Good morning from Paul & Graham! We're ready & raring to go, for a massively busy month from this point onwards with trading updates galore. We'll try to cover as much as humanly possible!

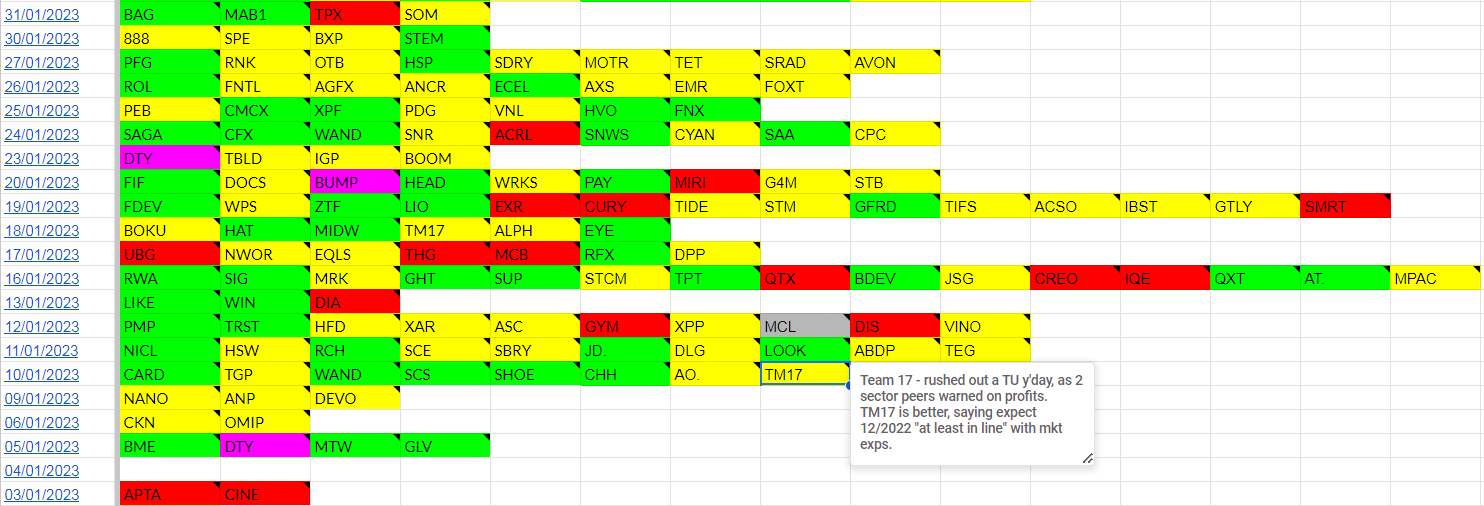

This (below) was how busy Jan 2023 looked on my spreadsheet here, which is a quick reference tool to compare with this year's imminent RNSs if you wish (hover over any cell in the spreadsheet for a summary - as you can see I'm hovering my pointer over TM17) - and please do remember that our view on shares is only on that particular day, using the facts, figures, and forecasts available at that time. These will obviously change considerably over a year, hence we subsequently change our opinions in response to later changes in the facts, figures & forecasts. So remember this is mostly reactive, rather than predictive -

(In case you're unaware, as with any image, you can enlarge this by right-clicking your mouse, and selecting "Open link in new tab", or similar)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Live prices tracking spreadsheet for Paul & Graham's 2024 share ideas (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs) - search on any podcast provider for "Paul Scott small caps", or web link here.

Summaries

CMC Markets (LON:CMCX) - up 23% to 135p (£379m) - Trading Statement - Paul - GREEN

I rushed out a quick view below before 8am, of an ahead of expectations update. As suspected, this CFD/spread betting company's share has risen strongly in early trades today. We need more information, but it looks as if a sharp improvement in trading in Q3 (Oct-Dec) is likely to have a big operationally geared benefit to profits. Both Graham & I have this share on our top ideas for 2024, as we liked the full liquid asset backing from its bulletproof balance sheet, and the geared trading upside in for free.

Surface Transforms (LON:SCE) - down 3% to 11.16p (£39m) - Trading update (profit warning for 2023) - Graham - BLACK (profit warning), AMBER/RED

I’m giving this one a moderate thumbs down after the company fails to meet previously downgraded 2023 forecasts which were issued as recently as mid-November. It is at least funded for the short-term. I hope shareholders can avoid further dilution but would not like to bet on it.

Celebrus Technologies (LON:CLBS) - Up 10% to 236p (£94m) - Contract Update - Paul - AMBER/GREEN

Contract updates means management are confident of hitting FY 3/2024 forecasts. Looks interesting company, but it's already had a big rally of late, so less attractive value.

Plus500 (LON:PLUS) - up 4% to £17.32p (£1.38bn) - Trading Update (ahead) - Graham - GREEN

I’m taking an outright positive stance on this for the first time. The company has answered critics by buying back shares and significantly beating forecasts for 2023. Some concerns may linger but PLUS is more credible than ever before and remains attractively priced.

Paul’s Section:

CMC Markets (LON:CMCX)

Up 23% to 135p (£379m) - Trading Statement - Paul - GREEN

CMC Markets Plc ("CMC" or the "Group"), a leading global provider of online retail ("D2C") and institutional ("B2B") platform technology, today issues a trading update for FY 2024.

The current financial year is FY 3/2024, so this is a Q3 update.

It’s a financial trading (spread betting, CFD, etc) company, which isn’t obvious from the vague self-description above! 59% owned by Peter Cruddas.

At an initial look, today’s trading update looks very good -

Trading Update

The Group delivered a strong performance in the third quarter of FY24.

This was driven by an improvement in market conditions led by an increased contribution from the B2B and institutional business with the Group benefiting from the long-term investments in this area. As a result of this strong performance the Group now expects to generate FY24 net operating income of between £290-£310 million from the previously guided range of between £250-£280 million.

The next scheduled update to the market will be the FY24 pre-close update on 9 April 2024.

That’s really helpful that they include both revised, and previous guidance. All companies should do this, as it’s transparent, and saves us all time to dig out previous guidance.

Taking the mid-point of the above ranges, that’s a 13% uplift.

Quite a turnaround, as last time we reviewed CMCX here on 16 Nov 2023, it said trading was subdued, with a small loss in H1. Broker consensus forecasts continued declining, so I’m quite surprised to read this ahead of expectations update today. Presumably there’s now likely to be a jump up in the graph below, when it updates later this week. There aren’t any broker notes available to me on CMCX, which is a pity. Surely they can fix that?

I’m trying to work out how “net operating income” compares with profit before tax.

In H1, £122.6m net operating income turned into a £(2.0)m loss before tax! So it seems to be a revenue-type figure, not profit.

Last year, CMCX reported net operating income of £288m, and a PBT of a whopping £52m! So does today’s indication of £290-310m net operating income imply a similar level of profitability?

We’ll have to wait and see, but it seems likely to me that we might see a large increase in forecast profits after today’s update - since the business has big operational gearing - largely fixed costs, which means much higher profits when trading volumes rise.

Paul’s opinion - I need more information to be certain, but on a first look, this sounds very positive.

Both Graham and I (coincidentally, as we didn’t discuss it at all) picked CMCX for our top ideas for 2024. The reason was that valuation was completely (and more) underpinned by net working capital on the balance sheet. So any trading recovery was in for free.

I don’t think either of us expected a big trading recovery to happen immediately, so the timing at least looks lucky for us!

I’m typing this at 07:55, so it will be interesting to see how the share price reacts, I suspect a strong upward move could be about to happen.

If any readers have access to revised broker forecasts, please do share them in the comments below.

Celebrus Technologies (LON:CLBS)

Up 10% to 236p (£94m) - Contract Update - Paul - AMBER/GREEN

Celebrus Technologies plc (AIM: CLBS, "the Group", "Celebrus"), the AIM-listed data solutions provider, is pleased to announce several software contract wins made during the financial quarter to 31 December 2023. These wins demonstrate the appeal of the Celebrus platform across a range of industry sectors, as well as illustrating the deepening relationships with existing customers who recognise the importance of our new features and differentiators.

There are vague points about 4 contract wins or renewals, but I copied these snippets below because they contain a rough idea on contract size, which sound quite good -

The second win is an existing global top 10 banking customer, which has renewed its multi-million dollar annual license for a further three years, incorporating an uplift in Celebrus session volumes and increasing ARR to the Group by 19% from the original contract…

The third win is a UK bank which has been using a light, bespoke version of Celebrus that is no longer supported. The bank has signed a three-year multi-million dollar contract for the full Celebrus platform…

Outlook - overall, this sounds in line with expectations for FY 3/2024 -

…reinforce the Board's confidence in both achieving full year market expectations* and continuing to drive growth in ARR, with customers across a wide range of industry sectors…

* For the purpose of this announcement, the Group believes market consensus for FY24 to be revenue of £32.1m, and adjusted profit before tax of £5.4m.

Yes! They’ve quoted adj PBT, the figure that most of us want, not the meaningless EBITDA figures that far too many companies seem to wrongly think is the standard. Great to see that one or two companies are listening to what investors want. Why can’t companies give both EBITDA, and adj PBT at the same time? Then everyone will be happy!

Broker updates - both Cavendish and Canaccord put out notes, thank you.

Canaccord has 10.7p adj EPS for FY 3/2024, then 13.0p for the year after.

Cavendish is somewhat lower, at 9.8p and 11.8p.

Earnings growth actual & forecast looks impressive when taken in isolation since 2020 to now, but if you look further back, the bullish forecasts are only taking it back to earnings in the 2018-2020 level. So I think we need to be a bit careful about chasing this share price too high - it’s had a very good run already - up over 50% since the lows just 2 months ago, on reassuring rather than forecast-changing news -

Paul’s opinion - well done to patient holders, I think the rally of the last 2 months looks justified - this is a decent company, well financed, and operating in a very interesting area.

There are modest divis too.

What we need to see is an acceleration of growth, I think it needs that to get a more serious re-rating. This company always looks poised for great things, but doesn’t quite seem to reach escape velocity in terms of growth or profitability. That could change, who knows? I’d want to see “significantly ahead” of expectations and broker forecast rises to get me interested again.

It could attract a takeover approach though, as companies in this sector are often popular with buyers, and they’re happy to pay a premium multiple very often.

There was a query from the last interims, where receivables were unreasonably high, so I need to see that resolved in the next balance sheet.

I’ll stick with my moderately positive view, AMBER/GREEN, despite the share price having risen a lot since my last review on 27/11/2023, so it’s not good value any more really. Still an interesting, profitable company though, with interesting potential.

Share price is back to where it was 5 years ago -

Graham’s Section:

Surface Transforms (LON:SCE)

Share price: 11.16p (-3%)

Market cap: £39m

Surface Transforms (AIM:SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs, is pleased to provide the following pre-close trading and operations update for the year to 31 December 2023 ("FY23")

This stock has been a difficult hold:

Today we learn that the company’s 2023 revenues are up 63% to £8.3m.

Revenues have been growing every quarter and Q4’s £3m were a nice jump on Q3’s £2m.

However, the full-year result is still a revenue miss against previously downgraded expectations, and the RNS doesn’t spell this out for shareholders who may not know or might forget the full-year forecast (around £8.6m).

Similarly, the company says that capex for the year was £9m, as previously forecast. But it doesn’t spell out that the full-year profit figure for 2023 is likely to be poor - you have to read the broker reports to see that.

Cavendish are forecasting an adjusted pre-tax loss of £10.3m (previously £8.5m) while Zeus have suggested an adjusted pre-tax loss of £10.4m.

I note in passing that revenues for the year are smaller than the probable pre-tax loss. This is something I keep an eye out for with early-stage companies, as a sign that a company is still very far from generating a respectable financial performance!

Funding: as previously announced, the company has secured a £13m capex loan, none of which had been drawn down at year-end. Scouring previous RNS announcements and broker notes, I don’t see any disclosure of the interest rate attached to this loan - perhaps a reader can enlighten me, if they have found this information?

On top of that loan, the company raised equity of £8.3m (gross) in November, shortly after a terrible profit warning which Paul reported on here. The placing price was 10p. Gross cash had fallen to £6.1m by the end of 2023.

Operational update

There’s an impressive ramp-up in capacity coming:

No new technical problems have arisen in recent months. Accordingly, focus remains on delivering further operational improvements, capacity installation to remove potential single points of failure, upgrading internal manufacturing processes and further strengthening operational management and supervision.

The Company continues to expect to complete the installation of £50m p.a. sales capacity by mid-year 2024 and £75m p.a. sales capacity by the end of 2025, to support existing contracts, expected growth and to build manufacturing resilience.

As a reminder of the purpose of this company, Surface Transforms is “the UK’s only manufacturer of carbon-ceramic brakes for automotive use”.

2024 outlook

The Company is maintaining its revenue guidance for 2024 at £23m. Overall, the outlook for 2024 to 2027 continues to remain very positive reflecting contracts in series production and recent new business announcements, with capacity being installed to fulfil these awards.

A note issued by Hardman & Co. in November did suggest revenues of £23m for 2024. It also suggested that pre-tax profit would break even in H2 of 2024.

CEO comment excerpt:

We continue to be capacity constrained not demand constrained, so our factory expansion remains a crucial task in positioning the Company for the future. It is therefore pleasing that the recent debt facility provides the foundation for the programme to continue apace. At the same time we are continuously improving operations to enhance productivity, thereby driving increased output in 2024, with the new senior leadership team in place to deliver these ongoing improvements in a timely manner.

Graham’s view

I’m looking for any reasons to not give this company the thumbs down.

Paul has given this share some detailed analysis not just around the time of the profit warning in November (here and here) but then again in December.

Two major positive points:

Access to a loan and a recent equity raise should stave off the need for another fundraising in the short-term.

Customer demand is thought to be strong, with revenues forecast to surge to £23m in 2024 thanks to increased capacity.

But also quite a few sources of concern I can immediately think of:

The causes of the November profit warning - manufacturing difficulties - are likely to crop up again as the company expands.

Financial risk levels will be elevated by the use of debt. Additionally, the interest rate attached to the capex loan has not been disclosed yet, to my knowledge. The lender is Liverpool’s Urban Development Fund so perhaps it’s a reasonable rate?

As an early stage manufacturer, it’s too soon to be able to predict its performance metrics such as ROCE/ROA.

The reporting style could be better. I would like it to clearly outline if it is hitting or missing expectations for revenues and profits.

My main concern is that the company might need to raise more equity, sooner or later. If you agree that the company can reach breakeven by H2 of the current year, you might be willing to bet that no more equity will be needed, and that the latest cash balance (£6m) plus the £13m loan will be enough.

However, from a value perspective, based on achievements to date, I think it’s perfectly reasonable to give this one a moderate thumbs down. The StockRanks agree, seeing no signs of quality here and very little value, either:

So this one gets the thumbs down from me, although for the purposes of SCVR continuity we might call it AMBER/RED (see Paul’s December coverage).

Plus500 (LON:PLUS)

Share price: £17.32 (+4%)

Market cap: £1.38 billion ($1.75 billion)

Plus500, a global multi-asset fintech group operating proprietary technology-based trading platforms, today issues the following trading update for the financial year ended 31 December 2023.

This is topical considering that Paul has covered CMCX today, and CMCX was on both of our top ideas lists for 2024.

It’s a short update.

Key financial results for 2023::

Revenue $725m, EBITDA $349m, both significantly ahead of current market expectations.

Cash balance at the end of the year was $900m.

Market expectations (via Liberum) were for revenues of $645m and EBITDA of $300m. So both line items have been beaten by c. 12-13%.

Shareholder returns: the company reminds investors that it made $350m of shareholder returns in 2023, with a combination of dividends and buybacks.

The company’s share count has been on an attractive downslope, and is now only around 80 million:

The company also has plenty of operational achievements to crow about: “the expansion of the Group's US futures businesses, the launch of a localised retail trading platform in Japan and further progress in the significant UAE market… Additionally, the Group added a regulatory licence in the Bahamas, which means it now holds 13 regulatory licences globally, representing a key competitive advantage for Plus500.”

Outlook statement doesn’t give anything away.

Graham’s view

I last covered this one in the SCVR back in February 2023, and took a neutral stance on it then (the share price was £18.80 that day).

Historically, I had concerns with certain aspects of Plus500’s operations. Firstly, its hedging practices didn’t match up with what I expect from a company in this sector (note: I hold IG group (LON:IGG) shares). I also had a perception that the company’s customers were churning very quickly, creating an inherent instability in the business model that was worse than its competitors.

Years have passed and I think it’s fair to say that Plus500 has performed admirably well. It has grown up, it has expanded, and it now has more credibility than ever before.

And I must say that I applaud the company’s use of buybacks. If sceptics like myself are refusing to buy the shares, and the stock is trading too cheaply, then buying back whatever shares it can afford is a smart move. $130m of buybacks in 2023 was a fine way to answer critics.

The stock remains “cheap” today:

Note also that that company’s cash balance still covers more than half of its market cap.

If I was going to invest here, I’d have to make peace with the apparent reality that the company sees its cash balance as a primary risk buffer, and that this cash balance could be vulnerable to market movements in a worst-case scenario. But with that buffer approaching $1 billion, perhaps I could still sleep easily at night.

While I still prefer others in this sector, I think it would unfairly penalise Plus500, and be somewhat contradictory, if I were to remain neutral on it, given that I am so positive on its competitors. I am therefore going to tentatively give this stock the thumbs up at the current level. My prior concerns have been answered by a string of many years of high profitability, a ballooning cash balance, and a reducing share count. The 2023 result is particularly impressive given low market volatility that limited interesting trading opportunities during the year.

You may wish to bear in mind that this is not a domestic UK stock; group international headquarters are in Israel.

Chart since listing in 2013 -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.