Good morning! It's just Paul here today, as Graham has a prior engagement.

Podcast - what with one thing and another, I didn't manage to muster any inspiration to record my weekly summary this weekend. We can't have a gap, so I'll record it late either today or tomorrow. Apologies for any inconvenience.

Mello Monday is from 17:00 tonight - with entertaining speakers, and terrific companies - I want to see 3 out of the 4 presentations.

Summaries

Synectics (LON:SNX) - 105p (pre-market) £19m - Trading Update (materially ahead) - Paul - GREEN

A positive trading update, and broker increases forecast EPS to 13.1p. Combined with a strong (net cash) balance sheet, reasonable divis, and a increased order book, this all looks attractive value to me. Not the most exciting company, but shares look cheap. So I think this looks a nice entry point. Stale bulls might sell into the liquidity, perhaps?

Quartix Technologies (LON:QTX) - Down 3% to 150p (£73m) - Konetik update - Paul - AMBER

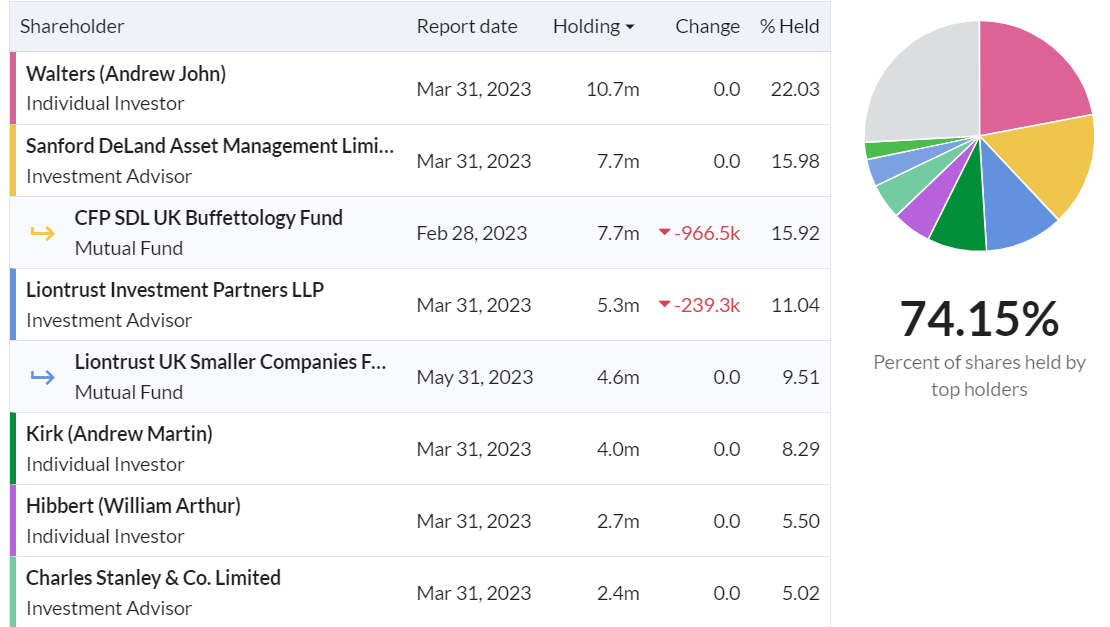

Founder Andy Walters is back in charge, and kicking ass! After a board room clear-out, today's update basically tells us that the acquisition made in Sept 2023 was no good. Are shares good value after a 9-year round trip back to where they started? No, not really, based on current forecasts, about 19x earnings (which have been in a downtrend since 2018). That said, I think a turnaround here looks possible, and you can't beat a founder, motivated with a 22% stake to sort out problems.

Surface Transforms (LON:SCE) - down 7% to 10.6p (£28m) - Result of Open Offer - Paul - AMBER/RED

The open offer has been well supported, with oversubscriptions meaning it raises £2.7m. This is conditional on the proposed £13m capex loan completing, which still hasn't yet happened. It's due "imminently" the company says. High risk, until the crucial loan is agreed.

Update: loan has been agreed, so the fundraising package should now go ahead.

Paul’s Section:

Synectics (LON:SNX)

105p (pre-market) £19m - Trading Update (materially ahead) - Paul - GREEN

Many thanks to gmtrader, who flags this materially ahead update in the reader comments below.

Synectics plc (AIM: SNX), a leader in advanced security and surveillance systems, provides an update on trading for the year ended 30 November 2023 ("FY 2023").

Good news here -

The Company expects results for FY 2023 to be materially ahead of market expectations, reflecting strong trading in the second half, particularly in the oil & gas market.

A resurgence in the oil & gas sector has been widely reported, as the Russian invasion of Ukraine refocuses the world on energy security, after a long period where environmental concerns had taken precedence, hence restricting new supplies that are now needed.

Outlook & order book - sounds good too -

Additionally, the Company ended FY 2023 with a strong order book, totalling £28.6 million (30 November 2022: £24.4 million) providing the Board with continued confidence for the year ending 30 November 2024.

The StockReport shows forecast revenues of c.£53m for FY 11/2024, so an order book of £28.6m at the start of the new year gives decent visibility.

Net cash - again, looks healthy -

Net cash at 30 November 2023 was £4.6 million (30 November 2022: £4.3 million) with undrawn bank facilities of £3.0 million.

Balance sheet - I’ve checked its last published accounts as at 31 May 2023, and confirm that SNX has a very healthy balance sheet, with NTAV of around £16m, including a robust working capital position. So it comfortably passes my balance sheet review, meaning shareholders shouldn’t have to worry about solvency or dilution.

Broker update - Shore Capital publishes an update today, many thanks for that. It increases adj PBT from £2.3m to £2.8m for FY 11/2023. This is 13.1p adj EPS (up from previous forecast of 10.9p). Shore leaves FY 11/2024 forecast unchanged, since it was already anticipating decent growth to 16.8p.

Paul’s opinion - at just 105p/share, this looks cheap to me. Synectics is not the most exciting company, and has been listed a long time. It has the occasional bull run (a large one, 6-bagging from 2008 to 2013), but then came all the way back down again. I’ve always seen the company as an also-ran in a large market, with little to differentiate it from the competition.

That said, it has strong finances, and pays reasonable divis. Not sure why the shares are listed, it doesn't seem to have done anything much with the listing.

Everything has its price, and this looks attractively cheap to me. Not something I’d want to hold forever though, but after a positive update today, and a share price at/near 20-year lows, I’d say risk:reward is probably as good as it’s likely to get, for maybe a 50% gain over the next year, would be my best guess, dependent on market conditions.

Quartix Technologies (LON:QTX)

Down 3% to 150p (£73m) - Konetik update - Paul - AMBER

This is an unusual announcement re the recent acquisition (15 Sep 20023) of Konetik. The founder, Andy Walters, returned to Quartix on 26 Sept, just after this acquisition was announced by former CEO Richard Lilwall. It’s now been decided that the acquisition was a dud (my interpretation), and attention is refocusing on the core business & strategy.

What’s the damage? £2.2m in cash was paid for Konetik, plus up to £1.2m in deferred payments linked to performance. Given that today we’re told performance has been weak at Konetik, then I’m assuming hopefully no further payments will be needed.

So the total damage is only about 3% of the market cap, not a disaster. It did use up most of the cash pile (£3.25m at 30 June 2023), but Quartix is a nicely cash generative business, so I’m sure this loss will be replenished. It does mean less in divis though, in the short term.

Paul’s opinion - I’m not too bothered about the failure of this recent acquisition, as it was fairly small. It’s better to take decisive action when a mistake is made, rather than drag it out.

The more interesting question is what happens to Quartix now that the founder is back in charge as Exec Chairman? He’s hit the ground running that’s for sure, with a sweep out of the board room. There was a profit warning on 6/10/2023. Refocusing strategy on the core activities seems very sensible.

Are Quartix shares cheap now, and worth revisiting?

They’re certainly cheap compared with the previous share price, but as we’ve consistently maintained here at the SCVRs in recent years, there was no convincing reason as to why QTX shares should be on a premium rating, because it hasn’t generated any earrings growth for years. So it’s been more a situation where an unjustified premium price has gradually come down to earth, the way I see things.

At 150p/share, the StockReport has a forward PER of 18.9x, hardly a bargain considering EPS has been in a downtrend since 2018.

What could make Quartix shares re-rate? Good news on the refocused strategy is what’s needed. Despite the lack of earnings growth, QTX still makes a very healthy PBT margin, and spews out cash, so it’s still a good business. It was making progress in France too, so if that opens the door to more international expansion, then maybe it could once again interest investors?

The trouble is, telematics is a crowded space, so to be more bullish on QTX I would need to do a lot more research, speak to people who use its products, etc.

In the meantime then, I’ll just have to sit on the fence with an AMBER view.

Note that there might possibly be an overhang, given that the 16% shareholder is a fund which apparently has been hit particularly hard with client redemptions.

Shares have done a 9-year round trip to back where they started -

Surface Transforms (LON:SCE)

Down 7% to 10.6p (£28m) - Result of Open Offer - Paul - RED

Surface Transforms (AIM:SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs is pleased to announce that the Open Offer was significantly over-subscribed, raising gross proceeds of £2.7m.

Applications were received for 27,420,745 Open Offer Shares, representing a take-up of 137.1 per cent of the 20,000,000 available Open Offer Shares.

I went through the terms of the fundraising package here on 15/11/2023. It hinges on a £13m capex loan being agreed. Plus the formality of passing a vote at a GM. So I’ve looked for an update today on the £13m loan, all it says is -

…the £13.2m loan, described during the fund raising and still expected to conclude imminently…

We need more details on who is providing this loan, what the terms are, etc.? Without that information, I feel we’re too much in the dark to make this share investable. So for that reason, I’d rather wait until the loan deal is signed, and the money is in the bank.

Maybe the proposed lender is a connected party? I’d be surprised if SCE could borrow for capex from conventional lenders.

Anyway, fingers crossed the loan is agreed, as that would trigger release of the cash from the conditional placing and open offer. Good luck to holders.

Update: Conclusion of Loan Agreement

My wish has been granted! A further RNS came out at 11:34 saying -

Surface Transforms plc (AIM:SCE) manufacturer of carbon fibre reinforced ceramic automotive brake discs is pleased to announce that it has signed a £13.2m loan agreement with the Liverpool City Region Urban Development Fund which is part funded by the European Regional Development Fund (ERDF). The loan will contribute to the Company's forthcoming £44m investment programme.

The investment is supporting capital expenditure that will see the production capacity available in the Knowsley site rise from £50m sales capacity per year in 2024 to £150m sales capacity per year in 2027. The capacity increase is required to support the forecast substantial sales increase underpinned by the Company's current £390m* lifetime contract value and £300m prospective contract pipeline. The remainder of the £44m capital investment programme will be funded from free cash flow as the Company moves into profit, still expected during 2024.

Paul’s updated view - I think you would need to be a tremendous optimist to imagine that this is the last fundraise! However, assuming everything now completes, this buys management some time to see if they can fix production problems, and scale up. It certainly has not been anything near plain sailing so far. This share is a useful reminder that it’s all very well small companies winning large orders, but unless they’re outsourcing production, then scaling up manufacturing of complicated, cutting edge products, is not something we can just assume will be achieved. Things always take longer, and cost more than planned.

Should we shift from red to amber? I think we should move up a bit yes - because the main problem (running out of money) has been resolved, at least for the time being.

It’s got a huge order book, so there is clearly plenty of demand for the products, which I like.

SCE shares are still speculative of course, and it will probably need another fundraise. Also, its production problems could continue as it tries to scale up production.

So on balance I’ll go with AMBER/RED - ie still speculative and higher risk, but out of intensive care.

The share count will shortly go up from 241.7m, with 82.9m new placing shares, and 27.4m new open offer shares, new total = 352m. Shares have bounced to 12.5p in a relief rally, taking the market cap up to £44m at the time of writing.

The Stockopedia data gets updated when the new shares are formally issued, which is something to bear in mind over the next few weeks, as the old number will be shown until that point.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.