Good morning from Paul & Graham!

Today's report is now finished.

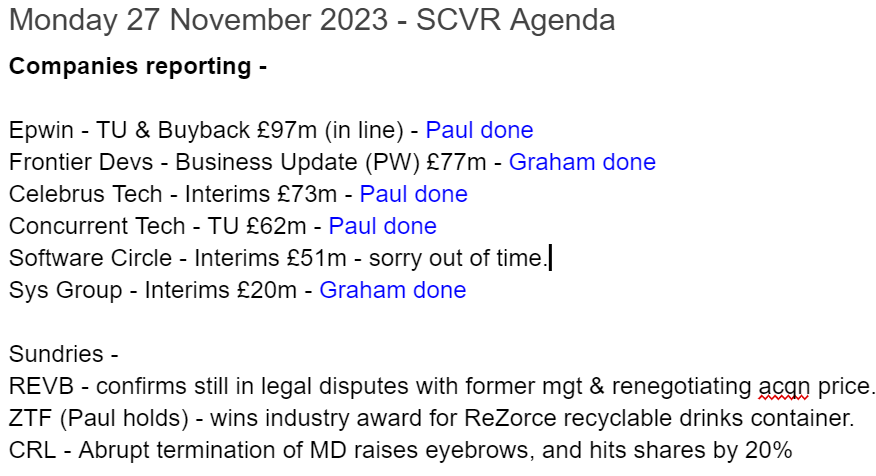

Mello Chiswick - it’s this week, Wed 29 & Thu 30 November. It’s an absolutely superb line-up of high calibre speakers this year. Also a great social event, where we enjoy chatting to pretty much everyone in the bar over the course of the evening, so if you’re there, do say hello. Everyone on the Stockopedia team loves to meet subscribers in person. We've roped in Roland to provide some cover here, so that people not attending Mello won't lose out with substandard SCVRs.

++ BREAKING NEWS ++

Musicmagpie (LON:MMAG) announces that both named potential bidders, BT and Aurelius have stated they do not intend to bid for MMAG. It continues to seek buyers, and this is looking increasingly like a desperate, rescue or bust type of situation. I was already RED, because the business model doesn't work. I think equity could easily be worth zero here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries -

D4t4 Solutions (LON:D4T4) / £CLBS - 176p (pre-market) £70m - Interim Results - Paul - AMBER/GREEN

H1 results as expected, and it sounds fairly confident in meeting full year expectations too. I raise a query on its revenue recognition and receivables, which look very unusual to me - almost all H1 revenues seems to have been billed at the end of the period, and not yet paid by customers. Other than that query, I have a generally favourable view of this business, at £70m market cap it could end up being bid for maybe?

Frontier Developments (LON:FDEV) - down 19% to 158.6p (£63m) - Business Update (profit warning) - Graham - GREEN

This video game developer offers yet more bad news with another profit warning taking the share price lower again. The shrinking cash balance is now almost one third of the market cap as the company goes back to its original, focused strategy. A highly contrarian pick.

Epwin (LON:EPWN) - up 6% to 71p (£102m) - Trading Update (in line) & Buyback - Paul - AMBER/GREEN

A remarkably perky update today, and it's going to start £2m share buybacks, on top of a generous (and twice covered) c.7% dividend yield. How come Epwin is baulking sector trends? Looks very interesting, worth a closer look I think, but I'm wary of macro.

SysGroup (LON:SYS) - down 4% to 38.25p (£19m) - Half-Year Report - Graham - AMBER

This managed IT services company announces that it’s embarking on an artificial intelligence/machine learning strategy, hoping to help small and medium enterprises to use these new technologies. I wish them good luck but would be in no rush to buy in here.

Concurrent Technologies (LON:CNC) - up 4% to 75p (£64m) - Trading Update - Paul - AMBER/GREEN

A rather gushing update today focused too much on revenue growth, but is only in line with 2023 market expectations for profit (although after a big rise in July). Some slippage of orders into 2024. Very upbeat about growth & pipeline, so it still looks good to me. Although I'll want to scrutinise cashflow and balance sheet carefully when the FY 12/2023 results come out.

Paul’s Section:

D4t4 Solutions (LON:D4T4) / £CLBS

176p (pre-market) £70m - Interim Results - Paul - AMBER/GREEN

Celebrus Technologies plc (AIM: CLBS, "the Group", "Celebrus"), the AIM-listed data solutions provider, announces its half year results for the six months to 30 September 2023 ("H1 FY24").

We looked at Celebrus (new name), D4T4 (old name) quite recently on 31 Oct, when it issued an in line H1 update, my thoughts being -

AMBER/GREEN - In line update. H2 seasonal weighting. Loads of cash. Maybe bid target? Tough macro might make pipeline tough to convert? (SCVR 31 Oct 2023)

Today's news -

H1 revenue jumped from £8.1m H1 LY, to £13.0m this time, but don’t get excited because a lot of the increase is low margin pass-through hardware sales.

Adj PBT is £0.2m, improved from a loss of £(1.3)m in H1 LY.

Note there’s a heavy H2 seasonal bias to profitability, which is normal for this company.

Cash remains healthy (and no debt) at £14.7m, although that’s down from 6 and 12 months ago.

Outlook sounds OK -

Solid progress in the first half and the high visibility of opportunities expected to close in the second half underpin the Board's confidence in both achieving full year market expectations*** and continuing to drive growth in ARR.

*** For the purpose of this announcement, the Group believes market consensus for FY24 to be revenue of £32.1m, and adjusted profit before tax of £5.4m.

Year-to-date progress and the high visibility of opportunities expected to close in the second half underpin the Board's confidence in achieving full year market expectations and the continued growth in ARR.

Bill Bruno, CEO of Celebrus, commented:

"Several key steps have been taken to further our strategy in the first half of the financial year. Not only have we delivered the expected results and continue to remain confident in our ability to meet market expectations for the full year, but we have continued to invest in Sales and Marketing and are seeing the positive effects in the form of building pipeline momentum. A key investment at the beginning of the year was in Customer Success, and we have now built a Sales and Marketing machine that can focus on winning and expanding those wins as we land them. We continue to focus on driving ARR and our ability to build scalable, single-tenant, cloud-based environments for our Celebrus customers."

As a Board we have aligned on profiles for potential acquisition targets that could provide good bolt-on technology to the Celebrus platform. While there is nothing imminent, we are making this more of a focus. As we began to sell more directly to customers, we soon realised that there would be more we would want to deliver for customers in the world of data activation. We will continue to explore this prudently.

The big H2 weighting does tend to make H2 a nail-biting time for Celebrus shareholders, but it has a good track record of delivering, or at worst seeing a delay if deals slip past the year-end.

I'm not too keen on the talk above about possible acquisitions. Doesn't that imply the Celebrus product isn't giving clients enough of what they want? Or that management may not be that confident about the growth potential of its core product? Don't shoot the messenger, I'm only asking questions.

Annualised recurring revenue is important here, although as with a lot of SaaS companies, they still need high margin additional revenues to hit forecasts -

Annual recurring revenue ("ARR") increased to £17.4m (H1 FY23: £15.8m, FY23: £16.7m)*

Balance sheet - my usual checks for financial health. Overall it’s strong, with NTAV of £16.5m. Remember software companies don’t need a big asset base, as they typically get paid in advance of providing services, and have few fixed assets. So this is more than adequate.

Receivables has ballooned, from £7.6m at 31 March, to £17.3m at 30 Sept 2023. That looks very peculiar. Note 7 shows trade receivables of £13.9m, which is crazily large, as H1 revenues were £13.0m. So it looks as if almost none of the revenues booked in H1 have actually been paid for by the customers! The commentary says this -

Trade receivables at the period end were £13.9 million (H1 FY23: £1.8 million); the majority of these result from contract wins and invoicing towards the end of the period. In relation to certain of these contracts, especially those with a third-party hardware component, trade creditors were £5.3 million (H1 FY23: £0.2 million).

The Group has no overdue receivables of any significant size, and no bad debt losses have been recorded in the period.

We have to trust management that the numbers are real, and haven’t been manipulated, with almost all the H1 revenues being booked at the last minute, that certainly raises questions for me. I’m not suggesting anything is wrong, just flagging that this looks unusual, and needs explaining. I would have expected revenues (especially the significant recurring revenues) to be booked monthly throughout H1. Not almost the whole lot booked at the end of the half-year, and hardly anything collected in cash. That doesn’t make sense for a recurring revenues business, surely?

Despite not getting paid by its customers in H1, Celebrus still has a very healthy cash pile of £14.7m, which should go up once customers pay up.

Note that creditors have gone up a lot too, in particular the new deferred income line in long-term creditors of £3.7m is unusual. So it looks as if a customer has been billed up-front for multi-year services, but hasn’t paid the invoice yet. If my reading of the figures is right, the double entry would be DR receivables, and CR deferred income - both balance sheet entries, so this won’t have had any effect on the P&L.

Paul’s opinion - I’m a little disturbed by the balance sheet movements mentioned above.

Everything else looks OK though.

Celebrus/D4T4 has always looked a promising company, and has a nice track record of profitability and cash generation. The trouble is that growth has been too pedestrian to keep investors excited, so the valuation has drifted down, along with lots of shares in this 2-year small caps bear market.

Could Celebrus be a good stock pick for a recovery or a takeover bid? At £70m market cap, I think risk:reward looks pretty good actually, so I’ll remain at AMBER/GREEN.

Although I’d like more detailed explanations of the peculiar balance sheet movements, and why apparently almost all of H1 revenues got billed at the end of the period and hasn’t been paid, when this is supposed to be a recurring revenues business?

On a 5-year view, the share price has come all the way back down again -

Epwin (LON:EPWN)

Up 6% to 71p (£102m) - Trading Update (in line) & Buyback - Paul - AMBER/GREEN

This is only in line with expectations, but I’ve been wanting to refresh my view on Epwin for a while, as its value metrics are looking really attractive, and someone sensible (fund manager perhaps?) mentioned it on a podcast recently -

A PER lower than the dividend yield is often worth checking out, although it can also be a warning sign that something’s going wrong, and/or debt might be too high, and that the yield may not be sustainable at that level. So everything needs to be carefully checked, especially with smaller caps where information can be scarce.

Looking back at our archive, we’ve rather neglected Epwin this year, with the only coverage being on 4 April 2023, with Roland concluding AMBER at 72p per share (almost identical to today’s 71p), saying that FY results were solid, and it might be good value, but macro factors present the main risks.

Today’s news is an FY 12/2023 trading update, and news of a new share buyback (usually a good sign).

Epwin Group Plc (AIM: EPWN), the leading manufacturer of energy efficient and low maintenance building products, with significant market shares, supplying the Repair, Maintenance and Improvement ("RMI"), new build and social housing sectors is pleased to announce a trading update for the second half of its current financial year (FY 2023) to date

This is worded very well I think, giving us the information we need (although I would prefer adj PBT, rather than operating profit) -

On track to meet FY 2023 expectations; continued strategic progress

Trading in the second half has been resilient, despite the more variable end-market conditions widely reported across the UK construction sector in September and October 2023. The Board remains confident of achieving FY 2023 underlying operating profit ahead of the prior year and in line with market expectations (company compiled analyst consensus of £24.0m).

Bear in mind that the market cap is only £102m, so an operating profit of £24m is impressive. What’s the catch then? And how come it’s performing fine, when the sector is struggling?

These factors seem to have helped -

The Group has made good further progress with its strategy, including continued operational improvement, new product development, integrating recent value-enhancing acquisitions and sustainability. The medium and long-term drivers for the Group's products remain positive.

Interim results - to June 2023 look good, and it achieved £11.9m H1 underlying operating profit, so guidance today is for a very slightly better H2, to do £24m FY op profit.

H1 adj PBT was £8.7m, so that’s a £3.2m shortfall between op profit & PBT. Assuming that remains the same proportion for the FY 12/2023, this implies about £17m adj PBT this full year.

That’s about 9.7p adj EPS, giving a PER of only 7.3x (an earnings yield of an attractive 13.7%), with about half earnings paid out in divis (forecast 4.75p divis, a yield of 6.7%).

Is the balance sheet over-geared? In a word, no! More details -

It’s not great, with only £5m NTAV. Clearly there have been substantial acquisitions over the years, as it’s dominated by £99m goodwill and similar at the top.

Note that lease entries are quite large, and show a deficit (RoUA: £70.6m, liabilities £93.3m), so a good question to ask management would be to expand on excess/loss-making leases, which they clearly have.

There’s £7.8m in deferred consideration that will have to be paid - not excessive, but it’s cash out of the door in future.

Bank debt is £26m gross, £13m net of cash - that looks fine, providing future profitability remains as buoyant as it has proven in 2023. Covenant net debt was a modest 0.6x EBITDA at the interim results.

Overall then, I think the balance sheet is adequate, but not strong. Gearing is not a worry to me, and bank debt looks fine, it’s not excessive.

Cashflow statement - operating cashflow looks amazing, but it’s overstated compared with reality, due to lease costs being lower down, as annoyingly required by bad accounting standards.

Overall though, it looks a decently cash generative business, which is using its cashflows to pay divis, fund capex, and make acquisitions.

Share buyback - this is music to my ears. I wish more companies with bombed out share prices would do buybacks -

The Board considers that the Group's strong balance sheet and cash generation provides the opportunity to take advantage of current market conditions to repurchase shares at attractive levels. The Board takes a disciplined approach to investment, returns and the capital efficiency of the Group, in order to maximise shareholder value. The Group intends to return capital to shareholders both by way of the Company's on-going dividend policy and the buyback programme, alongside the Group's continued investment in its strategy….

The Programme will not impact the Company's existing dividend policy.

Even better, looks like the divis are safe, with buybacks on top. Very nice!

It’s about £2m-worth of shares to be bought back in the market by Shore Capital -

intends to commence a share buyback programme (the "Programme") of up to 3 million ordinary shares

Paul’s opinion - I’m really impressed with this update.

I don’t really understand how Epwin seems to be shrugging off tough sector conditions, so that is my main query. My worry is that sometimes companies can continue performing well in a tough sector for a while, but gravity catches up with them usually once the order book has been worked through. So good performance now does not guarantee continued good performance in 2024 and beyond. Similar to what we’ve been saying about the structural steel companies in recent updates - good so far, but what happens next?

Overall though, it’s difficult to ignore this solid update in tough times, and the generous dividend income stream for investors (enhanced by the £2m buyback). So I think it’s only fair to up our view here from amber to AMBER/GREEN. Not fully green due to macro factors, but it’s up to you to decide if the lowly valuation already factors in downside risk?

It would be worth readers considering the products that Epwin sells, and what competition there is? I do wonder if building supplies companies have benefitted from jacking up prices when supplies were in demand, and short supply, during the pandemic, so could face downward pressure on prices now that supply chains are normalising, from customers shopping around perhaps? Who knows, only time will tell!

So many 5-year charts for small caps are looking almost identical aren't they! Here's another one -

Concurrent Technologies (LON:CNC)

Up 4% to 75p (£64m) - Trading Update - Paul - AMBER/GREEN

Concurrent Technologies Plc (AIM: CNC), a world-leading specialist in the design and manufacture of high-end embedded computer systems and boards for critical applications, is pleased to announce a trading update for the year ended 31 December 2023 ("FY23").

Checking our previous notes, I was bowled over by an excellent, ahead of expectations update on 7 July 2023, even making this share a podcast mystery share! (my favourite update of the week). Previous sins of sloppy accounting & late results, quickly forgiven.

Today’s update says -

Revenues ahead of expectations.

*Consensus revenue expectations for 2023 are £27m

Additional upside from acquisition of Phillips Aerospace.

Supply chain problems have “continued to ease”.

Strong order book from product development investment over last 2 years.

Larger orders, and more diversified markets.

Continued strong order intake, material revenue growth expected in 2024.

Multi-year pipeline of £100m revenues anticipated from recent design wins (albeit not yet contracted).

After all that bullish talk, what about profit then??! It’s in line, due to higher costs -

The Board are pleased to note that profit contribution has strengthened quarter-on-quarter throughout FY23, and it is anticipated that Q4 2023 will be the strongest quarter in an already record-breaking year. To position the business for the future, management have continued to invest in the operational scale of the Company to deliver an increasing level of revenue in the future years. Accordingly, the profit of the Company as a whole in FY23 is expected to be in line with current market expectations**.

**Consensus profit before tax expectations for 2023 are £3.5m

Order slippage - nicely finessed here! -

This increased level of performance across the Company has been delivered despite several larger multi-year orders, for which the Company has already been down selected, moving from the current year into FY24 due to customer timelines, further strengthening the conviction of management in the delivery of further growth in FY24.

Broker update - thanks to Cavendish for updating us. It’s leaving FY 12/2023 unchanged at £3.5m adj PBT, but there’s a small increase to FY 12/2024 to £4.3m, and FY 12/2025 to £5.8m.

In EPS, that’s 4.56p, 4.79p, and 6.26p.

The current share price of 75p seems in the right ballpark for now, I’d say.

Paul’s opinion - I find today’s update a bit too over-excitable, and would have preferred a more measured tone. It’s mixed too - lots of focus on revenue, but no change to (admittedly raised in July) 2023 forecast profit, and delayed order slipping into 2024 was rather glossed over. That said, delays being absorbed without a profit warning is good enough.

The commentary on product development, design wins, etc, all sounds encouraging to me, and is nice supporting evidence to expect continuing growth in revenues and profits hopefully.

The last balance sheet showed cash reducing, and inventories having built up too much. So when the FY 12/2023 figures come out, I’ll be looking for cash to have improved, and inventories under better control.

All in all then, I think this share looks good. I’m going to moderate to AMBER/GREEN, as I want to see cashflow and balance sheet improvements in the Dec 2023 figures first.

Graham’s Section:

Frontier Developments (LON:FDEV)

Share price: 158.6p (-19%)

Market cap: £63m

This morning brings more bad news for FDEV shareholders. There has been no shortage of bad news at this stock:

I turned positive on it on 19th Jan 2023, with the shares trading at £5.20 (vs. a peak share price of £32, and a current price of around £1.60). Despite letting the share price fall by over 80% before turning positive, I was still far too early!

Unfortunately, the company continues to struggle on the sales front: the new Warhammer game released ten days ago has seen lower than expected sales so far. This is on the back of FDEV’s first game in the F1 Manager franchise failing to perform to expectations.

Change of strategy - the company admits that attempts to diversify its games portfolio in the last five years haven’t worked, and it is going to refocus on “creative management solutions” (CMS) games.

These games “delivered stronger and more predictable returns through Frontier’s expertise and leadership in that genre”.

The Company's four CMS games (Planet Coaster, Planet Zoo, Jurassic World Evolution and Jurassic World Evolution 2) continue to perform well and have each achieved over $100 million of gross revenue with a combined total of over $500 million. All four games achieved profitability within one month of release and delivered over 100% return on investment within 12 months of release. The three games which have been in the market for four years or longer - Planet Coaster, Jurassic World Evolution and Planet Zoo - have all achieved a cumulative return on investment of over 250%.

The plan is to release a new CMS game every year for the next three years (starting in FY May 2025, not the current year FY May 2024).

Outlook

Next we have the revenue/profit warning for the current year:

FY May 2024 revenues now expected to be £80-95m, down from previous expectations of £108m. That’s a downgrade of up to 26%.

The previous expectation of a £9m adjusted EBITDA loss “remains achievable towards the upper end of revenue guidance”, thanks to cost savings and an improved gross profit margin. We discussed the company’s planned cost cuts last month.

For FY May 2025, the company is expected to “at least break even”.

Graham’s view

The reasons I have been positive on this share in 2023 are 1) a healthy balance sheet, 2) a cheap price to sales multiple for a videogame developer, 3) the possibility that in the medium-term, its run of poor title launches could come to an end.

Today the company announced that its cash balance finished October at £20m. This is down from £28m as of May 2023 - the company is loss-making, so this is hardly a surprise.

They are currently in cost-cutting mode, with a recruitment freeze and staff redundancies.

Let’s keep a watchful eye on the cash balance, but I am hopeful that they can stop the bleeding soon. They do think that FY 2025 will be “at least break even” (possibly at the adjusted EBITDA level).

I note that joint corporate broker Liberum have put their target price, recommendation and forecasts under review - so I don’t have access to any broker forecasts as of this morning.

On balance, I think the “healthy balance sheet” still holds, providing that the company does stop the bleeding in the next 6-12 months. The October cash balance is nearly one-third of the current market cap.

Price to sales ratio: this is currently about 0.65x-0.80x, depending on where the current year’s sales figure eventually ends up. This remains extremely low in a video game context (Team17, covered by Paul on Friday, has a price/sales ratio of 1.7x).

If you are willing to deduct the cash balance from the market cap and use enterprise value, then the EV/sales ratio for the current year is in a range of 0.45x-0.55x.

So the healthy cash balance and the cheap price to sales ratio are still in place.

The great imponderable factor, then, is whether the company’s run of poor launches can come to an end.

I would argue that today’s announcement does improve the likelihood of this happening: they are going back to their bread and butter with the development of titles in the genre that has worked out well for them in the past (with the likes of Planet Zoo and Jurassic World Evolution). Surely this strategy is the most likely to see them return to their previous levels of financial performance?

I am therefore going to leave my positive stance on this share unchanged.

However, I can completely understand if most people would prefer to avoid a share with valuation metrics that looked like this:

(Paul adds: this is a rare occasion where Graham and I disagree! But that's fine, it would be a bit odd if we agreed on everything, and we encourage everyone to DTOR and form their own opinions. Graham's explained it all well, but for me, the overall balance would be more like AMBER/RED, to reflect very poor performance, and having to go back to basics after a failed strategy to diversify. The cash pile looks likely to dwindle, as it sorts itself out. Also, I'm not a fan of price to sales ratios. I'm happy to eat my hat, once it rebounds!)

SysGroup (LON:SYS)

Share price: 38.25p (-4%)

Market cap: £19m

SysGroup plc (AIM:SYS), the end-to-end data solution provider, is pleased to announce its unaudited half year results for the six months ended 30 September 2023…

After many years of poor share price performance, perhaps this one has found a base?

Let’s check out the highlights for these interim results:

Revenues down 3% to c. £11m (Paul reported on fast revenue growth at the most recent full-year results, but this was mostly thanks to prior acquisitions).

Adj. EBITDA £1.6m (H1 last year: £1.7m)

Pre-tax loss £1.09m (H1 last year: pre-tax loss £0.19m).

Net debt £3.4m

Not a very inspiring set of highlights by any means, even at this low market cap of less than £20m.

The new Executive Chair is working on a (drum-roll) Artificial Intelligence/Machine Learning strategy:

SysGroup is well positioned to participate in the burgeoning field of AI/ML, a technology set to redefine our era. AI's prominence is undeniable, with daily media coverage and increasing demand for AI strategies at the board level of every company. The reality is that AI is here to stay and will be a powerful tool for those that embrace it.

Sysgroup will be “the go-to end-to-end data solution provider for SMBs embarking on their AI/ML journey”.

Turning back to the results, here is the latest reconciliation between adj. EBITDA and the pre-tax loss:

It’s never nice to see a pre-tax loss, but some investors might take comfort in knowing that there was a profit before these items. Personally, I prefer to see much cleaner accounts than this.

The company has £20m of balance sheet equity but it’s all goodwill. Deduct goodwill and intangibles, and the company is in negative equity.

Graham’s view

I don’t see anything here that particularly stands out to me here, either good or bad. Obviously I would treat the AI/ML strategy with caution, as so many companies are jumping on this bandwagon. But my stance is neutral. With a half-decent cash flow performance, SysGroup could justify this market cap.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.