Good morning from Paul & Graham!

Graham's youtube link today - I'll have him on in the background whilst I'm finishing off my next section here on Asos!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Agenda

I've turned a couple of items grey, to indicate that the announcement isn't very important, so we won't elaborate on it in the main report, but quite useful to leave it in the list as a reader note -

Summaries

Sopheon (LON:SPE) - up 88% to 920p y’day (£98m) - Possible Cash Offer - Paul

Possible takeover bid at 1,000p/share seems to have been agreed by an American trade buyer, backed by private equity. The 104% premium is a remarkable outcome, so it's highly likely to go through, although is not quite a formal offer yet, despite due diligence having been successfully completed. The price is more than fair, given lacklustre financial and share price performance from Sopheon over the last 4 years. Likely to go ahead, I reckon.

Vertu Motors (LON:VTU) - up 1% to 76.7p (£261m) - Acquisition - Paul - GREEN

I only intended to flag that this latest (small) acquisition is nicely asset backed, with little goodwill involved in the transaction - adding to the appeal of Vertu’s acquisitive strategy. Below, I’ve summarised my take on the bull & bear points currently.

Eckoh (LON:ECK) - down 6% to 40p (£116m) - Half-Year Trading Update (rev miss) - Graham - AMBER

Sales are currently taking longer to close and Eckoh is now set to miss full-year revenue expectations. Revenue forecasts are trimmed 6% though profit forecasts are unchanged. It’s an uninspiring update and I’m struggling to find reasons to get excited about this one.

Various Eateries (LON:VARE) - down 2% to 27.5p (£24m) - Trading Update (in line) - Graham - RED

This restaurant/club operator has published an “in line” statement for FY 2023, although estimates for FY 2024 have been downgraded. I am wary of this sector and Various Eateries seems to be in a precarious position, with a dwindling cash balance as it attempts to expand.

ASOS (LON:ASC) - Down 10% to 357p (£424m) - Final Results - Paul - AMBER/RED

Poor figures - it's loss-making, badly run I think, and struggling to execute a turnaround. Debt is a worry too. However, there might be strategic value in the share, especially to stakebuilder Frasers (LON:FRAS) . So this could go either way, but weak fundamentals means I have to lean towards a negative view.

Paul’s Section:

Sopheon (LON:SPE)

Up 88% to 920p y’day (£98m) - Possible Cash Offer - Paul

“Agreement in principle” has been reached between Sopheon’s management, and Wellspring Worldwide Inc (specialist software) for a £10.00 (a large premium of 104%) cash takeover bid. Wellspring itself is controlled by an American private equity outfit called Resurgens Technology Partners. So this is both a trade sale, and a private equity sale.

Discussions are well advanced, with due diligence already completed. So this bid has clearly been in progress for some time, yet the market was not notified, hence there has been in effect a false market in SPE shares for possibly around 2-3 months, where material, price sensitive information was not disclosed to the market. The UK disclosure rules really must be changed, to force companies to tell the market as soon as meaningful takeover talks begin with a credible buyer. Everyone who has sold in the last couple of months has lost out, because they weren’t told that meaningful bid talks were being held. Why didn't Sky News or Betaville spill the beans, I wonder?!

Irrevocable support has been received from two large “key” shareholders, holding 37.3% (Barry Mence, and Rivermore).

A wobbly outlook comment will certainly give shareholders a good reason to vote for this deal, if it (as seems highly likely) progresses to an actual bid -

The Sopheon Board reiterates the outlook statement made in the interim results (as further described below) but also highlights that the current uncertainty regarding U.S. government budgets has the potential to cause delays in closing certain transactions in its pipeline.

Paul’s opinion - this is a cracking deal, that of course Sopheon shareholders are likely to accept - they’ve doubled their money overnight! An outstanding result, given such difficult market conditions, and worsening macro.

This is the point that people on bulletin boards go through the motions of pretending that they’re disappointed with the deal and the company is worth more. That’s nonsense, this is clearly an attractive valuation, as SPE management says in the announcement.

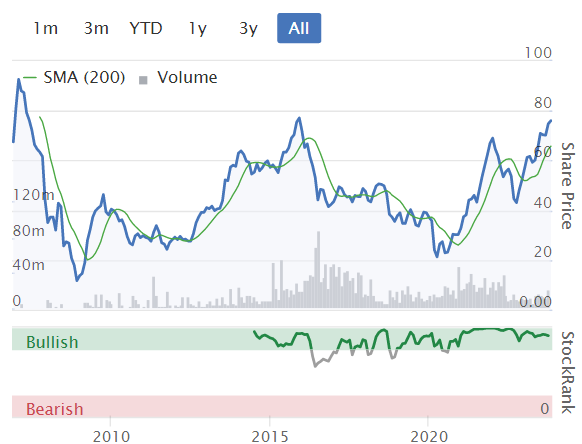

Performance at Sopheon has been lacklustre in recent years, with the high profitability achieved in 2017 & 2018 melting away gradually, with a 2023 result forecast to be not much above breakeven. That, and a nasty bear market, is why the shares have fallen by more than half from the Dec 2018 peak of about £12/share. So to receive £10/share now is a marvellous outcome in the circumstances I feel.

Here's my summary of SPE's life as a listed company -

Vertu Motors (LON:VTU)

Up 1% to 76.7p (£261m) - Acquisition - Paul - GREEN

Vertu further expands its footprint in the South West of England with the acquisition of Rowes Garage Limited

This is only a small deal, of 4 (mainly Honda) outlets in the South West, but something in the announcement caught my eye which is worth flagging - the asset backing. The £6.2m acquisition price includes freehold property valued at £3.6m. The goodwill element of the acquisition is only £0.9m.

Acquisitive groups often hollow out their balance sheets, and sometimes then end up in financial trouble, because acquisitions are mainly goodwill. However, in this sector, car dealers usually seem to own their freeholds, so the acquisition price in this case is not much above the net tangible assets being acquired - a good thing. There also seems a spin-off benefit of deepening the group's relationship with Honda.

To my mind, this makes VTU’s acquisitive strategy much more attractive than it would be in other, less asset-backed sectors. VTU seems to be a sector consolidator, buying up smaller independent groups of car dealers, and might itself end up being bid for by a larger group, possibly overseas?

Paul’s opinion - VTU is a long-standing favourite value share here in the SCVRs.

Bull points -

Particularly strong asset-backing,

Acquisitions seem sensible,

Management come across well in webinars, on top of the detail,

Good performance throughout the pandemic & vehicle supply disruption,

Divis/buybacks,

Low PER,

Bonanza of takeover activity in the sector, with seemingly everyone apart from VTU receiving bid approaches!

Bear points off the top of my head might include -

Uncertainty re change in business model being pushed by manufacturers might pan out,

Used car gross profit possibly falling as supply gradually normalises,

Higher interest charges now eating up a considerable portion of operating profit,

Uncertain demand for (high margin) servicing/repairs for EVs,

Wage & energy cost rises (probably peaked now?)

General macro factors.

Personally I banked my profits a while ago (mentioned here before I think), purely as I wanted funds to buy more Plexus Holdings (LON:POS) (I hold). Also, VTU has had a great run (in a very tough small caps market) in the last year. Although I strongly suspect I’ll be kicking myself if or when it announces a bid approach, which seems quite likely.

I only intended flagging the fact that acquisitions are solidly asset-backed, but ended up doing a recap on the share overall. I’m happy to stick with GREEN, given the likelihood of a bid, and the great asset backing, whilst acknowledging there are uncertainties about the future.

ASOS (LON:ASC)

Down 10% to 357p (£424m) - Final Results - Paul - AMBER/RED

Sale of Topshop? - Thomson Reuters useful news snippets in the Stockopedia “News” tab for Asos, says today that it has declined to comment on rumours that the fairly recently acquired Topshop brand (from the wreckage of Philip Green’s Arcadia group) is now up for sale. It had previously been widely reported in the press that talks are underway to sell Topshop to US brands giant Authentic Brands - who the internet says owns >50 consumer brands, and had revenue of $22bn in 2021, and is private equity backed (CVC and HPS).

It will be interesting to see how this pans out. The Topshop acquisition by Asos in Feb 2021 has clearly not boosted Asos’s results, or possibly might have masked even worse performance from the rest of Asos? Asos paid £265m cash for Topshop, which is looking a big mistake now, with hindsight, given Asos’s precarious financial position.

Final Results (a year + 3 days to 3 Sept 2023, which I’ll call FY 8/2023)

It’s the usual story from Asos - turnaround underway, but lousy figures. Lots of adjustments.

Some numbers -

Big revenues of £3,538m (down 9% reported, down 11% adjusted)

Low gross margin of only 44.2% (LY: 43.6%) - this has always been Asos’s achilles heel, which is why it has never made any significant profit (apart from a brief patch in the pandemic). It’s slowly dawning on the market, after 20 years of being a massive multibagger, that Asos isn’t actually a good business at all. Maybe we became intoxicated by the stellar revenue growth, with hardly anyone noticing that it didn’t make profits.

Profitability? It’s a loss before tax of £(70)m on an adjusted basis, and a draw-dropping £(297)m statutory loss before tax.

Net debt - doesn’t seem too bad, but that cash figure no doubt swings up & down a lot, is probably at or near a peak on reporting dates, otherwise it would have been used to pay down gross debt. Hence I imagine it needs the borrowing facilities, and is highly dependent on the £464m bond - carefully inspecting the terms of this is vital research if you’re thinking of buying or holding this share.

Note also the very expensive £31m cost of refinancing fees this year.

Balance sheet - overall is not strong, but not a disaster (providing it can keep the lenders sweet, and in compliance with covenants).

NAV is £867m, less intangible assets of £701m, gives NTAV of £166m.

Inventories have come well down, from £1,078m a year earlier, to £768m this time. That needs to come down further, and the commentary seems to acknowledge this.

Cashflow statement - looks bad to me. The benefit of de-stocking has been offset by reduced trade creditors. There’s nothing in operational cash generation to pay for the hefty capex, £136m of which is “purchase of intangible assets” - which sounds like some or all might be development spending? Physical capex spending was another £42m.

The gap of negative cashflow has been financed with £78m fresh equity issuance, and about £200m of extra borrowings.

This is absolutely not a healthy business, based on these numbers.

Outlook - is mainly aspirations, which are not of much interest to me, as Asos has such a bad track record of execution.

Specific guidance is useful, and here it is -

o Sales decline of 5 to 15%, with P4 FY23 trends (i.e., high double-digit declines) continuing through the first half of FY24 and a return to growth in the final quarter of FY24.

o Adjusted EBITDA positive.

o Stock back to pre-COVID levels (c.£600m as previously communicated).

o Capex of c.£130m.

o Positive cash generation, reducing our net debt position.

Adj EBITDA is meaningless here, due to the heavy capitalisation of costs into intangibles.

Paul’s opinion - I see this as a badly run, poorly performing, loss-making business.

So the shares are a punt on whether it can either be turned around, which I think will take time (if it can be achieved at all), or whether the strategic value of the business might result in some kind of takeover deal (all eyes are on large shareholder Frasers (LON:FRAS) )

I haven’t regurgitated here the turnaround plans, because it all strikes me as just fixing the absolute basics of how a business like this should be run. I was told years ago by a former (senior) finance member, that it was a very poorly managed business, with all sorts of deep-seated problems, and he seems to have been proven correct.

Are the shares any good? Not on fundamentals I’d say. However, to an acquirer? Who knows, maybe? If a shrewd operator got involved here, and stripped out a load of costs, then every 1% on the margin would be a £35m bottom line improvement.

So this could go either way.

Looking back at my previous notes here, I was red in our reviews on 14/3/2023, 10/5/2023, and 26/5/2023, but moderated to AMBER/RED on 15/6/2023 and 26/9/2023, to reflect the debt refinancing, and the stakebuilding by Frasers.

I think that’s the right stance to take now too, so I’ll stick at AMBER/RED - a poor quality business, struggling to be turned around, but might be of strategic value to an acquirer?

Eckoh (LON:ECK)

Share price: 40p (-6%)

Market cap: £116m

Eckoh plc (AIM: ECK), the global provider of Customer Engagement Data Security Solutions, today announces an update on trading for the six months ended 30 September 2023

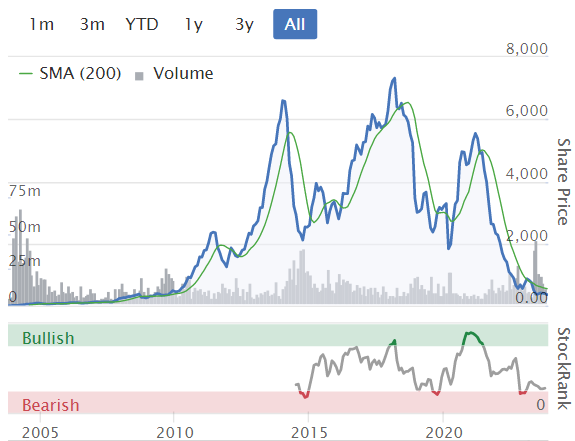

Investors have been less than impressed with this company’s performance in recent years:

Starting with the good news: H1 trading is in line with expectations.

Revenues are £18.8m (last year: £19.6m), “reflecting the loss of a large (non-security) UK client” as previously disclosed.

H1 adjusted operating profit is c. £4.1m (last year: £3.5m).

Separately from revenues, the company has a forward-looking measure, “Total Contract Value”. This is the value of business signed during the period, including renewals. It’s up 40% year-on-year to £24.6m. This should bode well for future revenues.

Switching to cloud-based deliveries to customers: Eckoh says that this change has hurt revenue growth in the short-term, but is increasing the “visibility and quality” of earnings. Fair enough. 83% of revenue is now recurring (up from 79%).

Net cash at the end of H1 has risen modestly to £7.3m.

And now for the bad news: revenues aren’t meeting expectations for the full year.

Here’s the explanation:

The Company is, like others, experiencing a lengthening of sales cycles with new clients, especially in the contracting phase. Consequently, the completion of contracts is taking longer, and several sizeable enterprise deals where Eckoh is the chosen supplier, which were expected to close in the Period, will now shift to the second half. Despite this, Data Security Solutions annual recurring revenue ('ARR') for the key North American market still strongly increased year-on-year by 22% to $16.8m.

But the company still plans to hit profit forecasts:

Whilst the longer than expected sales cycles will marginally impact revenue, the Board is confident that the Company is on track to meet profit expectations for the full year.

Graham’s view

We have struggled to get excited about this company - see my comments a year ago and Paul’s comments in May. Growth hasn’t been particularly exciting and the valuation always seems to be a little on the high side.

Again today, we have declining real revenues and investors have to make do with a strong “total contract value” instead.

We also have lengthening sales cycles and a revenue downgrade for the current year. Investors must make do with the promise that large pipeline deals will be closed next year, and a promise that revenues are now higher quality than they were before.

Valuation also remains on the high side:

However, I do think that valuation has cooled from where it was before: trailing price to sales is now only about 3x (I think it was previously 4x).

Let’s see if the current EV/sales multiple can tempt us.

With £7m of cash on the balance sheet, that gives it an enterprise value of about £109m.

The new revenue forecast for the current year from Singers is £39.6m (down 6% from their previous forecast).

So this is on a current EV/sales multiple of about 2.75x.

I can’t find any way to make this stock look cheap, unless you’re willing to use a very expensive peer group as comparables.

So I’m sticking with my neutral stance on this one.

Various Eateries (LON:VARE)

Share price: 27.5p (-2%)

Market cap: £24m

Paul last covered this one in June.

Here is its share price performance since listing in 2020:

Very few shares are held by small shareholders:

Today’s full-year update for the financial year ending on October 1st 2023 is in line with expectations. Figures that follow are unaudited.

Key points:

Revenues slightly higher than expectations at £45.5m, up from last year primarily due to new site openings.

Like-for-like sales marginally up, excluding the benefit of reduced VAT in the prior year. If we include that benefit in the prior year, I expect that LFL sales would be lower.

Adjusted EBITDA £3.8m.

I tend to treat EBITDA as a nonsense figure for restaurants, as depreciation matters in this sector. However, Various Eateries does consider EBITDA to be important.

Indeed, the company provides two versions of adjusted EBITDA. Checking last year’s results, I see that it provided two different versions of it then, too.

That’s in addition to “actual” EBITDA. So all told, there are three different versions to understand!

Today’s update says that there was a Group EBITDA loss of £1.6m, before AIM costs of £0.6m. So I guess that means the actual EBITDA loss is £2.2m. That’s before we get into depreciation, etc.!

I tend to treat companies with an EBITDA loss very cautiously.

As an aside, I note that WH Ireland have reduced their revenue forecast for the current year (FY 2024) by 4%, despite today’s statement being “in line”.

Some reassuring comments on inflation:

Previously announced inflationary pressures persisted throughout the year but encouragingly some, including food and energy, are beginning to ease. Reducing operational costs and improving efficiency remain priorities, along with exploring technological solutions.

We also get a reminder that the company is not looking to maximise profits:

…a focus on the top line as opposed to short-term profit maximisation is fundamental to the success of any roll-out strategy. The Group has therefore continued to prioritise revenue and customer retention, deliberately not passing cost increases onto customers in full.

I’d be a bit more relaxed about this strategy if the company wasn’t in the restaurant business. If you offer customers a discounted deal now to get them in the door, fair enough - but then how can you have confidence that they will turn up when you want to charge them a full price in order to turn a profit? There aren’t any switching costs!

How long can the company survive without turning a profit? It says today that cash at bank is £1.9m. A year ago, it was £9.4m. Six months ago, it was £3.1m.

The company has loans from insiders including major shareholder Hugh Osmond and Executive Chairman Andy Bassadone. The interim balance sheet showed borrowings from related parties of £13m.

Graham’s view

I share Paul’s view that this stock should be given the thumbs down. I tend to dislike the restaurant/nightclub sector but this one strikes me as a dangerous investment even within this sector.

Reasons:

Unexciting like-for-like sales growth

Strategy of not passing on cost increases to customers properly - why will they turn up when the company does pass them on?

A dwindling cash balance.

Hopefully this one works out for everyone involved but significant dilution would be a good outcome for shareholders here, in my view.

(Paul adds - thanks Graham, a good review there, I agree with your scepticism. An embarrassing financial performance since listing (albeit in tough times), despite all its sites being new, with expensive fit-outs, I dread to think how this will perform once the sites are tatty, and needing refurbs. The tiny market cap, wobbly balance sheet, and only having 2 controlling shareholders, which Graham highlights, must surely mean that de-listing may be a considerable risk here?

There again, the sector might be about to turn upwards, given easing pressure on real incomes, with inflation declining. Could this be a time to buy in this sector, on a contrarian basis? The takeover bid for Restaurant (LON:RTN) might be pointing in that direction, who knows?! Is this another case (of many), where following star management with previous successes under their belts, doesn't work, or isn't worth paying a premium for?)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.