Good morning from Paul & Graham!

Today's report is now finished, I think we've covered the most interesting companies today, in a fairly thorough fashion.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Volex (LON:VLX) (Paul holds) - 298p (pre-market) £540m - Interims - Paul - GREEN

Decent interim results, with profit up 16% vs H1 LY. Outlook reassures with in line FY expectations. Balance sheet is still positive NTAV, but goodwill and debt are both increasing, at top end of what I'm comfortable with. Overall, I remain upbeat about this share - a resilient, good quality group, on a cheap rating, I think.

Motorpoint (LON:MOTR) - down 7% to 72.3p (£65m) - Interim Results - Paul - AMBER

Poor H1 results, with a big drop in revenues. Costs cut, but not enough to rescue profitability, which has moved into an H1 loss. Recently, post period end, used cars have plunged 6% in value, in 6 weeks. I'm worried this could trigger another profit warning. So for now, I'm steering clear. Sector read-across also worries me. Could be good longer term though maybe?

PayPoint (LON:PAY) - up 0.5% to 527.4p (£383m) - Results for half ended September 2023 (in line) - Graham - GREEN

These results don’t look very good at first glance, but they are impacted by the normal seasonality of the acquired Appreciate/Love2shop business. I continue to view this as an under-appreciated and under-rated “fintech” stock with many attractive features.

XPS Pensions (LON:XPS) - up 0.4% to 227p (£471m) - Half-Year Report (ahead) - Graham - GREEN

These shares haven’t budged much today despite an ahead-of-expectations outlook and EPS upgrades of 4% for this year and 8% next year. That may reflect the already racy valuation that’s baked in here. I’m cautious on the price but have to keep my positive stance.

Jet2 (LON:JET2) - down 4% to 1084p (£2.33bn) - Interim Results - Paul - GREEN

Straying into mid-caps, as there's so much interest in JET2 from subscribers here. This looks a terrific share, if you can tolerate the sector risk. Low PER, excellent balance sheet, and a brilliant long-term track record. I'm very keen on this too!

Paul’s Section:

Volex (LON:VLX) (Paul holds)

298p (pre-market) £540m - Interims - Paul - GREEN

Volex plc ("Volex", the "Company", or the "Group"), the global supplier of integrated manufacturing services and power products, today announces its half year results for the 26 weeks ended 1 October 2023 ("H1 FY2024").

It reassures right from the start -

Strong revenue growth and margin expansion underpins confidence

in the full year and progress towards five-year plan

Impressive summary (my comments below) -

Revenue growth - good at 11.2%, and of this, 4.2% is organic, the rest from acquisitions. That’s pretty good in my view.

Operating margin has risen to 9.4%, vs 9.0% last year in H1 - impressive.

Remember to convert these figures from dollars into sterling! (divide by 1.25)

Acquisitions strategy is causing debt to rise, and the commentary sounds as if management is relaxed about debt.

Adjustments to profit are mainly ($8.6m) acquisition-related (costs of deals, and goodwill amortisation), which is fine. However, note the share options charge is also adjusted out, and is quite hefty at $3.0m in H1.

Outlook - sounds very confident about achieving the 5-year growth plan. Diverse markets provides resilience. Conclusion -

As a result, the Board remains confident in our ability to achieve long-term objectives and meet full-year market expectations.

Valuation -

The StockReport shows consensus of 31.5c for FY 3/2024, rising to 35.8c in FY 3/2025. That no doubt factors in an uplift for recent acquisitions, so there should be a solid basis for this anticipated rise in earnings.

Convert into sterling, that’s 25.2p (PER 11.8x) and 28.6p (PER 10.4x) - good value, but don’t forget the $141m (£113m) net bank debt, which needs to be adjusted for, which is 21% of the £540m market cap.

Given the consistently resilient trading reported this year, and allowing for net debt, I think this share remains good value. Also management don’t seem to be given any credit for the successful acquisition strategy. Once the next bull market starts, I think there’s scope for Volex to re-rate upwards from a PER of 10.8x, to something more like 15-20x. That in itself provides nice upside, even without any earnings growth. The same can be said for lots of decent quality small-mid caps, and I think people sitting in cash could end up kicking themselves for ignoring these buying opportunities, once markets have recovered. Although taking a bolder approach does expose us to profit warning risk, which I see as offset by upside from takeovers.

Balance sheet - intangibles are growing, due to the acquisitions strategy, now totaling $254m. However, NAV is higher, at $312m. So NTAV of $58m is tolerable. As long as NTAV stays positive, I’m relaxed about this.

A resilient, cash generative business can handle a reasonable amount of debt, although it’s now at the top end of what I’m comfortable with.

Cashflow statement - quite good cash generation in H1 vs H1 LY at $25.6m post tax & interest costs (LY H1 $8.2m). These numbers are dwarfed by acquisitions activity, with $131m paid out, funded by $106m of increased loans, and $72m fresh equity raised.

So investors here need to be comfortable with the acquisitions, as that’s key to the growth strategy. It seems well thought out, and VLX has established a good track record for buying reasonably priced, decent quality companies to bolt on. They seem a logical fit, and VLX knows what it’s buying, given that it has a quite narrow sector focus on electrical connection equipment. Hence hopefully acquisition risk would be fairly low. The Exec Chairman explained the process for acquisitions in previous webinars, which can involve quite a long-term getting to know each other process before a deal is sealed, especially where it's a retirement sale, where cultural fit is important to the vendor.

My opinion - remains very positive. I see this as a successful acquisition-driven group, that doesn’t seem to have put a foot wrong, despite the pandemic, energy crisis, and tough macro.

Buyers are getting a lot for their money I think - a decent quality business, that’s performing well, with a good growth strategy, at a reasonable price. Thumbs up from me, I’m very happy to stick at GREEN. It's only a small position for me at the moment, but I want to increase (hopefully before it re-rates!)

I’ve not read all the commentary yet, just the key bits, as I wanted to get this section out by 8am.

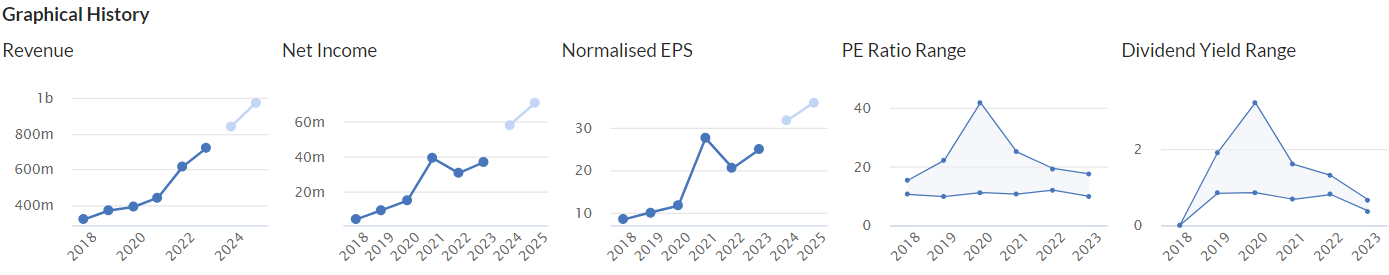

Given the chaos of recent years, this is an impressive track record -

Looks like it's formed a base too, and a good StockRank -

Motorpoint (LON:MOTR)

Down 7% to 72.3p (£65m) - Interim Results - Paul - AMBER

Motorpoint Group PLC, the UK's leading independent omnichannel vehicle retailer, today announces its unaudited interim results for the six months ended 30 September 2023 ("H1 FY24").

The waffly, PR headline suggests to me that these numbers are going to be bad! -

Positioned to navigate continued market challenges, whilst building strategic capabilities to lead in market recovery

They are bad - this is a big drop in revenue -22.8%, and the H1 profit LY has turned into a loss this time -

Also note the big increase in finance costs.

Thankfully it has reduced operating costs by £6.7m by reducing staff numbers (by 12%) and marketing costs.

At least cash is OK, with net cash having risen to £11.2m, and an undrawn bank facility. Although I think this excludes vehicle stocking loans (yes it does, see below).

Other points -

Reduced customer demand due to cost of living, and higher interest rates.

Prioritising unit profit ahead of sales growth.

Paused new site expansion now (after Ipswich opened) - a good idea when a format isn’t working. It currently has 20 sites - these are car supermarkets, so typically large, out-of-town plots with shed-type buildings are large open air parking areas.

Outlook -

The impact of high inflation, interest rates, and consumer uncertainty continues to affect demand for used cars.

This is impacting the value of used cars, which has fallen since the end of the period, with a reduction in wholesale values of c.6% in just the last six weeks.

Whilst we have taken proactive measures to limit the impact on our stock, the current environment is likely to be volatile as new car supply into the used car market begins to increase. Our lean cost base means that we are well placed to weather this period and the correction in values bodes well for next year and beyond as the used car market begins to normalise.

Key elements of a normalised market are already underway, including an easing interest rate environment, continued corrections in used car values, and an increase in market size as demand grows and supply is bolstered by new car registrations feeding into the used segment. Motorpoint is a leaner and more agile business, and is ready to seize the significant growth opportunity as market conditions improve.

The rapid fall in used car values since the period end is unquestionably a near term challenge, however it also provides reassuring signs of supply finally beginning to improve in the nearly new market that we have dominated in the past. I believe next year will be a key turning point for the market and I look to the future with confidence.

The most striking point above is that used car values are now falling fast (-6% in the recent 6 weeks!) from the elevated levels in recent years that was caused by lack of supply. With new car supply starting to normalise, that’s clearly feeding through to improved used supply, hence lower prices.

Does this mean the bonanza for the franchised dealers is now over too, I wonder?

Is it time to bank profits on Vertu Motors (LON:VTU) (I hold - small position) I wonder? Although someone would probably bid for it immediately after we sell, after waiting years for a bid! There aren’t many listed car dealers left, after a flurry of takeover activity. The listed conventional dealers have several profitable activities, especially aftersales, whereas Motorpoint just does used car sales and finance commission. So it’s much more focused, which is obviously hurting its profitability in the short term. Is it a viable business model longer term though? I’d say probably yes, because it has made profits in the past - although that was before all the new, online only entrants moved into this space. So maybe MOTR’s business model is now damaged or broken? Only time will tell.

Balance sheet - is quite small, with £32m NTAV (although mkt cap is now only £65m). It looks well-structured to me, with £144m inventories (all the cars), mostly financed with stocking loans of £102m. So the £11.2m reported net cash is misleading, as the real net debt is £91m once stocking loans (which is debt!) are included. That goes up to £153m net debt once leases are included, but I don’t include them personally.

It would be interesting to find out who provides stocking loans to car dealers, and what the terms are - e.g. any covenants? Risk of withdrawal of those stocking loans is important, as that would kill the business instantly, although that sounds very unlikely.

Paul’s opinion - I’m in a quandary on this. MOTR shares are now very cheap compared with historic levels. I don’t see any signs of financial distress here, and a £(3.7)m H1 loss before tax is weak, but not a disaster. What happens in H2 though? With a sudden, recent 6% drop in wholesale prices, that implies its £144m inventories might have just fallen in value by up to £8.6m, which due to fast stock turn, could possibly be a hit to profit in H2.

Shore Capital (house broker) updates today, and reiterates its FY 3/2024 guidance, expecting an improvement in H2 profitability. It’s expecting breakeven in H2. That doesn’t seem at all consistent with the profit hit from plunging used car values in the last 6 weeks, so I don’t understand that stance.

Zeus has very similar forecasts. Thanks to both for publishing their research, although we should always bear in mind that forecasts are frequently wrong, as nobody can predict the future with certainty.

I like investing in shares where the forecasts look far too modest, and then enjoy the profits from the subsequent out-perform update. MOTR looks the opposite to that. I struggle to see how H2 is likely to be better than H1. Although yesterday’s Autumn Statement will be pumping additional cash into consumers pockets (giving back some of the PAYE plundered from us through fiscal drag!) from Jan 2024, and the considerable increases in Living Wage, pensions and benefits from April 2024 could trigger increased consumer demand, as inflation falls to an expected 2.8% by end 2023. So macro could actually turn positive in the coming months. Will that be enough to rescue FY 3/2024 results for MOTR though?

I suspect this share could have another profit warning in it, maybe in early 2024. Although I also think there are credible reasons to start to anticipate something of a recovery in calendar 2024. Possibly.

As to whether MOTR’s business model is damaged, or broken, from much more online competition, I just don’t know at this stage. Although performance in recent years suggests to me that it’s been considerably damaged by increased competition. Will that competition survive though? They don’t make any money either, and spend huge amounts on advertising, so their deep-pocketed backers could pull the plug, giving back some market share to MOTR.

I just can’t decide, so will sit on the fence with AMBER.

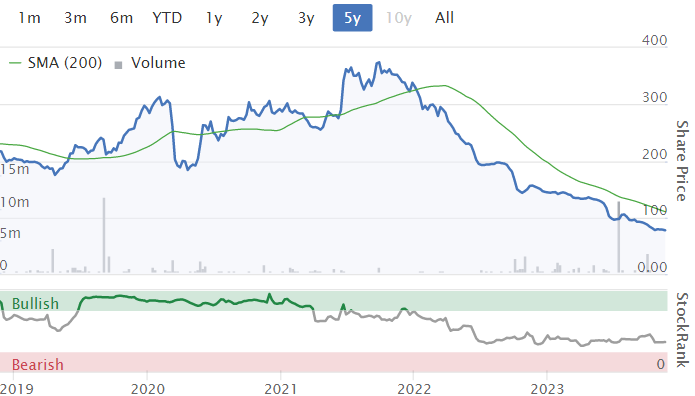

In permanent decline, or poised for a powerful rebound? -

Jet2 (LON:JET2)

Down 4% to 1084p (£2.33bn) - Interim Results - Paul - GREEN

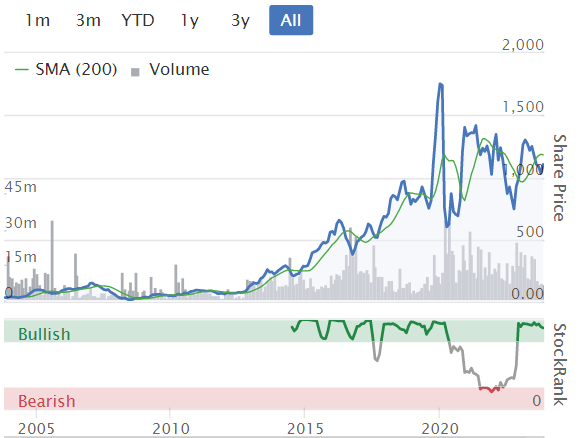

I’ll have a look at this holiday/airline business, as it’s the readers’ top share of interest today, and I’ve followed it for many years, when it used to be an obscure little freight airline and distributor called Dart Group. It roughly 100-bagged from the lows, but there wasn’t really any indication at all that this was going to be the outcome, as is often the case with major multibaggers. As Ed pointed out in his brilliant recent multibaggers webinar, the major winners can often come from unlikely, and apparently quite ordinary businesses. Also Ed pointed out that they’re often cheap, value shares at the start of their multibagging journey. Dart Group definitely was. I remember looking at it with David Stredder, and we couldn’t understand why it remained stuck at about 75p, despite being on a really low PER. I gave up in disgust in the end, as it refused to budge. Whoops! Patience is a virtue in shares, definitely, and I don’t have enough. Many investors see long-term as after lunch, so at least I’m not that bad!

Conventional wisdom is to avoid airlines, so again, an unlikely winner. It must all be down to good execution from strong management, something that’s not always easy to pick up on, when management are publicity-shy, and just get on with the job rather than promoting the shares.

Philip Meeson is still the largest shareholder, at 18.3%, is stepping down soon I believe, having taken JET2 from a minnow to a giant. What a remarkable career, hats off to him.

[This table appears on the Stockopedia home page every day]

Interim Results - for the half-year ended 30 Sept 2023.

No fancy PR BS headline here, JET2 lets the numbers do the talking -

Full year forecast consensus revenue is £6.2bn, so there’s clearly a big seasonal bias towards H1, being the summer season for holidays. Hence we cannot just double the above figures to annualise them.

Load factor (seats filled) flat at 90.7%

Package holidays (higher margin) now make up 70.8% of passengers (LY: 65.9%)

I'll skip over the rest of the detail.

Outlook -

Some short term caution - it will be interesting to see if the recently announced NI cuts might stimulate demand? -

Although bookings have been a little slower in recent weeks with average load factors currently 1.3ppts down on Winter 2022/23 at the same point, average pricing to date remains robust.

We are currently on track to deliver Group profit before FX revaluation and taxation for the year ending 31 March 2024 of between £480m and £520m, in line with our previous guidance.

Canaccord has kindly done the number-crunching, and shared it on Research Tree (many thanks to both). It forecasts £500m adj PBT, bang in the middle of the company’s guided range. This is 160.3p adj EPS - for a PER of 6.8x - gosh that’s cheap! In old money that’s an earnings yield of 14.8% (the inverse of the PER, and much more useful I think).

Very modest divis of 14.5p are forecast, yielding only 1.3%, but covered 11x by earnings, so JET2 has scope to become a bigger dividend payer longer term, should management decide to adopt that policy.

Balance sheet is large, and quite complex, with various ways of looking at cash, and net cash, as the reader comments today show!

I tend to fall back on NTAV as a good overall view, and this is £1.57bn. That is 67% of the market cap, so JET2 has very healthy real asset support for its share price.

Cash + money market deposits total a huge £3,215bn, but “Borrowings” total £761m, so I would say net cash is £2,454m. So plenty of interest should be earned on that. Indeed finance income in H1 was £80m ,exceeding finance expenses of £(33)m.

Note that deferred revenue creditors total £1,121m - this is the credit entry to reflect the amount within the cash pile that has been received from customers up-front. So to be prudent, we should take this off the £2,454m net cash pile, giving £1,333m of net cash which JET2 can call its own.

The commentary claims “own cash” of £2,121m, which is gross cash, not net cash. Deducting the £761m debt above, comes to £1,360m net own cash, which is near enough to my figure of £1,333m. So this is the most prudent measure of net cash, and it’s 57% of the market cap - so a tremendously healthy cash position, in my view.

Also remember that JET2 owns a load of aircraft too. The last Annual Report shows £877m NBV of “aircraft, engines, and other components”. Only £20m in land & buildings, so JET2 doesn’t seem to like (or need?) much in property.

It also leases aircraft, with £530m NBV of leased aircraft, engines, etc. So I make that about 62% of the aircraft & similar by value, are owned rather than leased. Sounds nice and prudent.

Paul’s opinion - it’s been a long time since I last reviewed JET2, and I have to say, these numbers have delighted me. What I see is a remarkable business, that has been built up by an obviously brilliant entrepreneur, and clearly serves an excellent niche, providing affordable holidays to households mainly in the Midlands & North of UK.

The valuation statistics look terrific - a lovely low PER, excellent asset backing from a prudent, strong balance sheet. The only missing piece is divis, but those should naturally flow as the business matures.

The only downside risk I see is sector risk - are investors so keen to own travel companies now that we know the go-to response of politicians is to shut them down when a nasty bug appears? That could mean the whole travel sector deserves to be on a permanently lower rating than pre-pandemic.

Overall though, I very much like what I’ve seen on a quick review of this share. It looks excellent. Definitely a GREEN from me!

Graham’s Section:

PayPoint (LON:PAY)

Share price: 527.4p (0.5%)

Market cap: £383m

The headline for these interim results inspires confidence:

Strong revenue growth across the Group and significant progress with ongoing business transformation

We already had a trading update in early September that was in line with expectations. These interim results take us to the end of September:

Today’s results confirm that net revenue is up, but profits are lower (both “underlying” PBT and actual PBT).

The £4.6m of exceptional/non-underlying items comprise £4m of amortisation and £0.6m of one-off items.

The gift voucher and Christmas savings group Appreciate was acquired in February 2023, so this latest H1 period (March to September) is the first period which includes Appreciate’s revenues and H1 losses.

“Love2Shop” (the new name for Appreciate) generated a £1.8m loss in H1, which is the same as the amount by which PayPoint’s overall underlying PBT declined in H1. So I think it’s fair to say that the original set of Paypoint businesses has had a flat performance.

The good news is that Love2Shop is a seasonal business, and PayPoint investors can look forward to a positive contribution from it in H2.

CEO’s comments refers to a difficult economic backdrop and reduced revenues from energy payments:

This has been a positive half year for the PayPoint Group with a period of significant activity supporting a number of key initiatives across the business…

It is testimony to the transformation of the business that we continue to deliver overall Group net revenue growth in a period where energy sector net revenue has decreased by almost 20% and against the background of uncertain consumer behaviour and weakening confidence due to the Cost of Living challenges.

He also notes that “trading momentum has remained strong into the second half of the year” (more on that in the outlook).

The company has a total of four divisions, so there’s quite a lot of detail, but the main points are:

Shopping (i.e. the convenience store business) - net revenue up 4% to £32m.

Payments & Banking- net revenue down 2% to £25m. Cash payments are falling and energy payments greatly reduced, in part due to “unseasonably warm weather”.

E-Commerce (parcel pickup/delivery at Collect+ in partnership with Yodel, Amazon etc) - net revenue up 72% to £5m.

Love2shop - £17.5m of revenues. Lots of restructuring and change seems to be happening here. Park Christmas Savings has started growing again.

Outlook

This is in line with expectations.

The word “momentum” is mentioned 13 times in today’s RNS.

The energy business is showing “a more resilient performance early in H2”; hopefully its poor performance in H1 is not representative of a long-term trend.

Interim dividend - 19p, vs. 18.6p last year. It seems reasonable to give shareholders a small increase, as it is well covered by earnings (there is no “final” dividend in addition to the interim dividend).

Note that the interim dividend is paid in two equal instalments of 9.5p each, in December and March. I’m not sure why they do it this way but I have no objection!

Earnings per share - 17.4p in H1, or 22.4p on an underlying basis. The share count is up and the tax rate is up. So these numbers are quite a bit off H1 EPS last year (24.7p / 28.1p underlying).

Estimates - Liberum has a full-year EPS forecast of 66.4p for the current financial year (FY March 2024), presumably based on adjusted earnings. Strong seasonality is expected in H2 with gift vouchers and Christmas savings activity, etc.

Net debt was £83m at the end of September. With £69m of EBIT due this year, again according to Liberum, Paypoint’s leverage continues to seem reasonable.

Graham’s view

I’ve been a fan of PayPoint for a long time, so I’m at risk of becoming a broken record.

It tends to trade cheaply:

This is despite being a high-margin, high ROCE business:

My favourite aspect of this stock is the importance of the “PayPoint One” terminal to so many convenience stores. However, the other parts of the business are interesting too and while they may not have the same market share, I still think they are important parts of the retailing/shopping infrastructure (I was a fan of Appreciate for many years and formerly held shares in that one, too).

It’s unthinkable to me that I wouldn’t give this stock the thumbs up at a PER of 8x and with current trading looking so robust. But of course I may have missed something - if cash payments declined very rapidly, for example, that could take a bite out of profits. And I acknowledge that it will be a challenge to hit H2 numbers, with quite a lot of seasonality being priced into the forecasts.

It has been a while since the market has shown much interest in PayPoint:

XPS Pensions (LON:XPS)

Share price: 227p (+0.4%)

Market cap: £471m

This is a consultancy on workplace pensions. The shares have performed remarkably well in recent years:

I’m encouraged to see that I give it the thumbs up in June (at 170p), despite it being “a little expensive”. Strong organic growth with recurring, inflation-linked fees were impressive enough to push me into taking a positive stance.

That theme continues today with more signs of strong growth. The momentum in the advisory revenue streams (actuarial/investment consulting) is particularly striking:

It has two advisory revenue streams: Pensions Actuarial and Consulting (the larger division) and Pensions Investment Consulting.

The company tells us that this is “the eighth consecutive half year of YoY growth in revenues” at its advisory and administration divisions.

Recent news and outlook: the company has been appointed to the John Lewis pension scheme, and sold a division (National Pension Trust) in July for up to £42.5m (including defcon), which will enable a deleveraging of the balance sheet. XPS will continue to generate revenues from work on the NPT even after the sale.

Outlook is ahead of expectations:

The strong first half financial performances underscores the resilience and predictability of the XPS business model. We expect the demand for our services to remain high underpinned by both market and regulatory tailwinds as well as the strength of our brand. The business continues to trade well in H2 and combined with the completion earlier this week of the EPS accretive sale of NPT, the Board are confident of achieving overall full year results ahead of its previous expectations.

Estimates: Canaccord Genuity have upgraded the EPS forecast for the current year (FY March 2024) by 4%, thanks to better-than-expected trading and a reduced finance cost from deleveraging. FY March 2025 sees an even bigger 8% upgrade to EPS expectations.

Market commentary: there are some comments on the state of pensions in general which should be of general interest.

In general, most defined benefit schemes are in a healthier financial position than they were. Schemes continue to need to re-look at their long-term objectives and strategies to reflect the 'new world' of higher long term interest rates and funding levels. This has driven significant demand for advisory services, and we expect this to continue. XPS is well placed to meet this demand with the depth of capability we have.

This is a theme we’ve been following at the SCVR: higher rates boosting the health of pension schemes, sometimes making formerly uninvestable pension sinkholes becoming investable businesses again.

I suppose that any general change in conditions - positive or negative - can drive demand for advice from consultants. In this case, a positive change is driving demand.

Then there is the question of whether there will be changes to overarching pension rules:

Pension funds have also been the subject of Government scrutiny and newspaper headlines, with focus on asset allocation and whether changes could be made so that the very large sums of money in the pension system make an increased contribution to long term growth in the UK economy. This is a live, ongoing debate with cross party support for change and we have been pleased to be an active participant including attending meetings with Treasury and the Bank of England. The timing and extent of future developments is still unclear, however any changes to the system are expected to drive demand for advice from our clients.

Again, any change drives demand for advice.

Graham’s view

I’m certainly going to keep my positive stance on this share - the analyst’s equivalent of “letting my winners run”.

It remains more expensive than I would normally wish to pay for a consultancy:

However, XPS seems to be a much better-than-average consultancy. I keep going back to those recurring, inflation-linked fees: not many consultants benefit from that!

One important point to be aware of is that the stock does look horribly overvalued if you use the unadjusted numbers (e.g. profit after tax in H1 was only £5.5m). So if you’re interested in this one, I’d strongly recommend taking a look at the adjustments and satisfying yourself that they are reasonable:

Once again, I would have to insist that the share-based payments (£3.1m) are a real cost. The others (adding up to £6m) can arguably be adjusted out.

It remains very expensive, but my sense is that XPS has done enough to justify the premium valuation. So my thumbs are staying up for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.