Good morning from Paul & Graham!

Today's report is now finished.

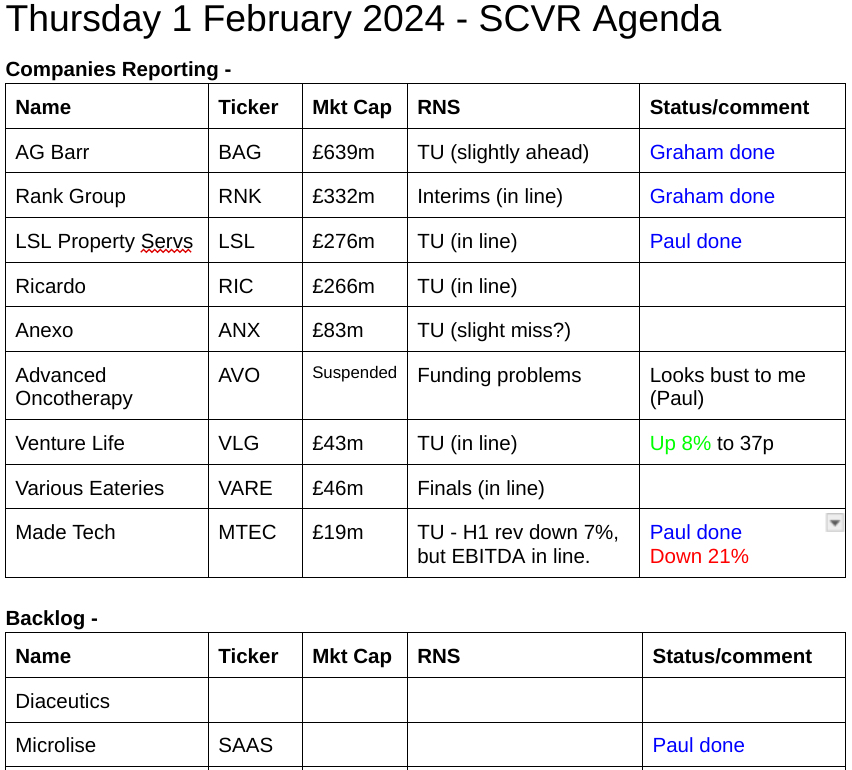

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

.

Other mid-morning movers (with news) -

B90 Holdings (LON:B90) - down 12% on TU. We dropped coverage here in 2019, serial loss-maker.

Superdry (LON:SDRY) - up 14% to 22.4p - no news, but I’ve just looked at the last accounts, which confirm my view that equity probably worth zero, and CVA only realistic option, shareholders will be lucky if they salvage anything in my view. Newco (Dunkerton + fresh backers?) most likely maybe?

Everyman Media (LON:EMAN) - Blue Coast (biggest s/holder, linked to NED M Rosehill) buys 3.75m at 56p. Now holds 25.1m, 28.3%. Interesting move. I wonder if they might bid for all of it?

Argentex (LON:AGFX) - up 5% to 58p - man of the moment Richard Steveley of Rockwood Strategic discloses a purchase, taking him from undiscloseable up to 3.5%

CAP XX (LON:CPX) - down 21% to 0.75p - Interim results. Looks bust to me without an imminent fundraise. Patent loss legal case being appealed. Commendable quick reporting of Dec 2023 H1 results though.

Summaries

Microlise (LON:SAAS) - 132p (£152m) - FY 12/2023 Trading Update [slightly ahead] - Paul - AMBER/GREEN

Rarer than hen's teeth - a 2021 IPO that actually looks quite good, and hasn't collapsed in price! I've circled back to look at this telematics company's recent update, as it drove a c.30% rise in share price. I can see why, this looks a really interesting company. Not cheap though, but performing well, and seems to have nice growth potential too, albeit in a crowded market. Worth a closer look I reckon.

A G Barr (LON:BAG) - up 2% to 579p (£649m) - Trading Update - Graham - GREEN

Profits are coming in slightly ahead of expectations which the company attributes to “positive underlying brand momentum” despite wet summer weather in Q3. Cost inflation seems to be cooling down, which bodes well for the restoration of profit margins. I remain positive.

Made Tech (LON:MTEC) - down 21% to 10.3p (£15m) - Trading Update - Paul - AMBER/RED

It's not actually a profit warning, and the H1 highlights seem OK, but slow order intake and worries about the general election sound like we're being warmed up for a poor H2. No broker forecast changes at this stage. The one good feature is a strong balance sheet, with plenty of cash. Although note it's burning cash due to heavy capitalised development spend (payroll that's put on the balance sheet instead of being expensed). Not a serious investment, but might be a fun punt for a rebound at some point maybe?

Rank (LON:RNK) - up 3% to 72.7p (£340m) - Half-Year Report - Graham - GREEN

The full-year outlook (FY June 2024) is in line with expectations as this gambling operator posts its full-year results. The investment thesis appears to be playing out with a high degree of operating leverage visible. Revenues continue to grow while cost inflation has cooled.

Inspiration Healthcare (LON:IHC) - Bank covenant waiver granted - Paul - AMBER

Good to see that the required bank covenant waiver flagged in yesterday's SCVR has now been granted (no other detail provided). So as mentioned yesterday, once this was granted, I've moved up from amber/red, to AMBER. It wasn't really in any doubt, but shareholders should get a better night's sleep tonight!

Inspiration Healthcare Group plc (AIM: IHC), the global medical technology company pioneering best-in-class, specialist neonatal intensive care medical devices, announces that further to the announcement on 31 January 2024, the Company's lender has granted a covenant waiver in respect of the 31 January 2024 covenant test date.

LSL Property Services (LON:LSL) - Up 4% to 275p (£285m) - Trading Update [in line] - Paul - AMBER/GREEN

I like things like this as cyclical recovery candidates. Doesn't look obviously cheap at this stage, but they never do when earnings are at a low point. 2023 is in line with expectations, and increased earnings in 2024 are expected. Has switched to a franchise model. Net cash. Quite interesting potential I think, but has risen 27% already in last 6 weeks, so I'll bide my time.

Paul’s Section:

Microlise (LON:SAAS)

132p (£152m) - FY 12/2023 Trading Update [slightly ahead] - Paul - AMBER/GREEN

Microlise Group plc (AIM: SAAS), a leading provider of transport management software to fleet operators, provides the following unaudited trading update covering the expected results for the year ending 31 December 2023 ("the Period"). The Group expects to publish its full year results for the Period in early April 2024.

I can’t remember anything about Microlise, and we didn’t look at it in 2023. So starting from scratch, what’s it’s track record like? Looks a bit patchy, but with strong revenue growth, and good forecast profits for 2023 & 2024 - although bear in mind it only floated in mid-2021, so pre-IPO numbers are often not comparable (since private companies typically minimise profits to reduce tax) -

Latest news - highlights for FY 12/2023 sound impressive -

SAAS says FY 12/2023 adj EBITDA was slightly ahead of expectations (£9.4m actual, vs analysts range of £9.1 - 9.2m)

Key question - how much of EBITDA turns into real profit?

Many thanks to analysts Tom & Harold at Singers, who crunch the numbers for us (incredibly helpful, and I know a lot of work goes into these notes). They reckon £9.4m adj EBITDA above turns into £5.5m adj PBT and 4.3p adj EPS (my two preferred measures, but the hardest ones to actually find, usually missing from most companies’ trading updates!)

Hence at 132p, SAAS shares are currently valued at a PER of 30.7x FY 12/2023 earnings (after this latest upgrade to forecasts) - a punchy rating, so the outlook needs to be very good to justify that.

Analysts flag the key bull points as being -

Mission-critical product

Minimal customer churn (although that depends how it’s calculated - some companies offset negative churn against other customers buying more licences)

Big customer wins

Undervalued relative to peers.

Recurring revenues gives visibility - ARR ended 2023 at £47m (with 10% organic growth)

Net cash was £16.8m at end 2023, unchanged from a year earlier.

Balance sheet? Surprisingly threadbare! NTAV is slightly negative, with the business seemingly funded by up-front customer payments, but that’s normal in the software sector, so not a concern. With more acquisitions happening, I think management need to be a little careful not to overstretch their balance sheet in future. Although arguably a reliably profitable recurring revenue business like this could even take on a bit of bank debt, and at present it has none, so I’m probably fussing unnecessarily here.

Dividends? There aren’t any. So looks like it’s focusing on growth, rather than income for investors. They’ve managed to achieve a PER of c.30x, so arguably more value has been created for shareholders through that, than through potential divis!

IPO - It floated on AIM in July 2021 (oh dear!) at 135p. Given that’s almost the current share price, this has to be seen as a rare success relative to its 2021 peer group.

Who owns it? - looks like a founder CEO, which I like, but 50% is a bit too high for my liking. Other shareholders are just along for the ride, with no say in how anything is done. So additional checks are always needed in this type of situation I think (eg lockins, share options, remuneration, track record of key management etc) -

Customers - this sounds impressive, and ultimately is what determines success or failure - offering a product that customers want, which benefits their business. Some impressive brand names here -

The Group added 450 new customers during the year with key customer wins including McCulla, BCA/ECM, LF&E and two significant customer wins in Australia, further cementing our position in one of our key target markets. Microlise also extended its relationships with numerous existing customers including Tesco, Culina and Bidfood. The Company continues to have high rates of customer retention, experiencing very low churn of 0.7% during the Period, reflecting the strength of our customer relationships and the value our product offering brings to customers.

Outlook - fairly general, but sounds positive to me -

Microlise expects to deliver strong revenue growth in FY24, driven by further organic growth and recent M&A. To service a growing pipeline and deliver an improved proposition, the Group has commenced its investment programme into its TMS offering following the acquisitions of Vita Software and ESS as planned. Looking ahead, the Board sees an opportunity for organic growth to improve from current levels as we move through the year supported by a healthy orderbook and pipeline of opportunities across OEM and direct customer divisions. Operating margins are expected to trend upwards in FY24 and beyond, as we focus on careful management of the cost base and efficiently scaling the Group…

"The three acquisitions made during the period have resulted in an improved and expanded offering which is already having a positive effect on trading momentum and pipeline. This, together with the resolution of the microchip supply crisis, gives us confidence in the Group's continued success."

Paul’s opinion - not an obvious value share, and I’m unfamiliar with the company, but for my first proper look at it, I have to say this looks a nice growth company.

It’s just an initial review, but I’m leaning positively towards SAAS shares, which I think are worth investors taking a closer look with some proper research.

Hence I’ll go with AMBER/GREEN.

Made Tech (LON:MTEC)

Down 21% to 10.3p (£15m) - Trading Update - Paul - AMBER/RED

Made Tech, a leading provider of digital, data and technology services to UK public services, is pleased to provide a half year update on trading for the six months ended 30 November 2023 (the "Period"). The Group expects to publish its half-year results for the Period on 26 February 2024.

A disastrous Sept 2021 float. The story was of lucrative public sector IT work, but the reality has turned out to be that it’s much harder to make money from this than they thought.

Graham turned red here on 2/5/2023 and since we both think it’s a crock, we haven’t looked at it since. I have to look today, to get it into the system as a profit warning. Although it’s not actually a specific profit warning - no FY 5/2024 guidance is given by the company, and the Singers analyst has left forecasts unchanged today. Although slow order intake in H1, and comments about a slowdown caused by the general election does sound like it’s warming us up for a profit warning later this year maybe? The 20% drop in share price suggests that’s how other people have interpreted this update too.

H1 highlights look OK - EBITDA has risen, and a decent order book, plus half market cap in net cash -

Outlook -

Management continues to focus on further productivity and cost control measures to further improve margin performance over time….

The Board anticipates that the procurement market will be impacted by the uncertainty created by the upcoming General Election in the short term. Notwithstanding this temporary market backdrop the strong improvements made to Made Tech's operating model and margins, the investment in its commercial offering, combined with its strong balance sheet and Contracted Backlog, position the Group well to execute on its growth strategy.

We have a promising pipeline of new business opportunities, although the market is undoubtedly challenging right now and we expect this to remain so ahead of the general election. The medium term drivers of demand in our market remain strong and we are focused on making further improvements to the business and putting all the necessary building blocks in place to enable us to capitalise on the increase in trading momentum that we expect post the election. "

This is the first company in our universe which has blamed the forthcoming election for poor order intake, but given that it’s targeting public sector organisations, there might be some credibility in that I suppose. Although MTEC projects are not exactly major, or controversial projects, and given that the same civil servants run the country before and after elections, it might be stretching credibility a little.

Share based payment charges in the last 2 years full accounts are a sick joke - over £2m pa.

Balance sheet at May 2023 is actually very good indeed. This is a well-financed small business, with £10m positive working capital, and no debt.

Paul’s opinion - much to my surprise, this is actually quite interesting, due to the cash asset backing, supporting about half the market cap. That’s proper cash as well, not just money up-front from customers.

Real profits are not far below EBITDA, if you can persuade management to keep their hands out of the share options till. Ah, no they’re not! I’ve just spotted that it capitalised £3m of payroll into intangible assets in FY 5/2023, so scrub that. The cash pile is falling, and forecast to continue falling, which suggests it’s burning cash, not generating it. So that’s killed off any early signs of interest from me.

Bottom line, it looks a low quality business, probably tendering for Govt work where there’s little prospect of making genuine profits/cashflows.

On the upside it has an unusually strong balance sheet, so insolvency/dilution risk seems very low. For that reason, the shares might be a fun trading punt (maybe a 20-50% tradeable spike up in price to quickly sell into? As happened a year ago), with the downside fairly well protected by that strong balance sheet. But as a serious investment? Nah, I wouldn’t waste any time on it.

LSL Property Services (LON:LSL)

Up 4% to 275p (£285m) - Trading Update [in line] - Paul - AMBER/GREEN

Estate agents chain updates us today - only in line, but the update might have interesting read-across of wider interest.

2023 results in line with expectations

LSL issues a pre-close trading update for the 12-month period ending 31 December 2023.

“Positive final quarter”

Group Underlying Operating Profit in the second half of the year showed a material improvement on H1.

The switch to a franchise model seems to have gone well -

Following the conversion of our Estate Agency network to a wholly franchise model during H1, the Division continues to perform ahead of plan for both revenue and profits, with second half operating margin of c.30%.

Outlook - this sounds as if they’re not factoring in much general market recovery, so I wonder if there might be possible upside on current forecasts? -

…and at this early stage we remain comfortable with delivering profits in 2024 materially ahead of 2023…

The Group's trading in January was in line with management expectations and ahead of 2023. At this early stage of the year, we remain on track to deliver a material increase in profit for 2024 compared to 2023 due mainly to the benefits of improved performance in Surveying, as well as a full year of operating the franchising model. A further update on current trading and outlook will be shared with the release of our preliminary results.

Cash looks healthy, although I would need to see the whole balance sheet before being sure -

Strong balance sheet with Net Cash of £34.9m at 31 December 2023 (31 December 2022: £40.1m), providing flexibility for future deployment of capital.

Earnings upgrades - nothing has started yet, but notice below that 2024 is already more than double the 2023 greatly lowered forecasts. Although Zeus points out in a helpful update note today that 2023 results were suppressed by one-off costs re the changeover to franchise model.

As investors we want to get in before the earnings upgrade cycle starts, I would suggest, and often the PERs look quite high at this stage in the cycle because forecasts are low in absolute terms (but could have multi-bagging upside in a recovery) -

Paul’s opinion - I think this is an interesting time generally to be looking for cyclical recovery shares. Given everything that’s happened with the housing market, and the seemingly positive outlook for at least some level of recovery in transactions, then estate agents would be an area of considerable interest to me at the moment.

LSL doesn’t seem obviously cheap, and the share price has had a 27% bounce in the last 6 weeks, hence I don’t see any rush to get involved personally in the short-term. But I would happily place a 50p bet with anyone that this share ends 2024 higher than it is now.

Graham’s Section:

A G Barr (LON:BAG)

Share price: 579p (+2%)

Market cap: £649m

This is an update for the year ended 28th January 2024.

AG Barr is an old soft drinks company which I’ve included in my favourite ideas list for the past two years. Thankfully, the news today is positive:

Revenue c. £400m, up 26% year-on-year including the impact of an acquisition, up 7.6% on a like-for-like basis.

Adjusted PBT £49.5m, up 13.8%, and slightly ahead of expectations.

Brief explanation:

Despite the wet summer weather which impacted Q3 market conditions, our positive underlying brand momentum ensured a strong H2 Group performance.

The company has some non-soft drink operations:

Cocktails: strong performance in the off trade, but the on trade channel “remains variable”, with reduced footfall at late night venues.

MOMA Foods: this subsidiary makes porridge and oat drinks, and has posted double-digit sales growth.

Inflation

The key theme in the soft drinks sector has been inflation. By putting BAG (and NICL) in my best ideas lists, I’ve been betting that inflation will continue to feed through to consumer prices and that pre-inflation operating margins might again be achieved by these companies.

A.G. Barr says that inflation continues to “drive value growth” while also impacting volumes; i.e. revenues are going up while the amount of product actually being sold is going down.

Fortunately, there are signs that inflation might be levelling off (note that UK CPI is currently 4.0%):

We continue to experience cost inflation albeit at a less significant level than in the prior year. Our supply chain capital investment programme is on track supporting the in-sourcing of the Boost and Rio brands. The associated operational leverage and synergy benefits are supporting the acceleration of our margin rebuild programme.

Graham's view

Here are the company’s operating margins and ROCE figures from 2018 (left-hand-side) to now:

A return to pre-Covid operating margins and ROCE would provide a nice boost to earnings and in my view would easily justify the current valuation:

I am therefore going to stay optimistic and positive on this one even though the share price is already up 13% year-to-date.

New CEO: existing CEO Roger White is stepping down after twenty years for a well-earned rest. Hopefully A.G. Barr is one of those businesses that is so wonderful that any idiot could run it.

Rank (LON:RNK)

Share price: 72.7p (+3%)

Market cap: £340m

I’m keeping an eye on this for signs of a return to former glory. In the past, when there has been a favourable mix of a) tourists and business travellers wishing to splash bets, and b) moderate cost inflation, profits at this casino group have soared.

Here are the interim results to December 2023:

Like-for-like net gaming revenue +9%

Like-for-like underlying operating profit £21.7m (last year: £2.7m), “reflecting both the growth in NGR and the operating leverage of the group”.

Wage inflation of 8% (costs up by £8.3m) were offset by declining energy prices (costs down by £5.4m).

At first glance, the investment thesis appears to be playing out. Cost inflation has cooled down, giving the company the chance to make meaningful profits as revenues take off.

Outlook - there was a “good performance” over Christmas and New Year, which were “busy”. Full-year like-for-like profits for the current year (FY June 2024) remain in line with expectations.

Financial KPIs: the core “venues” division (i.e. casinos and bingo halls) has seen faster revenue growth (10%) than the non-core “digital” division (8%).

Debt: the company is carrying net debt of £145m under current accounting rules but if you’re happy to look past leases, then it’s actually in net cash of £18m.

I like this statement of confidence re: the company’s financial strength:

The Group's strong financial position is enabling ongoing investment in our venues and digital businesses and positions the Group to take full advantage of any future improvement in the macro-economic climate and the planned and much needed reforms in the UK Government's review of gambling legislation.

Dividend: none are being paid currently, but Rank “expects to recommence dividend payments as soon as circumstances permit”. Maybe soon? The StockReport suggests that dividends are forecast at the end of the current financial year.

CEO comment: excited on two fronts, both the operational leverage and the regulatory reforms:

"After what has been a very challenging few years for Rank due to a wide range of external macro factors, we are starting to build revenues and, with our strong operational leverage, we are improving our profitability, with the Group delivering revenue and operating profit growth across all businesses.

Grosvenor casinos - fewer high net-worth tourists are visiting the UK, which is holding back spend per visit. But overall casino visitor numbers are still up 8%.

Mecca bingo halls - the estate has reduced to 55 as another loss-making venue has been closed. Twenty venues have shut down post-Covid, leaving a smaller, more focused estate. Mecca is now trading around breakeven (previously loss-making) and is expected to be profitable by the year-end.

Graham’s view

I’ve been positive on this one since last August; the share price hasn’t co-operated yet, but I’m enjoying the news flow. Revenues are rising well, and costs are no longer soaring as they were previously.

Valuation based on current forecast numbers still leaves plenty of upside in my view:

I can’t argue that this is a high-quality stock, as its performance is so sensitive to factors that are beyond its control - energy costs, high-net-worth visitor numbers, and consumer sentiment. But it does strike me as a value stock with good potential from this level, so I’ll stay positive on it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.