Good morning from Paul & Graham!

Today's report is now finished.

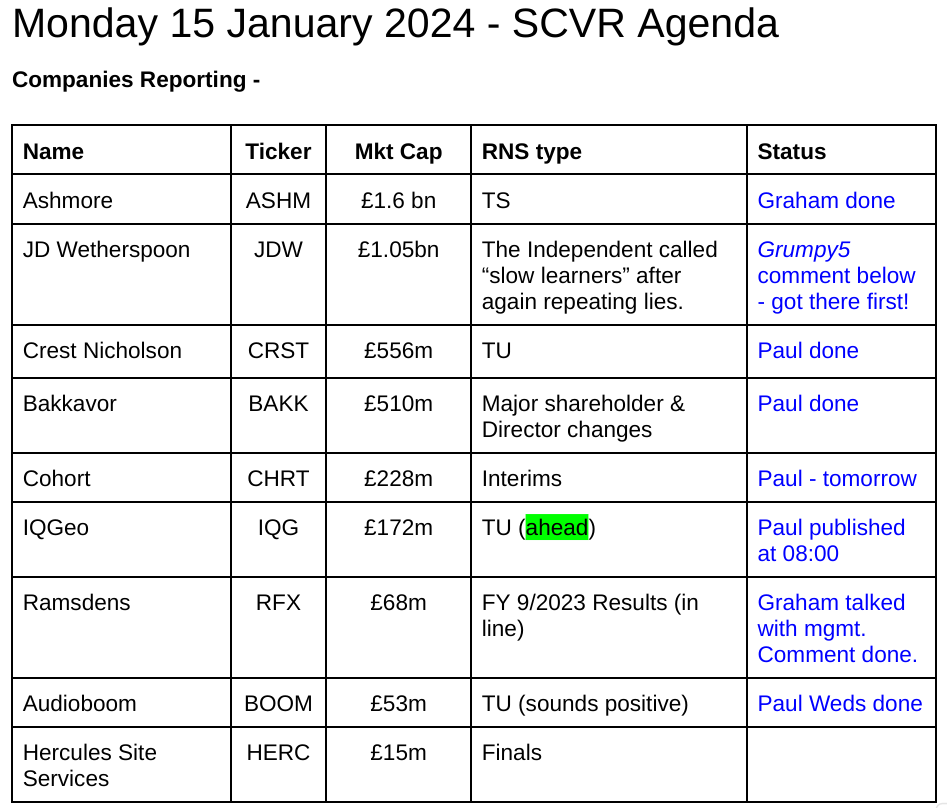

Updating my SCVR summary spreadsheet, would you believe, we've already looked at 60 unique companies so far in 2024 - a flying start, I'd say! Although 11 of those were just quick comments, not full sections. Even so.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

IQGeo (LON:IQG) - up 17% to 325p at 08:19 (£201m) - Trading Update (ahead) - Paul - AMBER/GREEN

Excellent update, ahead expectations for FY 12/2023. The outlook comments look really encouraging too. I'm very much warming to this high growth, niche software company. Shares are expensive on PER, but that's a clumsy measure for a rapid growth company. Looks good to me, but beware risk to valuation if growth slows down. Possibly a risk worth taking, I'm increasingly thinking.

Ashmore (LON:ASHM) - unch 223.5p (£1.6bn) - Trading Statement - Graham - AMBER

This emerging markets fund manager reports further outflows in Q2 but at a slower pace than Q1 and slower than the average quarterly decline last year. Perhaps significantly, equities saw an inflow. Could we be about to see the long-awaited turn in EM sentiment?

Crest Nicholson Holdings (LON:CRST) - down 5% to 206p (£528m) - Trading Update (profit warning) - Paul - BLACK (pw), GREEN on fundamentals.

It's a mild profit warning, due to more legacy problems/costs, making CRST look a bit accident- prone. The large discount to NTAV remains a big attraction, and I continue to wonder if it might attract a bidder?

Ramsdens Holdings (LON:RFX) - down 5% to 205p - Annual Results - Graham - GREEN

The market seems disappointed with a muted Q1 trading update, but the PBT estimates for the current financial year are unchanged. I remain a big fan of this company - offering net cash, a good yield, store expansion, and a proven business model at a cheap P/E multiple.

Bakkavor (LON:BAKK) - up 4% to 88.2p (£510m) - Major Shareholder & Director Changes - Paul - AMBER/RED

A 20% stake has changed hands, making me wonder if it might become a bid target? I crunch the H1 numbers from a few months ago, but the weak, overly indebted balance sheet puts me off. Still, I've upped my view from red last time (which was a bit too harsh) to AMBER/RED, to reflect the low margins, heavy bank debt, and higher finance costs.

Paul’s Section:

IQGeo (LON:IQG)

Up 17% to 325p at 08:19 (£2101m) - Trading Update (ahead) - Paul - AMBER/GREEN

IQGeo Group plc (AIM: IQG), a leading developer of geospatial productivity and collaboration software for telecoms and utility network operators, is pleased to announce an update on the Group's trading for the year ended 31 December 2023, ahead of the release of its audited final results in March 2024.

We had an almost 5-year gap in reviewing this share from 2018 to Sept 2023 when it cropped up on my radar here on 26/9/2023 - with very strong revenue growth, and the prospect of a long awaited breakthrough into profitability. The high valuation, and balance sheet queries put me off a bit at the time.

That was resolved here on 20/10/2023 with my notes from a call with management, who explained credibly I thought, why receivables were unusually high. Having resolved queries, I felt much happier about IQG shares, turning amber.

IQG looks a very interesting niche software company, with large, sticky clients, and very strong growth.

FY 12/2023 strong trading, ahead of expectations - excellent news today -

The Group is pleased to report that it expects results to be ahead of expectations, demonstrating sustained and strong growth and momentum across all key metrics, underpinning confidence in further improvement and growth in the current financial year and beyond.

Summary of the key points, with my comments -

5-12% broker upgrades today.

FY 12/2023 revenues £44.2m (organic growth +56%, total +66%) - exceptional growth.

Exit ARR (annualised recurring revenue) £21.1m, up 40% (+50% at constant currency) - note this is slightly less than half revenues, so not as high a % as some other software cos.

Order intake of £56.9m is above revenues, but over what periods? This is usually a multi-year figure, so not that meaningful without more detail of the timescales. Ideally we need a table, showing orders itemised over each of the next 5 years.

Adj EBITDA up a very impressive 237% to £6.4m+

Net cash £11.0m end Dec 2023.

Outlook - strong pipeline, gross margin to rise, “megatrends” over next 10 years in its market, where it claims to be the market leader - that has certainly caught my attention!

Valuation - for a software company, adj EBITDA is meaningless. They need to give us real world profit measures, of adj PBT and adj EPS (providing adjs are sensible).

Cavendish helps out with more detailed numbers in an update this morning -

FY 12/2023 adj EBITDA of £6.4m becomes adj PBT of £3.4m, and adj EPS of 4.7p

FY 12/2024 forecast rises to £5.5m adj PBT and 8.1p EPS.

PER is a clumsy measure for rapid growth companies, so I would expect it to be high, which it is - 59x (2023) and 34x (2024) - expensive, and dangerously so if growth doesn’t meet the big forecast increase. Or cheap, if growth is strong, or stronger than forecast, and continues in future years. Someone might bid for the company, lofty valuations for software companies are commonplace.

Paul’s opinion - this seems a really impressive growth company, so despite the very full valuation, I’ll go up from amber to AMBER/GREEN. Well done to holders who kept your nerve during the sell-off last year.

Sometimes when you find an exceptional growth company, we need to just pay up. This might be one such situation, it looks like it to me. Although if growth disappoints, it has a long way to fall from a high valuation.

Even I can see that this is a super 5-year chart -

Crest Nicholson Holdings (LON:CRST)

Down 5% to 206p (£528m) - Trading Update (profit warning) - Paul - BLACK (pw), GREEN on fundamentals.

A pattern seems to be emerging of the largest housebuilders doing quite well in tough market conditions (reported so far: Persimmon (LON:PSN) , Taylor Wimpey (LON:TW.) , and Vistry (LON:VTY) - all reviewed in last week’s SCVRs), and the smaller ones struggling more - eg MJ GLEESON (LON:GLE) and now Crest Nicholson Holdings (LON:CRST) issuing profit warnings due to legacy issues.

Today CRST mentions some more problems, on top of the issues announced leading to its profit warning that I covered here on 16/11/2023. It’s looking rather accident-prone -

… comprehensive review of the costs associated with the work required on this project as well as our other legacy sites. Consequently, further additional costs have been identified which will impact FY23 and the Group now expects the Adjusted Profit Before Tax to be £41m for FY23.

In addition, the Group expects to recognise an exceptional charge of £13m (which is not cash in FY23) in respect of a legal claim that it has recently received relating to a low rise apartment scheme built by the Group which was damaged by fire in 2021. The Group is addressing this claim diligently and efficiently and will provide further details in our preliminary results. This is unrelated to the general fire remediation programme that the Group is currently delivering.

Outlook - this is the same thing the other housebuilders have said recently -

The recent reduction in mortgage rates has provided a more constructive backdrop for house buyers and the wider housing market. Although it is too early to gauge customer behaviour, we have been encouraged by an increase in customer interest levels and inquiries this calendar year.

Valuation - no broker updates available to me. Looking at my notes from 16/11/2023, I see previous guidance (lowered range) was adj PBT of £45-50m. So today’s updated £41m figure isn’t too bad, and seems to be due to one-offs rather than general trading deteriorating further. I can live with that.

The main attraction of CRST in particular is the still large discount to NTAV - Stockopedia has it at 0.66, and the 5% fall in share price today will reduce it further. That’s very attractive valuation territory, especially after the whole sector has had such a remarkable surge in the last 3 months. Many others are now at premiums to NTAV.

Paul’s opinion - this is a mild disappointment today from CRST, so a 5% trimmed share price feels about right to me.

The big discount to NTAV strongly appeals to me here, so on fundamentals I still think this is an attractively valued share, so GREEN. Although it has to be marked BLACK for my spreadsheet, in order to flag that it is a profit warning.

Bakkavor (LON:BAKK)

Up 4% to 88.2p (£510m) - Major Shareholder & Director Changes - Paul - AMBER/RED

This company makes ready meals for supermarkets, and operates on a low PBT profit margin of about 3%, after hefty finance costs.

This announcement may or may not be significant, time will tell. It’s unusual though, so thought I’d flag it, and also gives me a reason to briefly review BAKK shares.

BAKK floated in Nov 2017, shares have done poorly, just over halving over the last 6 years. Although it’s paid out about 26p in divis since floating, softening the losses from the shares.

I only looked at it once in 2023, here on 1/6/2023, where I flagged the weak balance sheet with negative NTAV, and heavy debt. Thus I didn’t see the generous dividend yield as being well supported.

Today’s news is that Baupost, a big US hedge fund, has disposed of its entire 20.1% stake in BAKK to LongRange Capital Fund, which doing some googling is described as a “buyout fund”. Which makes me wonder if it might try to buy all of BAKK, for a potential premium, I’m just guessing there. Today’s RNS says LongRange has $1.5bn under management, not huge compared with BAKK’s £510m market cap. Could it be too large for them to takeover, possibly? Not necessarily, if debt was involved in funding a deal, but BAKK already has a lot of debt.

Baupost’s Board representative will be standing down, understandably.

A relationship agreement means LongRange also gets a non-independent Board seat, through a former NED called Bob Berlin, who knows BAKK well, it says.

So, are BAKK shares any good? I’ve had a quick look at its interim results here H1 6/2023 -

It claims that H1 was “strong”, but H1 adj EPS was down, from 4.6p to 3.9p.

Smaller operations in the USA (breakeven) and China (loss-making) look uninspiring. The main business is UK.

Big increase in finance costs, so adj PBT fell about 10% in H1.

Balance sheet is weak, NTAV negative about £(56)m - the heavy fixed assets are being funded by negative working capital and bank debt. Combining that with paying out almost all earnings as divis doesn’t look a comfortable situation to me. I like “inefficient”, asset-laden balance sheets, not accidents waiting to happen, with all the associated risks of dilution - although to be fair it got through the pandemic without having to raise equity - probably because lockdowns would have helped it sell more ready meals, as restaurants closed.

Supermarkets are notorious for squeezing out the profits from their suppliers eventually, so I don’t see this ever becoming a high margin business.

Paul’s opinion - it’s definitely not the sort of share I would want to invest in, but good luck to any holders. Maybe RED was a bit harsh last time, so I’ll edge up a bit to AMBER/RED, mainly reflecting the weak balance sheet with too much debt, and low margin business model.

Speculative upside could come if the new 20% owner intends bidding for the rest of the company, so a potential trade maybe? Who's right, the 20% seller, or the 20% buyer?! No idea!

Graham’s Section:

Ashmore (LON:ASHM)

Share price: 223.5p (unch.)

Market cap: £1.6 billion

It has been nearly a year since we last covered Ashmore, but I thought this morning’s trading statement deserved a brief mention.

As you may know, Ashmore is an emerging markets fund manager, with particular expertise in fixed income. I like this specialisation as I believe it’s an asset class which many investors might wish to access but where they may feel unable to do so themselves.

Today brings a Q2 update from Sep to Dec (year-end is in June).

Over the quarter AuM increased from £51.7 billion to £54.0 billion.

Comparing market cap to funds under management, I see that we have a multiple of £34, i..e you get £34 of AuM for every £1 invested in Ashmore stock at the current valuation. This is a much more expensive rating than you get at the other fund managers.

Ashmore is also expensive relative to earnings:

In share price terms, the stock is still lower than it was a year ago, but it has made a nice recovery since December:

But let’s continue with this morning’s update.

Key points from this Q2 update:

Net outflows $1.6 billion

Positive investment performance $3.9 billion (so again, AuM is growing despite outflows).

Comment:

The Group's net outflows reduced from prior quarters as, while there continues to be some risk aversion among certain investors, clients responded to the improving global macro environment. Equities delivered a net inflow and, within the fixed income themes, the outflows were broadly spread with no significant patterns.

Could there be light at the end of the tunnel? Equities are only a small part (12%) of Ashmore’s total AuM but it seems significant that this segment has seen an inflow.

Checking the Q1 statement, total net outflows then were $2.9 billion.

In the previous financial year (FY June 2023), net outflows were $11.5 billion, or an average of $2.9 billion / quarter.

So a reduction to $1.6 billion in a quarter might be seen as cause for relief, possibly?

Further commentary by the company:

The Fed's signalling of the end of its rate hiking cycle and continued economic stability in many emerging countries delivered strong performance across Emerging Markets over the three months. Fixed income indices rose by 6% to 9% and equities increased by 8%, and the majority of Ashmore's strategies outperformed over the quarter.

Graham’s view

I’m a long-term fan of this company and perhaps have a blind spot when it comes to the bear case against it. But as Ashmore itself says, and I agree, the likely imminent turn in the interest rate cycle and a resumption of “risk-on” could see a big swing in sentiment in favour of emerging markets.

The S&P 500 and the US dollar have been so strong for so long - both before and during the tightening of interest rates - that they have seemed to almost swallow up the demand for other equity markets and more exotic currencies. But could that be about to change?

We should bear in mind that Ashmore always says that investors are underweight in their allocations to emerging markets. But personally, I’m inclined to agree with them.

While I do lean towards taking a positive stance on this stock, I’ll moderate it and take a neutral position this morning. Its earnings multiple is much more aggressive than other fund managers and perhaps already prices in a recovery.

Ramsdens Holdings (LON:RFX)

Share price: 205p (-5%)

Market cap: 64.6m

I just came off a quick call this morning with Ramsdens management, so many thanks to them for taking the time out to speak with me.

Before getting into the contents of the call, let’s review today’s full-year results for the year ended September 2023.

We have strong growth in the key measures of profitability, along with growth in net assets:

The result “was driven by strong performances across all four income streams” (pawnbroking, foreign exchange, retailing, and gold purchasing).

Foreign currency: gross profit up 7% year-on-year to £13.6m, ahead of pre-Covid levels thanks to larger transactions with customers and higher margins than pre-Covid.

However, “the key summer period was slower than originally anticipated”.

The company points out that more than 50% of purchases in Portugal, Italy, Greece and Spain use cash, which suggests that cash will remain in demand from UK holidaymakers.

Ramsdens did launch a new multi-currency card in September, to capture non-cash transactions, but it only generated minimal revenues before the financial year-end.

Jewellery retail: revenue up 23%.

Pawnbroking: active loan book up almost 20% to £10.3m. The company is not expecting to achieve the same level of growth in FY 2024. Repayment rates are in line with the long run averages.

Precious metals buying: revenue up almost 50% to £23.5m.

Net cash falls to £5m (£8.8m a year ago) due to the expansion of pawnbroking and jewellery retailing operations.

CEO’s review: describes it as “a great year”, delivering record profits.

Store expansion: eight new stores were opened during the year, including 5 in Yorkshire and the North West, and 3 in the South East. This has thankfully gone very well:

We are pleased to say that all new stores are trading well, with several well ahead of expectations. We ended the year with 160 stores and two franchised stores.

Q1 trading update

We also have an update for October to December 2023 which is in line with expectations:

Foreign currency: gross profit flat on the prior year. Comment:

While we are encouraged by growing sales of FX, purchases of FX from returning holiday makers are still subdued, indicating they are keeping their leftover FX cash for another trip or have spent their cash while abroad.

Jewellery retail: revenue is “broadly flat”, though gross profit is up 5%.

Pawnbroking: the loan book is already up by a few percentage points in the quarter to £10.6m.

Precious metals buying: gross profit up more than 10%, “due to growing awareness of the service offered by Ramsdens and the continued high gold price”.

Management call

I had a brief call with Peter Kenyon, CEO of Ramsdens this morning.

My questions were:

1. Store expansion. Is the company finding that there is more competition in the South East? I was thinking in particular of competition from H & T (LON:HAT) who have 270 stores and are very strong in the South East.

Answer: Mr Kenyon said that staff training was the biggest challenge with opening new stores as you have new staff who have to handle increasing amounts of business as the store matures. He said that competition was not a problem with these store openings, and the company planned to continue expanding in the South East.

2. Gold price risk. How does the company manage this?

Answer: Mr Kenyon said that gold was about 15% of pawnbroking items and that the company’s pawnbroking policies were very conservative, i.e. for gold with a value of £19 the company would only lend £12.50. He also mentioned that their prices for buying and selling gold are adjusted every single day.

I mentioned Albemarle Bond; it’s worth noting - and Mr Kenyon reminded me - that he has been with Ramsdens for many years (since 2001) and that he was with the company when it went through the 2013 gold price volatility.

Ramsdens subsequently went through a private-equity backed management buyout led by Mr Kenyon.

3. The company is valued on a P/E multiple of only 9x despite showing strong growth. How does the company explain this valuation, or how it would argue for a higher valuation?

Mr Kenyon rightly replied that he can’t control the share price and that he can only focus on making the company as cash generative as possible, pay the dividend, and keep making the company as strong as possible, but naturally he agreed that this valuation seemed low.

4. Cash policy. The company has £5m of cash. If it wanted to borrow to invest, it probably could but does the company prefer to keep a net cash balance long-term?

Mr Kenyon said that the cash balance was important e.g. in terms of managing the gold price risk, having a cash balance means that the company would have a buffer to protect it.

Estimates at Liberum for underlying PBT are unchanged for the current year, FY 2024. They raise their revenue estimate but reduce their margin estimate due to a greater emphasis on jewellery retailing. The net result is no change in the underlying PBT estimate, which they see increasing from £10.1m to £10.5m.

Graham’s view

I’m remaining positive on this stock. In my view, little has changed since we last looked at this one (in October). The main development is that we now have further confirmation that the store opening programme is going well.

It seems that the market is big enough to allow for the expansion of Ramsdens into the South East. Remember that its mix of services is different to H&T, who are far more heavily focused on pawnbroking.

Having spoken with Peter Kenyon, I have the impression that the company is in fact quite risk-averse, despite its growth ambitions. I think they are very aware of the dangers of over-extending either physically (through store openings) or financially (through leveraging up its balance sheet).

I think the best argument for the current share price is that the company’s growth expectations for FY 2024 are quite modest: revenue growth of 6% and underlying PBT growth of 4%.

Higher costs are expected to bite this year, including higher energy costs (£0.4m higher in FY 2024 due to the expiry of a fixed price energy deal) and a 10% increase in the real living wage.

However, I see these as minor short-term issues, not as problems that should detract from the long-term investment case.

The company has previously under-promised and over-delivered. I wouldn’t count on that happening again, but it’s something to be aware of:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.