Good morning from Paul & Graham!

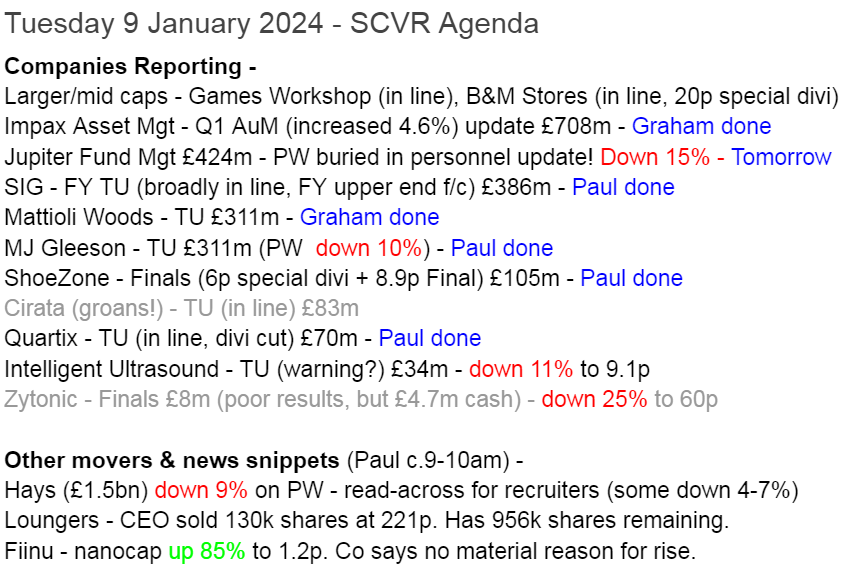

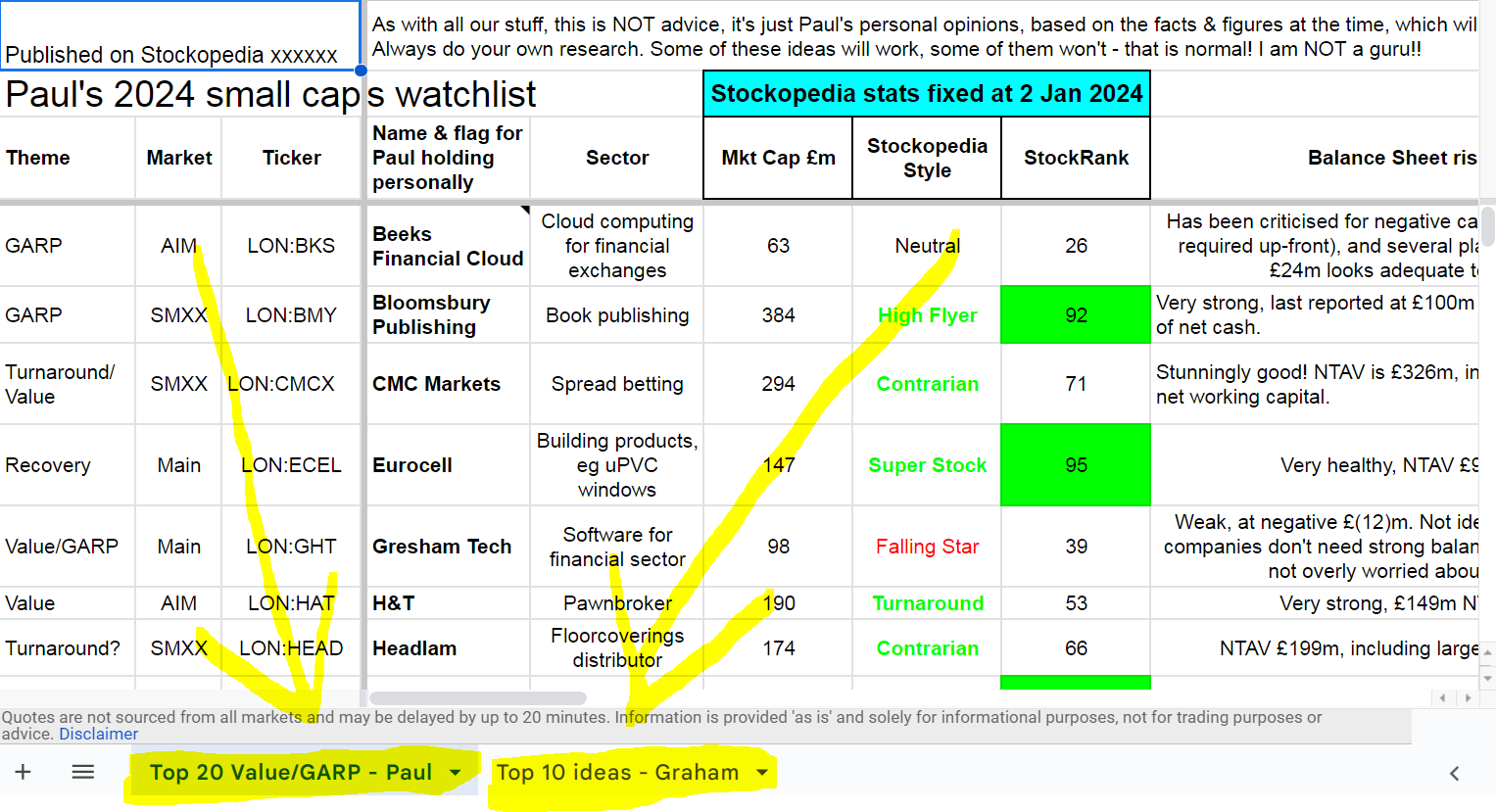

I'm getting up really early every day at the moment, trying to finish the full article on my 2024 share ideas, which is turning into a nightmare, but it's almost done. We scored a lovely (lucky!) early success yesterday, with the positive update from CMC Markets (LON:CMCX) which both Graham and I picked for our 2024 lists. For anyone who missed it, here's Graham's Top 10 ideas for 2024. The real-time prices spreadsheet for both our 2024 lists is here (note there are 2 tabs, at the bottom) -

Why not make a personal copy of this spreadsheet, and add your own share ideas to a new tab (using "Duplicate" on the tab button at the bottom)? Then we can compare performance amongst readers at the year end! You could publish a screenshot of your choices, or provide a link using the "Share" facility (anyone with the link can view, is the best setting).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Live prices tracking spreadsheet for Paul & Graham's 2024 share ideas (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs) - search on any podcast provider for "Paul Scott small caps", or web link here.

Getting busier now!

Summaries

MJ GLEESON (LON:GLE) - down 11% to 479p (at 08:31) £279m - H1 Trading Update - Paul - BLACK (profit warning) AMBER on fundamentals

Affordable house builder warns that gross margins below expectations, but doesn't say anything about FY 6/2024 profit expectations, and Liberum leaves forecasts unchanged - correction, a new note has just come through from Liberum that lowers forecast EPS by 22%, apologies. Good outlook comments, and Dec 2023 order book strongly up. Looks fully priced after strong recent rally, hence I've changed down from green to AMBER.

Mattioli Woods (LON:MTW) - unch. at 600p (£311m) - Trading Update (in line) - Graham - AMBER

It’s an inline H1 update from this serial acquirer of pensions and investment advice businesses. Modest organic revenue growth gets a boost from acquisitions. I like the company but the stock might be priced around right here, all things considered.

Impax Asset Management (LON:IPX) - unch. at 534p (£708m) - Q1 AUM update (forecasts unchanged) - Graham - GREEN

More outflows here of around £1 billion in Q1, but AuM has risen anyway thanks to positive market movements. The expansion of its fixed income offering appears to make sense. This stock was severely de-rated over the past two years and I now see it as a value opportunity.

Quartix Technologies (LON:QTX) - Unch 145p (£70m) - Trading Statement - Paul - AMBER/GREEN

In line update for FY 12/2023, and also confirms guidance for FY 12/2024. Putting through general price rise in Feb 2024, should boost profits. Possible trim to divis this year, as cash wasted on a small acquisition. Good growth in France. I like back to basics strategy of founder, returned as Exec Chmn. Not a bargain, at 17x earnings, but I'm leaning slightly towards a positive view.

Shoe Zone (LON:SHOE) - up 2% to 230p (£104m) - Final Results FY 9/2023 [in line] - Paul - GREEN

Lovely results, a bit ahead of forecast. Low PER and generous divis/buybacks. Balance sheet is fine, with net cash. Forecasts FY 9/2024 look beatable, so probably beating expectations as calendar 2024 plays out. My only concern is possible loss of some market share to aggressive Chinese direct to consumer operators like Shein and Temu.

SIG (LON:SHI) - up 2% to 32.7p (£388m) - FY 12/2023 TU - Paul - AMBER

Performance has come out towards the top of a tight range for underlying operating profit - but it's not a good measure as finance costs eat up half of it, leaving only a c.1% PBT margin. No sign of the turnaround working as yet, with broker forecasts in an inexorable downtrend. Balance sheet looks just about adequate. Not high risk, but getting margins up to 5% looks a tall order. If it's achieved though, on £3bn revenue, that would be a striking result, giving 2-3x possible upside on the share price I reckon. I'll watch from the sidelines, as it's a large business that clearly needs a lot of sorting out.

Paul’s Section:

MJ GLEESON (LON:GLE)

538p (pre-market) £314m - H1 Trading Update - Paul - BLACK (profit warning), AMBER on fundamentals

Apologies for this section which might seem muddled. I had to edit it because Liberum issued 2 notes this morning, with the first one (sector note) leaving Gleeson forecasts unchanged, which was what I initially worked on. Then a second note shortly afterwards, cut GLE forecasts by 22% due to its profit warning. Nightmare!

MJ Gleeson plc, the low-cost housebuilder and land promoter, provides a trading update for the half-year ended 31 December 2023 (the "period") ahead of announcing results on 15 February 2024.

Completions (sales)in H1 down 14% on H1 LY (last year)

Forward order book (586 plots) is up 84% vs 31/12/2022 comparative LY.

Gross margins lower than expected - this has triggered a 22% reduction in broker forecast EPS -

Additional costs relating to a number of older sites, along with the cumulative impact of current market conditions including extended site durations, sales incentives and multi-unit sales, are now expected to result in full year gross margins falling below expectations by circa 1.5% to 2.0%.

Net debt - doesn’t matter to me, as GLE is so well financed -

Reflecting the significant investment in bringing forward a higher proportion of home starts before June 2023 the Group will report net debt of £18.7m at 31 December 2023 (30 June 2023: net cash £5.2m). The cash impact of this investment is expected to unwind over the next two years.

Outlook -

Against the backdrop of stabilising interest rates the Board anticipates a recovery in demand for low-cost housing in the seasonally busier selling period over the coming weeks and months. Gleeson Homes also continues to negotiate further multi-unit sales and expects to enter into agreements over the coming months for delivery of homes in the current and next financial year.

That’s an important positive point above - housebuilders are no longer entirely dependent on consumer demand for new houses, they’re also now negotiating bulk deals with buy to rent investors.

There's also a possible (likely?) resumption of Govt support measures to stimulate the lower end of the new houses market, which is Gleesons space of course.

Broker update - thanks to Liberum for its notes this morning - highly recommended reading, as one covers the whole sector, not just Gleesons, but was clearly written before GLE's profit warning - so its 42.5p EPS forecast is already out of date. It's now 33p.

Quite surprisingly, it says that the big rally in housebuilding shares means most are now fully priced. That’s my view too, I wouldn’t be chasing these any higher right now. Also Liberum flags planning delays as a growth-limiting factor. It’s great when brokers put out balanced views, instead of just talking things up.

Edited - Liberum trims forecasts for some larger sector peers, but left GLE unchanged in a sector note (which was obviously written before GLE's profit warning today!). However, a second note has just come through from Liberum on GLE specifically, which cuts FY 6/2024 forecast EPS by 22% (from 42.5p to 33.0p), and a cut of 26% for FY 6/2025 from 49.4p to 36.4p.

Due to the cyclicality, PERs are not necessarily a good way of valuing housebuilders. I also like to scrutinise price to tangible book value. GLE was at a lovely discount some time ago, but is now showing as a small premium, at 1.1x NTAV. Still superb balance sheet support, but no longer free money! Although we'll have to reassess that after seeing what level the share price settles at after today's fall.

Paul’s opinion - yesterday’s 8% rise to 538p looks a bit much. Given the strong surge in the share price of late, I’m shifting down from green to AMBER - the current valuation looks about right to me, so immediate upside maybe gone for now? Even a risk of short-term profit-taking perhaps? It depends - how much will the market focus on the still difficult market conditions, or instead might it look through those and focus instead on the more positive outlook now that mortgage rates have fallen sharply, and the big increase in order book above? I don’t know, typing this at 07:46, but I’m guessing we could give back yesterday’s large gain, I suspect some investors/traders might bank profits in early trades, but we’ll find out in a few minutes!

EDIT: as mentioned above, a new note has just come through which does cut forecast EPS by 22% to 33p for FY 6/2024. So yes, it's a profit warning.

Anyway, it’s up to you to decide if the glass is half empty, or half full here? I think the price looks up with events now, after a great run.

Powerful recent rally more obvious when we zoom in to 1-year chart - then today's profit warning -

Quartix Technologies (LON:QTX)

Unch 145p (£70m) - Trading Statement - Paul - AMBER/GREEN

Quartix Technologies plc, a leading supplier of subscription-based vehicle tracking systems, software and services, is pleased to provide an update on trading for the year ended 31 December 2023 (the "Period").

Performance for FY 12/2023 - is in line with Cavendish forecasts -

The Board estimates that revenue, profit (adjusted EBITDA) and free cash flow for the Period will have been £29.8m, £4.9m and £3.1m respectively. The Company's cash balance at year-end was £2.3m.

Of course EBITDA is not profit! I’ll have to explain this to the Exec Chairman when I meet him in February! (and show him the recent update from Next (LON:NXT) which reinforces this point!)

Anyway, £4.9m adj EBITDA turns into £4.6m adj PBT, and 7.9p, according to Cavendish, so a PER of 18.4x - not exactly a bargain, but not excessive either, in my view.

Outlook for FY 12/2024 -

We look forward to achieving further growth in 2024 and are confident of achieving market expectations2 for the new financial year."

[2] The Company believes that market expectations for 2024 are as follows: revenue: £32.1m ; free cash flow*: £3.4m ; adjusted EBITDA: £5.4m

A note from Cavendish (many thanks) shows that £5.4m EBITDA almost all turns into real profits, adj PBT £5.1m - so as with Intercede (LON:IGP) this is another company scoring an own goal by quoting the often inflated EBITDA measure, when PBT is nearly as much, yet is a far more credible measure, so should be highlighted instead of omitted.

This is 8.2p forecast for FY 12/2024, so at 145p the 2024 PER is 17.7x, which I think is looking more reasonable than previous over-valuations.

Dividends - might be cut, to reflect the lower cash pile of £2.3m. This is due to cash wasted on an acquisition by the former CEO, which hasn’t worked. So I don’t see this as a recurring problem, the company should return to paying previously more generous divis in 2024 or 2025 onwards, I’m guessing.

Quartix is a bit like Fonix Mobile (LON:FNX) - a cash generative, capital-light technology business that can safely pay out its cashflows as divis to shareholders. What a refreshing change from all the cash consuming jam tomorrow companies that expect us to hope they can generate some real cashflows at some point in the future. None of that nonsense here with QTX I’m pleased to say! This is a proper business that makes money - albeit profit growth has been elusive, with EPS having been in a downtrend for 6-7 years - that has to improve to get back to a growth company rating -

International - France is the standout good performer, having risen to £7.4m ARR at Dec 2023, up 22% in the year, and not a million miles behind the home UK market, which is £16.5m ARR (only up 2%).

I get the impression that the recently returned Exec Chairman is pursuing a back to basics strategy - focusing on growing the key markets, and avoiding distractions.

USA is struggling at only £3.1m ARR, down 5% - maybe a new strategy might be needed here?

Other small European markets are growing nicely at +45%, but from a low base, so ARR only £2.1m exit rate end 2023.

Don’t forget attrition - customers leave for a variety of reasons, at a rate of about 13% pa, so Quartix has to recruit new business at that level just to standstill.

Price erosion is another problem, and was -4.6% in 2023. Put that together with customer attrition, and the growth of new subscriptions needs to be nearer +20% just to stand still overall financially.

Price increases - this could be significant - it says that 80% of subscriptions will be subject to a selling price increase from 2/2024, which could nicely boost revenues & profit.

Upgrading equipment - the issue of sunsetting of old 2G mobile networks has reared its ugly head again (in France this time), with a £4.1m exceptional cost to be provided for in the 2023 accounts. Ouch, that's material. This is a real, cash cost, so arguably should be provided for in advance, with an annual charge to the P&L spread over X years, rather than after the event as an exceptional charge. By not providing for potential future costs of this kind in advance, you could argue QTX is overstating profits.

Cost-cutting & efficiency steps are being taken, both for hardware and overheads. Sounds good.

Paul’s opinion - I’m keenly watching Quartix, for signs of renewed focus and resumption of profit growth, now the founder is back as Exec Chairman.

I’ve skipped over some of the detail in today’s update. I’d say overall this update sounds reassuring, and I’m leaning slightly towards the positive side, given the confident outlook, and price rises from Feb 2024. So let’s up this from amber to AMBER/GREEN.

This is a firm share price downtrend, and with the PER in the high teens, it would need earnings upgrades to turn this around I think -

Shoe Zone (LON:SHOE)

Up 2% to 230p (£104m) - Final Results FY 9/2023 [in line] - Paul - GREEN

I spotted ShoeZone in the top viewed companies widget on the Stockopedia home page, so we try to follow your lead and review the small cap companies you’re most interested in!

Impressive highlights table below, and note the big focus on shareholder returns through divis and buybacks -

Broker update - Zeus helps us out with a note this morning. It says FY 9/2023 results are in line with expectations.

Adj diluted EPS is 27.6p (beating Zeus forecast by 6%) for FY 9/2023, giving a PER of a modest 8.3x (up a highly impressive 53% on LY).

Zeus expects a drop to 24.7p adj EPS in FY 9/2024, and 24.0p the year after. Various factors explain this (eg living wage increase, and higher depreciation), there’s a really useful profit bridge here from Zeus (I hope they don’t mind me reproducing it here with thanks) -

Balance sheet is healthy, and ungeared. So I don’t see any risk from the generous shareholder returns, nor dilution being a risk.

Paul’s opinion - an impressive company, well managed by founder owners. Sites portfolio is actively managed (short leases) to exit smaller stores, and concentrate on larger & more profitable shed type retail units (“Big Box”) and “Hybrid” stores of around 2,000 sq.ft. in high footfall locations. “Original” stores are smaller, at c.1,250 sq.ft.

Online is creeping up nicely, and has a very low returns rate, and are often physically returned to stores, thus avoiding 2 lots of postage costs.

Forecasts seem modestly set, so if I were to bet on this, it would be that a revived consumer in 2024 might well cause earnings beats rather than misses.

The only downside scenario I can come up with is over the business model. It buys cheap shoes made in China, and sells them for a fat profit margin c.62%. The trouble is, Chinese companies have started selling direct to consumer now, Shein and Temu, and they must be taking a (probably small) slice of the market. These competitors are extremely aggressive, and do not operate to make profits. Hence I think there’s a very real risk that SHOE might lose some market share to them. If it reaches say 10% of SHOE’s revenues lost, then at 62% margin that would more than halve its profit. So keep you ear to the ground, and if you hear of lots of low income people buying shoes online from Temu or Shein, then I’d keep close to the exit.

However, for now, overall SHOE looks very good, so I’m GREEN.

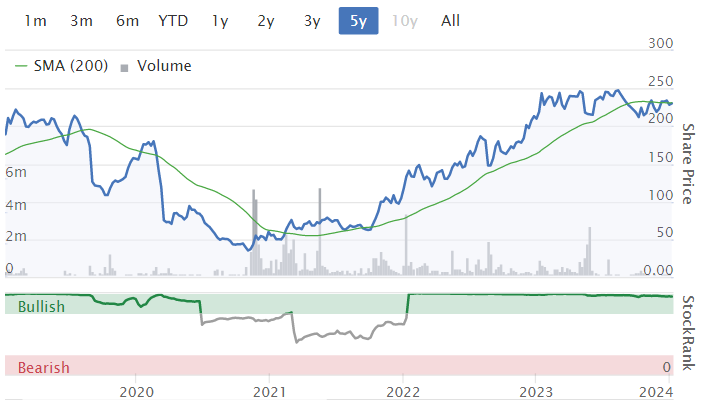

Wonderful performance from the pandemic lows, and it's completely shrugged off the more recent 2-year bear market in UK small caps, very impressive -

SIG (LON:SHI)

Up 2% to 32.7p (£388m) - FY 12/2023 TU - Paul - AMBER

SIG plc ("SIG", or "the Group"), a leading supplier of specialist insulation and building products across Europe, today issues a trading update for the year ended 31 December 2023 ("FY23").

We’ve not looked at this one since a year ago, on 16/1/2023, when we flagged improved profits in 2022, and reduced leverage, so an interesting turnaround. Shares have since been on a round trip back to the same level now as Jan 2023.

Unfortunately, progress has been backwards on fundamentals, with the FY 12/2023 forecast at 3.05p in Jan 2023, but it’s now down to only 0.75p

As you can see below, it’s not really making any money, on £3bn revenues - so what exactly is the point of this company?

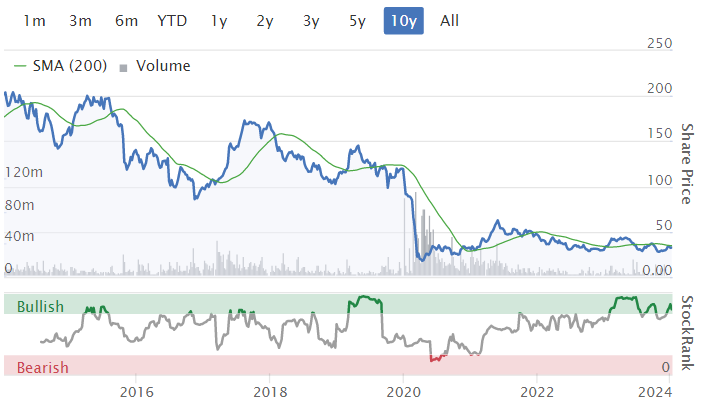

If it can get back to 2017 & 2018 levels of EPS, c.10p, then that would be interesting at a share price of 33p. But it looks like something structural has gone wrong here over the years. Also note the share count has almost doubled over this timescale in the graphs above, so 10p EPS then would only be 5p now.

Today it says that underlying operating profit should be in the upper range of £50-55m, but at the interims the £32.7m u/l operating profit became £15.0m u/l PBT (due to hefty finance costs).

Balance sheet was £140m NTAV at June 2023. Adequate, but I note there’s a deficit on the fairly large lease entries, suggesting an inefficient network of sites that needs pruning perhaps?

Paul’s opinion - this looks like a large, sprawling business, that’s not really making any meaningful profit margin despite shifting lots of products. So it probably needs a root & branch sorting out. The CEO has been in place for a year, and talks about efficiency improvements. If he can transform performance to the medium term target 5% operating margin, that would be c.£150m pa operating profit, less say £30m finance costs = £120m adj PBT. Take off tax, and put that on a PER of say 10-12, and we’re looking at upside potential of 2-3 times the current share price, by my rough calculations.

Trouble is, how likely is that to actually happen?

Downside risk looks fine, I don’t see any major risks in the numbers. Maybe one to research more closely, and the key point is to determine how likely profit improvements are. Judging from the constantly declining broker forecasts above, there’s no sign of improvement as yet. Hence I’d be happy to sit and watch rather than guess at if/when performance might improve. So I’m happy with AMBER for now.

The 10-year chart suggests this share could only ever be a shorter term trade, for optimists, not a long-term investment -

Graham’s Section:

Mattioli Woods (LON:MTW)

Share price: 600p (pre-market)

Market cap: £311m

It’s been a while since I last covered this one (April 2023), when I described it as a successful consolidator of wealth management businesses. It has a pleasing track record of making profits year in and year out, and paying a dividend that tends to increase over time.

But its share price didn’t get very far in 2023:

Today we have a H1 trading update from the company, for the period to November 2023.

Key points:

Revenues up 8% to £59.1m, including acquisitions.

Organic revenue growth 4%

Clients assets slightly lower at £15.2 billion, due to downward market movements.

The company notes that revenues in H2 are “historically higher than in the first half”. It will need a boost in H2 if it’s going to hit full-year forecasts.

Estimates: Equity Development have helpfully published a note with an unchanged full-year revenue forecast of £123.6m. They are forecasting adjusted net income of £23.3m, and statutory net income £12m.

Cash: £32.7m

Comment by Ian Mattioli: highlights the company’s ability to generate revenues in different ways and to benefit from the need for advice as tax rules change.

Revenues were 8% higher and the Group delivered organic revenue growth of 4%, reflecting the resilient nature of our revenue model combining fee-based revenues for specialist advice and administration with ad-valorem investment management revenues linked to the value of clients' assets, despite a slight fall in the value of client assets under advice and administration during the period."

We enjoyed particularly strong growth within our core pension consultancy and employee benefits business segments, with the proposed changes to pension and tax rules announced in the Chancellor's recent Autumn Statement driving strong demand for advice.

Outlook: in line with expectations. Let’s use some bullet points to cover this:

The value of new enquiries is up strongly (22%) - although it’s not clear how much of this will translate to higher revenues.

There was “pressure on asset values” in H1. Perhaps this has already turned around a little in H2?

New client relationship management system.is being delivered as planned.

Inflationary pressures on costs. Cost-saving initiatives in H2.

Graham’s view

I’m inclined to leave my AMBER stance on this one unchanged. Overall, I think the stock has many positive features - founder involvement, a track record of successful consolidation in a fragmented market, and an attractive dividend stream.

But for an advisory business, I’m not sure if a premium rating is justified. Note also that the PE ratio below uses the adjusted forecasts; it would be significantly more expensive if valued on earnings after all costs (especially acquisition-related costs).

Stockopedia calculates the operating margin as 10%, i.e. MTW does not earn the chunky margins of something like a fund manager or a major stockbroking platform. I wouldn’t expect it to, but I do think that it’s important to bear this in mind.

In conclusion, I’m not entirely convinced that this one is undervalued.

Impax Asset Management (LON:IPX)

Share price: 534p (unch.)

Market cap: £708m

This environmentally-focused fund manager nearly made it onto my list of favourite ideas for 2024.

This morning we have a Q1 AuM update for the period to December 2023.

AuM is up 4.6% over three months to £39.1 billion (so you get £55m of AuM for every £1 invested in Impax).

There were outflows of nearly £1 billion, offset by positive market movements.

Comment by Ian Simm, founder and 7% shareholder:

This quarter, after more than 12 months of market headwinds, the investment performance of our principal strategies has strengthened significantly, underpinning a 4.6% jump in assets under management. Although asset allocation decisions at some of our wholesale clients have led to net outflows this quarter, we've retained all our material client accounts and added some significant new ones, particularly in Europe.

In a separate RNS, the company announces that it is acquiring Absalon Corporate Credit, which will bring in c. £350m of AuM, for an undisclosed amount.

Estimates: Equity Development have not yet adjusted their forecasts higher for the current year, which they describe as “a conservative approach”. They see AuM growing 10% this year.

Graham’s view

Firstly, I think it’s great news that Impax is expanding its fixed income offering - environmental investing is typically associated with equities, infrastructure and private equity, but why not corporate credit? It makes perfect sense to me that Impax should have a strong set of fixed income products, and should continue to invest in this area.

Secondly, on the subject of outflows. Let’s remind ourselves of how Impax’s AuM evolved last year:

The above table shows that net flows last year were close to zero, but AuM continued to grow thanks to positive investment returns.

Flows turned negative towards the end of the year, with an outflow of around £900m in Q4.

Now, in Q1, we have a further outflow of around £1 billion.

The loss of momentum should be seen in the context of the Impax share price marching back down from its former heights:

Personally, I tend to be relaxed about outflows. In fact, I tend to like them - because they can often result in a share price overreaction!

Note that Impax’s AuM has continued rising despite recent outflows: from £35.7 billion as of Sep 2022, to £37.3 billion as of Sep 2023, to £39.1 billion as of Dec 2023. Revenues can be very robust even during a period of client withdrawals.

While I do have some worries about the stability of demand for ESG investing, at the end of the day this is a high-quality company (in my view) and it’s trading at a reasonable price. The PER is 15.6x according to Stocko.

A reminder of the quality metrics:

I do expect inflows to resume here at some point in the medium-term (perhaps not this year, but perhaps by the end of 2025?). With market moves also likely to carry AuM higher, I have no hesitation in keeping my positive stance here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.