Good morning, it's just Paul today, as it's Friday.

All done for today, and the week! Podcast tomorrow :-) Have a lovely weekend all!

Brief market comments

The bounce is on! Is it going to be another bear market rally, or the start of a new bull market? Who knows, it depends on whether people buy or sell.

Although it does seem to me that this week might be a turning point, as peak interest rates appear to be in, and markets look forwards. So who knows, but my money remains fully invested, as I think small caps are offering some tremendous value right now, for patient holders.

Yes there are lots of profit warnings happening, and likely. There are also loads of takeover bids too. So I think these seem excellent conditions for investors who can tolerate the odd disappointment, and who think medium/long term (and of course who pick our shares carefully).

Managing my portfolio

Nobody forces us to sell anything, if we're ungeared. So if I don't like the market price of a share I hold, then I ignore the market price as being unsatisfactory. What's wrong with holding? Especially if there's a divi to look forward to every 6 months.

A few years ago, I decided that staring at profit & loss figures every day was clouding my judgement. So I removed the columns in my spreadsheet showing the original cost, and the running profit/loss on each position. I found this greatly helped my decision-making. Instead of worrying about positions in the red, and gratefully selling them if they got back to breakeven, instead I focused on the fundamentals of each company, and the prospects. Is it decent value at the current price, with a reasonable outlook & balance sheet, and hence worth holding? If so, then my decision is to remain a holder, and my original buying price is totally irrelevant. That's something worth thinking about. Equally, if the fundamentals have gone wrong, and I don't like the value/prospects for the company any more, then it should be sold - and again, my buying price is irrelevant. It's easier to sell a duff share if you don't look at your P&L on it.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

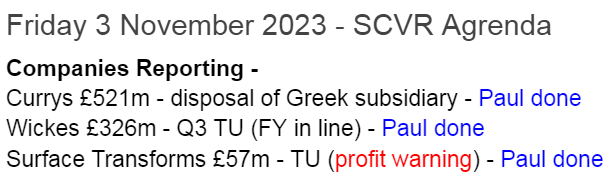

A nice leisurely morning is in prospect, instead of the usual frenzy trying to take everything in, and then decide what to prioritise. I'll be able to manage all 3 of these by myself -

Summaries

Surface Transforms (LON:SCE) - 23.5p (y’day) £57m - Trading Update (profit warning) - Paul - RED

It's another profit warning unfortunately, bad luck to holders. Production delays (again) mean FY 12/2023 revenue forecast of £13.0m becomes only £8.6m. Should be sorted by Q1 2024 (they say), but that leaves an obvious need for more funding - dilution coming, at any unknown price, means I haven't got any choice than to move to RED for now. Pity, as I like the company's longer-term prospects.

Currys (LON:CURY) - up 4% to 48p (£544m) - Proposed Disposal - Paul - RED

Proposed disposal of its Greek business takes some pressure off its stretched balance sheet. However, on reacquainting myself with the numbers, I remain of the view that this is a risky share, with some big nasties on its balance sheet, which could trip it up if we go into a recession.

Wickes (LON:WIX) - up 1% to 133p (£341m) - Q3 Trading Update - Paul - AMBER/GREEN

An in line with expectations update for Q3. Valuation looks about right, but I'm leaning towards a more positive view now, due to the c.8% dividend yield (and buybacks) and sound balance sheet. Although I'm assuming we're not heading into a nasty recession. If we do, then it could clobber WIX's profits and put paid to the generous divis, but wouldn't risk insolvency (unlike Currys).

Paul’s Section:

Surface Transforms (LON:SCE)

23.5p (y’day) £57m - Trading Update (profit warning) - Paul - RED

Surface Transforms (AIM:SCE), manufacturer of carbon fibre reinforced ceramic brake disc materials provides the following trading update for the ten months to 31 October 2023 and revised outlook for the 2023 financial year.

We’ve covered this speculative share 5 times this year, usually AMBER, but on 2 occasions when Roland covered it, he’s more sceptical, with RED or AMBER/RED. Re-reading our previous notes, the common themes this year have been -

Great news on order intake, with big multi-year projects contracted - so demand is very strong.

Production delays as it struggles to gear up to actually make products on a greater scale.

Clearly needs another fundraise, in our opinion.

Today’s update is more of the same, I’m afraid.

Sales are accelerating, but below budget.

Production line - technical problems are constraining output.

Remedial action being taken (sounds pretty basic stuff - eg. training, maintenance of machines, new COO).

Reduced guidance for FY 12/2023 - sales now expected to be £8.6m (£6.3m already achieved by end Oct 2023). That’s quite a big miss, with the StockReport showing £13.0m consensus forecast for revenues.

On the positive side, it expects to reach target production by Q1 2024. Will shareholders see this as an annoying, but temporary/fixable problem? Or a more serious disappointment? I don’t know yet, as the market hasn’t opened yet (writing this at 07:55).

Outlook - it remains upbeat, “very positive” for 2024-2027.

Production capacity is being greatly increased (once they’ve solved the technical problems) -

The Company remains on course to have capacity equivalent to £50m sales per year run rate in 2024 and for £75m sales run rate in 2025. Additionally the Company is well advanced with its plans for the next phase aimed at progressively providing £150m of sales capacity by 2027.

Financing - this is the bit that is more important to me. I can forgive technical problems, assuming they’re not disastrous. The way I read this, another equity raise is inevitable, even if it succeeds in getting a capex loan -

To finance its capital expenditure plans, the Company is in advanced discussions on a £13m capital expenditure loan that would be released as new capacity is expended in 2024 and 2025 but cannot be used for working capital purposes. The outcome of these discussions is not certain but is expected to conclude before the end of 2023. Success in securing the loan will enable the Company to finish installing the current capacity build to £75m as well as commencing the next stage of the capacity build towards £150m sales capacity; however there remains the need to finance the working capital of the significant sales increase over the next few years.

Paul’s opinion - my feeling is that, with this type of share, you have to expect commercialisation to take longer, and encounter problems along the way. The main thing is they’ve got a huge order book. Fulfilling that, for a company that’s almost a startup (in terms of production) is bound to be difficult.

Yet again, a promising UK growth company is under-financed, it’s the same depressing story. Personally I’d be tempted to have a flutter on this share, but not whilst it is so obviously in need of more financing, as we have no way of knowing if that can be raised on reasonable terms or not. Why sit there waiting to be diluted? The profit warning, and higher dilution risk means I’ve got no choice than to move from amber to RED for now. Pity, as it’s a very promising company, it just needs to get the finances properly sorted out.

EDIT at 08:13 - Oh blimey, I've just seen the early share price - heavily whacked, down 41% at 08:14, 13.0p bid, 15.0p offer. Bad luck to holders. Let us know how you see it. Are you tempted to add, sell out, or hope to weather the storm? I suppose it depends on your position size too.

Currys (LON:CURY)

Up 4% to 48p (£544m) - Proposed Disposal - Paul - RED

An agreement to dispose of its Greek operations (Kotsovolos - Greeks do seem to love the letter “o” don’t they!) has been reached.

The enterprise value is £175m, so this is material to the group’s £544m market cap.

The logic is -

The Disposal will simplify the Group's structure enabling it to focus on its larger markets of the UK & Ireland and Nordics, while simultaneously strengthening Currys' balance sheet, increasing flexibility to invest and grow the business and improve shareholder returns.

Sounds sensible to me.

The disposal valuation is 6x adj EBITDA, which doesn’t look a generous price, there again this is a rather unattractive sector (low margin retailing of other companies’ products). CURY says this valuation is greater than its own, so it makes sense on that basis.

Net cash from the disposal is expected to be £156m. Uses of the cash -

In the short term, the Board intends to use the proceeds to reduce net debt and then at the appropriate time, following peak trading, enter into discussions with pension trustees regarding the potential to reduce the pension fund's accounting net deficit and required future contributions. Reducing indebtedness may also provide, at the appropriate time, the Group with greater flexibility to invest to grow the business, after which Currys will also explore the potential to return any surplus capital to Shareholders

Given its stretched balance sheet, I don’t think CURY should be paying any divis at all, so I would treat its forecast 4.4% yield as not being something you can rely on. Indeed the last divi was passed, after poor free cashflow was reported for FY 4/2023, see my review here on 6 July 2023 for more of the gory detail. That includes £50m cash required by the pension fund this year, rising to £78m pa for the next 3 years - they’re hoping to negotiate this down.

Paul’s opinion - CURY shares look high risk, if you delve into the detail, in particular its dreadful balance sheet, which last reported had negative NTAV of £(728)m. Maybe it can keep the plates spinning (or maybe the Greeks will keep all the plates, to smash after dinner?!), but the business is completely dependent on trade creditors extending a huge £2.0bn funding for working capital. In times of higher interest rates, companies are less willing to offer generous payment terms like this. Although maybe Currys is too big for the manufacturers to say no to?

There’s also an issue with negative lease entries, implying plenty of loss-making stores.

It could all be fine, but there are very considerable risks with this share, that’s why it looks cheap on a PER basis. So I'm not trying to predict what the outcome will be, as I don't know. Just flagging up the risks.

I’d be looking at much better funded retailers, with positive balance sheets, if I wanted to invest in this sector (worth considering now that real incomes have started modestly rising again).

CURY is far too risky for me, so it has to remain at RED, although we’ll look at the figures with fresh eyes next time it reports. The Greek disposal should boost the balance sheet a bit, but of course it means losing profits from that division too, and we won't see the revised balance sheet until the full year end in April 2024.

I think there are much better risk:reward opportunities in the market than CURY, but I don’t know how the shares will do. With a peak in 2015, this looks more than just a blip! More like a business that seems to be in structural decline. Maybe one for traders, hoping for a quick bounce perhaps? With a tiny c.1% profit margin, I could see this company bouncing between small profits, and small losses in future. Above all, they have to hope the trade creditors don’t get cold feet and start demanding cash on delivery, as that would instantly kill the business. As could a recession, if we get one - a balance sheet as stretched as CURY's doesn't have any fat in it for a rainy day.

Wickes (LON:WIX)

Up 1% to 133p (£341m) - Q3 Trading Update - Paul - AMBER/GREEN

This looks straightforward, it’s in line with expectations -

Wickes Group plc - Trading Update for the 13 weeks to 30 September 2023

Balanced business model continues to deliver; on track to meet full year expectations

Year-to-date revenues are basically flat against last year, on a LFL (like-for-like) basis.

Given that this lags well behind inflation, that’s not a good outcome on sales, so there must be offsetting margin improvements (lower freight costs, etc).

I don’t find the company’s splitting “core” and “DIFM” revenues is of any use. Sales are sales, to me.

Customers are taking longer to commit to bigger ticket purchases, and there have been some delays from an IT glitch.

Guidance is confirmed - and helpfully it's clearly specified in numbers -

Based on trading to the end of October, we remain comfortable with current market consensus for FY2023 adjusted PBT of £45.3-49.0m

That’s a small profit margin,only about 3%, given that forecast revenues are £1.57bn.

Also it doesn’t tie in with the StockReport’s consensus forecast, which seems to have got higher earnings forecasts from Thomson Reuters.

There’s nothing available on Research Tree.

If I take £47m adj PBT as the mid-point of the FY 12/2023 provided today by Wickes, then take off 25% corporation tax, I get PAT of £35.3m. Dividing that by 257m shares in issue, gives 13.7p EPS, a PER of 9.7x.

Whereas the StockReport says 23.5p, giving a PER of 5.6x, which looks wrong to me.

Ah it’s coming back to me now, this is the one where the 1 January year end has confused Thomson Reuters (not difficult!) and it’s therefore putting the forecasts into the wrong years.

Checking back my more detailed notes here on 15 Sept 2023, with the interim results, I covered this point of incorrect broker consensus figures back then too.

Paul’s opinion - nothing has really changed since my last review c.7 weeks ago.

Dividend yield and buybacks are generous, and affordable given the strong balance sheet, but with such a wafer thin profit margin, it wouldn’t take much of an economic downturn to wipe out profits, and take the dividend down with it.

I thought the price was up with events at 147p, and went AMBER on 15 Sept.

Given that it’s now cheaper, at 133p, then it’s a bit more attractive, especially as the fundamentals haven’t changed - same full year guidance as before.

Overall, if you have to own Wickes or Currys, I would say Wickes is a vastly safer investment proposition. There’s not enough here to excite me though, and I think it’s probably priced about right. So I’ll stick with amber. Or maybe I should be a bit more positive, given the 8.2% (hopefully sustainable) dividend yield, and the high StockRank of 89?

OK, yes let’s go up a little to AMBER/GREEN! I’m basing that on my assumption that the economy isn’t heading into a deep recession of course. If it does, then all bets could be off.

Note that the share count has barely changed since it listed, so theoretically there's nothing to stop the share price regaining previous highs -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.