Good morning from Paul & Graham!

I'm sitting here in Bournemouth, surrounded by garden furniture, brought in to prevent them becoming airborne hazards as we brace for Storm Ciaran. One of my skylights has already started leaking water, so I've got a bad feeling about this.

As I woke up early, let's start with a joke which made me chuckle -

I was passing a pet shop, and saw an adorable kitten in the window, labelled "Netherlands kitten for sale".

I've never heard of a "Netherlands kitten", but my interest piqued, I went in, and enquired, "How Dutch is that moggie in the window?!"

(I'll get me coat. Acknowledgement: John Heald)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

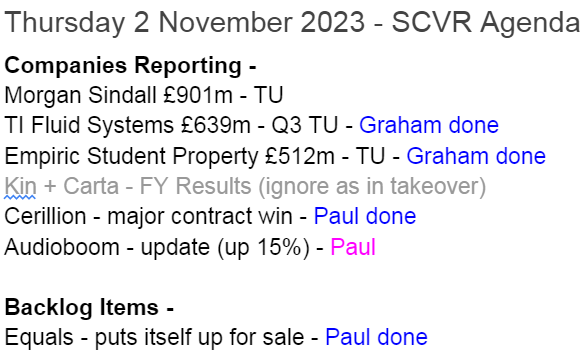

Equals (LON:EQLS) - up 14% to 117p y’day (216m) - Strategic Review - Paul - GREEN

An intriguing announcement at lunchtime yesterday, with this payments/forex company putting itself up for sale, and naming one trade, and one financial buyer that it has approached. I think this looks interesting, so have shifted up from amber to green. More detail below.

Cerillion (LON:CER) - 1,275p (y’day) £376m - Major new customer win… - Paul - GREEN

Very impressive, I wax lyrical below about one of my favourite shares.

Next (LON:NXT) - 7144p (£9.1bn) - Q3 Update (y'day) - Paul - AMBER

Not a small cap but... a quick look at yesterday's reassuring Q3 update, and small upgrade to profit guidance.

Empiric Student Property (LON:ESP) - up 2% to 87p (£525m) - Business & Trading Update - Graham - GREEN

This student accommodation REIT offers a positive-sounding update. Dynamic pricing has resulted in higher rental growth than previously reported for the current academic year. At a discount to NAV, this looks good to me. The LTV is cautious and its borrowing costs are low.

TI Fluid Systems (LON:TIFS) - up 6% to 131.6p (£682m) - Trading Update (in line) - Graham - GREEN

The recovery story continues at this automotive parts manufacturer. 2023 is shaping up to reach the performance levels of 2021 and hopefully the company can keep going from there and get margins back to where they were pre-Covid. Valuation is very cheap if they do this.

Paul’s Section:

Equals (LON:EQLS)

Up 14% to 117p y’day (216m) - Strategic Review - Paul - GREEN

This announcement was issued at lunchtime yesterday, and sounds interesting - the way I read this, the company has decided to put itself up for sale, and an official “Offer period” under takeover panel rules has started -

The Board of Equals Group plc ("Equals" or the "Company") (AIM: EQLS) notes the recent market speculation, and confirms that it is conducting a review of the Company's strategic options (the "Strategic Review").

As part of this process, the Company has contacted a limited number of potential counterparties including Fleetcor Europe Limited and Madison Dearborn Partners, LLC to assess whether such parties could put forward a proposal that would deliver greater value to Equals' shareholders than pursuing a standalone independent strategy. Any such proposal could include an offer for the entire issued and to be issued share capital of the Company.

A couple of points on the above -

The approaches seem to have been outbound, from Equals, not incoming.

Naming 2 potential counterparties (it’s not stated if this is with, or without their consent) suggests to me that there’s probably some interest, and maybe they agreed to be named? That’s guessing though.

Fleetcor - Wikipedia says that it’s a payment processing group. If you have a US subscription, the Stockopedia page for Fleetcor is here. It’s valued at nearly $17bn, and looks highly profitable. Equals would be a relatively inexpensive trade buy for it, so looks an obvious fit as an acquirer.

Madison Dearborn looks to be a US-based private equity fund manager, saying on its website that it invests in 5 focused industries, including financial services.

Current trading - sounds fine -

The Board remains confident in the long-term prospects of the business and believes that the Company is well positioned to create significant value for shareholders as an independent company. Current trading remains in line with the Board's expectations.

Paul’s opinion - not a sector that interests me personally, because it's difficult to create and maintain a lasting competitive advantage in forex/payments. But if I had to buy a forex/payments company it would probably be EQLS, which has impressed with its more recent results (although quite a chequered past with heavy losses until its breakthrough year in 2022).

EQLS management come across well on webinars, and seem to have created an interesting suite of services.

I think the valuation looked reasonable before this news, so speculating on a takeover happening at a premium could make sense here. That’s up to you, but I wouldn’t try to persuade you not to, as EQLS does look an interesting company that a bidder might be prepared to pay up for.

Hence I’m happy to shift from amber to GREEN, now we have bid interest adding to the potential upside. On top of a quite interesting company if it remains standalone.

According to Equals website, management only hold 2.6% of the equity. Although if they sell the company, presumably they might also benefit from cashing in share options as part of a deal?

I don’t know what Graham thinks, but he’s welcome to add a note below if he disagrees! EDIT: here we go -

Graham adds: I’m a bit more cautious on this, as I don’t see any confirmation that there is bid interest - only that Equals contacted various parties to see if they would be interested. To what extent the other parties are in fact interested is unclear. I suppose the longer it takes the two named parties to confirm they aren’t going to make an offer, the more interested they must be! But I also find it curious that management would actively go in search of a bid - why not let the bidders come knocking on the door? This RNS throws up more questions than answers for me. So while I am impressed by the company’s financial performance, my neutral stance as explained in September remains unchanged.

Cerillion (LON:CER)

1,275p (y’day) £376m - Major new customer win… - Paul - GREEN

Cerillion, the billing, charging and customer relationship management software solutions provider…

This is mainly focused on the telecoms sector. It’s one of our favourite GARP shares here at the SCVR, with me being GREEN on it on 15 May, 21 June, and 16 Oct (ahead exps update).

Today’s contract news sounds excellent, and “Tier-1” telco is interesting, as I think it’s more usual for contracts to be more medium-sized customers. That raises the exciting potential that CER is getting more established with the bigger telcos, as the industry migrates towards cloud-based software that CER specialises in.

This all sounds really encouraging I think -

The new customer contract was secured after a rigorous selection process, and work has commenced to replace the existing, separate legacy platforms with Cerillion's single, integrated solution. Cerillion will be supplying and implementing the core elements of its flagship solution, including billing, charging, fulfilment and product catalogue, on a SaaS basis, for an initial 5-year term. Over time, Cerillion believes that this new relationship has the potential to develop further.

Previously, CER has used a land & expand approach with selling additional things to customers once it’s established - which I very much like, as it’s proof that customers like its software. Customer relationships tend to be very sticky, and hence long-term.

This is another key advantage CER seems to have -

Key criteria in the selection process were the commercial, operational and financial advantages of Cerillion's 'out-of-the-box' product model. Cerillion's single product approach confers all the major benefits of a customised solution without the significant cost and integration risks associated with a bespoke approach. The ease with which Cerillion's software enables new products and packages to be brought to market was also a significant factor in the decision-making process for this new customer.

Louis Hall, CEO of Cerillion plc, said:

"We are delighted with this new customer win, which is with a Tier-1 European telecommunications provider. It is another indication that our model of providing a single, out-of-the box solution suite with powerful capabilities that are constantly updated - rather than customised bespoke solutions - is gaining increasing market awareness and appeal. We look forward to a productive and deepening relationship with our new client."

Paul’s opinion - remains highly positive.

Singers has issued an update today, via Research Tree (many thanks to both). This says that CER should be tracking in line or slightly ahead of existing FY 9/2024 forecasts, for 44.1p EPS.

The earnings growth since 2020 has been stellar (12.3p in FY 9/2020) to est.42.6p for FY 9/2023. Maybe 50p might be a more realistic expectation for FY 9/2024? I think the company likes to under-promise, and over-deliver, which we like!

I rarely find growth companies on rich valuations where I think it’s worth paying up, but this is one of the few.

There should be a good rise in share price today, but as we know, forced sellers often use liquidity to dump their shares. So anything can happen! Although I would imagine that even fund managers with big redemptions would probably be trying to hang on to this one. I bet it's had bid approaches too, but the founder CEO owns 30%, so any deal would have to be agreed by him, and at top dollar, I imagine.

A safe (but volatile) port in this year's small caps storm -

Zooming out, CER has already been a serious multibagger, and the good news keeps coming -

Next (LON:NXT)

7144p (£9.1bn) - Q3 Update - Paul - AMBER

I always try to find time for a quick comment on a few key mid/large caps in retail, and housebuilding usually. That’s because there’s often useful info for broader market read-across.

Next says -

Aug-Oct went better than expected, with full price sales up 4.0% vs LY (2.0% was guided)

Small increase in (usually prudent) FY 1/2024 profit guidance, up £10m to £885m (c.19% profit margin!!) - still a stunningly profitable business, in such a difficult sector where many competitors struggle to make any profit at all.

Online generated all the sales growth (both in Q3, and YTD) - very surprising, as the online-only fashion groups ASOS (LON:ASC) and Boohoo (LON:BOO) are reporting declining sales.

Weather - short-term this does affect sales, but average performance over time is a better indicator of consumer demand. I’m loving this graphic (simple and clear) -

Paul’s opinion - a long-term favourite of mine, as the best in class clothing retailer.

Latest guidance (from Next) is 558p EPS (down c.3% on LY), so at 7,144p/share that’s a PER of 12.8x - good value for a high quality business, but maybe fair, considering that EPS is only really back to pre-pandemic levels, despite buybacks reducing the share count a bit each year.

Overall then, a wonderful business, but probably valued in the right ballpark for a UK company, but I wonder if it might attract bid interest from overseas at some point?

I keep this on my list of “crisis buys” - it often plunges on major unexpected macro events, but always recovers. I remember buying some on the morning of the Brexit vote shock, when markets collapsed (there were even some mid & large caps with no bids at all on the order book, in the first hour! It was crazy).

Is there any macro read-across from the above? I suppose it reassures and confirms that with inflation now having fallen below average wage rises, that the squeeze on consumer incomes has slightly eased. So now might be an interesting time to consider a fresh look at sectors that have suffered. Although Next is such a quality business, it seems to sail through all crises with barely a scratch, and each crisis wipes out a bit more competition (and gives Next the opportunity to buy brands for tuppence-halfpenny). I wonder if Superdry (LON:SDRY) might eventually end up in Next’s stable?

Graham’s Section:

Empiric Student Property (LON:ESP)

Share price: 87p (+2%)

Market cap: £525m

Empiric Student Property plc (ticker: ESP), the owner and operator of premium, studio-led, student accommodation across the UK, is pleased to provide a business and trading update as at 02 November 2023.

This REIT has impressed me with perfect occupancy, significant rental price increases, and a conservatively geared balance sheet (see comments in August).

The stock has been steady in recent times::

All of the themes that have impressed me with it are evident once again in today’s update.

Performance highlights:

99% revenue occupancy for 2023/24 (this means full occupancy!)

LfL growth in rents at 10.5% for 2023/2024, even higher than previously reported.

Minimum LfL growth in rents of 5% targeted for 2024/2025.

2023/2024: the upward revision to rental growth is due to “a higher level of late cancellation and rebooking activity, crystallising further the benefits of dynamic pricing”.

For the current academic year, UK students are 50% of total, while 31% are Chinese.

2024/2025: it still seems rather early to be posting predictions about rental growth for next year. But hopefully (from a shareholder point of view) there will be rental growth of closer to 10% once again. It seems that student accommodation remains in very short supply relative to the demand - here are the CEO’s comments:

"The booking cycle for academic year 2023/24 has exceeded all expectations, with the estate effectively full and like-for-like rental growth above ten per cent…

"Underpinned by the continued attractiveness of the UKs Top Tier Universities, the demand for high quality student accommodation remains strong. With demand and supply imbalance expected to continue for the foreseeable future, our premium accommodation offering and high quality customer service, positions us well for growth within this resilient and growing market."

Acquisitions/disposals: on the acquisition side, £40m+ of properties are under offer. On the disposal side, £24m+ of properties are under offer.

Balance sheet: the key figures here are very attractive to me. LTV (loan to value) is now only 28%, below ESP’s long-term target of 35%. And the weighted average cost of debt is cheap at 4.4%. Although it will pick up slightly:

As previously announced, we expect to amalgamate and refinance all 2024 and 2025 maturities in early 2024. Following refinancing, based on current forward interest rates, we anticipate the weighted average cost of debt to be within the range of 4.5 to 4.7 per cent

Earnings and dividends: last year, the company generated “EPRA earnings” (recurring earnings for a real estate business) of 3.4p per share. For the current year, they now expect to earn 4p per share. This allows for a new dividend target of 3.5p (previously 3.25p). Dividends are paid quarterly.

I think that brokers had already pencilled in about 4p of EPS this year - the StockReport shows an EPS forecast of 4.08p.

Outlook

For the academic year 2024/25 we expect revenue occupancy to remain strong. We will target like-for-like weekly rental growth of at least 5 per cent, offsetting the impact of ongoing inflationary pressure and we expect to deliver a gross margin above 70 per cent.

Gross margin last year was 67.1%, and 58.8% the year before that. Less profitable non-core properties have been disposed of, leaving a more profitable core.

Graham’s view

I remain very impressed by this company’s performance, both in terms of occupancy/rents and also margins and profits.

Net assets as of June 2023 were £715m (c. £1.1bn of assets, c. £400m of borrowings). It would make more sense to me if this company was trading closer to NAV, so I remain positive on it.

The StockRank is not convinced yet, seeing it as expensive from a P/E point of view (although it does rate the company’s Quality as being above average):

TI Fluid Systems (LON:TIFS)

Share price: 131.6p (+6%)

Market cap: £682m (€782m)

TI Fluid Systems plc (TIFS), a global industry leader in highly engineered automotive fluid storage, carrying, delivery and thermal management systems for light vehicles issues, a trading update for the third quarter and nine months ended 30 September 2023.

Listed since 2017, this company’s share price has struggled as the company has fallen into unprofitability. It is also carrying substantial debts. See my comments in August.

Here are the main points from today’s Q3 update. They are confident in the full year outlook, i.e. performance should be in line with expectations.

Revenue growth year-to-date: 12.4% at constant currencies (8.9% at actual exchange rates). Q3 revenue growth 7% at constant currencies. Euro strength is a headwind against reported revenues. Excluding that headwind, it looks like TIFS are outperforming the broader markets in which they operate.

Year-to-date revenue is now €2.62 billion, including 15% growth in the largest region which is “Europe & Africa”.

New BEV deals worth €819m (to be generated over multiple years).

Profits/cash flow: the company now expects its adjusted EBITDA margin to expand back over 7% this year. This was 7.2% in 2021 before falling to 5.5% in 2022. Regardless of your views on EBITDA, it can’t be a bad thing to see this profit margin improve.

Adjusted free cash flow conversion is expected to be “approximately 30% of adjusted EBITDA”. Checking 2022, I see that they only achieved 23.5% free cash flow conversion. It was 33% in 2021. So again, it looks like they are recovering back to 2021 performance levels.

CEO comment: ignoring the corporate-speak, the main point is that they are looking to get margins back to proper levels:

As we outlined at our Capital Markets Day in September, we are Taking the Turn to a successful future. Our strategy is focused on capitalising on the opportunities of electrification while leveraging the strengths of our conventional portfolio. In doing so, we will drive sustainable growth and return to double-digit adjusted EBIT margins in the medium term."

Graham’s view

On revenues of €3.6 billion, a double-digit adjusted EBIT margin would mean adjusted EBIT of €360m+. The current market cap is little over twice that.

I’m going to maintain my positive stance on this one, acknowledging that there are some major risks faced by investors here. The company’s debt continues to concern me although the company itself seems more relaxed, pointing to a 1.7x leverage multiple as of September (net debt/adjusted EBITDA).

For healthy companies, that leverage multiple would normally be considered quite safe. That is the view of TIFS, as it continues to pay dividends and buy back its own shares:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.