Good morning, it's Paul & Graham here again today!

We'll leave it there for today.

As I expected, Richard Staveley of Rockwood Strategic (LON:RKW) (part of the Harwood Capital stable) was absolutely brilliant on the Mello Funds & Trusts show yesterday afternoon. I took detailed notes, it really was a masterclass in how to create & manage a small caps portfolio. It's a tiny fund, only £46m, but it's established a fantastic performance track record, no.1 in small caps funds. You can see why when Staveley explains Rockwood's approach. He'll be appearing in person at Mello Chiswick too, along with loads of other superb speakers, so I'm looking forward to that.

Multibagger webinar is tonight at 18:00 - all subscribers should have been sent emails about this event, but you can register here if not. The boffins at Stocko HQ have come up with a data-driven way to spot multibaggers - that is certainly more than enough to grab my attention! I've set an alarm on my phone so I don't miss it.

Big drop in UK consumer inflation - this is as expected, but the ONS report today confirms that there has been a huge drop in CPI inflation from 6.7% in Sept, to 4.6% in Oct 2023, mainly due to a big jump in Oct 2022 inflation dropping out of the numbers as it annualises. What it describes as "core" inflation (which excludes volatile food/drink/energy prices) dropped from 5.9% in Sept, to 5.6% in Oct 2023.

Still some way to go before things have normalised, but it's clearly moving in the right direction. How long before investors start anticipating lower interest rates, and all that cash on the sidelines starts surging back into small caps?! Your guess is as good as mine!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

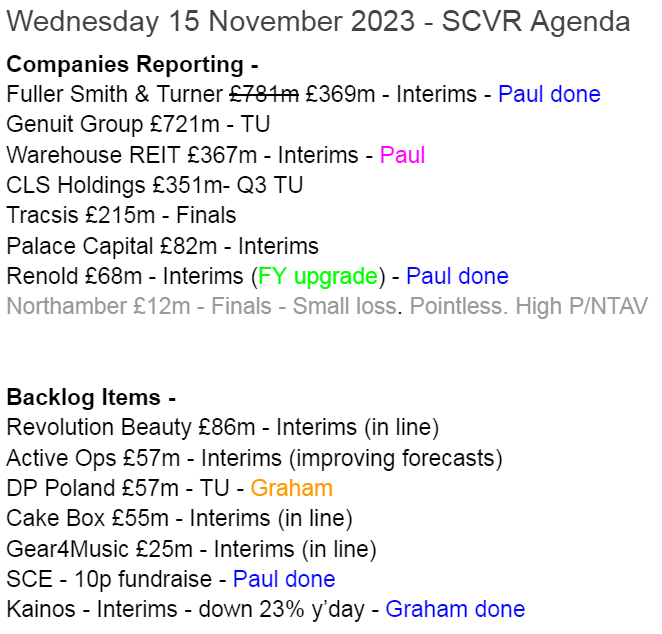

Here's today's list, as usual we'll cherry-pick the most interesting companies, and over/under expectations updates primarily. If it's just in line, then it probably won't be covered -

Summaries

Renold (LON:RNO) (Paul holds) - 30p (pre-market) £68m - Interim Results - Paul - GREEN

Excellent interim results. Cavendish raises FY 3/2024 forecast by 9%, but even then it seems modest, so I'd anticipate another beat. This share looks far too cheap, even allowing for the cash-hungry pension scheme. I see continued upside here, providing nothing goes wrong. Although it's using cashflow to fuel the pension scheme, and make acquisitions, so no divis for now.

Kainos (LON:KNOS) - down 15% this week to £10.01 (£1.25bn) - Interim Results - Graham - AMBER

This IT provider published decent results, but the market took fright at some weaknesses in the commentary and pushed the stock down by c. 25% at one point. Kainos has cash of over £100m and is probably a fine company in its field, but the valuation seems hard to justify.

Surface Transforms (LON:SCE) - 10.75p (£26m pre dilution) - Fundraise - Paul - RED

As expected, SCE has come back for more cash, but it looks nowhere near enough (again), so I doubt this fundraise will be the last. A vitally important point is that most of this 10p equity raise is conditional on securing a £13m capex loan from an unknown lender. Therefore, I think this share remains very high risk unless & until the loan has been agreed (on what terms though?). Hence I'm not giving it the green light yet, as so much risk remains. Fingers crossed the funding is secured, as this looks such a promising company with a huge order book. What a pity to see it struggling like this.

Fuller Smith & Turner (LON:FSTA) - up 6% to 608p (market cap £369m - see below) - Interim Results - Paul - GREEN

This pubs group is much cheaper than it looks on the StockReport. I've been guided by a previous analysis of the complicated 3-class shares structure, by our Graham, and confirmed it with a Liberum note. Strong asset backing (above the market cap) and decent profit growth, with sector-leading LFL revenue growth, make this share appeal to the value investor in me. Although I'm more of a 'Spoons man in terms of value for money, as a customer!

Paul’s Section:

Renold (LON:RNO) (Paul holds)

30p (pre-market) £68m - Interim Results - Paul - GREEN

Renold (AIM: RNO), a leading international supplier of industrial chains and related power transmission products, announces its interim results for the six month period ended 30 September 2023.

A long-standing favourite of mine, this has been an under the radar, but convincing turnaround in recent years. Problems of the past are now behind it, and Renold is now on the front foot, with debt under control, bolt-on acquisitions being done, and it sailed through the pandemic and energy crisis with aplomb (no dilution necessary, share count has remained at 225m since 2018).

The main negative is a large pension fund, which is cash hungry, which is cash that could otherwise have been used to pay divis, hence why the PER will be a fair bit lower than companies without pension deficits.

Considering tough macro, I find these interim highlights very impressive! (assisted by acquisitions)

Note that profit adjustments are fairly small (about 10% of profit), and this year go in the opposite direction - ie lowering adj profit vs statutory profit (thanks to a one-off property disposal gain).

Very good figures, and note that net debt is less than 3 half years’ profit, or 0.7x rolling adj EBITDA, generally considered low -

Pension deficit - has reduced under IAS 19 from £62.2m 6 months ago, to £52.7m at 30 Sept 2023. Still substantial of course. The cash contributions from Renold were a whopping £6.0m in H1, but that includes an accelerated payment of £2.6m that was originally planned for H2. Pensions are important to valuing the share, so make sure to read all the information on that in today’s results. Note the additional £1m cash contributions (if adj operating profit over £16m) has kicked in this year. That’s fine, it’s affordable, and a well known factor. This is why the PER is so low.

Outlook - order book has fallen, but I think that’s OK as the explanation is that supply chains are normalising, so customers don’t feel the need to order further in advance, as they were doing last year.

CEO comments below start off sounding cautious, but then surprise and delight us with an ahead of expectations conclusion (for FY 3/2024) -

"I'm pleased to report continued progress which builds on the momentum the Group has enjoyed in recent periods, delivering a record half year result. Sales, margins, profits and cash generation have all progressed well. Global markets continue to be uncertain and we remain vigilant for changes in patterns of demand beyond the current order book shortening. We are delighted with the purchase of Davidson in Australia, which further builds our inorganic growth strategy and we remain well positioned to continue developing through acquisition. There remains uncertainty over the implication of global economic pressures in the medium term, however the Board is increasingly confident in delivering a result for the current year ahead of previous market expectations."

Cashflow statement - excellent cash generation in H1 of £17.1m (that’s after capex, and working capital movements).

The pension scheme payments used £6.0m of that, but the more normal £3m half-yearly payment would have been about 18% of cash generation. So this pension issue is being nicely diluted into a bigger, more cash generative group. Becoming less of an issue, in other words.

It’s also self-funding the acquisition payments of £4.9m in H1, without borrowing more.

The big gap is obviously there are no dividend payments, but that is the company’s stated strategy - it is making acquisitions, as a better use of its cash generation, at this stage. The capacity to pay future dividends is clearly there, however.

Balance sheet - dominated by £42m of intangible assets, and the £52.7m pension deficit.

NAV is £51.8m (up from £38.2m a year earlier), and NTAV is c.£10m. So not the greatest balance sheet, but the pension deficit is a manageable, long-term liability, which is being managed fine.

Broker update - thanks to Cavendish for crunching the numbers.

It ups FY 3/2024 forecast by 9.3% to 6.0p.

However, the company has just reported 3.8p achieved in H1, so the forecast looks light, and hence I’d expect another upgrade probably after Christmas.

We like it that way around - under-promise, and over-deliver!

It’s difficult to see if there is any H1/H2 seasonality from the historic numbers, due to the multi-year covid disruption. It looks as there’s some variability in seasonal profitability, but if anything, H2 seems the stronger half most years. Another reason to imagine the 6.0p current year forecast might be beatable.

Paul’s opinion - remains highly positive. This is an excellent quality business, that investors still seem to be prejudiced against due to its lacklustre historic track record. But we're not buying the past, we're buying the future!

These numbers clearly show a very much improved business, that has decent margins, is strongly cash generative, making good bolt-on acquisitions in the same sector (so they know exactly what they’re buying, hence not likely to make any expensive mistakes).

The shares are strikingly cheap, at a PER of only 5x the new (prudent) forecast.

I think the discount for the pension deficit is now far too large, which gives considerable upside to equity.

In my opinion, this share could be double the current level in the next bull market, so patient holders should be increasingly confident that you’re onto a winner here. Providing nothing goes wrong of course, as with everything.

It’s another thumbs up from me, I’m very pleased with how Renold is working out. GREEN.

Stockopedia awards an unbiased, top-class StockRank of 97.

Considering the last 2 years have been a savage bear market for small caps, RNO has been a safe port -

Surface Transforms (LON:SCE)

10.75p (£26m pre dilution) - Fundraise - Paul - RED

As expected, this accident-prone maker of high end ceramic brake discs has had to come back to the market for more equity, yet again. No surprises there, as it’s been obvious for some time that another fundraise would be required.

The longer it takes to refinance, the more it leads to small shareholders selling in the market (very sensible, and a key advantage we have), hence big destruction of existing shareholder value, with the eventual fundraise being done on distressed terms and heavy dilution. We see this huge error from management over & over again in UK small caps, and SCE is only one of the latest examples.

That’s why I think it’s usually best to just not invest in any cash burning shares, but instead watch and wait for them to reach a tipping point where they’re close to breakeven, and have ample funding. The valuation is often on the floor by then as well, so risk:reward favours the cautious, later investors. The early optimists take all the risk, and often end up with very little at the end of it. Plus they’re almost forced to keep averaging down, in the hope of the eventual gains. I’m speaking from experience here! Lots and lots of it, doing it the wrong way around, backing cash burners way too early, and losing my shirt. They nearly all fail, requiring much longer, and costing multiples of what the initial business plan suggested. Early valuations built on hope/hype are almost always way too high.

Look at SCE as an example - it floated originally in 2002, so it’s taken over 20 years to begin to commercialise its ceramic brake discs.

On the upside though, its huge order book demonstrates there’s very strong demand, so for that reason, despite all the problems, I do think this company looks potentially interesting, hence why we’re covering it here. If it was just another no-hoper, we wouldn’t be wasting ours or your time on it.

This Proposed Placing announcement came out after hours on Monday this week (13 Nov 2023). Key points -

New equity being raised at 10.0p per share (15% discount on an already bombed out share price).

£2.0m firm placing

£6.0m conditional placing

Key point - “conditional” in this case is more important. Usually in placings that just means subject to the rubber stamping at a shareholder vote (18 Dec 2023). However, in this case it’s absolutely key that SCE secures a loan facility of £13m for its required capex. If that loan facility is not agreed, then the conditional placing (and open offer) could fail, and result in a potentially disastrous outcome of a larger, even more deeply discounted fundraising being required, or potential insolvency even, if it wasn’t possible to raise more equity. So this share remains high risk I’d say.

£2.0m Open Offer to existing holders (with scope to increase it to £3.0m if there is excess demand)

Zeus & Cavendish are the joint brokers.

Directors are only stumping up £135k between 5 of them.

Proposed Loan Facility

To finance its capital expenditure plans, the Company is in advanced discussions on a £13 million capital expenditure loan facility that would be released if new capital expenditure is incurred in 2024 and 2025. The proposed Loan Facility has a five-year term and can only be used to finance capital expenditure and not for working capital purposes. The outcome of these discussions is not certain but is expected to conclude before the end of 2023. Success in securing the Loan Facility (or alternate debt funding) will enable the Company to finish installing the current capacity build to £75 million9 p.a. (Part 2 of Phase 2), as well as commencing the next stage of the capacity build towards £150 million9 p.a. revenue capacity (Phase 3); however there remains the need to finance working capital required to support the significant production increases during 2023 and 2024.

The following day, 14 Nov, SCE announced this - Result of the Placing & Subscription

The placings have succeeded, conditionally raising £8.3m through the future issue of 82.9m shares (existing equity is 241.7m, so this is c.34% increase in the share count.

In addition, there could be 20-30m new shares issued in the open offer, taking the total to between 102.9m to 112.9m new shares (dilution of c.43% to 47% of the existing shares). It could be less than that of course, if the Open Offer bombs. Although Open Offer applications are also conditional on the loan facility being agreed, so applicants are not taking any additional risk, as if the loan agreement fails, then they wouldn’t have to pay up for the open offer shares. That’s my understanding anyway, correct me if I’m wrong. Hence I think it does make sense for existing holders to apply for open offer shares, as they're not taking any additional risk.

Paul’s opinion - this situation actually makes me feel quite sad. Such a promising UK company, with massive demand for its products, that is struggling to raise a relatively small amount of money to push through to full commercialisation.

Mind you, I can also see why investors are reluctant to fund something that has disappointed so many times.

This is not a normal fundraise, it hinges on securing a £13m loan for capex, which in itself looks a stretch - few lenders will normally extend such a loan to a still loss-making venture. So I wonder what the cost would be, even if it is possible to secure it?

If the loan negotiations fall through, then we’re into potentially very choppy water. For this reason, I see it as far too risky for me to want to get involved at this stage.

It could all turn out fine, which would be great. I’m only flagging risk, not predicting what will happen, as I have no idea what negotiations are going on behind the scenes, so I couldn't even guess at the likely outcome, and wouldn't want to guess, as I don't have enough information.

This share highlights yet again that the UK stock market is simply not the right place for speculative startups requiring repeated rounds of funding. SCE should have never been floated in the first place, this type of business should be funded by venture capitalists or private equity, not retail investors on AIM.

Maybe someone with deep pockets might come along and buy SCE in its entirety? That would probably be the best thing for the business, but leave AIM investors nursing losses.

I can say with considerable confidence, that this latest placing won’t be the last!

SCE clearly, very obviously actually, needs a lot more investment. Investors need to hope that it can turn the corner with the various technical problems, so that the next fundraise (almost certainly necessary in 2024 I think) could be at a higher price, and hence less dilution.

Overall then, for me the risk is too high, so I’ll stick at RED until the £13m loan has been agreed (on sensible terms), triggering the equity fundraise going ahead. Subject to all that happening, then I’d consider having a small punt on this share myself, but not until that immediate funding risk has been removed. There could possibly be a decent short-term bounce if the funding deal all goes ahead, and focus returns to the upside potential from the large order book... until the next operational & funding problems emerge.

Right back to where it started, but with about 3 times as many shares in issue (compared with 5 years ago), once this latest placing goes through -

Stockopedia hates this type of thing, so gives SCE a scornful StockRank of just 3.

EDIT: I didn't intend spending so much time on SCE, but it's super-interesting! Could go either way I think.

Fuller Smith & Turner (LON:FSTA)

Up 6% to 608p (market cap £369m - see below) - Interim Results - Paul - GREEN

This is a “premium pubs and hotels business”, with 376 sites, mostly in London and the South of England.

The next key point is that there are 3 classes of shares, with different voting rights (to ensure founder family control) and dividend rights. Graham summarised it really well here in the SCVR dated 20 July 2023 - essential reading, as the market cap shown by the StockReport at £781m is calculated using 136m total shares in issue. But the 85m B shares within that only have rights over one-tenth of the dividends. Hence Graham’s view is that the share count should be adjusted to a notional 61m (valuing B shares at one tenth of A and C shares). That sounds convincing to me.

Therefore we think the market cap should be adjusted from £827m (using 136m total share count) to £371m (using the 61m notional share count). That’s clearly a massive difference, so this issue needs very careful checking before anyone buys the shares.

Ah silly me, I’ve just realised I can check it from a broker note! Many thanks to Liberum, which published an excellent sector note (via Research Tree) on 27 Oct 2023, which shows FSTA’s market cap as £345m at 568p per share back then, which implies 60.7m shares in issue, the same as Graham calculated above, allowing for rounding). Therefore we’re definitely correct on this. I’ve flagged the incorrect StockReport market cap (or rather, technically correct, but not actually correct!) to the HQ team at Stocko, with an explanation, so hopefully they can get the data adjusted. They’ve acknowledged my message, and the data team are now investigating.

Key points from today’s Interims from FSTA -

H1 revenue up 11.8% to £188.8m

Impressive LFL sales growth +12.7% in H1

Adj PBT up 48% to £14.5m

Adj EPS 17.2p (but calculated only on A & C shares, per footnote 3 - confusing!)

H1 divi up 42% to 6.63p

Doing more buybacks of A shares.

Net bank debt flat at £129m.

Current trading has slowed down a little, masked by quoting +11.7% for the 32 weeks to 11 Nov 2023 (down from +12.7% in the first 26 weeks). My estimate suggests the last 6 weeks is +7.4% - sneaky reporting, I’m not impressed.

Balance sheet is wonderful, with mostly freehold property. NAV is £443m, less £29m intangible assets gives NTAV of £414m, or 12% above the market cap. When were freeholds last revalued I wonder? There could be upside there (or maybe even some downside, as I’m not convinced pub valuations generally are realistic at the moment, given the poor returns often made on capital values. Alternative use value can underpin some sites though, especially in London where FSTA has a lot of sites).

There’s a pension scheme, so that would need scrutiny.

Potential upside is mentioned from hopefully cessation of rail strikes, and a return of inbound tourism (still below pre-covid, it says).

Paul’s opinion - FSTA looks really interesting, once I got to the correct market cap!

Graham explained very well why he was GREEN on 20 July 2023, and the share price is almost the same now, despite today’s uplift on good results.

With the lovely asset-backing, and a confusing shareholder structure that might put off lots of investors, I agree with Graham that this share might be undervalued.

The hospitality sector is back in focus, after the bid for Restaurant (LON:RTN) and sector dynamics are now looking positive to me, with the squeeze on consumers easing somewhat (wage growth now above inflation), and probably an appetite for people to let their hair down a bit.

So I think this could be a good time to take a fresh look at the whole sector.

The family shareholdings might block a takeover bid for FSTA though. OR, ensure that any bid had to be a knockout price to succeed?

Even I can see there's a breakout on this chart, for traders maybe?!

Graham’s Section:

Kainos (LON:KNOS)

Share price: £10.01 (down 15% this week)

Market cap: £1.25 billion

Kainos Group plc (KNOS), a UK-headquartered IT provider with expertise across three divisions - Digital Services, Workday Services, and Workday Products, is pleased to announce its results for the six months ended 30 September 2023 (H1 24).

I’ve been promising to cover these results since Monday - so let’s take a look at them now!

The shares fell by over 20% on Monday but have since recovered some of the fall.

The IT provider’s results were pretty good by all accounts, despite the market reaction.

Here is the highlights table. I’ve yellowed some of the items that stand out to me:

As you can see, I’ve highlighted 12% growth in PBT - a strong, inflation-beating result, and faster than revenue growth of 7% (I always like to see profits growing faster than revenues).

Note also that the revenue growth in H1 is fully organic and at constant currencies it’s a little higher at 8%.

The company has three divisions: Digital Services, Workday Services and Workday Products. The last two recorded strong revenue growth but Digital Services, the largest division, saw a small (c. 1%) revenue decline.

So why were the shares so disappointed?

Let’s start with bookings down 9%. The company observes that “the comparative period included a 125% increase in Workday Services bookings”.

Then at the Digital Services division, there are references to “reductions in scope”:

Within Digital Services, strong public sector revenue growth of 17% was offset by the anticipated decrease in healthcare and project scope reductions in some commercial sector engagements, with overall revenues at £109.2 million (H1 23: £110.5 million).

This division also saw much lower revenues from public sector healthcare: £20.4m in H1 this year vs. £29.5m in H1 last year. The company describes this as a continuation of post-pandemic decline, i.e. these revenues are still falling after getting a temporary boost from Covid.

Now let’s turn to the outlook: overall it’s a very positive outlook statement, with the company only referring to “significant funding challenges facing the NHS” as a cause for weaker sentiment for Digital Sentiment.

Financial performance: nothing very strange to report here. However as I highlighted in the table above, EPS growth looks very small at 1% - this seems entirely due to taxation. The company’s tax rate jumped sharply from 21% to 28% in the period, as the company saw its UK rate increase and also saw a higher proportion of its profits being taxed at higher rates overseas.

Graham’s view

We rarely cover this one in the report and I’m not inclined to make a habit out of covering it.

For IT providers/consultancies (not software owners), I like to see modest valuations. But this one remains at the racier end of the valuation spectrum, even after recent share price weakness:

But remember that Kainos helps companies to deploy Workday, and this is how Workday ($WDAY) is valued:

Personally, I’d rather take my chances with the absurd Workday valuation than to pay over the odds for a Workday partner.

If I was choosing a stance purely on valuation I would give Kainos the thumbs down. However, I don’t believe that Kainos is actually a bad business, but I would say it is probably overpriced. So I can take a neutral stance on the stock.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.