Morning all! Graham here. I think I'll stop here - today's report is now finished (12.30).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

S&U (LON:SUS)- £21.41 (-6.5%) £260m - Trading Statement - Graham - AMBER

I am switching to a neutral stance on this one, hopefully on a temporary basis. I am spooked by the mention of a Skilled Person Review, which recently led to the collapse in the share price of another one of my favourite small caps (JIM). I also note that the bearish language used by the Chairman seems to be even more bearish and exasperated than usual. Collections and repayments are ahead of budget but defaults are increasing while S&U's borrowings have also significantly increased. So I would now apply additional caution towards this stock.

£HEAD - 201p (-5%) £162m - Trading Update - Graham - AMBER

Results are only "broadly" in line, implying a small miss against prior expectations. Prior expectations, after a profit warning in the summer, already pencilled in a sharp slowdown in profitabilty on flat revenues. Revenues are failing to match inflation, with lower volumes currently tracking the performance of the floorcoverings market as whole. This is a tricky sector but the depressed pricing of this stock (P/S only 0.25x) should allow for significant upside if conditions improve.

MS International (LON:MSI) - 882p (+3%) - Half-year Report - Graham - GREEN

Paul and I have consistently championed this one and it's pleasing to see that it's delivering for shareholders. The cash balance has grown, H1 profits are very considerably higher, and the prospect of deliveries to the US Navy has been crytallised with the announcement of naval gun production, maintenance and support contracts. Valuation is considerably higher than before but personally I don't see it as being overvalued here. So I'm keeping our positive stance on MSI.

S&U (LON:SUS)

- Share price: £21.41 (-6.5%)

- Market cap: £260m

This motor finance and property bridging company issues a trading update with arguably even more downbeat language than usual:

Following a very good first half, S&U continues to make steady, if more cautious, progress despite the "current economic, tax and regulatory burdens weighing on business" we reported at half year.

The company's financial year-end is in January, so today's update refers to progress since the half-year results for July.

Growth continues in the loan books:

- Motor finance: £327m (up from £313m at the half-year results).

- Property bridging: £119 (up from £104m at the half-year results).

S&U's borrowings increase to £209m vs. committed facilities of £280m - perhaps another increase in the facilities might be prudent soon? Although S&U say that the curent facilities will "comfortably" allow them to carry out their plans over the next year, I would nevertheless be on the lookout for an increase.

Chairman Mr. Coombs continues in his usual style:

...caution is necessary. Those burdens weighing on business are reflected in a lack of consumer confidence, cost-of-living pressures, persistently higher rates of interest, and a new raft of regulation, all of which inevitably affect profitability.

Further out, an anaemic outlook for growth in the UK, recently predicted by both the Office for Budget Responsibility and by the Governor of the Bank of England, combined with restrained growth in household expenditure over the next two years, make S&U's focus on working with our customers, credit quality and appropriate forbearance more essential than ever before. The volume of consumer finance used-car market transactions fell by 5% in the year to October 2023 according to the Finance and Leasing Association ("FLA"), whilst prices in the housing market remain subdued and, in many areas, actually in retreat. Hence, whilst we remain ambitious and optimistic, it would be unwise to plan for major growth until these trends have stabilised and economic prospects improved.

In the outlook statement, he refers to "the obstacles all businesses face in times of feeble growth, pressures on the consumer, high taxation and inflation, and regulatory changes and political uncertainty" (don't worry - this is normal!). He finishes with the promise that S&U will emerge "as successful and as strong as ever".

Motor finance

Live collections have fallen to 91% of due (vs. 94% last year). Despite this, "the number of bad debts and voluntary terminations" (i.e. handing back the car keys) remained below budget.

The FCA is currently taking an interest in S&U's motor finance business: a review "has developed into a more formal interaction wit the FCA". There is now going to be a "skilled person review" (this is explained here). The timing of this is interesting, as the long-standing CEO of this business has just retired.

Property bridging

Higher rates "have put a break on recent profit growth", and one additional loan is now extended or technically defaulted. So 16 out of 130 loans are now extended or technically defaulted. But recent repayments are "20% above budget".

Graham's view

I am normally very positive on this share; however, I believe that additional caution is warranted today in light of the "skilled person review". Recent events at Jarvis Securities (LON:JIM) are very fresh in the mind - the skilled person reviews can be a "lengthy and costly process", as S&U acknowledge today.

Purely on the financials, I remain a fan of S&U, despite the many short-term economic headwinds. However, some additional cautious is justified when the FCA are taking an interest. Therefore, I will (temporarily, I hope) switch to a neutral stance today.

I hope I don't miss a sudden re-rating in this stock while on a neutral stance. But S&U shares have been trending sideways for some time:

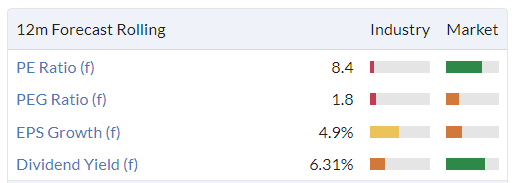

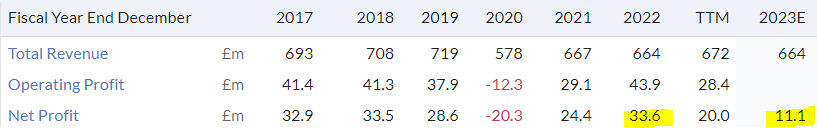

This stock may seem cheap but in the context of current valuations in the banking sector, it is arguably on a premium rating:

Headlam (LON:HEAD)

- Share price: 201p (-5%)

- Market cap: £162m

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, is providing a trading update in respect of the eleven months of the year to 30 November 2023 (the 'Period').

The financial year-end here is December.

FY 2023 is expected to be "broadly in line with expectations" (this often means a slight miss).

September and October were "weaker than expected" due to consumers cutting back on home improvement projects.

Key points:

- Revenues flat year-on-year (UK slightly positive, while Continental Europe saw a decline).

- Volumes down 5% in the UK (thought to be in line with the market as a whole). Compared to 2019, UK market volumes are thought to be 20% lower.

Margins and costs "remain well controlled" despite cost inflation still being "elevated".

Graham's view

The official announcement doesn't add too much; expectations have likely been lowered (see if you can get your hands on a Peel Hunt note for more information).

As of 12th October, consensus expectations for 2023 were revenues of £664m and underlying PBT of £11.9m. This implies an equal weighting between H1 and H2 for the current year, and overall a very sharp deterioration in profitability versus 2022 results.

Checking Paul's notes in July, he observed that the company has "very solid asset backing", including freehold property. So hopefully it can weather these conditions without suffering any financial distress.

Even though inflation has cooled, I still have higher revenue growth expectations for companies than I would have in low-inflation conditions, and Headlam's flat revenue performance this year must be seen as a disappointment against that.

And while it says that margins are costs are controlled, the slowdown in profitability clearly demonstrates that higher operating costs are taking a toll.

As with every low-margin business, small differences in performance can lead to enormous swings in bottom line performance, and that is what we are witnessing here.

I will maintain Paul's neutral stance on this one. The price to sales multiple is only about 0.25x and that does allow for shareholders to do well if margins and the operating cost profile can improve.

MS International (LON:MSI)

- Share price: 882p (+3%)

- Market cap: £144m

This is an unusual collection of seemingly unrelated businesses, with heavy insider ownership (Chairman Michael Bell owns 18%).

Its four divisions are as follows: Defence, Forgings, Petrol Station Superstructures, and Corporate Branding.

Share price momentum this year has been excellent:

This morning we have confirmation of production order contracts with the US Navy, relating to a 30mm naval gun, along with a related contract for maintainenance and support. Delivies will commence in the new year.

Given the share price trajectory, I think it's clear that the market has been attempting to price in this news in recent months.

The Chairman has been working on the project since I was a toddler:

I first reported on our efforts to break into the US Navy market in my Chairman's Statement of 25th July 1988, when I stated, "The first unit built to suit the US Navy specific requirements awaits ships trials in the United States". It has been a long haul, but vision; persistence; determination and capability has resulted in success.

Separately, MSI reports the first sales of a counter-drone weapon: this should have been achieved last year but was delayed by the war in Ukraine.

Here are the financial highlights for H1:

- Revenues £57m (H1 last year: £42m)

- PBT £7.7m (H1 last year: £3.5m)

Net cash is £50m, covering a significant chunk of the market cap.

News from the other three divisions (excluding Defence) is less dramatic, and very little is said about them. Note that MSI acts in many ways as a private company: there are no broker forecasts and the company often appears to say the bare minimum that it must regarding its operations. There has been no increase in the share count for many years. If anything, the share count has declined over time. As it has little need to raise funds, we can understand why it would seem to take little interest in the stock market's opinion of its performance.

With the share price having multiplied several-fold over the past couple of years, perhaps it will now start to catch the attention of more prospective investors, whether it wants to or not! Paul and I have been consistently positive on this one and I can't consider changing stance on the back of today's excellent results. The step-change in profitability and the very healthy cash balance (still over one third of the market cap) strike me as sufficient grounds to think that the valuation here remains reasonable.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.