Good morning from Paul & Graham!

That's it for today.

Mello Trust & Funds online show (free) - is today from 13:00 - I'm flagging it in particular as the highly regarded Richard Staveley from Rockwood Strategic is giving a presentation. I know he's been favourably discussed in the reader comments here before, hence the mention. I couldn't make last night's Mello, so if anyone has views on Sosandar (LON:SOS) and Solid State (LON:SOLI) then please do post a comment below with your impressions of their presentations last night. Must admit, I am far from convinced by the major change of strategy at SOS.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

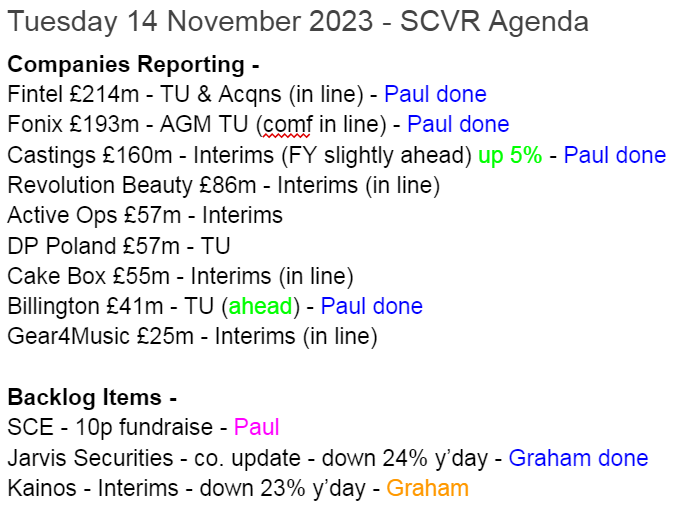

Quite a bit to look at today, so we might grey out some of the unremarkable, in line updates -

Summaries

Fonix Mobile (LON:FNX) - 193p (pre-market) £193m - Trading Update (AGM) - Paul - GREEN

Today's AGM update reassures on positive trading. Sounds like it's a bit ahead of forecast, and with very sticky clients, risk strikes me as low. Capital-light, and paying out a >4% dividend yield, there's a lot to like here. I think it's worth the c.20x PER. The wild card is international expansion, which has worked very well in Ireland. Other countries to follow, I wonder?

Jarvis Securities (LON:JIM) - down 32% this week to 56.2p (£25m) - Dividend and Company Update (divi suspended, trading in line) - Graham - GREEN

Jarvis suspends its Q4 divi although it claims that this suspension is in line with expectations. It also provides more details on the ongoing regulatory reviews. The market is pricing in awful news; I’m stubbornly remaining Green on JIM until the bad news is revealed.

Billington Holdings (LON:BILN) - up 10% to 350p (£45m) - Trading Update (ahead exps) - Paul - AMBER/GREEN

Another ahead of expectations update, coming on top of a previous one as recently as Sept 2023. It looks stunningly cheap now, but of course cyclical companies often do look cheap just before a recession that causes future earnings to collapse. That's the big unknown here. With a strong balance sheet, plenty of cash, and good divis, I feel forced to go up from amber to AMBER/GREEN.

Fintel (LON:FNTL) - unch 206p (£216m) - Trading Update & 2 Acquisitions - Paul - AMBER

Formerly known as SimplyBiz. Today we get an in line update, and news of 2 new acquisitions (4 in total this year). We've not reviewed it since Jan 2023, so I run through everything below, and come out reasonably impressed - a decent business, but maybe priced about right for now? I can't find anything wrong anyway, but in a deep bear market for small caps, the valuation isn't cheap enough to get me interested.

Castings (LON:CGS) - up 5% to 385p (£168m) - Interim Results - Paul - GREEN

Smashing interim results. Superb asset-backing, and a generous flow of dividends (plus specials). Encouraging diversification away from the dominant truck turbocharger housings. I remain of the view this seems a lovely tuck away and forget income share.

Paul’s Section:

Fonix Mobile (LON:FNX)

193p (pre-market) £193m - Trading Update (AGM) - Paul - GREEN

Positive start to new financial year with strong growth in both the UK and Ireland

Founded in 2006, Fonix provides mobile payments and messaging services for clients across media, telecoms, entertainment, enterprise and commerce.

When consumers make payments, they are charged to their mobile phone bill. This service can be used for ticketing, content, cash deposits and donations. Fonix's service works by charging digital payments to the mobile phone bill, either via carrier billing or SMS billing. Fonix also offers messaging solutions.

The current financial year is FY 6/2024.

A reassuring update today - I’ve highlighted the key points as usual -

Fonix has had a positive start to the financial year, comfortably in line with expectations, with strong income growth from new and existing media clients in both the UK and Ireland. This week will see Fonix once again power donations for BBC Children In Need for the tenth consecutive year.

The business has continued to progress its planned investment in both technology and exploring new international markets, as the business looks to expand its market reach whilst continuing to deliver new and enhanced products and services.

With high levels of repeating revenue and a strong, expanding run-rate from key clients, the Board continues to be confident in the growth potential for Fonix for the rest of the financial year and beyond.

Paul’s opinion - today’s update reassures nicely, which it needs to with a forward PER c.20x.

A stand-out feature of FNX is how sticky its clients are.

Also the international expansion excites me, as this can apparently be done at little cost & risk.

I’d like to speak to management again, and my key question would be how can it dislodge incumbents in international markets (which it must have done very effectively in Ireland), to grow further? Bolting on additional, decent-sized overseas markets, could be transformative, if it’s possible.

Fonix seems to have an excellent business model - capital-light, and cash-generative, so it can self-fund growth at the same time as paying out most of its cashflows as dividends (with cover of about 1.2x).

I’ve reviewed this company 6 times in the last year, in 5 cases going green, with just a slight wobble in Mar 2023 when the share price got a bit ahead of itself at 237p, so I shifted down a gear to amber briefly, purely on valuation concerns.

With the price now more reasonable, at 193p, and the good news continuing to flow, I’m happy to remain at GREEN.

This really does look a very good, high quality company, that’s also paying a c.4% dividend yield. It’s not put a foot wrong since floating in Oct 2020. Management remain big shareholders - there's nothing quite like the owner's eye!

Superb track record actually -

This shre price may not look impressive, but bear in mind there have been divis of about 19p on top of the share price, and the background has been a savage bear market, where many other shares (small and medium) have halved or more. In that context, I wouldn't sniff at this performance -

Here it is on a chart - showing FNX since listing (top line, up 96% since listing), and the relevant index, FTSE AIM All Share Index (FTSE:AXX) (down 28% over the same period)

Billington Holdings (LON:BILN)

Up 10% to 350p (£45m) - Trading Update (ahead exps) - Paul - AMBER/GREEN

Billington Holdings Plc (AIM: BILN), one of the UK's leading structural steel and construction safety solutions specialists, is pleased to provide an update on current trading.

Company’s headline -

Strong trading performance continues across the Group and results for the year ending 31 December 2023 are now expected to be ahead of previous market expectations

That’s a good headline above. I like it when these headlines are simple, and factual, as this one is.

As a general point, what we dislike is when a PR has been let loose on a negative update, and has tried to buff it up with some positive-sounding waffle. Investors see straight through that, and it undermines trust in the company’s management. No such concerns here with BILN though, I’m pleased to say.

Background -

From our previous notes, to get me up to speed -

14/12/2022 - 290p - AMBER - Good TU - signif ahead. Good order book & bal sht.

18/4/2023 - 390p - AMBER - In line results. Good outlook.

Why were we only amber, considering the newsflow was good, and valuation cheap? Worries about cyclicality - this type of business tends to be very cyclical. We’ve seen in the past how, in recessions, after a time lag as they work through the existing order book, performance falls off a cliff and takes the share price with it, as new orders dry up.

Consider this - BILN shares peaked at 500p in Feb 2007, then crashed to a low of about 38p in April 2013. Since then the shares have almost 10-bagged. So you can see the extreme cyclicality with this type of share. Which is why I’m very wary about something so closely linked to the business investment cycle. Especially given that major building projects are no longer subsidised by the mis-allocation of capital that 15 years of zero interest rates arguably caused. Macro conditions are likely to drive this share price very much, in the medium term I’d say, so investors need to be very clear on what your macro view is.

Interim Results (June 2023) - We didn’t look at the interims to June 2023, so I’ll have a quick look now.

Excellent numbers! H1 adj PBT soared 237% to £5.0m, on £60.2m revenues (up 30%). (adjs were only small, so OK)

Balance sheet at June 2023 looked fairly good, with £36m NTAV. No financial debt, and £10.8m cash is robust. Only query was a £2.2m “Pension asset”, which would need checking to ensure it’s not a real-world deficit.

Cashflow - not great, as growth means that working capital is absorbing cash. Hence little scope for paying divis - divis were negligible in 2020-22, but I see a bigger (15.5p) final divi has just been paid in July 2023, which will fall into the H2 numbers in FY 12/2023 as a £2.0m cash outflow.

Outlook (from H1 results, issued 19 Sept 2023) was quite mixed, with some negatives (softening demand from office & warehouse builders, difficulties with trade credit insurance, deferred or cancelled projects). On the plus side, it mentioned benefits from easing steel, and energy prices (helping margins), stability in securing supplies, and buoyancy in other sectors (energy from waste, high-tech manufacturing, infrastructure, and data centres).

Still, it rounded off the interims with another ahead of expectations update (19/9/2023).

Today’s update at last!

Strong trading performance continues across the Group and results for the year ending 31 December 2023 are now expected to be ahead of previous market expectations

The Company is pleased to report that trading has continued to be strong across the Group, with further good quality orders secured and increased volumes being delivered in the second half of the year.

The Group continues to benefit from improved manufacturing efficiencies from the deployment of its capital investment programme across all the Group's production facilities.

The successful and efficient delivery of high quality contracts, combined with the increased capacity and positive final determination of contract values has seen the momentum gained during the first half of 2023 continue.

Consequently, the Group now expects revenue and profit before tax for the year ending 31 December 2023 to be ahead of previous market expectations.

Subjectively, that seems more positive to me, than the Sept 2023 update, which mentioned quite a few negative factors that are not mentioned today.

Outlook - the CEO says -

Going forward into 2024 we have a healthy pipeline of further opportunties [sic] however, we do remain mindful of continuing inflationary pressures and an uncertain macroeconomic outlook, but with our strong balance sheet I do believe the Group is well positioned for the future."

Broker update - thank to Cavendish for an update note this morning.

It’s a whacking great 33% increase to FY 12/2023 profit forecasts - quite unusual to see when we’re only 9 weeks away from year end.

Adj PBT for FY 12/2023 is now upped to £13.3m (a healthy 10.6% margin on £125m revenue). Forecast EPS is upped from 62.9p to 83.9p.

Net cash is expected to be £16.0m, comparing very favourably with the £10.8m at June 2023. That’s after paying out the £2m divi in H2, I’ve checked the broker’s cashflow forecast to confirm that point.

The PER on FY 12/2023 numbers is only 4.2x - either this share is much too cheap, or the market thinks 2023 is a bumper year before the recessionary rot sets in, as happened in previous recessions.

Cavendish is treating this as a bumper year, since its 2024 forecast is much lower, at 49.3p EPS, bringing the PER to 7.1x, which is probably sensible at this stage of the cycle, where we’re seeing mounting evidence across many sectors of businesses being more cautious about committing to larger contracts.

Paul’s opinion - I’m mesmerised by value like this! A strong, cash-rich balance sheet, a 2023 PER of only 4.2x, and a forecast 5.7% dividend yield (20p per share in both 2023 and 2024) is bound to excite me.

You can make up your own mind about how much macro factors offset the sparkling performance in 2023.

I’d say the balance sheet looks plenty strong enough to ride out a downturn in demand, if that does transpire (which has to be a high probability assumption for 2024 I would imagine?).

With figures this good, I can’t remain on the fence, so have to shift up from amber to AMBER/GREEN. I’d be completely green, if macro had been more stable & predictable.

Note the concentrated shareholders - to save me looking it up, does anyone know the background to Gutenga Investments Ltd? Note they sold 260k shares in May 2023 -

Note the cyclicality! -

Fintel (LON:FNTL)

Unch 206p (£216m) - Trading Update & 2 Acquisitions - Paul - AMBER

Fintel (AIM: FNTL), the leading provider of fintech and support services to the UK Retail Financial Services sector today provides an update on two further strategic acquisitions.

It’s been a while since we last looked at this acquisitive group, which used to be called Simplybiz. I like the reliable recurring revenues here, and it’s sailed through the 2-year small caps bear market relatively unscathed, and with a high StockRank, as you can see here -

Current trading & outlook - sounds OK -

The Core business continues to deliver resilient earnings in line with board and market expectations for FY23, with the ongoing pressures in the UK housing market being largely offset by continued progress in software license sales and acquisitions…

"Our positive trading momentum has continued into the second half, with continued growth in SaaS and Subscriptions revenues, supported by our resilient, diversified revenue base…

With a strong M&A pipeline, underpinned by our balance sheet and cash position, we are confident in making further strategic progress."

Fresh acquisitions - 2 more, making it 4 in total this year -

VouchedFor - FNTL paid £7.5m to acquire this review site for financial intermediaries. 2-year earn-out (linked to recurring revenues), capped at £10m. Currently trading at breakeven, so this could be a drag on margins for the time being?

AKG - a much smaller deal, £1.6m up-front, and £0.4m max earn-out.

Paul’s opinion - I’ve got a generally favourable opinion of this group.

Multiple acquisitions can make it difficult to keep track of what’s going on, and the VouchedFor deal looks quite hefty for something only trading at breakeven, so FNTL must have high hopes to improve performance there.

There’s little balance sheet support, so this share is all about good profit margins and resilient, recurring revenues. Plus a small divi. There’s a large bank facility available for up-front funding of acquisitions, although given macro uncertainty, I wouldn’t want to see the borrowings increased too aggressively. FNTL has stayed the right side of the line in the past though, which reassures.

Overall, this looks OK, and seems priced about right on a fwd PER of 15.7x, so I’m happy to stay at AMBER, and it looks fairly safe (i.e. low risk of profit warning, due to recurring subscription revenues). I can’t see anything wrong with FNTL, but in a bombed out small caps market, it doesn’t offer enough value to tempt me in.

Castings (LON:CGS)

Up 5% to 385p (£168m) - Interim Results - Paul - GREEN

Quick comments - strong H1 numbers with PBT up 38% to £10.3m. Helped by recovery in demand from truck manufacturers. Also note the 5-fold increase in finance income to £648k in H1 from higher interest rates.

Ludicrously strong balance sheet, as always, with NTAV of £127m (76% asset backing vs market cap). Cash of £31.3m, and no interest-bearing debt.

Cashflows good - used about two thirds for dividends, one third for capex.

Forecast yield is 5%+specials, this is the main reason to hold this share.

Chairman stepping down after 63 years with the company, what a slacker! ;-)

Outlook - sounds good, with FY 3/2024 outlook “marginally ahead” of expectations.

Good to see production diversifying, as I was worried CGS was too reliant on truck turbocharger housings, it says -

We have also seen continued progression in our other growth sectors of wind energy, rail, trailer braking and trailer coupling, as well as increasing opportunities to supply parts into the US market.

Valuation - very reasonable, at fwd PER 10.7x, 5% yield, and so strongly asset backed.

Paul’s opinion - GREEN, it’s a lovely business, reasonably priced, for patient investors.

Very long-term chart -

Graham’s Section:

Jarvis Securities (LON:JIM)

Share price: 56.2p (-32% this week)

Market cap: £25m

This stockbroker published an update at 12:52 pm yesterday afternoon: “Dividend and Company update”.

The market dumped the shares another 24% on the news:

Dividend news:

In line with current market expectations, the Company confirms that it is not declaring a fourth quarter dividend (total interim dividend for the twelve months ended 31 December 2023: 8.75p).

Checking the last three updates from the company, including the declaration of the Q3 dividend, there was no mention of the Q4 dividend being suspended.

A broker note published on 10th August by WH Ireland estimated the full-year dividend for 2023 to be 8.75p. As far as I know, they are the only broker covering the stock.

The Q1, Q2 and Q3 dividends do indeed add up to 8.75p. So no Q4 dividend was needed for Jarvis to hit forecasts.

However, I think the broker note might possibly have contradicted itself a little bit, as it also mentioned a 1p dividend being declared in Q4.

And judging by message board comments, it sounds like many investors were still hopeful of a Q4 dividend.

So personally, I’m not 100% convinced that the suspension of the Q4 dividend is entirely in line with market expectations. I think shareholders had a reasonable belief that a small Q4 dividend was still possible.

Company update

The rest of the announcement covers the ongoing regulatory review:

…an additional review (known as phase 1c) ("Phase 1c") is required by the FCA to be undertaken in respect of its subsidiary, Jarvis Investment Management Ltd ("JIML") . Phase 1c will review JIML's approach to uninvested client cash, interest retention and term deposits.

I have had one long unanswered question about JIM when it comes to uninvested client cash. I have always wondered where it places this money to earn interest, as it seems to me that it has earned very attractive returns on client cash. But for good commercial reasons, a stockbroker is unlikely to give you a list of its counterparties.

However, it is normal in this industry for interest on client cash to be an important revenue stream (disclosure: I’m currently a shareholder in Hargreaves Lansdown (LON:HL.) and I’m a former shareholder of Jarvis Securities (LON:JIM) ).

The FCA (see this recent FT article) seems to be of the opinion that providing “fair value” to customers means giving them more of the interest earned on their cash (the FCA might be forgetting that interest earned by brokers on client cash could help to subsidise lower fees and annual charges).

If the FCA wants stockbrokers to earn from commissions and charges alone, rather than from interest on client cash, that will certainly be a difficulty for low-frills, discount brokers such as Jarvis.

The update continues:

The FCA have also provided additional direction for the pre-existing Phase 2, if required. This phase would include a review and assurance report on the remediation work undertaken by JIML on the matters raised in any of the s.166 reports. This review may be required before the voluntary restrictions on JIML's new business and assets can be lifted.

These restrictions impinge on the ability of Jarvis to pay dividends.

Exceptional costs of £1.3m in the current financial year should be the least of shareholder concerns here.

The company “continues to trade in line with current market expectation” which is £6.6m of adjusted PBT (before the exceptional costs).

Graham’s view

The market is telling me that I am completely wrong on this share. The share price is down by 66% over the past year. I gave it the thumbs up in September 2022 at 94p, in March at 139.5p, in August at 125p

So feel free to ignore my views on this one, as the market clearly disagrees with me.

I can accept that a regulatory review is time-consuming for management. I can accept that where regulatory mistakes were made, this reflects poorly on the company. I can accept that there are exceptional costs and (possibly) fines to be paid. I can accept that all of this makes for poor publicity, which is not good for business.

But then at the end of the day we are left with a company with £5m of its own cash (as of July) and with £6.6m of PBT (before the exceptional costs associated with the review), and it’s trading at a market cap of £25m.

This is a company that has always made a profit for the last 20 years, has paid dividends every year, and more often than not has generated amazingly high quality metrics, thanks to careful cost control and a capital-light business model.

I have had some concerns about the company - were they investing enough in their trading platform to stay competitive? Were they being careful with their choice of counterparty when putting client cash on deposit?

It’s also worth mentioning, as readers have commented on, that the FD recently left the company. The timing of this change was interesting. He was replaced immediately by a company insider, rather than an external hire.

With a major investigation still underway and likely to last for several more months, it would be very easy for me to switch my stance to Amber or even to Red. I can’t predict the outcome of this investigation any better than you can. However, until profitability at Jarvis takes a more serious hit, or the company is fined into oblivion, I have to stick to my conviction that this stock is underpriced. When the facts prove me wrong, I will change my mind.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.