in line) - Graham – GREEN

H1 revenue is in line at Peel Hunt: up 3.2% year-on-year. They have been involved in a large IPO (for “CAB Payments”) and should hopefully produce at least a breakeven result for 2023. The balance sheet should provide downside protection for investors here.

Paul’s Section:

Thruvision (LON:THRU)

29p (pre market) £43m - H1 Trading Update - Paul - AMBER/RED

The current financial year is FY 3/2024.

Thruvision (AIM:THRU, "Thruvision" or the "Group"), the leading provider of walk-through security technology, today publishes a trading update for the six months to 30 September 2023 ("H1 2024").

It’s bad news I’m afraid, so holders will need to brace for a potentially difficult day.

…the anticipated order from US Customs and Border Protection (CBP) did not get awarded in September, due to US Federal Government and Departmental budget challenges. Without the CBP order there will be a material impact on the Group's performance in the second half and for the current financial year as a whole.

With an encouraging pipeline of opportunities, it is anticipated that second half revenue will exceed that of the first half. However, without a CBP equipment order this year, it is unlikely that full year revenue will meet current market expectations.

Pity, as the rest of the update mentions some quite encouraging snippets -

H1 revenue £3.5m (up 27%)

Cash £2.3m at end Sept 2023

Major contract win with a new Asian customer (customs agency), and a new Central American customs agency - good validation of the products I think.

H2 revenues expected to exceed H1’s £3.5m, but less than expected due to not winning the anticipated big US contract.

Revised forecasts - have been put out via Progressive, and I’m afraid this is a big miss. Revenues for FY 3/2024 are slashed from £13.6m, to £8.1m. This results in a much bigger loss than expected of adj PBT £(3.2)m.

I would imagine that’s likely to put cash under pressure, so I think the risk of a placing just got a lot higher. Although Progressive reckons cash would be unchanged at £2.8m, which doesn’t tie together well with a loss of £(3.2)m. However, looking at the FY 3/2023 balance sheet, there’s clear scope to reduce inventories and receivables, which might allow THRU to absorb this year’s losses without needing more cash. Maybe.

Progressive suggests the US orders may now be deferred for a year.

Paul’s opinion - unfortunately I think this does a lot of damage to the bull case. FY 3/2024 was forecast to be breakeven at EBITDA level, but performance has now effectively gone backwards to similar to FY 3/2022.

Given this backward step, and the fact that it’s getting a bit tight for cash, then I don’t see how the £43m market cap can be justified any more. Pity, as THRU looks quite a promising company, with good products (that detect concealed objects as people walk through a scanner).

Last time I looked at THRU on 21 July, I was AMBER, and mentioned the dependence on US Customs as a risk factor. Today’s disappointment means we don’t have a lot of choice than to go down to AMBER/RED. It would need to at least halve in price to tempt me to have a punt on this, given the failure to win a key contract.

Beeks Financial Cloud (LON:BKS) (Paul holds)

Up 3% to 93p (£61m) - Final Results FY 6/2023 - Paul - GREEN

I last looked at this cloud SaaS specialist for financial markets here on 6 Sept 2023, when it issued a rather annoying FY 6/2023 trading update which tried to gloss over the reality that it had missed forecast revenue by about 10%. Canaccord clarified that underlying PBT of £2.3m was short of its forecast of £3.1m. It did however come with more upbeat commentary on the new financial year, which seems to have started well, and in line with exps for FY 6/2024.

Moving on to today’s FY 6/2023 numbers, here are my notes -

Revenue £22.4m (up 22%), roughly what was expected.

Underlying PBT £2.33m, again roughly as expected.

NB. Note that they adjust out £2.3m cost of shares based payments (for staff, not mgt), which I regard as a payroll cost, so I see underlying profit as being about breakeven.

Big contract in Johannesburg stock market has just gone live.

Record pipeline, some at advanced stage - potentially transformational contracts, which take time to deliver, as we’ve been told before.

Growth acceleration forecast for FY 6/2024 - Progressive note shows revenue rising from £22.4m to £29.1m - if achieved I think that could trigger a re-rating.

Paul’s opinion - this has been quite a painful long-term hold for me, but with a lower valuation, and encouraging outlook today (of growth accelerating, and potentially transformational contracts at a late stage of negotiation), I think there’s a catalyst here for a re-rating. So I’ll stick my neck out and say that, based on the facts, figures & forecasts we have available today (which will of course change in future), then this share looks quite attractive to me. So I’ll probably be adding to my position, when funds permit.

The balance sheet looks OK-ish, but this is quite a capex-hungry business, so I think it needs to focus new contracts on getting more cash up-front from customers, something we’ve discussed before.

It’s not the finished article, but Beeks looks to have good potential I reckon, and so far broadly speaking, so good. Very impressive organic growth has been achieved over the years, and in a bull market I think the market cap would be multiples of the current £61m. So good upside I reckon, but we’re having to be patient! The outlook comments seem to be saying we could see some nice big contract wins, which I think would be a nice catalyst for an opening bell jump. Hence why I want to be in this share ahead of possible announcements of that kind.

The main downside risk for me, is if revenues stop growing, and it just gets stuck being around breakeven.

Graham’s Section:

XP Power (LON:XPP)

Share price: 1286p (-46%)

Market cap: £250m

This Q3 trading update is a stark profit warning:

XP Power, one of the world's leading developers and manufacturers of critical power control components to the electronics industry, is today issuing a trading update.

The share price has taken a huge dive:

Key points:

“Weaker end-market demand resulted in some customers deferring shipments into 2024.”

“The economic uncertainty in China has also led to a reduction in demand in that market.”

Presumably using adjusted numbers, operating profit for 2023 should be “broadly similar to last year”.

Last year, adjusted operating profit was £42.9m (before exceptional costs relating to a lawsuit in the United States).

Checking recent forecasts from commissioned researchers, I see that the analysts were previously pencilling in an operating profit of £49.3m in the current financial year.

So we could be looking at a c. 15% reduction in forecasts. It has all materialised in H2, implying a serious deterioration in trading over the last few months.

One bright spot might be that hopefully the adjustments/legal costs will be less severe this time around. H1 results did not include too many adjustments.

Q3 revenues: down 2% year-on-year at constant currencies. That’s a sharp reduction from the revenue performance in H1 this year (plus 24%).

Order book shrinks further from where it was at the end of H1, from £250m to £225m.

The “book to bill” ratio (orders received vs. units shipped) was only 0.6x, as new orders failed to replace orders fulfilled.

A declining order book has been a trend since the industry’s supply chain problems eased, and it was not a worry at first. It was just the reversal of an unusual situation. But it’s becoming more persistent, implying a real slowdown. The company says:

While we have yet to see a recovery in orders from the Semiconductor Manufacturing Equipment sector, our customers’ outlook for 2024 and 2025 is encouraging, although the timing of the overall economic recovery remains uncertain.

Net debt rose last year after the loss of that US legal case. XPP had to pay large damages based on “unjust enrichment”, plus punitive damages. Net debt was £151m at the end of 2022, and fell slightly in the first six months of 2023.

Today we learn that net debt has risen again, to £163m, not helped by adverse foreign exchange movements. When it rains, it pours!

We now expect net debt to rise further by the year-end, reflecting a combination of the higher than planned capital expenditure on the Californian site relocation which will take place in late December, lower than expected revenue and profitability and a less than expected working capital reduction. In order to conserve cash, we have temporarily suspended the build for the new Malaysian plant, which will restart when the market outlook becomes clearer.

Banking covenants: current covenants could be breached in the near-term, so XPP is initiating dialogue with its lenders, to ask for flexibility (it does not say that it has been granted this flexibility yet). They are also exploring “other near-term options to strengthen the balance sheet”.

Dividends have been paid to shareholders on a quarterly basis; no more dividends will be paid this year.

Graham’s view

Checking the archives, I remember that XPP already received covenant flexibility from its lenders back in January of this year. So it’s not as if the company has suddenly started to struggle with the debt load; this has been an ongoing issue.

I took a neutral stance on the shares then, saying that investors could “probably” still have faith in XPP, but that deleveraging needed to be its top priority.

Roland also looked at the stock in August, coming to similar conclusions.

Unfortunately, and it may not be entirely the company’s fault, they haven’t pulled through with the required deleveraging this year. Net debt is up year-to-date, despite what looked like a decent profit performance in H1. The wheels have sadly come off in Q3.

It troubles me that the company didn’t say that it has already received covenant flexibility with its lenders. Typically, when we learn that a company is breaching its covenants, they immediately follow up with the news that the bank is cutting them some slack. That’s not the case here, so we are left with that uncertainty.

In a similar vein, they say that they are “taking appropriate actions to reduce costs and conserve cash”, but they don’t elaborate on the “other near-term options” they are exploring. Does that mean an equity raise?

I don’t like to switch from neutral to red after a severe share price decline, but sadly I am left with little choice here as this update leaves me with a question mark over the company’s solvency; if they need to recapitalise, then we could be looking at some serious shareholder dilution.

I also have to say that the size of this profit warning comes as a shock to me, and I find it hard to trust the explanation that macro conditions are entirely to blame.

For context, here is the total return for the Semiconductor Index (3-year chart):

It’s true that this index has taken a dip over the last few months, but it was much lower last year.

So I’m concerned that there could be more to the story at XPP, as I was not aware that macro conditions were so severe.

While I still think there is a decent business at XPP, the fact is that they have flown too close to the sun when it comes to their balance sheet. The dividends, it turns out, were unsustainable (nearly £20m paid in both 2021 and 2022). Cash may now need to go in the other direction: from shareholders back to the company.

Peel Hunt (LON:PEEL)

Share price: 85p (+2%)

Market cap: £104m

Peel Hunt, a leading UK investment bank, today issues a trading update in respect of the six-month period ended 30 September 2023.

H1 revenues are expected at £42.4m, in line with guidance and up 3.2% year-on-year.

They refer to their “strong balance sheet” - as of March 2023, they had £27m of cash and £102m of total liquid assets.

Net assets at that time were £93m (compare vs. market cap of £104m).

The company also has access to a £30m RCF but it’s undrawn.

Like most small investment banks, the balance sheet here is rock solid.

Investment banking - they were joint bookrunner on the largest UK IPO of the year so far: Cab Payments Holdings (LON:CABP) which raised £335m. Revenues in this division are “significantly ahead” of H1 last year, but “overall deal activity remains subdued”.

Trade execution - revenues are “above pre-Covid levels”, but it sounds like business has been fairly quiet.

Retailbook - gradual progress with this joint venture. Peel Hunt is “hopeful of receiving regulatory approval for RetailBook to operate as a standalone entity in the coming months”.

Copenhagen office - will be operational shortly.

Outlook

Whilst exact timing of recovery cannot be predicted, there are encouraging signs that interest rate rises are bringing inflation under control, and we may be nearing the end of the current tightening cycle. We have the balance sheet strength and regulatory capital to weather the remainder of this cyclical downturn and are well positioned to benefit from the strength of our platform and considerable operational gearing as market conditions normalise.

Graham’s view

Only two years ago, this floated at 228p per share. That’s the difference between a bull market and a bear market: utterly different rates of profitability, and utterly different perceptions of the value of investment bank shares.

I’m going to continue to give this one the green light on the basis that it’s trading not far off its book value, providing downside protection, and there will be a bull market again, some day!

For 2023, I’d like to see Peel Hunt minimise the financial damage and grind out a breakeven result at a minimum. It looks like a marginal profit is currently in the forecasts. Given the lack of activity in the markets, that would be a fine result in my view.

We’ve already seen a good deal of corporate action in this sector: Numis getting bought out, and finnCap/Cenkos merging and changing name. We might see competition between banks continuing to weaken, the longer that these conditions go on, eventually setting them up for some bumper years when circumstances improve.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.