Good morning from Paul & Graham!

Get ready for the renowned Stockopedia multibagger series of webinars - the next one is 11:00 today - details here. I think many of us have really been inspired by the insights from this research. And the next batch of 10-baggers will be somewhere buried in these Small Cap Value Reports, as multibaggers start off as small, and good value!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries -

Smartspace Software (LON:SMRT) - up 113% y’day to 71.5p (£21m) - Possible offer - Paul - PINK (takeover)

Shares more than doubled yesterday, when a potential bidder (rebuffed by the company) announced its approach to the market. SMRT now says it is consulting major shareholders. It looks a generous offer to me, it's difficult to imagine shareholders turning this down, but who knows!

hVIVO (LON:HVO) - 20p (pre-market) £136m - £16.8m RSV contract & Trading ahead of guidance - Paul - GREEN

Large contract win, and trading is ahead of expectations. 2 brokers update their numbers. Looks a very impressive growth company to me, and valuation still seems reasonable, so a continuing thumbs up!

Volution (LON:FAN) - up 5% to 417p (£825m) - AGM Trading Update - Graham - GREEN

A positive update from this designer and manufacturer of ventilation systems. Despite weakness in new builds, refurbishment demand remains strong. No change to revenue forecasts but EPS estimates get a small boost. Strong indications of a quality business.

Cohort (LON:CHRT) (Paul holds) - unch 532p (£222m) - Half Year Results - Paul - GREEN

Solid H1 results, with the usual H2 weighting to profit expected, hence trading in line with expectations. A very large multi-year order book gives nice visibility. Strong balance sheet with net cash. Not the most exciting of shares, but if you want a decent quality business at a reasonable price, Cohort looks worthy of consideration.

Springfield Properties (LON:SPR) - down 2% to 72.8p (£86m) - Trading Update - Graham - GREEN

Staying positive on this Scottish housebuilder after a confident, in-line trading update. Debt has risen but the company insists that land sales and normal seasonality will reduce this as planned by year-end (May 2024). Valuation is tempting at a 40% discount to tangible book.

Paul's Section:

Smartspace Software (LON:SMRT)

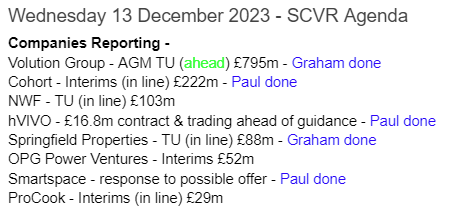

Up 113% y’day to 71.5p (£21m) - Possible offer - Paul - PINK (takeover)

An announcement was made to the market by Skedda Inc. yesterday, saying it had made a series of proposals to possibly acquire Smartspace, most recently at 82p per share, a large 144% premium, but not such a large premium if you zoom out the chart onto a longer timeframe.

SMRT management has not been supportive of this possible offer, but an 8.3% shareholder JO Hambro has been supportive.

Response to possible offer - out this morning from SMRT.

Says that it rejected a previous possible offer from Skedda Holdings Inc. (the market was not informed at the time), but is now consulting major shareholders about the 82p possible offer.

The Takeover Panel rules have kicked in.

Paul’s opinion - I’m probably not the best person to ask, as I never really saw much attraction to this share, with it being tiny and persistently loss-making. Hence I was amber on it in May 2023, when I looked at its last results, which did show strong ARR growth and reduced losses, but very small numbers (in particular revenue per client looked tiny).

Clearly there must be more to it than that, otherwise it wouldn’t have a bidder sniffing around trying to buy it!

Its track record as a listed company has been poor, but losses are now forecast to be largely eliminated, thanks to increasing revenues.

This situation once again brings up the question of when companies should inform the market about bid approaches. My view is that if a material premium is being offered by a credible potential buyer, then it should be required to be announced. That is not the case currently, so we’ve had a false market in SMRT shares, which were worth materially more than the stock market price, due to undisclosed price sensitive information being withheld by the company. Totally wrong.

Such a large premium is bound to appeal to many shareholders, so it will be interesting to see what level of support there is. Or people can sell immediately in the market (although for well under the 82p bid price).

Skedda is a trade buyer, being a workplace software company headquartered in Australia.

It will certainly be interesting to see how this situation pans out! I imagine many shareholders will be very happy to walk away with a 144% premium - it’s a sensible offer.

A generous offer of 82p in the short term -

Less generous when you zoom out to 5-years -

hVIVO (LON:HVO)

20p (pre-market) £136m - £16.8m RSV contract & Trading ahead of guidance - Paul - GREEN

It’s useful when companies title the RNS with the key point(s), as above, it’s certainly attention grabbing.

Things really seem to be powering ahead at HVO - figures in recent years have shown highly impressive top line growth, and a move into profit, hence why we’ve been reporting positively on it this year (most recently green on 12 Sept).

hVIVO plc (AIM & Euronext: HVO), the world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces that it has signed a £16.8m full-service contract with an existing top five global pharmaceutical client to test its respiratory syncytial virus ("RSV") antiviral drug candidate using the hVIVO RSV Human Challenge Study Model.

This is a big contract, in the context of £55-60m forecast revenues pa -

It says the majority of revenues will be booked in FY 12/2024, with some also in both 2023 and 2025.

Trading update - most of the announcement is rather technical, but this bit covers overall trading, pity they only mention EBITDA, as most of us prefer real profits, not EBITDA, but this is the fashion unfortunately -

The Company is pleased to report that trading has continued to be strong across the Group, with revenue slightly ahead of previous market expectations. The Group has continued to improve operational efficiencies which, coupled with the facilities funding that will benefit both FY23 and FY24, has resulted in EBITDA margins exceeding 20% for the year ending 31 December 2023. Consequently, the Group now expects EBITDA to be ahead of previous market expectations. With the addition of today's contract, the Company has clear revenue visibility into 2024. Further details will be shared as part of the Company's FY23 Trading Update in late January 2024.

Visibility is a good point - this is one of the things I like about HVO, its large forward order book. This also benefits cash, as contracts seem to have a large element of cash paid up-front, a very nice position to be in for HVO.

Broker forecasts - both Cavendish and Liberum post updates on Research Tree, thanks to all. Liberum has upped FY 12/2023 by 6% at EBITDA level, but +35% at EPS, from 1.0p to 1.3p. So maybe they’ve tweaked the model to include higher interest received on cash balances?

Next year’s forecast falling to 1.2p seems anomalous, given the growth trajectory, so I imagine HVO is probably set up to issue ahead of expectations updates throughout 2024.

Paul’s opinion - excellent news today, and this share is really gaining momentum, looking to be a very credible growth company in a large market. Valuation still looks reasonable too.

Hence I’m more than happy to remain at GREEN.

Cohort (LON:CHRT) (Paul holds)

Unch 532p (£222m) - Half Year Results - Paul - GREEN

Cohort plc, the independent technology group, today announces its half year results for the six months ended 31 October 2023.

To expand on that, Cohort is a collection of 6 companies, which operate largely independently of each other, mainly focused on the defence sector.

The financial highlights start off well, but the extra gross profit gradually disappears, consumed by c.£1m in extra finance charges and higher corporation tax -

Note the very large multi-year order book, and a return to a healthy net cash position.

There was a heavy H2 bias to profits last year.

Balance sheet - NAV is £98m, including £54.5m intangibles (mostly goodwill), so NTAV is healthy at £43.5m.

Receivables strike me as excessive at £61m, which seems out of kilter with £94m H1 revenues. I would normally expect receivables (unpaid invoices to customers) to be less than half H1 revenues. So that’s a query point.

There’s a cash pile of £36.1m, in combination with £22.8m long-term bank loan. I think I queried why this is once before, but can’t remember the answer.

There’s also a £5.3m pension deficit.

Cashflow statement - cash generation is roughly used to fund capex (quite hefty at £2.7m in H1, similar to last year H1), dividends and share buybacks.

Outlook - reassuring I’d say -

The Group's order book at 31 October 2023 stood at £353.9m (30 April 2023: £329.1m), underpinning most of the second half of this financial year. In line with previous experience, we anticipate a stronger Group performance in the second half and thus remain on track to achieve our expectations for the full year.

The continued expansion of the Group's order book is a strong indicator that we are offering competitive products in a growing market. On-order revenue is now deliverable out to 2033. The pipeline of order opportunities for the remainder of the year also looks strong. Demand for our solutions and services continues to be driven by international tensions in the Asia-Pacific region and Europe. This backdrop is driving increased spending on defence and security in Europe, including the UK, other NATO countries and the Asia-Pacific region. Overall, we continue to see a positive outlook for organic growth in the years ahead.

Paul’s opinion - I continue to view Cohort as a decent group of quality businesses. Shares have had a good recovery of late, but still strike me as reasonably priced.

It’s been a reasonable safe haven in the last 2 years’ small caps bear market.

We have to disclose if we hold any share we write about, I am currently holding a small position here. I think it’s well-managed, and has a good long-term track record, and a positive outlook. So it’s another thumbs up from me.

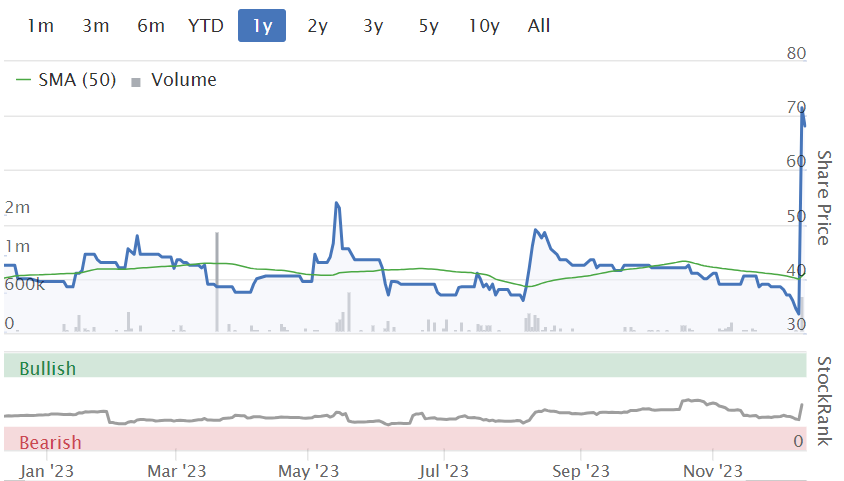

It looks as if the trend might be starting to turn upwards, perhaps? -

Graham’s Section:

Volution (LON:FAN)

- Share price: 417p (+5%)

- Market cap: £825m

Volution Group plc ("Volution" or "the Group" or "the Company", LSE: FAN), a leading international designer and manufacturer of energy efficient indoor air quality solutions, today announces an update on trading covering the four months which ended 30 November 2023.

This is an excellent update, that’s ahead of expectations.

The company’s year-end is in July, so the update covers the first four months of the new financial year.

Key points:

Revenues +8% year-on-year to £121m

The growth is primarily from acquisitions: 7.7% inorganic growth, combined with 2.9% like-for-like organic growth, minus 2.6% negative currency impact.

Recent acquisitions “are progressing well”.

Two-thirds of revenues are from the refurbishment of existing properties rather than new-builds, shielding Volution to some extent from a weak construction sector. UK residential is currently the company’s best-performing sector:

Despite the significant reduction in new build completions, this market benefits from regulatory drivers moving demand towards higher value energy efficient ventilation solutions.

Energy efficiency trends are also helping Volution in other markets such as Australia and the Netherlands.

Profitability is up, too:

Gross and operating profit margins have improved compared to FY23 due to strong pricing discipline, an ongoing focus on our operational excellence programme, including material value engineering initiatives, and the introduction of new products.

Outlook:

Whilst new build market conditions remain challenging, our refurbishment activities continue to benefit from strong regulatory drivers and consumer focus on eliminating the damaging health impacts of mould and condensation in buildings. Our strong start to the financial year, together with the tailwind from the three acquisitions completed in the calendar year, gives the Board confidence in delivering earnings ahead of the current range of market expectations for the financial year.

The existing range of earnings expectations was for EPS of 25.3p to 26.3p.

Analysts at Liberum are suggesting that there is no change to full-year revenue expectations, but that earnings upgrades are coming from margins. They boost their full-year EPS estimate to 26.5p.

Graham’s view

Paul and I have both been positive on this one - see my comments in July and Paul’s more recent comments in October.

The main weakness from my perspective is organic revenue growth, which appears to have reduced again from the c. 5% level achieved last year.

However, the company is making up for that with acquisitions that are performing well, and with improved margins, which seems the best possible outcome in struggling property and construction markets.

EPS forecasts out to FY 2025 suggest that growth will be limited in the short and medium term, and a case could be made that this has reached fair value at current levels:

However, I will maintain my positive stance on this one. I continue to appreciate the company’s communication style (very clear). But more importantly, long-term momentum in favour of more advanced and effective ventilation products to reduce mould and condensation appears to be working in Volution’s favour. The company has been under-promising and over-delivering, as you can see from the EPS momentum chart:

Springfield Properties (LON:SPR)

- Share price: 72.8p (-2%)

- Market cap: £86m

This H1 update is in line with expectations, with some fresh information on the state of the housing market:

Springfield Properties plc (AIM: SPR), a leading housebuilder in Scotland focused on delivering private and affordable housing, provides the following update on trading for the six months ended 30 November 2023.

Demand in private housing is “stable but subdued”. Selling prices are stable but demand has been affected by “high interest rates, mortgage affordability and reduced homebuyer confidence”.

Affordable housing: the company has restarted signing affordable housing contracts - this was a key discussion point earlier in the year, when rising costs made these fixed-price contracts unprofitable. With affordable housing now back in play, we have a clear catalyst for performance to start to pick up again.

Build cost inflation is now running at around 4%, with “greater availability of materials and labour”. If inflation stays low, then the issue with affordable housing contracts and inflationary cost increases has solved itself for now - but builders will need to be extra careful in future when signing these deals. Springfield is only signing contracts with a 12-18 month delivery timeframe, which reduces the risk of getting caught out by inflation again.

Net debt has risen to £94m, but the company insists that it is on track to get this down to £55m by the end of the current financial year. It plans to do this by sales from its large land bank (6,500 plots and a further 3,255 acres), which it can achieve “without impacting the Group’s development pipeline”.

The recent rise in net debt is explained by £11m of defcon for acquisitions, land purchases, and “the usual working capital cycle” as work-in-progress builds in H1 for delivery in H2.

Last year, net debt finished H1 (Nov 2022) at £74m before falling to £68m by the end of the year (May 2023).

Outlook - in line with expectations for the current year. Beyond that, the outlook is optimistic:

…the Board is encouraged by the early indications of a return in homebuyer confidence, with inflation reducing and the Bank of England holding interest rates for two consecutive months. Build cost inflation continues to moderate and there is greater availability of materials and subcontractors. The interest that the Group is receiving in its land bank - and at attractive valuations - reflects the market preparing for an upturn in trading conditions.

In Scotland, three local authorities have declared “housing emergencies”, underlining the lack of supply.

Estimates: Equity Development have published a note suggesting EPS for the current year of 6.2p, rising to 8p next year.

Graham’s view: I’m going to stay positive on this one, as I did in July. My concerns over limited headroom - the company using a temporary overdraft - had previously kept me neutral on this share.

However, with the company outlining a clear plan to keep its borrowings under control, and with more certainty now around its performance in a higher interest rate environment, I’m happy to stay positive.

As previously mentioned, Springfield is trading a discount to tangible book value (c. £144m as of May 2023). One of the benefits of all this tangible value is the flexibility to sell assets to pay down debt, as required. My own calculations and those of the analysts suggest that price to tangible book value is around 0.6x, providing plenty of upside if the market is inclined to value this at book value at some point in the future. The shares previously traded at up to double their current level at the start of this interest rate tightening cycle:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.