Good morning, it's Paul & Graham here!

It's striking how nearly all the updates today are "in line" - see our agenda below. EDIT - also interesting how it seems almost a lottery as to whether things surge strongly on in line updates (as we see today from Treatt (LON:TET) ) or in other cases, nothing happens, or they even fall on in line updates. The market isn't being rational at the moment, I think because there still seems forced/sentiment selling in some shares, but not others. So if you're trying to make sense of share price movements, don't bother, they often don't make sense right now! It's just supply and demand, driven by all sorts of factors.

I wonder if we are now seeing the capitulation phase of this bear market, with people just giving up and selling in despair? It feels a bit like that doesn't it? You won't find any despair from me or Graham, with such attractive value on offer. Equity investors have to be resilient, and accept that the market quite often takes fright, and experiences big falls. It always recovers though, that's the thing to remember. If you're holding good quality shares with no gearing (both at the companies, and in your portfolio) then we can ride out patches like this, and probably catch one or two takeover bids too. So it's not all doom and gloom by any means.

Some might argue that we need to take some pain now, as a necessary precursor to central banks reducing interest rates in future. As mentioned in my last podcast, I think political pressure is likely to build on central banks to loosen, especially as inflation is now coming down, as supply problems ease, and elections loom. One thing is certain though - nobody knows what will happen, and it will probably surprise everyone, as events of the last year have demonstrated! So the fewer predictions, the better - especially when they're forcefully expressed with total certainty - a sure sign that the commentator is clueless!

Graham Youtube show today (starts 11:30, but recorded) is covering Reach, Impax, and maybe Treatt.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

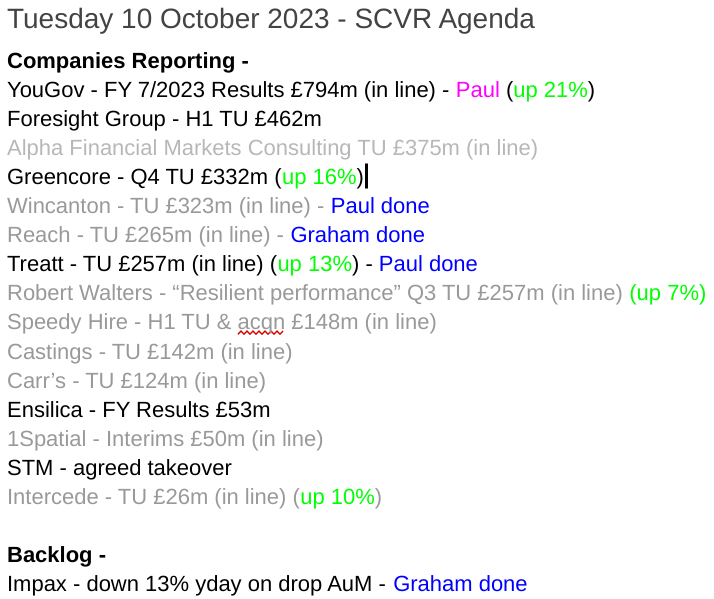

Amazingly, nearly everything is "in line" - so we'll just cherry-pick the companies that we think offer good value/GARP from this list, and the ones that readers tend to discuss the most, and the biggest price movers -

Summaries

Reach (LON:RCH) - up 2% to 82.55p (£262m) - Trading Update (in line) - Graham - GREEN

I remain positive on this, although I do believe that it’s a low-quality punt. More details on the scheduled pension contributions are needed and should be out with the full-year results next year. Enterprise value is probably over £500m but adj. operating profit forecast is c. £95m.

Treatt (LON:TET) - up 13% to 477p (£289m) - Trading Update - Paul - AMBER/GREEN

Despite some de-stocking by customers in H2, it's still managed to achieve FY 9/2023 profit expectations. It's a capital-intensive business (large fixed assets, and excessive inventories stand out), but generates a fairly decent return. There could/should be further upside from the new factory that's not come on stream, and the valuation has at last come down to something a bit more palatable, so I'll move my opinion up from neutral to moderately positive!

Impax Asset Management (LON:IPX) - 408.5p (£540m) - Q4 AUM Update - Graham - GREEN

I’m excited to see this fund manager with a “sustainability” focus trading at value levels. Given the popularity of the niche and the success of Impax, I think this deserves a higher rating than other managers. Inflows are marginally negative but AUM is still up year-on-year.

Wincanton (LON:WIN) - up 1% to 261p (£325m) - Trading Update - Paul - GREEN

Reassuring, in line with expectations year end update. Attractively low PER, good divis, and with the pension scheme now fully funded, the outlook looks bright. I could see earnings rise in future, as this year was hit by a lucrative contract loss. So I remain positive, although I don't like its balance sheet still, but that's not a deal-breaker.

Paul's Section:

Treatt (LON:TET)

Up 13% to 477p (£289m) - Trading Update - Paul - AMBER/GREEN

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, today publishes a trading update for the year ended 30 September 2023 ("FY23").

Profit growth returns with resilient revenue performance

I don't see revenue as resilient, it fell in H2! So this headline is a bit off. I think they should have flagged that profit is in line with expectations, despite softer revenue in H2, that's the key, and stronger message.

A nice 13% surge in share price this morning has grabbed my attention, although it’s in the context of a sharp fall in recent weeks, here’s the year-to-date chart -

To further set the scene, you can see below that forecasts were considerably lowered in autumn 2022, but have been stable since -

This share has previously struck me as too expensive, based on lacklustre forecasts. However, the bull argument was always that the forecasts understated the revenue and gross margin growth potential from its new factory that’s been coming on stream this year.

Graham reviewed its H1 (6m to March 2023) results here on 10/5/2023, key points being - H1 in line with exps, adj PBT up 15% to £7.3m, shares too expensive at 650p (27x forecast PER), outlook in line, and order book strong. He viewed it AMBER at the time.

What’s today’s news then? For starters, even after today’s surge, the price of 477p is much more palatable to me (lower!) than the 650p when Graham last looked at it.

FY 9/2023 revenue £147m, growth of only 5% (3% at constant currency), which it calls “resilient” after “industry de-stocking headwinds”.

(note that H1 revenue growth was +14.6%, so H2 works out at -3.7%, a sharp deterioration versus H1, and this is at a time of food/drink price inflation, so revenues shouldn’t be going down).

Adj PBT guidance is fine though, at c.£17m, in line with Board expectations. That’s a healthy 11.6% PBT margin, indicating some pricing power I’d say.

Passed on cost price inflation successfully.

Good cash generation evidenced by net debt of c.£10.5m (down from £22.4m a year earlier, and £18m at end H1.

Completed refinancing of £25m HSBC facility for 3 years minimum, so liquidity sounds fine, no concerns there, especially as the big capex has now been completed.

New UK factory - “transition now complete”.

FY 9/2023 results due out on 28 November - a fairly prompt reporting cycle.

Why would food/drink makers be destocking? I don’t understand that bit, surely it’s a continuous flow of ingredients? That might be a good question to ask in a webinar. The commentary said customers wanted to hold less inventories, due to higher interest rates - makes sense I suppose, and “early signs of a reversal of this temporary destocking effect..” OK I think that satisfactorily explains it. I was worried talk of de-stocking might be an excuse for an underlying drop in demand, but probably not.

Broker updates/ forecasts - nothing available. Come on Treatt, you need to keep your smaller shareholders & potential investors informed, so get something onto Research Tree please!

As it’s in line, then we can probably rely on the 22.0p broker consensus shown on the StockReport. That gives me a PER of (477p/22.0p) = 21.7x - hardly a bargain.

Although given that the new factory should be kicking in with better margins, and higher production capacity, then I think it’s reasonable to suggest that future earnings might rise to say 25-30p. That gives a PER range of between 15.9x and 19.1x - still not madly exciting. So bulls must be anticipating further growth beyond that - which is a reasonable assumption, as otherwise there wouldn’t have been much point in building & equipping a new state-of-the-art factory.

Balance sheet - as I keep emphasising in my podcasts, we can avoid companies with wobbly balance sheets and debt, which have been some of the worst profit warnings of late, which breach covenants and need more equity funding.

I’m pleased to report that TET’s last balance sheet is really strong, but note it’s tying up an awful lot of capital in both fixed assets, and excessive inventories. The return on that heavy net asset base doesn’t seem exciting. Hence I personally wouldn’t see this as a particularly high quality company, although Stockopedia gives it an upper–middle quality score of 72. Although maybe returns on capital could improve as the new factory beds in?

Paul’s opinion - mildly positive, taking a long-term view, I’ll go with AMBER/GREEN.

Today’s update reassures, and I particularly like that it’s coped with a downturn in H2, blamed on de-stocking, that has been absorbed within existing forecasts - due to nicely offsetting price rises, and cost savings. Note that headcount has reduced by 12%.

It seems reasonable to expect FY 9/2024 figures to further improve on FY 9/2023, so I can see some appeal to this share.

Wincanton (LON:WIN)

Up 1% to 261p (£325m) - Trading Update - Paul - GREEN

Wincanton plc, a leading supply chain partner for UK business, updates on trading for the six months ended 30 September 2023.

This is one of my least successful stock picks for 2023, being down 23% year-to-date, mainly due to a profit warning from the loss of a lucrative contract. Although shares have been making some recovery progress since, despite hideous small cap market conditions.

We had excellent news recently (see SCVR 21 Sept here), confirming what had previously been indicated, that the very cash hungry pension scheme is now fully funded.

A brief update, which strikes me as reassuring -

The Group continues to trade in line with market expectations.[1] As in prior years, profit is expected to be weighted towards the second half of the financial year, reflecting our seasonal peaks and the onboarding of new customer wins.

In line with the Q1 Trading Update, total revenue is expected to be lower year-on-year, reflecting the strategic reorganisation of the Group's transport operations.

[1] Current market consensus for FY24 PBT of £50.3m

This works out at about 31p adj EPS.

I don’t mind H2 weightings if that’s the normal seasonal pattern.

Very helpful also to have a footnote, telling us what market consensus forecast is, thank you for this, all companies should be doing this, to be investor-friendly, no excuses!

Has there been a change of policy at Numis I wonder? Normally they actively repel private investors, and don’t let us anywhere near their clients (which is crazy for small caps!). However this bit below sounds as if it might actually be possible for investors to penetrate the inner sanctum of Numis’s offices to meet Wincanton management. Or am I dreaming?!

Valuation - based on 31p EPS forecast for FY 3/2024, the PER is 8.4x, and I think there’s recovery potential in the future earnings, as this year was hit with the unexpected contract loss.

Paul’s opinion - I still don’t like the balance sheet, but it probably doesn’t matter. The PER is attractively low, and the dividend yield attractive, and sustainable or increasable, given the end of pension cash contributions.

Looks a nice business, and shares seem good value, so I’m happy to stick with my usual GREEN view.

Graham’s Section:

Reach (LON:RCH)

Share price: 82.55p (+2%)

Market cap: £262m

This is an in line update for Q3. Profit expectations are for an adjusted operating profit of £95m.

Revenues remain in reverse, both online and in print:

The explanation is simple enough, and the same as last time:

The factors affecting Q3 digital revenue are unchanged from those outlined in our half year results. These include depressed open market yields and the well-publicised declining digital referral volumes, in particular from Facebook's de-prioritisation of news. As a result over the nine-month period, year-on-year page views declined 21%.

Capital reduction - this is a technical accounting trick whose typical purpose is to allow a company to pay more dividends than its balance sheet would otherwise allow. It’s pleasant news when a company applies for this, as Reach announces that it is doing.

MGN pension scheme - this enormous pension scheme had a deficit of £476m as of December 2016 - you might ask why I’m using a number from 2016, but the company has been taking its time giving us updates on this one!

We are pleased to report that we have now concluded the 2019 triennial valuation for the MGN scheme, and at the same time concluded its 2022 triennial valuation.

The deficit for December 2022 is a mere £219m. Payments to eliminate this deficit will increase from £40.9m to £46m p.a., and will stretch until 2028.

The other pension schemes at Reach - “Trinity” and “MIN” are the subject of ongoing discussion. They are smaller but still material.

Outlook: “confident” of meeting profit expectations.

We do not anticipate the market backdrop to change materially in the near term and as a result we remain focused on the areas within our control; improving customer engagement, diversifying revenues and driving efficiencies. Our plans to reduce full year operating costs by 5-6% remain on track. We expect a High Court judgement on time limitation relating to historical legal issues in the next few months.

The fallout from the phone hacking scandal has been going on for about a decade. I don’t know what the legal position is but surely it must come to an end at some point? There is a six-year statute of limitations for many types of civil lawsuits.

CEO comment:

"This quarter we see continued evidence that our data driven strategy is working, supported by our resilient print business. Through this challenging period we have remained focused on the controllables. We are delivering our Customer Value Strategy and have made progress diversifying our audience. We continue to review our cost base so that we can accelerate our digital transformation."

Graham’s view

As I did before, what I want to do is add up the scheduled pension contributions (ignoring time value of money) to get a simple estimate of the enterprise value here.

The previous total contributions were £300m.

There are some new factors I have to take into account.

Firstly, the MGN scheme contributions are increased by £5m p.a. and are being extended for an extra year.

Secondly, 2023 is nearly over so I’m wondering if nearly all of the 2023 payments have been made already.

Thirdly, the other pension schemes could see adjustments announced in the next few months.

My best guess of future pension contributions is:

2024: £61m

2025: £61m

2026: £62m

2027: £60m

2028: £55m

2029: £9m

Add all of this up and I get £308m. This is a very rough estimate, probably with lots of errors, but hopefully it is somewhere in the ballpark. We will know more when the full year results are announced.

This means my estimate of Reach’s enterprise value is little changed vs. the last time I looked at it: £570m (vs. £540m last time).

With an adjusted operating profit of £95m, even in terrible market conditions and facing an enormous headwind from Facebook, I’m going to maintain my positive stance on this one.

As I said last time, I do consider this one to be a low-quality “punt” but I think the risk:reward is interesting.

The computers love it, for obvious reasons:

And remember that it somehow reached 400p in the post-Covid boom, five times the current share price:

Impax Asset Management (LON:IPX)

Share price: 408.5p

Market cap: £540m

My thoughts turned to Impax the other day when I saw that ESG funds were suffering some significant outflows: £500m withdrawn in August, a record amount for a sector that had been in uptrend like no other.

In a tough environment for flows generally, it seems that ESG is finally beginning to struggle.

Ethical funds and similar mission-oriented investments have been around for decades, but ESG really took off during the last bull market. I’ve previously suggested that after a punishing bear market, investors might want to put a higher immediate priority on returns than on ethics/ESG. Perhaps this is where we are today?

This is the context in which Impax released its Q4 AUM yesterday.

Note that the Impax share price is already down by more than half from the high it reached earlier this year. This brings it comfortably back within the domain of the small-cap report. The share price fell by another 13% yesterday.

In total, it is down by c. 72%:

Latest update:

On 30 September 2023, the Company's AUM totalled £37.4 billion, representing a decrease of 5.8% over the three-month period since 1 July 2023 and an increase of 4.8% over the financial year since 30 September 2022.

CEO comment excerpt:

"Investment conditions continued to remain challenging during the final quarter of our financial year, when moderate redemptions from several of our distribution partners compounded market-driven falls in net asset values…

"Although the macro environment is leading some clients to delay deploying their capital, we remain confident in the strength of our pipeline and our ability to convert. Meanwhile, we continue to develop new investment capabilities while enhancing our operating model to ensure that the business is efficient and scalable."

Checking the tables, I see that net flows are negative for the quarter (minus £893 million) and marginally negative for the full financial year (minus £92 million).

Market movements are negative for the quarter but positive for the year as a whole.

So the full-year performance shows an increase in AUM. It’s remarkable that the market cap can fall so precipitously even though AUM has increased!

Graham’s view

Let’s do my standard calculation, and divide AUM by the market cap. I get £69, i.e. for every £1 invested in Impax, the investor gets £69 of AUM.

This might be the cheapest I’ve ever seen Impax trading at. In May, you only got £42 of AUM for every £1 invested in Impax. The share price had already been cut in half by that point from its all-time high, and I was willing to give the stock the benefit of the doubt then.

So I am certainly going to give it the thumbs up today. Nothing is certain, but personally I think this looks like excellent value here, for a high quality stock.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.