Good morning from Paul & Graham!

Today's report is now finished, I'll switch to Autumn Statement work next.

Autumn Statement

Today from 12:30. Rather than my usual summary here, we're doing a Stockopedia team effort today, with a separate article here for discussion on this topic. Megan and I have jointly contributed to this article.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

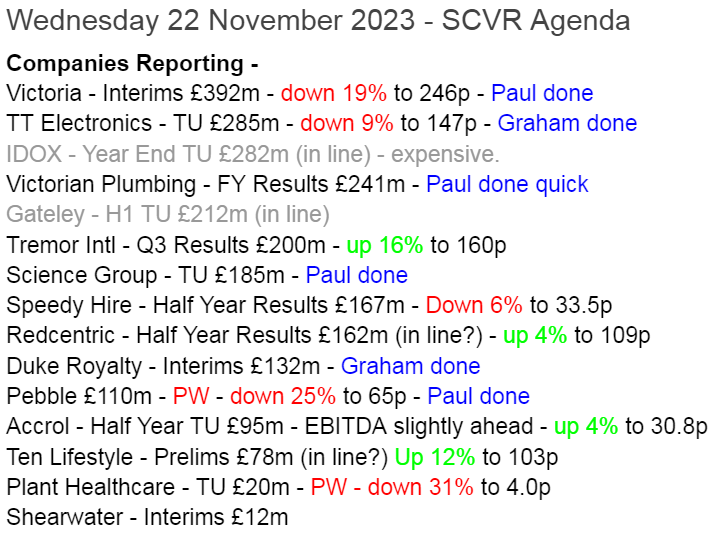

Very colourful today!

Summaries

Science (LON:SAG) - 405p (pre-market) £185m - Trading Update - Paul - GREEN

A reassuring update says that this diversified group is trading in line with expectations overall, despite some softer markets. Nice balance sheet with plenty of cash & liquidity, so expect more acquisitions, which management seems to adopt a sensible approach towards. Valuation remains quite modest, for a decent quality group. So I remain positive on this share.

Duke Royalty (LON:DUKE) - unchanged at 31.2p (£132m) - 2024 Interim Results - Graham - GREEN

Quarterly recurring revenues are now over £6m at Duke, although today’s interim results show profits being held back by losses on equity investments and by higher interest costs. For those willing to bear some risk, I think the NAV discount and 9% yield could be tempting.

Victoria (LON:VCP) - down 16% to 256p (at 09:32) £292m - Interim Results - Paul - RED

A sharp fall in H1 revenues, and wobbly sounding outlook worries me, as it's combined with a horribly weak balance sheet with massive debt - exactly the type of thing we need to be avoiding at present. This is looking high risk now, so needs to be seen as a dangerous. Or, if things work out, it could be a lucrative special situation. Could go either way, but I'm not interested in taking the risk here.

Pebble (LON:PEBB) - down 33% to 59p (£98m) - Trading Update - Paul - AMBER

Profit warning for FY 12/2023 wipes out a third of the share price. Seems a rather harsh reaction, to what seems a setback rather than a disaster, due to slowdown in order intake at one division. Balance sheet is sound. Reasonable track record. EBITDA is nonsense, due to heavy capitalisation of dev spend. Overall, nothing madly exciting here.

TT electronics (LON:TTG) - down 7% at 150.5p (£266m) - Trading Update (profit warning) - Graham - BLACK for spreadsheet - GREEN on fundamentals

TTG’s value has fallen by £20m today as adj. PBT is now expected at the lower end of the forecast range. The reason for this according to the company is £2m of costs associated with a breakdown of machinery. I continue to see good value on offer as TTG deleverages.

Victorian Plumbing (LON:VIC) - up 5% to 78p (£253m) - FY 9/2023 Results - Paul - AMBER/GREEN

Victorian Plumbing Group plc ("Victorian Plumbing", the "Group"), the UK's leading bathroom retailer1, announces its audited full year results for the year ended 30 September 2023 ("2023"), highlighting the significant progress made against its strategic priorities.

These numbers look good! Adj PBT is up 29% to £20.3m, on £285m revenues (up 6%).

Adj diluted EPS 4.7p, up 24%, for a PER of 16.6x

Huge marketing spend, at 28% of revenue.

Dividend payer, 1.4p (up 27%), plus 0.45p interim = 1.85p total, yield of 2.4%

Outlook - confident, and FY 9/2024 has started well, with revenue and margin growth vs LY. New warehouse to open in 2024, removing capacity constraints & inefficiencies.

Share based payments are hefty at £3.9m in both years, that’s 20% of operating profit!

Lovely balance sheet - capital-light, with £45m NTAV all in cash basically!

Cashflow - note it’s capitalising intangibles of c.£3m pa. Biggest outflow is payment of divis.

Paul’s view - this looks a good business. Probably priced about right, but given that it’s trading strongly in tough macro, I’ll go with AMBER/GREEN, as they’re clearly doing something right! [no section below]

Paul’s Section:

Science (LON:SAG)

405p (pre-market) £185m - Trading Update - Paul - GREEN

This is how SAG described itself in its last interim results -

Science Group is a science & technology business providing consultancy and systems to an international client base. The Group comprises five operating divisions, supported by a strong balance sheet including significant cash resources and freehold property assets.

I confirm the balance sheet is indeed good.

We’ve reported positively on SAG the last 3 times here -

24/3/2023 - GREEN 387p - Good FY 12/2022 results. Modest valuation. Cautious outlook. Good bal sht. Strong long-term track record.

18/5/2023 - GREEN 400p - in line AGM TU. Good value at 12x PER. Roland & Paul both like it.

24/7/2023 - GREEN 415p - complicated interims. Sound finances, good value. Owner-managed.

Today’s update - is reassuring -

The Board of Science Group anticipates that Adjusted Operating Profit for the year ending 31 December 2023 will be in line with expectations. Benefitting from the Group's sector portfolio and disciplined cost management, Science Group remains on track for another record year in 2023.

Track record shows no impact from the pandemic,decent growth, but paltry divis - so this is a growth stock, not an income investment -

Acquisition of TP Group seems to be going well.

Cautious outlook -

The Board remains cautious on the outlook for 2024 with geopolitical instability exacerbating the impact on our clients from high interest rates, a weak consumer economic environment and uncertainty associated with political elections (USA and UK). While the reduction in inflation in the Group's key geographies provides some optimism, confidence in end-user markets is unlikely to improve in the near term. However, as consistently demonstrated, the Board considers that Science Group's sector diversity, disciplined management culture and strong financial position will continue to provide resilience.

It made similarly cautious outlook comments earlier this year, but seems to have navigated this year fine, so I'm not reading too much into the caution above.

Share buybacks - surely these reduce liquidity over time (although provide an exit route for sellers)? Share buybacks do enhance EPS and DPS, and with the shares looking good value, buybacks are a good thing in my view -

In this challenging period for small cap investors, the Board recognises the importance of share trading liquidity. As a result, when permissible and if in the Board's opinion to be in the best interests of all shareholders, the Board has continued the buy-back programme. During 2023, the Company has (to 17 November 2023) bought back 828,885 shares, equivalent to approximately 1.8% of the issued share capital, at a total cost of £3.3 million.

Cash & liquidity look ample, giving it options for further acquisitions -

Science Group maintains a very strong balance sheet with gross cash at 31 October 2023 of £32.4 million and net funds of £19.2 million. This robust capital foundation, further enhanced by the undrawn bank facility of £25 million, enables the Board to continue to evaluate corporate opportunities in line with the Group's strategy.

Paul’s opinion - this update strikes me as neutral for the share price.

Broker consensus is 31.6p FY 12/2023 and 33.8p for FY 12/2024. So at 405p, the PER is 12.8x, dropping to 12.0x in 2024 which remains good value I think, for what seems to be a well-managed, decent quality group of companies.

Shareholders have done well over the last 5 years, SAG shrugging off all the pandemic, macro chaos, and a savage small caps bear market over this period - and note the green StockRank -

I can see why there’s little volume traded in SAG shares most days - it strikes me as the type of company that investors would tuck away and hold for the long-term, and would be of little interest to short-term traders.

I remain positive on SAG shares - a quality outfit, at a modest valuation, and it seems to be coping alright, despite softer markets in some parts of the business.

Victoria (LON:VCP)

Down 16% to 256p (at 09:32) £292m - Interim Results - Paul - BLACK (PW) for spreadsheet - RED on fundamentals

Victoria PLC (LSE: VCP), the international designers, manufacturers and distributors of innovative flooring, announces its half year-report for the six months ended 30 September 2023, delivering a H1 FY24 performance in line with management expectations.

EBITDA margin improvement despite softer market demand

Key numbers -

H1 revenue £643m (down 17%, which seems a large fall)

Underlying operating profit £54.3m (down 11%)

Profit before tax £31.7m (adjusted), and £(19.2)m statutory - adjustments are just too large for me.

Net debt (excl. leases) £671m - this is the big issue, VCP has got way too much debt.

Net debt/EBITDA 3.8x (LY: 3.4x) based on bank reporting basis.

Diluted adj EPS 13.48p (LY H1: 17.87p)

Finance costs are now huge, at £52.2m in H1 alone, with £22.6m of that called underlying, and £29.6m non-underlying.

Outlook -

"The remainder of the year continues to look more challenging with ongoing lower demand maintaining pressure on top line sales, alongside inflation edging up raw material input costs. Accordingly, the Board now expects the resulting impact of these headwinds to slightly more than offset the c. £20m EBITDA benefit from the previously announced reorganisation programme. Nevertheless, thanks to the extensive reorganisation Victoria has undertaken over the last 24 months, the business is far better prepared to meet these challenges."

We cannot predict precisely when the rebound will occur although we are (clearly) continually closer to that point. Nevertheless, we view the second half of FY2024 with caution, with increased geopolitical uncertainty and continuing high mortgage rates impacting consumer confidence and discretionary spending. Consequently, we are managing the business to optimise results, market share, and cash flow until the inevitable recovery in demand.

Balance sheet - is a complete mess. NAV of £82.8m is down from £294.7m a year earlier.

Intangible assets (acquisition-related) total £453.9m, so NTAV is negative £(371)m. In a bull market when interest rates were zero, nobody would have worried too much about that. In a bear market, with much higher interest rates, it’s a big problem.

The middle, working capital section of VCP’s balance sheet is fine.

It’s the long-term liabilities that scare me witless, at £1.26bn.

Paul’s opinion - clearly demand is much softer now, but partially mitigated with margin improvements.

I’ve previously expressed my concern over the excessive debt and weak balance sheet here, which combined with deteriorating profitability is now looking precarious.

Remember also the kerfuffle over the qualified audit report in Sept, which the company rebutted strongly, but it’s still a negative for some investors.

Again as previously mentioned, I don’t like all the adjustments in the figures, which seem excessive, and make it very difficult for me to determine if VCP makes any genuine profit at all? Combined with a mountain of debt, I’m repelled by these numbers I’m afraid.

So it has to be a shift from amber/red to just RED - due to the elevated risk.

As with lots of companies, it could all turn out fine, and people who take big risks can sometimes achieve out-sized returns due to the gearing effect (upside all flows to equity if things work out well, as the discount for downside risk disappears - as we saw with Videndum (LON:VID) yesterday on its refinancing). With VCP though, I just don’t want to take on this elevated level of risk. One for traders maybe? The share price is very volatile here because investor perceptions can change so much, and so rapidly, having a geared effect due to the massive debt pile.

I could be wrong, but I have a feeling VCP has been on the receiving end of a shorting attack? Let me know if you have any info on that, in the comments.

Note 2 shows that the company gives itself a clean going concern assessment. Although note 1 says that interims are unaudited (normal), but also says they have not been reviewed by the auditor - that’s not normal in my experience. Usually, I would expect the auditor to sign off the going concern note, even in interim results. Otherwise companies could put anything they like in interim statements. I’ve raised a query with some experts on auditing, and wonder if any readers have relevant experience & knowledge and could comment on this?

Looking at the 10-year chart, it’s had 2 distinct cycles of multibagger then major correction now. Look how much money was made in 2020-21 though, on that rebound! So this can be quite an exciting share to trade. On fundamentals though, I’m steering well clear. As I emphasise every week in my podcasts, the key shares to avoid right now are highly geared, weak balance sheet companies that are also showing signs of trading deteriorating. We’ve seen how these can very quickly turn ugly, and are then forced to raise fresh equity at multi-year low share prices - recent examples being XP Power (LON:XPP) and Videndum (LON:VID) . It wouldn’t surprise me if VCP ends up in a similar position, but that depends on how the debt is structured, which I think contains covenant-light bonds, so it might be able to survive without dilution. That’s the key area to research, for anyone considering a punt here.

Pebble (LON:PEBB)

Down 33% to 59p (£98m) - Trading Update (profit warning)- Paul - BLACK for spreadsheet (PW) - AMBER on fundamentals

The Pebble Group (AIM: PEBB, OTCQX: PEBBF), a leading provider of digital commerce, products and related services to the global promotional products industry, is today updating the market on its expected performance in the year to 31 December 2023 ("FY 23").

It’s a profit warning, but only seems mild, so I’m a bit surprised the price has been clobbered by 33% this morning. Mind you, profit warnings often sound mild if the PR has smoothed them over in the RNS, then you see broker forecasts slashed! I can’t find any broker updates here yet.

Slower order intake at one division is blamed for revenues now expected at £124m for FY 12/2023, down 7% on 2022. The StockReport shows consensus expectations at £140m revenue for 2023. So a £16m shortfall, which is quite big to happen this late in the year.

Margins are better than last year though, so the impact on EBITDA is modest -

Group EBITDA of approximately £16m (FY 22: £18.0m), maintaining Group EBITDA margins close to FY 22.

Net cash expected to be at least flat with last year’s £15.1m.

Paul’s view - this doesn’t sound a disaster by any means. I haven’t looked at PEBB this year, as the company never really interested me. It seems an OK company, I’ve just had a quick look at the last interims. Forget EBITDA though, as it’s capitalising loads of costs into intangible assets, so actual profit is much lower than the fantasy EBITDA numbers. Hence why it can only afford to pay tiny divis, there’s not much real cash generation here.

So overall I’d say it doesn’t really interest me. Although it’s a half-decent company, which is profitable most years, so it might be worth taking a fresh look, now it’s hit a new low since floating in Dec 2019. Let’s go with AMBER.

New low today at 60p -

Graham’s Section:

Duke Royalty (LON:DUKE)

Share price: 31.2p (unch.)

Market cap: £132m

Duke Royalty Limited (AIM: DUKE), a provider of alternative capital solutions to a diversified range of profitable and long-established businesses in Europe and abroad, is pleased to announce its interim results for the six-months ended 30 September 2023 ("Interim 2024").

Let’s catch up on the latest developments at Duke.

Total cash revenue is up 35% in H1 to £14.1m (H1 last year: £10.4m).

More meaningfully, recurring cash revenue is up 17% to £12.2m (H1 last year: £10.4m).

The recurring revenue figure excludes various one-off deals such as when Duke sells its equity stakes in businesses, so it’s a more useful measure of underlying revenue.

In Q1 (see our coverage in September), Duke’s quarterly recurring revenue crossed over the £6m mark for the first time. So it is no surprise to see H1 recurring revenue just over £12m.

Free cash flow comes in at £7.9m (H1 last year: £6.5m).

Dividends in H1 have been 1.4p so far (H1 last year: 1.4p).

The 0.7p quarterly dividend has been flat for two years - Duke was explicitly designed to be an income play and some investors might be wondering when they will get an increase in the quarterly payout.

However, for what it’s worth, the yield is perfectly reasonable based on the current share price:

More importantly, the flat payout has given Duke a chance to consolidate its asset base. Based on the current share count of 421.5m, the dividends in the first half of the year cost the company slightly less than £6m, which were covered by nearly £8m of free cash flow.

Operationally, the H1 highlights were:

Over £18m deployed into new and existing investments.

Number of royalty partners grew by one to 15. Note that the number of underlying operating companies is far larger (c. 60), as some of the royalty partners are themselves owners of groups of businesses.

Duke made a successful exit from one investment (this was previously announced).

£40m available liquidity for future investments.

Chairman comment excerpt:

"During the interim period Duke was able to post its twelfth consecutive quarter of increasing recurring cash revenue which was a fantastic achievement for the Company. In line with this strong financial performance, the Company also maintained its quarterly dividend of 0.70p per share. Investors can be reassured that the dividend payout remains well covered by operating cashflow with the attractive yield representing a pillar of Duke's ongoing business model and its overall financial discipline.

The outlook statement is quite long, I think these are main points:

“Cautiously optimistic” for the rest of the year.

Duke’s product is still thought to be unique in the financing industry..

They are currently reviewing how they articulate their message to business owners - they think that some changes to the message will open up more opportunities and broaden their appeal.

Balance sheet shows equity of £162m as of September 2023, down from £164m in March 2023.

Income statement shows a statutory profit of £3.4m, down from £10.3m in H1 last year.

Among other things, the latest period’s profit result was impacted by unrealised losses on equity investments and by higher finance costs (the interest bill grew by over £1m).

Graham’s view

I’m a former shareholder here, who bought and sold my shares in the company before its Covid-related slump:

Perhaps I’m overly anchored to the prior valuation, but I continue to think - see our prior SCVR comments in the archives for more - that Duke is likely to be undervalued here.

The shares currently trade at a 19% discount to balance sheet equity and at a yield of about 9%. I expect to see the quarterly dividend increase before too long.

It’s not a perfect investment by any means - there are plenty of risks and uncertainties associated with the portfolio. I would prefer if the company stuck to its core product and did not take equity stakes in its royalty partners. However, I think the sturdy performance through Covid does give Duke and its management team quite a lot of credibility at this point.

One reasonable question mark is around future fundraising plans. The company did raise funds at 35p in 2022, and it might be tempted to do that again. So don’t be too surprised if you see another placing before too long.

At the cost of some more dilution, investors would get further diversification of the portfolio. Long-term, I think much more diversification might be needed to get these shares onto a more premium rating.

TT electronics (LON:TTG)

Share price: 150.5p (-7%)

Market cap: £266m

TT Electronics plc ("TT", "the Group"), a global provider of engineered electronics for performance critical applications, publishes the following trading update on the Group's performance in the four-month period ended 28 October 2023 ("the Period").

This is another stock I’ve been positive on for the past year, but the share price hasn’t been cooperating very well:

Valuation has been appealing:

Let’s find out what the issues are with today’s trading update.

Organic revenue growth: 4%. As we noted in August, there were signs that revenues might be about to plateau as orders appeared to be slowing down. Consensus forecasts suggested only a marginal increase in revenues in 2024.

There is also a seasonality issue: last year saw a very strong H2 compared with H1, but that is not going to repeat.

Each division appears to be doing ok:

The performance of our Power & Connectivity division continues to show good year over year improvement, and GMS (Global Manufacturing Solutions) is sustaining its strong margin performance. Trading in Sensors and Specialist Components has been in line with our expectations other than the one-off impact of the previously highlighted machinery breakdown experienced in one of our facilities, which continued for longer than anticipated, impacting profit in Q3 by circa £2m.

Balance sheet: The investment thesis I set out here included a forecast reduction in net debt, which I hoped would lead to a better valuation for the equity. TTG confirm today that they are on track to show “much improved cash generation over last year and a further reduction in leverage”.

Outlook is at the lower end of expectations:

While the Board still expects good year on year improvement in revenue and profit, as a result of the machinery breakdown in S&SC we now expect to report Group adjusted profit before tax towards the lower end of current market expectations for 2023.

The company helpfully discloses that the range of forecast adjusted PBT is £43.1m to £46m.

The breakdown in machinery has cost them c. £2m as mentioned above, and is not being adjusted out, so we have a very simple explanation for adj. PBT hitting the lower end of the range.

TTG has a new CEO, who says:

I am excited about the potential for TT and can already see opportunities to unlock further value across the business, driving growth, efficiencies and performance through capitalising on our positions in the structural growth markets in which we operate. I look forward to sharing more detailed thoughts shortly after our FY23 results, as we plan the next phase of our disciplined growth strategy.

Graham’s view

I don’t think I should change my view on this on the basis of a one-off mishap. The market cap might be down by £20m today, but the cause is only £2m of exceptional costs.

A more serious concern might be the slowdown in revenue growth, although that has been baked into expectations for a while.

Up until today, EPS expectations had been pretty stable:

Net debt was last seen at £139m, about half the market cap, but the leverage multiple was only 1.8x as of the most recent interim results. I’m looking forward to seeing this fall even deeper into territory that most investors would consider to be safe.

As that multiple keeps falling, I can’t avoid the view that the market will have to re-rate TTG’s equity higher at some point. In short, it still strikes me as a higher-quality company than the 8x P/E multiple suggests. In bull markets, it has traded at much higher valuations:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.