Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

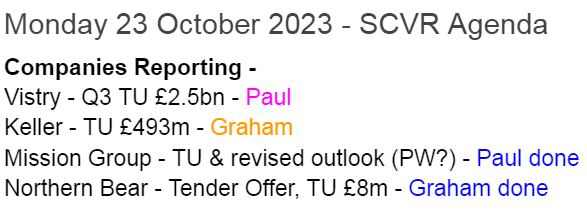

Agenda - quiet for news today.

Summaries

Mission (LON:TMG) - down 59% to 14.0p (at 08:44) £13m - Trading Update & Revised Outlook for 2023 - Paul - RED

A disastrous profit warning, with H2 performance having greatly deteriorated, but still profitable. Of far more concern is the bank situation, with a large increase in net debt to dangerous levels. The bank seems to have extended the facilities, but a covenant breach is expected in Dec 2023. Now way too high risk to get involved, in my view. We previously flagged the weak balance sheet & debt, here on 28 July.

Northern Bear (LON:NTBR) - up 29% to 57.6p (£11m) - Tender Offer & TU - Graham - GREEN

The Chairman has decided to move on, and the company is proposing to accommodate him with a 62p tender offer. All shareholders will be able to participate in the offer. Despite increased leverage, I remain positive on this as I think the PER will remain around 4x.

Keller (LON:KLR) - up 15% to 771p (£561m) - Trading Update - Graham - AMBER

Excellent news from this “geotechnical specialist contractor”, as full-year operating profit is set to be “materially ahead”. The company is carrying a modest amount of debt and the PER reflects this at around 6x. Fundamentally low quality but offering reasonable value.

Paul’s Section:

Mission (LON:TMG)

Down 59% to 14.0p (at 08:44) £13m - Trading Update & Revised Outlook for 2023 - Paul - RED

That’s an ominous title to the RNS above. Since it’s a cyclical group, marketing agencies, then it’s likely to be a profit warning if they’re revising the outlook, given toughening macro conditions.

MISSION Group plc (AIM: TMG), creator of Work That CountsTM, comprising a group of digital marketing and communications Agencies, wishes to provide an update on current trading and the Group's outlook for the remainder of the 2023 financial year to 31 December 2023 ("FY2023").

On 26 Sept it said that an H2 weighting was expected in 2023, and trading was in line with FY expectations.

Throw that out of the window, as today it says -

…recent trading has rapidly become more challenging than previously anticipated.

These sectors are under pressure, which should be useful to us in considering wider read-across to other shares -

This has been especially marked in the Consumer & Lifestyle, Property, and Technology & Mobility business units, where client wins have been more than offset by losses and several clients choosing to defer or significantly reduce spending. The Board now believes these more challenging trading conditions will continue for the remainder of the year and is taking a materially more cautious view on H2 2023 and therefore the FY2023 outturn.

Operational review is being carried out, with “initial cost reductions” starting, and to be “fully implemented by year end”. A second round of cost & efficiency savings is planned for 2024.

Revised guidance is a bit confusing, so I’ve referred to an update note helpfully published by Canaccord on Research Tree.

Adj PBT for FY 12/2023 is now £3.1m, down 60% from previous forecast. It did actual adj PBT of £1.0m in H1, which implies £2.0m in H2 - not a disaster, but nowhere near enough to support the net debt position which is now dangerously high at £25.5m.

Financial position - this is ringing my alarm bells.

Net debt has soared from £14.9m at June 2023, to £25.5m now (as at 20 Oct 2023). Reasons given -

As a result of the reduced trading performance, the payment of the final FY2022 dividend, and in particular the rapid reduction in pre-payments from certain clients

This sounds like the bank facility has been exceeded slightly -

The Group's committed bank facilities comprise a revolving credit facility of £20.0m, with an option to increase the facility by £5.0m, which expires on 5 April 2025.

But Nat West has given them additional facilities it seems, for the time being -

In addition to its committed facilities, the Group has available an overdraft facility of up to £6.0m with interest payable by reference to National Westminster Bank plc (Natwest) Base Rate plus 2.25%. Instead of increasing the revolving credit facility by £5.0m, the Group has agreed with Natwest that the overdraft limit of £6.0m will be increased to £10.0m, until further notice and subject to regular review.

Net debt not expected to change much in the short term -

Net debt is expected to be approximately £24.0m as at 31 December 2023 after a working capital outflow due to the forecast increase in turnover in Q4, resulting in an increase in trade debtors which is not expected to convert into cash until early 2024.

Covenant breach imminent -

The Group continues to be in compliance with its banking covenants but is now expecting the net debt / Adjusted EBITDA covenant in Q4 to be above current covenant limits at 31 December 2023. The Group is in constructive dialogue with Natwest regarding a covenant waiver.

Interim dividend, due to be paid shortly, is being cancelled. I would assume that no more divis are likely for the foreseeable future, as it’s now financially distressed and will have to get bank debt down significantly.

Paul’s opinion - this is bad, really bad.

We flagged here on 28 July that TMG had a stretched, overly indebted balance sheet, and that “the risk of another profit warning in the more important H2 looks quite high to me. For that reason I’d be reluctant to get involved at this stage”. Sorry to sound like a smart Alec, but I just want to reinforce that (a point covered in this weekend’s podcast) problems like this are often preceded by warning signs several months earlier. And of course the simplest balance sheet checks allow us to steer clear of any company with problem levels of bank borrowings such as TMG.

There’s another issue that occurs to me - plenty of cyclical companies have said that they’re trading as normal in H1 of this year. But it now looks as if signs of recession are beginning to spread into more sectors. So I think cyclical companies which seemed to be doing alright earlier this year, are now much more likely to be issuing profit warnings. Especially in B2B sectors, where there’s mounting evidence of customers reining-in discretionary, and project-based spending.

So maybe we need to focus on companies with high contractually agreed recurring revenues, and essential, non-cyclical products/sectors where demand is buoyant?

Plus of course my personal obsession - balance sheets! I’ll happily take a punt on a bombed out share being a cyclical recovery in due course, but only if it’s got a bulletproof balance sheet with net cash. If it’s got high bank debt, like TMG, then forget it. That's because banks don't like risk lending, and becoming quasi-equity. So they'll be pushing for an equity raise to bail them out, which often happen on ruinously dilutive terms in a downturn like this.

Note also with TMG how it says the big spike up in net debt has mainly been caused by customers no longer being so generous in paying up-front. That makes sense, since companies can now earn interest on their cash, so companies that rely on generous up-front payments from customers might find that generosity being scaled back, causing their own net debt to shoot up.

Overall, I think TMG has got so much worse than when we last looked, that our AMBER/RED warning on 23 July has to move now to bright RED.

The share price has crashed 60% to 13.5p at 08:33, so market cap now only about £14m, which means the window for doing a placing is rapidly closing I imagine, and could involve serious dilution now.

I can’t believe management has done this again. They over-expanded, using borrowed money, back in the early noughties, and ran slap bang into the 2008 financial crisis with too much debt, and almost went bust. Here we are again, in the same situation.

Graham’s Section:

Northern Bear (LON:NTBR)

Share price: 57.6p (+29%)

Market cap: £11m

This building services company has in recent years attracted the interest of micro-cap value investors. Indeed, a Canadian investor acquired 25% of the company and became Chairman of the Board (I’ll refer to him as “JB” from now on!).

Financial results were solid until 2021/2022, when goodwill impairments caused some statutory losses:

I last covered the stock in April, noting the small £7m market cap vs. operating profit of £2m for FY 2023.

Today we have news of a tender offer by the company at 62p, which is a 39% premium to last night’s close.

The max number of shares which will be bought is 5 million, or 26.7% of the current share count.

After a long period of strategic review - including discussions of Northern Bear’s M&A strategy, which I’ve commented on before - it seems that JB has decided to move on from the company.

He wishes to retire from the Board, and will do so if the tender offer goes ahead. He is also looking to sell his entire investment in the company, and will offer all of his shares to the tender offer.

Here’s my analysis of the situation:

Total share count: 18.7 million

JB’s shareholding: 4.7 million

Directors and other shareholders who have undertaken not to tender their shares: 4.7 million

Other shares which might be tendered: 9.3 million

Total number of shares which might be tendered: 14 million

So it seems inevitable that those who tender their shares will get scaled back, i.e. there will be far more shares tendered than the maximum 5 million the company is willing to buy.

Rationale

The Tender is proposed

“primarily as an accretive event for Shareholders and secondarily as a means of shareholders who wish to sell their investments, including Jeff Baryshnik, exiting their investments in an orderly manner, while still ensuring the Company could secure sufficient funding to pursue its growth strategy.”

It will

“create an exit strategy for Shareholders who wish to sell their investments” and “remove the prolonged uncertainty that an overhang of shares would create, should any significant Shareholders wish to sell their holdings through the market”.

Net cash at the most recent financial year-end was £3.2m, although average month-end cash since then was only £1.3m.

The tender offer will cost up to £3.1m, so the company will be looking to increase its debt facility, “with modest leverage required in relation to historical profit levels”.

Trading update: the current financial year remains in line with management expectations and is still “ahead of strong prior year results”.

The Board continues to monitor ongoing uncertainties in the macroeconomic climate in which the Company operates, including the challenges of attracting and retaining high quality employees in the construction industry as has been noted in previous trading updates.

Graham’s view

Firstly, you may be wondering why I’m reviewing a company as small as this. The reason is that NTBR is one of the more intriguing micro-cap “value” stocks. The P/E multiple fell to 4x last week:

This morning, the share price has risen towards the tender offer price, which is surely a better reflection of fair value.

Reasons for shareholders to be happy today:

They will be able to sell at least a portion of their shares at 62p.

For shareholders who don’t tender their shares, the new market cap at the reduced share count (assuming a share price of 60p) would be just over £8m, so the PER would still be around 4x.

The strategic direction of the company is clear enough now. As I reported in April, they are now satisfied with “organic progress of the Group’s businesses and, to the extent accretive, bolt-on acquisitions”.

For those who care about the current share price, the tender offer has woken up the market to the value on offer here, and boosted the share price.

Reasons why shareholders might be less pleased:

The company’s balance sheet will be leveraged and it might take a year or two to get it back into a comfortable net cash position (assuming no acquisitions over that time).

The tender offer has been designed in part to create an exit strategy for the Chairman. All shareholders will be able to participate in it, so that no one has been disadvantaged, but shareholders who aren’t selling might feel that there is no reason to offer a premium price of 62p to the Chairman and others who wish to exit.

I’m going to maintain my positive stance on these shares. While ordinarily I would be very cautious towards a leveraged company in the building services sector, I am inclined to have faith in Northern Bear paying it off - it has the track record to suggest that it can do it.

Keller (LON:KLR)

- Share price: 771p (+15%)

- Market cap: £561m

Keller Group plc ('Keller' or 'the Group'), the world's largest geotechnical specialist contractor, issues a trading update for the period ended 30 September 2023.

Let’s get up to speed on the Q3 trading update from this group.

The headline is excellent:

On track for a record year; full year operating profit to be materially ahead of market expectations

Key points:

Positive trading momentum maintained

North America: “more resilient pricing than expected” at Suncoast, boosting operating margin, although this is expected to moderate in 2024.

Europe: “the macro-economic environment remains a challenge”, with weak demand. There is a “competitive pricing environment” and “some challenging projects”. Profitability improvement in H2 is less than expected.

Debt: cash generation is “considerably ahead of the prior year and better than our expectations”, so that year-end net debt/EBITDA should be below 1x (normally considered to be a very safe level).

Adjusted net debt at the end of H1 was £245m, so debt management is an important issue for the company. However, it looks like the company has the earnings power to handle this. EBITDA this year will be well north of £200m.

Graham’s view

This one may be of interest to value hunters:

Given that it’s a construction/engineering stock, it’s quite low margin (£3 billion of sales converting to less than £100m of net income). I don’t see it ever fitting into a “quality” portfolio but maybe at a lower share price, the yield could be interesting. I’m inclined to agree with Paul that a 6% yield would not be enough to tempt me here, in the current environment.

So in my book this is offering reasonable value, but I’m inclined to stick with a neutral stance.

A three-year chart shows it staying within a range:

PS: My YouTube show today will be available at this link. It broadcasts live at 11.30am and then the replay is available afterwards. Cheers!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.