Good morning!

So, it's General Election week - as we get to decide which dismal set of lying nonentities will nominally be in control for the next five years - the next set of media-trained, clueless departmental spokespeople with (often) no relevant experience at all. The sort of people whose CVs are so lacking in practical experience & entrepreneurial vigour, that in many cases, any business owner would not even consider them for the shortlist, if recruiting for an office admin role supervising perhaps 4 or 5 staff. Let alone a more senior position. Yet they end up running the country!

Still, at least it leaves the civil service and the EU machinery untroubled to get on with running the show as before - in this charade of a democracy. I am currently undecided, and am awaiting today's guidance from Russell Brand, as to whether I should vote Green, Labour, or start a revolution.

GVC Holdings (LON:GVC)

Share price: 446p

No. shares: 61.3m

Market Cap: £273.4m

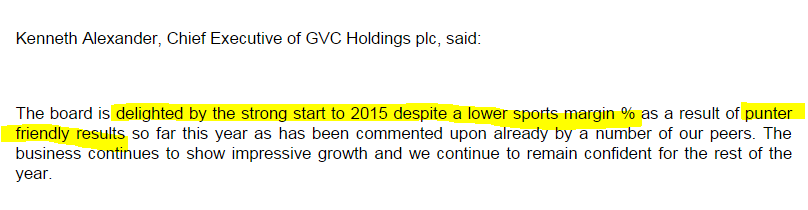

Trading update - this sounds upbeat and slightly negative at the same time. Confidence in the year sounds solid though;

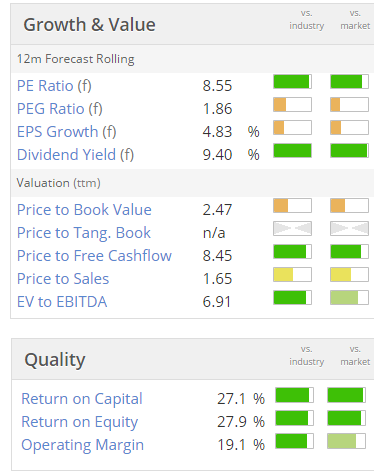

KPIs look good, apart from the margin, which is down;

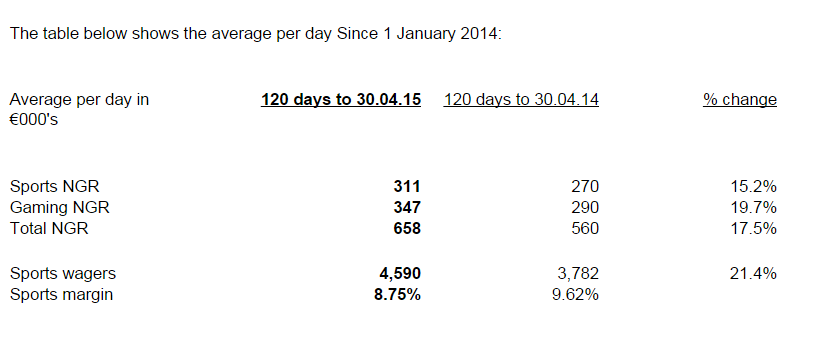

There's an amazingly high dividend yield here - questions have been raised about sustainability of earnings, but it keeps chucking out big divis. From memory, I think this is the company where staff bonuses are linked to dividends - sounds a good idea, providing they don't overpay and strip the balance sheet bare.

Xeros Technology (LON:XSG)

This one is impossible to value, and I see is down 17% today, after previous spectacular rises. It looks a ramped up speculation to me. Impossible to value, and probably over-valued. Lots of punters in it, using stop losses, so lambs to the slaughter. Reminds me of Bioprogress a few years ago - very volatile & lots of punters trading it on margin, so rich pickings for the city spivs, providing they can move the price more than 10% suddenly, to trigger those stops.

The market generally is looking frothy to me, and I think we could be due for a sharp correction in story stocks like this. Social media stocks have sold off in the US, and that seems an ominous sign to me - if a fancy sector goes wobbly, people might all rush for the exit at the same time, who knows? Just musing.

It's very quiet for results & updates, and I can't see anything of interest. I've had a quick look at Eleco (LON:ELCO) results, which are flat against last year. Its balance sheet is very weak, so extreme caution is needed there, in my view - it clearly has a stretched working capital position, and negative net tangible assets, so it's not for me.

I'll sign off now.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.