Good morning from Paul & Graham!

Today's report is now finished.

Graham's 11:30 video (also recorded) - featuring Mobico, Restaurant Group, and SIG starts at 11:30 - these are great I think, so I'm tuning in every day! It's like a video/podcast version of the SCVR, and is free, so if you have the time you might like it!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

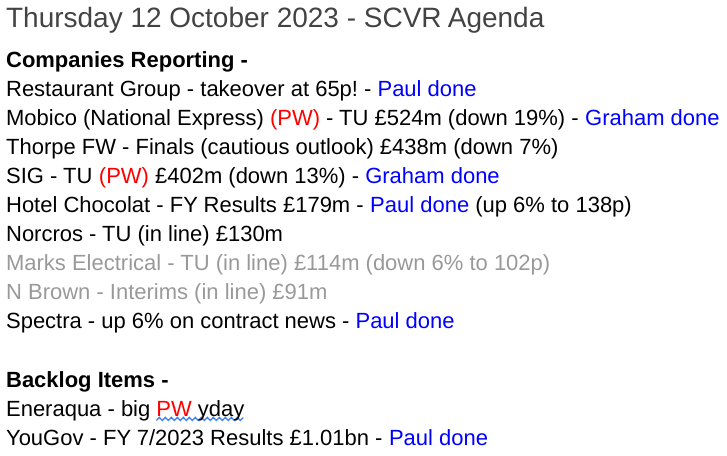

Summaries

YouGov (LON:YOU) - 880p (£1.01bn) - FY 7/2023 Results - Paul - AMBER

Superb figures for FY 7/2023, and lots of positives in the outlook comments too. I rummage through the numbers, and flag up some aspects I'm less happy with, so you can make up your own mind about whether these matter to you or not. A huge acquisition pending will take the balance sheet from net cash to heavy net debt, so they have to get that right. YOU has made tremendous progress over the years, building a much bigger, global business, with lots more to go for, so I definitely wouldn't bet against it.

Restaurant (LON:RTN) - up 37% to 66.4p (£507m) - Recommended cash acquisition of RTN - Paul

Bunting out for shareholders here, with a 65p cash bid from US private equity giant Apollo. It's a very good offer I think, for a struggling, over-indebted hospitality group with a terrible long-term track record of shareholder value destruction. Although its life-raft acquisition of Wagamama is now very much the jewel in its crown. Is this a one-off, or do we need to re-think our attitudes towards the hospitality sector? Discussed in more detail below.

Mobico (LON:MCG) - down 20% to 67.7 (£416m) - Q3 trading update (profit warning) - Graham - AMBER

This has been an awful long-term investment and shareholders have woken to another profit warning this morning. Passenger growth is weaker than expected and costs are higher. I review various factors and conclude that Mobico bonds are a more interesting investment.

Spectra Systems (LON:SPSY) - up 6% to 190p (£81m) - Largest Central Bank Consumables Order - Paul - GREEN

A nice update here, with more detail in a helpful note from WHI. Forecasts now seem very well underpinned, with the chance of beating expectations dangling in front of us I think. I remain bullish on this GARP share with a generous yield, strong balance sheet, and quirky high margin niches. At last the market seems to be noticing that it's doing well, with a modest share price rise of late.

SIG (LON:SHI) - down 14% to 29.3 (£350m) - Q3 trading update (profit warning) - Graham - RED

It was a marginal decision but I’ve decided to go red on this. Profits are trending towards the lower end of market expectations: the company has seen soft demand from Europe and is shrinking in real terms. It now needs cost savings to help it produce a reasonable result.

Hotel Chocolat (LON:HOTC) - up 9% to 142p (£195m) - FY 6/2023 Results - Paul - AMBER/RED

I've moved up a notch, from RED to AMBER/RED. Why? Because the Q1 (Jul-Sep) current trading section contains some nice positives - strong LFL up 13%, better margin, and cost-cutting. That should improve FY 6/2024 profits considerably from the collapse in profit to only breakeven in FY 6/2023. Balance sheet looks robust. But why is the market cap nearly £200m, for a business with such a poor track record? Definitely not for me.

Paul’s Section:

YouGov (LON:YOU)

880p (£1.01bn) - FY 7/2023 Results - Paul - AMBER

YouGov, the international research and data analytics group, announces its results for the year ended 31 July 2023.

- Strong performance amidst a difficult trading environment

- Confident in the Group's prospects for FY24 and meeting current market expectations

It’s been a few years since I looked at YOU. The shares have been very successful, so it’s one that slipped through our net when it was a small cap. I remember (this is c.2016-17) always complaining that its accounts were too aggressive, with heavy capitalisation of intangibles, resulting in little genuine profit pr cashflow. The shares also always looked very expensive. On reflection, clearly there was something good about the business that outweighed those factors, so my caution turned out to be wrong.

As you can see below, it roughly 30-bagged from 2010 to the highs in 2021, albeit with a big downward correction since - opportunity or a new downtrend, who knows, only time will tell!

In the shorter term, there was an explosive upward reaction to recent FY 7/2023 results, although this was largely recovering a recent spike down - here’s the year-to-date (YTD) chart for 2023 -

Quite a few companies have charts looking like this - with even “in line” results triggering a big rebound in some cases - cause for optimism maybe, or just a short term rally in a downtrend? We’ll find out over the next year or so.

What does it do? A nice clear self-description here -

YouGov, the international research and data analytics group, announces its results for the year ended 31 July 2023.

The FY 7/2023 figures are really impressive, here are a few key numbers -

Revenue £258m (up 17%, of which 9% is organic, and 8% from acquisitions)

Adj PBT £56.4% (up 63%, nearly all from organic growth)

Statutory PBT £44.7m - this is the figure I’m using, as I think the adjustments are disallowable, being almost all share-based payments, which I regard as an operating cost (staff & management remuneration). You don’t have to agree with me, that’s just my personal interpretation.

Adj EPS 40.5p (up a very impressive +71%)

Statutory EPS 31.5p (up 100%)

PERs are: adjusted PER 21.7X, and statutory PER 27.9x - not necessarily expensive, given that it’s reporting huge earnings growth, the big question is whether growth continues? If it does, then the relatively high PER could be worth every penny. The high PER in the past turned out to be fully justified, after all.

Net cash is very healthy, at £107m, boosted by £49.8m placing recently (July 2023), as part of the financing to fund a pending, very large acquisition - part of GfK. This is a key point that investors need to research carefully, as it’s so material to YOU, and will result in substantial net debt, so this acquisition has to work.

Outlook comments - positive. Confident in meeting FY 7/2024 market expectations.

Current trading in line. Improving trend from tech customers (who had cut back previously). New CEO from Aug 2023 - another key area to research - eg background, track record, strategy, etc.

Plenty of other positives mentioned - eg demand strong, sticky client relationships, new business momentum, high customer renewal rates.

Operates globally, with US biggest market, second is UK, third is Europe, fourth Asia. So it looks like plenty of market share to go for, as individually quite small in large markets I’d say.

High margins.

Total number of people on its opinion panels: 25.7m! I’m actually on its daily political views channel as a panellist, and I have to say the questions are usually ludicrous - asking ordinary people for opinions on complex geopolitical issues that the vast majority won’t have a clue about. The only intelligent reply is "Not sure", which I usually select, buut few others do. But that’s the social media world of today - everyone has a strong opinion, and speaks like an expert, despite being totally clueless. The result? Actual experts are drowned out by the background noise. Sorry, that’s one of my pet hates, let's move on.

Back to YOU, and I’m certainly impressed by the long list of positive aspects of this business summarised above.

Capitalised spending - an issue in the past, and it’s still aggressively accounted for. The cashflow statement shows capex was only £1.1m of physical items (office furniture and computers, I imagine), whilst development spend capitalised was hefty at £9.0m. Also panel recruitment costs of £7.3m were capitalised, which personally I would prefer to see fully expensed as incurred. At the very least, EBITDA is meaningless.

I’m only flagging this as something for you to consider, and make up your own mind, as there are different ways of viewing this, and of course YOU are within accounting standards (which in practice give a wide range of possible interpretations of profit!), so there’s nothing untoward in capitalising these costs, it’s allowed. Personally I would manually adjust things out, to be more prudent.

Employee shares - note that £10m pa cash is spent buying shares to be given to employees on share option exercises. Is this reasonable? I would say no, since the context is that it paid only £7.7m to shareholders in divis. So it’s a fair question to ask - whose benefit is this company actually being run for? Looks like it’s mainly staff and management to me. I'd want to see the ratio change in favour of shareholders, whilst also recognising that share options can be good for attracting & retaining key staff - providing management don't hog them for themselves! Although if the share price keeps going up, does any of this really matter?

Balance sheet - NAV of £196m, is mostly £114m intangible assets - although you could argue some of these do actually have some real world value.

The pending acquisition of part of GfK will radically change the balance sheet though, with net cash about to turn into hefty net debt, and NTAV will turn negative I think, due to the goodwill. So investors need to carefully check the big acquisition, as it’s making a dramatic change to the balance sheet.

An RNS from 2/10/2023 details the new 280m Euro bank facility to fund the bulk of the 315m Euro GfK consumer panel acquisition (awaiting competition clearance currently, I believe).

An RNS from 6/7/2023 details the rationale for the GfK acquisition, saying it’s an EU required disposal due to a larger deal, an argument being that YOU has achieved a good price for the purchase as it’s been forced. Revenue of 134m Euros, and adjPBT of 24m Euros don’t strike me as a bargain, given YOU has agreed to buy it for 315m Euros. Is this really a good deal? It might be, but I’m just raising a question mark for further digging. It does mention 4m Euro synergies, which helps.

Cashflow statement - the £69m (same in both most recent years) cash generation figure is fantasy, as it ignores capitalised internal costs, and tax. After those real world cash costs, it’s £42m cash generation. Then £3.2m leases rent, and £9.8m purchase of treasury shares for employees needs to come off that figure. So we’re looking at £29m cashflow remaining - not that much for a £1bn market cap company I suggest.

Paul’s opinion - I’ve only reviewed the numbers remember, not done a massive research job on the business itself.

There are lots of positives here, definitely. I can see why some investors like this share, and are prepared to pay top drawer for it. And that’s certainly worked in the past!

I’ve flagged up some negatives above too, so people can make your own mind up about whether or not those matter to you.

Based on just an initial review, I’m happy to go with AMBER, with a slight leaning more towards the positive side on fundamentals, but less keen on the high valuation, but you have to pay up for quality and growth (and then keep our fingers crossed that nothing goes wrong!)

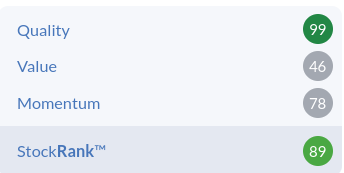

Stockopedia neatly sums it up - great quality, but expensive -

Categorised as a "High Flyer" here -

Restaurant (LON:RTN)

Up 37% to 66.4p (£507m) - Recommended cash acquisition of RTN - Paul

A huge surprise here, I thought the struggling hospitality sector would be one of the last places to see a takeover bid! Lots of bids are happening, but mostly for tech, and healthcare, and structural growth companies. So a struggling, low margin highly indebted restaurant operator seems a strange bid target. Maybe we need to re-think things? Could this be a sector to focus on for recovery, and more deals maybe? Or will this turn out to be a brave but foolish mis-step for the bidder?! Who knows.

Key points -

Bidder is Apollo, a huge American private equity firm (>$500bn assets under management, according to Google) - so this is a tiny deal for the bidder.

Management have agreed this deal, having negotiated improvements on 3 previous offers - well done management, this looks a more than fair price to me.

Price is a 34% premium to yesterday’s price, and shares have been in an improving trend of late.

Valuation (enterprise value = market cap + net bank borrowings), which is customarily done on an EBITDA multiple, is 9x - seems quite a full price, given macro conditions.

Only 19.9% support so far.

The market price has gone to a slight premium today (66.4p at 09:41 on high volume >26m share trades printed, with probably plenty more working in the background and not yet printed). So it looks, at this early stage, as if the market considers there’s a small chance of a higher bid emerging - could get exciting!

Paul’s opinion - I definitely didn’t see this coming! What a surprise. Reading the RNS, it seems Apollo is attracted to RTN’s scale, potential for further expansion, quality of brand (Wagamama is the main one), and good management - not everyone agrees with that, including activist shareholder(s).

They don’t seem to be put off by RTN’s terrible long-term track record of shareholder value destruction, low margins (although planned to increase in the medium term) and excessive debt!

It will be interesting to see if investors see read-across to the small (and tiny) listed restaurant groups at our end of the market? Hostmore (LON:MORE) shares are up 6% as I type this. I’ll take a fresh look at MORE once it’s refinanced, which is in progress, currently making it uninvestable for me personally, with that uncertainty (over dilution/solvency) hanging over it.

The nano-cap restaurants like Tasty (LON:TAST) (far too small to be listed, struggling) and Comptoir (LON:COM) (doing a bit better of late) don’t interest me as a bombshell delisting announcement could come any day and wipe out half the little remaining value. So they’re option money only. TAST’s format is very dated (although the fit-outs are nice), and it’s still struggling with uneconomic leases. I visited a COM in the summer, and it’s actually a nice & distinctive format, so that’s the only one I would even vaguely consider investing in. But as with all shares, anything can happen!

I wonder if this RTN deal might trigger wider interest in pub groups too? I’ve been meaning to look at Marston's (LON:MARS) actually. The highly indebted ones could be restructured by deep-pocketed private equity owners, perhaps making them attractive bid targets?

Another idea that occurs to me, is that with food inflation falling now, and energy prices becoming more reasonable, then possibly 2022/3 could be the low water mark for margins in hospitality? Apollo’s bid interest in RTN is perhaps flagging this as a possibility - something for us to think about!

Anyway, well done to any RTN shareholders here, swimming against the tide and ignoring the risks has paid off! ;-)

Spectra Systems (LON:SPSY)

Up 6% to 190p (£81m) - Largest Central Bank Consumables Order - Paul - GREEN

This is light on specifics, but sounds encouraging - this is the announcement in full, as it’s fairly concise -

Spectra Systems Corporation, a leader in machine-readable high speed banknote authentication, brand protection technologies and gaming security software, is pleased to announce that one of its long-time central bank customers for banknote security materials has placed a new order for the year ending 30 September 2024 as part of the five-year contract, which was entered into in 2019.

This consumables order is the largest in the Company's history and approximately 60 per cent. larger by value than the order for the year ended 30 September 2023.

Dr. Nabil Lawandy, Chief Executive Officer, stated: "I am very pleased that we have received such a large order incorporating the 22 per cent. price increase which was agreed last year when we solved our customer's supply chain concerns. This order makes a meaningful contribution to achieving our expected profitability this and next year."

There’s not much specific detail there. Has there been a broker update to help us?

Yes, a hat tip to W H Ireland, whose update note is very helpful, saying that today’s update “all but guarantees” FY 12/2023 forecast revenues & profit, and “injects significant visibility” into FY 12/2024 forecasts.

WHI emphasises that its forecasts are based only on “highly predictable revenue only”, giving a “high level of confidence” in its forecasts. I like that a lot, as it suggests the likelihood of a profit warning should be low, and maybe we might even see a beat against forecast? SPSY seems to operate on a shoestring, with low overheads, so more contracts seems to drop through nicely to profit.

Paul’s opinion - I’ve repeatedly flagged this share here, as a reasonably priced, well financed, generous dividend-paying GARP share. Today’s update adds to my confidence, so I remain an enthusiastic GREEN. The share price seems to be edging up a bit, whereas usually the good news is ignored in this small caps bear market. I think patience could pay off eventually with this share, providing nothing goes wrong of course, as with everything, which we can’t predict. Hence why we have a portfolio of shares, and accept the risk that the odd one disappoints from time to time.

The StockRank system loves it too! I always like to see my analysis confirmed by the computers, and it makes me think again if the StockRank is low -

Hotel Chocolat (LON:HOTC)

Up 9% to 142p (£195m) - FY 6/2023 Results - Paul - AMBER/RED

A neat little summary here at the top of the announcement today -

Hotel Chocolat Group plc, a direct-to-consumer premium chocolate company, today announces its audited full year results for the 53 weeks ended 2 July 2023 ("FY23") which are broadly in line with market consensus and in addition provides a trading update for the 13 weeks ended 2 October 2023 ("FY24 Q1") highlighting the significant progress made against its strategic priorities.

Very poor results for FY 6/2023, but this was flagged earlier this year, in 2 profit warnings. They call it a “transitional year”, which I can translate as, the year we totally screwed up almost everything. That was after a giant mess up in FY 6/2022 over its Japanese operations, which required a £30m exceptional charge.

It’s an underlying loss before tax of £(0.8)m for FY 6/2023, which after exceptionals becomes a statutory loss before tax of £(6.9)m.

Balance sheet - the good news is that solvency & dilution risk are slight - the one good thing management did was to raise loads of equity, and it’s still in a nicely comfortable position, with cash of £11.2m, and no interest-bearing debt. Leases are not debt, so shouldn’t be on the balance sheet at all. Rents are just future operating costs, much like business rates, and shop staff wages, which of course are not on the balance sheet, so IFRS 16 is total nonsense.

Although interestingly, IFRS 16 can point us to whether a company has loss-making sites (in which case the lease liabilities exceed the right of use asset - have a look at Superdry (LON:SDRY) to see a really, really bad case of this - indicating many of its sites must be bleeding cash like no tomorrow, which there probably won’t be once its latest cash injections have worn off).

HOTC seems to have almost balanced lease entries, which suggests to me it’s probably the central costs that are too high, not the store leases being a problem - a good thing.

Inventories still look far too high, but have come down somewhat. This might be since HOTC is vertically integrated, making the chocolate itself, which would tie up cash.

Cashflow - looks fine, until you come across the whacking great £11m lease cash outflows figure, which absorbs about three-quarters of the whole group’s cashflow. Capex of £9.8m is eating into cash reserves, which fell from £17.6m a year earlier, to £11.2m now. So I think if it cannot improve cash generation, then HOTC won’t be able to safely open more new sites.

Outlook - this is where we get some good news!

I’m encouraged by the Q1 update, with some much better figures, indicating that turnaround actions do seem to be making some headway -

Q1 (Jul-Sep 2023) - LFL stores revenues up an impressive +13%

Gross margin also up, thanks to less discounting, up 6ppt (which I think means going from say 50% to 56% - made up numbers, but that’s my understanding of their terminology, leave a comment if you think that’s wrong!)

Cost reductions made.

Too early to give guidance for FY 6/2024 - oh dear, they could have given a basic, conservative, wide range of guidance, instead of saying nothing.

Liberum does have a stab at forecasting, and pencils in £4.2m adj PBT for FY 6/2024. That looks sensible to me, given the upbeat Q1 comments, from a broadly breakeven year for FY 6/2023.

I’m going to ignore its following years forecasts, as these have tended to be wildly optimistic in the past, but for the record are £11.8m and £15.2m PBT.

Paul’s opinion - I’ve previously turned RED, on the 2 profit warnings earlier this year. But given today provides some evidence that things are starting to improve, then I think it’s only fair to move up a bit to AMBER/RED.

If HOTC was valued at say £40-50m, then I think it would be worth a punt for a recovery.

The trouble is, the valuation is sky high, at £195m, and for a share that historically the market has wildly overvalued, and been repeatedly proven wrong when it disappointed.

I can’t get anywhere near that valuation, as it has to execute well (as opposed to really badly in the past), just to come close to justifying today’s valuation.

Above all, every time I’ve tried the product, it’s seriously disappointed me - it tastes horrible, and is wildly over-priced, in my opinion. Fancy packaging, and store fit-outs don’t result in me wanting to buy the product. Some people like it though, but not enough for the company to actually make any profit at the moment.

So definitely not for me, and I think risk:reward currently looks very poor. But that could change in future, so we’ll keep an eye on it.

There's been about 21% dilution from new equity over this period, so not too bad at all. Hence a return to previous profitability could see this share sparkle again maybe? We've got to consider all possible outcomes!

Graham’s Section:

Mobico (LON:MCG)

Share price: 67.7p (-20%)

Market cap: £416m

National Express changed its name in June; it’s now “Mobico”.

But this probably won’t help long-term shareholders forget what they’ve suffered here. This was formerly a mid-cap, but it’s now in small-cap territory:

Perhaps it makes sense that National Express would fail to recover to its pre-Covid valuation, with former commuters now spending more days working from home?

Unfortunately, today brings a fresh profit warning.

The headline is:

Full recovery in profitability taking longer to deliver; decisive action being taken on our cost base and to accelerate deleveraging

Here are the key points:

Revenue up 10%; but costs are up, too.

2023 EBIT expected at £175m - £185m (previous guidance: operating profit of £200m - £215m). So the profit forecast has been cut by about 12%.

Cost reduction programme has delivered £15m of savings for 2023; will deliver £30m annually from next year. A further £20m of savings are targeted.

Looking to sell the North America School Bus business (paradoxically, selling this business will enhance growth for Mobico).

Dividend suspended.

The yield had become rather large with this share. A reminder that it can be risky to count on large dividends:

CEO comment:

"We recognise that the recovery of our profitability will take longer than we had previously expected. That is why we are announcing decisive actions to ensure we deliver sustainable profitability from our growing revenue base. Whilst our belief in the potential of the Group remains strong, we will move at greater pace with new leadership teams in the UK and North America.”

There are new CEOs at Mobico’s UK/Germany and North America businesses.

Some other key points:

UK Coach: revenues boosted by rail strikes. 12% of passengers who used them on a strike day for the first time decided to continue using them on a non-strike day. Q3 revenues up 26% year-on-year.

UK Coach Hire: two of the five depots will be closed due to their low returns. The remainder are under review.

UK Bus: passenger volumes at 97% of 2019. So almost a full recovery. But the growth in passengers is “slightly lower than previously anticipated”.

North American School Bus: driver recruitment, training and exam costs are above forecast.

Graham’s view

Paul reviewed the company’s final results back in March. Net debt then was £986m, or 2.8x EBITDA (an improvement from 3.6x). The company was anticipating “free cashflow of £1.25bn” by 2027.

Where are we now, in terms of the balance sheet? Well, the company recently (26 September) announced a €500m bond issue. These bonds were rated investment-grade by Moody’s and Fitch, carry a fixed coupon of 4.875%, and are being used to refinance existing debt. So all of that sounds very orderly.

I do note that the existing debt that is being refinanced is GBP bonds which only charged 2.5%. So while 4.875% might not sound too high, it’s a more than doubling of the prior interest rate.

Scrolling back further to the interim results, net debt was £908m (June 2023). Gross debt was £1.5 billion. The leverage multiple was still 2.8x, i.e. on the higher end of the spectrum.

With profits having been downgraded since then, it’s possible that the leverage multiple is now over 3x.

The company warned that interest charges would rise, both through higher bond coupons and higher rates on their bank facility:

2022: £51m interest

2023: £75m interest expected

2024: £82m interest expected

So that’s a hefty chunk of anticipated EBIT that will be eaten up by interest, e.g. there could be £75m of interest charged on £175m of EBIT.

I always think that it’s finely balanced when interest charges are eating up half of EBIT. It’s rare that a company will face that situation for long. Surplus cash flow should hopefully be used to pay down the debt, producing a positive snowball effect as the interest charges reduce. But if profits and cash flow take a hit, then things can quickly go in the opposite direction.

In this case, I think Mobico investors can take some comfort from the following factors:

Investment-grade credit ratings (of course the agencies are not to be trusted blindly)

Leverage multiple is probably around 3x, which is still respectable.

Bond investors were willing to refinance them at a reasonable price, although ECB rates are lower than BoE rates and I guess that will have helped. The company will need to manage its euro exposure carefully.

Forecasts suggest that the company is profitable, although after interest and taxes the bottom line is probably going to be quite small. Numbers below are before today’s £30m profit warning.

I’m going to have to take a neutral stance on this one, as I think it’s too soon to say whether or not it’s going to prevail in its battle against inflationary cost increases, weaker passenger growth than anticipated, and a large debt pile. If it does succeed, then the equity is priced to do well from the current level. But I think I’d rather own the bonds.

SIG (LON:SHI)

Share price: 29.3p (-14%)

Market cap: £350m

SIG plc… a leading supplier of specialist insulation and building products across Europe, today issues a trading update for the six months to 30 June 2023… in advance of the release of its H1 results on 8 August 2023.

Unfortunately this is another profit warning.

SIG is another large and complicated business that is active across Europe.

We last looked at it in Jan 2023, with Paul commenting on the company’s turnaround plan.

Today we learn the following about H1 performance:

Revenue is flat on a like-for-like basis at £1.4 billion. Volume declines offset by price inflation.

GN note: this means the company is shrinking in real terms. However, after taking into account acquisitions etc, SIG’s total revenues are up by 5%.

Other points:

“Challenging and variable” market conditions. Softer demand in May and June, particularly in Germany and France.

Underlying operating profit c. £33m

H2 to benefit from “ongoing productivity initiatives”.

Many thanks to the company for publishing the range of market expectations: underlying EBIT of £65.3m to £84m.

Full-year operating profit should be within but towards the lower end of that range.

Net debt at £176m (pre-IFRS 16, i.e. excluding leases) or £470m including leases.

The company reports that price increases from inflation added 9% to revenues. I’ve been using 8% as my inflation benchmark although hopefully I can start to bring it down soon, maybe to 6%. But as far as SIG is concerned, inflation is still running at 9%.

Outlook

We expect weak and uncertain demand conditions throughout the rest of the year, along with a continued, but further moderating, revenue tailwind from input price inflation. Whilst trading in recent weeks leads us to be more cautious as to the timing of any broad-based improvement in demand conditions, the second half will benefit from ongoing productivity initiatives as well as an expected profit on one specific property move.

Graham’s view

The outstanding feature of this one is its extremely low margins. I understand that it’s supplying the construction sector, where margins are unlikely to be very exciting, but the gross margin tends to run at only around 25%.

You then have all of the corporate and retailing apparatus on top of that, and it leaves the company with a wafer-thin profit opportunity. It makes sense that the company should focus so heavily on “productivity initiatives” - when you’re dealing with a profit margin like this, every pound and penny saved makes a huge difference to shareholders.

Is this stock offering value right now? If it is, I’m not seeing it. The market is pricing in improvements through cost savings:

There are so many high-quality companies trading at reasonable prices, I just don’t see why investors would want to get involved with this one. There is considerable financial risk here, too, with substantial leases and borrowings.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.